2025 DCK Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: DCK's Market Position and Investment Value

DexCheck (DCK) is revolutionizing crypto trading through its unique, AI-boosted analytics platform that offers real-time insights into crypto and NFT markets. Since its launch in June 2023, DexCheck has established itself as a comprehensive source of web3 data, tracking token unlocks, vesting schedules, crypto whale activities, and the performance of various tokens and NFTs. As of December 2025, DCK has a market capitalization of approximately $1.78 million with a circulating supply of 678.22 million tokens, currently trading around $0.001851. This innovative asset is playing an increasingly vital role in simplifying blockchain analysis and providing users with valuable insights across all major blockchains.

This article will comprehensively analyze DCK's price trends from 2025 to 2030, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

DexCheck (DCK) Market Analysis Report

I. DCK Price History Review and Current Market Status

DCK Historical Price Evolution

- June 2023: DexCheck token launched at an initial price of $0.014, marking the beginning of the project's market presence.

- March 2024: DCK reached its all-time high (ATH) of $0.18378 on March 11, 2024, representing a peak valuation period as the platform gained market traction.

- December 2025: DCK declined significantly to an all-time low (ATL) of $0.00164 on December 21, 2025, reflecting substantial market correction from its peak valuation.

DCK Current Market Position

As of December 26, 2025, DexCheck (DCK) is trading at $0.001851, with a market capitalization of $1,255,377.17 and a fully diluted valuation of $1,777,731.65. The token ranks #2,459 by market cap, with a circulating supply of 678,215,649 DCK out of a maximum supply of 1,000,000,000 tokens (67.82% circulation rate).

24-Hour Price Movement: DCK declined 2.99% in the last 24 hours, with a trading range between $0.001839 (low) and $0.001908 (high). Over the past week, the token has lost 5.029%, while the 30-day decline stands at 29.27%. Year-to-date, DCK has experienced a dramatic 93.41% decrease from its peak, indicating significant price erosion over the extended timeframe.

Trading Activity: Daily trading volume reached $17,347.98, with the token available on 5 exchanges. The current holder base consists of 13,970 addresses, reflecting the project's community engagement level.

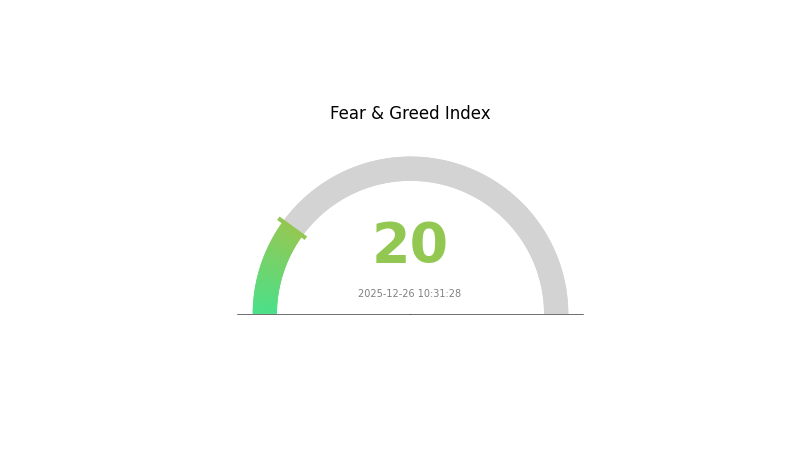

Market Sentiment: The broader crypto market is experiencing Extreme Fear conditions (VIX: 20), which may be contributing to downward pressure on alternative tokens like DCK.

Click to view current DCK market price

DCK Market Sentiment Index

2025-12-26 Fear and Greed Index: 20 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the index hitting 20. This reflects significant market pessimism and heightened investor anxiety. Such extreme readings typically indicate capitulation and potential buying opportunities for contrarian investors. When fear reaches these levels, assets are often heavily discounted, creating an asymmetric risk-reward setup. However, caution is warranted as further downside may still occur. Monitor key support levels and market developments closely before deploying capital.

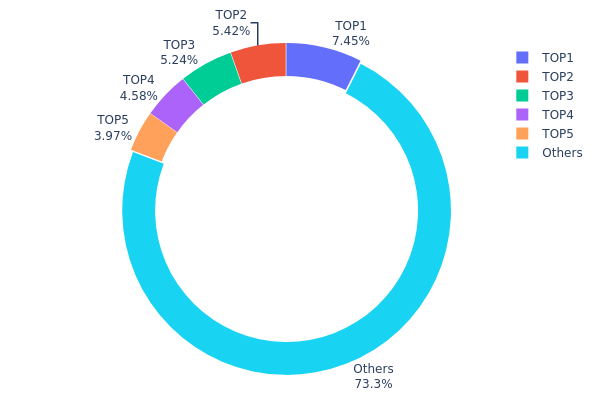

DCK Holdings Distribution

The address holdings distribution represents the concentration of DCK tokens across different wallet addresses on the blockchain. This metric reveals how token ownership is dispersed among market participants and serves as a critical indicator of network decentralization and market structure health. By analyzing the top holders and comparing them against the total supply, we can assess the degree of wealth concentration and evaluate potential risks associated with large holder influence.

DCK currently exhibits a relatively healthy decentralization profile based on its holdings distribution. The top five addresses collectively control approximately 26.63% of the circulating supply, with the largest holder accounting for 7.44% and the second-largest at 5.42%. This concentration level suggests moderate centralization rather than extreme dominance by any single entity. Notably, the "Others" category represents 73.37% of total holdings, indicating that the majority of DCK tokens are distributed across numerous addresses beyond the top five holders. This broader distribution pattern mitigates the risk of sudden large-scale liquidation events or coordinated price manipulation by a handful of whales.

The current address distribution structure demonstrates a balanced market composition that supports network stability and reduces systemic volatility concerns. While the top holders retain meaningful influence over market sentiment, the substantial proportion of tokens held by dispersed addresses creates a natural resistance against extreme price movements. This distributed ownership pattern is conducive to organic market development and suggests that the DCK ecosystem benefits from relatively robust decentralization mechanisms. However, continued monitoring of these concentration metrics remains essential to ensure the preservation of this favorable distribution as the project matures.

For current DCK holdings distribution data, visit Gate.com

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x564e...d0f8f4 | 74471.12K | 7.44% |

| 2 | 0x2e8f...725e64 | 54201.88K | 5.42% |

| 3 | 0x60aa...8c6696 | 52378.84K | 5.23% |

| 4 | 0xda98...455dee | 45781.74K | 4.57% |

| 5 | 0x0d07...b492fe | 39709.78K | 3.97% |

| - | Others | 733456.65K | 73.37% |

Core Factors Influencing DCK's Future Price

Supply Mechanism

- Total Supply: DCK has a total supply of 1 billion tokens, which directly impacts its price and investment value.

- Historical Pattern: Supply changes have historically driven price movements in cryptocurrencies multiple times, establishing a precedent for how supply dynamics influence market behavior.

- Long-term Significance: Scarcity serves as a core element supporting long-term value for cryptocurrencies like DCK, making the fixed supply ceiling a critical factor for sustained investor confidence.

Institutional and Whale Dynamics

- Key Market Indicators: Daily active addresses show strong positive correlation with DCK price prediction accuracy over three-month timeframes. Trading value distribution patterns reveal that when major holders significantly increase their positions, this typically signals impending major market movements.

Three, 2025-2030 DCK Price Prediction

2025 Outlook

- Conservative Forecast: $0.00135 - $0.00185

- Neutral Forecast: $0.00185

- Optimistic Forecast: $0.00231 (requires sustained market momentum and increased adoption)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual recovery phase with steady appreciation potential, characterized by consolidation and incremental growth as market sentiment stabilizes.

- Price Range Prediction:

- 2026: $0.00118 - $0.00253 (12% increase potential)

- 2027: $0.00131 - $0.00276 (24% increase potential)

- 2028: $0.00220 - $0.00286 (36% increase potential)

- Key Catalysts: Enhanced protocol development, improved market liquidity on platforms like Gate.com, expanding use cases, and positive macroeconomic conditions supporting risk assets.

2029-2030 Long-term Outlook

- Base Case: $0.00202 - $0.00286 (45% increase by 2029, driven by mainstream adoption and ecosystem expansion)

- Optimistic Scenario: $0.00245 - $0.00384 (50% increase by 2030, assuming breakthrough in institutional adoption and strategic partnerships)

- Transformative Scenario: $0.00384+ (assuming regulatory clarity, major exchange listings beyond Gate.com, and significant technological innovations that drive enterprise-level adoption)

- 2030-12-31: DCK reaches $0.00384 (consolidation phase after significant growth)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00231 | 0.00185 | 0.00135 | 0 |

| 2026 | 0.00253 | 0.00208 | 0.00118 | 12 |

| 2027 | 0.00276 | 0.0023 | 0.00131 | 24 |

| 2028 | 0.00286 | 0.00253 | 0.0022 | 36 |

| 2029 | 0.00286 | 0.0027 | 0.00202 | 45 |

| 2030 | 0.00384 | 0.00278 | 0.00245 | 50 |

DexCheck (DCK) Professional Investment Strategy and Risk Management Report

I. Executive Summary

DexCheck (DCK) is an AI-powered analytics platform revolutionizing cryptocurrency and NFT market analysis. As of December 26, 2025, DCK is trading at $0.001851 with a market capitalization of $1,255,377.17 and a fully diluted valuation of $1,777,731.65. The token has experienced significant volatility, with a 24-hour decline of 2.99% and a 1-year loss of 93.41% from its all-time high of $0.18378 recorded on March 11, 2024.

II. Market Performance Overview

Current Market Metrics

| Metric | Value |

|---|---|

| Current Price | $0.001851 |

| 24-Hour Change | -2.99% |

| 7-Day Change | -5.029% |

| 30-Day Change | -29.27% |

| 1-Year Change | -93.41% |

| Market Cap | $1,255,377.17 |

| Fully Diluted Valuation | $1,777,731.65 |

| Circulating Supply | 678,215,649 DCK |

| Total Supply | 960,416,884.58 DCK |

| Maximum Supply | 1,000,000,000 DCK |

| 24-Hour Volume | $17,347.98 |

| Market Dominance | 0.000055% |

Price Performance Analysis

DexCheck has demonstrated extreme volatility throughout its trading history. The token reached its all-time high of $0.18378 on March 11, 2024, but has since declined approximately 93.41% to current levels. The recent all-time low of $0.00164 was recorded on December 21, 2025, indicating ongoing downward pressure on valuations.

III. Project Fundamentals

DexCheck Platform Overview

DexCheck operates as a comprehensive web3 data analytics platform with the following core functionalities:

Key Features:

- Real-time insights into cryptocurrency and NFT markets

- Blockchain analysis tools designed for both beginners and advanced users

- Token unlock tracking and vesting schedule monitoring

- Cryptocurrency whale activity surveillance

- Multi-blockchain integration covering all major blockchain networks

- Telegram bot suite offering exclusive features to token stakers

Free Platform Access:

- Comprehensive web3 data access

- Market analysis and tracking tools

- NFT performance monitoring

- General blockchain insights

DCK Token Holder Exclusive Benefits:

- PRO feature access

- Private sale participation

- Telegram bot revenue sharing

- Staking opportunities

- DAO voting rights

- Premium support and community group access

Token Utility and Economics

DCK serves as the governance and utility token for the DexCheck ecosystem. Token holders gain access to premium features including exclusive Telegram bots that provide lower transaction fees, revenue sharing, and expedited transactions through private nodes and MEV relay access. The platform operates partially as a free-to-use service with premium features gated behind DCK token ownership.

IV. DCK Professional Investment Strategy and Risk Management

DCK Investment Methodology

(1) Long-Term Holding Strategy

Given the current market conditions and the platform's development status:

- Suitable Investors: Early-stage blockchain analytics enthusiasts, long-term web3 infrastructure believers, and investors with high risk tolerance

- Operational Recommendations:

- Accumulate during significant price pullbacks only after thorough project evaluation

- Maintain a diversified portfolio approach; DCK should represent only a small allocation within broader crypto holdings

- Monitor quarterly platform development updates and user growth metrics before adding to positions

- Set clear entry and exit targets based on project milestones

(2) Active Trading Strategy

-

Market Analysis Considerations:

- Monitor DCK/USDT trading pairs on Gate.com for volume and price action

- Track 24-hour volume trends; current daily volume of $17,347.98 indicates relatively low liquidity

- Observe support levels established at recent lows and resistance at previous consolidation zones

-

Key Operational Points:

- Exercise caution due to low trading volume, which increases price volatility and slippage risk

- Implement strict position sizing to manage execution risk in thin liquidity environments

- Track correlation with broader cryptocurrency market movements and Ethereum network activity

DCK Risk Management Framework

(1) Asset Allocation Principles

Given the speculative nature of DexCheck as an early-stage project:

- Conservative Investors: 0-1% portfolio allocation maximum; consider avoiding this token entirely

- Growth-Oriented Investors: 1-3% portfolio allocation; suitable for investors with higher risk tolerance

- Aggressive/Specialized Investors: 3-5% portfolio allocation; reserved for those specifically targeting emerging web3 analytics platforms

(2) Risk Hedging Approaches

- Diversification Strategy: Combine DCK holdings with established blockchain infrastructure tokens and diversified index positions to reduce concentration risk

- Position Sizing: Implement maximum loss limits per position; never allocate more than affordable loss amounts to any single emerging token

(3) Secure Storage Solutions

- Custody Recommendations: For significant DCK holdings, utilize Gate.com's secure wallet infrastructure for exchange-based holdings or consider cold storage solutions for long-term preservation

- Security Best Practices:

- Enable two-factor authentication on all exchange accounts

- For substantial holdings, implement offline storage methods

- Maintain backup access methods and recovery phrases in secure locations

- Verify smart contract addresses before any token transfers (DCK contract: 0x16faf9daa401aa42506af503aa3d80b871c467a3 on BSC)

Primary Security Considerations:

- Smart contract risk: Audit status and code quality of DCK token contract

- Exchange security: Conduct due diligence on trading platform security infrastructure

- Private key management: Never share seed phrases or private keys with any party

- Phishing attacks: Verify all links and transactions independently before confirming

V. DCK Potential Risks and Challenges

Market Risks

-

Extreme Price Volatility: DCK has experienced a 93.41% decline over one year and 29.27% loss in the past month alone, indicating severe market instability. Current low trading volume of $17,347.98 daily amplifies price movement risks.

-

Low Liquidity Risk: With minimal daily trading volume relative to market capitalization, investors may face significant slippage during execution of buy or sell orders, particularly for larger positions.

-

Market Sentiment Deterioration: The continuous decline from the $0.18378 all-time high suggests weakening investor confidence in the project's long-term viability and market adoption.

Regulatory Risks

-

Cryptocurrency Regulatory Uncertainty: Global regulatory frameworks for cryptocurrency analytics platforms and tokens remain inconsistent and subject to rapid change, potentially impacting DCK's operational status and utility.

-

Data Privacy Compliance: As a platform tracking whale activities and market movements, DexCheck faces potential regulatory scrutiny regarding data privacy, financial surveillance regulations, and compliance with anti-money laundering standards.

-

Securities Classification Risk: Regulatory bodies may classify DCK token or its revenue-sharing mechanisms as unregistered securities, leading to enforcement actions or platform operational restrictions.

Technical Risks

-

Smart Contract Vulnerabilities: While DCK is deployed on BSC (Binance Smart Chain), any undiscovered smart contract vulnerabilities could lead to funds loss or token supply manipulation.

-

Platform Dependency Risk: DexCheck's value proposition depends entirely on continued platform development and user adoption. Technology disruption or competitive displacement could significantly reduce platform utility.

-

Cross-Chain Integration Risk: As DexCheck claims integration across "all major blockchains," technical integration failures or inefficiencies could compromise data accuracy and user experience.

VI. Conclusion and Action Recommendations

DCK Investment Value Assessment

DexCheck operates at the intersection of AI-powered analytics and web3 data provision, addressing legitimate infrastructure needs within cryptocurrency markets. However, the project faces significant headwinds evidenced by its 93% depreciation from peak valuations. The current extremely low trading volume and minimal market capitalization indicate limited liquidity and market confidence.

The platform's free-to-use model with premium features behind DCK token ownership presents a potential utility mechanism, though actual adoption metrics and revenue generation remain limited. Long-term viability depends on substantial user growth, platform differentiation, and consistent revenue generation.

DCK Investment Recommendations

✅ Beginners: Avoid direct DCK investment; instead, learn blockchain analysis through the free platform access without financial commitment. If interested in the project, only allocate capital you can afford to lose entirely, limiting exposure to less than 1% of portfolio value.

✅ Experienced Investors: Only consider DCK allocation within a broader web3 infrastructure portfolio if you have thoroughly evaluated the project's development roadmap, user metrics, and competitive positioning. Implement strict stop-loss orders and position-sizing discipline; maximum allocation should remain below 3% of portfolio value.

✅ Institutional Investors: Conduct comprehensive due diligence including smart contract audits, regulatory analysis, and management background verification before consideration. Institutional allocation remains difficult to justify given current market metrics and project maturity stage.

DCK Trading and Participation Methods

- Primary Exchange: Access DCK trading exclusively through Gate.com, where the token maintains its primary listing and liquidity

- Direct Purchase: Acquire DCK through Gate.com spot trading against USDT or other base trading pairs; be aware of low liquidity conditions

- Staking and Governance: Hold DCK in compatible wallets to access staking opportunities and participate in DexCheck DAO voting mechanisms for protocol governance decisions

Risk Disclosure: Cryptocurrency investments carry extreme risk including potential total capital loss. This report is purely informational and does not constitute investment advice. All investors must conduct independent research and consult with qualified financial advisors before making investment decisions. Never invest amounts exceeding your personal loss tolerance capacity. DexCheck represents a highly speculative, early-stage project with significant operational, regulatory, and market risks.

FAQ

How high could DeepBook go?

DeepBook Protocol token could potentially reach $3.41552 by 2030 based on current market analysis and trends. However, the actual price trajectory will depend on market adoption, ecosystem development, and overall cryptocurrency market conditions.

What factors influence DCK price prediction?

DCK price prediction is influenced by market trends, historical price data, trading volume, overall cryptocurrency market conditions, and sentiment. These factors collectively determine future price movements and market direction.

What is DeepBook (DCK) and what is its current price?

DeepBook (DCK) is a cryptocurrency token. As of December 26, 2025, its current price is $0.054, representing significant growth from its all-time low of $0.010748, an increase of approximately 266.82%.

What are the risks of DCK price predictions and how accurate are they?

DCK price predictions face accuracy challenges due to high holder concentration and market sentiment volatility. Top wallets control significant supply, creating unpredictable price movements. Predictions should be viewed as reference points rather than guarantees, as actual prices may differ substantially from forecasts.

How does DCK compare to other DeFi tokens in terms of price potential?

DCK features strong use cases and strategic partnerships, positioning it to potentially outperform comparable DeFi tokens. Its unique protocol mechanics and growing ecosystem adoption suggest significant upside potential for investors seeking DeFi exposure.

2025 BAKED Price Prediction: Will This DeFi Token Rise to New Heights or Crumble?

2025 DAOLITY Price Prediction: Expert Analysis and Future Market Outlook for Cryptocurrency Investors

2025 PUSH Price Prediction: Expert Analysis and Market Forecast for the Push Protocol Token

2025 BAKED Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Latest Analysis and Investment Outlook for Chainlink Price in June 2025

2025 ICP Price Prediction: Analyzing Growth Factors and Market Potential in the Post-Halving Cycle

Samsung Q4 Profit Jumps 160 Percent, How the AI Chip Boom Is Reshaping Markets

How to Find My BNB Smart Chain Address

What Is Official Platform Verification Tool?

Copper Hits Record Above $13,000, What the US Import Rush Means for Traders

Understanding Profit and Loss (PnL) – Evaluating Your Financial Health