2025 DIMO Price Prediction: Expert Analysis and Market Forecast for the Decentralized IoT Movement Token

Introduction: DIMO's Market Position and Investment Value

DIMO (DIMO) emerges as a revolutionary platform designed to liberate data and establish a global platform accessible to developers, with an initial focus on automotive applications. Since its inception in 2022, DIMO has been transforming the trillion-dollar automotive industry by addressing the critical issue of compartmentalized or absent databases, where end-users have limited control over their underutilized data assets. As of 2025, DIMO's market capitalization has reached $13,020,000 with a circulating supply of approximately 412.25 million tokens, currently trading at around $0.01302. This pioneering asset, recognized as a "mobility data liberation protocol," is playing an increasingly vital role in enabling users to create digital twins of their vehicles on the blockchain, stream verified data through DIMO Miners, access decentralized applications such as DeFi auto loans, peer-to-peer car sharing, and pay-per-mile insurance, while earning $DIMO tokens.

This article will comprehensively analyze DIMO's price trends and market dynamics through 2030, integrating historical patterns, market supply and demand fundamentals, ecosystem developments, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

DIMO Price Analysis Report

I. DIMO Price History Review and Market Status

DIMO Historical Price Evolution

- February 2024: DIMO reached its all-time high of $2.00, marking the peak of the project's price performance to date.

- December 2025: DIMO hit its all-time low of $0.01236 on December 19, 2025, representing a significant decline from historical peaks.

DIMO Current Market Situation

As of December 23, 2025, DIMO is trading at $0.01302, reflecting short-term volatility across multiple timeframes:

- 1-hour performance: Down 0.38%, indicating slight downward pressure in the immediate term.

- 24-hour performance: Down 3.55%, showing continued selling pressure over the past day.

- 7-day performance: Down 13.10%, demonstrating sustained bearish momentum over the weekly period.

- 30-day performance: Down 33.86%, reflecting a significant decline over the monthly timeframe.

- Year-to-date performance: Down 92.85% from the previous year's levels, indicating substantial long-term depreciation.

The 24-hour trading volume stands at $15,810.35, with the token ranging between $0.01284 (24-hour low) and $0.01389 (24-hour high). The total market capitalization is approximately $13.02 million, with a circulating supply of 412,245,810.44 DIMO tokens out of a total supply of 1,000,000,000 tokens. The circulating supply represents 41.22% of the maximum supply, indicating significant future dilution potential.

DIMO currently ranks #1,483 by market capitalization and maintains a market dominance of 0.00041%. The token is held by 8,381 unique addresses, suggesting a distributed holder base.

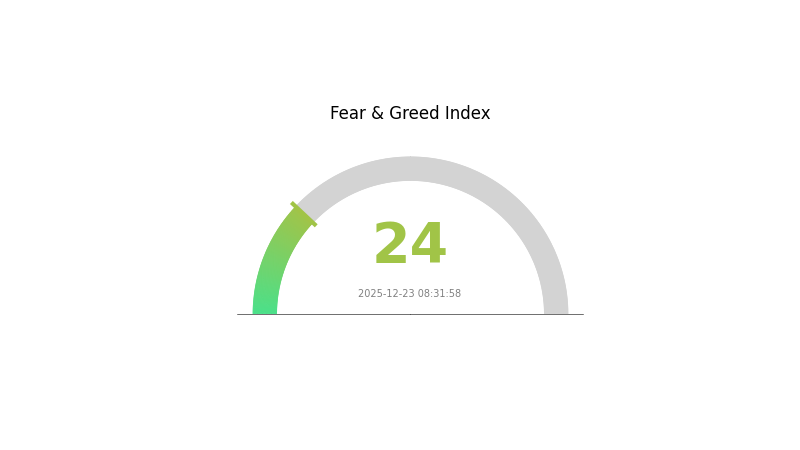

Market sentiment indicators reflect extreme fear, with the current VIX reading at 24, indicating heightened market anxiety and risk aversion across the broader cryptocurrency ecosystem.

Click to view current DIMO market price

DIMO Market Sentiment Indicator

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index at 24. This indicates investors are highly cautious and risk-averse. Market sentiment has turned sharply negative, reflecting widespread concerns about market volatility and uncertainty. During such periods, experienced traders often see potential opportunities as assets reach oversold conditions. However, beginners should exercise caution and conduct thorough research before making investment decisions. Consider dollar-cost averaging strategies to mitigate timing risks in volatile markets.

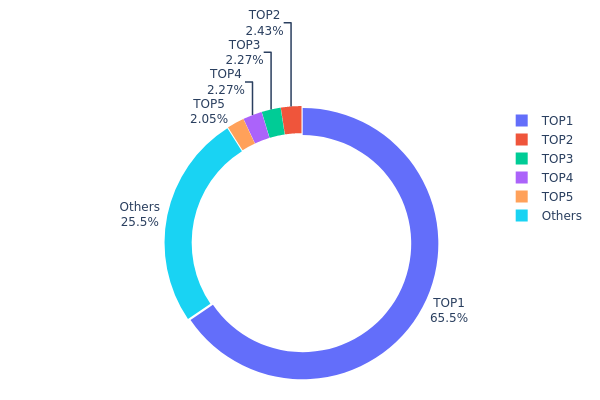

DIMO Holdings Distribution

The address holdings distribution chart illustrates the concentration of DIMO tokens across blockchain addresses, providing critical insight into the token's decentralization level and potential market structure risks. By analyzing the top token holders and their respective ownership percentages, this metric reveals the degree to which token supply is concentrated among a small number of entities versus distributed across a broader network of participants.

DIMO exhibits a pronounced concentration pattern that warrants careful examination. The top address alone controls 654,987.11K tokens, representing 65.49% of total holdings, creating a heavily skewed distribution landscape. The combined top five addresses account for approximately 75% of all DIMO tokens, while the remaining 25.52% is dispersed among other address holders. This extreme concentration in a single address, which nearly doubles the holdings of the second-largest holder at 2.42%, suggests potential centralization risks. The dramatic gap between the largest holder and secondary positions indicates that token distribution decisions are heavily influenced by a small number of entities.

The current holdings structure presents notable implications for market dynamics and governance stability. Such a concentrated distribution pattern increases vulnerability to market manipulation, as the dominant address holder could theoretically execute substantial transactions that significantly impact price discovery and liquidity conditions. Additionally, the reliance on a limited number of major holders raises considerations regarding decision-making authority and protocol direction. The concentration suggests DIMO is still in a relatively early stage of distribution maturation, with supply unlock schedules and potential future token releases playing critical roles in determining whether concentration levels normalize or intensify over time.

Click to view the current DIMO holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x9923...2a74e4 | 654987.11K | 65.49% |

| 2 | 0x9bd7...6e22e1 | 24282.59K | 2.42% |

| 3 | 0xe188...a64569 | 22696.75K | 2.26% |

| 4 | 0xdad4...ad7419 | 22696.75K | 2.26% |

| 5 | 0xa9d1...1d3e43 | 20506.32K | 2.05% |

| - | Others | 254830.49K | 25.52% |

Core Factors Influencing DIMO's Future Price

Macroeconomic Environment

-

Market Demand and Sentiment: DIMO's price is significantly influenced by market demand, regulatory changes, and macroeconomic trends. Market sentiment plays a critical role in price predictions—when optimistic and "greedy" sentiment prevails, it can drive bullish forecasts for DIMO. Conversely, fear or negative news may lead to bearish outlooks.

-

Current Price Volatility: DIMO currently trades at approximately US$0.01 and has experienced substantial volatility, with the current price representing a -99.21% drawdown from its historical high. This significant retracement reflects high uncertainty in the market, making DIMO a high-risk asset with potential for recovery but subject to extreme price fluctuation.

-

Institutional Adoption: Institutional adoption rates, continuous demand dynamics, and broader macroeconomic trends (such as inflation and interest rates) are expected to have significant impacts on DIMO's annual price movements.

Technology Development and Ecosystem Building

-

Continuous Technological Innovation: DIMO's future success depends on its continuous capacity for technological innovation and its ability to attract and retain users. The project operates in the decentralized vehicle data space, positioning itself as a revolution in how vehicle data is managed and monetized through blockchain technology.

-

Market Uncertainty: Recent price trends show a downward trajectory with some fluctuations, reflecting the broader uncertainty surrounding DIMO's long-term viability and adoption prospects. The ecosystem's ability to scale and gain meaningful adoption in the vehicle data market remains a critical determinant of future price performance.

III. 2025-2030 DIMO Price Forecast

2025 Outlook

- Conservative Forecast: $0.00903 - $0.01308

- Neutral Forecast: $0.01308

- Optimistic Forecast: $0.01805 (requires sustained adoption of DIMO's data sharing platform and increased integration with automotive partners)

2026-2028 Mid-term Outlook

- Market Stage Expectation: Gradual expansion phase with increasing ecosystem maturity and broader market recognition

- Price Range Forecast:

- 2026: $0.01416 - $0.02086 (19% upside potential)

- 2027: $0.01639 - $0.02313 (39% upside potential)

- 2028: $0.01199 - $0.02191 (58% upside potential)

- Key Catalysts: Enhanced vehicle data monetization mechanisms, partnerships with major automotive manufacturers, growth in Web3 vehicle ownership tracking, and increased user adoption on platforms like Gate.com for token trading and staking

2029-2030 Long-term Outlook

- Base Case: $0.01682 - $0.02193 (63% upside by 2029), with 2030 averaging $0.02161

- Optimistic Case: $0.02193 - $0.0309 (targeting 65% cumulative gains by 2030), contingent upon mainstream adoption of decentralized vehicle data markets and successful scaling of the DIMO ecosystem

- Transformational Case: $0.0309+ (65%+ appreciation potential), assuming breakthrough developments in automotive Web3 integration, significant institutional investment, and DIMO becoming the industry standard for vehicle data exchange

Note: These forecasts are based on predictive models and market analysis. Actual prices may vary significantly based on regulatory changes, market sentiment, technological developments, and macroeconomic conditions. Investors should conduct thorough due diligence before making investment decisions.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01805 | 0.01308 | 0.00903 | 0 |

| 2026 | 0.02086 | 0.01557 | 0.01416 | 19 |

| 2027 | 0.02313 | 0.01821 | 0.01639 | 39 |

| 2028 | 0.02191 | 0.02067 | 0.01199 | 58 |

| 2029 | 0.02193 | 0.02129 | 0.01682 | 63 |

| 2030 | 0.0309 | 0.02161 | 0.01837 | 65 |

DIMO Investment Strategy and Risk Management Report

IV. DIMO Professional Investment Strategy and Risk Management

DIMO Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with strong conviction in Web3 mobility infrastructure and data decentralization, who can tolerate high volatility and have a 2-5 year investment horizon

- Operational Recommendations:

- Accumulate gradually during market downturns, particularly when prices fall below $0.015 levels, to average down your entry cost

- Focus on the project's development milestones, adoption growth in the DIMO ecosystem, and partnerships with automotive manufacturers or developers

- Hold DIMO tokens through ecosystem participation to benefit from network effects as more users create digital twins of their vehicles and engage with DIMO applications

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Use historical price points at $0.01389 (24h high) and $0.01284 (24h low) as reference levels; watch for breakouts above $0.02 or sustained losses below $0.012

- Volume Analysis: Monitor the 24-hour trading volume of approximately $15,810 USDT; increased volume combined with price direction can signal trend strength or potential reversals

- Wave Trading Key Points:

- The token has declined -3.55% in 24 hours and -13.10% over 7 days, suggesting a downtrend; traders should wait for stabilization signals before entering long positions

- Given the -92.85% decline over 1 year, consider that capitulation points may present tactical buying opportunities for swing traders with strict stop-losses

DIMO Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of portfolio allocation, viewing DIMO as a speculative high-risk position with potential long-term upside if the mobility data infrastructure thesis succeeds

- Active Investors: 3-8% of portfolio allocation, allowing for more aggressive accumulation during market weakness while maintaining diversification across other crypto assets

- Professional Investors: Up to 15% of portfolio allocation, with sophisticated hedging strategies and dynamic rebalancing based on technical and fundamental metrics

(2) Risk Hedging Solutions

- Stablecoin Reserves: Maintain 40-50% of allocated capital in stablecoins on Gate.com to enable quick rebalancing if DIMO experiences sharp price declines or presents exceptional entry points

- Dollar-Cost Averaging: Deploy capital systematically over 12-24 months rather than lump-sum investing to reduce timing risk and manage volatility exposure

(3) Secure Storage Solutions

- Hardware Wallet Recommendation: For holdings exceeding $10,000 USD equivalent, use hardware wallets to maintain full custody and eliminate exchange counterparty risk

- Self-Custody via EVM Wallet: Transfer DIMO tokens to a secure self-custody wallet address; the token is based on the ERC-20 standard on the Ethereum blockchain (contract: 0x5fab9761d60419c9eeebe3915a8fa1ed7e8d2e1b), allowing straightforward wallet management through any EVM-compatible interface

- Security Precautions: Never share private keys, use hardware wallets for amounts exceeding your daily spending needs, enable two-factor authentication on Gate.com when trading, and verify contract addresses through official DIMO channels (https://dimo.zone) before transferring tokens

V. DIMO Potential Risks and Challenges

DIMO Market Risks

- Severe Price Volatility: DIMO has experienced a 92.85% decline over the past year and trades at $0.01302 compared to its all-time high of $2.00 (99.35% loss), indicating extreme volatility and significant risk of further downside if adoption fails to materialize

- Limited Trading Liquidity: With 24-hour volume of only $15,810 USDT across 5 exchanges, DIMO faces substantial liquidity constraints; large buy or sell orders could cause significant price slippage or manipulation risk in thin market conditions

- Market Capitalization Concerns: The current fully diluted valuation of $13.02 million against a 1 billion token supply raises questions about sustainable valuations; the token is ranked 1483 by market cap, indicating minimal institutional interest or adoption

DIMO Regulatory Risks

- Automotive Industry Compliance: DIMO's model depends on legal frameworks around vehicle data ownership and blockchain integration, which remain uncertain across different jurisdictions and could face regulatory restrictions from automotive regulators or privacy authorities

- Cryptocurrency Regulation Evolution: Changes in how regulatory bodies classify data governance tokens or mobility-focused crypto projects could negatively impact DIMO's legal status, adoption prospects, or token utility

- Data Privacy Regulations: GDPR, CCPA, and emerging privacy laws may conflict with DIMO's decentralized data model, potentially requiring significant protocol modifications that could diminish the token's core value proposition

DIMO Technology Risks

- Adoption Barrier: Converting traditional automotive manufacturers and consumers to blockchain-based vehicle data management faces significant friction; without major OEM partnerships or critical mass adoption, the DIMO ecosystem may remain niche

- Smart Contract Vulnerability: As an ERC-20 token operating within DeFi applications, DIMO depends on the security of underlying smart contracts; any exploits in connected applications could destroy user trust and token value

- Network Effect Dependency: DIMO's success relies entirely on network effects and ecosystem participation; failure to attract developers and users to build DeFi auto loans, P2P car sharing, or pay-per-mile insurance applications would eliminate the token's fundamental use case

VI. Conclusion and Action Recommendations

DIMO Investment Value Assessment

DIMO presents a compelling thesis around decentralizing vehicle data in a trillion-dollar automotive industry, yet the project faces significant execution risks and remains in early development stages. The token's 92.85% annual decline and minimal market capitalization ($13.02 million) reflect low adoption and investor skepticism. While the core concept of digital twins for vehicles and data monetization through blockchain aligns with emerging Web3 trends, DIMO's realizable value depends critically on regulatory clarity, major automotive partnerships, and ecosystem developer participation. For sophisticated investors, DIMO represents a high-risk, high-reward position where long-term value creation is possible but not guaranteed; for risk-averse investors, the volatility and adoption uncertainty present unacceptable downside risk.

DIMO Investment Recommendations

✅ Beginners: Avoid direct DIMO investment unless you can afford to lose your entire allocation; instead, research the project's technical roadmap, GitHub activity (https://github.com/DIMO-Network), and blog updates (https://blog.dimo.zone) over 3-6 months before considering even small exploratory positions

✅ Experienced Investors: Consider a 1-3% portfolio allocation if you have strong conviction in Web3 mobility infrastructure; use Gate.com for trading and implement strict stop-losses at -30% below entry points to manage downside risk; accumulate gradually during periods of maximum fear (below $0.012)

✅ Institutional Investors: Conduct detailed due diligence on the founding team, existing partnerships with automotive OEMs or developers, GitHub commit frequency, and ecosystem adoption metrics; only consider positions if partnerships with major vehicle manufacturers or significant developer traction materialize

DIMO Trading Participation Methods

- Gate.com Spot Trading: Directly purchase and sell DIMO tokens on Gate.com; provides access to order books, market data, and straightforward buy/sell mechanics for users seeking direct exposure

- Dollar-Cost Averaging on Gate.com: Set up recurring purchases (weekly or monthly) of small DIMO amounts to gradually build positions while reducing the impact of price volatility and timing risk

- Ecosystem Participation: For advanced users, earn DIMO tokens through the DIMO ecosystem by creating vehicle digital twins (NFTs) and running DIMO Miners; this method provides token exposure while supporting network security and data verification

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. All investors should make decisions based on personal risk tolerance and conduct thorough due diligence. Consider consulting a professional financial advisor. Never invest more capital than you can afford to lose completely.

FAQ

Will the price of dimo rise?

Yes, DIMO is expected to rise in value. Based on current market trends, the price could increase by 5% to reach $0.01334 by tomorrow.

Is Dimo a buy or sell?

Based on current technical analysis, DIMO is showing a strong sell signal. Moving averages and key indicators suggest downward momentum. Consider taking profits or reducing positions at this time for optimal risk management.

How much is Dimo worth?

As of December 23, 2025, DIMO is trading at approximately $0.018 per token. The price fluctuates based on market demand and overall cryptocurrency market conditions. Check real-time prices for the most current valuation.

Is Shieldeum (SDM) a good investment?: Analyzing the potential risks and rewards of this emerging cryptocurrency

Is Gather (GAT) a good investment?: Analyzing the Potential and Risks of the Virtual World Token

Is Deeper Network (DPR) a good investment?: Analyzing the potential and risks of this decentralized VPN project

2025 STORJ Price Prediction: Expert Analysis and Market Forecast for Decentralized Storage Token

2025 CUDIS Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2025 MSN Price Prediction: Expert Analysis and Market Forecast for Microsoft's Stock Performance

Curve Finance Proposes $6.6M Grant for 2026 Development

Bitcoin Whales Resume Accumulation

Gibt es Steuern auf Krypto in der Türkei?

10 NFT Games to Play-to-Earn in Recent Years

All About NFT Whitelists and How to Get Whitelisted in 3 Easy Steps