2025 MSN Price Prediction: Expert Analysis and Market Forecast for Microsoft's Stock Performance

Introduction: MSN's Market Position and Investment Value

Meson Network (MSN), committed to creating an efficient bandwidth marketplace on Web3, has emerged as a key infrastructure layer for decentralized storage, computation, and the Web3 Dapp ecosystem since its launch in April 2024. As of January 2026, MSN has achieved a fully diluted valuation of $530,600, with a circulating supply of approximately 17.46 million tokens trading at $0.005306 per unit. This innovative "DePIN" (Decentralized Physical Infrastructure Network) asset is playing an increasingly critical role in monetizing idle bandwidth resources from long-tail users across various hardware platforms.

This article will provide a comprehensive analysis of MSN's price trajectory through 2026-2031, incorporating historical performance, market supply dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for market participants.

I. MSN Price History Review and Current Market Status

MSN Historical Price Evolution

-

April 2024: Project launched on Gate.com with an initial price of $1.75. The token reached its all-time high (ATH) of $13.638 on April 29, 2024, representing significant early momentum in the market.

-

2024-2025: Following the peak in April 2024, MSN entered a prolonged downtrend. The token experienced substantial depreciation throughout the period, declining approximately 95% from its ATH by January 2026.

-

January 2026: MSN reached its all-time low (ATL) of $0.003605 on January 3, 2026, marking the lowest valuation point since launch.

MSN Current Market Position

As of January 4, 2026, MSN is trading at $0.005306, reflecting a market capitalization of approximately $92,622.33 with a fully diluted valuation of $530,600.00. The token exhibits a circulating supply of 17,456,150 MSN out of a total supply of 100,000,000, representing a 17.46% circulation ratio.

The 24-hour trading volume stands at $12,093.79, indicating relatively subdued trading activity. Over the past 24 hours, MSN has declined 2.4%, while the 7-day performance shows a steeper decline of 15.47%. The one-month performance deteriorated further with a 27.54% decrease, reflecting sustained bearish pressure on the asset.

The token currently holds a market ranking of 4,992 with a market dominance of 0.000016%. Approximately 53,975 unique holders maintain positions in MSN, distributed across the Ethereum blockchain network.

Click to view current MSN market price

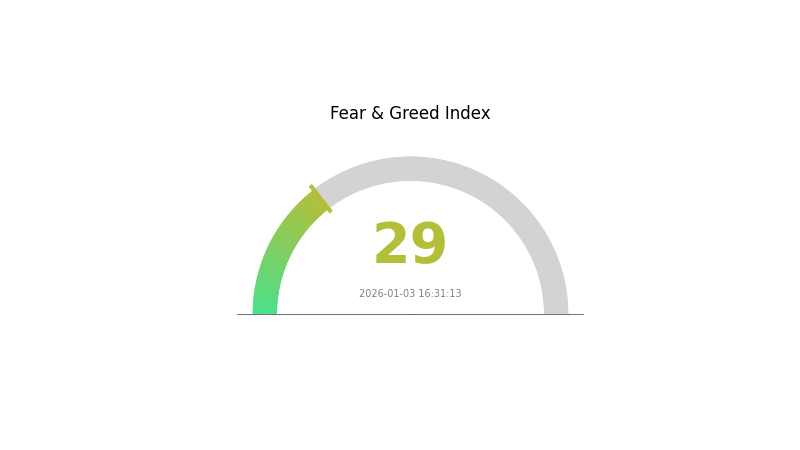

MSN Market Sentiment Index

2026-01-03 Fear and Greed Index: 29 (Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing a fear sentiment with an index reading of 29. This indicates heightened anxiety among investors, with bearish market conditions prevailing. When the index drops to fear levels, it typically reflects increased selling pressure, declining asset valuations, and cautious investor behavior. During such periods, risk-averse traders often reduce positions, while contrarian investors may seek potential opportunities. Market participants should remain vigilant and monitor key support levels. The prevailing fear sentiment suggests careful position management and thorough risk assessment are essential. Consider your investment strategy and risk tolerance before making trading decisions in this environment.

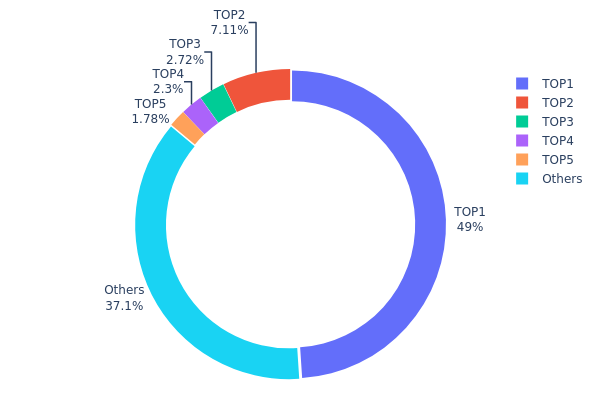

MSN Holdings Distribution

The address holdings distribution chart illustrates the concentration of MSN tokens across blockchain addresses, revealing the decentralization degree and potential market structure vulnerabilities. By analyzing the top token holders and their respective shareholding percentages, this metric provides critical insights into whether token distribution is sufficiently dispersed or subject to centralization risks.

The current MSN distribution exhibits pronounced concentration characteristics. The leading address (0xdecd...beeb0e) commands 48.95% of total holdings, representing nearly half of all circulating tokens. When combined with the second-largest holder at 7.11%, the top two addresses collectively control 56.06% of the token supply. The top five addresses account for approximately 62.85% of holdings, while the remaining addresses split the remaining 37.15%. This distribution pattern reflects significant concentration risk, as a relatively small number of entities could theoretically influence market dynamics through coordinated actions.

The pronounced concentration observed in MSN's address distribution raises material considerations regarding market stability and price volatility. With nearly half of the token supply concentrated in a single address, the potential for substantial sell pressure exists, which could trigger significant price movements if large-scale liquidation occurs. Additionally, such concentration may limit the token's decentralization narrative and create governance vulnerabilities. The moderate dispersion among remaining addresses (37.15% distributed across other holders) suggests that while some retail participation exists, institutional or core team holdings dominate the token's on-chain structure, which may impact market maturity and resilience to external shocks.

View current MSN Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xdecd...beeb0e | 51401.86K | 48.95% |

| 2 | 0x0529...c553b7 | 7469.35K | 7.11% |

| 3 | 0x93ae...1462f8 | 2857.14K | 2.72% |

| 4 | 0xd166...a54f41 | 2412.11K | 2.29% |

| 5 | 0x0d07...b492fe | 1873.93K | 1.78% |

| - | Others | 38985.61K | 37.15% |

II. Core Factors Affecting MSN's Future Price

Supply Mechanism

-

Token Supply Dynamics: MSN's price trajectory is influenced by its supply mechanism and historical market supply-demand relationships. Market supply fluctuations directly impact price volatility and investment attractiveness.

-

Current Impact: The supply-demand dynamics of MSN continue to play a crucial role in determining price movements, with changes in token availability affecting overall market sentiment and trading volumes.

Institutional and Whale Activity

- Institutional Adoption: Key factors include institutional participation and market applications. Institutional attention and adoption levels vary compared to competing projects, with differing degrees of ecosystem and institutional focus across the market.

Macroeconomic Environment

-

Monetary Policy Impact: Monetary policy adjustments and interest rate changes directly affect investment attractiveness. MSN's investment value is influenced by broader macroeconomic trends and central bank policy expectations.

-

Inflation Hedge Potential: MSN demonstrates certain defensive characteristics in inflationary environments, though its positioning as a "digital asset" remains evolving and not yet fully established in the market.

-

Geopolitical Factors: Geopolitical risks may influence MSN's price performance, with international tensions potentially affecting broader cryptocurrency market sentiment and investor risk appetite.

Technology Development and Ecosystem Building

-

Market Applications: MSN's value proposition is tied to market applications, technology development, and ecosystem construction. The expansion of use cases and ecosystem projects directly supports long-term price sustainability.

-

Ecosystem Growth: Continued development of decentralized applications and ecosystem expansion remains vital to MSN's future valuation, with ecosystem maturity serving as a key indicator of price potential.

III. MSN Price Forecast for 2026-2031

2026 Outlook

- Conservative Prediction: $0.0041 - $0.00519

- Neutral Prediction: $0.00519

- Bearish Prediction: $0.00706 (Market consolidation phase expected)

2027-2029 Medium-term Perspective

- Market Stage Expectation: Recovery and gradual accumulation phase with steady upward momentum

- Price Range Forecast:

- 2027: $0.00527 - $0.00649

- 2028: $0.00587 - $0.00928

- 2029: $0.00709 - $0.0106

- Key Catalysts: Institutional adoption acceleration, ecosystem expansion, and increased utility adoption driving demand recovery

2030-2031 Long-term Outlook

- Base Case Scenario: $0.00653 - $0.01159 (Assuming steady market maturation and mainstream integration)

- Optimistic Scenario: $0.01159 - $0.01507 (Assuming accelerated institutional investment and network effects realization)

- Transformation Scenario: Beyond $0.01507 (Under conditions of breakthrough technological advancement and mass adoption)

- 2026-01-04: MSN currently trading in consolidation phase with 95% cumulative upside potential by 2031

Analysis Note: The forecast data suggests a recovery trajectory post-2026, with the asset demonstrating resilience through a 95% projected growth rate by 2031. Traders monitoring this asset should track developments on platforms like Gate.com for real-time price action and trading opportunities.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2026 | 0.00706 | 0.00519 | 0.0041 | -2 |

| 2027 | 0.00649 | 0.00613 | 0.00527 | 15 |

| 2028 | 0.00928 | 0.00631 | 0.00587 | 18 |

| 2029 | 0.0106 | 0.00779 | 0.00709 | 46 |

| 2030 | 0.01159 | 0.0092 | 0.00653 | 73 |

| 2031 | 0.01507 | 0.01039 | 0.00655 | 95 |

Meson Network (MSN) Professional Investment Strategy and Risk Management Report

IV. MSN Professional Investment Strategy and Risk Management

MSN Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Infrastructure believers, Web3 ecosystem participants, and DePIN infrastructure enthusiasts with medium to long-term investment horizons

- Operational Recommendations:

- Dollar-cost averaging (DCA) approach over 6-12 months to reduce timing risk and accumulate positions at varied price levels

- Set long-term accumulation targets aligned with network adoption milestones and ecosystem development

- Maintain holdings through market cycles while monitoring network growth metrics and bandwidth utilization trends

(2) Active Trading Strategy

-

Price Action Monitoring:

- Track the 24-hour price movement (-2.4% as of January 4, 2026) and weekly volatility (-15.47% over 7 days) for entry/exit timing

- Monitor the trading volume ($12,093.79 in 24h volume) to assess liquidity conditions before executing trades

-

Wave Trading Key Points:

- Capitalize on the significant year-over-year decline (-95.05% over 1 year) which may present capitulation or recovery opportunities

- Observe resistance around the all-time high of $13.638 (April 29, 2024) and support near recent lows of $0.003605

MSN Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% portfolio allocation

- Active Investors: 3-7% portfolio allocation

- Professional Investors: 7-15% portfolio allocation with diversified entry strategies

(2) Risk Hedging Approaches

- Volatility Hedging: Maintain stablecoin reserves to opportunistically average down during severe drawdowns, as MSN has experienced significant volatility with -95.05% annual decline

- Position Sizing: Implement strict position limits relative to portfolio size given the project's current market cap of $530,600 and moderate trading liquidity

(3) Secure Storage Solutions

- Web3 Wallet Recommendation: Gate Web3 Wallet for convenient access, staking participation, and secure management of MSN tokens

- Self-Custody Approach: Store tokens in personal wallets for longer-term holders prioritizing security and decentralization

- Security Considerations:

- Protect private keys with extreme diligence

- Never share recovery phrases with any third parties

- Verify contract addresses before transactions: 0xaA247c0D81B83812e1ABf8bAB078E4540D87e3fB on Ethereum

- Use hardware authentication for large holdings

- Be cautious of phishing attempts targeting bandwidth marketplace participants

V. Potential Risks and Challenges for MSN

Market Risks

- Extreme Volatility: MSN has declined 95.05% over the past year and 27.54% over 30 days, indicating severe price instability that may not be suitable for risk-averse investors

- Low Liquidity: With only 24-hour trading volume of $12,093.79, liquidity is limited, potentially causing wide bid-ask spreads and slippage on larger trades

- Market Capitalization Concerns: Current market cap of $530,600 represents a micro-cap asset with significant concentration risk and limited trading depth

Regulatory Risks

- DePIN Regulatory Uncertainty: As a decentralized physical infrastructure network (DePIN) project, Meson Network faces evolving global regulatory frameworks for bandwidth sharing and distributed infrastructure assets

- Geographic Compliance: Different jurisdictions may impose varying restrictions on bandwidth trading and data transmission infrastructure operated by decentralized networks

- Token Classification Risk: Regulatory authorities may reassess MSN token classification, potentially affecting its tradability and utility across jurisdictions

Technology Risks

- Network Security: As a bandwidth marketplace leveraging idle resources from heterogeneous hardware (laptops, servers, IoT devices), the protocol faces potential vulnerabilities from diverse node security levels

- Scalability Challenges: Growing the network to compete with centralized bandwidth solutions requires robust infrastructure that can handle increasing data transmission demands

- Hardware Compatibility: Supporting various hardware devices introduces complexity in maintaining consistent performance standards and preventing malicious node participation

VI. Conclusion and Action Recommendations

MSN Investment Value Assessment

Meson Network presents a speculative infrastructure play within the DePIN sector, targeting an essential Web3 utility: efficient bandwidth distribution. The project's technological approach of monetizing idle bandwidth from diverse hardware offers genuine long-term infrastructure value. However, the asset's current state reflects extreme risk: a 95% annual decline, micro-cap market capitalization, and limited liquidity create an environment suitable only for risk-tolerant investors with conviction in decentralized infrastructure adoption. The project represents an early-stage, unproven technology facing regulatory uncertainty and intense competition from traditional and decentralized bandwidth solutions. Success depends heavily on network adoption acceleration and ecosystem integration within Web3 storage and computation layers.

Investment Recommendations

✅ Beginners: Avoid or allocate only symbolic amounts (0.1-0.5% of portfolio) after thorough research and risk acceptance. Consider DePIN infrastructure plays only after understanding bandwidth marketplace economics and decentralized infrastructure paradigms.

✅ Experienced Investors: Limited allocation (2-5% of portfolio) as speculative position in emerging DePIN infrastructure thesis. Implement strict stop-losses and position sizing. Monitor network adoption metrics and protocol developments closely.

✅ Institutional Investors: Conduct comprehensive due diligence on tokenomics, team credentials, and competitive positioning. Consider this as a venture-stage infrastructure investment rather than traditional cryptocurrency trading. Implement governance participation and long-term value creation strategies aligned with Web3 infrastructure development.

MSN Trading Participation Methods

- Gate.com Exchange Trading: Access MSN spot trading on Gate.com with competitive pricing and transparent order books, suitable for both entry and exit strategies

- Long-term Holding in Web3 Wallets: Transfer purchased MSN tokens to personal Web3 wallets or Gate Web3 Wallet for long-term holding while maintaining network participation eligibility

- Liquidity Provision Research: Monitor potential liquidity provision opportunities on decentralized exchanges as the ecosystem matures, though current liquidity conditions suggest limited DeFi integration

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on personal risk tolerance and should consult professional financial advisors. Never invest capital you cannot afford to lose completely. MSN's extreme volatility and micro-cap status present substantial risks unsuitable for most investors.

FAQ

What is MSN token? What are its uses and value?

MSN is the native token of Meson Network, primarily used for rewards, staking, and payments. Its value depends on market demand and network activity growth.

How to predict MSN price? What analysis methods are available?

MSN price prediction uses technical and fundamental analysis. Monitor market supply-demand dynamics, trading volume, and macroeconomic trends. Common methods include moving averages, RSI indicators, and historical price patterns analysis.

What are the main factors affecting MSN price prediction?

MSN price prediction is mainly influenced by high volatility in crypto markets, limited liquidity affecting large transactions, overall market sentiment, and correlation with the broader cryptocurrency market movements.

What are the risks of investing in MSN tokens? How should I evaluate them?

MSN token risks include high concentration of token holdings and limited team transparency. Evaluate by analyzing team background, project fundamentals, market liquidity, and regulatory environment. Monitor holder distribution and development progress carefully.

What are the advantages and disadvantages of MSN compared to other cryptocurrencies?

MSN leverages unused internet bandwidth for efficient resource sharing, offering unique network optimization. However, it faces lower market recognition and liquidity compared to mainstream cryptocurrencies, requiring continued adoption growth.

What has been MSN's historical price performance? What are its all-time high and low prices?

MSN reached its all-time high exceeding 0 USD on December 26, 2025. The token experienced significant price volatility, with its lowest point also recorded during 2025. Historical data shows MSN's price trajectory reflecting market dynamics in the Web3 sector during this period.

Is Shieldeum (SDM) a good investment?: Analyzing the potential risks and rewards of this emerging cryptocurrency

Is Gather (GAT) a good investment?: Analyzing the Potential and Risks of the Virtual World Token

Is Deeper Network (DPR) a good investment?: Analyzing the potential and risks of this decentralized VPN project

2025 STORJ Price Prediction: Expert Analysis and Market Forecast for Decentralized Storage Token

2025 CUDIS Price Prediction: Expert Analysis and Market Forecast for the Coming Year

2025 DIMO Price Prediction: Expert Analysis and Market Forecast for the Decentralized IoT Movement Token

Copper Hits Record Above $13,000, What the US Import Rush Means for Traders

Cryptocurrency Earning Platform Overview

Two-Factor Authentication (2FA): A Comprehensive Guide

Can Solana Reach $10,000 Dollars?

What is Cryptocurrency Market Cap and How Does It Work?