Is a $2000 bonus a poisoned candy? The crazy truth hidden in Trump's tariff plan.

Trump announced that he would distribute at least $2000 bonuses to American citizens, excluding high-income earners, with funding coming from tariff revenues. The crypto market seems to have heard the Christmas bells early, but the net tariff revenue in the U.S. is only $195 billion, and to distribute $2000 bonuses to 220 million adults requires $440 billion. This huge fiscal gap, along with inflation risks, suggests that behind this seemingly sweet gift, there may be a “inflation” Transaction History.

Crypto market frenzy: The illusion of history repeating itself

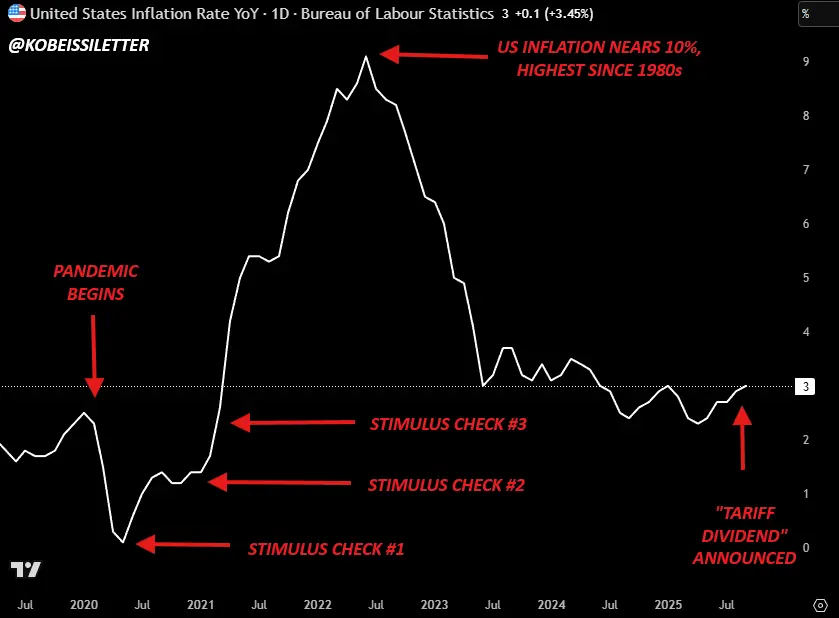

(Source: The Kobeissi Letter)

The crypto market always reacts quickly to various news. Within 24 hours after the release of the $2000 bonus news, the prices of Bitcoin, Ethereum, Solana, and other major cryptocurrencies generally rose. The trading volume on cryptocurrency exchanges surged instantly, and social media was filled with cheers for “new stimulus measures for the bull market.”

The market has muscle memory. It clearly remembers that the stimulus checks issued by the US government in 2020 drove the price of Bitcoin from $4,000 to $69,000, creating one of the craziest bull markets in cryptocurrency history. Today, the familiar melody is playing again, and the market naturally expects history to repeat itself. Investor Anthony Pompliano wrote on the X platform: “Stocks and Bitcoin will only react to stimulus measures – that means rising.”

But this time, the magician's trick has a loophole. The feast of 2020 seemed as if the Federal Reserve printed wine out of thin air; but today's $2000 bonus is merely redistributing some people's wine to others. This is not a brand new feast, but just a readjustment of the tax system. Its scale and sustainability are worrying. Bitcoin advocate Simon Dixon warns, “If you don't invest this $2000 into assets, it will be eroded by inflation.”

The Financial Myth of a $2000 Bonus

Trump's obsession with tariffs can be traced back to his 2016 campaign promise of “America First.” He firmly believes that high tariffs can protect American manufacturing and force foreign countries to repay American debts. This logic, though simple, is quite dangerous: tariffs are described as a “protection fee” paid by foreigners, rather than a hidden tax borne by American consumers.

By the fiscal year 2025, U.S. tariff revenue is expected to reach $195 billion. Trump claims that this revenue can be used to pay off up to $37 trillion in U.S. government debt and distribute $2,000 bonuses to the public. However, economists point out that companies will ultimately pass on the tariff costs to consumers, leading to increased inflation and decreased purchasing power.

The Harsh Calculation of Financial Reality

Number of Eligible Recipients in the United States: Approximately 220 million adults (referencing the relief check model during the pandemic)

Distribution total cost of 2000 USD bonus: 4400 billion USD

Net Revenue from U.S. Tariffs: 195 billion USD

Fiscal Gap: 245 billion USD

In other words, the $195 billion in tariff revenue compared to the $37 trillion national debt is like trying to fill a swimming pool with a single coin. Directly distributing that coin to the public is akin to using future money to buy applause in the present. Treasury Secretary Becerra later hinted that the $2,000 bonuses might be distributed in the form of tax cuts rather than cash. In other words, when this shiny golden gift box is opened, it might be completely empty inside.

Short-term Frenzy and Long-term Concerns

This kind of growth seems more like an illusion caused by psychological speculation. First of all, this policy has not yet received any legislative authorization. According to the U.S. Constitution, the power to levy taxes and make fiscal expenditures lies with Congress, not the President. If the Supreme Court rules that tariffs are illegal, the $2000 bonus plan may not be implemented.

As of November 10, according to data from the decentralized prediction market Polymarket, traders believe that the probability of the Supreme Court making a ruling in favor of the tariffs is only 23%; on the prediction platform Kalshi, this figure is even lower, at only 22%. In other words, most people in the market are betting that the plan will ultimately be rejected by the courts. But Trump himself directly asked on Truth Social: “Does the President of the United States have the authority to obtain the power to stop all foreign trade from Congress - which is much harsher than imposing tariffs - but cannot impose taxes on the grounds of national security?”

Secondly, even if this proposal is implemented, it means that taxes will be directly distributed rather than used to repay debts. Trump's promise to “use foreign funds to repay American debts” is likely to fall short again. The most critical point is that the large-scale distribution of cash will exacerbate inflationary pressures, forcing the Federal Reserve to adopt more aggressive monetary policies. At that time, liquidity will tighten, and risk assets will be the first to be affected.

Industry investment analysts warn that while some $2000 bonus funds will flow into the market to push up asset prices, the long-term consequence will be inflation of fiat currency and a decrease in purchasing power. After the latest round of stimulus measures, the inflation rate in the United States has approached 10%.

The Double Blow of Inflation and Geopolitical Risks

“The $2000 bonus is wrapped up like a Christmas gift box, but it’s more like Christmas candy that melts in your mouth; after the sweet taste (short-term stimulus), what remains is 'inflation', a decay that is difficult to eradicate.” Short-term political support brings long-term fiscal risks. Economists warn that this policy could cause 'double inflation': tariffs raising costs and the $2000 bonus stimulating demand, like stepping on the gas and brakes at the same time in a speeding car, ultimately leading to an overheated engine.

Geopolitical factors cannot be ignored either. Once the snowball of the trade war rolls again, the global supply chain will be impacted, especially for cryptocurrency mining that relies on global chips. In other words, behind the short-term madness lies a familiar script. Santa Claus has merely stuffed a Transaction History labeled “inflation,” “deficit,” and “trade war” into next year's Christmas stocking.

The last person to leave the table pays the bill

In this grand political drama, Santa Trump has prepared a special gift for the encryption world. When he announced that he would take out $2000 from the “tariff” pocket, the entire crypto market seemed to have heard the Christmas bells in advance. The “children” (retail investors) in the market are eagerly watching the chimney, firmly believing that some gifts will directly fall into their crypto wallets, thus opening a new round of “altcoin season.”

However, every child who believes in Santa Claus eventually faces a real question: how much do the gifts cost? This time, Santa's $2000 bonus did not come from his workshop in the North Pole; he simply maxed out credit cards across the country. This holiday, which costs over $400 billion, comes at the price of “inflation.” When the holiday hubbub makes the entire room (economy) overheated, adults (the Federal Reserve) may have to open the windows to let in a cool breeze (raise interest rates), prematurely ending the feast.

Therefore, what every cryptocurrency investor sees is a beautiful gift. In the short term, it shines with the tempting glow of history repeating itself; but in the long run, the back of the gift box may be printed in small letters with a “inflation” Transaction History. Is it the truth that can keep you warm through winter, or a Christmas treat that melts in your mouth but will give you cavities? For the believers in the cryptocurrency world, choosing which narrative to believe will determine whether they can leave this feast unscathed. Those who leave last must bear the final losses.

Further Reading:Trump distribution of 2000 USD tariff bonus, 85% of Americans benefit who can claim, how to claim?

Related Articles

ETH drops 0.92% in 15 minutes: macroeconomic bearish data and support loss resonate, triggering price pressure

Three weeks ago, a whale built a position in ETH and then liquidated 4,790 ETH, incurring a loss of approximately $125,000.