Satoshi Nakamoto's 1 million Bitcoins become a target for quantum hackers! Veteran: Buy when it crashes to $3

Over the weekend, the Bitcoin community erupted in heated debates about the potential impact of quantum hacking on Satoshi Nakamoto’s Bitcoin holdings. YouTuber Josh Otten shared a Bitcoin price chart illustrating that if quantum hackers stole and sold Satoshi’s 1 million BTC, it could cause Bitcoin to plummet to $3. Long-term Bitcoin holder Willy Woo responded that many veteran players would buy during a flash crash, and the Bitcoin network would endure.

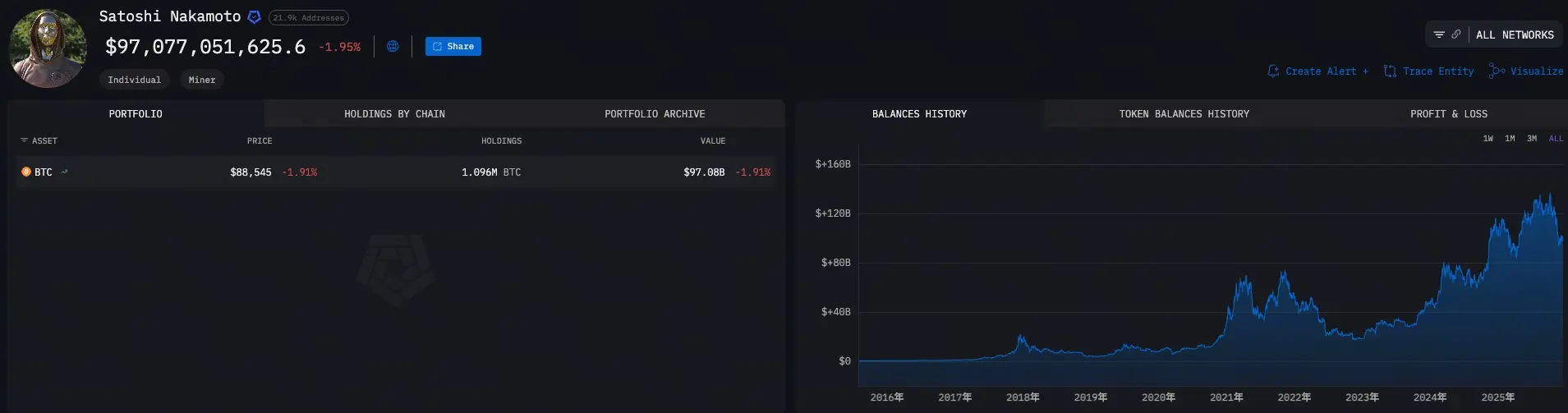

Satoshi Nakamoto’s 1 Million Bitcoins Become the Primary Target for Quantum Hackers

(Source: Arkham Intelligence)

The core of the Bitcoin community’s debate revolves around approximately 1 million BTC held by Satoshi Nakamoto. These Bitcoins are stored in early P2PK addresses, which reveal the full public key on the blockchain whenever transactions occur from these addresses. Willy Woo pointed out that about 4 million BTC are stored in such vulnerable address formats, making them theoretically susceptible to future quantum attacks.

Exposing the complete public key of a Bitcoin wallet on-chain exposes these wallets to the risk of quantum attacks, because, in theory, sufficiently powerful quantum computers could derive the private key from the public key. Once a quantum hacker obtains the private key, they can fully control the Bitcoin at that address and transfer or sell it. As the creator of Bitcoin, if Satoshi’s 1 million BTC were stolen by quantum hackers and dumped on the market, the impact on the market would be catastrophic.

Newer BTC wallet addresses are less vulnerable to quantum attacks because they do not expose the full public key on-chain. If the public key remains unknown, a quantum computer cannot generate the matching private key from this data. This means only Bitcoins transferred to new addresses are protected from quantum threats; Bitcoins remaining in old addresses—especially Satoshi’s long dormant holdings—become prime targets for quantum hackers.

Josh Otten’s price chart predicts a scenario where Bitcoin crashes to $3, based on the assumption that if quantum hackers successfully steal Satoshi’s 1 million BTC and sell all at once, the overwhelming sell pressure would completely destroy market confidence, causing a price collapse. Although extreme, this scenario is not entirely impossible, which is why it fuels fierce debate within the community.

Veteran Holders Buying the Dip vs. The Dilemma of Freezing Controversy

(Source: Trading View)

Willy Woo’s response reveals two contrasting approaches within the Bitcoin community regarding quantum threats. He states that many veteran players would buy during a flash crash, and the Bitcoin network would survive, with most cryptocurrencies not being immediately impacted. This perspective believes that even if Satoshi’s Bitcoins are stolen and sold by quantum hackers, true Bitcoin believers would see this as a rare buying opportunity, purchasing heavily at the extreme low of $3.

The logic behind this buy-the-dip strategy is that quantum hackers can only steal Bitcoins stored in old addresses. The Bitcoin network’s core operation remains unaffected as long as the community quickly migrates to quantum-resistant addresses. The long-term value proposition of Bitcoin still holds. Veteran investors believe that the short-term price collapse could instead provide an opportunity to reallocate Bitcoins—moving Satoshi’s long-dormant holdings from quantum hackers into the hands of long-term holders.

However, market analyst James Check presents a more controversial view. He argues that the threat of quantum computing poses a greater risk to Bitcoin’s market price because the Bitcoin community “cannot” agree to freeze Satoshi’s Bitcoin before quantum hackers infiltrate and reintroduce the stolen coins into circulation. This highlights a philosophical dilemma: Bitcoin’s core value lies in decentralization and immutability, but if freezing specific addresses to prevent quantum attacks violates these principles, does it contradict Bitcoin’s original intent?

Three Perspectives of the Bitcoin Community in Facing Quantum Threats

Tech Optimists: Believe that within 20-40 years, there will be enough time to upgrade to post-quantum cryptography, and users will naturally migrate to new addresses, solving the problem.

Market Opportunists: View quantum hacker dumps as a buying opportunity, believing Bitcoin will withstand short-term crashes and stabilize.

Preemptive Interventionists: Advocate for proactively freezing vulnerable addresses like Satoshi’s, though this raises ethical concerns about violating decentralization principles.

Realistic 20 to 40 Year Buffer Period

Bitcoin’s founder Adam Back offers a more measured technical perspective, providing a calmer outlook amid intense debate. He states that Bitcoin will not face a quantum threat within the next 20-40 years. Before a quantum computer capable of cracking modern cryptography is built, there will be sufficient time to adopt existing post-quantum cryptographic standards.

This timeframe is based on current progress in quantum computing technology. Although giants like Google and IBM have made breakthroughs in quantum computing, it still requires thousands or even tens of thousands of stable qubits to break Bitcoin’s SHA-256 and ECDSA encryption algorithms. Current top quantum computers only have a few hundred qubits with high error rates, and practical, large-scale quantum computers are still far off.

Market analyst James Check also agrees that the quantum threat isn’t the most urgent issue. He states that when truly feasible quantum computers emerge, users will have already migrated to quantum-resistant addresses. Post-quantum cryptography standards are already in place, and Bitcoin can upgrade via soft fork to incorporate these standards, provided the community reaches consensus. The technical implementation is not the main challenge.

The real challenge lies in community coordination and handling Satoshi’s Bitcoin. If Satoshi’s address remains untouched before the quantum threat materializes, should the community agree—and be able—to freeze these addresses? There is no simple answer. This touches the core of Bitcoin’s decentralization philosophy.