Spot Bitcoin ETFs Drive Crypto Equities and Miners Rally in Early 2026

Spot bitcoin ETFs, crypto equities and miners are experiencing renewed momentum as institutional inflows signal a market recovery, lifting related stocks amid Bitcoin’s breakout above $92,000.

(Sources: Glossdoor)

This surge highlights the interconnected dynamics between spot bitcoin ETFs, crypto equities and miners, where ETF flows often precede gains in mining firms and bitcoin-treasury companies. In this analyst insight, we delve into recent developments as of January 7, 2026, exploring how spot bitcoin ETFs, crypto equities and miners are shaping crypto trends in the new year, offering key perspectives for investors tracking decentralized finance and blockchain ecosystems.

What Are Spot Bitcoin ETFs and Their Role in Crypto Markets?

Spot bitcoin ETFs provide direct exposure to Bitcoin’s price without the need for custody, making them accessible through traditional brokerage accounts and appealing to institutional investors. These funds, launched in the U.S. in January 2024, track Bitcoin’s spot price via holdings in the cryptocurrency itself, influencing market liquidity and sentiment. Recent inflows into spot bitcoin ETFs have correlated with rallies in crypto equities and miners, as seen in early 2026 data showing $697.2 million daily net additions. This mechanism amplifies blockchain adoption by bridging traditional finance with digital assets.

- Inception and Structure: U.S.-listed since 2024, holding actual Bitcoin for price tracking.

- Investor Appeal: Enables easy access via regulated exchanges without direct crypto handling.

- Market Impact: Inflows often boost Bitcoin price and related crypto equities and miners.

- Recent Milestone: Largest daily inflow since October 2025 at $697.2 million.

How Spot Bitcoin ETFs Influence Crypto Equities and Miners

Spot bitcoin ETFs act as a barometer for institutional interest, where positive flows typically precede upticks in crypto equities and miners by enhancing overall market confidence. For instance, the $1.2 billion net inflows in the first two trading days of 2026 coincided with Bitcoin’s 7% rise to near $94,000, benefiting stocks like MicroStrategy (MSTR). Crypto equities and miners, including AI-linked firms, see amplified gains as ETF demand indirectly supports mining operations through higher Bitcoin valuations. This relationship underscores how spot bitcoin ETFs can signal broader crypto trends and recovery phases.

- Flow Correlation: ETF inflows align with Bitcoin price recoveries and equity rallies.

- Equity Examples: MSTR up 3.5% amid potential Bitcoin purchase announcements.

- Miner Gains: CIFR, IREN, and HIVE extend rallies tied to Bitcoin’s breakout.

- Broader Effects: Spot bitcoin ETFs fuel sentiment in decentralized finance sectors.

Recent Performance of Crypto Equities and Miners Amid ETF Inflows

As spot bitcoin ETFs recorded their strongest inflows in months, crypto equities and miners posted notable pre-market gains, with Bitcoin pushing above $92,000 and briefly hitting $93,000. Companies like Strive (ASST) surged 12%, while miners such as MARA, RIOT, and CLSK each rose around 3-3.5%. AI-integrated miners like CIFR and IREN built on prior session advances, reflecting how spot bitcoin ETFs bolster the ecosystem. Even related assets like gold and silver rallied, influenced by global developments, highlighting interconnected market dynamics.

- Bitcoin Breakout: Above $92,000, touching $93,000 in Asian trading.

- Key Equity Moves: MSTR at $163, ASST nearing $1 with 12% gain.

- Miner Highlights: HIVE up 6%, MARA above $10 per share.

- ETF Tie-In: Inflows signaling institutional return, lifting crypto equities and miners.

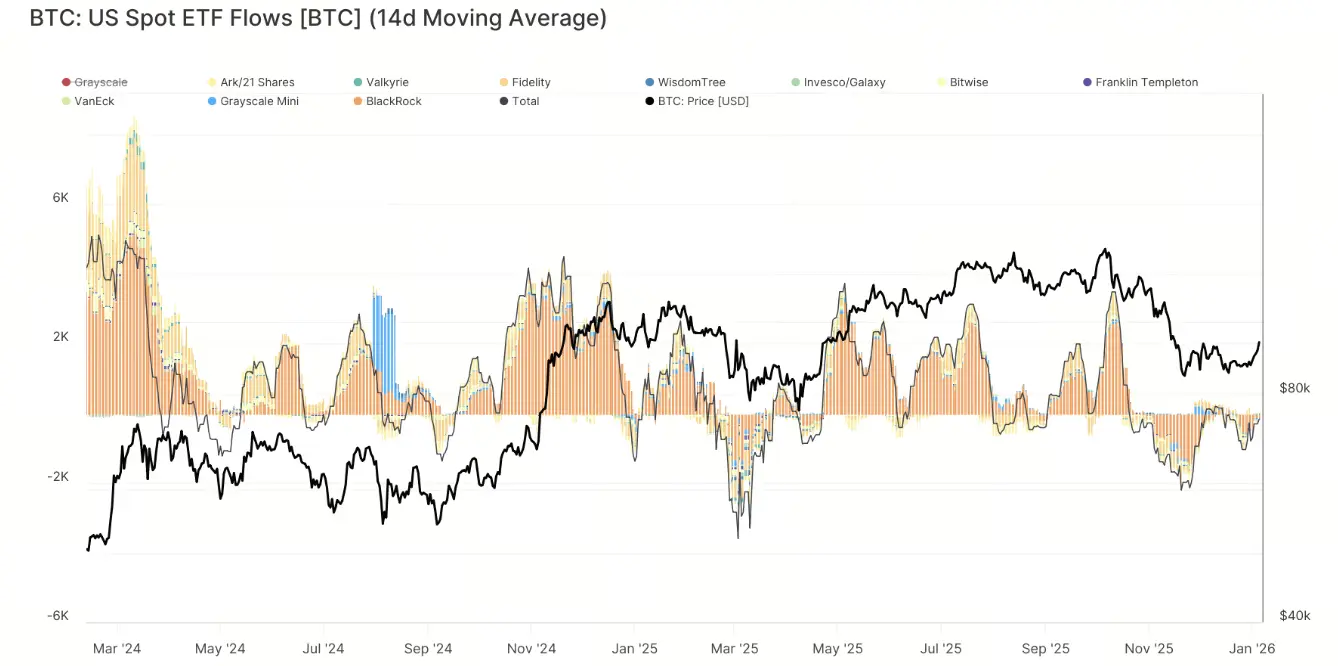

Historical Context: Spot Bitcoin ETFs and Market Bottoms

Extended outflow periods from spot bitcoin ETFs have historically marked local market lows, as evidenced by data from Glassnode showing alignments in 2024 and 2025. For example, August 2024’s yen carry trade unwind and April 2025’s tariff-related dip preceded inflows and recoveries in crypto equities and miners. The recent flip to positive flows in 2026 suggests fading capitulation, potentially setting the stage for sustained gains. This pattern reinforces the predictive power of spot bitcoin ETFs in forecasting trends for crypto equities and miners.

- Outflow Indicators: 30-day averages signal bottoms during past downturns.

- 2024 Example: Bitcoin low at $49,000 amid yen unwind.

- 2025 Case: $76,000 dip tied to tariff concerns.

- 2026 Shift: Positive inflows indicating recovery for crypto equities and miners.

Why Spot Bitcoin ETFs Matter for Crypto Equities and Miners in 2026

In a maturing blockchain landscape, spot bitcoin ETFs serve as a gateway for mainstream capital, directly impacting the valuation and performance of crypto equities and miners through enhanced liquidity and investor confidence. As of January 7, 2026, ongoing inflows amid Bitcoin’s rally underscore their role in driving decentralized finance innovation. This trend could accelerate adoption, benefiting miners with higher rewards and equities with stronger balance sheets.

In summary, spot bitcoin ETFs, crypto equities and miners are at the forefront of 2026’s early crypto resurgence, with inflows and price breakouts signaling robust institutional interest. Monitoring these interconnections provides valuable insights into broader market directions. Explore resources like official ETF filings or blockchain analytics platforms for further details, and always use secure, licensed exchanges when engaging with cryptocurrency investments.

Related Articles

XRP Price Prediction: Ripple Trades Below Key Moving Averages as the 20 Millionth Bitcoin Approaches and Pepeto Targets 267x Returns

The Origin Story of Sunny Lu: From a 100 BTC Scam to Building VeChain