Polymarket's Real Estate Markets: Turning a $400 Trillion Asset Class into Coffee-Money Bets

Polymarket’s real estate prediction markets, launched on January 5, 2026, in partnership with Parcl, transform the world’s largest asset class—global real estate worth approximately $400 trillion—into simple binary bets accessible for as little as the price of a coffee.

(Sources: Polymarket)

Users select a city, choose “up” or “down” for next-month home prices, and stake funds with potential doubling on correct predictions or total loss on incorrect ones. This analyst insight examines Polymarket’s real estate markets expansion, mechanics, early adoption challenges, parallels to past financial innovations, and deeper implications—including timing coincidences with U.S. policy signals—as of January 8, 2026.

Mechanics of Polymarket’s Real Estate Markets

Polymarket’s real estate markets leverage Parcl’s Solana-based property data protocol to create straightforward binary outcome contracts:

- Bet Structure: Choose a metropolitan area (e.g., Miami, Los Angeles, New York) and direction (price rise or fall over the next month).

- Settlement: Based on Parcl’s on-chain price indices derived from real estate data.

- Entry Cost: Minimal—often under $100 for meaningful positions.

- Payout: 2x on win; zero on loss (classic binary option).

No leverage, no perpetuals—just pure directional speculation on housing indices.

- Partner Role: Parcl provides verifiable, blockchain-tracked property price feeds.

- Accessibility: No down payments, loans, or intermediaries required.

- Risk Profile: High—full loss possible on wrong bets.

This “democratization” reduces the $400 trillion real estate market to clickable Yes/No decisions.

Early Adoption Reality for Polymarket’s Real Estate Markets

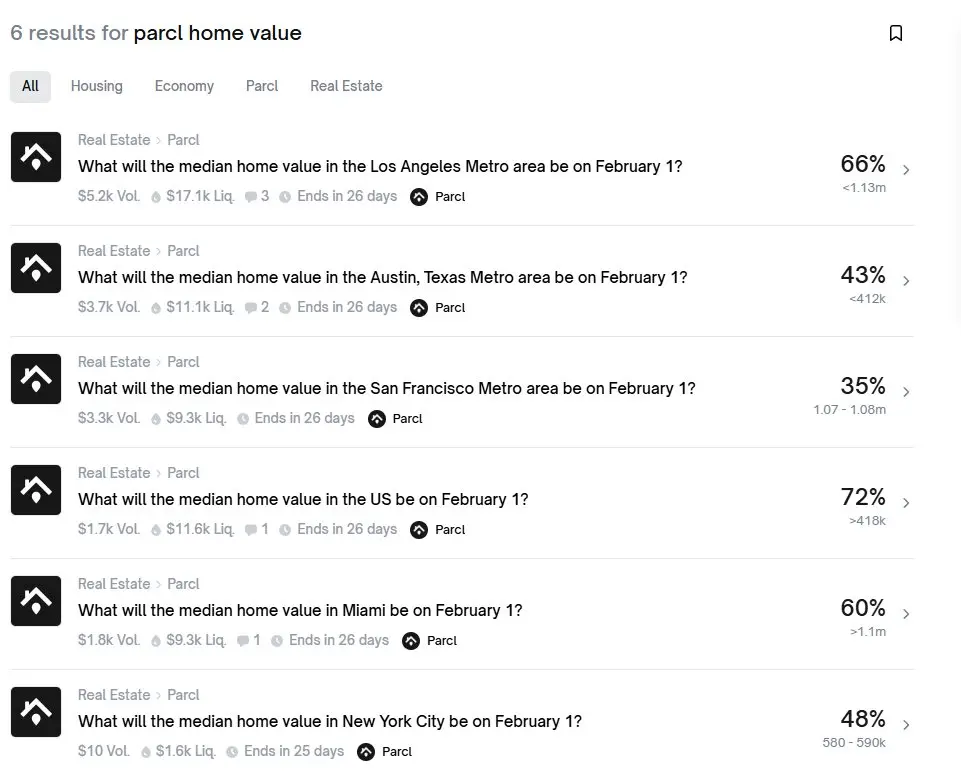

Despite hype, initial liquidity remains thin:

- Highest volume market (Los Angeles): ~$17,000 total.

- New York: ~$1,600.

- Overall two-day volume: Low double digits.

Contrast this with explosive activity in political or sports markets underscores a familiarity gap—users enthusiastically bet on elections or fights but hesitate on housing indices.

- Liquidity Challenge: Early markets dominated by small speculative positions.

- Participant Type: Likely sophisticated traders or “whale hunting grounds” rather than mass retail.

- Growth Potential: Requires education on indices and confidence in data feeds.

Parcl’s Broader Vision and Polymarket’s Real Estate Markets Fit

Parcl, backed by Dragonfly, Coinbase Ventures, and Solana Ventures (over $11 million raised), originally offered leveraged perpetuals on property indices (up to 10x). The Polymarket collaboration “downgrades” to milder binary options, broadening appeal while maintaining on-chain settlement.

- Original Product: Leveraged long/short on real estate indices.

- Polymarket Version: De-leveraged, time-bound binaries for regulatory friendliness.

- Strategic Synergy: Combines Parcl’s data depth with Polymarket’s user base.

Polymarket’s Trajectory and Valuation Context

Polymarket’s rapid category expansion—from 2024 election dominance (record volumes on Trump outcome) to 2025 UFC sports betting partnership—culminates in real estate. Valuation has soared from $1.2 billion in 2024 to nearly $9 billion amid reported ICE (NYSE parent) investment interest.

- Category Progression: Politics → Combat sports → Real estate.

- Next Possibilities: Any quantifiable outcome—divorce rates, birth rates, local business survival.

- Core Principle: If data exists, create a market.

Gambling vs. Investment: The Deeper Question in Polymarket’s Real Estate Markets

Nearly 70% of Polymarket users lose money, with profits concentrated in few wallets—a structure mirroring trading platforms. Real estate adds complexity: lagged data, seasonal noise, and index methodology debates turn bets into battles over definitions rather than pure economics.

Traditional homeownership: 30% down, 30-year mortgage, asset ownership. Polymarket version: $100 stake, one-month horizon, no ownership—just directional outcome.

- Key Distinction: One builds equity; the other is zero-sum speculation.

- Historical Echo: 2008 saw complex derivatives on housing; now retail accesses simplified versions.

Policy Timing and Structural Information Advantages

The launch coincided closely with U.S. President Trump’s statements advocating restrictions on institutional single-family home purchases—citing affordability for young buyers. Known ties (Trump family investments in Polymarket, advisory roles) fuel speculation, but deeper analysis points to structural dynamics:

Prediction markets aggregate expectations rather than create events. Housing affordability pressures—institutional buying, high rates—were already brewing policy discussions. Polymarket quantifies consensus probability.

The real concern: “Legalized information asymmetry”—those closest to policy signals gain inherent edges in pricing future outcomes, amplifying wealth gaps through compliant platforms.

In summary, Polymarket’s real estate markets distill a $400 trillion asset class into accessible, high-risk binary bets, democratizing speculation while exposing users to concentrated loss patterns. Early thin liquidity suggests education hurdles, but the model’s scalability hints at broader adoption. Beneath timing coincidences lies a more profound shift: prediction platforms as amplifiers of structural information advantages in an era of politicized economic narratives. As categories expand, participants must weigh whether they’re investing in insights—or gambling on proximity to power. Monitor volume growth and policy developments closely, using regulated tools for any engagement.