Trading Time: Non-farm Payrolls and Tariff Double Test, Has Bitcoin Already Dropped to Prepare for a Rebound to 95,000?

Daily Market Highlights and Trend Analysis, produced by PANews.

1. Market Observation

In the first week of the New Year, the A-shares market started strong, with trading volume surpassing 3 trillion yuan, marking the fifth time in history that this level has been exceeded. Meanwhile, the Shanghai Composite Index successfully broke through 4100 points. This Friday’s US December Non-Farm Payrolls report, the Supreme Court ruling on the legality of tariffs, and Saturday’s tariff decision on critical minerals (which will significantly impact Comex silver and platinum group metals prices) together constitute the main short-term market uncertainties. If tariffs are overturned, it could boost corporate profits, but concerns over fiscal deficits might pressure US Treasuries.

The precious metals market is also experiencing increased volatility. Silver prices plunged ahead of expectations for Bloomberg Commodity Index rebalancing, with about $7 billion in selling pressure. Despite this, Bawden Capital founder projects an ultra-high target of $200/oz, citing physical shortages and Chinese export restrictions. However, Citi points out that due to the US’s heavy reliance on silver imports, if tariffs are not imposed, silver prices may temporarily retreat due to metal outflows from the US. Palladium is most likely to face high tariffs, with Citi estimating rates as high as 50%.

Bitcoin rose close to $95,000 before rebounding to a low of $89,311, and is currently consolidating around $91,000. Bullish analyst cloakmk, based on weekly chart analysis, believes the long-term slow bull structure remains solid, with prices supported by trendlines. Despite short-term risks of shakeouts, the overall structure remains intact. Technical indicators show the 50-day moving average at $88,000, the 200-day at $75,000, with a golden cross still in place. Key support levels are between $85,000 and $88,000, with medium-term targets of $110,000–$130,000, and an optimistic outlook reaching $150,000. Traders Sykodelic_ and VegetaCrypto1 also hold bullish views, targeting $93,600 and $98,000–$100,000 respectively.

However, bearish and cautious opinions are also present. TaiBai suggests that if prices cannot break through resistance at $91,200–$91,500, it could be a potential shorting opportunity. AshCrypto notes a CME gap at $88,200 that remains unfilled. Trader Roman maintains a bearish target of $76,000. On the institutional side, Grayscale is optimistic about reaching new highs in the first half of 2026, while JPMorgan analyst Nikolaos Panigirtzoglou believes recent sell-offs may be nearing an end.

Ethereum after reaching nearly $3,300, has fallen back to around $3,000. Lennaert Snyder remains bearish, planning to short with a target of the monthly open at $2,970, with a stop at $3,190. He notes that only if intraday rebounds fail will short-term trades be considered. Ash Crypto states that if Ethereum, with its ETF, DeFi dominance, and deflationary mechanisms, cannot reach new highs by 2026, the altcoin bull market logic will collapse. Ethereum’s rebound from bottom levels has lagged behind Bitcoin’s double, indicating increased long-term risk for holding altcoins.

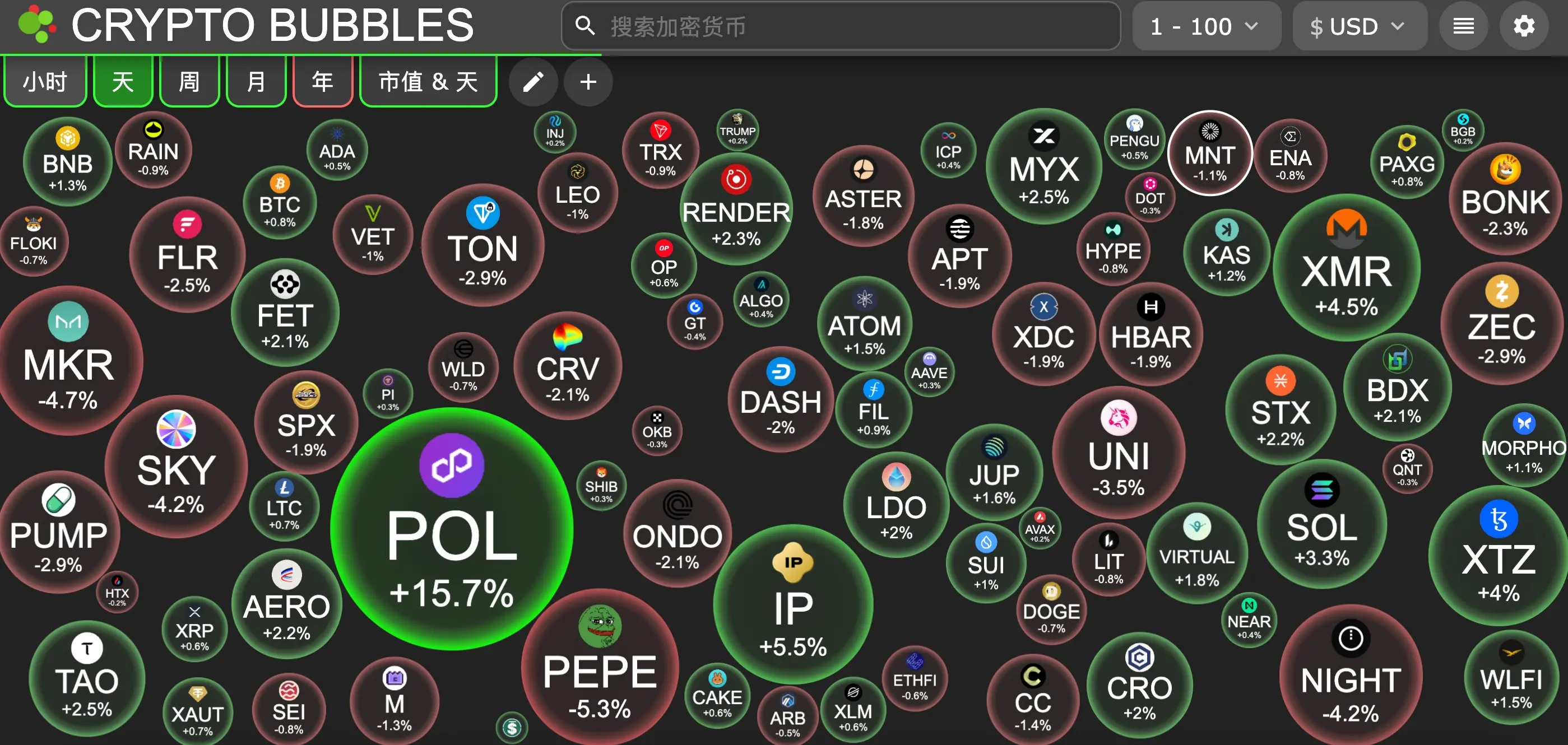

In the altcoin market, public chain projects have recently gained momentum. Solana is viewed by prominent trader Eugene as the strongest mainstream coin, targeting $160. If Bitcoin rebounds to $100,000, SOL could reach $200. Currently, SOL has rebounded above $140. Additionally, Polygon (POL) surged 15% in a day, nearing completion of its acquisition of Bitcoin ATM company Coinme (transaction value estimated between $100 million and $125 million), with a nearly 50% increase this month. Although Optimism (OP) proposed to allocate 50% of its Superchain revenue for token buybacks starting February, the price has not responded positively. The buyback strategy, including Jupiter’s $70 million JUP buyback, appears to have failed. (Related: Jupiter’s $10 million buyback “fizzled out,” what can support the token now?) Meanwhile, privacy coin Zcash (ZEC) plunged over 20% to $381 after the development team left, causing governance turmoil. Although the Zcash Foundation clarified that network operations are unaffected and the price rebounded somewhat, analysts remain bearish with targets of $200–$300. Additionally, Truebit protocol suffered an attack resulting in a loss of 8,535 ETH. According to CoinGecko, the TRU token’s price has nearly fallen to zero.

The Chinese Meme sector has revived since Binance announced the launch of “Binance Life” spot trading on January 7. On January 8, “I’m Coming” surged 400% after launching on Binance Alpha, with market cap reaching $17 million, now down to around $12 million. Related Chinese Meme tokens like “Hajime” rose over 20%. Furthermore, Yiyu’s tweet about “Mom” sparked social media attention on a similarly named token, which surged 300% within 6 hours, with a current market cap of about $1.3 million. Other Meme tokens related to “Dad,” “Son,” “Grandson,” etc., have also emerged. The intrinsic value of these Chinese Meme tokens remains highly debated within the community. (Note: Content for reference only, not investment advice, please conduct your own research.)

2. Key Data (as of 13:00 HKT, January 9)

(Source: CoinAnk, Upbit, SoSoValue, CoinMarketCap)

- Bitcoin: $90,858 (+7.8% YTD), daily spot trading volume: $42.95 billion

- Ethereum: $3,110 (+4.3% YTD), daily spot trading volume: $25.22 billion

- Fear & Greed Index: 27 (Fear)

- Average GAS: BTC: 1.75 sat/vB, ETH: 0.02 Gwei

- Market share: BTC 58.7%, ETH 12.1%

- Upbit 24-hour trading volume ranking: XRP, ETH, BTC, MED, ZKP

- 24-hour BTC long/short ratio: 49.77% / 50.23%

- Sector performance: Crypto sector broadly down, RWA sector down nearly 5%

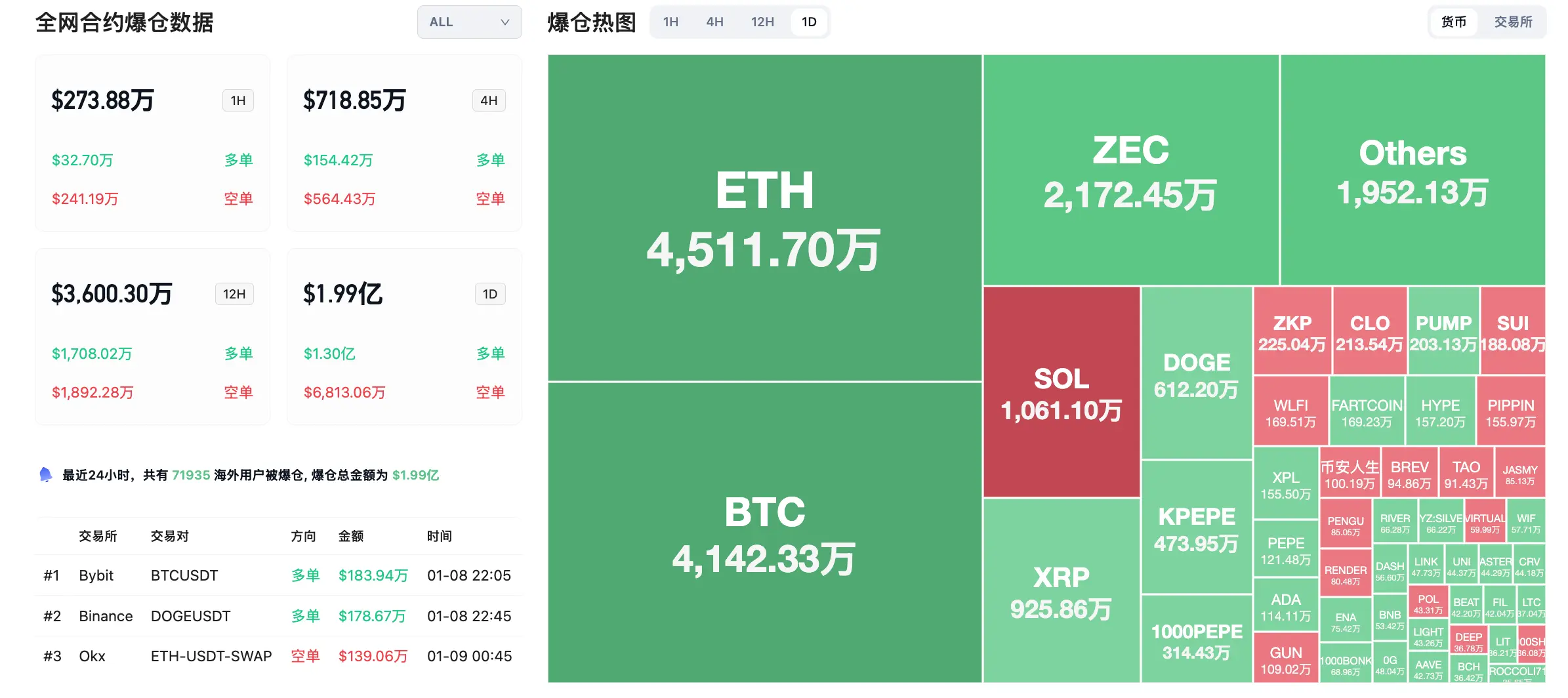

- 24-hour liquidation data: total 71,935 traders liquidated, total liquidation amount $199 million, with BTC at $41.42 million, ETH at $45.12 million, ZEC at $21.72 million

3. ETF Flows (as of January 8)

- Bitcoin ETF: -$400 million, third consecutive day of net outflows

- Ethereum ETF: -$159 million, BlackRock ETHA accounts for over 60%

- XRP ETF: +$8.72 million

- SOL ETF: +$13.64 million

4. Today’s Preview

- Binance Alpha to launch DeepNode (DN) airdrop on January 9

- Binance to delist multiple spot trading pairs including 1000SATS/FDUSD, AEVO/BTC on January 9

- US Supreme Court may rule on tariffs (January 9)

- US December unemployment rate: expected 4.5%, previous 4.6% (January 9, 21:30)

- US December non-farm payroll change: expected 6.5K, previous 6.4K (January 9, 21:30)

- US Section 232 tariff investigation results expected on January 10

- Movement (MOVE) to unlock approximately 164 million tokens at 20:00 Beijing time on January 9, representing 5.77% of circulating supply, worth about $6.1 million;

- Linea (LINEA) to unlock about 1.38 billion tokens at 19:00 Beijing time on January 10, representing 6.34% of circulating supply, worth about $9.8 million;

- Aptos (APT) to unlock about 11.31 million tokens at 10:00 Beijing time on January 11, representing 0.70% of circulating supply, worth about $21.6 million;

Top 100 cryptocurrencies by market cap with the largest gains today: POL +15.7%, Story +5.5%, Monero +4.5%, Tezos +4%, Solana +3.3%

( 5. Hot News

- Bitmine staking over 1 million ETH, accounting for a quarter of its total holdings

- Truebit experienced a security breach, over 8,500 ETH stolen

- Polygon nearing completion of acquisition of Bitcoin ATM company Coinme, transaction value estimated between $100 million and $125 million

- “Strategy counterparty” long position exceeds $200 million

- Morgan Stanley plans to launch a digital wallet this year to support tokenized assets

- Optimism proposes to allocate 50% of Superchain revenue for OP token buybacks

- CZ (Changpeng Zhao): may name the Chinese version of his memoir “Binance Life,” unrelated to Meme coins

- ZEC drops over 18% intraday after Zcash’s supporting organization ECC team collectively resigns

- PANews data: 63% of short-term markets on Polymarket had zero trading volume in 24 hours, with 505 top contracts accounting for 47% of trading volume

Related Articles

Bitcoin Bulls on Edge – the Massive $70 Million Liquidation Trap At $54,000

Vancouver City Staff Rejects Bitcoin Treasury Idea Ahead of March 10 Council Vote