The Republican Party of the United States submits the latest letter to the SEC: it will continue to defend the encryption industry

Source: decrypt.co; Compilation: Blockchain Knight

On Tuesday, Republican lawmakers on the House Financial Services Committee asked the SEC (United States Securities and Exchange Commission) to withdraw its proposed rule changing the definition of “exchange.”

In the letter, the lawmakers said the SEC’s proposed rules would “stifle innovation and harm the interests of digital asset market participants and the U.S. economy as a whole.”

The rule change, first proposed by the SEC last year, would redefine the term “exchange” in the Securities Exchange Act to mean “a system that provides variable trading benefits and communication protocols that connect buyers and sellers of securities.” ".

The Republican lawmakers argued in the letter that this definition falls outside the SEC’s purview and would “impede the growth of the digital asset ecosystem and technological innovation in the United States.”

This is not the first time Republicans have attacked the SEC for encroaching on the digital asset industry.

SEC Commissioner Hester Peirce, a Republican, has previously said the stance the SEC has taken “sends a message that we are not interested in promoting innovation and competition in financial markets, we only seek to protect existing players.”

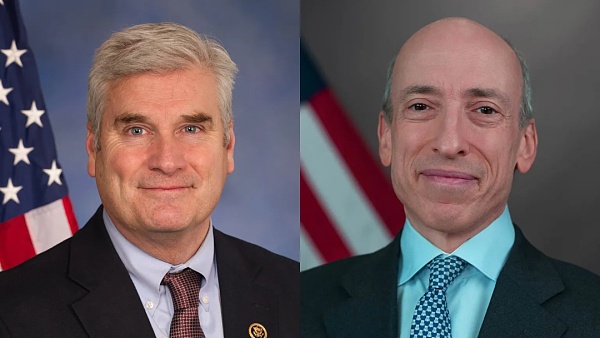

Just last month, Republican lawmakers said in a separate letter that SEC Chairman Gary Gensler is forcing the digital asset ecosystem into an inappropriate regulatory framework.

The SEC has sued a number of crypto businesses this year, including Kraken, Coinbase, Gemini, Binance, and Binance US.

Gary Gensler appears to be cracking down on all digital assets he considers to be “unregistered securities” and has filed charges against many of the associated companies as a result.

The top regulator even suggested that “the digital asset industry may not be popular in the United States at all. We don’t need more digital currencies. The current industry is based on non-compliance.”

The pointed view has been criticized by some lawmakers who say the regulator has crossed the line. Some Crypto companies have also expressed dissatisfaction with this, and they are now considering doing business in other countries.