Search results for "1INCH"

Binance Altcoin Netflow Shows Mixed Trends as Traders Shift Between Selling and Holding

Binance records large UNI and SNX inflows, showing traders are increasing exchange balances while preparing for heightened short-term activity across both assets.

Strong outflows in 1INCH, SHIB, CRV, and LINK show traders steadily removing tokens from Binance to reduce available supply and

CryptoFrontNews·2025-11-26 07:16

Data: The 1inch team withdrew 6.01 million 1INCH from Binance within 13 hours, worth 1.072 million USD.

According to Mars Finance, on-chain analyst Ai Yi monitored that in the past 13 hours, the 1inch Team Investment Fund withdrew 6.01 million 1INCH from Binance, worth 1.072 million USD, with an average withdrawal price of 0.1785 USD. Currently, they hold 16.97 million USD worth of 1INCH, but the top asset held is still ETH (26.6 million USD).

1INCH-2,05%

MarsBitNews·2025-11-23 01:59

The 1inch team withdrew 6.01 million 1INCH from Binance within 13 hours

According to Ai Yi, the 1inch Team has withdrawn 6.01 million 1INCH worth $1.072 million from Binance, with an average withdrawal price of $0.1785. Currently, the fund holds 1INCH worth $16.97 million, mainly still in ETH with $26.6 million.

1INCH-2,05%

TapChiBitcoin·2025-11-23 01:58

Decentralized Finance Fund Managers: Anonymous Gamblers in a Billion Dollar Market

The current DeFi fund manager model in implementation is an accountability vacuum, with billions of dollars of user funds managed by entities whose actions lack substantial constraints and whose failures have no real consequences. (Background: How to activate dormant DeFi capital, what is 1inch's new shared liquidity protocol Aqua?) (Additional context: Is Ripple introducing a staking feature? The CTO discusses the "dual-layer consensus model": adding a DeFi yield layer to XRP.) The current DeFi fund manager model in implementation is an accountability vacuum, with billions of dollars of user funds managed by entities whose actions lack substantial constraints and whose failures have no real consequences. The rise of DeFi fund managers Over the past year and a half, a new type of financial intermediary has emerged in the DeFi space. These entities call themselves "risk managers," "vault managers," or "strategy operators." They manage.

動區BlockTempo·2025-11-20 11:05

1inch Gives Developers Early Access to New Shared Liquidity Protocol Aqua

In brief

DeFi ecosystem 1inch has unveiled Aqua, a new shared liquidity protocol.

Aqua enables different strategies to access the same tokens, in a bid to eliminate pain points facing liquidity providers, such as the need to split or lock funds across pools.

Devs can access Aqua's software

1INCH-2,05%

Decrypt·2025-11-19 16:18

Crypto Spotlight: Bitcoin, Solana, XRP Lead Social Media Buzz

Bitcoin, Solana, and XRP lead crypto conversations due to price swings, ETFs, and big institutional moves like BlackRock and El Salvador.

Tether stays in focus as traders debate transparency, regulation, and its role in stabilizing crypto payments and market activity.

1inch and ChainLink gain

CryptoFrontNews·2025-11-19 10:02

Gate Research Institute: The main reason for this round of fall is the turnover of long-term investors | 1inch launches new protocol Aqua

Crypto market panorama

BTC (-3.19% | Current price 91,788 USDT): In the past 24 hours, the price of Bitcoin broke the momentum of stabilizing at 95,000 USD from November 15 to 17, and once again fell significantly to a low of 91,212.9 USD, with a cumulative decline of 14.2% over the past 7 days. Market sentiment has reached "extreme fear," RSI indicates overselling, and the MA5, 10, and 30 moving averages are in a bearish arrangement. The main reasons for the current decline in Bitcoin include panic selling by short-term holders, technical indicators signaling a downturn, and a shift in bearish sentiment in the prediction market. The prediction market shows that the probability of falling below 90,000 USD by the end of December has increased from 8% last week to 22%, while retail and leveraged traders often overreact to changes in the prediction market. In the short term, the oversold state and strategic buying.

GateResearch·2025-11-18 03:48

1inch launches a new liquidity protocol Aqua, allowing multiple Decentralized Finance strategies to share the same fund pool.

The DEX aggregator 1inch has launched a new liquidity protocol Aqua, allowing DeFi applications to share funds across multiple strategies without affecting user fund custody. Aqua introduces a "shared liquidity layer" where funds can be retained in user wallets, supporting various DeFi operations, and developers can access the toolkit via GitHub.

1INCH-2,05%

DeepFlowTech·2025-11-17 12:02

1inch: The Ultimate DeFi Aggregation Protocol for Optimal Crypto Swaps

1inch is the leading decentralized exchange (DEX) aggregator, revolutionizing how users trade cryptocurrencies by finding the best prices across multiple liquidity sources.

1INCH-2,05%

CryptopulseElite·2025-11-17 09:27

Binance launches 1INCH/USDC, COTI/USDC, and LSK/USDC spot trading pairs and Bots services.

According to Mars Finance, Binance will launch the 1INCH/USDC, COTI/USDC, and LSK/USDC spot trading pairs on November 18, 2025, at 16:00, and will provide Bots services for these trading pairs. In addition, ASTER/USDC and ZEC/USDC will also support spot grid and spot Dollar Cost Averaging (DCA) services. Users can enjoy Taker fee discounts on existing and newly added USDC spot and Margin Trading pairs, and specific trading permissions should comply with local laws and regulations.

MarsBitNews·2025-11-17 07:11

Data: LTC rise over 29%, GAS reaches today's new high

Mars Finance reported that the market has shown significant fluctuations recently, with LTC rising 29.12% to reach a new monthly high, and GAS rising 5.88%. 1INCH and AUCTION have seen a decline, falling 10.47% and 5.1% respectively. BAT, RAY, UNI, and ZEN have rebounded, rising 7.25%, 5.26%, 5.74%, and 29.12% respectively, while ICX has risen 5.33% to reach a new high for today.

LTC-1,12%

MarsBitNews·2025-11-15 04:17

Data: COTI falls over 25% in 24 hours, DCR rises over 24%.

According to Mars Finance news, Binance spot data shows that the market has experienced significant fluctuations. COTI has fallen by 25.81% in 24 hours, while DCR has risen by 24.37%, showing signs of a rebound after hitting a low. In addition, 1INCH, ICP, STX, ILV, and PEOPLE have all experienced a "pullback after reaching a high," with declines of 6.01%, 14%, 6.52%, 6.36%, and 5.86%, respectively.

MarsBitNews·2025-11-10 09:55

Trust Wallet Token and 1inch Show Renewed Strength as Bullish Momentum Builds

Trust Wallet Token (TWT) and 1inch (1INCH) extended their short-term recovery on Friday, signaling renewed bullish sentiment after a sharp sell-off earlier in the week. On-chain data shows growing user engagement and trading activity, while both assets continue to rebound from key technical

ICOHOIDER·2025-11-07 11:11

1INCH price surges 29% in a single day. Can the team’s $5 million buy-in hold the $0.20 support level?

On November 7, 2025, the decentralized exchange aggregator 1INCH token price surged 29%, reaching a key resistance level of $0.20. The rally was driven by a $5 million strategic purchase from the team’s fund on major centralized exchanges (CEX). On-chain data showed a surge in network activity—trade counts jumped from 1,000 to 4,800, and active addresses increased from 324 to 551. Technical indicators presented mixed signals: the MACD remained bullish, while the Money Flow Index (MFI) hit an overbought level of 82. Whether the price can sustain its breakout depends on the defense of the $0.20 level. Historical patterns indicate that similar team operations at the end of 2024 helped 1INCH rise from $0.24 to $0.53.

MarketWhisper·2025-11-07 03:35

1inch Price Surges 19% on Strong Breakout, What’s Coming Next?

The 1inch price has shown bullish momentum after breaking key resistance, with a 542% increase in trading volume indicating strong buyer interest, while active addresses have remained steady despite price changes.

1INCH-2,05%

BitcoincomNews·2025-11-06 11:31

Data: Multiple tokens are showing a rebound from the bottom, with ATM rising nearly 10%.

Mars Finance reports that the Binance Spot market shows various dynamics, including a significant rise in multiple coins such as 1INCH and ADA, demonstrating a "bottoming out and rebound" state; while ATM and BAT have shown a "high to low" trend, falling by 9.5% and 5.48%, respectively.

ATM-1,64%

MarsBitNews·2025-11-04 03:48

1inch Becomes First Major DeFi Ecosystem To Attain ISO 27001 And SOC 2 Compliance

In Brief

1inch has become the first full DeFi ecosystem to achieve ISO 27001 and SOC 2 Type 1 certifications, reinforcing its commitment to security, governance, and bridging decentralized and traditional finance.

Decentralized finance (DeFi) platform 1inch announced that it has become the firs

MpostMediaGroup·2025-10-30 08:24

1inch Unite DeFi Singapore: Key Takeaways from 2025's DeFi Summit

1inch Unite DeFi Singapore has emerged as a premier gathering for the decentralized finance (DeFi) community, bringing together over 1,000 developers, builders, and leaders to explore innovation, scalability, and real-world adoption in Web3.

CryptopulseElite·2025-10-29 08:56

1inch integrates Flowdesk to provide liquidity analysis services for Société Générale's stablecoin.

1inch announces the integration of Flowdesk to provide liquidity analysis services for the EURCV and USDCV stablecoins issued by Société Générale. Flowdesk will manage the order processing and liquidity services for these two stablecoins.

1INCH-2,05%

MarsBitNews·2025-10-22 07:52

1inch Integrates Flowdesk As Resolver For EURCV And USDCV Stablecoin Deployment

In Brief

1inch has partnered with Flowdesk to provide liquidity for Societe Generale’s MiCA-compliant EURCV and USDCV stablecoins, bridging traditional finance with decentralized finance.

Decentralized exchange (DEX) aggregator 1inch announced the integration of digital asset trading and

1INCH-2,05%

MpostMediaGroup·2025-10-22 07:12

What is Turtle Protocol? It raised $11.7 million to tackle the fragmentation of DeFi liquidity, with 13.9% of the tokens allocated for airdrop.

As the issue of liquidity fragmentation in DeFi becomes increasingly prominent, a protocol aimed at optimizing capital efficiency, the on-chain liquidity distribution protocol Turtle Protocol, is gaining market attention. What is Turtle Protocol? Essentially, it is a coordinating layer protocol that aggregates high-quality yield opportunities across protocols and cross-chain, deploying liquidity intelligently to where it is most needed. The project is headquartered in Zug, Switzerland, and as of October 2025, it has raised $11.7 million in funding. The latest round of financing, amounting to $5.5 million, attracted well-known investors such as GSR and FalconX, as well as personal investments from founders of projects like Polygon, 1inch, and Gnosis. With its unique multi-chain liquidity distribution network, Turtle Protocol is committed to addressing the long-standing issue of low capital efficiency in the DeFi space.

TURTLE-2,81%

MarketWhisper·2025-10-21 02:37

1inch Hits $500B in Volume on Ethereum — Milestone Unlocked

Key Notes

1inch Network announced it had surpassed $500 billion in all-time trading volume on the Ethereum network since its launch in 2019.

The milestone figure differs from other platforms, with DeFiLlama showing ~$235B in total volume while some Dune dashboards report over $716B.

The milesto

1INCH-2,05%

Coinspeaker·2025-10-08 13:48

Coinbase–1inch DEX Expansion Meets Meme Hype: Pudgy Penguins Dips, Brett Holds, While BullZilla R...

The search for the top meme coin in 2025 has become an obsession for crypto enthusiasts. With fortunes shifting quickly in this arena, the stakes are higher than ever. Early adopters know that the top meme coin can multiply capital faster than traditional assets, often rewriting the rules of

CryptoNewsLand·2025-10-03 20:54

1inch Rebrands To Reflect Expanded Mission Connecting DeFi And Global Finance

In Brief

1inch has rebranded with a new identity, enhanced security, and streamlined features to unify DeFi and support broader adoption across retail and institutional users.

Decentralized finance (DeFi) platform 1inch has announced a rebrand, introducing a new visual identity, updated

MpostMediaGroup·2025-10-02 13:58

Coinbase integrates 1inch Swap API into the application

Coinbase has integrated the 1inch Swap API into its app, enabling smooth non-custodial token swaps. This move marks a significant expansion into DEX, enhancing Coinbase's competitiveness in a declining spot trading market.

TapChiBitcoin·2025-10-02 02:36

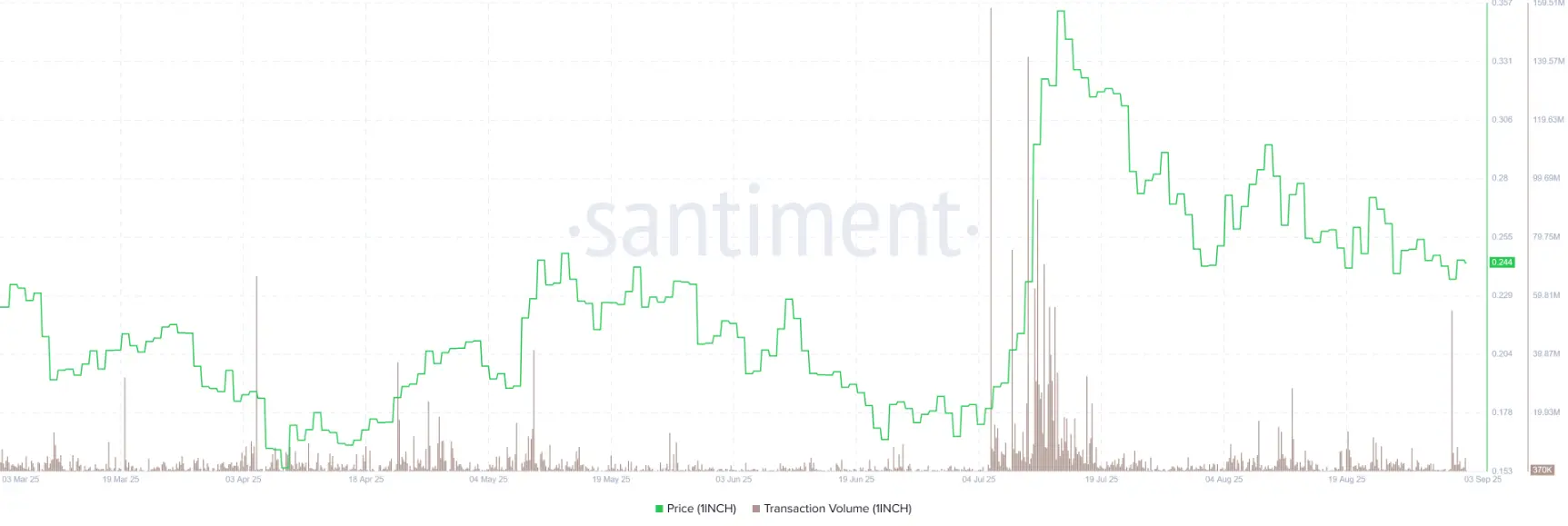

1INCH is poised for a breakout as the bullish trend begins to take shape.

The price of 1inch (1INCH) is currently in a descending wedge pattern around $0.257. A breakout could lead to bullish momentum, supported by increased trading volume and on-chain data indicating accumulation among large investors.

1INCH-2,05%

TapChiBitcoin·2025-10-01 14:05

1inch Rebrands to Reflect Broader Mission Uniting DeFi and Global Finance

1inch’s design, messaging and product strategy aim to better reflect the platform’s true scale

The 1inch SaaS model has fueled widespread adoption by Binance, Ledger, MetaMask & more

DUBAI, UAE, Oct. 1, 2025 /PRNewswire/ — 1inch, the leading DeFI ecosystem, has rebranded, unveiling its new

CaptainAltcoin·2025-10-01 03:54

Griffin AI Unveils TEA Turbo, An AI Agent Simplifying DeFi Transactions With Natural Language And Integrated Liquidity

In Brief

Griffin AI has launched TEA Turbo, an AI-powered agent on Ethereum that converts plain-language prompts into ready-to-sign DeFi transactions with integrated liquidity from Uniswap, 1inch, and Aave.

Platform focused on deploying and building AI agents for decentralized finance (DeFi), G

MpostMediaGroup·2025-09-18 13:47

OKX Wallet Partners With 1inch To Offer Gas-Free Swaps, MEV Protection, And Enhanced Liquidity

In Brief

OKX Wallet now offers secure asset management and trading with enhanced features from 1inch, including gas-free swaps, MEV protection, and deep liquidity.

Decentralized finance (DeFi) platform, 1inch announced that it has become the first third-party swap provider to relaunch on the OK

1INCH-2,05%

MpostMediaGroup·2025-09-15 09:45

1inch (1INCH): Whale strengthens accumulation, technical signals reinforce growth prospects

1inch (1INCH) has surged above 0.258 USD, breaking a symmetrical triangle pattern, indicating potential strong growth. Accumulation by large wallets reinforces this positive outlook, with price forecasts suggesting a target of 0.272 USD.

1INCH-2,05%

TapChiBitcoin·2025-09-09 14:33

Crypto Update: 1inch in Range, Prosper Loses Ground, ConstitutionDAO Trades Strong

1inch holds steady in a tight trading range with modest gains and limited volatility, signaling short-term consolidation.

Prosper weakens sharply, with market cap falling under $8M amid declining volume and uncertainty around contract upgrades.

ConstitutionDAO shows resilience, maintaining

CryptoNewsLand·2025-09-07 22:34

The Definitive Guide to Winning Web3 Hackathons

The blockchain hackathon ecosystem saw explosive growth in 2024 and continues to expand massively in 2025. This year, well-known hackathons such as ETHDenver 2025, HeDERA Africa, and Unite DeFi 2025 (in collaboration with 1inch) pushed things even further, giving builders the chance to compete for r

EDGE-2,13%

Coinpedia·2025-09-06 07:35

1INCH is poised for double-digit growth thanks to positive on-chain signals.

1inch (1INCH) is sending a promising bounce back signal, maintaining trading around the 0.243 USD mark on Wednesday afternoon and gradually approaching the important resistance zone. If it surpasses this barrier, the token could trigger a rise to the sky with a double-digit range. On-chain data also reinforces the bullish outlook.

TapChiBitcoin·2025-09-03 10:46

1inch Partners With Barter To Enhance Resolver Network And Optimize Intent-Based DeFi Trading

In Brief

1inch has partnered with Barter to enhance its resolver network, improving efficiency, trade execution, and user experience in intent-based DeFi trading.

Decentralised finance (DeFi) platform 1inch has announced a collaboration with Barter, a prominent solver, to enhance its resolver n

MpostMediaGroup·2025-09-01 15:28

1inch unlocks direct Solana–EVM swaps: goodbye to bridges, here’s how it really works

1inch has activated Solana–EVM cross‑chain swaps directly on DApp, Wallet, and Fusion+ API, connecting Solana to over 12 EVM networks without using bridges or messaging protocols. The feature is live since August 19, 2025 and, in practice, relies on chain escrow and a Dutch auction model with anti‑M

TheCryptonomist·2025-08-20 09:06

1inch (1INCH): Opportunity to bounce back after technology breakout?

1inch (1INCH) is experiencing a slight recovery around $0.246 after a drop of over 5% this week, amid recent developments enabling cross-chain swaps with Solana. However, technical indicators suggest continued bearish pressure, with potential declines toward $0.232 if resistance persists at the 200-day EMA.

1INCH-2,05%

TapChiBitcoin·2025-08-20 08:34

1inch DAO fights for revenue as delegate calls it a ‘front’ for decentralisation

1inch’s decentralised governance is under threat.

That’s according to delegates at 1inch DAO, the crypto collective behind the Ethereum decentralised exchange aggregator, who say 1inch Labs, the for-profit firm that built the protocol, is cutting the DAO off from the revenue it needs to

1INCH-2,05%

YahooFinance·2025-08-19 18:09

1inch launches native cross-chain swap service between Solana and EVM

1inch has launched a native cross-chain swap feature between Solana and over 12 EVM networks, enabling direct asset transfers without bridges. This enhances security by avoiding wrapped tokens, addressing liquidity fragmentation, and aims to connect Solana with major chains while targeting a $500 million daily trading volume.

TapChiBitcoin·2025-08-19 15:27

1inch Pioneers Solana Cross-chain Swaps, Unlocking Seamless Interoperability

1inch now enables trustless, MEV-protected cross-chain swaps between Solana and 12+ EVM networks without relying on bridges and unsafe messaging protocols.

Users and developers can access new swaps via the 1inch dApp, Wallet, and Fusion+ API for seamless DeFi interoperability.

DUBAI, UAE,

CryptoNewsLand·2025-08-19 14:34

Top 3 Altcoins to Watch in the Third Week of August 2025

Amidst Bitcoin's struggles, altcoins are influenced by external signals that may drive price movements. This article analyzes three altcoins: 1Inch, OKB, and Cyber, highlighting potential price breakouts and market sentiments to watch for in the upcoming week.

TapChiBitcoin·2025-08-18 03:06

The total market capitalization of encryption has surpassed 4 trillion USD! Whales have spent 210 million USD buying up ETH, and Arthur Hayes has simultaneously increased his investment in Ethereum ecosystem assets by 6.8 million USD.

The total market capitalization of the crypto market broke the $4 trillion mark in early Asian trading, with a 24-hour rise of 1.54%. As mainstream tokens approach historical highs, on-chain whales have initiated intensive operations: a mysterious institution spent $210 million to purchase nearly 50,000 ETH, and Arthur Hayes simultaneously increased his stake in ETH ecological assets by $6.8 million; meanwhile, a whale that had been silent for three years activated $19 million in ETH to participate in staking, while the 1inch team cashed out $8.36 million at a high position. The market presents a complex pattern of whale accumulation, on-chain staking, and profit-taking.

ETH-2,52%

MarketWhisper·2025-08-11 07:05

Important news from last night and this morning (August 10 - August 11)

SharpLink is suspected of having used the $200 million it previously raised to buy ETH.

According to on-chain analyst Yu Jin's monitoring, 10 hours ago, a new wallet withdrew 52,809 ETH (200 million USD) from Coinbase Prime, and then distributed it to 8 wallets for Ethereum staking, one of which is a known address of SharpLink (SBET). SharpLink raised 200 million USD by selling stocks last Friday, so it is likely that they converted these funds into ETH over the weekend. If the speculation is correct, SharpLink (SBET) currently holds 621,000 ETH, worth 2.65 billion USD. The average purchase price is approximately 3,226 USD.

1inch team investment fund sold part of E

ETH-2,52%

PANews·2025-08-11 02:38

1inch (1INCH) price prediction: after a pullback of over 40%, retesting key support, on-chain indicators suggest a potential rebound.

1INCH experienced a 40.7% Depth pullback from $0.391 to $0.232 between mid-July and early August. However, although the technical indicators still appear weak, 1INCH is retesting the $0.24 support area converted from the May resistance level. On-chain data shows an enhanced accumulation trend, and investors can follow potential reversal opportunities.

1INCH-2,05%

MarketWhisper·2025-08-04 07:26

1INCH plummet over 40% from the local peak: Is a buying opportunity opening up?

1inch (1INCH) is in a downward trend with weakening momentum but may have established a local bottom, preparing for a potential short-term rebound. Despite bearish dominance, indicators suggest a possible accumulation phase, raising hopes for a price reversal.

1INCH-2,05%

TapChiBitcoin·2025-08-04 00:30

Carbontec Uncovers $520,000 Exploit Path in 1inch Router’s Rescue Function

Carbontec's investigation revealed a serious design flaw in 1inch's Aggregation Router, allowing over $520,000 in mis-sent tokens to be withdrawn by anyone, not just the contract owner, highlighting a systemic security issue in DeFi protocols.

1INCH-2,05%

Coinpedia·2025-07-15 17:16

Is the 1inch team becoming swing trading experts? The next time they trade Spot, will they make a guaranteed profit?

The 1inch team achieves profits in the crypto market through a low buy high sell strategy. They are proficient in Decentralized Finance mechanisms and know how to seize opportunities amid market fluctuations. Recently, they made large-scale purchases of their own Token 1INCH and successfully profited, demonstrating excellent execution and market insight. This provides important insights for retail investors: successful trading comes from strategy and patience, not blind chasing.

1INCH-2,05%

DeepFlowTech·2025-07-15 09:08

Is the 1inch team becoming swing trading experts? They are bound to make profits without losses in the next spot trading.

The 1inch team has demonstrated exceptional trading skills in the crypto market through a strategy of buying low and selling high. With a deep understanding of DeFi mechanisms and counter-cyclical operations, they have achieved considerable gains amid market fluctuations, reminding retail investors that pursuing success should focus on execution rather than blindly chasing.

1INCH-2,05%

ForesightNews·2025-07-15 02:30

Whale's Major Action: Before the release of the US CPI, top wallets increased their holdings of 1INCH, LINK, and CRV.

As Bitcoin (BTC) prices hover near historical highs, mid-sized altcoins are attracting the attention of top crypto wallets. In the past seven days, tokens such as 1inch (1INCH), Chainlink (LINK), and Curve (CRV) have seen new highs in open interest, with increases in investor balances and outflows from exchanges serving as clear evidence. Below are the trends of these funds and their potential impacts.

MarketWhisper·2025-07-15 01:33

SafePal and 1inch to Give Away Hardware Wallets to Boost DeFi Security

SafePal and 1inch are giving away 300 co-branded hardware wallets to reward active DeFi users, focusing on genuine engagement and reinforcing security practices, amid rising interest in decentralized exchanges.

YahooFinance·2025-07-14 12:28

Load More