Search results for "EMPIRE"

Prince Group Chen Zhi: From Net Cafe Dropout to Billion-Dollar Fraud Empire – The Dramatic Fall in 2026

Prince Group Chen Zhi, the enigmatic founder and chairman of Cambodia's Prince Group, was arrested in Cambodia and extradited to China on January 7, 2026, marking the collapse of one of Southeast Asia's most notorious alleged fraud networks.

BTC-0,19%

CryptopulseElite·14h ago

Prince Group founder Chen Zhi has been arrested; after embezzling 127,000 BTC, he will be extradited to China for trial.

Cambodian Prince Group founder Chen Zhi was extradited back to China, with the United States seizing $15 billion in Bitcoin, igniting new tensions in the crypto market and geopolitical landscape

(Previous background: Prince Group statement responding to $15 billion Bitcoin illicit funds: Founder Chen Zhi was framed, and one day his innocence will be proven)

(Additional background: Timeline> The process of Prince Group Chen Zhi being "hacked" by the U.S. government to seize 127,000 Bitcoins! Perhaps the truth will never be known)

On the 6th, Chen Zhi, founder of the Prince Group in Cambodia, was handcuffed by Chinese police at Phnom Penh Airport and immediately escorted on a special flight back to China. The 38-year-old entrepreneur, regarded by the outside world as "Cambodia's richest man," maintained a calm exterior during the extradition; however, alongside him, there was also the final illusion of a cryptocurrency scam network spanning five continents with over a hundred billion dollars in assets.

Extradition concludes, crypto empire collapses

The U.S. Department of Justice took the most unprecedented action last year

BTC-0,19%

動區BlockTempo·14h ago

Trump Family Crypto Empire Expands Again: World Liberty Financial Applies for National Bank License to Target Stablecoin Dominance

The crypto company World Liberty Financial, deeply supported by the family of U.S. President Donald Trump, has officially submitted an application for a national bank trust license to the U.S. Office of the Comptroller of the Currency, aiming to establish "World Liberty Trust" to unify its stablecoin USD1 issuance, custody, and redemption operations.

If approved, this move will be a key infiltration of the rapidly expanding crypto landscape by the Trump family into the core of the traditional financial system. Its stablecoin USD1 has already surged to a market cap of approximately $3 billion. The application comes after the appointment of the new OCC Director by the Trump administration and the signing of the GENIUS Act, marking a significant shift in U.S. crypto regulatory policy and paving the way for other crypto companies to obtain federal licenses.

MarketWhisper·19h ago

Prince Group's Chen Zhi Arrested and Extradited to China! 14 Billion Bitcoin Scam Empire Collapses

Prince Group founder Chen Zhi was arrested in Cambodia and deported to China. The United States accused him of orchestrating a scam, seizing $14 billion in Bitcoin, the largest case in history. Singapore froze 150 million SGD, Taiwan confiscated 4.5 billion TWD, and Hong Kong froze HKD 2.75 billion. Cambodian Prime Minister Hun Sen quickly distanced himself. Chen Zhi, 37 years old, previously held the title of Duke and served as a government advisor.

MarketWhisper·20h ago

Qianhai patrol officer receives 18,000 Tether coins and is accused of espionage, selling secrets at a low price, sentenced to 7 years in August

Qianhai Coast Guard member received 18,500 USDT to leak secrets to China; Kaohsiung High Branch Court sentences him to 7 years and 8 months in August.

(Background summary: Tether trading leads to death! A 25-year-old crypto trader was robbed of hundreds of thousands and died after a "flying tackle" to block the car; 7 villains face consequences)

(Additional background: Tether Golden Empire: Tether's "Borderless Central Bank" ambitions and cracks)

On the 6th, Kaohsiung High Branch Court sentenced a national security leak case: Coast Guard officer Li from the Southern Mobile Coast Guard Team was sentenced to 7 years and 8 months for providing maritime defense deployment information to Chinese intelligence personnel, under the National Security Law. He did not accept traditional cash bribes but used Tether USDT for settlement.

18,522 USDT as spy remuneration

According to court investigations, Li was in debt due to investment losses and was targeted at the end of 2022 by a Chinese intelligence agent named Tony. The other party made a clear offer

動區BlockTempo·01-07 08:30

The "Most Powerful Brain" behind the Venezuela incident? An article guiding you through the AI intelligence empire—Palantir

Author: Shutu Blockchain

In the past two days, global public opinion has been buzzing about a blockbuster news story "comparable to a Hollywood movie": the United States launched a lightning-fast operation against Venezuela, "precisely locking onto" President Maduro overnight, and completed the control of the regime and the takeover of key oil and gas assets in a very short period.

Although the details of this operation remain uncertain, one name has been frequently mentioned in the finance and tech circles: Palantir — a company whose stock price has skyrocketed nearly 20 times in two and a half years, crowned as the "AI Intelligence Empire" for its data integration and AI decision-making capabilities, and regarded by many as the most powerful digital brain behind such "seamless operations."

What's even more interesting is that beyond traditional military and government intelligence, Palantir has quietly become one of the "data and compliance infrastructure providers" in the crypto industry over the past two years — providing services to exchanges, custodians

PANews·01-06 03:37

The trillion-dollar IPO myth will unfold in 2026, but the "small unicorns" have already collapsed

The past 2025 has showcased an unprecedented "Tech Ice and Fire Show" in the capital markets.

On one side are the newly listed tech giants, whose stock prices have plummeted like a kite with a broken string. Once hot star companies have seen their market values evaporate by billions of dollars within months, with some cases experiencing declines of over 50%. The market's "coldness" has quickly spread, causing many star companies planning to go public to become fearful and repeatedly postpone their IPO plans.

On the other side, the "hot pursuit" of capital is burning fiercely.

A brand-new "Trillion-Dollar Club" is gathering outside the gates of the capital market. From Elon Musk's space empire SpaceX to Sam Altman's OpenAI, and the emerging giants like Anthropic, they are preparing with valuations often reaching hundreds of billions or even trillions, gearing up for the next wave of technological advancement.

PANews·01-06 01:30

Maduro is sanctioned, and Venezuela's legendary "60 billion in Bitcoin" has the US swallowed?

With the dramatic change in Venezuela's political situation, Maduro was detained by the US military, and the shadow reserves of Bitcoin worth up to $60 billion have become a mystery. These crypto assets accumulated through gold swaps and oil transactions—who actually controls them? Who holds the key private keys? This article is based on "Maduro's 'Lightning Strike' by the United States: Where Will Venezuela's 'Legendary $60 Billion Bitcoin' Go?" by Ye Huiwen from Wall Street Insights, reorganized by律動.

(Previous summary: Data: Predictive market 'spoils' Maduro's fall with $10 million in advance)

(Background supplement: US lawmakers propose legislation to ban government officials from insider trading in prediction markets! Polymarket suspected of leaks in Maduro arrest plan)

Table of Contents

Digital Assets of the Shadow Financial Empire

Gold Swap and Crypto Channels

The Role of Key Figure Alex Saab

Crude Oil

動區BlockTempo·01-04 07:40

Elon Musk boasts: Crush all opponents in 5 years! xAI invests billions to build supercomputing empire

Elon Musk announced on Twitter: xAI will have more AI computing power than all its competitors combined within 5 years, including Google, OpenAI, Meta, and Microsoft. xAI's valuation skyrocketed to $200 billion, with Middle Eastern investors entering the scene, and Musk can even leverage Tesla and SpaceX for fundraising. The Colossus supercomputing center supports its computing ambitions, with hundreds of thousands of GPUs and billions of dollars being invested.

MarketWhisper·01-04 06:15

Trump's Crypto Empire Fully Revealed! DAT Company Raises $20 Billion in a Frenzy, Concealing Deadly Risks

Trump claims to be the first crypto president, ending regulatory crackdown and launching TRUMP meme coin. Under his policy endorsement, over 250 publicly listed companies have started accumulating cryptocurrencies, and these DAT (Digital Asset Vault) companies have planned to borrow over $20 billion. However, the October flash crash led to the liquidation of $19 billion in leveraged bets, affecting 1.6 million traders, with some companies' stock prices plunging over 80%.

MarketWhisper·01-04 03:50

United States, swallowing Venezuela's oil... The birth of an "energy empire" and Bitcoin's counterattack

In the New Year of 2026, the U.S. military arrested Venezuelan President Maduro, triggering a major shift in the global energy landscape. The United States controls 18% of the world's crude oil, forming a powerful "energy fortress." This event marks the end of the "petrodollar" era and the beginning of the "AI dominance" era. At the same time, Bitcoin is gaining attention due to its decentralized nature and has become a safe asset to counter U.S. hegemony. Global capital faces a dilemma, and how to protect assets has become crucial.

BTC-0,19%

TechubNews·01-03 21:33

Expert Says XRP Haters Are Are So Close to Being Right— But They’re Miss One Crucial Piece

A crypto analyst has rebutted claims that Ripple uses XRP as a cash machine to build a conventional fintech empire.

“Critics Misread Ripple’s Strategy”

Notably, these accusations typically resurface whenever Ripple announces new acquisitions, such as Hidden Road (now Ripple Prime) and Rail. Criti

XRP-2,29%

TheCryptoBasic·01-01 06:05

Dogecoin Price Prediction December 2026: Metaplanet Builds $3 Billion Bitcoin Empire as DeepSnitch AI Nears $1 Million Milestone Ahead of January Launch

Although the Dogecoin price prediction is clouded by bearish sentiment, corporate giants are executing sophisticated strategies to dominate the market. Tokyo-listed firm Metaplanet added another 4,279 Bitcoin to its treasury, bringing its total stack to a staggering 35,102 BTC worth around $3

CaptainAltcoin·2025-12-31 18:37

Trump's Financial Empire Expands! Truth Social ETF Listing Behind $6 Billion Fusion Merger and Acquisition

Trump Media's Truth.Fi launches the first batch of five Truth Social ETFs on the New York Stock Exchange, including Defense (TSSD), Frontier Technology (TSFN), American Idol (TSIC), Energy (TSES), and Red State Real Estate (TSRS). Focused on American manufacturing companies. On December 18, announced a $6 billion merger with nuclear fusion company TAE, paving the way for ETF launches.

ETH-1,09%

MarketWhisper·2025-12-31 02:07

Jensen Huang: How to Spend $60 Billion? A Complete Record of Buying from Groq to Intel

NVIDIA's market capitalization approaches 5 trillion USD, Jensen Huang holds 60.6 billion USD in cash and is aggressively acquiring AI ecosystems. In December, they reached a 20 billion USD agreement to acquire Groq, committed to investing 100 billion USD in OpenAI, invested 5 billion USD in Intel to turn rivals into allies, invested 2 billion USD in Xilinx, and 1 billion USD in Nokia, building a technological empire.

MarketWhisper·2025-12-30 08:51

Real estate tycoon Grant Cardone announces building a Bitcoin real estate empire: continuous free cash flow to buy BTC

Real estate investor Grant Cardone plans to establish the world's largest Bitcoin real estate company by 2026, continuously using cash flows such as rent and depreciation to buy Bitcoin. His strategy is to use income from rent and other sources to support Bitcoin investments and aims to bring this business model to market.

動區BlockTempo·2025-12-30 04:25

The biggest black swan in the crypto world in 2026! MicroStrategy's 45 billion empire faces collapse pressure

MicroStrategy holds 671,268 Bitcoins with a market value of $45 billion but has $60 billion in BTC assets, resulting in a $15 billion valuation discount. Carrying $8.2 billion in debt and $7.5 billion in preferred stock, with annual fixed expenses of $779 million. If Bitcoin falls below $13,000, the company will go bankrupt, and the selling pressure from 6.7 million BTC could trigger a black swan event more severe than FTX.

BTC-0,19%

MarketWhisper·2025-12-30 02:34

Maximilian Schmidt Shiny Flakes: Real Story Behind Netflix Documentary

Maximilian Schmidt built drug empire "Shiny Flakes" from his bedroom using Bitcoin. Arrested in 2015, Maximilian Schmidt shiny flakes ran another operation from prison, earning 4.5 more years. Netflix documented his story.

IN-4,1%

MarketWhisper·2025-12-29 08:42

The Rise and Fall of FTX’s Ryan Salame: From Crypto Power Broker to Federal Inmate

Ryan Salame, once a powerful co-CEO of FTX’s Bahamian subsidiary, now serves a 90-month sentence at FCI Cumberland, marking a stunning personal and legal collapse. His journey from a traditional finance background at Circle to the pinnacle of Sam Bankman-Fried’s inner circle—and finally to federal prison—encapsulates the hubris, regulatory neglect, and illicit political maneuvering that doomed the FTX empire. Salame’s guilty plea to operating an unlicensed money-transmitting business and orchest

POWER-0,04%

MarketWhisper·2025-12-29 07:43

Inversion CEO Says He’s More Bullish on XRP Than ETH, Insists Ripple Is a Force Not to Be Reckoned With

The CEO and founder of Inversion recently admitted that he is more bullish on XRP than Ethereum, insisting that Ripple is a force to be reckoned with.

During a recent episode of the Empire podcast, host Jason Yanowitz spoke with Santiago Roel Santos, founder and CEO of Inversion, and Rob Hadick,

TheCryptoBasic·2025-12-27 14:17

"Doubao" daily active users surpass 100 million! ByteDance's most cost-effective blockbuster threatens the advertising empire

ByteDance's AI application Doubao's daily active users (DAU) surpassed 100 million, becoming another hundred-million-level product after Douyin. An insider revealed that Doubao has the lowest promotional costs among the company's products that have broken 100 million DAU, mainly driven by user organic sharing and content popularity. The three-grid and other P-picture gameplay continuously topped trending searches, generating millions of organic downloads daily. Doubao is also rapidly expanding across multiple scenarios such as AI+hardware, and will participate in CCTV Spring Festival Gala interactive collaboration in 2026.

MarketWhisper·2025-12-25 05:44

BlackRock's Cryptocurrency Ambitions Fully Unveiled: How Bitcoin and Ethereum ETFs Are Reshaping the Trillion-Dollar Asset Management Empire with Digital Assets

BlackRock, the world's largest asset management company, is ramping up its crypto assets efforts with unprecedented intensity, and its strategy goes far beyond the highly successful Bitcoin and Ethereum spot ETFs. The company has recently launched global recruitment in New York, London, and Singapore to build comprehensive digital asset and tokenization capabilities, marking a shift from being a passive product provider to an active participant in constructing the crypto market infrastructure. Although traditional ETF businesses face fee pressure, BlackRock aims to open new growth avenues by integrating crypto assets with its core technology platform Aladdin and expanding into higher-fee private markets. Market analysis suggests that its long-term narrative depends on whether it can successfully attract the massive capital of traditional institutions into the crypto space and reshape its profit model in the process.

MarketWhisper·2025-12-25 04:05

Google Parent Alphabet to Buy Intersect Power for $4.75B to Fuel AI Data Center Expansion

Alphabet Inc. has agreed to acquire clean energy developer Intersect Power LLC for $4.75 billion in cash, plus existing debt, as the Google parent races to secure reliable electricity for its rapidly expanding artificial intelligence (AI) data center empire, Bloomberg reported.

Alphabet Snaps up I

BTC-0,19%

Coinpedia·2025-12-23 18:36

Earn 250 million dollars a year! How did Joe Rogan create the world's largest podcast, and even Luo Yonghao is learning from him?

American podcast host Joe Rogan has built a media empire with annual revenues of $250 million through "The Joe Rogan Experience," with episode view counts reaching 50 million. From Elon Musk smoking marijuana to Trump’s campaign rallies, this long-form conversation show that "talks about anything" is redefining the boundaries of media influence.

(Previous Summary: Huang Renxun also praised! What makes "Acquired" a must-listen podcast for Silicon Valley and Wall Street elites?)

(Background information: Trump's full victory speech: I love Musk, he is a superstar, make America great again)

Table of Contents

From comedian to podcast king, the show's value is $250 million

Podcast Chat, Precise Campaigning: Trump's Three Hours

China Mirror: The Attempts of Luo Yonghao and Others

Controversy and

動區BlockTempo·2025-12-23 11:21

The migration path of Binance's stablecoin landscape

Author: danny; Source: X, @agintender

In the world of cryptocurrency, what truly determines victory or defeat is never the code, but the game of liquidity, power, and regulation. The rise and fall of BUSD is not a tragic tale of a stablecoin, but a financial war about how exchanges attempt to "unify the world."

When BUSD was pushed onto the historical stage, it carried not only a narrative of compliance, but also Binance's ambition to reshape the stablecoin order through high-pressure tactics — by enforcing exchange rates and merging trading pairs, directly swallowing the depth of its competitors into its own ledger.

The "automatic conversion" of 2022 was a textbook-level blitzkrieg; while the regulatory iron fist of Valentine's Day 2023 caused this seemingly impeccable empire to collapse in an instant. The dual nature of BUSD, the shadow-like Binance-Peg, and the misalignment of regulatory boundaries together constitute its downfall.

金色财经_·2025-12-22 02:38

Binance Hegemony Rise and Fall: From BUSD's "Unified" Approach to $U's "Conquest" in the Stablecoin War

In the crypto world, what truly determines victory or defeat is never the code, but the game of liquidity, power, and regulation. The rise and fall of BUSD is not just a tragic story of a stablecoin, but a financial war over how exchanges attempt to "unify the world."

When BUSD was brought onto the stage of history, it carried not only a compliance narrative but also Binance's ambition to reshape the stablecoin order through heavy-handed tactics—by enforcing exchange rates and merging trading pairs, directly swallowing competitors' depth into its own ledger.

The 2022 "automatic conversion" was a textbook-level blitzkrieg; meanwhile, the regulatory iron fist on Valentine's Day 2023 caused this seemingly invincible empire to collapse in an instant. The twin BUSD, the shadow-like Binance-Peg, and the misalignment of regulatory boundaries together form its Achilles' heel.

But the story is not over yet.

From FDUSD

FDUSD-0,01%

PANews·2025-12-19 12:08

US version of TikTok officially sold: Oracle and two other major US capital groups take control, ByteDance retains the core, did Trump win?

TikTok's parent company ByteDance has sold over 80% of its US assets, retaining approximately 19.9% of the shares. US-based alliances such as Oracle, Silver Lake Capital, and MGX supported by the UAE hold 50%.

(Background recap: "The Best Life of Post-00s on Earth" — Trump's youngest son, 19 years old, made $150 million from crypto and is now recommended to join TikTok's board)

(Additional background: The birth of the strongest e-commerce ever? Amazon joins TikTok's US bidding, creating a complete online + offline empire)

Table of Contents

Transaction Structure: Formal "US Control," Actual Profit Sharing

Algorithm Black Box: Data Locked in the US, Logic Still in Beijing

Legal Boundaries and Subsequent Variables

According to reports, TikTok CEO Zhou Shouzi told employees on the 18th that the parent company ByteDance has sold over 80%

動區BlockTempo·2025-12-19 08:24

New York Times: What Trump is hiding behind embracing Crypto

A series of crypto companies breaking industry boundaries have gone public, attracting investors and simultaneously pushing market risks to high levels. Over 250 listed companies are accumulating cryptocurrencies, with leveraged borrowing expanding. Deregulation and the Trump family’s business empire are intertwined, transmitting crypto market risks throughout the entire financial system. This article is based on a piece by The New York Times, compiled, edited, and written by Foresight News.

(Previous summary: Trump ventures into clean energy! TMTG announces full stock merger with TAE Technologies to create a "nuclear power plant," DJT jumps 22%)

(Additional background: The most money-raising US president in history, how the Trump family turns political influence into their own treasury)

Table of Contents

Capital Frenzy: An Out-of-Control Crypto Gamble

Flash Crash Horror:

TRUMP0,09%

動區BlockTempo·2025-12-18 13:15

The most money-grabbing president in history! The Trump family’s $3.4 billion wealth accumulation methods fully revealed

After the Trump family returned to the White House, they amassed wealth through various channels such as cryptocurrencies, foreign investments, and policy exchanges, reaching an unprecedented scale in American history. Since 2016, the Trump family has profited $3.4 billion from activities related to the presidency, with over $1.8 billion in 2025 alone. The core strategy of the Trump family is to monetize political influence: Donald Trump Jr., Eric, and Barron each play their roles, building a vast business empire spanning cryptocurrencies and real estate.

MarketWhisper·2025-12-17 03:29

Anchorage acquires Hedgey for a complete layout! Building a token empire from custody to TGE

Anchorage Digital announced this week the acquisition of Hedgey, a startup specializing in token equity structure management. This is the second acquisition Anchorage has completed in three days. On Monday, Anchorage just acquired Securitize's wealth management division, and now Hedgey's token allocation, distribution, and ownership management technology are also integrated.

MarketWhisper·2025-12-17 01:34

Gate CEO Dr. Han Documentary: Fully Betting on Web3, The Secrets of the 46 Million User Empire

Gate releases the documentary "Behind Gate: Dr. Han," which systematically captures the authentic moments and forward-looking insights of founder and CEO Dr. Han during his work schedule for the first time. The film is shot in multiple locations across Hong Kong. Dr. Han explains Gate's core strategy, emphasizing the commitment to "All in Web3" and continuously advancing localized and compliant platform development.

ETH-1,09%

MarketWhisper·2025-12-16 05:02

Evening Must-Read 5 Articles | The Future of the U.S. Economy Amid Inflation Fission

1. Not Just a Quick Purchase of Juventus: The $15 Billion Annual Profits of the Tether Empire

On December 12, 2025, Tether announced plans to acquire Italian football club Juventus FC entirely. Tether submitted a full cash mandatory bid to its controlling shareholder Exor to purchase 65.4% of its shares and is prepared to launch a public tender offer for the remaining shares after the transaction is completed, aiming to increase its stake to 100%. However, EXOR Group rejected Tether's proposal to acquire Juventus shares, reaffirming no intention to sell Juventus shares. Click to read

2. US SEC Hands-On Guide to Crypto Asset Custody

The US SEC Investor Education and Assistance Office issued this investor notice to help retail investors understand how to hold crypto assets. This notice outlines the types of crypto asset custody

金色财经_·2025-12-15 11:50

a16z Leaves the US: The Dusk of the VC Empire and the Rise of a New King

Author: Anita

On December 10, 2025, a16z Crypto announced the opening of an office in Seoul. The press release described it as an "offensive," but upon closer inspection, seeing a16z's heavy reliance on liquidity exits and the surge in regulatory liabilities, it becomes clear that this might be a form of "escape" for a16z.

U.S. long-arm jurisdiction has cornered the Crypto industry.

PANews·2025-12-15 11:10

Trump withdraws from 33% of Crypto cases! The New York Times reveals that half of the defendants have made donations or business dealings

The New York Times investigation reports that the Trump administration rejected 33% of cryptocurrency cases during the Biden era, far above the 4% average in other industries. Of the 14 cryptocurrency investigations that were overturned, more than half of the defendants had close ties with the government, including political donations or business dealings with Trump's large cryptocurrency empire. SEC Commissioner Hester Peirce defended the overturning decisions, stating that these decisions should not have been made in the first place.

MarketWhisper·2025-12-15 05:20

OpenAI releases GPT-5.2! Aiming to replace professionals, with even fewer hallucinations; API fee overview

OpenAI this morning unexpectedly released GPT-5.2, directly targeting real-world professional applications and clashing head-on with Google Gemini 3.

(Background summary: ChatGPT will support PayPal direct payments in 2026, the final piece of OpenAI's e-commerce empire)

(Additional background: OpenAI's native browser "ChatGPT Atlas" with three major features—can AI agents shake up Chrome dominance?)

Table of Contents

New model focuses on "economic value"

Release rhythm signals "red alert"

Long texts and agents, a paradigm shift in development ecology

Computing power costs

O

penAI on the 12th unexpectedly launched its flagship model GPT-5.2, and the market is positioning this update as a response to G

動區BlockTempo·2025-12-12 03:25

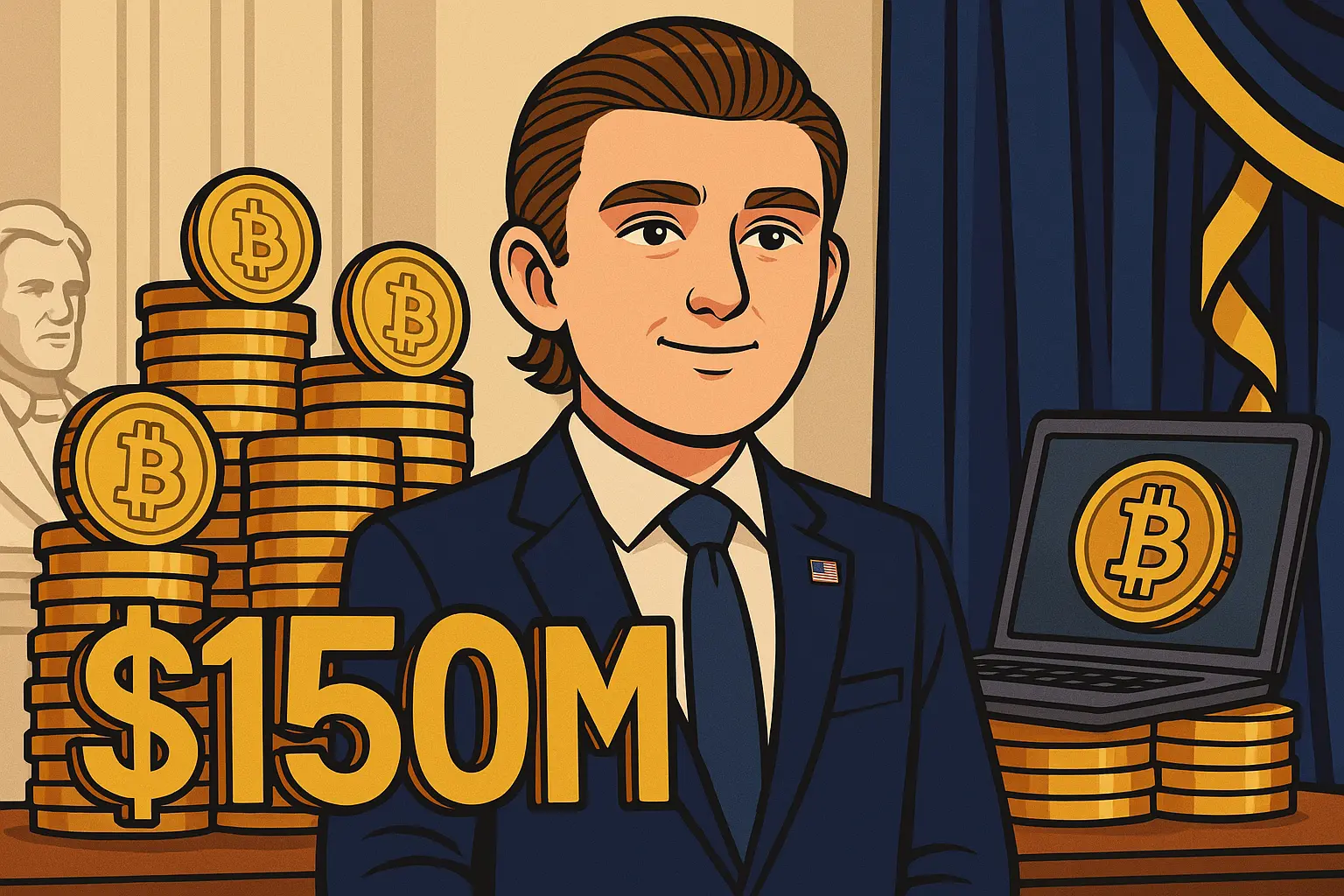

19-year-old Barron Trump has a net worth of $150 million! Trump family crypto empire profits revealed

Baron Trump is the co-founder of WLFI and a "DeFi Visionary." This 19-year-old college student is believed to have a net worth of around $150 million. His brother Eric Trump and little Donald Trump became co-owners of American Bitcoin, acquiring a 20% stake in the company. This Trump-related project has launched multiple family brand Meme coins, generating over $400 million in revenue.

MarketWhisper·2025-12-12 02:50

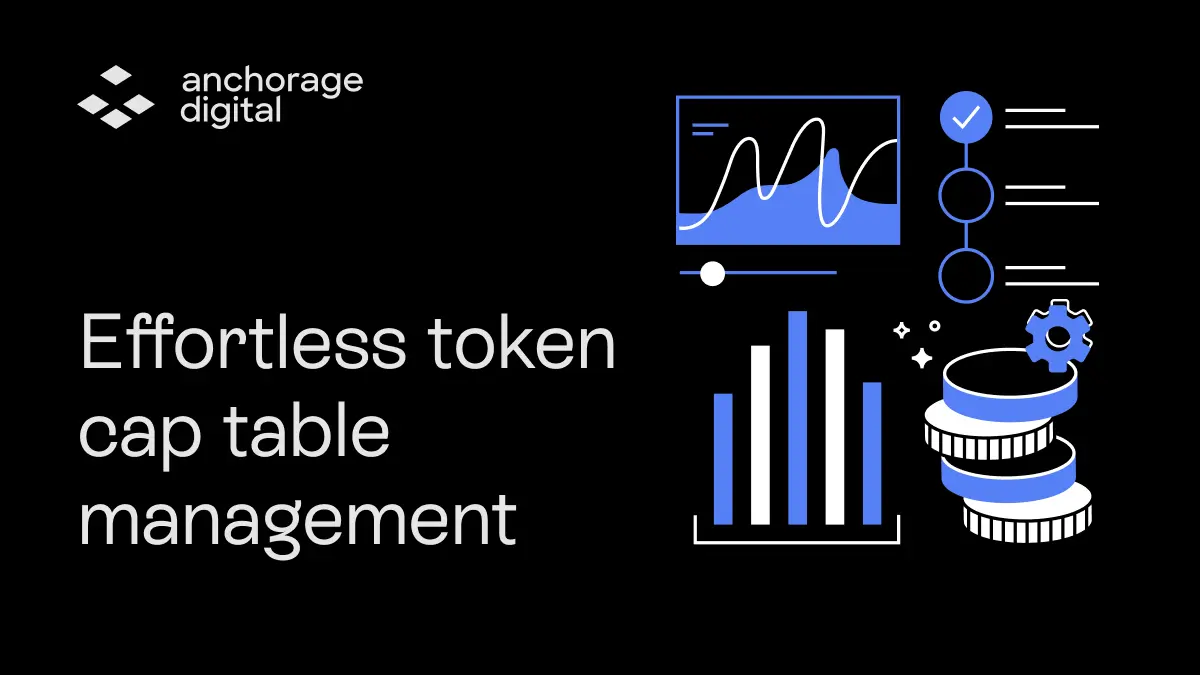

Nga revives the Garantex cryptocurrency empire that was blacklisted to avoid sanctions

Global Ledger's investigation reveals that despite sanctions, the Russian exchange Garantex has resumed operations, holding over $34 million in Bitcoin and Ethereum, primarily using Tornado Cash to obscure fund flows. Russia's digital payment system is advancing with the introduction of the stablecoin A7A5.

TapChiBitcoin·2025-12-12 01:33

Tether launches QVAC Health to aggressively enter the AI health market! 100% localized operation, integrated with hundreds of devices... Six major highlights at a glance

Stablecoin leader Tether announced today (10th) the launch of a new product, QVAC Health. The official statement claims this is the world's first personal health and wellness platform designed with a core principle of "100% device-side operation, never touching the cloud." What's the highlight? (Background: Tether launched its own AI platform QVAC, supporting P2P, encrypted payments, and local high privacy; initial applications will be showcased.) (Additional background: Tether's investment empire encompasses 120 companies, involved in Bitcoin mining, AI, Taiwan's XREX, and Juventus Football Club.)

動區BlockTempo·2025-12-10 14:03

The Trump Billionaires Club mobile game is here! TRUMP token players grab a share of millions

The official X account of the TRUMP meme token announced that it will launch a mobile game called "Trump Billionaires Club", specifically designed for Trump fans, where players have the opportunity to share $100K worth of TRUMP token rewards. Set in New York, this 3D mobile game powered by OpenLoot allows players to build a business empire and win prizes using TRUMP tokens.

MarketWhisper·2025-12-10 03:18

41 Developers Support a $1.7 Trillion Empire: A Comprehensive Analysis of the Bitcoin Core Development Team and Funding System

Bitcoin currently has a market capitalization close to $1.75 trillion, but its core development team consists of only 41 people, with annual expenditures of $8.4 million. Research reports have revealed the state of Bitcoin's funding system and the absence of Asian developers, highlighting the vulnerabilities faced in Bitcoin development and the importance of decentralization. The reports also introduce the major sponsoring organizations and their roles.

動區BlockTempo·2025-12-08 15:24

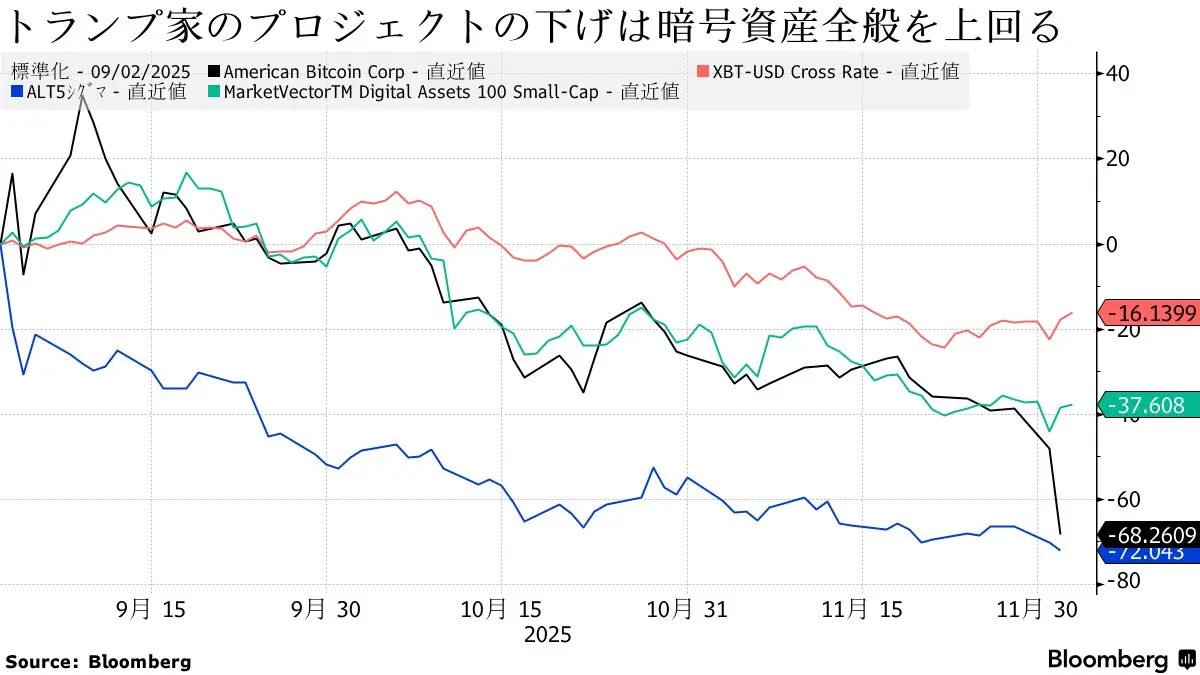

Trump Cryptocurrency Empire Collapses! Shocking Disappearance of $1 Billion in Family Assets

The stock price of American Bitcoin, co-founded by Eric Trump, the second son of President Trump, plummeted 33% within one minute of trading on December 2, ultimately crashing over 51%. Trump-related cryptocurrency projects have collapsed across the board: the WLFI token fell 51%, ALT5 Sigma plunged 75%, and the TRUMP and MELANIA meme coins have dropped 90% and 99% from their all-time highs, respectively. According to Bloomberg, the Trump family has lost over $1 billion in assets since October, as the Trump premium has turned into a Trump drag.

MarketWhisper·2025-12-05 06:55

YouTube King MrBeast Targets Finance: Cryptocurrency Exchanges May Become the Next Prey in His Business Empire

MrBeast (real name Jimmy Donaldson), the world's most-subscribed YouTube superstar, is expanding his vast business empire into the heart of fintech. The CEO of his holding company, Beast Industries, recently confirmed the launch of a financial services platform called "MrBeast Financial" and a mobile phone company called Beast Mobile. According to trademark application documents that have surfaced, the financial platform's scope of business clearly includes "cryptocurrency exchange" services. With revenues exceeding $400 million last year, Beast Industries is no longer satisfied with just content and consumer products, and is now seeking to leverage its massive influence over Gen Z to become a gateway to next-generation financial and digital asset services.

BTC-0,19%

MarketWhisper·2025-12-05 05:22

MrBeast Financial Platform Launch: Beast Industries Unveils Banking, Crypto Trading, and Beast Mobile for 450M+ Fans

MrBeast, the YouTube sensation with over 450 million subscribers, is set to disrupt fintech and telecom in 2026 through Beast Industries, his burgeoning media empire.

CryptopulseElite·2025-12-05 02:29

Taiwan Fully Bans Xiaohongshu for 1 Year! Government Reveals 3 Main Reasons: Zero Cybersecurity Compliance, Explosive Growth in Fraud, Refusal to Comply with Laws and Regulations

On December 4, the Criminal Investigation Bureau of the National Police Agency under Taiwan's Ministry of the Interior officially announced that, effective immediately, it has issued an "Internet domain name system discontinuation and access restriction" order for the Chinese social media platform "Xiaohongshu" (Little Red Book) APP and related websites, with the ban tentatively set for one year.

(Previous context: Nine Taiwanese companies and three women involved in the "Prince Group" scam empire! Laundering money with cryptocurrency and setting up shell companies in luxury residences.)

(Background supplement: A degree from a 985 university is not as valuable as 10,000 followers—Xiaohongshu is becoming a new hunting ground for cryptocurrency exchanges.)

On December 4, the Criminal Investigation Bureau of the National Police Agency under Taiwan's Ministry of the Interior officially announced that, effective immediately, it has issued an "Internet domain name system discontinuation and access restriction" order for the Chinese social media platform "Xiaohongshu" (Little Red Book) APP and related websites, with the ban tentatively set for one year.

Officials pointed out that this measure is based on Article of the Fraud Crime Prevention Act.

動區BlockTempo·2025-12-04 14:46

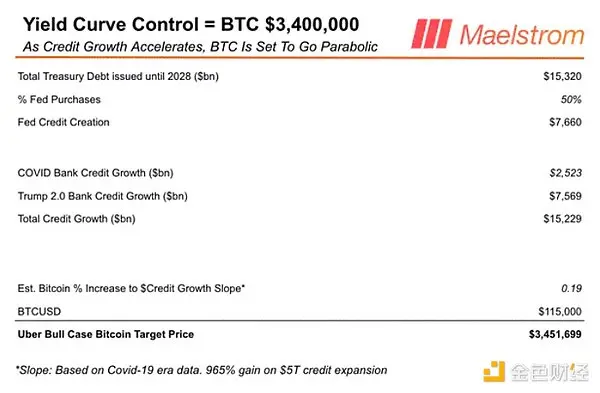

Arthur Hayes: How Trump Would Control the Fed and Impact BTC

Source: Arthur Hayes, BitMEX Founder; Translation: Jinse Finance

Bessent's (Buffalo Bill Bessent) plan aims to reindustrialize America and attempts to prevent "Pax Americana" from declining from a quasi-empire to merely a strong power. This is nothing new. The emergency of World War II allowed the Treasury to take over the Federal Reserve from 1942 to 1951. Part of Bessent's work was to reshape the yield curve, that is, yield curve control. How did the yield curve during that period compare to now?

The Fed capped short-term Treasury yields at 0.675% and set 10- to 25-year Treasury yields at 2.5%. This shows that the current yield curve reflects both higher short-term and long-term interest rates. However, the key difference is that the yield curve in the past was steeper than it is now.

金色财经_·2025-12-04 12:42

Tether's Latest Investment Landscape: Crypto Sector Still Dominates

Original Title: Tether Investments: What a $100B stablecoin empire does with its profits

Original Author: Bennett Tomlin, protos

Original Translation: Rhythm Worker, BlockBeats

Original Author: Rhythm BlockBeats

Original Source:

Reprinted from: Mars Finance

Tether has now become one of the most influential financial groups in the world. Not only does it operate the highest market cap stablecoin, but its investment portfolio also spans cryptocurrencies, payment processing, video streaming, artificial intelligence, brain-computer interfaces, farmland, satellites, soccer, and many other fields.

These investments are aimed at expanding the company's reach and influence. If successful, they will likely bring significant financial returns in the future.

Tet

MarsBitNews·2025-12-04 07:49

The Collapse of the Huiwang Gray-Black Crypto Empire

On December 1, 2025, Huione Pay announced the suspension of its operations.

This is not a simple closure of an ordinary payment company, but rather the complete collapse of a gray and black financial network spanning payments, escrow black markets, and crypto stablecoins, under the sanctions and regulatory crackdowns of multiple countries.

The true center of this network is the Huione Group.

The Countdown of Huione

Once known as the "Alipay of Cambodia," Huione was the largest third-party financial system in the Southeast Asian gray industry circle and a secret overlord of USDT payments. Its downfall did not come suddenly, but was a countdown with its ending already written.

As early as March this year, Huione had its license revoked by local financial institutions, losing its legal status. In May, the U.S. Financial Crimes Enforcement Network (FinCEN) issued a final rule under Section 311 of the Patriot Act, designating Huione Group as a "primary money laundering concern" and completely cutting off its ties with the United States.

PANews·2025-12-04 06:08

Trading stocks at 9, authorized by banks at 15! 22-year-old Canadian youth builds a billion-dollar quant empire

22-year-old Canadian Denis Dariotis founded quantitative trading software company GoQuant, which handles over $1 billion in transactions daily through quantitative strategies and data analysis. He started trading stocks at age 9, and at 15, licensed his quantitative strategies to a major Canadian bank, becoming his first major client. GoQuant has now completed a $7 million funding round and has around 80 employees.

MarketWhisper·2025-12-03 06:06

Barron Trump Net Worth 2025: Youngest Trump's $150M Crypto Fortune

Barron Trump is worth an estimated $150 million at 19, primarily from crypto ventures. As World Liberty Financial co-founder, Barron Trump holds 10% of the family's $1.5B crypto empire through WLFI token sales, USD1 stablecoin stake, Alt5 Sigma deal, and locked tokens.

TRUMP0,09%

MarketWhisper·2025-12-03 05:55

Trump’s son’s mining company plunges 51% in 30 minutes! Family’s crypto empire evaporates $800 million

As Bitcoin fell more than 30% from its all-time high and the market experienced intense volatility, American Bitcoin, a Bitcoin mining company supported by Trump’s son, suffered a major blow to its stock price on December 2. Within 30 minutes, half of its market value was wiped out, triggering multiple trading halts. The mining company, co-founded by Eric Trump, saw its intraday price drop as low as $1.75, a decline of 51%.

MarketWhisper·2025-12-03 00:41

Load More