Search results for "GMX"

GMTrade officially launches a new brand and prepares for the issuance of the mobile trading application.

GMXSOL, một sàn giao dịch phái sinh phi tập trung được xây dựng trên GMX V2 trên Solana, đã đổi thương hiệu thành GMTrade. Đây là một cột mốc quan trọng khi nền tảng này nhằm nâng cao vị thế của mình trong hệ sinh thái giao dịch phi tập trung, ra mắt một ứng dụng di động chuyên dụng cho trải nghiệm giao dịch liền mạch.

GMX5,48%

TapChiBitcoin·2025-11-26 09:05

Data: Multiple tokens show signs of bottoming out and rebounding, TFUEL and others fall over 12%

According to Mars Finance, Binance Spot data shows a divergence in the market. AXS rose by 5.08%, and FET rose by 7.81%, both showing a bottoming rebound state. On the other hand, GTC fell by 9.36% in 24 hours, PHB fell by 8.67%, TFUEL fell by 12.61%, and RARE fell by 21.2%, all showing a high-to-low reversal state. Other tokens include GMX rising by 5.34%, ID rising by 5.02%, and SUI rising by 5.11%, also demonstrating a bottoming rebound trend.

TFUEL5,61%

MarsBitNews·2025-11-21 09:56

The Return of L2 Kings? The Three Arrows and Breaking Points of the Arbitrum Renaissance

Although Optimism was the first TGE on L2, Arbitrum is the true pioneer of the L2 wave. In the first half of 2023, Korean Whales were live trading contracts on GMX, while DeFi Degens used GLP Lego combinations for Yield Farming, and grassroots communities banded together to hype ancient cat and dog Meme coins. Arbitrum was one of the brightest zones in the spring market of 2023.

However, this ecological prosperity, like a blooming flower brocade, has dimmed after the epic TGE and airdrop of Arbitrum's native token ARB.

Looking back at this point in time in November 2025, there are three main reasons for this situation.

--The huge positive externality generated by Arbitrum's epic airdrop has been seized by competitors ZkSync, Starknet, and Linea;

--At that time, the king-level L

PANews·2025-11-13 13:19

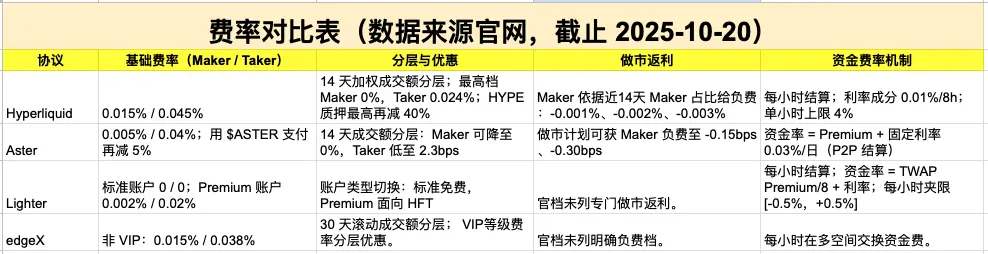

Part Four | In-Depth Analysis of PERP DEX: Hyperliquid, Aster, Lighter, edgeX

edgeX - Perp DEX incubated by well-known crypto market maker Amber Group

This generation of Perp DEX is fundamentally different from the previous generation of Perp DEXs like GMX and DYDX. Since it remains a Perp DEX at its core, we will continue to refer to it as a Perp DEX in this discussion.

This article is the concluding piece of a one-month series on Perp DEXs, focusing on the last member of the top four Perp DEXs according to DefiLlama data — edgeX — and extending the discussion to the current state and trends of the entire Perp DEX sector.

As the landscape of mainstream players has largely taken shape, Perp DEX

PANews·2025-10-21 02:03

The integration path of TradFi experience and Decentralization innovation

Abstract

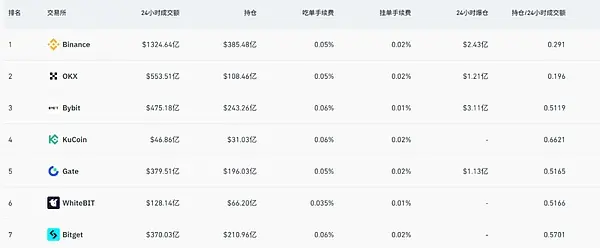

Traditional platforms, while mature in "compliance + experience + coverage", are constrained by centralized custody, insufficient transparency, settlement delays, and regional barriers. Web3 approaches this with self-custody, on-chain verifiability, and global accessibility, enhancing capital efficiency through oracle services, partial settlement, unified collateral, and fund reuse. The landscape is becoming multi-polar: dYdX (order book), GMX (GLP pool), Hyperliquid (high-performance matching), Avantis (multi-asset synthesis/RWA). The characteristics of Web3 leverage trading lie in the CEX-level low latency experience + institutional-level risk control compliance + multi-asset integration. By 2030, it is expected to grow into a hundred billion dollar level infrastructure.

1. Industry Status and Overview

In the development process of global capital markets, leveraged trading has always been an important tool for promoting liquidity and risk pricing efficiency. Since the 1970s IG

金色财经_·2025-10-09 07:56

The perp DEX welcomes the "singularity moment"; why has Hyperliquid become the game changer?

Written by: imToken

"Derivatives are the holy grail of DeFi"; it has been widely agreed in the market since 2020 that on-chain perp protocols are the ticket to the second half of DeFi.

But the reality is that for the past 5 years, whether constrained by performance or cost, perp DEX has always faced a difficult trade-off between "performance" and "decentralization." During this period, the AMM model represented by GMX, while achieving permissionless trading, has struggled to compete with CEX in terms of trading speed, slippage, and depth.

Until the emergence of Hyperliquid, which achieved a seamless experience comparable to CEX on a fully self-custodied blockchain with its unique on-chain order book architecture, the recent HIP-3 proposal has further pushed the boundaries of Crypto and

PANews·2025-10-08 05:35

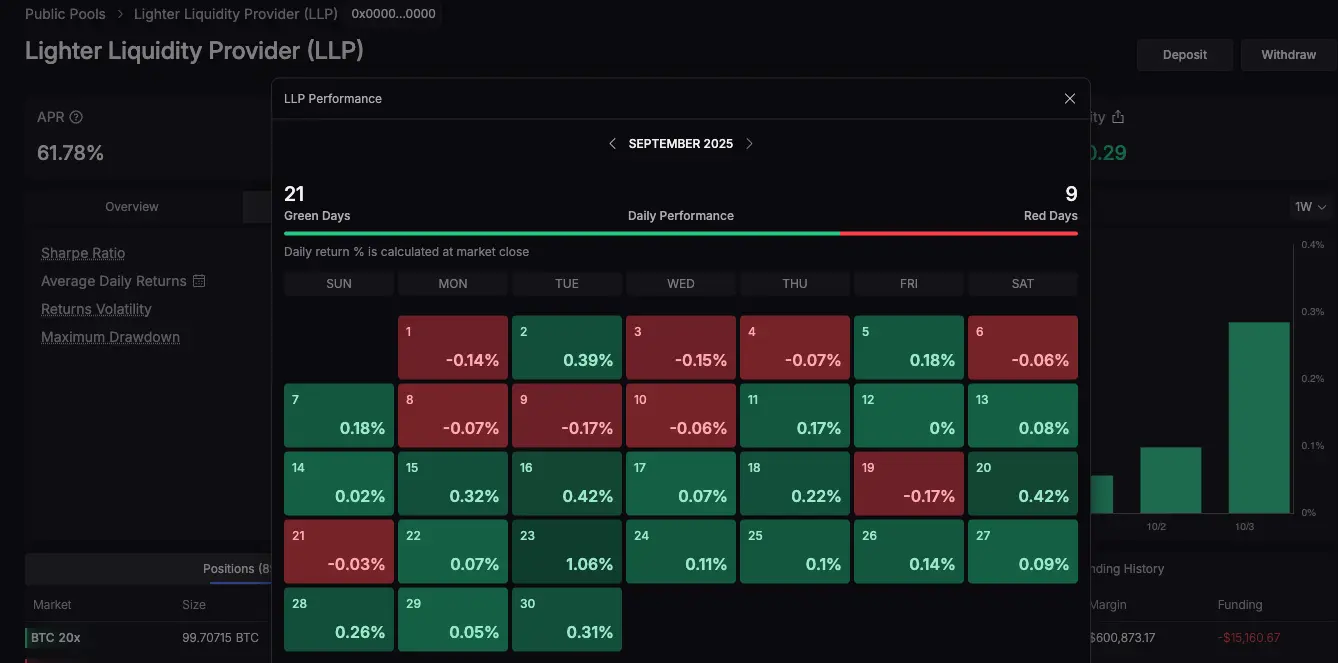

Part Three丨Depth Analysis of Perp DEX: Hyperliquid, Aster, Lighter, edgeX

Lighter - Don’t trust—verify

This generation of Perp DEX has fundamentally differed from the previous generation represented by "GMX, DYDX". Since it is still a Perp DEX, the title will continue to discuss it as a Perp DEX.

Lighter is a Perp DEX invested by the well-known American venture capital firm a16z, based on Ethereum's ZK Rollup, and it also follows the order book (CLOB) model.

During the AMA at the end of August this year, the team mentioned some future plans for Lighter. For example, the launch of RWA derivatives and Pre-launch.

PANews·2025-10-07 00:55

Why can Hyperliquid kick open the door to on-chain derivation?

"Derivation is the holy grail of DeFi," and regarding the on-chain perp protocol being the ticket to the second half of DeFi, the market reached a consensus as early as 2020.

But the reality is that over the past 5 years, whether constrained by performance or cost, perp DEX has always made difficult trade-offs between "performance" and "decentralization". During this period, the AMM model represented by GMX has achieved permissionless trading, but it is difficult to compete with CEX in terms of trading speed, slippage, and depth.

Until the emergence of Hyperliquid, which achieved a seamless experience comparable to CEX on a fully self-custodied blockchain with its unique on-chain order book architecture, the recently passed HIP-3 proposal has further pushed the boundaries between Crypto and

HYPE3,91%

金色财经_·2025-09-26 14:17

2025's Perp DEX Wars: New Money, New Tech, No off-Switch

Perpetual futures have become crypto’s main event, and the perp DEX wars—led by Hyperliquid, Aster, GMX, DYdX, ApeX, Drift, Jupiter, EdgeX, and Sunperp—are where the action won’t quit.

From Order Books to Onchain: Inside 2025’s Perp DEX Dogfight

Perpetuals are derivatives without an expiry;

Coinpedia·2025-09-26 03:37

Is a FDV of 45 billion for Hyperliquid a reasonable valuation?

I want to ask, what does everyone think @HyperliquidX is? If it’s just a pure Perp Dex application, then a 45B FDV is already too high. If it’s a new innovative species L1, then a circulating market capitalization of 15B might still be undervalued? What’s even more confusing is how should Hyperliquid's followers benchmark their expectations?

1) If we consider HL as a Perp Dex, its valuation is already quite high compared to its predecessors like dYdX and GMX, but if we view it as an on-chain Binance and compare it to the valuations of other L1s like Solana and BNBChain, HL still has substantial growth potential.

Objectively speaking, although HL currently has a leading effect in the market share of Perp Dex that is bound to create a premium valuation, the overall on-chain

HYPE3,91%

金色财经_·2025-09-24 08:30

Depth Analysis of Perp DEX: Hyperliquid, Aster, Lighter, edgeX

Original Author: JV

Reprint: White55, Mars Finance

Hyperliquid

This generation of Perp DEX has fundamentally differentiated itself from the previous generation of Perp DEXs like "GMX, DYDX". Since its main focus is still on Perp DEX, the title will continue to discuss it as Perp DEX.

with 'Perp

MarsBitNews·2025-09-21 02:25

Article 1 | Depth Analysis of Perp DEX: Hyperliquid, Aster, Lighter, edgeX

Hyperliquid

This generation of Perp DEX has fundamentally changed compared to the previous generation of Perp DEX represented by "GMX, DYDX". Because it is still fundamentally a Perp DEX, we will continue to discuss it under the title of Perp DEX.

Starting with "Perp DEX", it quickly rose to prominence and became known to many.

Hyperliquid is an L1 public chain, similar to Ethereum and Solana. Hyperliquid has a grand vision to serve as a blockchain for all finance and to provide a high-performance on-chain financial trading infrastructure. Hyperliquid offers both perpetual contract trading and spot trading, and is currently promoting the stablecoin USDH.

Its development path can be glimpsed from the HIP, from HIP-1, HIP-2 to HIP-3, and recently the community has proposed HIP-4. HIP-4 aims to do

PANews·2025-09-20 13:42

The "Infinite War" of Perptual Futures: Why is it said that the DEX market in 2025 still has opportunities for a hundredfold rise?

Author: Sicily

As we examine the current Perp DEX space, a suffocating sense of "involution" seems to be approaching.

The narrative of GMX's "real yield" has set a precedent, while the application chain paradigm of dYdX has become a dominant force. Hyperliquid has further escalated the "arms race" of performance to a fever pitch. The names on the leaderboard chase each other, and every new project seems to be struggling to find its foothold in this crowded and blood-soaked battlefield.

As a result, a pessimistic tone began to spread: Has the war of Perp DEX entered the "garbage time"? The pattern is set, opportunities have passed, and what remains is just the brutal melee of the existing market?

If you think so too, then you might be making a serious temporal mistake similar to believing that the end of the internet is portals.

Because the DEX we see today

PERP-0,06%

TechubNews·2025-08-27 16:05

GMX Finalizes $44 Million Compensation for GLP Holders After Hack

GMX has reimbursed users affected by a $42 million exploit, offering a total compensation package of $44 million in GLV tokens. An additional $500,000 incentive pool rewards long-term holders. The reimbursement restores impacted holders to their original positions.

GMX5,48%

ICOHOIDER·2025-08-14 09:49

Odin.fun was hacked for about 60 BTC! The founder admitted that "there are not enough funds for compensation" and pointed to Chinese hackers as the culprits.

Odin.fun has once again suffered a security vulnerability, with approximately 60 Bitcoins stolen. Co-founder Bob stated that the current project does not have sufficient funds for full compensation. (Background: Your computer is helping hackers mine Bitcoin! 3,500 websites have been implanted with "mining scripts," invisibly hijacking users without their notice) (Additional context: GMX hackers chose to "act as white hats" and returned $40.5 million! They received a $4.5 million bounty, and $GMX rebounded by 16%) Rune trading platform Odin.fun reported a major hacking attack last night, with approximately 58.2 to 60 Bitcoins withdrawn without authorization, valued at around $7 million, and the platform's token $ODINDOG plummeted by 40% on that day. The platform's founder Bob stated that the company currently lacks the assets to compensate for the stolen amount, but the funds stored by users on the platform are currently safe. This is Odin.fu

動區BlockTempo·2025-08-13 07:28

Decentralized Finance platform Credix was hacked for 4.5 million dollars! Official website urgently closed: User funds will be restored within 24 hours at the earliest.

The security team SlowMist today (4th) issued a warning on the X platform, indicating that the DeFi platform Credix has suffered a hacker attack, resulting in losses of up to $4.5 million. (Background: Your computer is helping hackers mine Bitcoin! 3,500 websites have been implanted with "mining scripts," invisibly hijacking users without their knowledge) (Additional background: The GMX hacker chose to "be a white hat" and returned $40.5 million! Received a $4.5 million bounty, $GMX rebounded 16%) Another DeFi protocol has been hacked! The security team SlowMist today (4th) issued a warning on the X platform, indicating that the DeFi platform Credix has suffered a hacker attack, resulting in losses of up to $4.5 million. According to the information disclosed by SlowMist, Credix's multisignature Wallet was compromised six days ago (end of July) through

DEFI-3,26%

動區BlockTempo·2025-08-04 12:10

These Were Top Crypto Hacks of July

In July, 17 major hacks resulted in $142 million in losses, a 27.2% increase from June. Notably, CoinDCX lost $44.2 million due to social engineering, while GMX lost $42 million but recovered the funds. BigONE lost $27 million in various cryptocurrencies.

UToday·2025-08-01 07:50

CoinDCX, GMX Among Top Targets as July Crypto Hacks Hit $142M

In July, crypto hacks increased significantly, resulting in $142 million lost from 17 major attacks, targeting platforms like CoinDCX, GMX, and WOO X, with hackers shifting focus to off-chain systems for quicker attacks.

GMX5,48%

BitcoincomNews·2025-08-01 01:00

Cryptocurrency hacks reached 142 million dollars in July.

In July 2025, cryptocurrency attacks caused at least $142 million in losses, a 27% increase from June. Major hacks included CoinDCX ($44 million) and GMX ($40 million), with a notable decrease in damages compared to July 2024.

LA-0,67%

TapChiBitcoin·2025-07-31 23:31

GMX Crypto: Bithumb’s Pivotal Move Lifts Investment Warning, Igniting Confidence

landscape, South Korean cryptocurrency exchange Bithumb has announced the lifting of its investment warning designation on GMX crypto (GMX). This pivotal decision, effective July 30, signals renewed confidence in the popular decentralized perpetual exchange token and marks a crucial moment for its

BitcoinWorldMedia·2025-07-30 09:34

Crypto Weekly Roundup: GMX Hacked, Ripple CEO Called to Testify, & More

This week in crypto, GMX suffered a $42 million exploit, while President Trump’s Truth Social announced a utility token, and South Korea moved to officially support crypto firms as venture companies. Let’s find out more

Bitcoin

Bhutan’s sovereign investment fund, Druk Holding and Investments

CryptoDaily·2025-07-13 13:33

Crypto Hacker Who Drained $42,000,000 From GMX Goes White Hat, Returns Funds in Exchange for $5,000,000 Bounty - The Daily Hodl

A hacker who stole $42 million from the GMX exchange is returning the funds for a $5 million bounty. The exploit involved a re-entrancy attack, but the system remains secure, leading to an 18.4% increase in GMX's value.

GateUser-299f2bac·2025-07-12 16:00

GMX hacker chooses to "become a white hat" and returns $40.5 million! Receives a $4.5 million bounty, $GMX rebounds 16%

The decentralized perpetual futures exchange GMX suffered a loss of approximately 42 million USD due to a hacker attack that exploited a reentrancy vulnerability. After the incident, the hacker returned 96% of the funds under the protocol, keeping 4.5 million USD as a white hat bounty and gaining additional profits. Subsequently, the price of GMX token rebounded by about 16%.

GMX5,48%

動區BlockTempo·2025-07-12 02:54

GMX Exploiter Return $40M Days After Hack, Token Zooms Higher

An attacker who drained over $40 million from GMX's V1 contracts is returning funds after accepting a $5 million bounty. Approximately $10.5 million has already been sent back, with more expected. GMX's trading price increased by 13% following these developments.

YahooFinance·2025-07-11 16:09

Techub News Evening Report: Shanghai State-owned Assets Supervision and Administration Commission discusses trends in encryption coins and stablecoins, GMX stolen funds are expected to be recovered.

Bitcoin price reached $118,004, and market sentiment leans towards greed. The China-Egypt sides signed a memorandum of understanding to promote local currency settlement and Central Bank digital currency cooperation. The State Bank of Pakistan plans to launch a digital currency pilot. Crypto market dynamics include GameSquare acquiring Ether and the GMX hacker pledging to return funds. The Shanghai State-owned Assets Supervision and Administration Commission follows the development of Crypto Assets, and the SEC clarifies that tokenization of securities still needs to comply with the law.

GMX5,48%

TechubNews·2025-07-11 10:29

On-chain "reconciliation": How GMX uses a 10% bounty to "persuade" hackers to return a huge sum of money?

The GMX protocol was attacked by a hacker, resulting in a loss of $42 million. The hacker ultimately responded to the project party with "ok" and decided to return most of the funds. This attack highlights the vulnerabilities in DeFi security, and the hacker's choice to compromise stems from concerns about the high-risk nature of money laundering and rational considerations, reflecting the evolution of the hacker's role and a new balance in the DeFi world.

GMX5,48%

MarsBitNews·2025-07-11 09:54

Weekend Recommended Reading: The U.S. aims to leverage stablecoins to create the third phase of the Bretton Woods System. Is the Pump.fun public sale worth participating in?

This week, the industry is focusing on the impact of crypto assets lobbying groups on Trump, the role of stablecoins in the global monetary system, and the security incidents related to GMX. Hong Kong is actively positioning itself in the global tokenization competition, while the SEC plans to accelerate the review of encryption ETFs. Additionally, interviews with FTX China creditors revealed legal strategies and institutional issues.

PUMP2,25%

TechubNews·2025-07-11 09:17

GMX announced a hack of $42 million: "Reentrancy vulnerability" exploited by hackers, how to compensate users?

On the evening of July 10, Taiwan time, the centralized perpetual futures exchange GMX released a detailed report on platform X following the theft of $42 million on July 9, revealing the root cause of the attack, initial response measures, and subsequent plans. (Background summary: What was stolen from GMX was not only money but also status) (Background supplement: In-depth analysis of six major on-chain derivation protocols comparison: GMX, Synthetix…) The veteran decentralized perpetual futures exchange GMX's V1 deployment on Arbitrum was attacked by hackers on July 9, resulting in losses of up to $42 million. On the evening of July 10, Taiwan time, GMX released a detailed report on platform X, revealing the root cause of the attack, initial response measures, and subsequent plans. Reasons for GMX's hacking.

GMX5,48%

動區BlockTempo·2025-07-11 03:52

Hacker returns the money after exploiting 40 million USD from GMX

Kẻ tấn công đứng sau vụ khai thác 40 triệu đô la trên sàn giao dịch phi tập trung GMX đã bắt đầu hoàn trả sau khi chấp nhận phần thưởng lỗi trị giá 5 triệu đô la. Cuộc tấn công đã nhắm vào hồ bơi GLP V1 của GMX, dẫn đến những thiệt hại đáng kể. Sau khi hứa hẹn miễn truy tố, kẻ tấn công đã hoàn trả các khoản tiền, thúc đẩy sự phục hồi một phần trong giá token của GMX.

GMX5,48%

TapChiBitcoin·2025-07-11 01:55

$42M Stolen in GMX V1 Exploit As Exchange Shuts Down Trading

Decentralized derivatives exchange GMX has confirmed a $42 million exploit targeting its GMX V1 GLP pool on Arbitrum, prompting a temporary shutdown of trading and a white-hat bounty offer to the attacker.

$42 Million Drained From GMX V1 GLP Pool

In a significant security incident, an attacker has

GMX5,48%

CryptoDaily·2025-07-10 15:06

Analysis of GMX Security Incident Vulnerabilities and Tracking of Stolen Funds

GMX was attacked, and the attacker exploited a reentrancy vulnerability in the project contract to carry out the attack, profiting approximately $42 million. The Beosin security team conducted a vulnerability analysis and fund tracking of this attack incident and shared the results as follows:

GMX5,48%

金色财经_·2025-07-10 11:52

Written after the hacker attack: Does the DeFi world really have risk-free returns?

> What are the sources of risk for the seven major high-yield strategies?

Article by: stablewatch

Compiled by: Azuma (@azuma\_eth)

Editor’s Note: The DeFi market has recently been turbulent. First, the popular project USDf briefly lost its peg due to concerns about reserve assets and sources of income. Then, the well-established contract trading platform GMX suffered over $40 million in losses due to a hacker attack (see "Over $40 million stolen, the story of GMX's precise ambush"). In a flash, the market is in a state of alarm, and in the face of seemingly decent yields, the safety of the principal seems even more important.

After the incident last night, stablewatch published an article titled "Does the DeFi world really have risk-free returns?" For all users intending to continue participating in DeFi, it is necessary.

DEFI-3,26%

ForesightNews·2025-07-10 08:50

GMX was hacked for 42 million dollars, how should the security of Decentralized Finance be ensured?

Written by: ChandlerZ, Foresight News

On July 9, the V1 system of the decentralized trading platform GMX was attacked on the Arbitrum network. The attacker exploited a vulnerability within the contract to withdraw approximately $42 million in assets from the GLP liquidity pool. GMX has since suspended trading on the platform and locked the minting and redemption functions of GLP. The attack did not affect GMX's V2 system or its native token, but the incident has once again sparked discussions about the internal asset management mechanisms of DeFi protocols.

Attack process and capital flow

Security firms PeckShield and Slow Mist analysis indicate that attackers exploited GMX V1 during calculations.

TechubNews·2025-07-10 08:49

BlockSec: Analysis of GMX Attack Principles

GMX was attacked by hackers, resulting in losses of over $40 million. The attackers exploited a reentrancy vulnerability by improperly using the executeDecreaseOrder function to manipulate the redemption mechanism, mistakenly accounting for a large amount of unrealized losses as assets, which caused the redeemed GLP value to far exceed its actual holdings. This incident revealed the flaws in GMX's leverage mechanism and security design, warning developers to strengthen the security of fund operations.

GMX5,48%

DeepFlowTech·2025-07-10 07:11

Over $40 million stolen, the story of GMX's precise ambush.

Original | Odaily Daily Report (@OdailyChina)

Author | Asher (@Asher\_ 0210 )

Last night, the leading on-chain DeFi protocol GMX platform encountered a major security incident, with over $40 million in cryptocurrency assets stolen by hackers, involving various mainstream tokens such as WBTC, WETH, UNI, FRAX, LINK, USDC, and USDT. After the incident, Bithumb issued an announcement stating that GMX's deposit and withdrawal services would be suspended until the network stabilizes.

Due to this theft incident

GMX5,48%

星球日报·2025-07-10 00:46

Arbitrum revenue rise to the sky, Ostium break through

According to data from EntropyAdvisors on Dune, Arbitrum recorded a protocol revenue of 1.43 million USD in the past week, up 23% from the previous week. GMX contributed 550,000 USD, Ostium 225,000 USD, Gains Network 120,000 USD, Pendle 85,000 USD, and Uniswap 82,000 USD. Notably, Ostium's revenue surged by 120%.

TapChiBitcoin·2025-06-24 18:51

Everything you need to know about DeFi derivation.

> This article will outline the basics of Perptual Futures, covering various aspects from basic execution (on-chain) to order book / price discovery, Oracle Machine, settlement, fees, and more.

Written by: Diogenes Casares

Compiled by: AididiaoJP, Foresight News

Since dYdX and GMX were launched in April 2020 and 2021 respectively, the usage of DeFi derivatives platforms has grown exponentially, and now HyperLiquid poses a challenge to centralized exchanges in terms of trading volume and open contract volume. Despite HyperLiquid

DEFI-3,26%

ForesightNews·2025-06-20 08:57

00s post-00s encryption new elite Christian discusses personal experiences: founding Infini, Heavy Position in GBTC and Coinbase made a fortune

Editor: Wu Says Blockchain

This content is derived from an interview with Christian, a post-00s investor and entrepreneur in the cryptocurrency field, conducted by "Turtle Talk". Wu has been authorized to edit and reprint it. Christian is one of the most noteworthy Chinese entrepreneurs in this cycle, providing an in-depth review of his journey from university to founding the crypto payment project Infini. The interview covers three core sections: first, the transformation of his personal investment path from decentralized allocation to "logic-driven + concentrated positions" practical experience; second, his assessment of the current market structure and sentiment, including insights on bull and bear cycles, main funds, and the essence of projects. Christian also shares reflections on the gains and losses from heavily invested cases like Cheems, GMX, and Coinbase, and points out that the current logic for selecting coins should focus on three major standards: "team structure, token structure, and consensus concentration."

TechubNews·2025-06-13 09:08

On-chain derivation Battle Royale: dYdX/GMX decline, Hyperliquid dominates, who will get the next ticket?

GMX and dYdX have long fallen from the "Holy Grail", but decentralized derivation should still have new tickets.

Written by: Web3 Farmer Frank

Which on-chain derivation protocols have you used recently?

This is pretty much an awkward footnote in the DeFi derivation track. To be realistic, without Hyperliquid, which has James Wynn as the "best on-chain spokesperson," the once "holy grail" status of dYdX and GMX has long been lost over the past two years, and their rapid decline has nearly ended the on-chain derivation narrative.

TechubNews·2025-06-05 09:55

Perp DEX's Technology Innovation and Market Competition: Opportunities and Challenges for On-Chain Perpetual Contract Exchanges

Decentralized Perpetual Futures Trading Exchange ( Perp DEX ) has become one of the most vibrant areas in the DeFi ecosystem. Not only has the annual trading volume reached new highs repeatedly, but the platform's innovations and strategic products are also continuously emerging. On-chain researcher Jason Zha has conducted an in-depth analysis of the development context of Perp DEX, platform competition, and future potential, revealing key trends in the on-chain derivation market.

From dYdX to Hyperliquid: The Evolution of Perp DEX

The origin of Perp DEX can be traced back to 2019, when dYdX first launched the on-chain order book ( order book ) perpetual futures trading model, laying the foundation for the decentralized derivatives market.

Thereafter, GMX introduced the (Liquidity Pool) structure, due to HLP.

ChainNewsAbmedia·2025-04-14 08:07

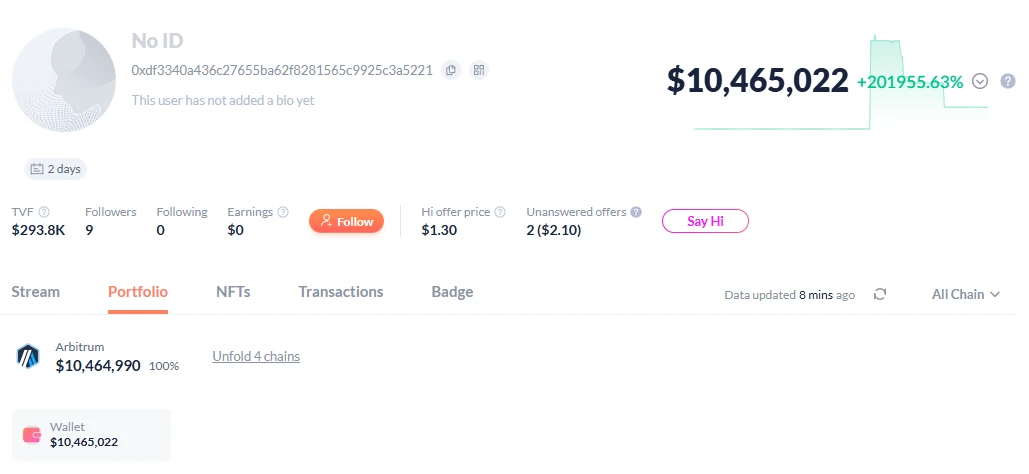

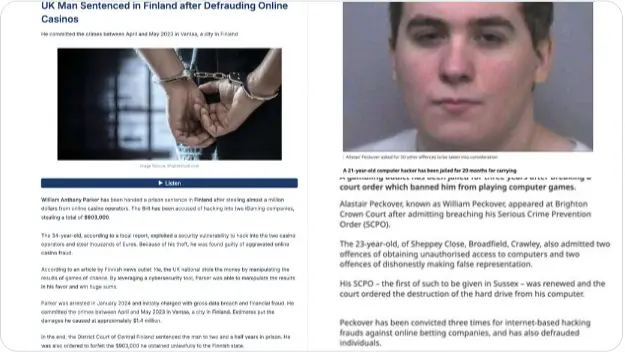

William Parker: The British Hacker Behind $20 Million Worth of Suspicious Transactions

The cryptocurrency world has been rocked by revelations that a mysterious trader, who has made at least $20 million from leveraged trades on platforms like Hyperliquid and GMX, has been identified as William Parker. According to blockchain investigator ZachXBT, Parker is a hacker from

Blotienso·2025-03-21 12:07

Who Is the Hyperliquid Whale? ZachXBT Uncovers a British Hacker Behind $20M Trades

A British hacker, William Parker, earned $20 million through leveraged trades on Hyperliquid and GMX. Investigator ZachXBT revealed Parker's history of financial crimes including hacking and theft schemes.

BitcoincomNews·2025-03-21 08:47

Token buybacks cannot save coin prices! Messari analysts: Sustainable protocol revenue is the key.

The cryptocurrency market has experienced turbulence, and many protocols have adopted token buybacks as a measure to stabilize stablecoin prices. However, Messari analysts and community perspectives indicate that buybacks are merely an auxiliary means and not a long-term solution.

Buybacks are not a panacea: Messari analyzes two major risks

Messari analyst Monk tweeted yesterday that programmatic Token buybacks do not effectively prevent coin price declines, and may instead lead to capital misallocation. He listed two major issues: "High-price buybacks during bull markets lead to cash depletion" and "During bear markets, the lack of funds results in a loss of innovative flexibility":.

RAY, GMX, GNS and SNX have

ChainNewsAbmedia·2025-03-21 07:14

Messari: Why Buybacks Can't Stop Token Prices from Falling Sharply

Messari analyst DeFi MONK found that token buybacks could not stop the price from falling. He pointed out that RAY, GMX, GNS, and SNX buyback tokens, but the present value is much lower than the buyback price. Buybacks are not about price, but about revenue and narrative. When the income is good, the project party may not be able to buy back, and when the income is bad, it may lack investment. Buybacks are considered poor capital allocation and should prioritize growth or distribution of real value to holders.

金色财经_·2025-03-21 05:12

ZachXBT exposes the mysterious Hyperliquid whale 50x

ZachXBT identifies mysterious whale making $20 million from high-leverage trading on Hyperliquid and GMX as British hacker William Parker. Parker, previously known as Alistair Packover, had legal issues linking to theft. ZachXBT's findings are based on phone numbers connected to the whale trader's wallet addresses. The claims are yet to be independently verified. Notably, the mysterious whale earned significant profits through leveraged trading on decentralized exchanges.

TapChiBitcoin·2025-03-21 05:12

Messari researcher: The current token buyback strategies of cryptocurrency projects are mostly "capital misallocation" and it is recommended to distribute actual value to holders in the form of stablecoins/Mainstream Tokens.

The article points out that some encryption projects such as RAY, GMX, GNS, and SNX have repurchased millions of dollars worth of tokens programmatically, but the value of the tokens has significantly fallen. Researcher MONK believes there are fallacies in this repurchase, including being unrelated to price movement and depleting cash reserves. It is suggested that projects should prudently repurchase tokens, focusing on rise or allocating actual value to holders.

DeepFlowTech·2025-03-21 02:39

On-Chain Inquiry Links $20 Million Hyperliquid Profits to Illicit Activities

ZachXBT uncovered $20M in profits from high-leverage trades linked to fraud on Hyperliquid and GMX, raising concerns about illicit activities on decentralized platforms and potential regulatory scrutiny.

HYPE3,91%

CoincuInsights·2025-03-20 14:09

The Mysterious Giant Whale, Which Was Deliberately Liquidated with 50x Leverage on Ethereum, Closed Its Long Positions in Another Altcoin This Time!

A well-known whale in **Ethereum (ETH)**, who became famous for intentionally getting liquidated with a 50x long position, seems to have shifted focus to **Chainlink (LINK)**, recently selling 18.36 million LINK worth $1.34 million. The whale incurred a $512,000 loss, closing long positions on GMX for LINK and turning them into Bitcoin short positions on Hyperliquid with 40x leverage, currently sitting on a $290,000 unrealized profit. These actions followed a significant token unlock for Chainlink leading to tokens entering the market and a 4% increase in BTC price.

Bitcoinsistemi·2025-03-14 15:49

GMX proposes to expand the buyback coverage to 90%, and the monthly buyback scale may increase to 345,000 coins.

The GMX proposal plans to increase the coverage of repurchase and distribution expenses from the current 27% to 90%, with the monthly repurchase scale increasing from 103,700 coins to 345,500 coins GMX, and the repurchase amount will increase from $3.34 million to $8.489 million, providing GMX with stronger market stability. GMX has repurchased 103,764 GMX in the past 30 days, with a total value of $3.3412 million. It is worth noting that expanding the repurchase coverage can hedge the impact of dumping 100,000 GMX within 12 days.

DeepFlowTech·2024-11-26 01:41

Load More