Search results for "HOUSE"

Washington Pressures U.S. Oil Giants to Return to Venezuela, Tying Compensation to New Investment

The administration of President Donald Trump has made it clear in recent weeks that U.S. oil companies will not recover compensation for assets expropriated by Venezuela more than two decades ago unless they return to the country and commit substantial new investment. The White House and the State D

Moon5labs·17h ago

Gate Daily (January 5): Cryptocurrency Fear and Greed Index turns to "Neutral"; White House urges oil giants to invest in Venezuela

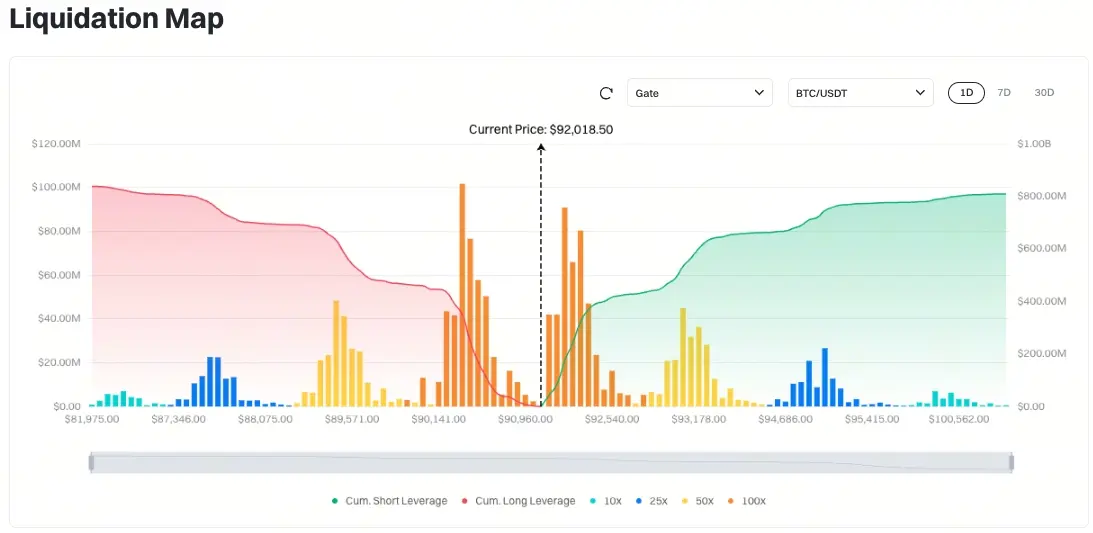

Bitcoin (BTC) opened this week with a sharp surge, temporarily reporting around $92,480 on January 5th. The Cryptocurrency Fear and Greed Index shifted from "Fear" to "Neutral," indicating an improvement in investor sentiment. The White House has called on American oil giants to invest in Venezuela to recover seized assets. Trump stated that impeaching Venezuelan President Maduro would release the country's $17.3 trillion worth of oil reserves.

MarketWhisper·23h ago

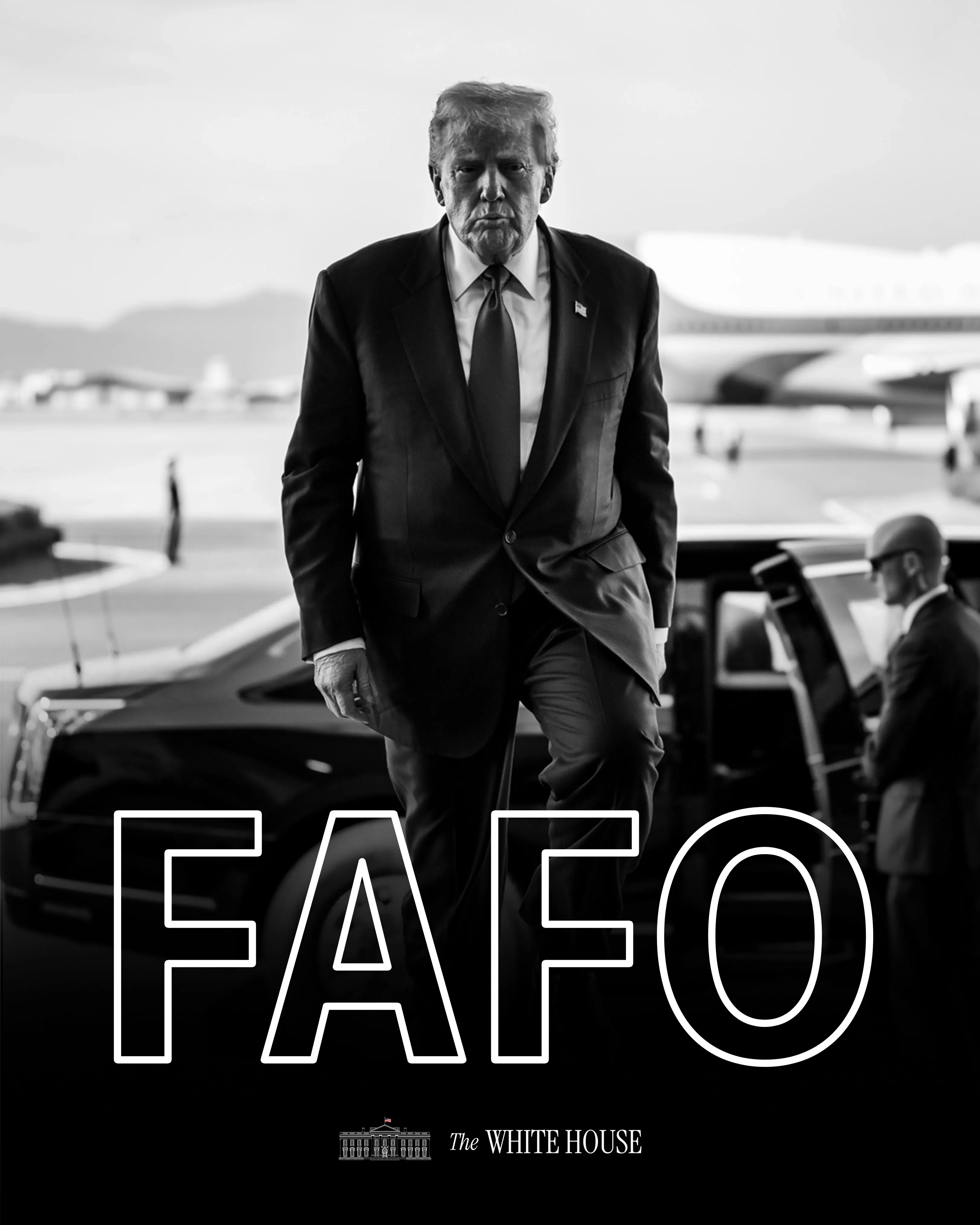

What Is FAFO? Trump's Warning Meme Coin Surges 550% After Maduro Capture

FAFO ("F*** Around and Find Out") surged 550% to $0.001416 after Trump administration captured Maduro and the White House posted Trump's FAFO photo. The Solana meme coin has $3.5M market cap and 10B supply, driven by Trump's political messaging.

MarketWhisper·01-04 08:23

Trump Backs Tax Exemption for Small Bitcoin and Crypto Transactions

The white house affirmed that President Donald Trump was in favor of tax exemptions on small Bitcoin and cryptocurrency transactions. This stance is part of Trump’s more general pro-crypto agenda, which seeks to bring digital assets into the daily economic life without overregulation. This

BTC1,96%

Coinfomania·01-03 09:36

Family Offices Increase Crypto Allocations, Eye 2026 With Caution

Global family offices increased their exposure to cryptocurrencies in 2025, with a growing number entering the market for the first time, as improvements in infrastructure helped offset limited in-house expertise.

However, sharp price swings and weak recent performance are raising questions about h

CryptoBreaking·01-03 09:00

Low Earth Orbit Satellite House of Cards: If Musk's Starlink crashes, could global satellites collide within 3 days?

Elon Musk's SpaceX is about to go public, and concept stocks like Innolux (3481) are also making waves. As thousands of artificial satellites are launched into orbit, the space environment around Earth is becoming increasingly precarious. A recent research paper published in December 2025 introduces a new indicator called the CRASH Clock, revealing startling data: if all human operations cease, a catastrophic collision could occur in less than three days in low Earth orbit.

(Innolux (3481) stock price hits the daily limit! FOPLP enters the low Earth orbit satellite supply chain, and SpaceX concept stocks take shape)

This article, "The Orbital House of Cards: Frequent Megaconstellation

ChainNewsAbmedia·01-02 10:13

Family Offices Increase Crypto Allocations, Eye 2026 With Caution

Global family offices increased their exposure to cryptocurrencies in 2025, with a growing number entering the market for the first time, as improvements in infrastructure helped offset limited in-house expertise.

However, sharp price swings and weak recent performance are raising questions about h

CryptoBreaking·01-02 08:58

2025 Crypto ETF Review: Bitcoin, Ethereum Flourish, and More Coins Like XRP Join the Feast

Article by: André Beganski

Translation by: Block unicorn

Although asset management firms have previously strived to launch products tracking the spot prices of Bitcoin and Ethereum, the regulatory environment began to shift as President Trump returned to the White House in January. Many anticipate new opportunities in 2025.

According to Farside Investors data, as of December 15, since the historic launch of the spot Bitcoin ETF in January 2024, it has accumulated a net inflow of $57.7 billion. Compared to $36.2 billion at the beginning of this year, this represents a 59% increase. However, the capital inflow has not been consistently stable.

For example, according to CoinGlass data, on October 6, Bitcoin's price approached a historical high of $126,000.

TechubNews·2025-12-31 02:45

2025 Global Trading Atlas: 11 Key Trades Intertwined with Politics and Markets

Author: Bloomberg

Translation: Saoirse, Foresight News

This is yet another year filled with "high certainty bets" and "rapid reversals."

From Tokyo's bond trading desks, New York's credit committees, to Istanbul's foreign exchange traders, the markets have brought unexpected gains and caused intense volatility. Gold prices hit record highs, the stock prices of solid mortgage giants swung wildly like "Meme stocks" (stocks driven by social media hype), and a textbook-level arbitrage trade collapsed in an instant.

Investors heavily bet on political changes, expanding balance sheets, and fragile market narratives, driving significant stock market rallies and a rush into yield trades, while cryptocurrency strategies largely rely on leverage and expectations, lacking other solid support. After Donald Trump returned to the White House, global financial markets first suffered heavy losses and then recovered; European defense stocks ignited a hot trend; speculators

TRUMP2,67%

PANews·2025-12-30 10:06

Trump's speech hides a secret! XRP's vision aligns with the White House financial revolution

Trump recently delivered a speech emphasizing the modernization of the financial system and encryption technology, which aligns closely with Ripple CEO Brad Garlinghouse's vision for cross-border payments. The speech took place after a meeting with Ripple executives, and Ripple has donated millions of dollars to the inauguration fund. The XRP community views this as a policy benefit, but there has been no official confirmation. This highlights XRP's sensitivity to political signals and the significant gap between hype and actual progress.

XRP10,66%

MarketWhisper·2025-12-30 08:11

California proposes "Billionaire Wealth Tax," crypto executives warn: it will accelerate capital and talent outflow and kill the innovation economy!

California proposes a one-time 5% wealth tax on billionaires with net assets exceeding $1 billion, sparking strong opposition from the tech and cryptocurrency industries. Supporters hope to inject new momentum into public finances, while opponents warn that this move could accelerate capital and talent outflows, impacting California's innovative economic foundation.

(Background: Is Trump imposing a heavy crypto tax? The White House reviews a proposal to align with the CARF crypto asset reporting framework, requiring overseas account holders to pay taxes on their holdings.)

(Additional context: Is the tax eating up more than half of the profits? Three legal profit strategies of crypto whales.)

Table of Contents

One-time wealth tax: proposal still awaiting referendum approval

Supporters: can inject huge funds into the state treasury

Tech and crypto industry pushback

A recent tax proposal targeting ultra-high-net-worth individuals has emerged in California, drawing significant attention and strong opposition from the tech and cryptocurrency sectors. The proposal's main

動區BlockTempo·2025-12-29 12:50

Nanjing Museum's Cultural Relics Management Scandal: Famous Painting "Spring in Jiangnan" Flows from the Museum to the Auction House, Revealing Systemic Flaws and Public Trust Crisis

A Ming Dynasty masterpiece originally belonging to the public collection, flowing from the museum storage to the auction house, unexpectedly reveals the long-standing systemic loopholes and trust crises within China's cultural and museum system. The controversy at Nanjing Museum is not just a case of missing cultural relics, but a collective interrogation about transparency, power, and public responsibility.

(Background recap: The other side of the US AI boom: giving Chinese Bitcoin miners "jobs")

(Additional context: China's authorities have for the first time commented on stablecoins, marking the end of the gray era of StableCoin)

Table of Contents

From Auction House to Storage: A Reversed Cultural Asset Flow

Escalating Allegations: Systemic Issues Surface

"Collective Closure" Rumors: The Spillover Effects of Trust Crisis

Systemic Reflection: From Planned Economy to Modern Governance

Technical Insights: Can Blockchain Become the Infrastructure of Trust?

Conclusion

Recently,

動區BlockTempo·2025-12-27 07:55

The White House Power Expansion Proposal and the "Ultimate Puzzle" of US Cryptocurrency Tax Regulation

The IRS has submitted proposals for international standards on digital asset reporting and taxation to the White House, enabling access to cryptocurrency transaction information of taxpayers on overseas exchanges. This article will analyze the institutional background of the CARF framework, the evolution of the current US tax system, and the compliance implications for various market participants. The article is based on a piece by TaxDAO, organized, translated, and written by Foresight News.

(Previous summary: Why does the US embrace crypto? The answer may lie in the $37 trillion debt)

(Additional background: The most revenue-collecting US president in history, how the Trump family turned political influence into their own treasury)

Table of Contents

Introduction

1 White House reviews new regulations, targeting global crypto tax sources

2 CARF ushers in the global crypto tax "CRS 2.0" era

3 US crypto regulatory framework: gradually moving towards a

動區BlockTempo·2025-12-26 17:00

Trump Is Back – Yet Crypto Crashes Anyway: Is the Bull Run Dead?

Despite Donald Trump's return to the White House, the cryptocurrency market is closing 2025 in the red, trading at roughly 20% of its peak levels from the Biden era. What was supposed to be a triumphant bull run fueled by pro-crypto rhetoric and regulatory tailwinds has instead turned into a year of disappointment and debate.

CryptopulseElite·2025-12-25 08:38

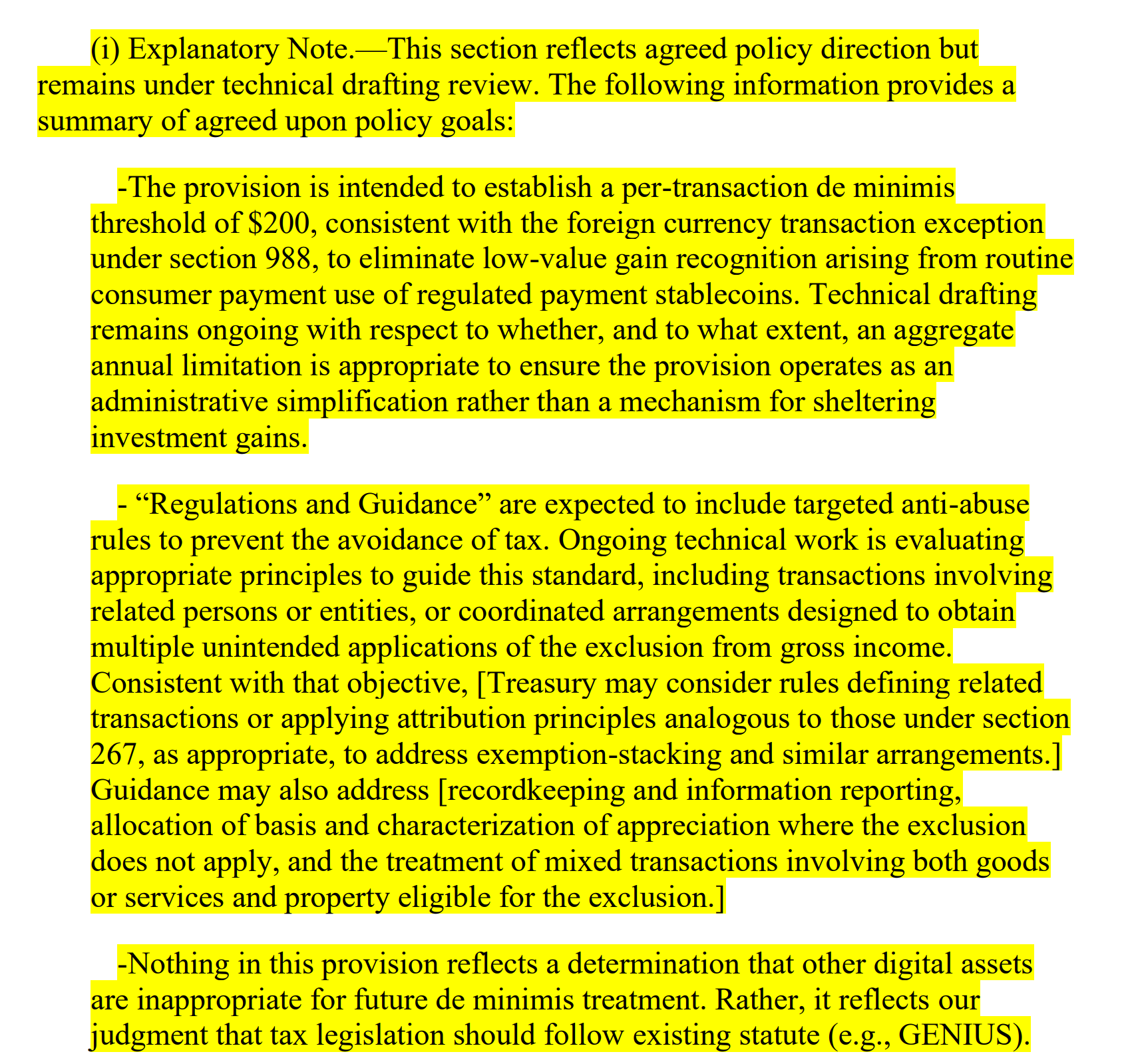

US lawmakers draft PARITY bill! Stablecoin transactions exceeding $200 per transaction are tax-exempt

A bipartisan group of U.S. House Representatives has introduced the "Digital Asset PARITY Act," which plans to establish a tax-free safe harbor for transactions below $200 for stablecoin payments, and allows staking and mining rewards to be taxed after a five-year delay. The bill also strengthens wash sale rules to prevent tax avoidance. The bill aims to improve the payment and tax environment for cryptocurrencies and is expected to be passed by 2026.

ETH1,99%

CryptoCity·2025-12-25 04:00

Former CFTC Acting Chair Caroline Pham officially appointed as MoonPay Chief Legal Officer

Former CFTC Acting Chair Caroline Pham Joins MoonPay, Signaling Deep Integration of Regulation and Crypto Infrastructure, Paving the Way for Institutional Funds in 2026.

(Background recap: Binance US deposits and withdrawals revived! Partnered with MoonPay, USDT becomes the standard currency for buying and selling Crypto)

(Additional background: Crypto mansion showdown: MoonPay raises funds to buy a beach house, still losing to Curve founder's thousand-pingyuan estate)

Crypto payment provider MoonPay announced a major development in mid-December, with former CFTC Acting Chair Caroline Pham officially joining as Chief Legal Officer and Chief Administrative Officer. For the market, this is not just a job change, but the "regulators" are officially entering the scene.

Licenses, connections, and 2026

動區BlockTempo·2025-12-25 03:50

DeepSnitch AI Price Prediction: Lawmakers Push for Staking Tax Reform as DeepSnitch AI Prepares for Explosive January Launch

https://deepsnitch.ai/?utm_source=coincentral.com&utm_medium=article&utm_campaign=deepsnitch-price-prediction-staking-tax-januaryA bipartisan group of 18 US House lawmakers is pressuring the IRS to change its “burdensome” tax rules on crypto staking rewards before the start of 2026. This

CaptainAltcoin·2025-12-24 10:35

TikTok's parent company ByteDance splashes out $23 billion! Plans to seize AI survival rights by 2026.

ByteDance is reported to plan to invest 160 billion RMB in AI infrastructure by 2026, with "half of the budget" allocated for purchasing a large number of Nvidia H200 chips, striving to maintain AI competitiveness under the blockade of the Trump 2.0 era.

(Previous summary: The US version of TikTok is officially sold: three major US investment groups including Oracle take over, while ByteDance retains the brain. Did Trump win?)

(Background: 28-year-old retired "ByteDance's Guo Yu", 34 years old reveals the truth: financial freedom is not true freedom)

Table of Contents

The capital scale is only 1/10 of Silicon Valley.

85 billion RMB shopping spree H200

Doubao and overseas data centers double-line computing power

According to the Financial Times, in the winter of 2025, one year after Trump returned to the White House and as Washington's blockade on the Chinese tech industry intensified, ByteDance announced plans for January next year.

動區BlockTempo·2025-12-23 09:00

Trump family WLFI investigated! 17 billion investment portfolio shrinks to 8 billion USD

The World Liberty Financial (WLFI) project led by the family of US President Trump has seen its governance token fall more than 40% since it began trading publicly. The fund's investment portfolio has plummeted from a peak of $17 billion in September 2025 to below $8 billion in December. The US continues to investigate the scandal involving the Trump family allegedly selling coins to sanctioned targets in Iran, North Korea, and Russia, while the White House insists that the accusations are baseless.

MarketWhisper·2025-12-23 02:25

U.S. lawmakers draft new bill! Striving for "stablecoin transactions not exceeding 200 dollars" to be tax-free.

The U.S. cryptocurrency tax system is expected to undergo significant adjustments. Two bipartisan congressmen recently proposed a tax reform draft called the "Digital Asset PARITY Act," aiming to establish a "tax-free safe harbor" for everyday use of stablecoin payments and to present a compromise on "when to tax staking rewards."

The "Digital Asset PARITY Act" was jointly introduced by Republican Ohio Congressman Max Miller and Democratic Nevada Congressman Steven Horsford, both of whom are members of the House Ways and Means Committee.

ETH1,99%

区块客·2025-12-22 18:58

Galaxy Forecasts Stablecoins to Surpass ACH Transactions by 2026

Stablecoins Poised to Surpass US ACH Transactions by 2026, According to Galaxy Research

Forecasts indicate that stablecoins could handle more transaction volume than the US Automated Clearing House (ACH) network within the next three years. Driven by increasing adoption, regulatory clarity, and

CryptoDaily·2025-12-22 16:20

Dogecoin's Wild 53,255% Futures Market Surge, What's Behind It? - U.Today

Dogecoin's futures activity surged 53,255% in 24 hours, reaching $260.34 million on Bitmex amid year-end trading adjustments. Despite recent gains, Dogecoin remains down 58.5% yearly, with challenges ahead as 2025 approaches. House of Doge plans to enhance its payment solutions in 2026.

UToday·2025-12-22 14:25

House Lawmakers Introduce Digital Asset PARITY Act to Simplify Crypto Taxes

Lawmakers propose a safe harbor for stablecoin payments under two hundred dollars to reduce tax burden.

Taxpayers could defer staking rewards for five years before paying ordinary income taxes.

New rules extend wash sale and constructive sale principles to digital asset trading.

Two

CryptoNewsLand·2025-12-22 10:21

US lawmakers urge IRS to end double taxation on crypto staking before 2026

18 bipartisan U.S. House lawmakers have urged the Internal Revenue Service to reexamine the country's taxation laws on cryptocurrency staking.

Summary

A group of U.S. lawmakers has urged the IRS to review its 2023 guidance on staking rewards before the 2026 tax year.

The letter recommends

Cryptonews·2025-12-22 08:24

After experiencing the "2025 Compliance Breakthrough Year", is a 10 trillion dollar crypto market no longer a fantasy?

Time always comes unexpectedly, and the K-line always fluctuates unexpectedly. This is the footnote of 2025. Today, we stand at the tail end of time, looking back at the past and looking forward to the future.

The year 2025 that is about to pass has not seen grand waves in the cryptocurrency industry, but it has also endured a calm. From the frenzy sparked by TrumpCoin at the beginning of the year, to the return of Ethereum in midsummer, and then to the bloodbath brought by 1011 in late autumn, it outlines the fluctuations of the cryptocurrency market.

But setting aside the fluctuations on these K-lines, the cryptocurrency industry has finally ushered in another spring.

In January, the White House issued an executive order, completely abandoning the previous approach of "restrictive regulation."

In March, Trump launched a Bitcoin reserve plan, incorporating 200,000 seized Bitcoins into the strategic reserves.

In April, the U.S. Department of Justice disbanded the dedicated cryptocurrency enforcement team, releasing development space for compliant platforms.

In July, the US stablecoin bill (GE

TRUMP2,67%

区块客·2025-12-22 08:03

White House encryption czar David Sacks: The "Digital Asset Market Clarity Act" will begin deliberations in January next year.

The U.S. Crypto Assets regulatory legislation, the "Clarity Act," will enter its final review stage in January next year, symbolizing that formal legislation is one step closer. The bill aims to establish a clear regulatory framework for crypto assets, has received support in the House of Representatives, and will be integrated with the Senate version to pave the way for the final version.

区块客·2025-12-22 07:34

Why Generation Z is betting on Crypto Assets, sports betting, and speculative markets: the current paths of people can no longer be walked.

In the past world, hard work, education, and stable jobs were reliable ladders to the middle class. However, for today's Generation Z and millennials, this path is rapidly collapsing: soaring student loans, stagnant wages, shrinking job opportunities, and housing prices far exceeding incomes have made the notion that "following the steps can lead to upward mobility" a lie that can no longer deceive young people.

As a result, young people are turning their attention to high-risk markets such as cryptocurrency, prediction markets, and sports betting, adapting to the era of "Financial Nihilism (Financial Nihilism)."

The ineffective formula for success: hard work can no longer guarantee one's future.

According to a report by the WSJ, post-war America once created a predictable life script: go to college, find a stable job, buy a house, start a family, and enable upward mobility; however, this model is now completely collapsing.

First, student loans from 2004 were 3

ChainNewsAbmedia·2025-12-22 07:14

US lawmakers push to fix staking ‘double taxation’ before 2026

A bipartisan group of 18 US House lawmakers is urging the IRS to reevaluate crypto staking tax rules to prevent double taxation and encourage participation. They seek to tax staking rewards only upon sale, aiming to support blockchain security and innovation.

ETH1,99%

Cointelegraph·2025-12-22 04:30

The Fed Chair Race Heats Up: "Trump's Close Friend" Hassett's Declaration of Independence and Rate Cut Blueprint

Kevin Hassett, the director of the White House National Economic Council and one of the final candidates for the Fed chair, has recently been vocal, defending the independence of the Fed on one hand and emphasizing that interest rate decisions need to be based on consensus and data; on the other hand, he clearly stated that there is "ample room" for unconventional rate cuts. Hassett is viewed as a close friend of President Trump, and his candidacy is under significant pressure regarding its independent nature due to this relationship. He suggested that the productivity leap brought by artificial intelligence provides a historic window for the Fed to implement a more accommodative monetary policy, and his policy thinking has been interpreted by the market as leaning towards "Greenspan-style" adaptive management. This personnel competition not only concerns the monetary policy path of the United States for the coming years, but the outcome of the independence struggle will also profoundly affect global risk assets, including the liquidity expectations of Bitcoin and Crypto Assets markets.

MarketWhisper·2025-12-22 04:03

Bipartisan lawmakers in the U.S. join forces to break the ice: The cryptocurrency tax bill draft sends key signals.

Recently, bipartisan members of the U.S. House of Representatives proposed a discussion draft titled the "Digital Asset PARITY Act," aimed at establishing a clear and fair tax framework for digital assets. The core of the draft includes providing a tax-free safe harbor for small stablecoin transactions, allowing staking and Mining rewards to enjoy five years of tax deferral, and introducing the wash sale rules from the securities sector into Crypto Assets. This move marks a crucial step in the U.S. cryptocurrency tax policy transitioning from ambiguity to institutionalization, intending to alleviate the compliance burden on ordinary users while responding to the industry's long-standing core demands, and is expected to inject significant policy certainty into the market.

ETH1,99%

MarketWhisper·2025-12-22 01:43

The US Crypto Assets tax revolution! $200 stablecoin tax exemption, stakers defer payment for 5 years.

Bipartisan members of the U.S. House of Representatives have jointly introduced the "Digital Asset Equalization Act," marking a historic breakthrough in the cryptocurrency tax system. According to a report by Bloomberg, the draft proposed by Republican Congressman Max Miller of Ohio and Democratic Congressman Steven Horsford of Nevada will exempt capital gains tax on stablecoin transactions under $200 and allow for a five-year tax deferral on staking and mining rewards.

ETH1,99%

MarketWhisper·2025-12-22 01:41

Galaxy Forecasts Stablecoins to Surpass ACH Transactions by 2026

Stablecoins Poised to Surpass US ACH Transactions by 2026, According to Galaxy Research

Forecasts indicate that stablecoins could handle more transaction volume than the US Automated Clearing House (ACH) network within the next three years. Driven by increasing adoption, regulatory clarity, and

CryptoDaily·2025-12-21 16:15

PA Daily | As of this year, the proportion of 118 TGE falling below the issue price is 84.7%; Tether is developing a mobile encryption Wallet with integrated AI features.

Today's News Highlights:

1. Bipartisan members of the U.S. House of Representatives draft a cryptocurrency tax proposal, involving tax exemption for stablecoins and deferral of taxes on staking rewards.

2. Tom Lee responds to the conflicting discussions with Fundstrat, emphasizing that different analysts have different responsibilities and time horizons.

3. Arthur Hayes: The season of copycats always exists, it's just that some traders do not hold the rising currencies.

4. Tether CEO confirms the development of a mobile cryptocurrency wallet integrated with AI.

5. Data: So far this year, 118 TGEs have a break-even ratio of 84.7%, with only 15% of projects showing an upward trend.

6. F2Pool co-founder Wang Chun once lost 490 bitcoins after testing private key security by transferring 500 bitcoins to a suspicious address.

macroeconomic

Members of both parties in the U.S. House of Representatives are drafting a cryptocurrency tax bill that includes tax exemptions for stablecoins and deferral of taxes on staking rewards.

Representative Max

PANews·2025-12-21 09:17

After experiencing the "2025 Compliance Breakthrough Year", is a 10 trillion dollar crypto market no longer a fantasy?

Time always comes unexpectedly, and the K-line always fluctuates unexpectedly. This is the footnote of 2025. Today we stand at the tail end of time, looking back at the past and looking forward to the future.

As 2025 approaches, the crypto industry may not be described as grand and tumultuous, but it has certainly weathered a calm sea. From the frenzy sparked by Trump Coin at the beginning of the year, to the return of Ethereum in midsummer, and then to the bloodbath brought by 1011 in late autumn, it outlines the fluctuations of the crypto market.

But putting aside these fluctuations on the K-line, the cryptocurrency industry has finally迎來了它的另一個春天.

In January, the White House issued an executive order, completely abandoning the previous approach of "restrictive regulation."

In March, Trump launched a Bitcoin reserve plan, incorporating 200,000 seized Bitcoins into the strategic reserves.

In April, the U.S. Department of Justice disbanded the specialized cryptocurrency enforcement team, releasing development space for compliant platforms.

In July, the U.S. Stablecoin Bill (GE

TRUMP2,67%

区块客·2025-12-21 08:03

White House encryption czar David Sacks: The "Digital Asset Market Clarity Act" will begin deliberations in January next year.

US Crypto Assets regulatory legislation has moved forward again. White House AI and Crypto Assets Czar David Sacks stated on Thursday that the highly anticipated Digital Asset Market Clarity Act is set to undergo its final markup in January next year, symbolizing that this key piece of legislation is one step closer to formal enactment.

David Sack posted on social media platform X, stating: "Today we had a very positive call with Senate Banking Committee Chairman Tim Scott and Agriculture Committee Chairman John Boozman, who confirmed that the Clarity Act will be reviewed in January."

> We have never been so close to passing this cryptocurrency market structure bill, which has also been personally endorsed by President Trump.

> We had a

区块客·2025-12-21 07:30

24 major American technology giants such as Nvidia, OpenAI, and Google join Trump's "Genesis Project": Accelerating the development of nuclear fusion, pharmaceuticals, and new materials.

The White House launches the "Genesis Project," with 24 top technology companies committed to doubling U.S. scientific productivity within a decade. The plan integrates data and Computing Power from national laboratories, pushing AI from chat applications to nuclear fusion simulations and new material searches, while promoting investment in Computing Power infrastructure from the Capital Market.

動區BlockTempo·2025-12-21 07:25

Polish Parliament Approves New Crypto Bill, Sent to Senate for Final Vote

Polish Parliament Advances Crypto Regulation Bill Amid President’s Veto Concerns

The lower house of Poland’s parliament, the Sejm, has approved a new bill aimed at regulating the country’s cryptocurrency sector, despite previous vetoes by President Karol Nawrocki. The legislation aligns Poland’s cr

CryptoDaily·2025-12-20 17:55

White House Crypto Czar David Sacks: "Digital Asset Market Clarity Act" to Begin Review in January Next Year

U.S. Cryptocurrency Regulatory Legislation Moves Forward Again. White House AI and Crypto czar David Sacks announced on Thursday that the highly anticipated Digital Asset Market Clarity Act has been scheduled for final markup in January next year, bringing this key legislation one step closer to official enactment.

David Sacks posted on social platform X: "Today, we had a very positive call with Senate Banking Committee Chairman Tim Scott and Agriculture Committee Chairman John Boozman. They confirmed that the Clarity Act will enter markup in January."

> We have never been this close to passing this crypto market structure bill, which President Trump personally endorsed.

> We had a

区块客·2025-12-20 07:28

Chris Waller leaves meeting with Trump knowing he won’t become Fed chair

Federal Reserve Governor Chris Waller left the White House with a clear sense that the top job at the U.S. central bank was slipping out of reach. He realized it almost immediately after his meeting with President Donald Trump in the Oval Office ended.

Waller had just completed what officials

Moon5labs·2025-12-20 04:03

Polish Parliament Revives Crypto Regulation Bill, Advances It to Senate

_Poland’s lower house has revived a disputed crypto bill, advancing it to the Senate and reopening debate over strict national MiCA implementation._

Poland’s parliament has moved forward with a controversial crypto regulation bill after overriding a presidential veto. The country’s lower house,

LiveBTCNews·2025-12-20 03:30

Pro-crypto US Senator Lummis won't seek reelection in 2026

Wyoming Senator Cynthia Lummis announced she will not seek reelection in 2026, citing exhaustion from her legislative duties. A key advocate for digital assets, she helped push a significant crypto market structure bill through the House.

BTC1,96%

Cointelegraph·2025-12-19 21:20

Polish Parliament Approves New Crypto Bill, Sent to Senate for Final Vote

Polish Parliament Advances Crypto Regulation Bill Amid President’s Veto Concerns

The lower house of Poland’s parliament, the Sejm, has approved a new bill aimed at regulating the country’s cryptocurrency sector, despite previous vetoes by President Karol Nawrocki. The legislation aligns Poland’s cr

CryptoDaily·2025-12-19 17:50

Poland’s Lower House of Parliament Overrides Presidential Veto on Crypto Bill - Coinspeaker

Key Notes

Poland's Sejm passed a crypto regulation bill and sent it to the Senate for further consideration.

The legislation aims to harmonize Poland’s rules with the EU’s Markets in Crypto-Assets (MiCA) framework.

If approved and any presidential objections are resolved, the Polish financial w

Coinspeaker·2025-12-19 15:18

After experiencing the year of 2025's compliance breakthroughs, is the $10 trillion crypto market no longer a fantasy?

Time always arrives unexpectedly, and K-line fluctuations are always unpredictable—this is the footnote of 2025. Now, we stand at the tail end of time, looking back at the past and envisioning the future.

The nearly past 2025 in the crypto industry was not particularly tumultuous, but it was also calm and peaceful. From the frenzy sparked by Trump Coin at the beginning of the year, to Ethereum's return in midsummer, and then the bloodbath brought by 1011 in late autumn, the crypto market's ups and downs are vividly outlined.

But beyond these fluctuations on the K-line, the crypto industry has finally welcomed another spring.

In January, the White House issued an executive order, completely abandoning the previous "restrictive regulation" approach.

In March, Trump launched the Bitcoin Reserve Plan, incorporating 200,000 confiscated Bitcoins into strategic reserves.

In April, the U.S. Department of Justice disbanded the specialized crypto enforcement team, creating more space for compliant platforms to develop.

In July, the U.S. Stablecoin Bill (GENIUS) officially took effect.

In August,

PANews·2025-12-19 13:03

White House Confirms: CLARITY Crypto Regulation Bill Heads to Senate in January

U.S. crypto legislation is about to make a major leap forward. David Sacks, the White House’s lead advisor on cryptocurrency and artificial intelligence, announced that the CLARITY Act — landmark legislation aimed at clearly defining regulatory authority over digital assets — will reach the Senate f

Moon5labs·2025-12-19 11:01

Crypto CLARITY Act set for Senate markup in January, Sacks says

The CLARITY Act is progressing towards becoming law with a Senate markup scheduled for January, aiming to clarify crypto regulations and reduce uncertainty for firms. The bill has faced delays but is now set for potential amendments before returning to the House and ultimately to President Trump.

Cointelegraph·2025-12-19 10:35

Who will succeed Powell?

Who will become Powell's successor? This seemingly settled matter has become more uncertain after the latest statement from JPMorgan Chase CEO Jamie Dimon. White House economic advisor Kevin Hassett was initially considered the frontrunner, but Dimon's support for another Kevin—former Federal Reserve Governor Kevin Warsh—has shifted the balance. According to Polymarket's predictions, Hassett's probability of winning has dropped from nearly 80% to around 50%, while Warsh's chance has risen from about 10% to approximately 40%. As the competition intensifies, what might have been decided within the year will likely be postponed until early next year. But this isn't necessarily a bad thing, as it allows candidates to prepare more thoroughly and provides the market with more feedback, especially for the United States at a crossroads.

金色财经_·2025-12-19 10:33

White House Crypto Czar David Sacks: "Digital Asset Market Clarity Act" to Begin Review in January Next Year

U.S. Cryptocurrency Regulatory Legislation Moves Forward Again. White House AI and Crypto czar David Sacks announced on Thursday that the highly anticipated Digital Asset Market Clarity Act has been scheduled for final markup in January next year, bringing this key legislation one step closer to official enactment.

David Sacks posted on social platform X: "Today, we had a very positive call with Senate Banking Committee Chairman Tim Scott and Agriculture Committee Chairman John Boozman. They confirmed that the Clarity Act will enter markup in January."

> We have never been this close to passing this crypto market structure bill, which President Trump personally endorsed.

> We had a

区块客·2025-12-19 07:21

Load More