Search results for "LONG"

Ripple Outlines M&A Strategy, Rules Out Exchange Deals

Monica Long said Ripple is building a full crypto stack by integrating blockchain, stablecoins like RLUSD, and custody services.

Ripple’s acquisitions target enterprise users, connecting corporate and hedge fund clients directly to its blockchain infrastructure.

Long said Ripple will

XRP-5,06%

CryptoFrontNews·48m ago

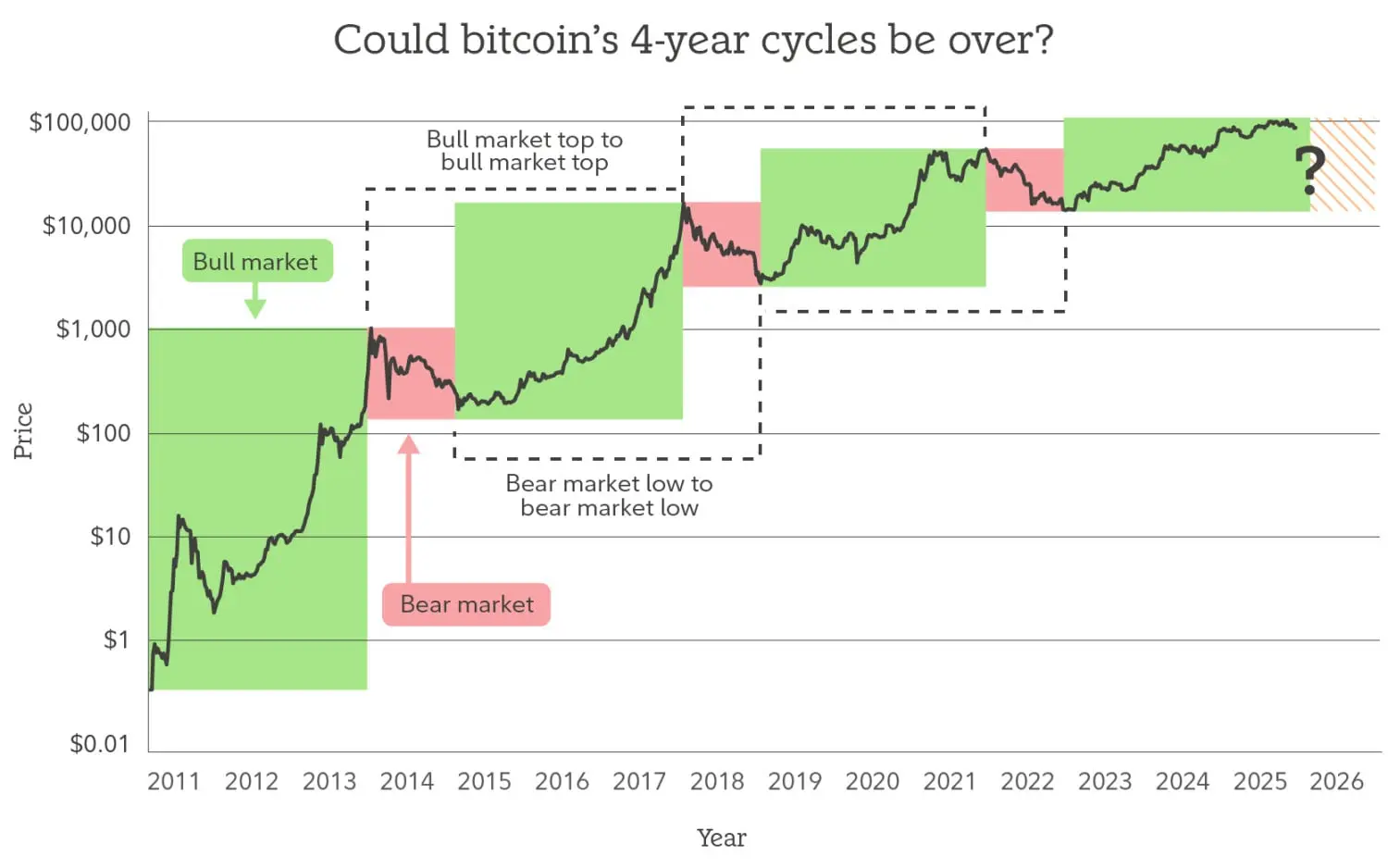

Bitwise Chief Investment Officer: Will Bitcoin enter a long-term bull market in 2026? The key is to overcome three major tests.

The crypto market is set to rise in 2026, but whether this trend can continue remains uncertain. Bitwise Chief Investment Officer Matt Hougan pointed out that for the market to break out into a genuine long-term bullish trend, it must first overcome three key challenges: market stability, regulatory legislation, and the overall financial environment.

(Previous context: Arthur Hayes' long article: Elections, oil prices, and printing presses—why Bitcoin only cares about Trump’s face)

(Additional background: Fidelity’s 2026 crypto market outlook report: More countries may establish Bitcoin reserves, and long-term holding of BTC remains profitable)

Table of Contents

1. Systemic risk has cooled, the market has already passed the first hurdle

2. U.S. legislative progress, becoming a key variable affecting mid-term trends

3. Stock market trends remain an external factor that crypto assets cannot ignore

Long-term fundamentals are taking shape, but the key still depends on whether all three hurdles can be fully cleared

BTC-1,69%

動區BlockTempo·1h ago

Former Ripple CTO Shares His Retirement Plans, but There's a Catch - U.Today

David Schwartz, former CTO of Ripple, announced his retirement plans and will join Ripple's board while advising Evernorth. Ripple's president, Monica Long, clarified the company's strategy and denied acquisition plans for a crypto exchange.

XRP-5,06%

UToday·1h ago

Ripple Confirms No IPO Plans and Emphasizes Growth Focus for 2026

_Ripple confirms it has no IPO plans, citing strong finances, $500M raised, and a growth strategy focused on acquisitions and products._

Ripple has confirmed that it has no plans for an initial public offering (IPO) in the near future.

Monica Long, Ripple’s president, emphasized that the

XRP-5,06%

LiveBTCNews·1h ago

While retail investors sell off, giant whales increase their holdings by 50,000 Bitcoins. Who is right and who is wrong?

Written by: Blockchain Knight

At the beginning of 2026, Bitcoin broke through $94,000, reaching a new high in over a month, marking the end of the market stagnation that persisted at the end of 2025.

Compared to the dull performance of the same period last year, this rebound has achieved a decisive reversal in market sentiment. The core driving forces are favorable macroeconomic conditions, recovering institutional demand, and healthy market mechanisms.

On the macro level, the shift in the US economic landscape provides support for Bitcoin.

First, the US Treasury yield curve has moved away from the inversion seen in 2022-2024, with short-term easing expectations coexisting with long-term high yields, prompting re-pricing of duration risk and credit risk.

Second, the structural weakening of the US dollar, although still solid, is controlled in its depreciation. Policy directions are enhancing trade competitiveness, and this combination benefits assets with defensive characteristics.

Meanwhile, at the end of 2025, ETF

BTC-1,69%

TechubNews·3h ago

Nanominex Review: Structured Cloud Mining in the 2025–26 Crypto Landscape

As cryptocurrency markets mature, some participants are reconsidering whether buying and holding is the only long-term approach. In 2025, some users view mining as a longer-term process rather than a quick shortcut. For users exploring income-oriented crypto strategies, mining can be one

CryptoNinjas·4h ago

No rush to ring the bell! Ripple reiterates no IPO plans for now, with sufficient cash on hand

Blockchain payment company Ripple President Monica Long stated that the company currently has no IPO plans and emphasized that Ripple's financial situation is stable. Rather than going public, the company prefers to expand through acquisitions and product development.

During an interview with Bloomberg on Tuesday, Monica Long mentioned: "At this stage, we still plan to remain private. Typically, companies pursue an IPO to gain investor support or liquidity in the public market, but our current financial health is very strong. We are fully capable of continuing to fund and invest in the company's growth without going public."

Ripple only completed a $5 billion private placement financing in November last year, with investors including Fortress Investment.

XRP-5,06%

区块客·5h ago

Cardano Has 4.34 Years Left: Treasury Math the ADA Community Can’t Ignore

Cardano treasury spending vastly exceeds network revenue, creating a widening sustainability gap.

Current treasury reserves support roughly 4.34 years of operation at present spending levels.

Incentive misalignment threatens long term ecosystem viability without urgent governance

CryptoNewsLand·5h ago

Dalio US Elections: Why Investors Should Diversify Now

Billionaire investor Ray Dalio warns about the US economy's future, highlighting political risks, the weakening dollar, and advocating for asset diversification. He stresses long-term planning amidst increasing political polarization and warns of potential declines in dollar-based returns.

Coinfomania·5h ago

Dormant Polymarket Trader With a Strong Record on Israel–Iran Strike Bets Returns to Wager on War Again

A long-dormant Polymarket trader has resurfaced with a series of wagers tied to the possibility of an Israeli military strike on Iran.

The return has attracted attention not only because of the sensitive geopolitical context, but also due to the trader’s past performance. Consequently, those

TheCryptoBasic·5h ago

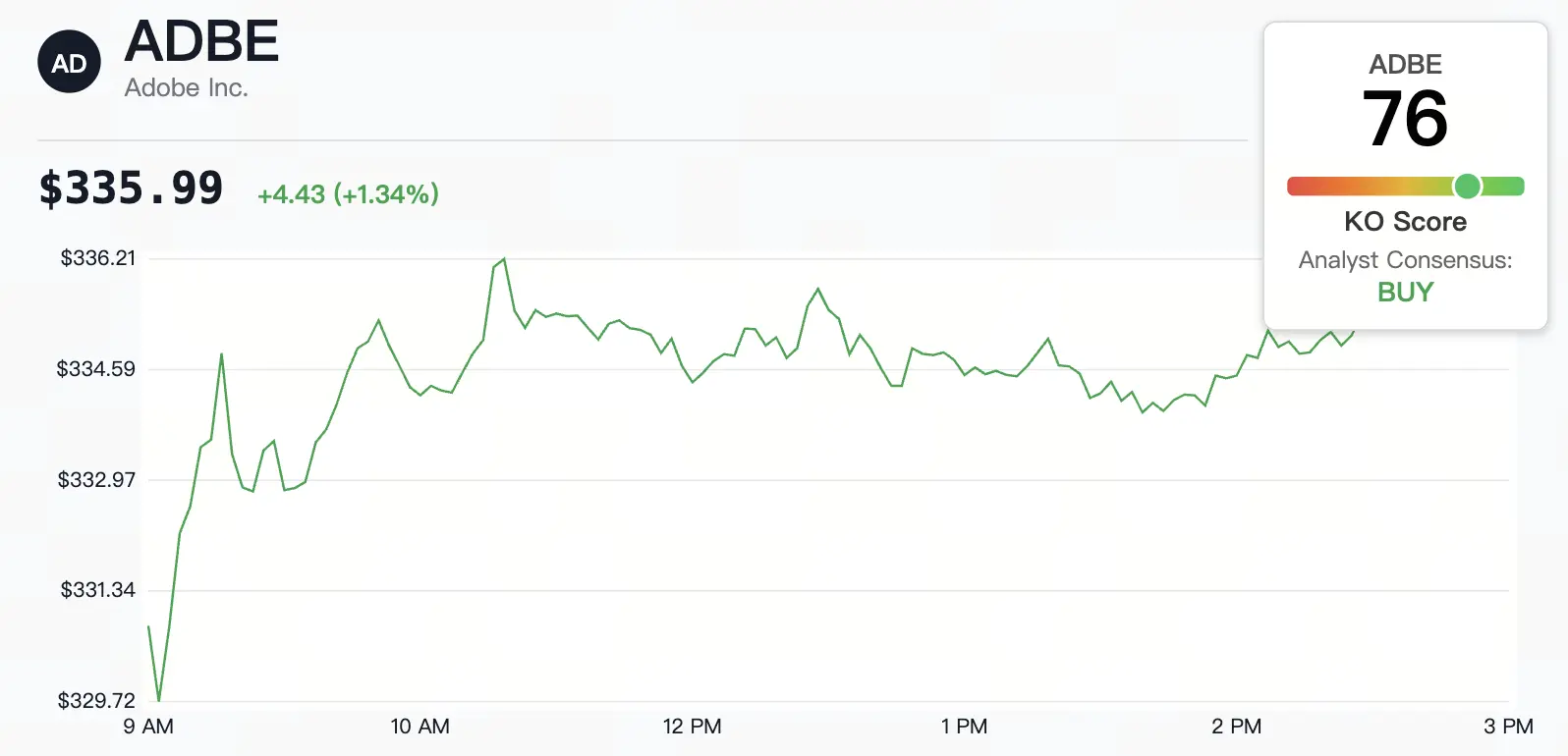

Adobe Stock Dips 4.8% in Early 2026: Analyzing the Pullback and Long-Term Outlook

Adobe stock has faced early 2026 headwinds from yield pressures and sector rotation, resulting in a 4.8% drop that tests key technical support.

CryptopulseElite·6h ago

U.S. Treasury bonds are about to surpass $40 trillion. Why might Bitcoin become the biggest winner?

By the end of 2025, the total US federal government debt has approached $38.4 trillion, equivalent to about $28.5 thousand per American household, and is rushing towards the $40 trillion mark at a rate of $5 billion to $7 billion per day. Behind this massive figure is an astonishing interest expense of over $1.2 trillion annually.

Traditionally, the ever-expanding national debt has been viewed as a pressure on the long-term value of the dollar, reinforcing Bitcoin's narrative as "digital gold" and an inflation hedge. However, a disruptive turn is occurring in this debt story: mainstream stablecoin issuers, led by USDT and USDC, are transforming from external observers to significant internal buyers of the US debt market by holding large amounts of short-term US Treasuries. This role reversal has created an unprecedented deep linkage between the cryptocurrency market and the "vessels" of the US financial system—the Treasury market and global dollar liquidity—causing Bitcoin's future to be simultaneously influenced by "hard currency" faith and short-term liquidity tides.

MarketWhisper·6h ago

TAKE Price Shows Post-Crash Recovery, Eyes $0.15–$0.17 Upside Target

TAKE cryptocurrency stabilized after a significant decline, trading between $0.09–$0.11 with signs of a recovery. Analysis suggests a potential long entry around $0.095 aimed at $0.15–$0.17 as market conditions show accumulation and reduced volatility.

TAKE-0,74%

CryptoFrontNews·7h ago

Goldman Sachs: Political changes in Venezuela have limited short-term impact on the oil market; bullish on gold in 2026

The United States launched a targeted killing operation and arrested Venezuelan President Nicolás Maduro last week, drawing significant international market attention. Investors' concerns quickly shifted to whether Venezuelan crude oil would be affected, if oil prices would experience significant volatility, and whether the US would deepen its involvement in the local energy industry in the future. In response, Daan Struyven, Head of Commodity Research at Goldman Sachs (Goldman Sachs), provided an initial analysis on the development of the event, the oil market response, and the medium to long-term impact in the latest episode.

Maduro's arrest by the US creates a power vacuum in Venezuela

Venezuelan President Nicolás Maduro (Nicolás Maduro) was arrested by the US authorities in Caracas on 1/4, on drug-related charges. His wife was also detained. Currently, Vice President Delcy Rodríguez (Delcy Rodrígue

ChainNewsAbmedia·9h ago

Sell Your Bitcoin and Cry Later? Tim Draper Backs a Way out as BTC Holders Face Brutal Liquidity Trap

Bitcoin holders can now tap liquidity without selling, as Tim Draper backs Sats Terminal’s non-custodial bitcoin-backed lending marketplace designed to preserve long-term upside while avoiding custody risks and forced exits.

Never Sell Your BTC Again? Tim Draper Backs a Non-Custodial Borrowing

BTC-1,69%

Coinpedia·10h ago

Pi Coin Price News: On-chain data reveals mysterious surge in trading volume, are big players secretly positioning?

The highly anticipated mobile mining project Pi Network has recently experienced unusual market activity. Its token Pi Coin, amid declining social media discussion, has defied the trend with seven consecutive days of price increases, with daily trading volume soaring to 8 million USD, reaching a near three-week high, forming a rare phenomenon of “discrepancy between volume, price, and social buzz.” Analysis suggests that this may be an early deployment by large investors (whales) under the condition of still low retail investor participation.

Meanwhile, Pi Network has officially launched its first multi-signature wallet, aiming to enhance security and practicality, adding a key piece to its long-term roadmap. The market is watching whether these changes indicate that Pi Coin will break free from long-term skepticism and enter a new development phase.

PI-1,17%

MarketWhisper·10h ago

MSCI Index continues to favor MicroStrategy! MSTR rises over 6% after hours, but analysts warn: the game is not over yet

Global index giant MSCI announces it will temporarily retain Digital Asset Treasury (DAT) companies in its indices, prompting MicroStrategy (MSTR) to surge after hours. However, analysts warn that the review of non-operating companies is not yet complete, and long-term risks remain.

MSCI Index Continues to Include MicroStrategy, MSTR Shares Surge After Hours

----------------------

Bitcoin reserve company MicroStrategy (now named Strategy) stock MSTR surged over 6% after hours early this morning (1/7), mainly because the global index provider MSCI decided not to remove Digital Asset Treasury (DAT) companies from its global indices for now.

Image source: Google Finance MSCI Index Continues to Include MicroStrategy, MSTR Shares Surge After Hours

MSCI pointed out that it is important to distinguish between pure investment companies and those that view digital assets as core operational assets.

CryptoCity·10h ago

Iceberg Alert: Quantum Computing Could Threaten One-Third of Bitcoin, 6.5 Million BTC Facing Ultimate Security Test?

Coinbase Global Investment Research Director David Duong issued a strong warning, pointing out that the progress of quantum computing may surpass market expectations, with approximately one-third of Bitcoin supply potentially facing the risk of "long-term quantum attacks" due to their public keys being exposed on-chain. Based on on-chain data from the 900,000th block, it is estimated that about 65 million Bitcoins (worth approximately $100 billion) have addresses that are more vulnerable.

This risk has gained the attention of institutions. BlackRock explicitly listed quantum computing as a risk factor in its revised Bitcoin ETF prospectus. This marks a new stage where Bitcoin's security narrative is shifting from theoretical discussion to real risk assessment and defensive preparations.

MarketWhisper·10h ago

Polymarket adjusts trading mechanism, 15-minute crypto market opening and closing order fee

Prediction Market Platform Polymarket recently updated its official trading documentation, showing that its "15-minute cryptocurrency price movement market" has officially started charging transaction fees to the (Taker), indicating a change in Polymarket's long-standing zero-fee mechanism. However, this applies only to specific short-term crypto markets, while most other markets continue to operate with no transaction fees.

Polymarket quietly updates, charging first in the 15-minute crypto markets

According to the latest Polymarket documentation, the platform has officially started charging transaction fees for the "15-minute cryptocurrency up/down markets," and these fees are only applied to the Taker side. The documentation indicates that this system is not universally applied but is limited to high-frequency, very short-cycle crypto markets. Most other markets still maintain the original no-fee structure.

Clear purpose for the fees, making the taker fee fully

USDC0,04%

ChainNewsAbmedia·11h ago

Chevron (CVX) Dominates Venezuela Opportunities, Can High Dividends Offset the Oil Price Headwinds?

With the change of government in Venezuela in 2026 and the strong intervention of the Trump administration, the global energy landscape is facing yet another major restructuring after the shale oil revolution. Trump's proposed "Oil Industry Revival Plan" aims to have U.S. companies take over Venezuelan oil fields, using oil revenues to cover reconstruction costs, thereby cutting off China's and Russia's influence in South America's energy sector. Among many international oil giants, Chevron has become the biggest potential beneficiary due to its long-term presence and operations in the region. This report will analyze Venezuela's current production capacity, the U.S. government's strategic blueprint, and whether Chevron has a long-term investment moat amid the current global oversupply.

Venezuela's Crude Oil Status: Potential and Challenges on the Ruins

Although Venezuela possesses the world's largest proven oil reserves (approximately 3.03 trillion barrels), years of sanctions and mismanagement have severely impacted its oil industry.

ChainNewsAbmedia·11h ago

ADA Falling Wedge Breakout Signals Cardano Price Recovery After Long Decline

ADA/USDT breaks a multi-month descending channel, confirming a structural shift supported by expanding bullish candles.

Higher-timeframe charts show controlled compression, aligning with long-term accumulation rather than renewed distribution.

Market

ADA-3,06%

CryptoFrontNews·12h ago

Global M2 remains strong at $115.9 trillion... Market indicators simultaneously signal stability

The global M2 supply continues to grow amid a mild recovery, and the Bitcoin market shows signs of stability after adjustments. Despite short-term fluctuations, the liquidity foundation remains solid, and long-term holders remain active. Meanwhile, net inflows in the ETF market are significant, indicating recovery signals.

TechubNews·13h ago

[Gift Master PICK] SOL USD Margin Longs Account for 72%... BTC and ETH Also Show a Rebound Trend

■ Major Cryptocurrency Long Positions Status

Based on position volume, Bitcoin(BTC) long positions account for 69.23%( of USD margin, a+1.42%p) increase from the previous day, and 62.85%( of coin margin, a-0.15%p) decrease.

Ethereum(ETH) recorded 71.04%( of USD margin, a+1.30%p) increase, and 68.99%( of coin margin, a+0.09%p) increase. XRP shows 61.92%( of USD margin, a+0.79%p) increase, and 43.95%( of coin margin, a-0.56%p) decrease.

Solana(SOL) statistics show 71.96%( of USD margin, a+3.47%p) increase, and 76.68%( of coin margin, a-1.99%p) decrease. Dogecoin(DOGE) recorded 70.69%( of USD margin, a-2.03%p) decrease, and 45.26%( of coin margin, a-1.31%p) decrease.

■ Long Position Accounts

TechubNews·13h ago

AI·Carbon Neutrality carries $3.5 billion bonds... Export-Import Bank opens a new chapter in policy-based finance

Korea Eximbank successfully issued a total of USD 3.5 billion in foreign exchange bonds (global bonds), becoming the first case of the government's artificial intelligence industry transformation policy officially implemented in the financial market. At the same time, by strengthening investment in the environmental protection sector, it once again demonstrates its status as a policy financial institution.

The global bonds issued this time include three types. The most notable is the USD 500 million, 10-year bond. This bond is the first in the country to explicitly specify the policy goal of "supporting artificial intelligence (AI) transformation" at the time of issuance. Eximbank stated that it has explained the Korean government's direction for cultivating the AI industry to global investors and confirmed relevant investment demands to attract funds. This move is significant, marking that policy finance has surpassed mere financing and is now integrated with medium- and long-term industrial strategies.

Another bond worth USD 1.25 billion is a 3-year term. This is aimed at expanding efforts for greenhouse gas emission reduction and renewable energy, among other areas.

TechubNews·14h ago

Ripple President: We Still Plan to Remain Private - U.Today

Ripple President Monica Long announced no timeline for an IPO, emphasizing the company's strong financial position after a $500 million fundraising round. Ripple is also focused on integrating recent acquisitions to enhance its ecosystem.

UToday·16h ago

Chainlink (LINK) Price Long Reset May Be Ending – Here’s What the Chart Is Showing

The Chainlink (LINK) price has stabilized since its 2021 peak, forming a solid foundation. Analysts highlight that LINK is holding key support levels and accumulating, suggesting a potential bullish shift. Market behavior indicates that a decisive move may be approaching.

CaptainAltcoin·20h ago

Long-term government bond yields decline across the board... Expectations of a rate cut by the Bank of Korea increase.

As of January 6, 2026, Korea's government bond yields have generally declined, with long-term bond yields decreasing notably, reflecting market expectations of future interest rate cuts and economic slowdown. This situation has increased bond prices but reduced the attractiveness of other financial products, significantly impacting household and corporate funding and investment strategies.

TechubNews·22h ago

Cardano Founder Goes Quiet on X, Community Starts Asking Questions - U.Today

Charles Hoskinson, founder of Cardano, has taken a break from the social media platform X, stating he has outgrown it and will focus on new communication strategies for 2026. He plans to prioritize long-form writing and AMAs while remaining active in the crypto space.

ADA-3,06%

UToday·23h ago

Best Crypto to Buy Now for 10x Growth in 2026: This Indicator Shows Why Investors Are Watching Ta...

Crypto markets continue to reward projects that combine real utility with clear growth narratives. While hype-driven tokens fade, investors increasingly focus on networks building long-term value as the best crypto to buy now. This shift has brought renewed attention to three different sectors of th

BlockChainReporter·23h ago

Dogecoin Sees 2,055% Liquidation Imbalance as Bulls Take Over - U.Today

Dogecoin (DOGE) price action is against long traders, as they have suffered more losses in the recent liquidation event recorded by the meme coin on the crypto market CoinGlass data reveals that, in the last four hours, there was a 2,055% liquidation imbalance, as total losses amounted to $1.14

DOGE-2,38%

UToday·23h ago

Can XRP Reach $100 If Ripple Replaces SWIFT?

Speculation around XRP’s long-term potential has intensified following comments from a former SWIFT executive suggesting that cryptocurrencies could eventually play a role in the global payments network. Former SWIFT CEO Gottfried Leibbrandt said the organization could welcome digital assets such as

XRP-5,06%

BlockChainReporter·23h ago

Crypto bill faces years-long delay as Trump-era conflict rules stall progress

TD Cowen says U.S. crypto market structure reform likely slips to 2027--2029 as Democrats push Trump-focused conflict rules and CLARITY Act talks become the fallback.

Summary

TD Cowen expects comprehensive U.S. crypto market structure legislation to miss 2025 and likely pass around 2027, with f

Cryptonews·01-06 13:24

Tom Lee Predicts Bitcoin Could Reach $250K in 2026

Tom Lee forecasts Bitcoin at $250,000 by end-2026, citing institutional adoption, ETFs and supportive U.S. regulation.

ETF inflows hit $23B as stablecoin laws passed, building long-term foundations despite Bitcoin ending 2025 nearly flat.

Forecasts vary widely, with targets from $10,000

BTC-1,69%

CryptoFrontNews·01-06 13:06

PeerDAS and ZK-EVM are now live! V God calls out: Ethereum has overcome the "three difficult dilemmas"

Ethereum co-founder Vitalik Buterin stated that the long-standing "Blockchain Trilemma" that has troubled the blockchain industry has actually been solved. He emphasized that after recent upgrades, Ethereum has undergone a transformation, becoming a "brand new, more powerful decentralized network" capable of balancing security, decentralization, and scalability simultaneously.

Vitalik Buterin posted on social platform X: "Now, we have PeerDAS, which will be introduced in 2025, and partial adoption in 2026."

区块客·01-06 12:50

Trader Adds BTC and ETH Longs, Retains Heavy Unrealized Profit

Trader 0x10a3 has expanded long positions in BTC and ETH.

His unrealized profit stands at over $3.5 million.

BTC and ETH are expected to record a new ATH by the end of 2026.

A trader just added long positions in BTC and ETH while maintaining multiple assets with a similar position. His unrealize

TheNewsCrypto·01-06 12:49

Arthur Hayes's latest article: After Trump's "colonization" of Venezuela, he will start the crazy money printing machine. Last year's biggest loss was PUMP

Arthur Hayes

Translated by: Yuliya, PANews

Imagine a video call between U.S. President Donald Trump and Venezuelan President Pepe Maduro, as Maduro was flying from Caracas to New York.

> Trump: "Pepe Maduro, you're a bad guy. The oil in your country is now mine. Long live America!"

>

> Pepe Maduro: "Trump, you crazy!"

>

>

Note: Arthur Hayes refers to the Venezuelan president as "Pepe Maduro" instead of his real name Nicolás Maduro. "Pepe" is a Spanish term

PANews·01-06 12:02

KOSPI is expected to break through 5,000 points... The semiconductor boom is driving the securities sector to continuously raise expectations

South Korea's KOSPI Composite Index( has been soaring continuously in recent days, with the market even predicting that it could break through the "5,000-point" mark as early as the first quarter of this year. As the representative South Korean stock index KOSPI experienced a rare single-day increase of 100 points, the securities industry has also seen a series of upward revisions to target indices.

YuanDa Securities on January 6th raised its expected fluctuation range for this year's KOSPI from the original 3,800~4,600 points to 4,200~5,200 points. This is a significant upward adjustment compared to its forecast just two months ago, reflecting the current optimistic market sentiment. YuanDa Securities analyst Kim Long-kyu stated: "As the earnings expectations for the semiconductor industry rise sharply, the upward outlook for KOSPI has also been pushed higher."

In particular, the earnings forecasts for leading stocks such as Samsung Electronics and SK Hynix have surged, which is considered the background for this index adjustment. As of the end of September 2025, Samsung Electronics' 2026...

TechubNews·01-06 11:51

Solana Price Analysis for Jan 6: Can SOL Break Through These Crucial Resistance Levels?

Solana (SOL) is experiencing strong bullish momentum, recently reclaiming the critical $130 level with an 11.1% weekly gain. Technical indicators suggest potential resistance at $139.58 and $144. Increased development activity further bolsters long-term confidence in the project.

TheCryptoBasic·01-06 11:41

Ethereum Market Cap Climbs Above Netflix as ETH Reclaims Top Asset Ranking

Ethereum has once again strengthened its position in global financial markets as the Ethereum market cap surpassed Netflix to reclaim its spot as the 36th-largest asset worldwide. This development reflects growing investor confidence in Ethereum’s long-term role across finance and technology.

ETH-0,56%

Coinfomania·01-06 11:23

Secondary Market Daily Report 20260106

Market Trends

The cryptocurrency market currently exhibits a volatile and oscillating pattern, with clear differences in bullish and bearish views. On the macro level, fluctuations in U.S. oil export policies are indirectly affecting Bitcoin's safe-haven narrative; within the industry, although regulatory pressure and volatility risks coexist, the continuous net inflow into Bitcoin ETFs indicates that long-term institutional funds remain resilient. In the short term, the market is focused on the key battle zone for BTC between $94,000 and $100,000, with high volatility, so caution is advised.

Mainstream Coins

BTC

Has short-term bullish trading opportunities. Recent price movements are related to the adjustment of U.S. policies towards Venezuela's oil; the continued inflow into BTC ETFs also supports the market. Currently, focus should be on the $94,000 support level; if it stabilizes, the highly correlated BCH may show stronger breakout potential after surpassing the $700 resistance.

ETH

Fundamentals remain stable

Biteye·01-06 10:53

Pi Network Launches First Multi-Signature Wallet to Strengthen Security

Pi Network's launch of its first multi-signature wallet marks a significant security enhancement for users. This wallet requires multiple keys for transactions, reducing risks associated with single key wallets. It supports safe ecosystem transactions and community governance while receiving positive initial feedback. However, long-term success hinges on user adoption and real-world application.

PI-1,17%

Coinfomania·01-06 10:51

iM Bank launches high-interest savings products with a maximum annual interest rate of 15%... in conjunction with branch openings to accelerate the expansion of non-face-to-face services

iM Bank celebrates the opening of its new branch by launching high-interest deposit and savings products to attract customers to open accounts through non-face-to-face channels. The launched "The Coupon Deposit" offers an annual interest rate of 3.2%, while "The Coupon Savings" provides an annual interest rate of 15%. This strategy aims to stably attract customers. Although the short-term effects are significant, the long-term impact still needs to be monitored.

TechubNews·01-06 10:13

Bitcoin in 2026: From $10K to $250K — How Crypto Bulls and Bears See BTC’s Future

Not long ago, billionaire venture capitalist Chamath Palihapitiya confidently predicted Bitcoin would reach \$500,000 by October 2025. That call famously missed the mark, joining a growing list of bold Bitcoin price forecasts that failed to materialize.

CryptopulseElite·01-06 09:23

Why SHIB’s Long-Term Outlook Is Weakening

Shiba Inu (SHIB) is facing mounting structural challenges that are eroding its appeal as a long-term investment. Slowing token burns, stalled ecosystem development, and growing transparency concerns are increasingly difficult to ignore.

CryptopulseElite·01-06 09:10

Legendary Trader Peter Brandt Shares Cryptic XRP Price Analysis

Peter Brandt, a long-standing top market analyst, recently shared a cryptic XRP price analysis amid heightened optimism over the recent rally.

Notably, CoinMarketCap data shows that, except for SUI, XRP has outperformed all other cryptocurrencies in the top 50 by market cap. The red-hot coin has

TheCryptoBasic·01-06 09:07

The Sui price is expected to continue its upward trend after breaking through the long-term resistance.

As of Tuesday's recording, Sui (SUI) is trading above $1.95, approaching the highest peak in the past two months. The upward momentum remains solid after a streak of six consecutive bullish sessions, reflecting growing optimism in the market. Meanwhile, the signals

SUI-5,18%

TapChiBitcoin·01-06 09:05

NVIDIA Alpamayo Ecosystem Debuts: Enabling AI Self-Driving Cars with Reasoning Capabilities and Explainable Decision-Making

During the 2026 CES exhibition, NVIDIA (NVIDIA) officially announced a complete ecosystem called Alpamayo, composed of open-source AI models, simulation tools, and real driving data. The goal is to accelerate the development of "reasoning-capable" autonomous driving technology. This system targets the most challenging long-tail scenarios in self-driving, which are rare, complex, and seldom appear in past data. It aims to enable vehicles not just to see but to understand the situation like humans, reason about causality, and clearly explain why they make certain driving decisions.

Alpamayo Open-Source Ecosystem Unveiled, Announcing Three Core Components

At CES, NVIDIA CEO Jensen Huang (Jensen Huang) revealed the full architecture of the Alpamayo family, covering three main cores:

VLA model with "thinking process"

ChainNewsAbmedia·01-06 09:03

Can XRP and Cardano Survive Crypto's Evolution in 2026?

Galaxy Digital CEO Mike Novogratz has issued a stark warning: XRP and Cardano must demonstrate genuine utility soon or risk fading in an industry shifting from hype to business fundamentals. As 2026 begins, the pressure is on for these major altcoins to prove their long-term relevance.

CryptopulseElite·01-06 08:44

Fidelity 2026 Crypto Market Outlook: We May Be Entering a Super Cycle, with a Bull Market Lasting for Years

The cryptocurrency market is undergoing a transformation, with countries and corporations beginning to include it on their balance sheets. Trump has established Bitcoin reserves, indicating that cryptocurrencies are gradually gaining mainstream recognition. Despite price volatility, long-term investors remain optimistic about its value, especially in the context of the current market structural changes. Cryptocurrency demand may increase in the coming years, but price uncertainty should still be monitored.

BTC-1,69%

PANews·01-06 08:38

Gate Research Institute: Solana ETF Achieves Largest Single-Day Net Inflow | Giza's AI Agent Asset Management Scale Exceeds $40 Million

Cryptocurrency Market Overview

BTC (+1.17% | Current price 93,921 USDT): The daily chart shows that Bitcoin has broken above the medium- to long-term downtrend channel. The MACD green bars continue to rise, and the RSI is moving higher, releasing a somewhat positive technical signal, indicating that the price still has room for further upward movement. Currently, BTC is testing the resistance at around $93,400, a level that coincides closely with a previous high-volume trading zone. If this resistance is broken effectively, it could open the way to test the $100,000 mark. The liquidation heatmap indicates that recent major liquidation clusters are concentrated below the current price, especially in the $85,000–87,000 range, suggesting that leveraged long positions are relatively concentrated. In contrast, liquidity above is more dispersed, implying that before the market continues to rise, some time is still needed for momentum to build. The recent slow upward movement has already cleared some short

GateResearch·01-06 08:05

Load More