Search results for "ME"

The three most powerful individuals in the history of crypto VC, even making Dragonfly partners feel inferior

Author: Haseeb >|<, Dragonfly Partner

Translation: Deep Tide TechFlow

LPs sometimes ask me who I consider the most outstanding venture capitalists in the crypto space.

I've thought about this a lot.

Since I started engaging in crypto venture investing, I've always aspired to be the best. I am passionate about competition, and investing is the purest form of competition. Only one person can win a deal, only one can pick the winner of this cycle.

But when you honestly examine and carefully calculate, you'll find that three people have already proven themselves as the "Greatest of All Time" (GOAT) in crypto VC.

This might sound a bit like bragging (it is), and it may not be very appealing to those who are not in crypto VC. But I am a crypto VC. This article is dedicated to those of us who have made this our lifelong career.

PANews·1h ago

Sun Yuchen was caught during street interviews: Buffett taught me to "carefully choose a marriage partner"! I taught him to invest in Tesla and Bitcoin.

Sun Yuchen appeared in a well-known street interview at the end of 2025. He reiterated that he became a billionaire at the age of 25, astonishing those unfamiliar with the cryptocurrency industry.

(Background recap: The judicial breakthrough in the TUSD reserve fund embezzlement case! Sun Yuchen: "Justice may be late, but it will never be absent.")

(Additional background: Why do Chinese people not become wealthy beyond three generations? Nine years ago, Sun Yuchen gave a harsh answer.)

Tron founder Sun Yuchen graced the cover of Forbes magazine in 2025, showcasing the image of a young, wealthy blockchain entrepreneur. Today (31), the very popular online account "Street Interview with Rich People" from The School Of Hard Knocks also interviewed Sun Ge.

In the video, we see James Dumoulin, founder of The School Of Hard Knocks, and Sun Yuchen, founder of TRON.

動區BlockTempo·01-03 09:05

Sun Yuchen was caught during street interviews: Buffett taught me to "carefully choose a marriage partner"! I taught him to invest in Tesla and Bitcoin.

Sun Yuchen appeared in a well-known street interview at the end of 2025. He reiterated that he became a billionaire at the age of 25, astonishing those unfamiliar with the cryptocurrency industry.

(Background recap: The judicial breakthrough in the TUSD reserve fund embezzlement case! Sun Yuchen: "Justice may be late, but it will never be absent.")

(Additional background: Why do Chinese people not become wealthy beyond three generations? Nine years ago, Sun Yuchen gave a harsh answer.)

Tron founder Sun Yuchen graced the cover of Forbes magazine in 2025, showcasing the image of a young, wealthy blockchain entrepreneur. Today (31), the very popular online account "Street Interview with Rich People" from The School Of Hard Knocks also interviewed Sun Ge.

In the video, we see James Dumoulin, founder of The School Of Hard Knocks, and Sun Yuchen, founder of TRON.

動區BlockTempo·01-02 09:00

Sun Yuchen was caught during street interviews: Buffett taught me to "carefully choose a marriage partner"! I taught him to invest in Tesla and Bitcoin.

Sun Yuchen appeared in a well-known street interview at the end of 2025. He reiterated that he became a billionaire at the age of 25, astonishing those unfamiliar with the cryptocurrency industry.

(Background recap: The judicial breakthrough in the TUSD reserve fund embezzlement case! Sun Yuchen: "Justice may be late, but it will never be absent.")

(Additional background: Why do Chinese people not become wealthy beyond three generations? Nine years ago, Sun Yuchen gave a harsh answer.)

Tron founder Sun Yuchen graced the cover of Forbes magazine in 2025, showcasing the image of a young, wealthy blockchain entrepreneur. Today (31), the very popular online account "Street Interview with Rich People" from The School Of Hard Knocks also interviewed Sun Ge.

In the video, we see James Dumoulin, founder of The School Of Hard Knocks, and Sun Yuchen, founder of TRON.

動區BlockTempo·01-01 08:55

Sun Yuchen was caught during street interviews: Buffett taught me to "carefully choose a marriage partner"! I taught him to invest in Tesla and Bitcoin.

Sun Yuchen appeared in a well-known street interview at the end of 2025. He reiterated that he became a billionaire at the age of 25, astonishing those unfamiliar with the cryptocurrency industry.

(Background recap: The judicial breakthrough in the TUSD reserve fund embezzlement case! Sun Yuchen: "Justice may be late, but it will never be absent.")

(Additional background: Why do Chinese people not become wealthy beyond three generations? Nine years ago, Sun Yuchen gave a harsh answer.)

Tron founder Sun Yuchen graced the cover of Forbes magazine in 2025, showcasing the image of a young, wealthy blockchain entrepreneur. Today (31), the very popular online account "Street Interview with Rich People" from The School Of Hard Knocks also interviewed Sun Ge.

In the video, we see James Dumoulin, founder of The School Of Hard Knocks, and Sun Yuchen, founder of TRON.

動區BlockTempo·2025-12-31 08:50

I built a bot to "earn passive income" on Polymarket: Here's my setup logic

A developer shares how to build a Polymarket trading bot that captures BTC 15-minute market price fluctuations, turning $1,000 into $1,869 within a few days, with a backtested return of 86%. The article details the bot's construction logic, backtesting methods, and its limitations.

(Background: Leading prediction market Polymarket announces self-built L2, is Polygon's flagship gone?)

(Additional context: How to achieve an annualized 40% return through Polymarket arbitrage?)

Table of Contents

Bot Construction Logic

Backtesting

Limitations of Backtesting

Infrastructure

A few weeks ago, I decided to build my own Polymarket bot. The full version took me several weeks.

I am willing to invest

BTC-1,69%

動區BlockTempo·2025-12-30 02:35

From Memes to Monthly Passive Income: New Crypto DOGEBALL’s Staking and Referral Rewards Could 10...

The meme-coin era has entered a new phase where new crypto projects are blending culture with cash flow, and DOGEBALL is rapidly becoming the name investors can’t ignore. Built for passive income seekers chasing 100x upside, DOGEBALL is capturing early attention as a best crypto presale with real me

ETH-0,56%

BlockChainReporter·2025-12-27 08:33

When crypto assets generate returns and stocks become collectibles, it's a major shift in valuation logic.

Author: Matt Harris

Translation: Tim, PANews

At a dinner last summer, someone mistakenly thought I was in finance and asked me a question about the art market. Although I am not an expert, I answered from the perspective of a venture capitalist. In the end, I barely explained how the art market operates and how it differs from the markets I have studied throughout my life.

However, these questions have always lingered in my mind. Why can I be well-versed in one market but feel unfamiliar with another? Can assets cross between these two markets, or are they forever stuck in a fixed valuation model?

Two Types of Markets

Each market is answering the same question, "What should this be worth?" but the underlying logic varies.

Cash flow markets are essentially a math problem. Whether it's a stock or a bond, value equals the present value of future cash flows discounted. These markets

PANews·2025-12-27 03:36

About the 2025 Crypto Memory: Ups and Downs, Refinement, and Integration

Written by: Yangz, Techub News

Jingle bells, jingle bells, jingle all the way...

When this familiar holiday tune rings out on the streets and alleys, foreigners' New Year has arrived, and 2025 is entering the countdown. If I had to use one word to summarize the extraordinary year in the crypto world, the first that comes to mind is: "Ups and downs"; as for which narratives left a deep impression on me, the ones that come to mind are: the rollercoaster journey of DAT under Strategy's leadership from frenzy to silence, the wave of crypto company IPOs and stablecoin craze sparked by Circle going public, the market's enthusiasm and calmness after the approval of altcoin ETFs, and also

TechubNews·2025-12-25 11:39

Former FTX US President raises $35 million in funding; this time they created a special exchange

The fintech company Architect, founded by Brett Harrison, former President of FTX US, who left several months before the crash, completed a $35 million Series A funding round, valuing it at $187 million. The company is building AX, a perpetual contract exchange for "traditional assets," focusing on forex, interest rates, metals, and other traditional financial assets.

(Background: CFTC Chair Michael Selig's appointment: The FTX case taught me a lot, ensuring innovation is Made in America)

(Additional background: SBF: FTX didn't go bankrupt at all! Customers could have fully withdrawn their coins but were instead swept into a $130 billion disaster)

On December 23, the fintech company Architect, founded by former FTX US President Brett Harrison,

US-7,48%

動區BlockTempo·2025-12-25 04:30

LazAI Mainnet is online, and we had a chat with Metis about this move.

Written by: Eric, Foresight News

On the evening of December 22, Beijing time, LazAI, an AI data and application layer incubated by Metis, announced the official launch of its Alpha mainnet. The last time Metis left a deep impression on me was when it took the lead in launching a decentralized sequencer. As many L2s have turned towards a transaction-centric direction in recent years, why has Metis chosen AI with unwavering confidence?

With questions in mind, we had a chat with Metis.

Focusing on "data", Metis's unique approach

The Metis team indicated to the author that the launch of LazAI was not a hasty decision in response to the AI craze. As early as the beginning of this year, Metis had established a strategic focus on AI, and LazAI has been in development for nearly a year.

TechubNews·2025-12-23 07:46

CFTC's new chairman Michael Selig takes office: The FTX case taught me a lot, ensuring that innovation is Made in America.

Michael S. Selig officially takes over the CFTC, declaring the end of the "enforcement as regulation" era and laying down new rules for the U.S. crypto market.

(Previous summary: The U.S. CFTC announced the approval of BTC, ETH, and USDC as margin and collateral for derivatives contracts)

(Background information: U.S. CFTC: Federal-level "spot crypto market" officially launched, Bitcoin and Ethereum will trade alongside gold)

Table of Contents

From legal clerks to regulatory hubs

Core policy: Principle-oriented and legislative acceleration

Power vacuum and rapid case formation window

The regulatory turning point that the market is anticipating

Washington is shrouded in cold winds, but on December 22, a rare warmth enveloped the CFTC headquarters. Michael S. Selig raised his right hand under the watchful eyes of everyone and received the seal of the 16th chairman, concluding.

動區BlockTempo·2025-12-23 02:55

2025: The darkest year for the crypto market, and also the dawn of the institutional era.

Written by: Jocy, Founder of IOSG

This is a fundamental shift in market structure, while most people are still viewing the new era through the logic of the old cycle.

In the 2025 cryptocurrency market review, we see a paradigm shift from retail speculation to institutional allocation, with core data showing institutional holdings at 24% and retail investors exiting at 66% — the turnover of the 2025 cryptocurrency market is complete. Forget about the four-year cycle; the institutional era of the cryptocurrency market has new rules! Let me use data and logic to break down the truth behind this "worst year."

1/ First, look at the surface data — Asset performance in 2025:

Traditional Assets:

Silver +130%

Gold +66%

Copper +34%

Nasdaq +20.7%

S&P 500 +16.2%

Cryptographic assets:

BTC -5.4%

ETH

TechubNews·2025-12-22 10:29

2025 Six Major AI Paradigm Shifts: From RLVR Training, Vibe Coding to Nano Banana

Author: Andrej Karpathy

Compiled by: Tim, PANews

2025 is a year of rapid development and full of uncertainties for large language models, and we have achieved fruitful results. Below are what I personally consider noteworthy and somewhat surprising "paradigm shifts" that have changed the landscape and left a deep impression on me, at least on a conceptual level.

1. Reinforcement Learning with Verifiable Rewards (RLVR)

At the beginning of 2025, the LLM production stack of all AI laboratories will roughly present the following form:

Pre-training (GPT-2/3 from 2020);

Supervised fine-tuning (InstructGPT from 2022);

and Reinforcement Learning from Human Feedback (RLHF, 2022)

For a long time, this has been a stable and mature technology stack for training production-level large language models. By 2025, reinforcement based on verifiable rewards

PANews·2025-12-22 09:29

IOSG Founder: Bitcoin has undergone a historic handover, optimistic about the first half of 2026.

Author: Jocy, Founder of IOSG

This is a fundamental shift in market structure, while most people are still using the logic of the old cycle to view the new era.

In the 2025 cryptocurrency market review, we see a paradigm shift from retail speculation to institutional allocation, with core data showing institutional holdings at 24% and retail investors exiting at 66% — the turnover of the 2025 cryptocurrency market is complete. Forget the four-year cycle; the cryptocurrency market in the institutional era has new rules! Let me use data and logic to dissect the truth behind this "worst year."

1/ First, look at the surface data — Asset performance in 2025:

Traditional assets:

- Silver +130%

- Gold +66%

- Copper +34%

- Nasdaq +20.7%

- S&P 500 +16.2%

Cryptocurrency assets:

- BTC -5.4%

- ETH -12%

- Mainstream Altcoin

PANews·2025-12-22 07:02

One-Click Metaverse Avatars: Why Ready Player Me, with $72M in Funding, Attracted Over 3,000 Enterprise Partners

Ready Player Me is driving the world toward an open, boundless virtual ecosystem. Streaming giant Netflix announced the acquisition of a16z-backed Ready Player Me to enhance its TV gaming experience, particularly enabling personalized avatars across games.

CryptopulseElite·2025-12-22 06:29

Netflix's acquisition of the virtual avatar platform Ready Player Me brings a major change to its Web3 digital identity strategy?

Streaming giant Netflix recently announced its official acquisition of the Estonian avatar creation platform Ready Player Me, with specific deal terms undisclosed. Ready Player Me has previously secured a total of $72 million in funding from top venture capitalists including a16z, and its team of about 20 people will join Netflix. This acquisition signifies that Netflix's gaming strategy is shifting from mobile to a television-centric approach, aiming to build an ecosystem that allows users' virtual identities to flow across games. For the encryption and Web3 industry, this event may have a profound impact on the future development of avatars, digital identity, and the interoperability of the Metaverse.

MarketWhisper·2025-12-22 02:54

Metaverse dreams shattered? Netflix acquires Ready Player Me, services to be shut down in 2026.

Streaming media giant Netflix announced the acquisition of the Metaverse identity platform Ready Player Me, which is supported by a16z. This Estonia-based virtual avatar creation company has previously raised $72 million in funding. However, after the acquisition is completed, Ready Player Me will cease operations on January 31, 2026, and the entire team of about 20 people will be integrated into Netflix.

MarketWhisper·2025-12-22 01:56

MocaPortfolio Goes Live, Launches First Token Drop With Magic Eden (ME)

Additional tokens from projects inside Animoca Brands’ ecosystem are going to be disclosed in the future, and the Magic Eden token drop is the first of many scheduled drops.

In order to participate in the Magic Eden token drop, new players have the opportunity to take advantage of a fast-track

TheNewsCrypto·2025-12-20 15:08

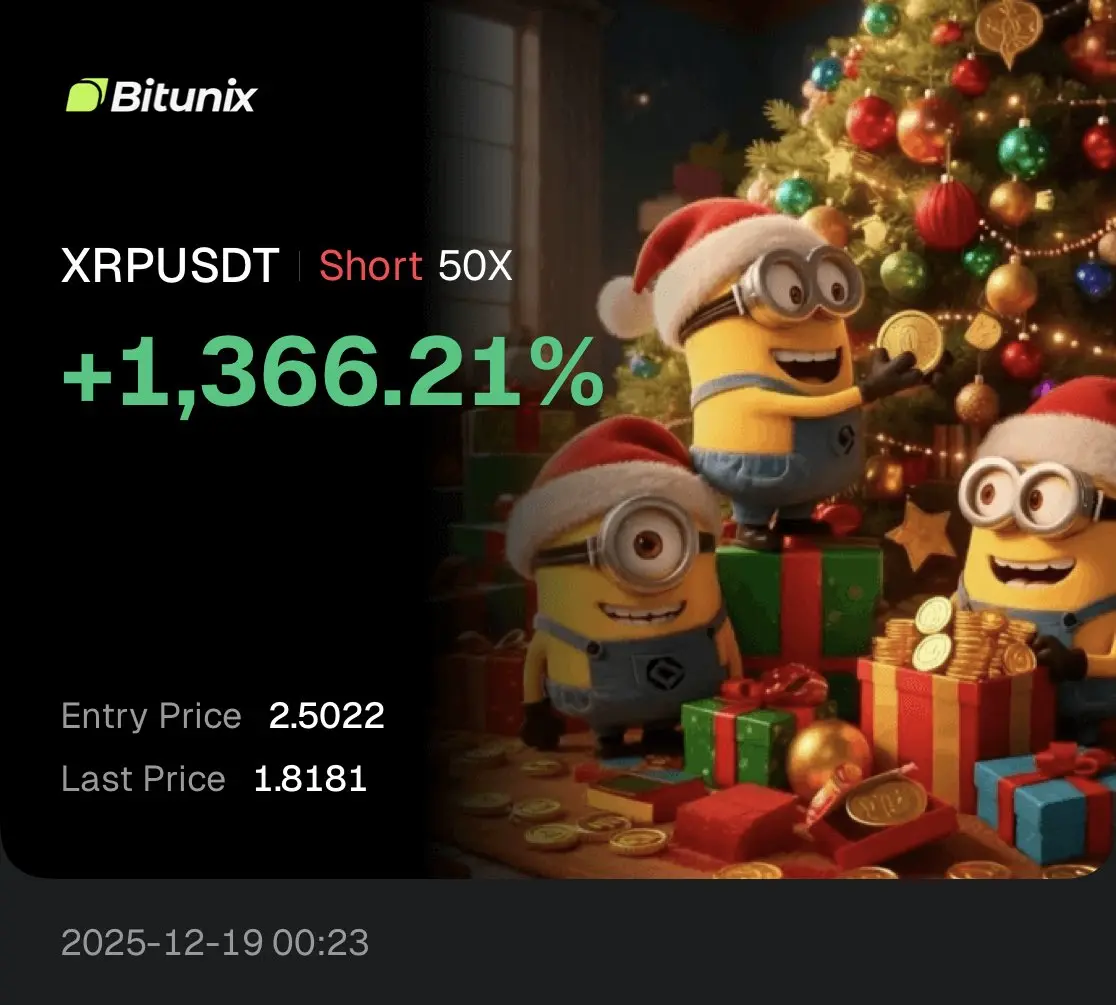

Trader Shorts XRP, Secures 1,366% Gains, Says “Merry Christmas to Me”

A crypto trader profited over 1,300% from a short position on XRP as its value plummeted 49% from its July peak. Despite criticizing XRP's community, the gains reflect a wider market downtrend rather than XRP-specific issues.

TheCryptoBasic·2025-12-19 10:15

Trump: The next Federal Reserve Chair must be a "super dovish" who regularly consults with me on interest rates. Has the Fed's independence been destroyed?

Trump explicitly stated that the next Federal Reserve Chair must believe in "large-scale rate cuts" and will soon announce a candidate. He demands lowering interest rates to the crisis level of 1% and believes the next Chair should consult with him on rate setting. This article is sourced from Wall Street Insights, compiled, translated, and written by Foresight News.

(Previous context: Trump named Kevin Warsh as his "preferred" candidate for the next Federal Reserve Chair, with Kevin Hassett's chances dropping by 30%)

(Additional background: Trump: Rate cuts are a litmus test for the Federal Reserve Chair, and tariffs may be adjusted to lower the prices of some goods)

Table of Contents

All three candidates support rate cuts, but to varying degrees

Trump demands the Federal Reserve Chair consult with him on rate decisions

Rate cuts have limited impact on mortgage rates

On Wednesday, U.S. time, President Trump made a nationwide speech in which

動區BlockTempo·2025-12-19 03:50

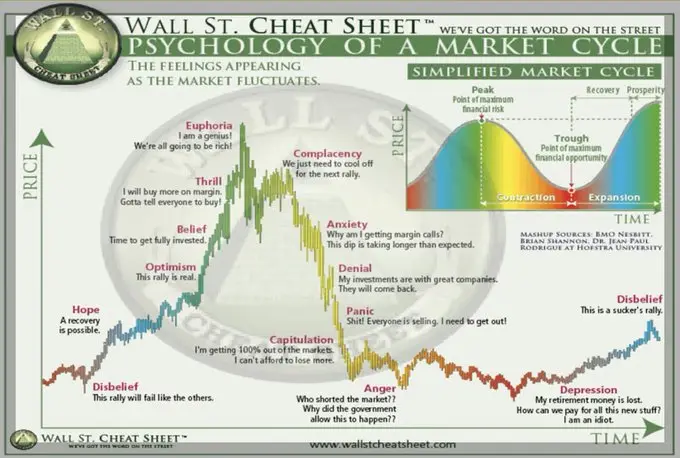

Stop only focusing on Bitcoin; we have long been in a bear market.

Author: XY

Translation: Tim, PANews

Entering the bear market for a year

It took me some time to convince myself: we are in a bear market, and it has been ongoing for about a year.

November 2024 will be a period of market excitement, and the issuance of $TRUMP pushed the market to extreme euphoria, marking the final狂欢 that no one wants to believe.

Below, I will explain my perspective.

It all started with that old cliché: “History doesn’t repeat itself, but it often rhymes.”

This silly phrase has caused huge misconceptions in market analysis, essentially doing more harm than good.

It led us to develop path dependence and also caused us to lose the ability to question.

Yes, this reliance on historical patterns for prediction is like looking at the world through a prism engraved with old patterns, inevitably leading to misreading the current new reality, and ultimately causing us to overlook the latest driving factors of the market. This is precisely the dangerous root

PANews·2025-12-18 09:36

VC "dead"? No, the industry is undergoing a brutal reshuffle

As a former VC investor, what are your thoughts on the current "VC is dead" rhetoric on Crypto Twitter?

Regarding the paid question, I’ll give a serious answer. I also have quite a few thoughts on this rhetoric.

First, the conclusion -

1. The fact that some VCs are already dead is undeniable.

2. Overall, VCs will not die; they will continue to exist and push the industry forward.

3. VCs are actually similar to projects and talent—they are entering a phase of "clearing out" and "big waves washing away the sand," somewhat like during the internet bubble of 2000. This is the "debt" from the last crazy bull run. After a few years of repayment, a new phase of healthy growth will begin, but the threshold will be much higher than before.

Now, let me elaborate on each point.

1. Some VCs are already dead

Asian VCs are probably the hardest hit in this round. Starting from this year, most of the top players have shut down or disbanded. The remaining few might not even make a deal once every few months, focusing on...

PANews·2025-12-18 03:07

The realization of cryptocurrency value and identity transformation

A few weeks ago (at that time I hadn't yet read the article "Underground Argentina: Jewish Moneylenders, Chinese Supermarkets, Young People Giving Up, and Middle-Class Reverting to Poverty"), an old classmate I hadn't seen in a long time called me one day. During the conversation, he suddenly asked:

Are you still paying attention to digital currencies?

This old classmate and I have a very deep connection to the crypto ecosystem. When I was still clueless and attended my first offline Bitcoin lecture, I talked to him about my mindset at the time: I didn't understand what Bitcoin was, but I was very curious and wanted to listen.

Since then, until now, he has been one of the very few people in my real life who knows about this experience of mine.

The difference is that since then, I have fully immersed myself in the crypto ecosystem, while he still fights and struggles in the business world.

Despite that, over the years, every time we chat, we talk about the crypto ecosystem and crypto assets.

This time when he called, as usual, we started talking about...

金色财经_·2025-12-18 00:18

At the Breakpoint conference, it was announced that a token will be launched soon: handing over SOL to Toby, can it really let MEV work for me?

Author: Tia, Techub News

The Solana Annual Developer Conference Breakpoint is usually seen as a window for new projects to "issue" tokens. This year, the project that received the pass is the liquidity staking protocol Toby. The team announced the issuance of a governance token, TOBY, with a core selling point: directly incorporating the additional profits that validators earn from MEV into the tobySOL holdings, so that stakers no longer only receive on-chain inflation rewards, but also share in the arbitrage, liquidation, and tip income generated by block ordering.

This narrative has gained attention because Solana's MEV value chain has been essentially monopolized by Jito over the past two years. Jito-Solana client share exceeds 94%, and in 2024

PANews·2025-12-16 12:05

Bankless: This crypto cycle has overlooked Ethereum

Author: David Hoffman, Source: Bankless, Translation: Shaw Golden Finance

About two years ago, Ryan and I had a phone call with Chris Burniske, shortly after we recorded a podcast episode with him.

In the cryptocurrency space, Chris has always been a mentor to Ryan and me, because both of us entered the crypto industry to try to understand, categorize, define, and model this inherently unknown industry.

During the call, he said something that Ryan and I both didn’t want to hear: “This cycle might skip Ethereum altogether.”

And indeed, that’s how things turned out. Setting aside debates about cycle dynamics and timing, most on-chain activity over the past few years has been unrelated to Ethereum, and the price of Ether reflects that.

I suppose this is probably how Bitcoin holders felt in 2021. Bitcoin

金色财经_·2025-12-15 01:14

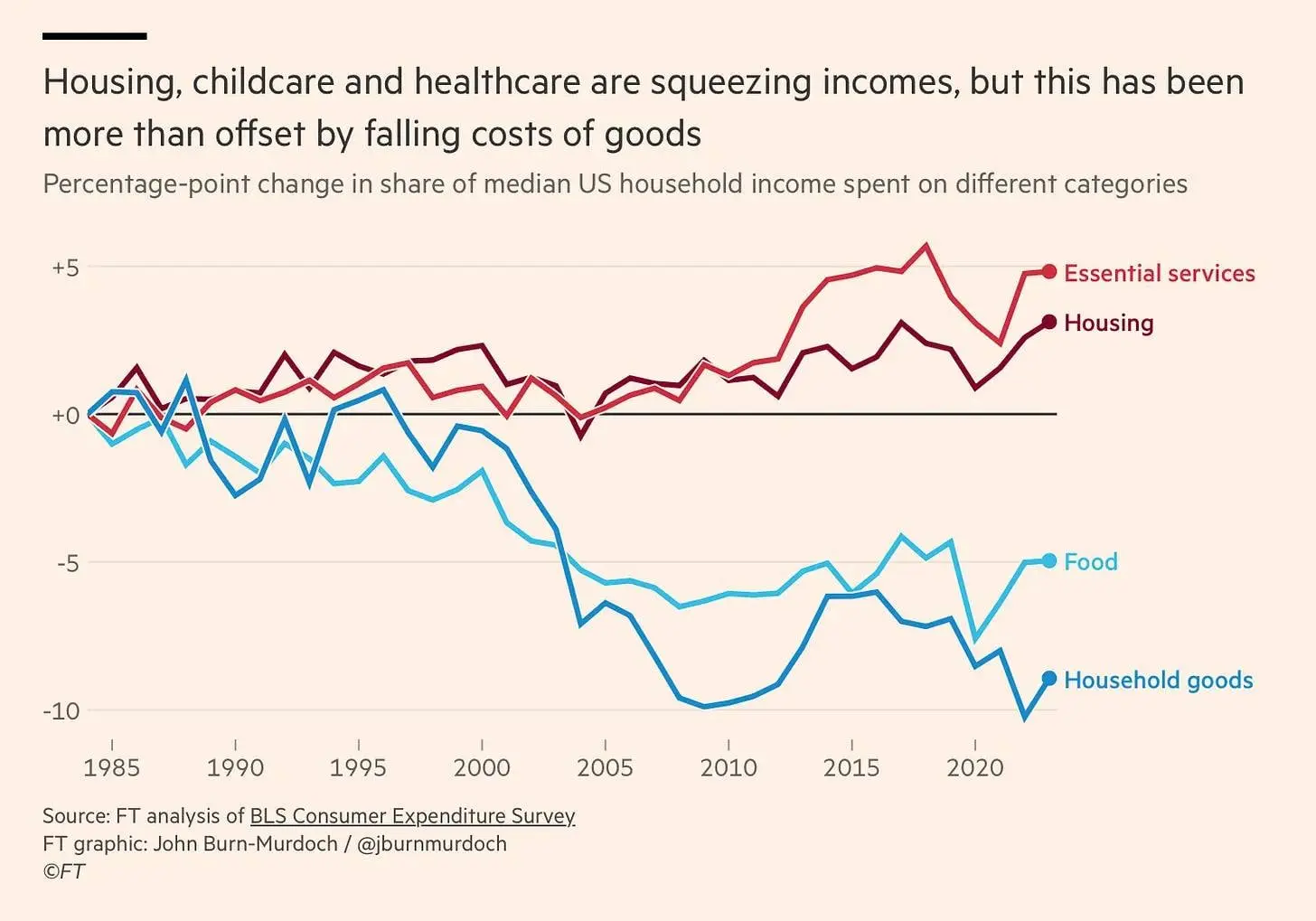

A joyless casino economy, American young people are losing confidence in the future

Author: KYLA SCANLON

Translation: Deep潮TechFlow

Good morning, greetings from Washington, D.C.! This article is a bit long, so it might be truncated in your email. Recently, I embarked on a new journey for work, with destinations including Michigan, Kentucky, and Washington, D.C. During security checks, I saw a lady ahead of me coughing with her mouth open like a baby. I looked at her, initially surprised by her "carefree" attitude, then a wave of deep fear washed over me.

Most people are friendly. But living in society means facing different internal norms of others. Some people cough openly—that's the reality. I have a theory: they might believe that collective comfort isn't their responsibility, perhaps because they lack a sense of belonging in public spaces. This is a social drift phenomenon, becoming increasingly apparent in public spaces (for example, looking down 90 degrees while...

PANews·2025-12-14 23:33

The story of big capital players selling off Nvidia

I recently saw an interview video online discussing Sequoia Capital partner Shaun Maguire reminiscing about his experiences selling NVIDIA shares.

Regarding selling NVIDIA, I had previously read about SoftBank CEO Masayoshi Son's story of selling his NVIDIA shares. This time, I saw another well-known investor expressing regret over NVIDIA, which gave me some new perspectives to think about.

In the interview, Shaun talked about his investment story with NVIDIA:

He bought in during NVIDIA's IPO, at the age of only 13. Because he enjoyed playing games, he was very optimistic about NVIDIA's future.

He held onto NVIDIA shares until its market cap reached $600 billion.

With NVIDIA valued at $600 billion, half of its revenue came from gaming and data center businesses. He thought the valuation was too crazy, so he sold.

As we all know, the story afterward is that NVIDIA's market cap soared, now exceeding 5 trillion.

金色财经_·2025-12-13 02:35

Crypto Speculation Hits 2024 Lows Amid Rising Traditional Finance Risks

Crypto Market Sentiment Shows Divergence Between Digital Assets and Traditional Finance

While traditional leveraged investment products continue to reach record highs, sentiment in the cryptocurrency market reflects a notable shift away from speculative assets. Recent data indicates a decline in me

CryptoBreaking·2025-12-12 14:23

Lessons learned from spending millions in the crypto world before the bull market returns

Year-end review: reflecting on the mistakes made over the past year and summarizing some lessons learned.

Sharing this not only as a wake-up call for myself but also in the hope that it can serve as a reference for everyone.

The principles are actually very simple, but only after experiencing losses do you truly understand.

It's like the moment your position blows up—you realize why you shouldn't have used high leverage.

一、A paradise for speculators, a tomb for investors

Humen Hu, a hedge fund manager, has a very precise definition of investment and speculation:

“If your returns depend on the price difference of the same asset at different times, that's speculation. If they depend on intrinsic value appreciation and dividends, that's investing.”

In the first few years I got involved in the crypto world, I was a pure BTC holder and achieved good results.

This strong positive feedback led me to seek a “sleepable” investment in this market for most of the time.

PANews·2025-12-12 12:06

Munger's "List of Mistakes": Bitcoin is crap, Jack Ma is too arrogant, Elon Musk is crazy

Charlie Munger has commented on Bitcoin and Musk. Today, it seems that some of his views are right, some are wrong, and some of his reflections on his mistakes may not be entirely accurate (for example, his failed investment in Alibaba, where he believed the reason for failure was that it was a damned retailer); others still require further verification.

Here is a summary:

Munger's comments on Bitcoin:

Munger said: “Bitcoin is stupid, evil, and makes people look foolish.”

+ "In my life, I try to avoid things that are stupid, and evil, and make me look bad in comparison to someone else, and bitcoin does all

BTC-1,69%

PANews·2025-12-12 04:05

30 Years of Wall Street OG: How Horse Racing, Poker, and Investment Legends Inspired My Bitcoin Journey

A seasoned Wall Street investor, using the odds-thinking learned from his father at the horse racecourse, combined with the wisdom of investment masters like Munger and Druckenmiller, analyzes the currently seriously undervalued investment opportunity in Bitcoin and how to make wise decisions under uncertainty using probabilistic thinking. This article is adapted from a piece by Jordi Visser, organized, translated, and written by Foresight News. (Background: Michael Saylor: Major banks like JPMorgan, Citigroup, Bank of New York Mellon, and Wells Fargo are starting to offer "Bitcoin collateralized loans") (Additional background: Standard Chartered significantly cuts Bitcoin forecasts! The 2025 end-of-year target is halved to $100,000, and it will take another five years for BTC to reach $500,000) When I was five years old, my father took me to Monticello Raceway in upstate New York for the first time. He handed me a horse racing guide and began teaching me how to interpret the races.

BTC-1,69%

動區BlockTempo·2025-12-10 12:37

30 Years of Wall Street Veterans: Horse Racing, Poker, and Investing Legends Taught Me Bitcoin Revelations

Written by Jordi Visser

Compiled by: Luffy, Foresight News

When I was five years old, my father took me to Monticello Racecourse in upstate New York for the first time.

He handed me a horse racing guide and started teaching me how to interpret the information: past records, jockey records, track conditions. Those numbers and symbols are like a mysterious language to me.

For many years after that, we went there often. The racecourse became his "classroom". He never asked me to "find the winner", but always guided me to another thing: Is there any betting value in this game?

Whenever I finished predicting the odds for an event, he would ask me about the basis for my assessment. He then uses his own experience to point out the information I missed or the dimensions I should have dug deeper. He taught me:

Identify patterns from horse racing records

Weigh the weights of different influencing factors

BTC-1,69%

DeepFlowTech·2025-12-10 09:15

Bitwise CIO: How to Invest in the Crypto Industry

Author: Matt Hougan, Chief Investment Officer at Bitwise; Translation: Jinse Finance

The interesting thing about this industry is that many people you meet are absolutely convinced about everything:

“Ethereum is better than Solana; it will ultimately dominate.”

“Solana is stronger than Ethereum and will definitely crush its competitors in the long run.”

“Only Bitcoin truly matters.”

I always find this incredible.

I've been working full-time in the crypto industry for eight years, surrounded by about 140 colleagues who share ideas with me. I also frequently communicate with top venture capitalists, project founders, researchers, and foundations, giving me deep insights into these network ecosystems.

But even so, I still can’t confidently tell you which public chain will ultimately win out, or how things will precisely unfold.

At the current stage of cryptocurrency development, I believe the ultimate outcome is unpredictable.

金色财经_·2025-12-09 03:06

Pessimists are often right, but only optimists can change the world.

I've seen many people reposting that "I've wasted 8 years in crypto" post. I relate to it deeply, but I also feel it's a bit too pessimistic, so I'd like to add a few objective thoughts:

1) I also entered the space in 2017, which makes it exactly 8 years for me as well. Although the journey has had its ups and downs, I believe joining the crypto industry has been the greatest opportunity of my life. In terms of personal growth, wealth accumulation, resources, and networking, it has far surpassed my previous 10+ years of experience in the internet sector.

This is an absolute fact—my gratitude for crypto will always remain.

2) To be honest, from a purely experiential perspective, the crypto industry has become more mature over the past 8 years, but it has also gotten worse. The original pure cypherpunk spirit is gone, the holder faith is gone, the motivation for continuous learning and technological innovation is gone, and the persistent belief that crypto will change the internet is also gone.

金色财经_·2025-12-08 14:50

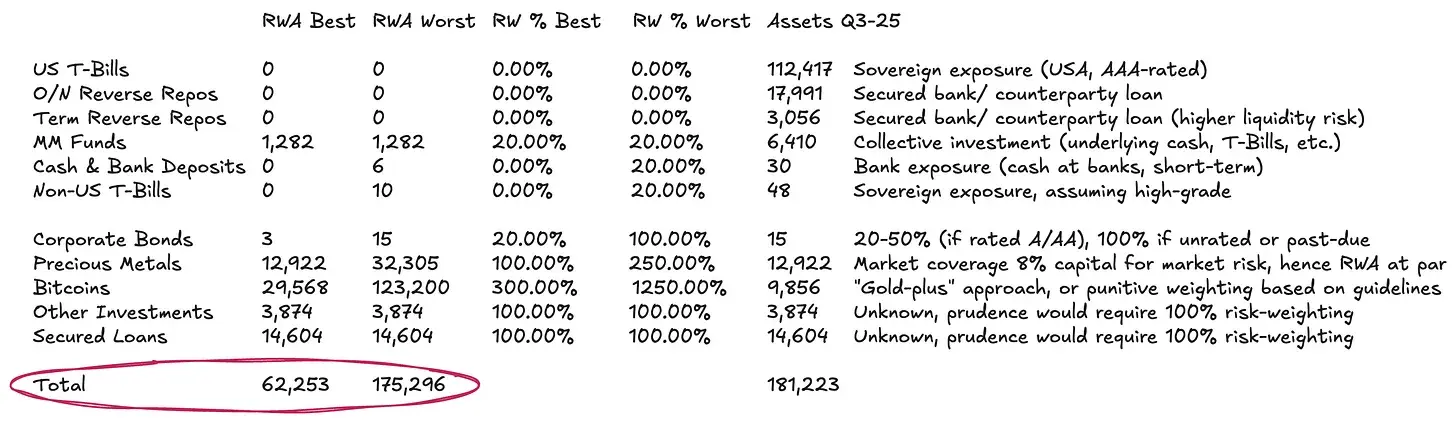

Tether Financial Analysis: Needs an Additional $4.5 Billion in Reserves to Achieve Stability

Author: Luca Prosperi

Translated by: TechFlow

When I graduated from university and applied for my first management consulting job, I did what many ambitious yet timid male graduates often do: I chose a company that specialized in serving financial institutions.

In 2006, the banking industry was the epitome of “cool.” Banks were usually located in the most magnificent buildings on the most beautiful streets in Western Europe, and at the time, I was eager to seize the opportunity to travel around. However, no one told me that this job came with a more hidden and complicated condition: I would be “married” to one of the largest yet most specialized industries in the world—the banking industry, and for an indefinite period. The demand for banking experts has never disappeared. During economic expansion, banks become more creative and need capital; during economic contraction, banks need restructuring, and they still need capital. I once tried to escape this vortex, but just

BTC-1,69%

金色财经_·2025-12-08 12:58

2025 Tether Financial Analysis: An Additional $4.5 Billion in Reserves Needed to Maintain Stability

Author: Luca Prosperi

Translated by: TechFlow

When I graduated from college and applied for my first management consulting job, I did what many ambitious yet timid male graduates often do: I chose a company that specialized in serving financial institutions.

In 2006, banking was the epitome of "cool." Banks were usually housed in the grandest buildings on the most beautiful streets of Western Europe, and at the time, I was eager to use this opportunity to travel around. However, no one told me that this job came with a more subtle and complex condition: I would be "married" to one of the world's largest yet most specialized industries—banking—and for an indefinite period. The demand for banking experts has never disappeared. During economic expansion, banks become more creative and need capital; during contractions, banks need restructuring, and they still need capital. I once tried to escape this vortex, but

BTC-1,69%

DeepFlowTech·2025-12-08 06:30

Load More