Search results for "REACT"

Crypto Liquidations Shake the Market in a Matter of Hours

The crypto market faced intense pressure as crypto liquidations surged to $156 million within just four hours. Traders witnessed sharp price movements across major digital assets. Sudden volatility forced leveraged positions to close rapidly. Many participants struggled to react as losses piled up q

Coinfomania·01-08 11:08

Crypto Markets React as U.S.–Venezuela Tensions Escalate with Reports of the Capture of President Maduro

Bitcoin led the crypto market rebound after it crossed the $90,000 resistance level.

The market’s rebound comes as US forces ousted Venezuelan President Nicolas Maduro.

The crypto market has staged a comeback as more than $100 billion was added to the assets’ valuation in the past 24

CryptoNewsFlash·01-05 15:41

Maduro is taken to a New York detention center! Economist: How will the investment market react?

On the 3rd, Trump announced the arrest of Venezuelan President Maduro and his wife, describing it as an "absolute decisive action" involving 15,000 soldiers, an aircraft carrier, and dozens of F-35 fighters. Maduro was taken to a detention center in New York and faces drug-related terrorism charges. Institutional sources say that oil prices and energy stocks will experience a major shock, and the OPEC+ meeting may amplify the volatility. Venezuela possesses the world's largest oil reserves, and Trump announced the takeover of the country, with markets betting on opportunities for oil and gas reconstruction.

MarketWhisper·01-05 00:59

Crypto Markets React as U.S.–Venezuela Tensions Escalate with Reports of the Capture of President Maduro

Bitcoin led the crypto market rebound after it crossed the $90,000 resistance level.

The market’s rebound comes as US forces ousted Venezuelan President Nicolas Maduro.

The crypto market has staged a comeback as more than $100 billion was added to the assets’ valuation in the past 24

CryptoNewsFlash·01-04 15:41

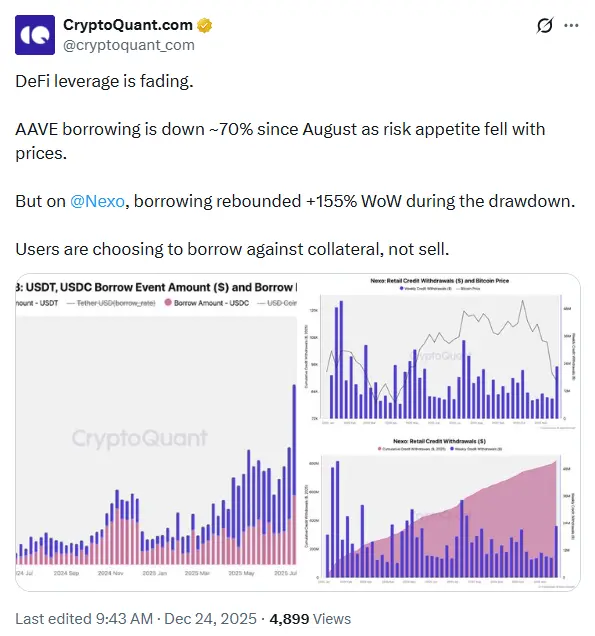

How does the DeFi lending market react to investors' sell-off?

Cryptocurrency prices have experienced a significant correction since the beginning of October 2025, after Bitcoin set a new all-time high (ATH). Alongside the market decline, decentralized lending activity also saw a considerable contraction.

The contrasting developments between Aave and Nexo in the context

TapChiBitcoin·2025-12-25 08:09

CPO of BingX: The Year That Redefined Growth in Crypto and 100% User Growth

As we close out 2025, one truth has become impossible to ignore. This was the year the crypto industry stopped being defined solely by price movements and began to be measured by resilience. Markets surged, corrected sharply, and shifted narratives faster than most could react. For many

IN-1,41%

Coinpedia·2025-12-15 15:09

React bug triggers wallet-draining attacks as hackers hit crypto websites

A critical React Server Components RCE bug is being weaponized to hijack servers, drain crypto wallets, plant Monero miners, and deepen a $3B 2025 theft wave despite urgent patch pleas.

Summary

Security Alliance and Google TIG say attackers exploit CVE-2025-55182 in React Server Components to

Cryptonews·2025-12-15 10:42

ETF’s Update: Bitcoin, Ethereum, XRP Prices React to Latest Institutional Activity

Bitcoin, Ethereum, and XRP spot ETFs revealed contrasting trends, with Bitcoin and Ethereum facing significant outflows, while XRP experienced sustained inflows. Market sentiment fluctuates ahead of the Federal Reserve's policy decision, impacting investor behaviors.

CryptoNewsLand·2025-12-14 16:36

Plume Network Secures ADGM License to Drive Real-World Asset Expansion Across the Middle East

Plume gains ADGM license and expands its real world asset activities across key Middle East markets.

UAE strengthens its digital finance sector with rising approvals for major global blockchain and fintech firms.

PLUME token rises as investors react to the company’s regional growth plan and new

PLUME0,57%

CryptoNewsLand·2025-12-10 14:15

In the early hours of this Thursday, it is not the rate cut itself that will determine the direction of risk assets.

This Thursday (Beijing time), the Federal Reserve will announce its final interest rate decision of the year. Market expectations are very consistent:

According to CME FedWatch data, there is over an 85% probability of a 25 basis point rate cut.

If it happens, this will be the third consecutive rate cut since September, bringing the federal funds rate down to the 3.5%-3.75% range.

For crypto investors accustomed to the narrative of "rate cuts = bullish," this sounds like good news.

But the problem is, when everyone expects a rate cut, the cut itself is no longer a driving factor for the market.

Financial markets are expectation machines. Prices reflect not "what happened," but "what happened relative to expectations."

An 85% probability means the rate cut has already been fully priced in; when it is officially announced early Thursday morning, unless there is a surprise, the market is unlikely to react much.

So what is the real variable?

金色财经_·2025-12-09 08:36

FOMC meeting today: What to expect and how the crypto market could react

As the FOMC meeting kicks off, markets are focused on a likely rate cut and how it could possibly sway crypto market volatility.

Summary

FOMC meets Dec. 9--10 to review U.S. economic data and monetary policy.

Markets expect a 25-basis-point cut and updated dot plot projections.

Crypto could m

Cryptonews·2025-12-09 07:36

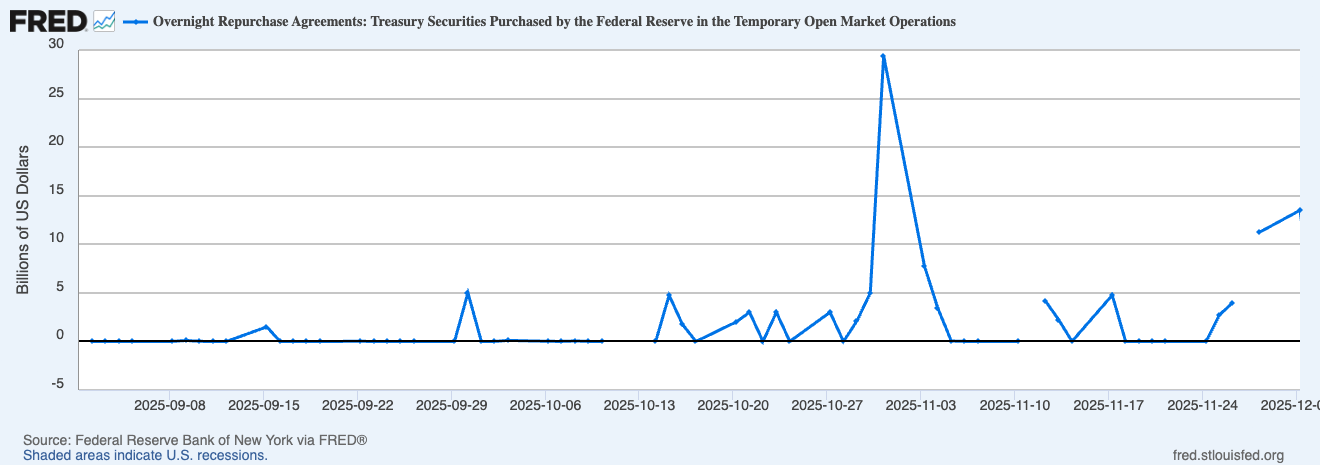

The Federal Reserve injects $13.5 billion overnight! Bitcoin gives early warning of a US dollar liquidity crisis

The Federal Reserve's overnight reverse repo operations reached $13.5 billion, which is a significant anomaly for professional traders tracking dollar liquidity. This sudden surge indicates a sharp increase in demand for short-term dollars within the banking system, possibly signaling tightening in the funding markets or shaken confidence among institutions. As a liquidity-sensitive asset, Bitcoin was the first to react to this change over the weekend, experiencing price volatility. Bitcoin is no longer independent from the US dollar system; instead, it is deeply embedded within the global liquidity cycle.

MarketWhisper·2025-12-08 03:34

STOP GUESSING, START WINNING: This AI Terminal Tracks the Market 24/7!

🤯 The crypto market moves faster than any human can react and guessing your way through it is no longer an option. In an environment dominated by high-speed whales and constant volatility, traders need intelligence, not intuition.

AI Cloud 3 ($AIC) introduces a new standard with the first GenAI

AIC-10,7%

Coinstagess·2025-12-07 14:33

Bitcoin ETFs Face Renewed Outflows as Vanguard Entry Shifts Market Dynamics

ETF data shows alternating inflows and withdrawals across November as institutional activity shifts and major issuers navigate uneven capital movement trends.

BlackRock’s IBIT records the largest net withdrawal during the period, revealing changing exposure strategies as traders react to shifting m

CryptoFrontNews·2025-12-07 09:01

Here Is XRP Price If 10 Fortune 500 Companies Add It to Their Balance Sheets

How could the XRP price react if the top 10 Fortune 500 companies decide to add XRP to their balance sheets?

Notably, as U.S. regulators provide greater clarity on crypto laws, more firms are showing interest in holding XRP as part of their corporate treasuries. Interestingly, multiple companies

XRP0,04%

TheCryptoBasic·2025-12-06 14:39

SlowMist CISO: New attack chain emerges for the latest remote code execution vulnerability in React/Next.js; DeFi platforms need to be aware of security risks

Mars Finance news, SlowMist Chief Information Security Officer 23pds posted on the X platform that, given the emergence of new attack chains for the latest remote code execution vulnerability in React/Next.js, the success rate of attacks will increase significantly. Currently, a large number of DeFi platforms use React, so many will be affected by this vulnerability. All DeFi platforms must pay close attention to security risks.

MarsBitNews·2025-12-05 03:18

These Altcoins Could 10x in 2026: Reactor ($REACT) Leads As Revenue-Backed Token

As the crypto market moves toward its next expansion cycle, several assets are entering 2026 with real fundamentals, improving adoption trends, and strong value drivers. Among them, Reactor (REACT), Internet Computer (ICP), and Stellar (XLM) stand out for their utility, scalability, and clear

CryptoDaily·2025-12-04 17:24

Bitcoin Bear Thesis Persists After New $93,500 Rejection

Cryptocurrency Markets React to U.S. Jobs Data Amid Federal Reserve Rate Outlook

Bitcoin experienced a decline from its 2025 yearly open amid significant market reactions to the latest U.S. employment figures. Despite robust job data suggesting a resilient economy, markets continue to anticipate a

CryptoBreaking·2025-12-04 15:53

Shiba Inu Burn Rate Rockets 217%, Will SHIB Price Follow? - Coinspeaker

Key Notes

SHIB burn rate went up by 217% over the last 24 hours as many ecosystem metrics dropped.

4,971,698 SHIB were permanently removed from circulation.

However, the SHIB price has failed to react accordingly, shifting focus to Maxi Doge.

Shibburn, the dedicated burn tracker for the

Coinspeaker·2025-12-04 14:01

Best Crypto to Stock Up on Ahead of the Santa Rally 2025: REACT, SUI, and LINK

Seasonal patterns matter in crypto, and the Santa rally is one of the most watched. Late December often brings renewed risk appetite, thinner order books, and short-term momentum that pushes high-performing assets higher. As the biggest rally of 2025 approaches, three assets stand out for traders

CryptoDaily·2025-12-03 16:03

Best Crypto to Buy on December 2025 Dip: Reactor ($REACT) Could Be the Next Hidden Gem

December has turned into a battlefield for crypto investors. The market dropped almost 10% in a single day, Bitcoin is down 30% in just a month, and millions in short liquidations have fueled a brutal deleveraging cycle. Everywhere you look, charts are red and sentiment is collapsing.

But in the mi

CryptoDaily·2025-12-02 14:24

Crypto Markets React as Liquidity and Stimulus Rise

Dan Gambardello emphasizes Fed cuts, QE revival, and global liquidity as key factors for long-term crypto positioning. Despite Japan's 20% crypto tax causing price drops, small caps saw gains. Regulatory changes and macroeconomic shifts continue to influence the crypto market.

CryptoFrontNews·2025-12-01 15:03

What Crypto To Buy Now? Analysts Overwhelmingly Point To Remittix After 200% Black Friday Bonus

DeFi project stories now dominate talk about what crypto to buy now as traders react to Black Friday offers and sharp moves. Bitcoin trades just above $90,000 after the Thanksgiving bounce, and every dip looks like a reset rather than an exit. Inside that noise, one payment focused token running a 2

AsiaTokenFund·2025-12-01 12:20

How Will the Crypto Market React to More Than $15 Billion in Bitcoin, ETH and XRP Options Expiry?

The crypto market is preparing for one of the most significant monthly expirations of the year, with Bitcoin, Ethereum and XRP options worth over $15 billion coming due. The event arrives at a moment when overall sentiment remains deeply fragile, even after a recent rebound that pushed major

Moon5labs·2025-11-28 14:01

The IMF warns that the tokenization market may exacerbate the risk of flash crashes, and the government will intervene in regulation.

According to Mars Finance, Cointelegraph reports that the International Monetary Fund (IMF) has released a video warning that although the tokenization market can make financial transactions faster and cheaper, this technology also brings new systemic risks. The IMF acknowledges that tokenization can lead to significant cost savings by reducing intermediaries and enabling instant settlements, but also points out that automated trading may increase market volatility and the risk of flash crashes. Complex smart contracts may react like dominoes under market pressure, turning localized issues into systemic shocks. The IMF predicts that based on historical experience, governments will not remain spectators in this important currency evolution and will play a more active role in the field of tokenization in the future.

MarsBitNews·2025-11-28 10:45

XRP吸金8亿却只pump3%! ETF失灵还是Ripple出大事?

Despite strong interest from institutional investors in XRP, the token has struggled to react meaningfully to the launch of several new ETFs, and the XRP price prediction remains unclear. In recent days, more than 6 ETFs linked to XRP have been launched, with total assets nearing $800 million—however, XRP has only pumped 3% over the past week.

MarketWhisper·2025-11-28 00:19

December Rate-Cut Odds Jump to 85% as Analysts React to Softer Labor Data and Fed Signals

December rate-cut odds have surged to 85% due to disappointing labor data and encouraging signals from Fed officials. Traders now anticipate a potential third cut this year, influencing Bitcoin prices upward.

BTC-0,57%

CryptoFrontNews·2025-11-27 04:02

Analysis: Powell's position is unknown, but it can be assumed that he will support a rate cut in December.

According to Deep Tide TechFlow news, on November 25, Pepperstone research director Chris Weston stated, "The market is highly focused on the positions of each Fed voter and their views on the interest rate cut in December. Given that the market (and the Fed) has not yet received the data that typically influences its policy decisions, this is reasonable. Perhaps the biggest unknown is Powell's own perspective, but overall, one can assume he will vote in favor of the interest rate cut in December." So far, the sudden shift in interest rate cut bets has had a limited impact on the dollar. Fed officials still have disagreements about the next possible actions, as the bank has not yet received the full set of data. Weston said, "In a situation where the labor market is weak and both short-term and long-term inflation expectations in the U.S. are declining, maintaining the interest rate in December would be a disconnection, and the market may react negatively." ( Jin10 )

DeepFlowTech·2025-11-25 08:43

Stablecoin Net Flow Drops As 972M Shift Signals Market Turning Point

Stablecoin net flows show a sharp drop of 972 million during a period where liquidity enters the market at a slower speed.

BTC follows the trend shown in the chart as large holders sell and short term traders react to every sudden move in supply.

The current shift lines up with earlier cycles wher

BTC-0,57%

CryptoNewsLand·2025-11-20 21:34

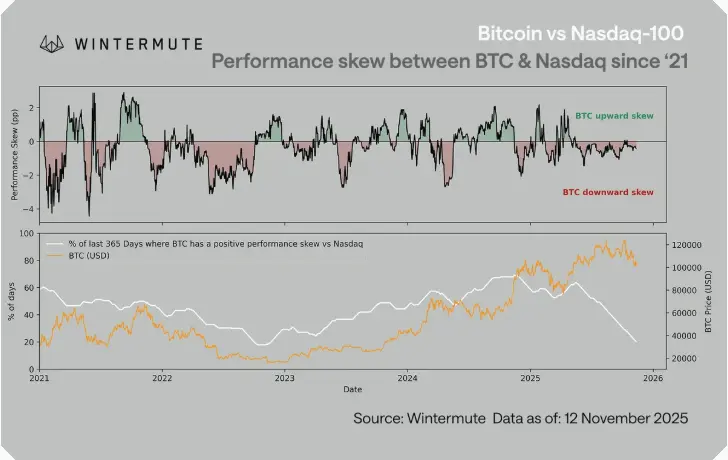

Bitcoin Tracks Nasdaq Losses, Not Its Rallies

Bitcoin remains tightly correlated with the Nasdaq-100, but only in ways that hurt. Despite trading near record highs, BTC continues to react far more aggressively to equity market declines than rallies, an unusual dynamic that signals investor fatigue rather than market euphoria.

BTC Tracks

BTC-0,57%

Coinpedia·2025-11-14 15:50

Crypto Bull Market Defies Logic as Every Positive or Negative Signal Triggers Dumps

Crypto markets react unpredictably, with tariffs, rate decisions, and government events consistently triggering sell-offs despite traditional market expectations.

Gold, stocks, and ETFs movements fail to stabilize crypto prices, causing consistent downward pressure regardless of positive or

CryptoFrontNews·2025-11-14 10:02

Canary Files MOG ETF Drives Surge in Memecoin Prices

Cryptocurrency markets often react quickly to the latest developments in crypto regulation and product launches. Recently, Canary Capital has submitted a filing to the U.S. Securities and Exchange Commission (SEC) proposing a Bitcoin ETF that would track Mog Coin, a meme-inspired cryptocurrency.

CryptoBreaking·2025-11-13 06:22

Is the Standstill Over = Market Rebound? An Analysis of the Performance of U.S. Stocks, Gold, and BTC After Each Government Restart.

Written by: David, Deep Tide TechFlow

At 5 a.m. Beijing time on November 13, a government shutdown crisis that lasted for 43 days and set a record in U.S. history is about to come to an end.

The U.S. House of Representatives passed a temporary funding bill by a vote of 222-209 on the evening of November 12, local time, which was signed into law by Trump.

Thus, the stalemate that began on October 1 has come to an end.

In these 43 days, there have been widespread flight delays, interruptions in food assistance programs, and a suspension of economic data releases, with uncertainty looming over every aspect of the world's largest economy.

How will the market react with the end of the suspension?

For investors in the cryptocurrency market and traditional financial markets, this is not only the conclusion of a political event but also an experimental window to observe how asset prices respond to the "elimination of uncertainty."

History

BTC-0,57%

DeepFlowTech·2025-11-13 03:08

Bitcoin Price: Reaction From Demand, What Now?

In the last article we talked about that daily demand zone we were waiting for months. I remember saying that if price was going to react anywhere, it would b

BTC-0,57%

BitcoinInsider·2025-11-11 13:04

HBAR Price: Accumulation Is Done, What Comes Next?

In one of the previous articles, we talked about how HBAR could react from the supply level above, accumulate for a bit, and then potenti

HBAR-1,45%

BitcoinInsider·2025-11-11 13:04

Uniswap Proposes Major ‘UNIfication’ Plan to Activate Protocol Fees, Burn UNI Tokens, and Cut Cir...

Uniswap plans to cut UNI supply by 16% through a new burn and fee activation system.

The proposal merges Uniswap Labs and Foundation into one body to align governance and growth.

UNI price jumps over 40% as traders react to Uniswap’s new token and protocol changes.

Uniswap has introduced a propos

UNI0,1%

CryptoNewsLand·2025-11-11 12:13

SEI Holds Near $0.1602 Support As Buyers React to Bullish Structural Shift

SEI has shown a bullish change of character despite a 3.8% price drop to $0.1604. The token signals a potential structural reversal with increased buying activity near support levels, indicating growing market participation and a possible accumulation phase.

CryptoNewsLand·2025-11-08 19:33

Trump first admits that some of the tariff costs are borne by American consumers. How did the crypto market react?

U.S. President Donald Trump acknowledged on November 6 that some of the costs of his tariff policies may be borne by American consumers, marking a shift from his long-standing stance that "foreigners pay." Meanwhile, the U.S. Supreme Court is reviewing the constitutionality of his broad tariff powers, and the ruling could have far-reaching implications for U.S. trade policy, the sustainability of global supply chains, and macroeconomic conditions. The business community has expressed serious concerns, particularly leaders in industries such as toys and textiles, who are facing the challenge of high tariff costs.

MarketWhisper·2025-11-07 07:16

Order Flow: The Hidden Driver Behind Market Fluctuations

Most retail traders focus on price, volume, relative strength index (RSI), and technical indicators like the moving average convergence divergence (MACD).

But what truly drives these numerical changes is a much more hidden force — order flow.

Order flow is the collection of buy and sell instructions entering the market every second. As the pulse of liquidity, it reveals the identities of buyers and sellers and how aggressive their trading is.

From Wall Street to decentralized exchanges, professional institutions use order flow to price risk, detect imbalance signals between bulls and bears, and predict short-term trends before they appear on charts.

Understanding order flow is key to helping you break free from fighting against the market’s hidden currents.

1. Why is order flow important?

All market prices are the result of a battle between buyers and sellers, and order flow reflects the intensity of this struggle.

Market makers adjust their bid and ask prices based on this information: once they detect an informational advantage, they can react accordingly.

PANews·2025-11-07 00:10

Fed Cuts Rates 25 bps and Ends QT, But Markets React Coldly—Stocks, Crypto, Gold All Fall

The Federal Reserve announced a 25 basis point rate cut and the end of quantitative tightening (QT), yet markets responded with indifference, as stocks, cryptocurrencies, and gold broadly declined.

CryptopulseElite·2025-10-31 08:07

Trump and Chinese President Signal Trade Easing — Bitcoin and Global Markets React with Optimism

The meeting between Donald Trump and the Chinese president in South Korea has become one of the most closely watched diplomatic events of the season. Both leaders made clear their intention to ease trade tensions and reduce tariffs that have shaken global markets in recent months — from stocks to

Moon5labs·2025-10-30 15:02

Solana Price Stuck Between Key Levels, What Comes Next

In the last Solana update, I mentioned how the price could react long from a clean demand zone

SOL-0,82%

BitcoinInsider·2025-10-27 16:46

Why Don’t Americans Care About the Next Fed Rate Cut - and How Will Crypto React?

The Fed plans to lower interest rates on October 29 to aid the slowing economy, but many Americans focus more on inflation. Crypto markets prepare for volatility as Bitcoin adjusts for the anticipated rate cut.

BTC-0,57%

BitcoincomNews·2025-10-23 11:44

How the Crypto Market Could React to the Upcoming Fed Meeting on October 29

The crypto market is holding its breath ahead of the U.S. Federal Reserve’s meeting on October 29. Investors have long anticipated that the Fed will cut interest rates by 25 basis points, which could paradoxically trigger a short-term selloff once the decision becomes official.

The “Buy the

BTC-0,57%

Moon5labs·2025-10-23 08:00

Kaspa Accumulation Surges As Whales Take Control – Here’s How KAS Price Could React

Kaspa on-chain data is lighting up again, and this time it’s not retail traders making moves, it’s the whales. According to Kaspa Daily, one of the network’s largest wallets just pulled off a massive accumulation event, adding 154 million KAS directly from Gate.io

That transaction alone pushed

CaptainAltcoin·2025-10-21 14:24

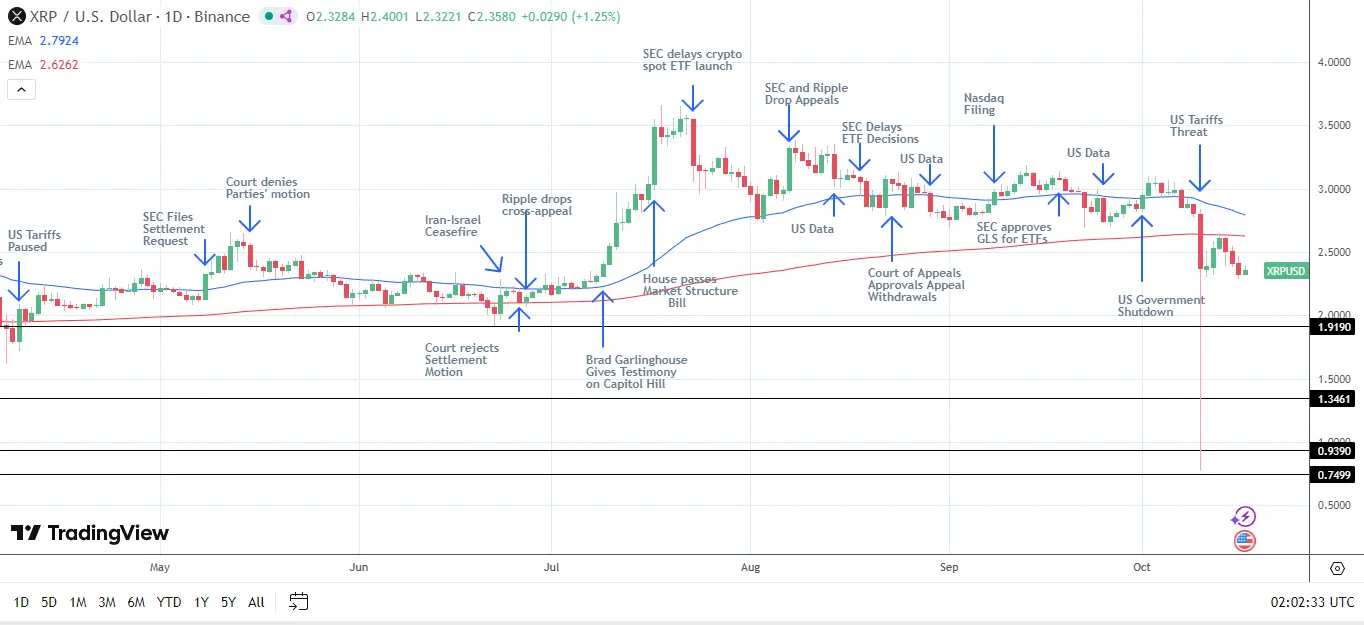

XRP Today News: The U.S. government shutdown remains unresolved, and the ETF delay intensifies the risk of falling below 2 dollars.

The U.S. government shutdown has been extended to 16 days as of October 16, making the approval timeframe for the XRP Spot ETF increasingly uncertain. In the 10th round of voting, no new Democratic members joined, heightening concerns about the extension of the government shutdown. Today's news on XRP indicates that the risk of XRP falling below $2 has increased as traders react to the latency of inflows from institutional investors.

MarketWhisper·2025-10-17 03:48

Pi Coin excels as the market falls— How will the price react next?

Pi Coin has demonstrated superior strength compared to most other major cryptocurrencies in the context of today's market correction of over 3%. While Bitcoin, Ethereum, and BNB all recorded declines ranging from 3% to 12%, the price of Pi Coin only fell by 1.5% in the last 24 hours — a sign of rare resilience.

TapChiBitcoin·2025-10-15 03:05

ADA Price Prediction: Where Do Crypto Analysts See ADA Price At the End of October

Cardano is currently trading at $0.8573 as investors react to ETF-related catalysts and broader market movements. Inclusion in the Hashdex Nasdaq Crypto ETF and anticipation around potential SEC approvals have pushed ADA toward $1, signalling renewed interest

Meanwhile, Remittix (RTX) is

CaptainAltcoin·2025-10-06 13:33

Here’s XRP Price if 100 Treasury Companies Stack 300 Million XRP Each

How could the XRP price react if 100 treasury companies each procured 300 million XRP tokens?

Corporate interest in cryptocurrencies is growing, and XRP is becoming a favorite for companies looking for crypto treasury strategies. As regulations in the U.S. become clearer and the Bitcoin Treasury tr

TheCryptoBasic·2025-10-06 07:13

Load More