USDC News Today

Latest crypto news and price forecasts for USDC: Gate News brings together the latest updates, market analysis, and in-depth insights.

Visa Begins US Stablecoin Settlement via USDC on Solana

In brief

Visa will allow partnered issuers and acquirers in the U.S. to settle with stablecoins, starting with USDC on Solana.

The expansion follows its global pilots that began rolling out in 2023.

Its monthly stablecoin volumes have eclipsed a $3.5 billion annual run rate.

Decrypt's

USDC0.02%

Decrypt·8h ago

Visa Taps Circle’s USDC to Offer Stablecoin Settlement to US Banks

Visa has expanded its stablecoin settlement to the United States, allowing banks and fintechs to transact using the USDC token.

The card payment giant announced Tuesday that issuers and acquirer partners can now leverage stablecoins to settle transactions using Circle’s stablecoin USDC. The move co

USDC0.02%

TheCryptoBasic·9h ago

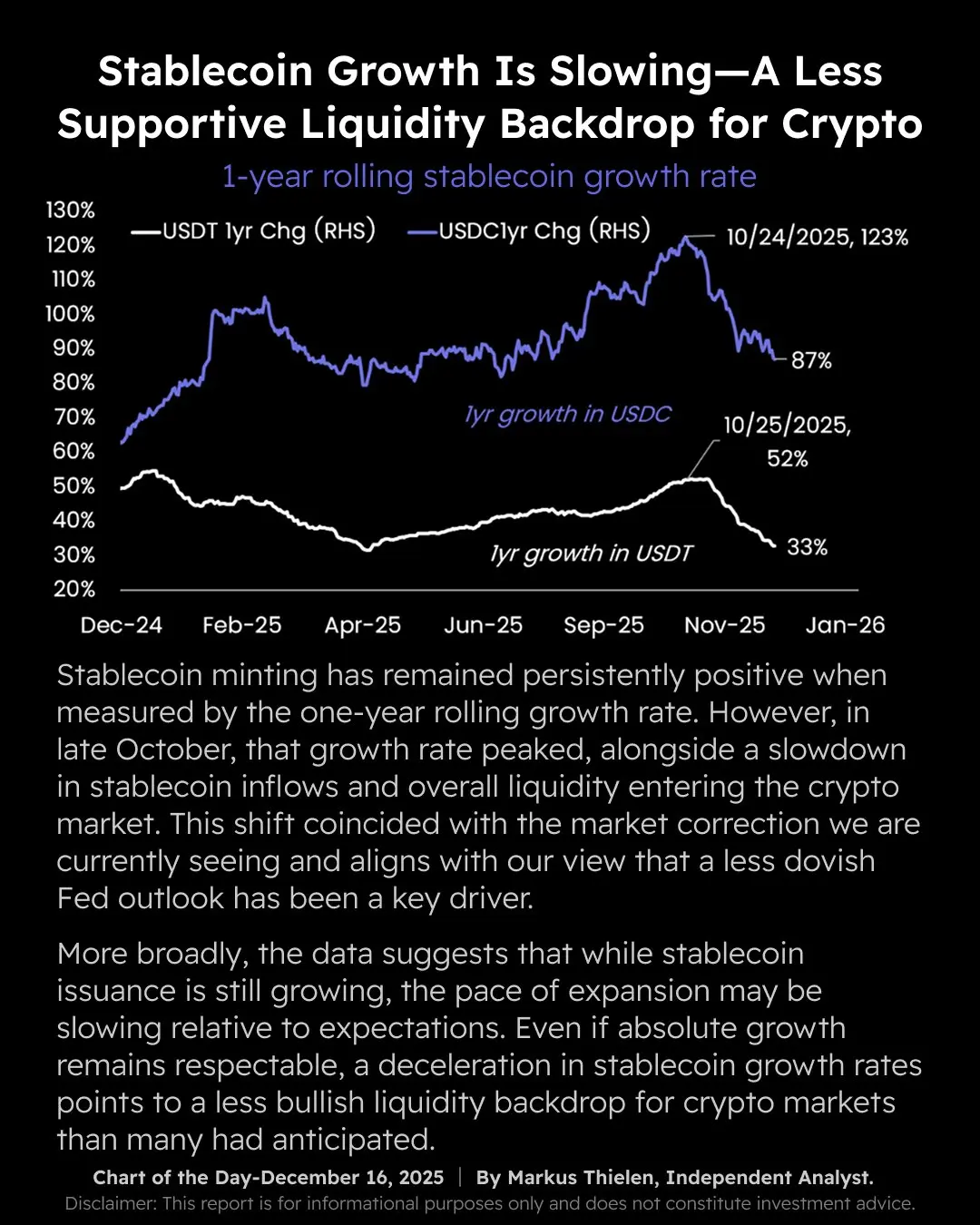

Matrixport: $260 Billion Stablecoins Turn Dead Water, Crypto Liquidity Exhausted

Matrixport's latest report reveals a fatal paradox in the crypto market: the total supply of stablecoins has surpassed $260 billion, reaching a record high. However, the inflow of new funds has peaked and slowed down, causing Bitcoin to lose a key moving average and drop below $86,000. The core issue lies in the Federal Reserve's cautious stance on interest rate cuts, which suppresses risk appetite, turning the massive stablecoin reserves into "dead weight" rather than market-driving fuel.

USDC0.02%

MarketWhisper·16h ago

What Is Circle's Acquisition of Interop Labs? Boosting Cross-Chain Interoperability for USDC and Arc in 2026

Circle—the issuer of the USDC stablecoin—announced a signed agreement to acquire the team and proprietary intellectual property of Interop Labs, a key contributor to the Axelar cross-chain protocol.

USDC0.02%

CryptopulseElite·17h ago

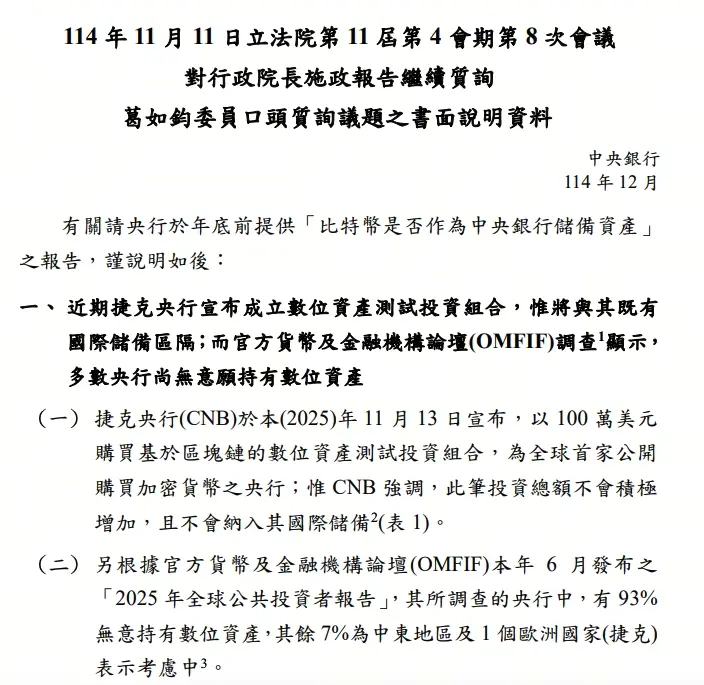

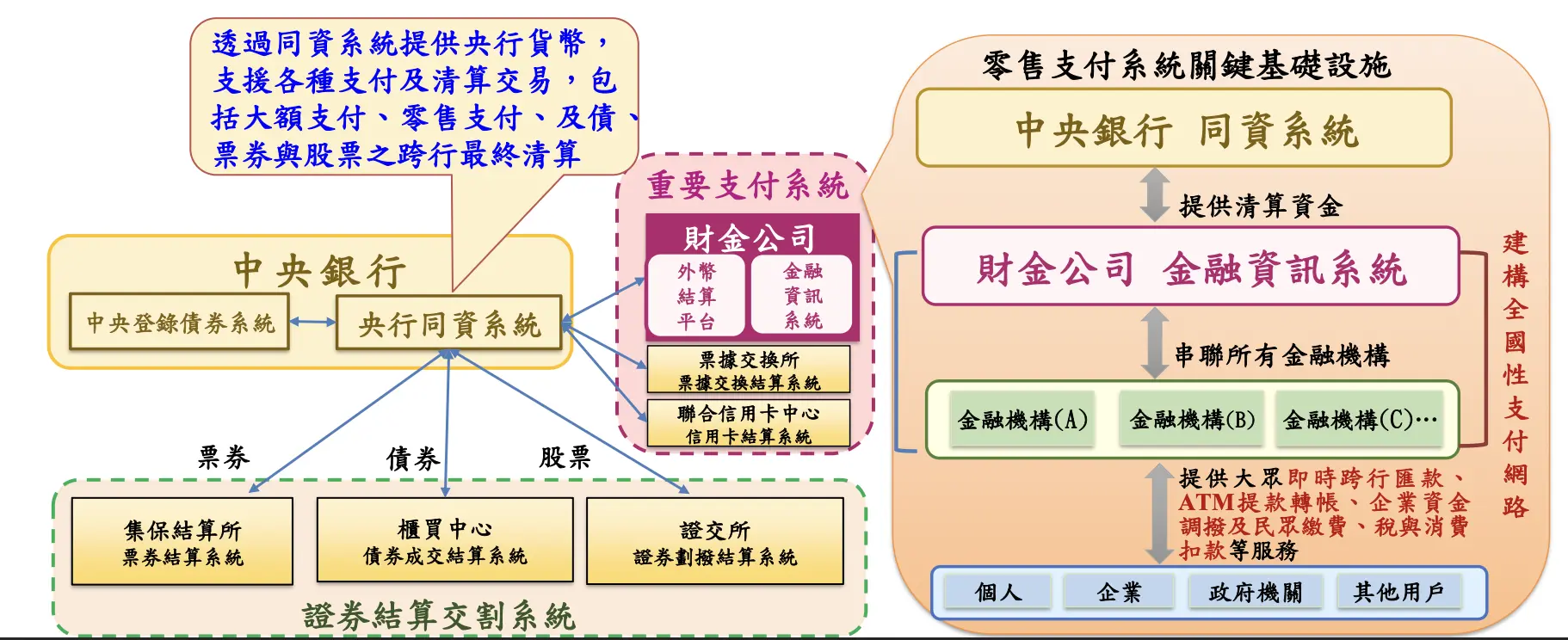

Will Taiwan include Bitcoin in its strategic reserve assets? The central bank provides the final answer......

Taiwan's Central Bank responded to legislator Ge Rujun's inquiry about whether Bitcoin should be used as a central bank reserve asset by officially submitting a written assessment document. The conclusion is clear: Bitcoin is not suitable as a central bank reserve asset. The Taiwan Central Bank pointed out four core risks associated with Bitcoin: extreme price volatility, liquidity risk, cybersecurity custody risk, and an immature regulatory framework. These risks do not meet the three main principles of reserve assets: "safety, liquidity, and profitability."

USDC0.02%

MarketWhisper·18h ago

Nasdaq applies to the SEC for the 5×23 trading new system; the fastest "no closing" US stock market to be implemented in the second half of 2026

Nasdaq applies to the SEC for a 5×23 trading plan. If approved, US stocks could trade 23 hours daily as early as the second half of 2026.

(Background: Interactive Brokers opens "stablecoin deposits," allowing USDC to be deposited into brokerage accounts)

(Additional context: Interactive Brokers plans to issue a US dollar stablecoin: the technical foundation is ready, and a revolution in brokerage settlement is coming?)

Nasdaq submitted the 5×23 plan to the U.S. Securities and Exchange Commission (SEC) on the 15th, requesting a review of the "5×23" system. If approved, starting from the second half of 2026, US stocks will be tradable for 23 hours a day, only during the day

USDC0.02%

動區BlockTempo·22h ago

Interactive Brokers connects "Stablecoin Deposit": Why is the Wall Street giant breaking down the "Payment Berlin Wall" at this time?

Author: BlockWeeks

Between the crypto market and traditional financial markets (TradFi), there has long been an invisible wall: the friction costs of fiat channels.

Recently, the globally renowned electronic broker Interactive Brokers (IBKR) announced a milestone update: officially supporting clients to deposit funds using stablecoins (mainly USDC) for trading stocks, futures, and forex, among other traditional assets.

If not examined carefully, this might seem like a simple payment feature update. But in the eyes of observers well-versed in financial infrastructure transformation, this is a substantial acknowledgment by Wall Street’s top broker of the “on-chain settlement network.” When the US Dollar becomes USDC, and SWIFT becomes the

PANews·22h ago

Yen stablecoin 2026 is here! SBI Holdings is rushing into the trillion-yen cross-border settlement market

Japanese financial group SBI Holdings and Web3 infrastructure company Startale Group have signed a memorandum of understanding, planning to issue a regulated Japanese yen stablecoin through Shinsei Trust, with the goal of launching in Q2 2026. SBI Holdings CEO Yoshitaka Kitao stated that this move will lay the foundation for Japan's transition to a token economy.

USDC0.02%

MarketWhisper·22h ago

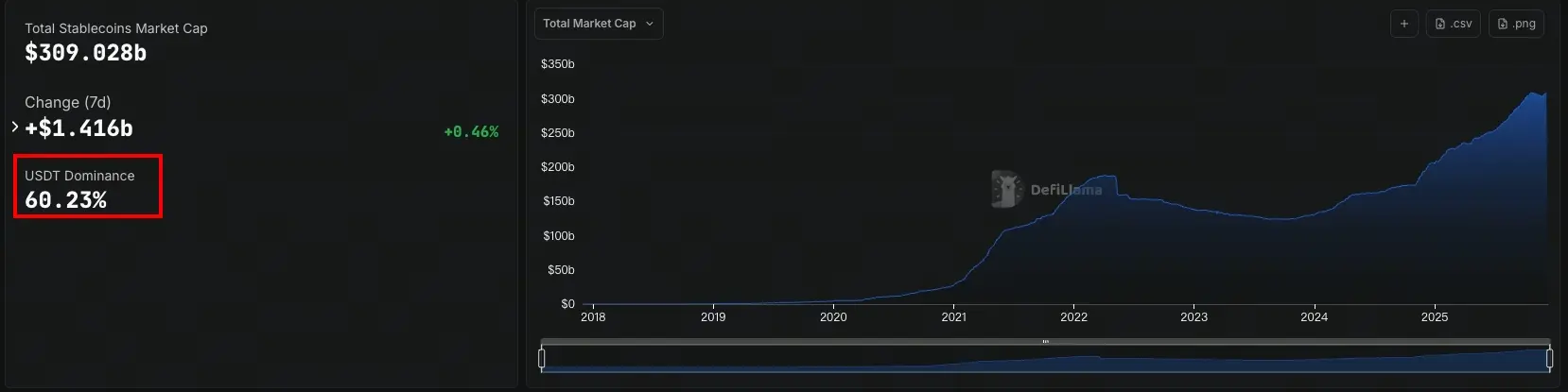

New Taiwan Dollar Stablecoin to Launch in 2026! Financial Experts Warn of Currency Sovereignty Defense Battle

Taiwan FinTech Association Director Wen Hongjun warns that USDT and USDC stablecoins account for about 99% of the global market share. If Taiwan does not issue a new Taiwan dollar stablecoin soon, it could be marginalized in emerging digital financial infrastructure. This is not just a payment issue, but a competition surrounding monetary sovereignty and control over financial ledgers. The Financial Supervisory Commission states that if virtual asset legislation and related regulations are passed quickly, Taiwan's issued stablecoin could be launched as early as the second half of 2026.

USDC0.02%

MarketWhisper·12-15 07:27

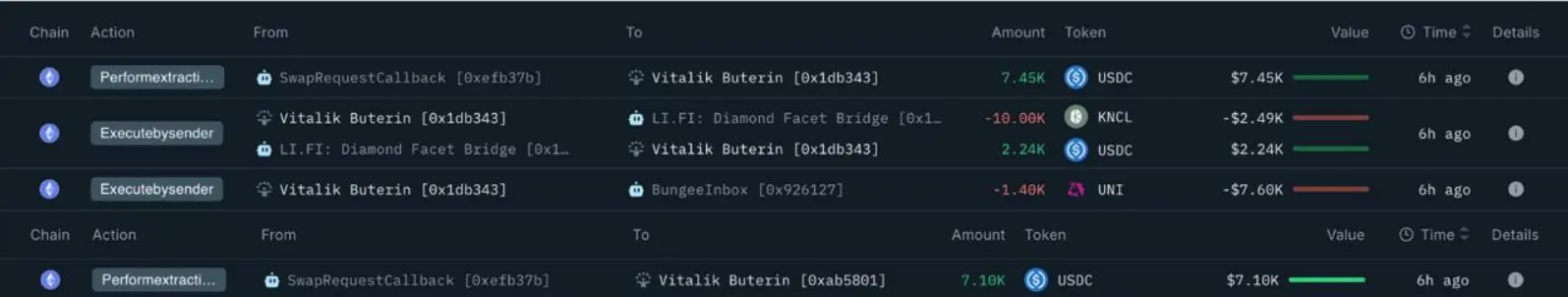

Vitalik Buterin sells UNI, KNC, and DINU, earns nearly 17,000 USDC

Vitalik Buterin, co-founder of Ethereum, recently sold various digital assets, including 1,400 UNI and 40 trillion DINU tokens, totaling 16,796 USDC. Despite their modest value, these transactions drew attention due to Buterin's influence in the crypto market, highlighting portfolio rebalancing rather than market trend signals.

TapChiBitcoin·12-15 04:51

Interactive Brokers officially launches "stablecoin deposits," allowing USDC to be instantly credited to stock accounts

Major US online broker Interactive Brokers (IBKR) has officially launched a stablecoin deposit feature, allowing global retail investors to fund their securities accounts directly from their crypto wallets using stablecoins. Funds can arrive in the account within seconds, enabling 24/7 real-time deposits.

(Background: YouTube has enabled stablecoin payments, allowing US creators to receive PYUSD as revenue)

(Additional context: Interactive Brokers plans to issue a US dollar stablecoin: the technical foundation is ready, is the broker's settlement revolution coming?)

According to Bloomberg today (12), the major US online broker Interactive Brokers (IBKR) has officially launched a stablecoin deposit feature, allowing global retail investors to fund their securities accounts directly from their crypto wallets using stablecoins, with funds arriving within minutes.

動區BlockTempo·12-12 16:00

The most commonly used overseas brokerage for Taiwanese investors in US stocks: Interactive Brokers (Interactive Brokers) now accepts stablecoin deposits

Interactive Brokers, the most frequently used US stock overseas broker by Taiwanese people, has recently opened the door for retail investors to deposit using stablecoins. According to a video released by the service provider, deposits can be made via USDC on three blockchains: Base, Solana, and Ethereum, reducing deposit costs, offering 24/7 service year-round, and enabling instant fund transfers. However, currently only US investors are allowed to use stablecoins, with Interactive Brokers stating that access will be gradually expanded.

Interactive Brokers Opens Stablecoin Deposit for US Retail Investors

Bloomberg reports that giant US broker Interactive Brokers has permitted retail investors to deposit using stablecoins. Interactive Brokers is a platform used by many overseas individuals to trade US stocks. For example, Taiwanese traders usually trade US stocks through overseas brokers or via omnibus accounts. Among overseas brokers, the most prominent are

USDC0.02%

ChainNewsAbmedia·12-12 15:55

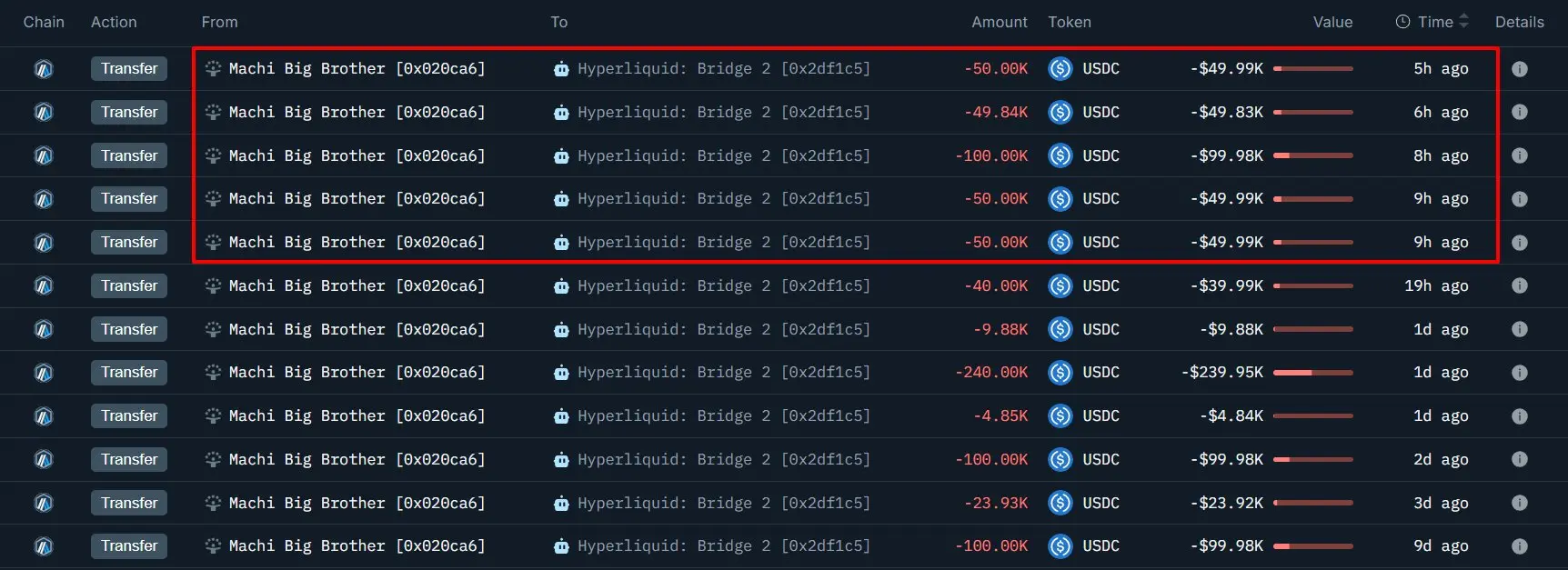

Huang Licheng invests another 300,000 USDC! Brother Maji stubbornly holds onto his ETH long positions, refusing to admit defeat

On December 12th, American-Taiwanese singer and L.A. Boyz member "Brother Ma Ji" Huang Licheng deposited 299,842 USDC into Hyperliquid and increased his ETH 25x leveraged long position. The current position is 6,900 ETH, with an entry average price of $3,240.93, and a liquidation price of $3,130.95, just about $110 away from triggering a liquidation.

MarketWhisper·12-12 01:44

Why is China banning stablecoins? Former Vice President of the Bank of China, Wang Yongli, reveals 4 major deadly reasons

Shenzhen Digital Information Service Group Co-Chairman and former Vice President of the Bank of China, Wang Yongli, recently published an article elaborating on China's firm policy logic to halt stablecoins. He pointed out that China's accelerated development of digital RMB and the clear policy orientation to resolutely curb virtual currencies, including stablecoins, are based on comprehensive considerations of factors such as its global leading position in mobile payments, the sovereignty security of the RMB, and the stability of the monetary and financial system.

USDC0.02%

MarketWhisper·12-11 05:41

OCC: Nine major US banks ban Crypto, Department of Justice intervenes in investigation

According to a survey by the Office of the Comptroller of the Currency (OCC), from 2020 to 2023, the nine major US banks restricted financial services to politically sensitive industries, with Crypto being the most affected. The OCC stated that these banks, when providing financial services, made inappropriate distinctions based on the customer's legitimate business activities. Measures taken against Crypto include restrictions on "issuers, exchanges, or custodians." The investigation is still ongoing and may result in the findings being submitted to the Department of Justice.

MarketWhisper·12-11 01:54

Circle Just Minted Another $500 Million USDC on Solana

Circle Internet Financial minted $500 million of USD Coin on Solana, contributing to a total of $15.03 billion USDC since October 11. This issuance boosted trading volumes and liquidity on decentralized exchanges, highlighting Solana's growing status for stablecoin use.

USDC0.02%

CryptoBreaking·12-10 08:00

CFTC Launches Crypto Pilot With BTC, ETH, USDC Driving Margin Heat

A new CFTC pilot program opens the door for regulated tokenized collateral in U.S. derivatives markets, signaling broader acceptance of bitcoin, ether and stablecoins while removing barriers that once constrained digital asset innovation.

CFTC Launches Tokenized Collateral Pilot and Pulls Back

Coinpedia·12-10 00:44

Privacy-Centric Version of Circle's USDC Stablecoin Rolling Out via Aleo Network

Circle is partnering with Aleo to launch USDCx, a privacy-focused and interoperable stablecoin that protects user data while ensuring regulatory compliance. Expected on Aleo's mainnet by January, it enhances usability in various financial applications.

Decrypt·12-09 18:27

CFTC Launches Pilot Allowing BTC, ETH, USDC as Collateral

The CFTC launched a pilot allowing Bitcoin, Ethereum, and USDC as tokenized collateral for U.S. derivatives under strict regulations, enhancing safety and oversight amid evolving digital asset markets.

CryptoFrontNews·12-09 15:32

Stripe opened USDC payments on the 12th, targeting Visa and Mastercard with a 1.5% flat fee.

Payment platform Stripe officially launched USDC payments on the 12th, with a single 1.5% fee directly challenging Visa and Mastercard, making blockchain completely invisible to merchants.

(Prior context: Will Stripe’s dedicated payment chain Tempo threaten the status of ETH and SOL?)

(Supplementary background: Stripe’s settlement blockchain Tempo completed a $500 million Series A funding round, valuing it at $5 billion.)

After Trump’s return to the White House, fintech regulation in the US has noticeably loosened, and Silicon Valley has shifted its focus from SEC penalties back to competing on efficiency. Seizing the opportunity, payment giant Stripe announced on December 12 that it will open stablecoin payment functionality to global merchants, supporting USDC, with initial networks being Ethereum, Polygon, and Coinbase’s...

USDC0.02%

動區BlockTempo·12-09 08:49

Historic Breakthrough for CFTC! Bitcoin, Ethereum, and USDC Approved as Collateral

The U.S. Commodity Futures Trading Commission (CFTC) has launched a digital asset pilot program, allowing Bitcoin, Ethereum, and USDC, among other payment stablecoins, to be used as collateral in the U.S. derivatives market. The program is only applicable to futures commission merchants (FCMs) that meet specific conditions. These firms can accept BTC, ETH, and USDC as margin collateral for futures and swaps trading, but must comply with strict reporting and custody requirements.

MarketWhisper·12-09 03:41

The US CFTC launches a pilot program, allowing Bitcoin, Ethereum, and USDC to be used as collateral in the derivatives market.

The U.S. Commodity Futures Trading Commission (CFTC) has launched a pilot program allowing Bitcoin, Ethereum, and USDC to be used as collateral in the derivatives market, replacing outdated guidelines and symbolizing the integration of digital assets into the traditional financial system. The new regulations require futures merchants to adhere to strict supervision and pave the way for other tokenized assets, enhancing market efficiency.

ChainNewsAbmedia·12-09 03:06

Why is x402 the key protocol for enabling encrypted payments?

x402 is extremely important for stablecoin payments. Some people (like Lincoln Murr) have compared it to a "Trojan horse." This is a very apt analogy. This Trojan horse is not just about using "stablecoins." Instead, it gradually influences users in three ways, thereby reshaping the financial payment network.

Previously, for stablecoin payments, users needed to: open a wallet → connect → sign the transaction → pay the gas fee → wait for confirmation. For most non-crypto-native users, this process is too complicated, since creating a crypto wallet already excludes 90% of users.

But with x402, the process (for the user) is: open a paid content (such as a paid short drama, etc.) → browser/wallet pops up "Need to pay 3 USDC," click "Allow" → payment is completed, and the content is immediately unlocked. Users don't need to know they are paying with a stablecoin (such as USD

PANews·12-09 03:05

Singapore-based stablecoin cross-border payment and fund management service provider MetaComp has completed a $22 million Pre-A round of financing, with participation from Eastern Bell Capital and others.

Singapore-based stablecoin cross-border payment service provider MetaComp has completed a $22 million Pre-A round of financing, which will be used to accelerate the expansion of the StableX network in Southeast Asia, South Asia, and the Middle East. The company has a monthly trading volume of over $1 billion, supports multiple stablecoins, and enables 24/7 forex execution.

USDC0.02%

DeepFlowTech·12-09 02:09

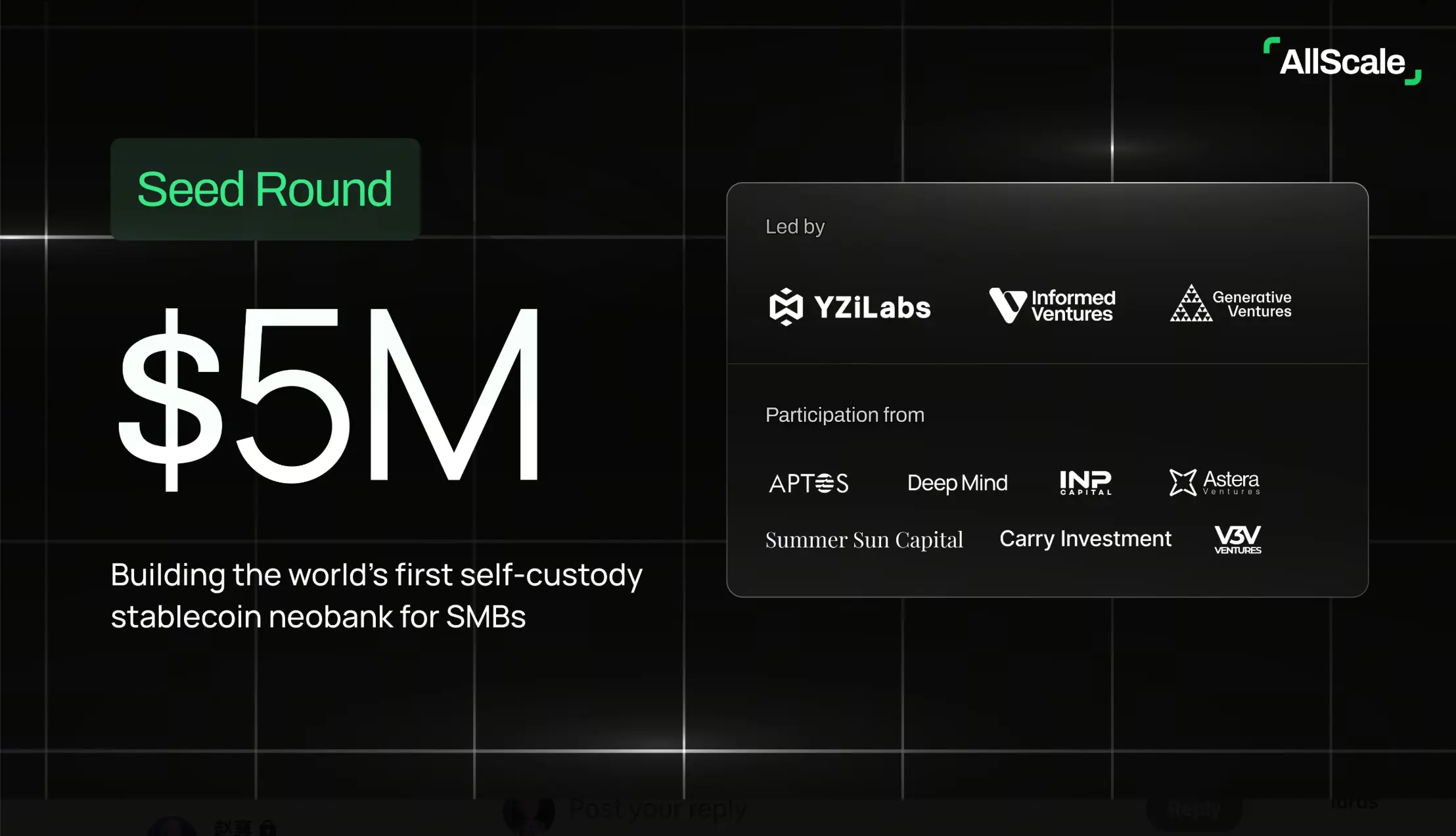

Targeting a market of 1.4 billion people! AllScale secures $5 million in funding to build the first self-custodial stablecoin digital bank

AllScale, a self-custody financial platform focused on serving small and micro businesses worldwide, recently announced the completion of a $5 million seed funding round. The round was led by YZi Labs, with participation from Infomed Ventures, Generative Ventures, and other institutions. The project aims to build the world’s first self-custody stablecoin digital bank, providing instant, low-cost, and borderless stablecoin payment and invoicing solutions for freelancers and small and micro businesses globally through account abstraction and an AI-driven financial assistant. Its vision is to become the underlying payment infrastructure powering the “super individual” economy.

MarketWhisper·12-09 02:03

CFTC launches pilot program allowing BTC, ETH, and USDC to be used as collateral

CFTC Chair Caroline Pham announced a digital asset pilot program allowing select cryptocurrencies as collateral in derivatives markets, focusing initially on Bitcoin, ETH, and USDC. This follows efforts to expand crypto collateral use and emphasizes stablecoins' benefits in payments.

TapChiBitcoin·12-09 00:18

CFTC to Pilot Tokenized Collateral in Derivatives Markets Starting With Bitcoin, Ethereum and USDC

In brief

The pilot program permits FCMs to accept Bitcoin, Ethereum, and USDC as margin with enhanced reporting requirements.

New guidance outlines how tokenized Treasuries and money-market funds can be used within existing CFTC rules.

Staff advisory limiting the use of digital assets as

Decrypt·12-08 22:33

Hyperliquid Links USDC Across Chains and Launches Leveraged Stablecoin Trading

Hyperliquid links USDC between HyperCore and HyperEVM, streamlining deposits and enabling safer, cross-chain transfers for users.

$STABLE traders can now take long or short positions with up to 3x leverage, meeting growing demand for flexible trading tools.

$HYPE token faces supply-pressure

CryptoFrontNews·12-08 17:46

Bybit partners with Circle to promote USDC adoption across the entire ecosystem

Bybit has just announced a strategic partnership with Circle, the issuer of USDC, to promote the use of USDC across the exchange’s entire trading ecosystem, including spot, derivatives, and payment products. This agreement is expected to significantly improve liquidity related to USDC, while also

USDC0.02%

TapChiBitcoin·12-08 06:39

Hyperliquid launches native USDC cross-chain support, officially connecting HyperCore and HyperEVM

Hyperliquid announced native interoperability of USDC between HyperCore and HyperEVM, marking a significant advancement in secure cross-chain transfers. In the future, this will replace the Arbitrum cross-chain bridge, and all USDC will be minted natively. The related functionality is being improved, and users and developers can continue using the existing bridge.

MarsBitNews·12-08 02:34

Electronic Currency Revolution: How Digital Payments Will Change Investment and Consumption in 2025

In the electronic currency revolution of 2025, digital payments are leading the way in global financial innovation. The advantages of electronic currency have attracted widespread attention, with its unparalleled efficiency in cross-border transactions revealing the profound impact of digital payment trends. In addition, the security of electronic currency is highly valued, ensuring the privacy and safety of users’ funds. When faced with the choice between electronic currency and traditional currency, its future development shows unlimited potential, shaping an entirely new blueprint for the financial markets. Through this article, you will gain an in-depth understanding of the core driving forces behind this digital innovation wave.

The Rise of Electronic Currency: A Digital Revolution Disrupting Traditional Finance

A New Era of Digital Payments: A Leap in Efficiency and Convenience

2025 is becoming a pivotal turning point for the payments industry, with digital wallets and open banking services taking center stage in the payments sector. According to industry surveys, the changes brought by the electronic currency revolution have far exceeded expectations, especially with the rise of stablecoins such as Tether (USDT) and USDC.

USDC0.02%

幣圈動態·12-06 13:04

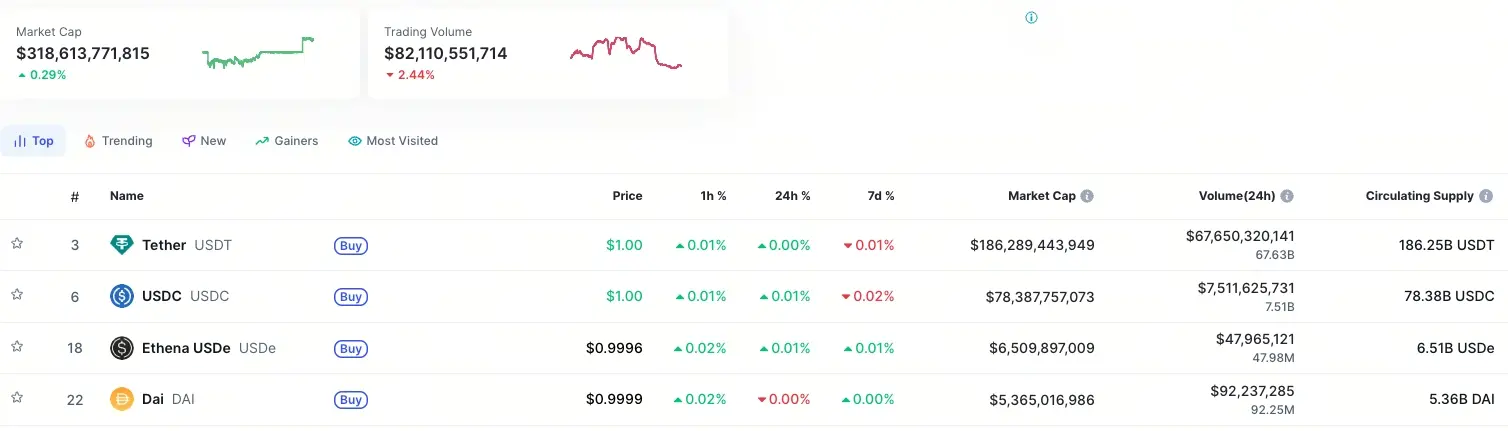

Circle increases USDC supply by 2 billion amid surging demand

Circle reported a $2 billion increase in USDC supply after issuing $8.2 billion and buying back $6.2 billion, reflecting rising demand for USDC and improving liquidity across blockchain networks. The total USDC supply now stands at $78 billion, fully backed by $78.1 billion in liquid assets. Analysts see USDC as essential for the stablecoin liquidity ecosystem and its role in fintech and blockchain platforms continues to grow.

USDC0.02%

TapChiBitcoin·12-06 06:36

Solv Foundation Integrates With Stellar To Unlock Yield For $200M In USDC

In Brief

Solv Foundation is expanding its platform to Stellar, enabling institutions and users to generate yield on $200 million in USDC while linking cross-border payments to on-chain capital market opportunities.

Solv Foundation, a prominent Bitcoin finance protocol, has announced plans to ex

MpostMediaGroup·12-05 14:40

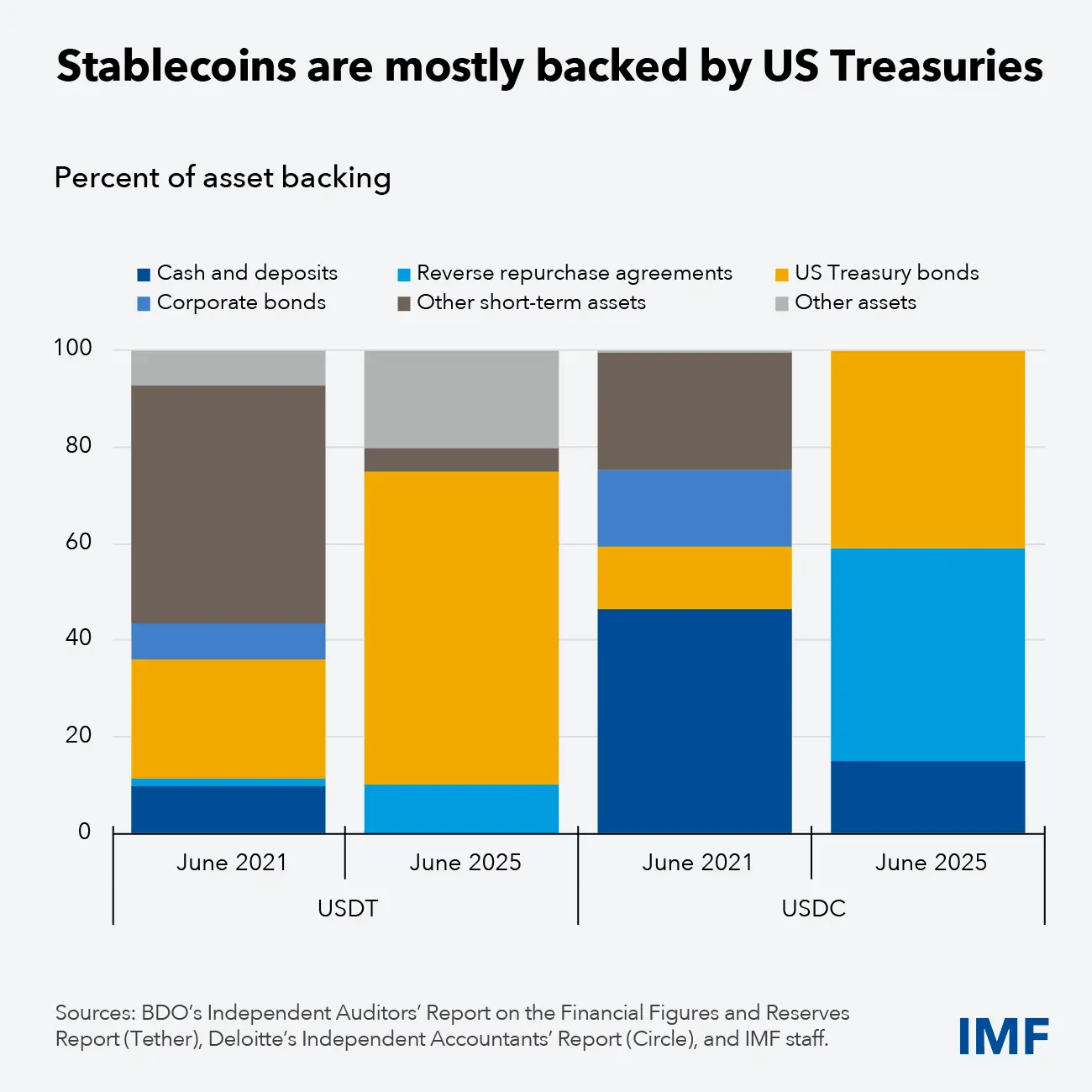

IMF Warning: Stablecoins Could Erode Central Bank Monetary Sovereignty Like a "Trojan Horse"

IMF warns that US dollar stablecoins are eroding monetary sovereignty, but the US sees them as a new leverage, putting the global financial order at risk of restructuring

(Background: FSC's Peng Jinlong: Taiwan's stablecoin will first be issued by "financial institutions," expected to launch as early as June 2026)

(Supplementary background: What is the "Taiwan disease"? The Economist's misunderstood balance of terror: Life insurance, the tax system, and real estate jointly hold the New Taiwan Dollar hostage)

The International Monetary Fund (IMF) released a 56-page report on the 4th, directly pointing out that US dollar-pegged stablecoins are rapidly hollowing out the monetary sovereignty of various countries. At the same time, Washington is treating this wave as a new tool of hegemony, resulting in a sharp strategic divergence.

Penetration Speed Surpasses Traditional Regulation

In inflation-stricken Istanbul and Buenos Aires, after receiving their salaries, people often immediately exchange their local currency for USDT or USDC. With just a few taps on their phones, funds cross borders through non-custodial wallets.

USDC0.02%

動區BlockTempo·12-05 08:22

SEI Native USDC Integration Marks a Major Step Toward Faster Blockchain Payments

The SEI ecosystem grows quickly and attracts new users who want faster performance on-chain. Developers push for stronger settlement speed, reliable liquidity, and stable transaction flow across exchanges and apps. The new SEI USDC integration now strengthens this demand and brings a fresh wave of a

Coinfomania·12-05 07:58

Taiwan stablecoins could launch as early as 2026! FSC: Banks will be given priority to issue them.

Financial Supervisory Commission Chairman Peng Jinlong revealed on December 3 that the Taiwan version of stablecoins is expected to be launched as early as the second half of 2026. The FSC has confirmed that banks will take the lead in issuing stablecoins. Currently, the draft "Virtual Asset Service Act" has entered the final stage of review by the Executive Yuan. If the three readings process is successfully completed, the FSC will finalize eight sub-laws, including the "Regulations on the Issuance and Management of Stablecoins," within six months.

USDC0.02%

MarketWhisper·12-05 05:50

IMF Sounds the Alarm: Fragmented Stablecoin Regulation Has Become a Global Financial "Roadblock"

The International Monetary Fund (IMF) has released its latest report, issuing a stern warning about the global stablecoin market. The report points out that fragmented regulatory frameworks in major economies such as the EU and Japan have created dangerous "regulatory patchworks." This not only threatens global financial stability and undermines regulatory effectiveness but also becomes a "roadblock" for the development of efficient cross-border payments. The IMF specifically emphasized that the stablecoin market, which has already surpassed $300 billion, is moving across borders at a pace faster than regulatory oversight can keep up with, and, for the first time, published global policy guidelines aimed at reducing fragmentation. This move marks a new level of recognition among major global financial regulators regarding the systemic risks posed by stablecoins.

MarketWhisper·12-05 02:14

IMF warns of stablecoin fragmentation crisis! $300 billion market faces major regulatory hurdles

The International Monetary Fund (IMF) has released the "Understanding Stablecoins" report, warning that the fragmentation of regulatory frameworks across countries is creating structural "barriers," threatening financial stability, weakening regulation, and slowing the development of cross-border payments. The global stablecoin market capitalization has exceeded $300 billion, with Tether's USDT and Circle's USDC accounting for the majority of the supply.

USDC0.02%

MarketWhisper·12-05 00:43

Central Bank Governor Yang Chin-long: Stablecoins are "wildcat banks," TWQR annual transactions reach 592 trillion

Taiwan Central Bank Governor Yang Chin-long stated that future payments will adopt a dual-track parallel strategy. On one hand, the bank will continue to optimize TWQR and promote cross-border interoperability; on the other hand, it will steadily advance wholesale CBDC and tokenized financial infrastructure. In 2024, TWQR's operational volume reached NT$582 trillion, 23 times the GDP for that year. Yang Chin-long warned of the risks of stablecoins, comparing them to "wildcat banks," which historically caused large-scale bank runs due to lack of regulation and insufficient reserves.

USDC0.02%

MarketWhisper·12-04 07:29

About 10 minutes ago, the USDC Treasury burned 60 million USDC on the Ethereum chain.

According to TechFlow, on December 3, Whale Alert monitoring shows that the USDC Treasury burned 60 million USDC on the Ethereum chain about 10 minutes ago.

USDC0.02%

DeepFlowTech·12-03 09:29

Binance launches BTC/USD and DYM/USDC spot trading pairs and trading bot services

Mars Finance reports that Binance will launch BTC/USD and DYM/USDC spot trading pairs at 16:00 on December 4, 2025, and will open trading bot services for these two pairs. Users will enjoy maker fee discounts on existing and newly added USDC spot and margin trading pairs until further notice.

MarsBitNews·12-03 06:30

CRCL stock plummets 75%! Stablecoin No.2 Circle faces its "darkest moment" on the US stock market

The world’s second-largest stablecoin issuer, Circle, saw its stock price plummet from $299 to $76—a staggering 75% drop in just a few months, leaving a large number of investors trapped. Behind the CRCL stock crash lies the stablecoin business model being hit by both the interest rate cut cycle and the tokenization of RWA money market funds. Institutional estimates show that for every 1% rate cut by the Federal Reserve, Circle’s revenue declines by 27%.

MarketWhisper·12-03 06:13

Load More

Hot Tags

Hot Topics

MoreCrypto Calendar

MoreHayabusa Yükseltmesi

VeChain, Aralık ayında planlanan Hayabusa yükseltmesini duyurdu. Bu yükseltmenin, protokol performansını ve tokenomi'yi önemli ölçüde artırmayı hedeflediği belirtiliyor ve ekip, bu güncellemeyi bugüne kadarki en çok fayda odaklı VeChain sürümü olarak nitelendiriyor.

2025-12-27

Litewallet Gün Batımları

Litecoin Vakfı, Litewallet uygulamasının 31 Aralık'ta resmi olarak sona ereceğini duyurdu. Uygulama artık aktif olarak korunmamakta olup, bu tarihe kadar yalnızca kritik hata düzeltmeleri yapılacaktır. Destek sohbeti de bu tarihten sonra sona erecektir. Kullanıcıların Nexus Cüzdan'a geçiş yapmaları teşvik edilmektedir; Litewallet içinde geçiş araçları ve adım adım bir kılavuz sağlanmıştır.

2025-12-30

OM Token Göçü Sona Erdi

MANTRA Chain, kullanıcıları OM token'larını 15 Ocak'tan önce MANTRA Chain ana ağına taşımaları için bir hatırlatma yayınladı. Taşıma işlemi, $OM'nin yerel zincirine geçişi sırasında ekosistemdeki katılıma devam edilmesini sağlar.

2026-01-14

CSM Fiyat Değişikliği

Hedera, Ocak 2026'dan itibaren KonsensüsSubmitMessage hizmeti için sabit USD ücretinin $0.0001'den $0.0008'e yükseleceğini duyurdu.

2026-01-27

Vesting Kilidi Gecikti

Router Protocol, ROUTE tokeninin Hakediş kilidinin 6 aylık bir gecikme ile açılacağını duyurdu. Ekip, projenin Open Graph Architecture (OGA) ile stratejik uyum sağlamak ve uzun vadeli ivmeyi koruma hedefini gecikmenin başlıca nedenleri olarak belirtiyor. Bu süre zarfında yeni kilit açılımları gerçekleşmeyecek.

2026-01-28