Tether (USDT) News Today

Latest crypto news and price forecasts for USDT: Gate News brings together the latest updates, market analysis, and in-depth insights.

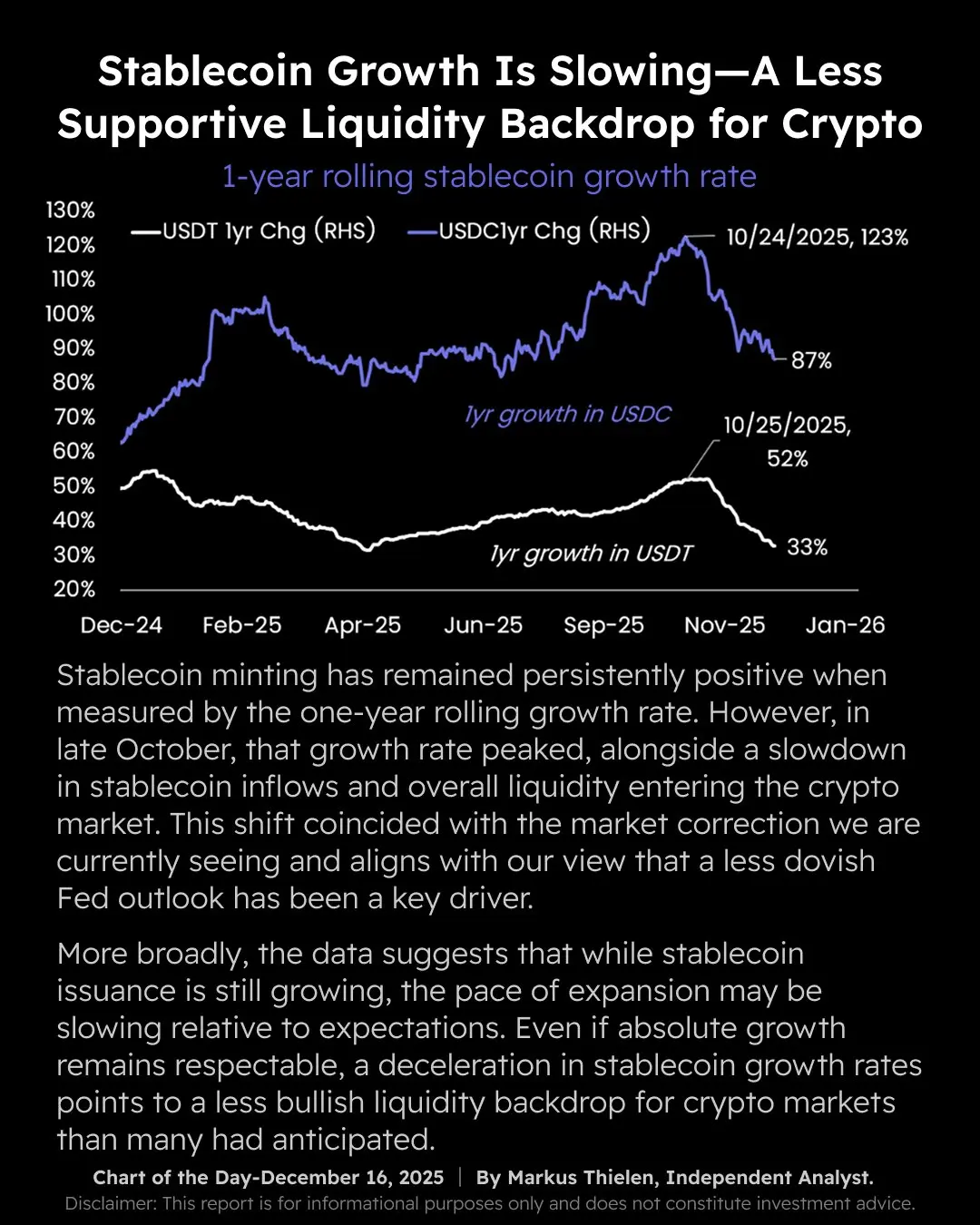

Matrixport: $260 Billion Stablecoins Turn Dead Water, Crypto Liquidity Exhausted

Matrixport's latest report reveals a fatal paradox in the crypto market: the total supply of stablecoins has surpassed $260 billion, reaching a record high. However, the inflow of new funds has peaked and slowed down, causing Bitcoin to lose a key moving average and drop below $86,000. The core issue lies in the Federal Reserve's cautious stance on interest rate cuts, which suppresses risk appetite, turning the massive stablecoin reserves into "dead weight" rather than market-driving fuel.

USDC0.02%

MarketWhisper·10h ago

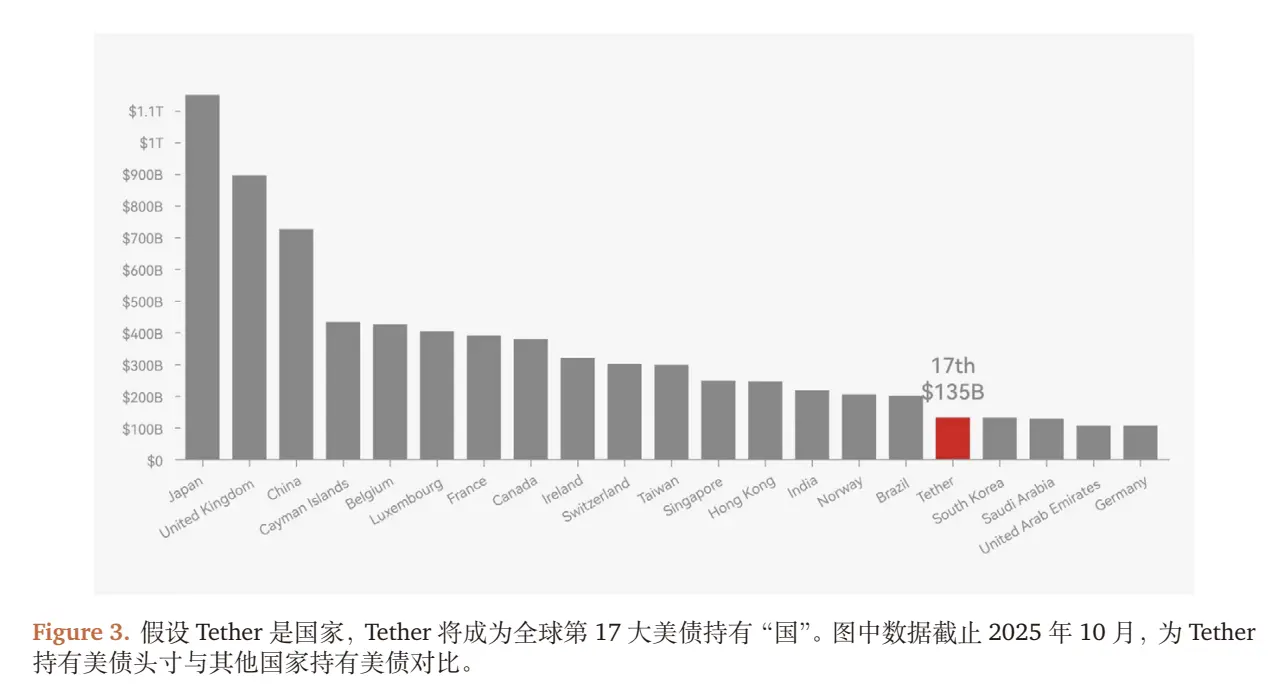

Galaxy Digital's Head of Research Says Tether’s Global Reach Is Underestimated

Tether’s scale, profitability, and expanding business interests remain widely underestimated, according to a new analysis by Alex Thorn, head of firmwide research at Galaxy Digital.

Alex Thorn: Tether Has Quietly Become One of Crypto’s Most Powerful Firms

Alex Thorn‘s assessment appeared in Galax

BTC1.92%

Coinpedia·18h ago

Juventus Owner Rejects Tether's $1.2 Billion Acquisition Offer, Sending Team's Stock Soaring

Shares of Juventus rose 17% after Exor rejected Tether's cash offer for the club. Tether previously acquired a minority stake in February. Despite the gain, shares are still down significantly over the past year and five years.

Decrypt·12-15 17:00

Tether's 1.1 billion euro bid to buy Juventus rejected? The century-long showdown between "new money" and "old wealth"

Stablecoin giant Tether has officially launched a comprehensive acquisition of Italy's century-old football powerhouse Juventus, showcasing a direct clash between the new crypto giants and traditional industrial dynasties. The company proposed to acquire 65.4% of the shares of Exor NV, controlled by the Agnelli family, at a price of €2.66 per share, paying entirely in cash, with the overall club valuation estimated at around €1.1 billion. However, this bold offer was immediately met with a “unanimous rejection” by the Exor board, and family head John Elkann explicitly stated that “Juventus is not for sale.” This acquisition attempt is not only about football but also reflects, on a deeper level, the cultural, trust, and value barriers faced by cryptocurrency capital in seeking recognition from the traditional world and diversifying assets.

MarketWhisper·12-15 02:38

Tether's acquisition of Juventus Football Club dreams shattered! Exor's board unanimously rejects: a century of heritage outweighs all monetary temptations

Tether submitted an offer of €1.1 billion to acquire Juventus and pledged to invest €1 billion, but Exor, controlled by the Agnelli family, rejected the offer the next day, emphasizing that commitment and heritage are more important than money for the club. Ultimately, the acquisition plan fell through.

STABLE2.53%

動區BlockTempo·12-14 06:10

Tether Plans Up to €1 Billion Investment in Juventus Pending Approvals

Tether made a binding offer to Exor to acquire majority control of Juventus Football Club.

Juventus shares jumped after the bid, pushing the club’s market value close to one billion euros.

Tether plans to invest up to one billion euros into Juventus, pending regulatory approval.

Tether, the

CryptoFrontNews·12-14 03:16

Tether Makes Bold Bid to Buy Juventus, Exor Rejects Offer

Tether proposed a €2.66/share bid for Exor's 65.4% stake in Juventus, valued at €1.1 billion, but Exor rejected it, stating the club is not for sale. Tether remains committed to investing €1B in Juventus and is focused on sports integration.

CryptoFrontNews·12-13 19:30

Tether Submits €1.1B Cash Bid for Juventus Control

Tether offered €2.66 per share for Exor’s 65.4% stake, valuing Juventus near €1.1B and aiming for full ownership.

Juventus shares and the JUV fan token jumped after the bid, though Exor sources say the club is not for sale.

Tether plans to invest €1B post-acquisition, expanding beyond crypto

JUV-0.41%

CryptoFrontNews·12-13 14:33

Tether prohibits shareholders from selling shares at low prices and is considering tokenizing its stock, with a target valuation of $500 billion.

Bloomberg reports that Tether is considering raising up to $20 billion through stock sales and tokenization of shares. The company previously intervened to prevent some existing shareholders from selling shares at low prices and is exploring ways to ensure investor liquidity while maintaining a company valuation of $500 billion.

Tether seeks $20 billion in funding; SoftBank and Ark may invest

By the end of September, it was reported that Tether, the world's largest stablecoin issuer, was in talks with investors to raise up to $20 billion, with SoftBank Group (SoftBank) and Ark Investment Management (Ark Investment Management) potentially among the major investors in this round of funding. The support of these two investment giants could help Tether accelerate growth and gain more mainstream recognition in the tech and financial sectors.

ChainNewsAbmedia·12-13 03:34

Tether intends to acquire Italian Juventus Football Club for 1.1 billion euros, potentially becoming the largest sports acquisition in Web3 history.

Stablecoin USDT issuer Tether has made a full cash acquisition offer to the Agnelli family holding company Exor, aiming to gain control of Italy's most renowned football club, Juventus.

(Background: Tether valued at $500 billion, surpassing SpaceX and ByteDance — a revealing article on the rise of the stablecoin leader)

(Additional background: Tether's 2025 financial analysis indicates an additional $4.5 billion in reserves are needed to maintain stability)

Italy's oldest and one of the most successful clubs: Juventus Football Club (Juventus). They have won a record 36 championships in Italy's top league and have twice claimed the European Champions League title.

Tether, which already holds an 11.5% stake in the club, made an early-week proposal to the Italian

STABLE2.53%

動區BlockTempo·12-13 02:50

Tether aims to buy the entire Juventus team, ready to invest 1 billion USD

Tether aims to acquire 100% of Juventus FC by purchasing a 65.4% stake from major shareholder Exor with cash. They plan to invest $1 billion for club development. Tether has reported a net profit of over $10 billion this year.

JUV-0.41%

TapChiBitcoin·12-13 00:11

Crypto Giant Tether Makes Offer to Acquire Juventus Soccer Club

Tether has submitted a cash offer to acquire 65.4% of Juventus from Exor, aiming to invest 1 billion Euros to enhance the club's growth. Tether recently acquired a minority stake and is committed to supporting Juventus in the evolving sports landscape.

Decrypt·12-12 21:03

Tether Eyes $20B Share Sale with Blockchain Tokenization

Tether targets $500B valuation by raising $20B and exploring blockchain tokenized shares for liquidity.

Hadron platform enables Tether to convert assets to tokens, potentially extending to its own equity.

Strategic investors join, but regulatory scrutiny and compliance remain key challenges for to

CryptoFrontNews·12-12 17:17

Bloomberg: Tether plans to raise $20 billion and considers "stock tokenization," stopping shareholder sell-offs to defend a $500 billion valuation

According to the latest report from Bloomberg, the world's largest stablecoin USDT issuer Tether is planning to raise up to $20 billion by issuing new shares, corresponding to its previously rumored valuation of $50 billion.

(Background note: Tether's valuation of $50 billion surpasses SpaceX and ByteDance, revealing the path to becoming a stablecoin giant)

(Additional background: In 2025, Tether's financial analysis indicates that an additional $4.5 billion in reserves is needed to maintain stability)

According to the latest report from Bloomberg, the world's largest stablecoin USDT issuer Tether is planning to raise up to $20 billion by issuing new shares, corresponding to its previously rumored valuation of $50 billion.

Meanwhile, to ensure the smooth progress of this large-scale fundraising, Tether executives are actively engaged in...

STABLE2.53%

動區BlockTempo·12-12 12:50

Tether's $500 billion valuation hits a wall! Bitcoin treasury investment plummets 75%

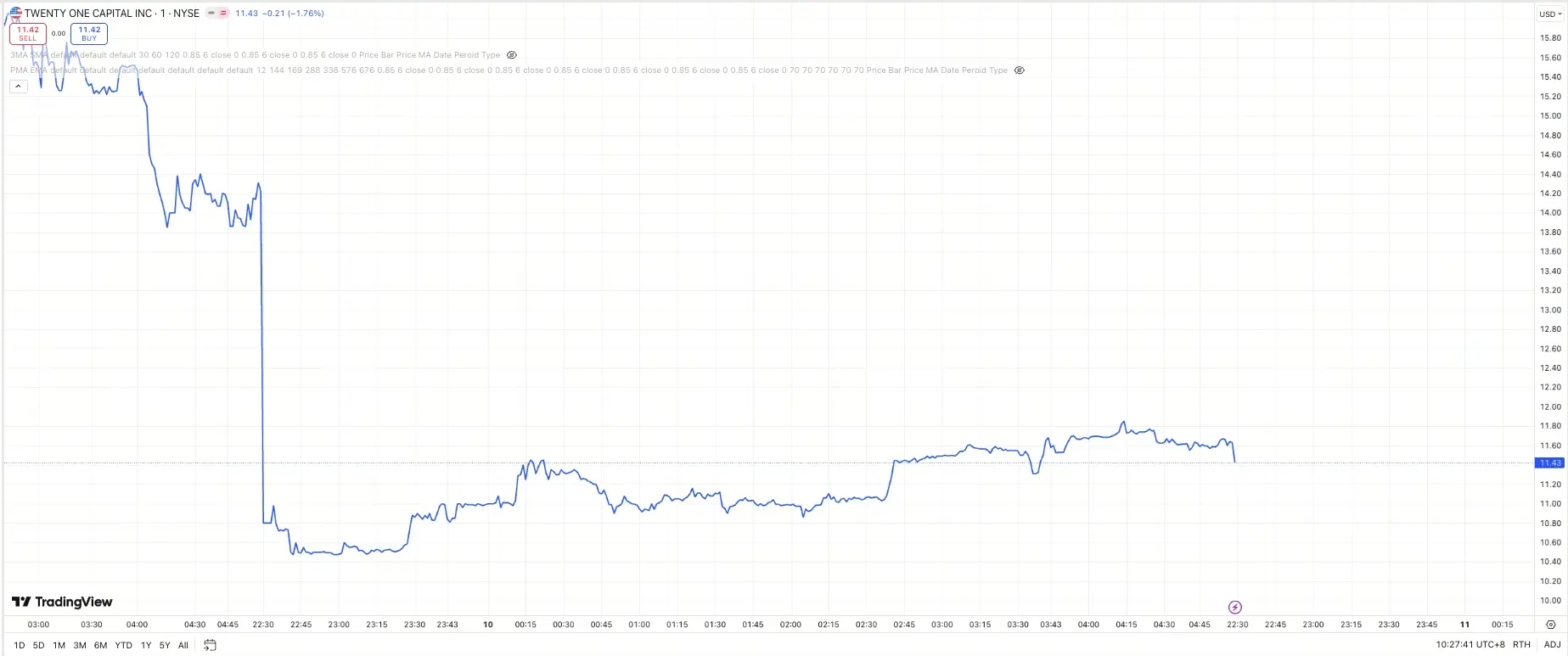

Tether-supported Bitcoin vault company Twenty One Capital Inc. listed on the New York Stock Exchange this week, with its stock price dropping nearly 20% on the same day, resulting in a poor performance on its first trading day after merging with special purpose acquisition company Cantor Equity Partners Inc. Although the stock price recovered over the next two days, it is still 75% lower than the all-time high reached one week after the merger was announced in April.

MarketWhisper·12-12 08:04

What Is QVAC Health? Tether’s New Privacy-First AI Health App Explained

Tether — the company behind the world’s largest stablecoin USDT — quietly launched QVAC Health, its first consumer-facing health and wellness application. QVAC Health is not just another fitness tracker — it’s Tether’s proof that the same privacy principles powering Bitcoin and USDT can protect your most sensitive biometric data too.

BTC1.92%

CryptopulseElite·12-12 06:37

USDT Rating Controversy: S&P’s "Stability Measure," Tether's "Market Debate," and the Transformation into a "Shadow Central Bank"

Article Authors: May P, Janus R

Source: CoinFound

About CoinFound: CoinFound is a TradFi Crypto data technology company serving institutional and professional investors. It offers RWA asset data terminals, RWA asset ratings, Web3 risk relationship graphs, AI analysis tools, and customized data services. From data integration and risk identification to decision support, it helps institutions acquire key intelligence at lower costs and higher efficiency, transforming insights into actionable strategies and building the underlying infrastructure for global RWA.

Takeaway

USDT Rating Downgrade and Controversy: USDT

PANews·12-12 02:14

Tether, Binance, and Circle collectively seek refuge, Abu Dhabi becomes the global "Crypto Heart"

If Dubai is the "Las Vegas" of the crypto world—lively, marketing-driven, retail investors—then Abu Dhabi is quietly becoming the "New Wall Street"—capital, compliance, institutions.

Recently, a uniform phenomenon has occurred across the global crypto market: leading stablecoin issuers and the largest exchanges have simultaneously obtained the same "pass."

On December 9th

The compliance stablecoin giant Circle obtained an ADGM financial services license (FSP).

On December 8th

The stablecoin leader Tether's USDT received recognition from ADGM.

The leading exchange Binance announced it has obtained full permission from ADGM and will launch a new "three-entity" compliant framework in 2026.

This is no coincidence. When trillion-dollar leaders collectively choose to "settle," it marks that crypto regulation in the Middle East has already

PANews·12-11 06:05

Tether introduces QVAC Health: a privacy-focused health platform emphasizing device-side AI analysis and data not stored in the cloud

Tether launched a new platform called QVAC Health on 12/11, entering the health technology field. It emphasizes that all data analysis is completed on the user's device without relying on cloud servers. The platform can integrate data from multiple wearable devices and health and fitness apps, utilizing on-device AI to analyze indicators such as activity, diet, sleep, and recovery.

Newly launched QVAC Health, local AI computation, offline operation without uploading to the cloud

QVAC Health is a health data platform that can integrate multiple activity trackers, nutrition apps, and various wearable devices. All data is collected into an encrypted dashboard (Encrypted

ChainNewsAbmedia·12-11 02:44

Tether Pivots to Wellness Apps and Robotics in Latest Step Away from Crypto

In brief

QVAC Health stores biometric and activity data locally instead of using cloud servers.

The release follows Tether's $81 million investment in a humanoid robotics startup.

The company is yet to explain how its non-crypto ventures fit into its long-term plan.

Decrypt's Art,

CUDIS6.42%

Decrypt·12-10 21:57

Tether launches privacy-focused health platform with on-device AI

Tether has launched a new platform that aggregates data from multiple wearables and wellness apps into a single, locally processed dashboard, aiming to give users control over their biometric information.

The platform, called QVAC Health, aggregates data from fitness trackers, nutrition apps and

Cointelegraph·12-10 20:53

Tether Secures Major ADGM Approval for USDT Across Nine Blockchains

Tether, the issuer of the world's largest stablecoin, USDT, has announced two major strategic developments, solidifying both its regulatory standing in the Middle East and its commitment to technology diversification. The Abu Dhabi Global Market (ADGM) Financial Services Regulatory Authority

Cryptoknowmics·12-10 18:52

Tether launches QVAC Health to aggressively enter the AI health market! 100% localized operation, integrated with hundreds of devices... Six major highlights at a glance

Stablecoin leader Tether announced today (10th) the launch of a new product, QVAC Health. The official statement claims this is the world's first personal health and wellness platform designed with a core principle of "100% device-side operation, never touching the cloud." What's the highlight? (Background: Tether launched its own AI platform QVAC, supporting P2P, encrypted payments, and local high privacy; initial applications will be showcased.) (Additional background: Tether's investment empire encompasses 120 companies, involved in Bitcoin mining, AI, Taiwan's XREX, and Juventus Football Club.)

動區BlockTempo·12-10 14:03

Stablecoins are disruptive. Who will become the disruptor?

Clay Christensen's theory of disruptive innovation explains that initially inexpensive products can reshape industries. Stablecoins have shown strong performance in emerging markets, attracting ignored customers. However, existing financial institutions have not overlooked this innovation; instead, they are actively following suit. In the future, stablecoins could become a massive market asset by 2030.

LUNA-10.48%

金色财经_·12-10 08:13

Step by step, system layout! Abu Dhabi has successively issued licenses to four major crypto giants, including Tether and Circle

Abu Dhabi Global Market (ADGM) is bringing its blueprint for "crypto Wall Street" to life with a clear pace. In about a month and a half, the international financial center has successively issued key licenses to the core pillars of the industry: on November 27, Ripple's stablecoin RLUSD was the first to obtain the status of "accepted fiat currency reference token"; On December 9, Tether's USDT received equal recognition on nine new blockchains, and on the same day, stablecoin issuer Circle received a financial services license, while a leading cryptocurrency exchange also received full operational authorization. This series of approvals is not accidental, it systematically builds a complete digital financial ecosystem covering stablecoin payments, asset transactions, and compliant settlements.

USDC0.02%

MarketWhisper·12-10 02:57

Twenty One plunges 25% on its first day of listing! $3.9 billion Bitcoin holdings severely undervalued

On December 9th, Twenty One Capital Inc. saw its stock price plummet by 25% on its first day of listing through a SPAC merger, with an opening price of $10.74, significantly lower than Cantor Equity Partners' closing price of $14.27. This Bitcoin treasury company, founded by Tether, SoftBank Group, and others, holds approximately $3.9 billion worth of Bitcoin.

MarketWhisper·12-10 02:29

Down 20% on First Day of Listing! Tether-Backed Bitcoin Treasury Company Twenty One Off to a Rocky Start

Bitcoin asset company Twenty One Capital, backed by stablecoin giant Tether, Bitfinex, and SoftBank, suffered a significant setback on its first trading day after going public on the New York Stock Exchange via a SPAC merger. On December 10, its stock ticker XXI opened below its issue price and closed at $11.42, plunging 20% compared to the pre-merger closing price of the special purpose acquisition company Cantor Equity Partners, with a market capitalization of approximately $4 billion. The company currently holds about $3.9 billion worth of Bitcoin and plans to expand into Bitcoin financial infrastructure and media education businesses beyond its Bitcoin holdings. This debut slump reveals a cautious market stance toward new crypto-listed companies, especially as the price of Bitcoin has fallen 28% from its yearly high and the digital asset treasury model faces structural challenges.

BTC1.92%

MarketWhisper·12-10 02:25

What will happen to Tether if Japan dumps US Treasury bonds?

Japan—the country holding the most U.S. government debt in the world—is making global financial markets anxious, as analysts warn of the risk of a large-scale bond sell-off in the near future.

These concerns have spread to the fi

BTC1.92%

TapChiBitcoin·12-09 14:33

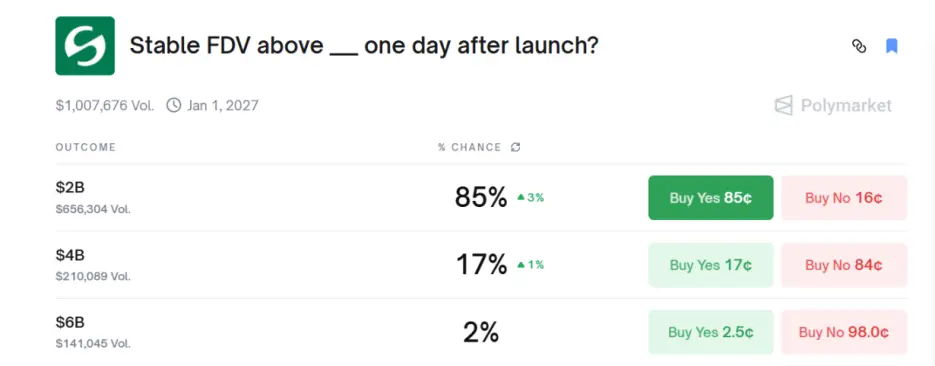

“Tether’s favorite” botched its debut—can Stable turn the tide?

Author: Jae, PANews

Another stablecoin branded as a “Tether offspring” has officially launched, but the market doesn’t seem to be buying into it.

On the evening of December 8, the highly anticipated stablecoin-specific public chain, Stable, officially launched its mainnet and the STABLE token. As a Layer 1 project deeply incubated by the core teams of Bitfinex and Tether, the “Tether offspring” narrative drew widespread market attention to Stable as soon as it debuted.

However, amid tightening market liquidity, Stable didn’t have a strong start like its competitor Plasma. Not only did its price remain sluggish, but it also fell into a trust crisis over alleged insider trading. Is Stable’s script to first dip before rising, or will it continue to open low and go lower?

STABLE drops 60% from launch high, mired in an insider trading trust crisis

Stab

STABLE2.53%

PANews·12-09 13:23

Tether USDT Receives Regulatory Approval Across Multiple Major Blockchains in Abu Dhabi Global Ma...

Tether USDT gains approval across multiple ADGM blockchains boosting regulated digital finance.

ADGM licensed firms can now offer USDT services supporting trading settlement and decentralized apps.

Binance secures full ADGM authorization to operate under strict compliance and traditional market

CryptoNewsLand·12-09 12:15

Tether USDT receives regulatory approval in Abu Dhabi, UAE aims to become a global compliance hub

Abu Dhabi Global Market (ADGM) has recently officially recognized USDT, issued by Tether, as an "Accepted Fiat-Referenced Token (Accepted Fiat-Referenced Token, AFRT)," allowing local institutions to legally operate USDT custody, trading, and settlement services. This not only expands the usage of USDT but also strengthens the UAE's strategy to build a globally compliant Crypto hub.

USDT Receives "Fiat-Level" Regulatory Recognition in Abu Dhabi, Approved on Nine Major Blockchains

According to Tether’s announcement, Abu Dhabi’s regulatory authority FSRA has officially included USDT under the AFRT framework, enabling licensed institutions to legally conduct stablecoin-related financial services such as trading, custody, and settlement. This approval covers Aptos, Near, and

ChainNewsAbmedia·12-09 08:15

ADGM Expands USDT Access as Tether Gains Multi-Chain Approval

ADGM adds major blockchains for USDT, widening regulated multi-chain support for settlement and trading.

Binance secures full ADGM authorisation to launch exchange, clearing and broker-dealer operations in 2026.

Ripple’s RLUSD and Tether’s reserve disclosures show growing regulatory and

MULTI-3.48%

CryptoFrontNews·12-09 07:02

Tether achieves another major milestone! Abu Dhabi approves compliant use of USDT on nine major blockchains, with an additional 1 billion USDT issued as reserve.

Stablecoin giant Tether has achieved a key breakthrough in the Middle East’s regulatory landscape. On December 9, the regulatory authority of Abu Dhabi Global Market (ADGM) officially approved licensed institutions within its jurisdiction to conduct regulated activities involving USDT on nine major blockchains, including Aptos, Polkadot, and TON. This move further expands upon previous approvals for USDT on Ethereum, Solana, and Avalanche, now covering nearly all major networks where USDT is circulated. At the same time, one of the world’s largest cryptocurrency exchanges also announced that it has obtained a full operating license from ADGM. These developments mark Abu Dhabi’s accelerated efforts to build its “Global Crypto Wall Street” blueprint through a systematic compliance framework.

BTC1.92%

MarketWhisper·12-09 05:39

Tether Secures $81M Funding Boost for Cutting-Edge Generative Bionics Innovation

Stablecoin giant Tether invests in Italian humanoid robotics startup

In a strategic move supporting advancements in artificial intelligence and robotics, Tether has announced its participation as a key backer in an €70 million ($81 million) funding round for Generative Bionics, an Italian AI startu

CryptoBreaking·12-09 05:31

Tether deepens AI bet, backs Italian firm’s humanoid robots

Stablecoin giant Tether has announced it is one of the backers of an $81 million funding round for an Italian artificial intelligence startup aiming to build advanced humanoid robots

The 70 million euro funding round for startup Generative Bionics was led by the AI fund of CDP Venture Capital,

Cointelegraph·12-09 04:46

Tether enters the humanoid industrial robot sector, participates in $81.5 million Italian fundraising project

Tether has recently continued to expand its presence in the AI and robotics sectors, and on 12/9 participated in the $81.5 million funding round for the Italian startup Generative Bionics. The company was spun off from the Italian Institute of Technology (IIT), focusing on humanoid industrial robots capable of working in hazardous and high-labor-demand production environments. Generative Bionics plans to gradually deploy its first batch of mass-produced models in the manufacturing, logistics, healthcare, and retail industries starting in early 2026.

Tether and multiple institutions participate in funding, aiming to create humanoid industrial robots

Generative Bionics recently completed its $81.5 million funding round, with capital coming from Tether,

BTC1.92%

ChainNewsAbmedia·12-09 03:04

When Chinese crypto tycoons start buying gold

Written by: Lin Wanwan

Twelve minutes’ drive north of Singapore Changi Airport stands one of the world’s most secure private vaults, Le Freeport, at the end of the runway.

This building, which cost around 100 million Singapore dollars, is known as the “Fort Knox of Asia.” It has no windows, yet maintains a constant temperature of 21°C and a humidity level of 55% year-round, perfectly suited for storing artwork.

Behind its heavily guarded steel doors lie hundreds of millions of dollars’ worth of gold, silver, and rare artworks: all kept tax-free and customs-free.

Three years ago, one of Asia’s youngest crypto billionaires, Bitdeer founder Wu Jihan, acquired this vault—rumored to have cost as much as 100 million Singapore dollars—for just 40 million SGD (about 210 million RMB).

This deal was confirmed that year by Bloomberg, and behind the purchase was Bitdeer, operated by Wu Jihan.

DeepFlowTech·12-09 02:59

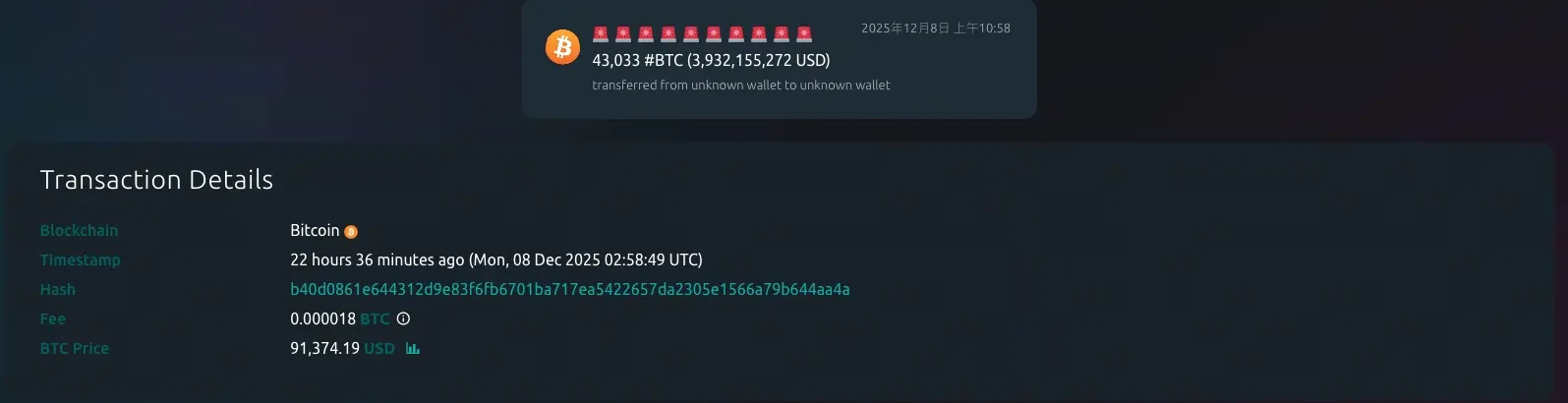

Tether spends 4 billion to buy Bitcoin? Twenty One on-chain data reveals liquidity trap

Whale Alert flagged a transfer of 43,033 bitcoins (worth approximately $3.9 billion) to an address associated with Twenty One (stock ticker XXI). However, on-chain analysts warn that interpreting this as a new Tether buy order would misrepresent the flow of funds—the source and pricing of these bitcoins had already been determined before the alert was issued.

BTC1.92%

MarketWhisper·12-09 01:36

Tether Invests in Italian Robotics Startup Generative Bionics Amid Humanoid Hype

In brief

Tether took part in a €70 million funding round for Italian humanoid robotics startup Generative Bionics.

The firm plans industrial testing and a production facility ahead of deployments targeted for 2026.

The deal adds Tether to a surge of investment in humanoid robots from tech, indu

Decrypt·12-08 23:06

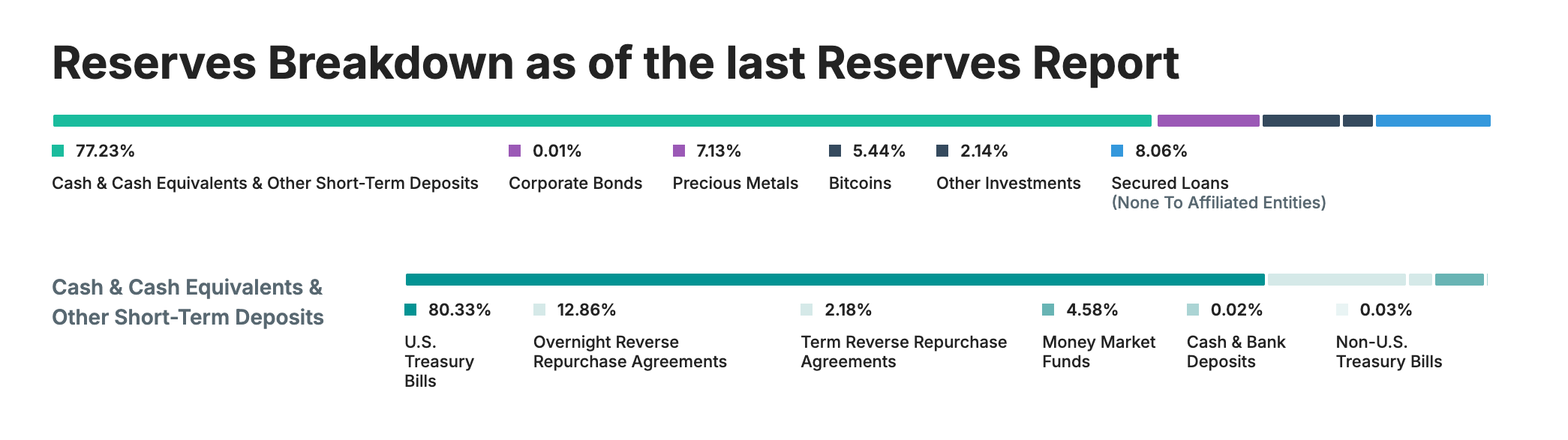

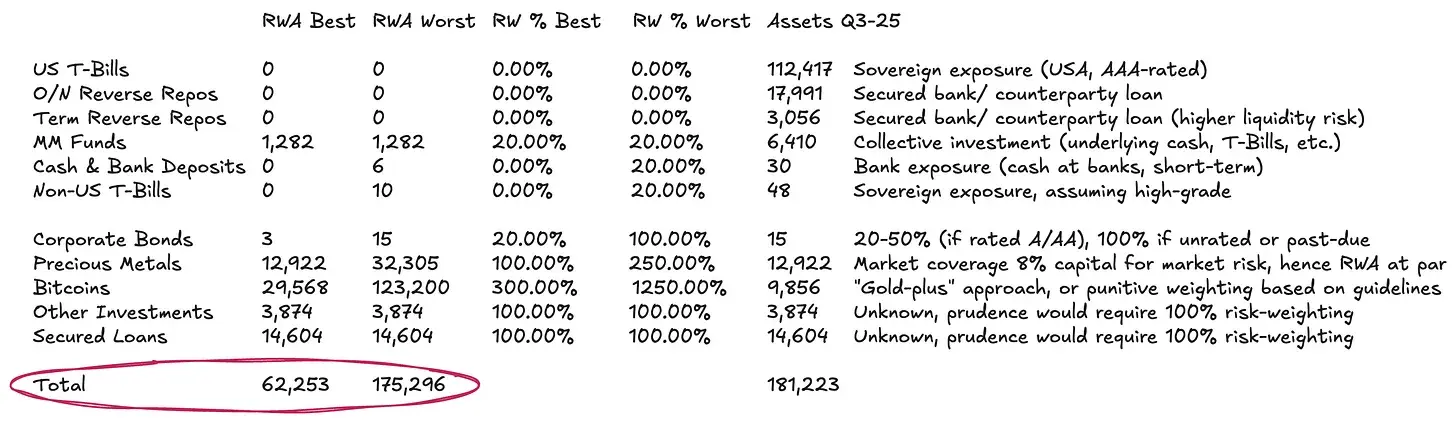

Tether Financial Analysis: Needs an Additional $4.5 Billion in Reserves to Achieve Stability

Author: Luca Prosperi

Translated by: TechFlow

When I graduated from university and applied for my first management consulting job, I did what many ambitious yet timid male graduates often do: I chose a company that specialized in serving financial institutions.

In 2006, the banking industry was the epitome of “cool.” Banks were usually located in the most magnificent buildings on the most beautiful streets in Western Europe, and at the time, I was eager to seize the opportunity to travel around. However, no one told me that this job came with a more hidden and complicated condition: I would be “married” to one of the largest yet most specialized industries in the world—the banking industry, and for an indefinite period. The demand for banking experts has never disappeared. During economic expansion, banks become more creative and need capital; during economic contraction, banks need restructuring, and they still need capital. I once tried to escape this vortex, but just

BTC1.92%

金色财经_·12-08 12:58

Load More

Hot Tags

Hot Topics

MoreCrypto Calendar

MoreHayabusa Yükseltmesi

VeChain, Aralık ayında planlanan Hayabusa yükseltmesini duyurdu. Bu yükseltmenin, protokol performansını ve tokenomi'yi önemli ölçüde artırmayı hedeflediği belirtiliyor ve ekip, bu güncellemeyi bugüne kadarki en çok fayda odaklı VeChain sürümü olarak nitelendiriyor.

2025-12-27

Litewallet Gün Batımları

Litecoin Vakfı, Litewallet uygulamasının 31 Aralık'ta resmi olarak sona ereceğini duyurdu. Uygulama artık aktif olarak korunmamakta olup, bu tarihe kadar yalnızca kritik hata düzeltmeleri yapılacaktır. Destek sohbeti de bu tarihten sonra sona erecektir. Kullanıcıların Nexus Cüzdan'a geçiş yapmaları teşvik edilmektedir; Litewallet içinde geçiş araçları ve adım adım bir kılavuz sağlanmıştır.

2025-12-30

OM Token Göçü Sona Erdi

MANTRA Chain, kullanıcıları OM token'larını 15 Ocak'tan önce MANTRA Chain ana ağına taşımaları için bir hatırlatma yayınladı. Taşıma işlemi, $OM'nin yerel zincirine geçişi sırasında ekosistemdeki katılıma devam edilmesini sağlar.

2026-01-14

CSM Fiyat Değişikliği

Hedera, Ocak 2026'dan itibaren KonsensüsSubmitMessage hizmeti için sabit USD ücretinin $0.0001'den $0.0008'e yükseleceğini duyurdu.

2026-01-27

Vesting Kilidi Gecikti

Router Protocol, ROUTE tokeninin Hakediş kilidinin 6 aylık bir gecikme ile açılacağını duyurdu. Ekip, projenin Open Graph Architecture (OGA) ile stratejik uyum sağlamak ve uzun vadeli ivmeyi koruma hedefini gecikmenin başlıca nedenleri olarak belirtiyor. Bu süre zarfında yeni kilit açılımları gerçekleşmeyecek.

2026-01-28