XRP News Today

Latest crypto news and price forecasts for XRP: Gate News brings together the latest updates, market analysis, and in-depth insights.

XRP News: Can XRP challenge $3 with an independent narrative amid the Bank of Japan's interest rate hike expectations?

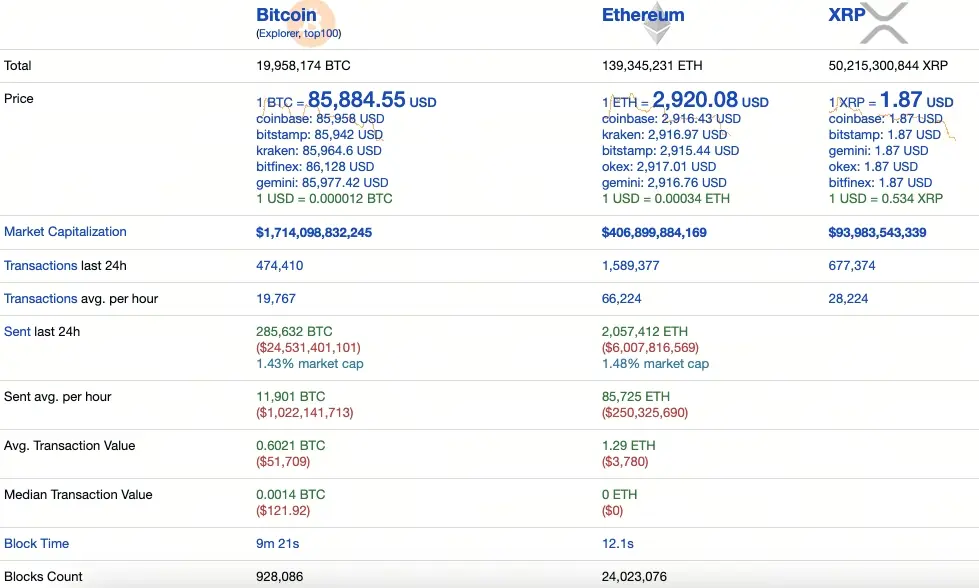

On December 17, XRP price dropped 3.49% in a single day, closing at $1.8631, significantly underperforming the overall crypto market. The immediate trigger for this decline was the surge in the Japanese 10-year government bond yield to 1.983%, hitting a new high since 2007, reigniting market fears of the Bank of Japan's imminent rate hike and large-scale "yen carry trade" unwinding. In the short term, XRP faces the risk of testing the November low of $1.8239; however, the medium to long-term outlook remains constructive due to continued strong capital inflows into spot ETFs and the advancement of the US cryptocurrency market structure bill, with a medium-term target still in the range of $2.5 to $3.0. This reveals the increasingly close linkage between the cryptocurrency market and traditional macroeconomic forces.

MarketWhisper·19m ago

From Asia to the US, XRP is gradually becoming a yield-generating digital asset for organizations.

XRP is gaining traction with organizations as new yield-generating models and tokenization are emerging in Asia, thereby positioning the XRP Ledger (XRPL) as a suitable infrastructure for compliant enterprise finance and expanding XRP's role as a digital asset capable of creating economic value.

XRP-4.03%

TapChiBitcoin·58m ago

Gate Daily (December 18): CFTC Acting Chair resigns to join MoonPay; Bhutan donates 10,000 Bitcoins to build a "City of Mindfulness"

Bitcoin (BTC) prices fluctuate sharply, surging past $90,000 at one point before rapidly crashing, and are temporarily reported at around $85,980 on December 18. CFTC Acting Chair Caroline Pham will leave the financial regulatory agency to join MoonPay. Bhutan commits to donating 10,000 Bitcoins to develop a "Mindfulness City." The Federal Reserve withdraws the 2023 guidance on "restricting uninsured banks from participating in crypto activities."

MarketWhisper·2h ago

Technical analysis for December 18: BTC, ETH, BNB, XRP, SOL, DOGE, ADA, BCH, HYPE, LINK

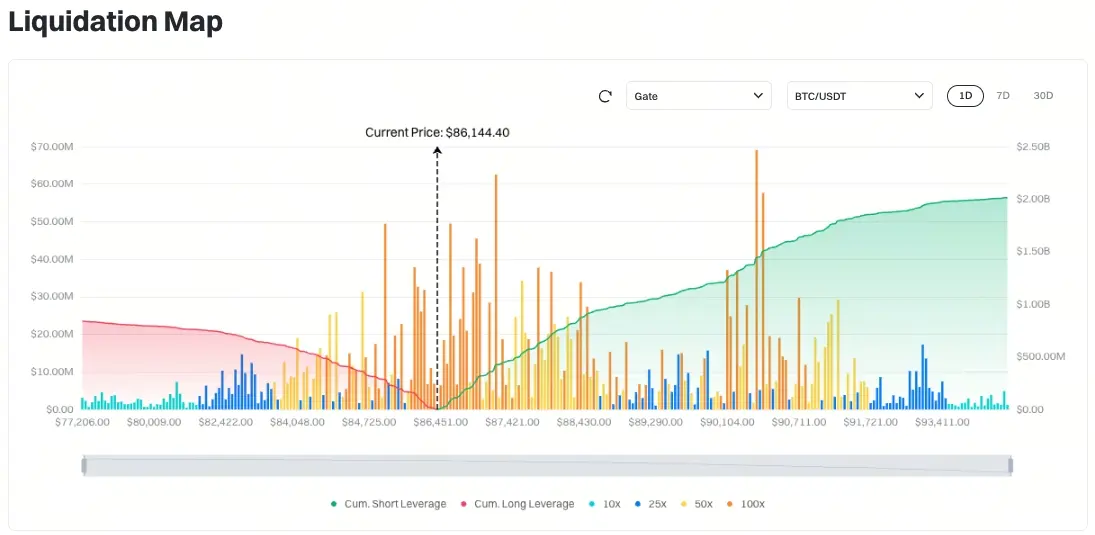

Bitcoin (BTC) experienced buying pressure that pushed the price above $90,000 on Wednesday. However, higher price levels quickly attracted selling pressure from bears. Data from Farside Investors shows that spot Bitcoin ETF funds experienced a net outflow of up to $634.8 million this week, reflecting cautious sentiment.

TapChiBitcoin·2h ago

XRP Tests Critical $1.88 Support Zone Amid Market Uncertainty

XRP is currently testing critical support at $1.88 amid increasing selling pressure and reduced market supply. Traders observe this movement closely, with opinions divided on whether this level will lead to recovery or further declines.

LiveBTCNews·5h ago

XRP Consolidates at $1.99 as Trading Range Levels Remain Intact

XRP is trading at around 1.99 with a slight above 1.98 mark of support and a slight below 2.01 resistance.

This support level of $1.90 trading range assists to determine whether the price is consolidating, or moving to lower Fibonacci.

The price structure of the XRP is flat-to-lower

CryptoNewsLand·9h ago

Ripple’s Yield Push Puts XRP Back in Institutional Focus

Ripple's efforts are rejuvenating interest in XRP, which has recently dipped but shows potential for recovery. With price hovering near $2, XRP could rise to $2.48 if bullish momentum builds, attracting institutional investments.

XRP-4.03%

CryptoDaily·12h ago

XRP Price Prediction for Dec 17: Can XRP Find a Floor to Reach $3

XRP shows a potential recovery if it holds key support, with liquidity available above $3.

XRP has experienced a slight uptrend over the past 24 hours, currently priced at $1.91, reflecting a 1.5% increase in the daily range, which fluctuated between $1.88 and $1.94.

Despite this recent upward

XRP-4.03%

TheCryptoBasic·14h ago

Here’s Why XRP Risks Dropping to $1: Analyst

Renowned analyst Ali Martinez has issued a fresh warning to XRP holders, cautioning that the token could fall to $1 amid intense selling pressure from whales

This warning comes as the broader crypto market continues to face downturns in recent weeks due to macroeconomic headwinds, triggering

TheCryptoBasic·18h ago

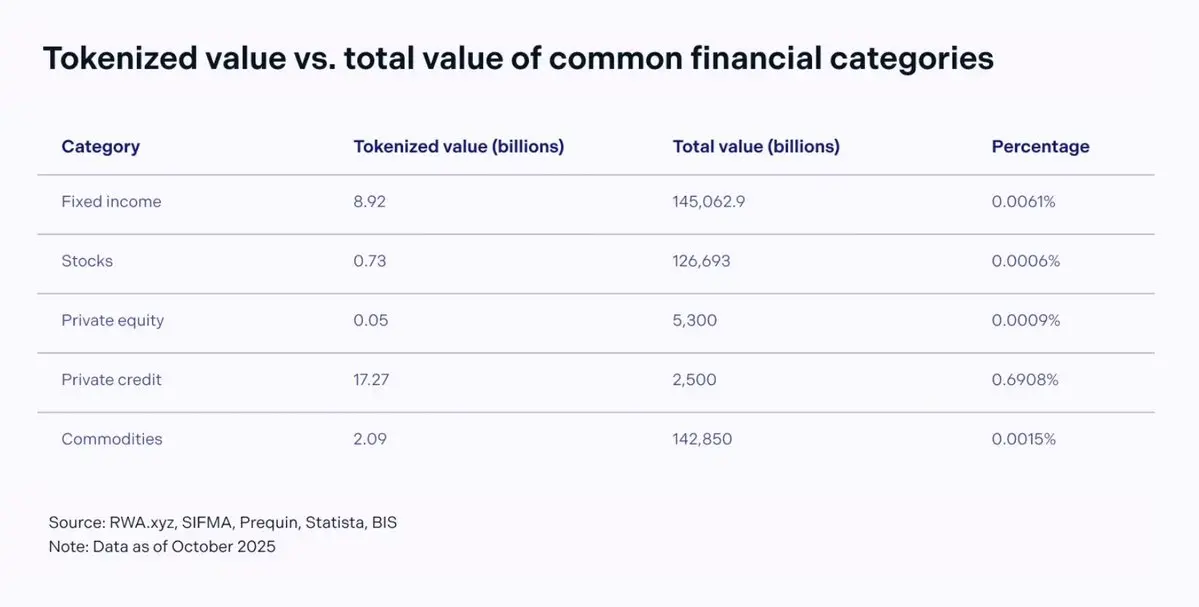

Here’s How XRP Could Benefit From $27T Liquidity Unlock, Says DAG CEO

As pressure builds across global markets, Zach Rector, CEO of Digital Ascension Group (DAG), suggests XRP could benefit from an impending liquidity unlock.

In a recent video commentary, Rector explained how major changes in financial infrastructure could free up trillions of dollars trapped

TheCryptoBasic·19h ago

Lark Davis Says Chainlink Is an ‘Infinitely Better’ Asset Than XRP

Prominent Bitcoin commentator Lark Davis has joined the long-running discussion on the rivalry between XRP and Chainlink (LINK).

He expects Chainlink to outperform XRP over the next decade, even as he acknowledges the strength and passion of the XRP community.

Why Davis Backs Chainlink

Davis

TheCryptoBasic·19h ago

Digital Wealth Partners Launches Algorithmic XRP Trading Strategy for Qualified Individual Investors

Digital Wealth Partners has launched an algorithmic trading strategy for XRP holders, allowing them to trade within tax-advantaged retirement accounts. This structured approach aims to minimize emotional trading, enhance potential growth, and provide access to institutional-grade protections.

XRP-4.03%

TheCryptoBasic·20h ago

XRP Holds $2.01 Support After $2.04M Whale Long Closes Near Resistance

A whale's exit from a $2.04 million XRP long at $2.038 has tightened XRP's trading range between $2.01 support and $2.04 resistance. Currently, XRP trades at $2.01, with focus on price behavior around these key levels.

CryptoNewsLand·20h ago

XRP Price Holds $2 as Technical Charts Tighten and ETF Inflows Accelerate

XRP price stabilized near $2 after heavy selling and multi-day charts are showing support and this has slowed downside momentum across recent trading sessions.

Short-term charts showed a bullish pennant, and buyers have defended low volatility contracts, and these momentum

XRP-4.03%

CryptoFrontNews·21h ago

Here is Possible XRP Price if XRP Secures Interoperability With 50+ Other Chains

Recent developments suggest that XRP may be moving toward a fully connected, multi-chain future that could massively change its role in the crypto market.

Ripple Executive Highlights Importance of Interoperability

During the episode, Kimes highlighted comments from Luke Judges, Ripple’s Global P

XRP-4.03%

TheCryptoBasic·22h ago

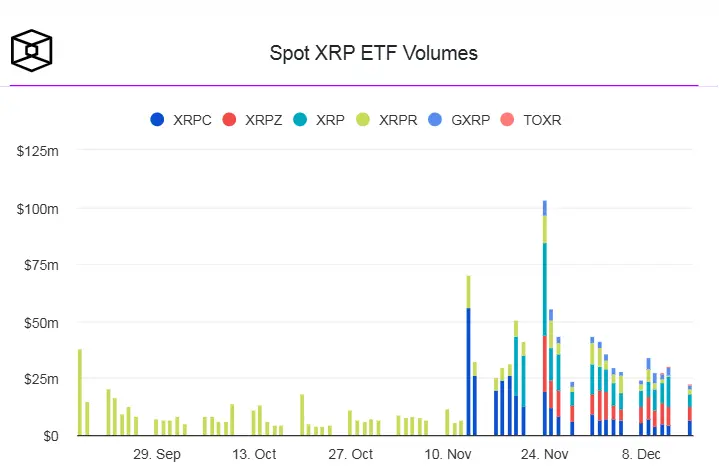

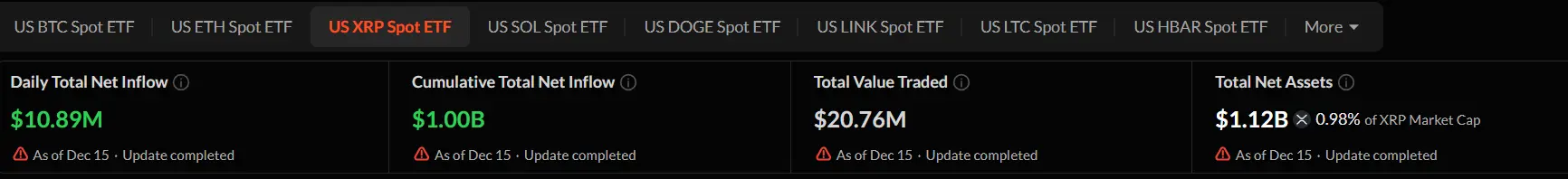

XRP Today's News: $1 Billion ETF Inflows Counteract the Bank of Japan's Rate Hike Storm

The US spot XRP ETF market has experienced 21 consecutive days of capital inflows, with total inflows surpassing $1 billion, indicating strong institutional demand. On December 15, a single-day net inflow of $10.89 million was recorded, with the Canary XRP ETF accumulating a total of $376.5 million since its inception, leading the market. However, the Bank of Japan is set to announce its interest rate decision, with market expectations of a 25 basis point rate hike, which could trigger the unwinding of yen arbitrage trades.

MarketWhisper·12-17 02:33

XRP Today News: ETF attracts $1 billion, bulls face off against Bank of Japan rate hike risk

The XRP market has recently exhibited a complex pattern of bullish and bearish battles. On one hand, the better-than-expected US employment data has boosted expectations of a rate cut by the Federal Reserve in March 2026, injecting liquidity and optimism into the market; more importantly, XRP spot ETF fund inflows have been extremely strong, achieving net inflows for 21 consecutive trading days, with a cumulative scale surpassing $1 billion, forming a stark contrast to the outflows of Bitcoin ETFs during the same period. On the other hand, the market is on high alert for the Bank of Japan (BoJ) interest rate decision on December 19, as its potential rate hike could trigger a "yen interest rate differential trade" unwind, becoming a major short-term downside risk. Analysts believe that the short-term (1-4 weeks) outlook for XRP is cautiously bearish due to the risk from the Bank of Japan, but the medium-term (4-8 weeks), supported by ETF demand and macroeconomic shifts, remains inclined to be optimistic.

MarketWhisper·12-17 02:12

Gate Daily (December 17): Putin's government refuses to recognize Bitcoin as currency; U.S. senator calls for investigation into Trump's relationship with PancakeSwap

Bitcoin (BTC) slightly rebounded and is temporarily reported at around $87,680 on December 17. Non-farm payrolls appeared better than expected, but the rising unemployment rate triggered volatility in the US stock and cryptocurrency markets. The chairman of the Russian State Duma Financial Market Committee stated that cryptocurrencies will never become currency in Russia and can only serve as investment tools. US Senator Warren called for an investigation into crypto projects related to Trump.

MarketWhisper·12-17 01:22

Alibaba Qwen3 Shocking Prediction! XRP, PEPE, and DOGE to Experience Volatile Fluctuations by the End of the Year

Alibaba's Qwen3-MAX AI model latest release predicts end-of-year prices for XRP, PEPE, and DOGE, showing that these three cryptocurrencies may face significant volatility in the remaining December. XRP could surge 82% to $3.50, PEPE is expected to skyrocket over 1100% back to twice its historical high, and DOGE might soar 800% to break through $1.20.

MarketWhisper·12-17 00:57

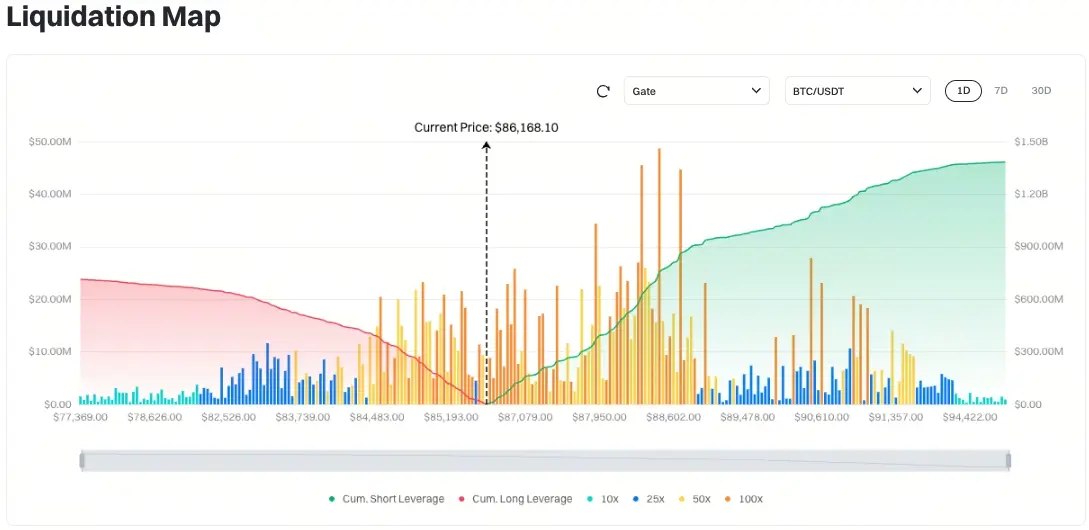

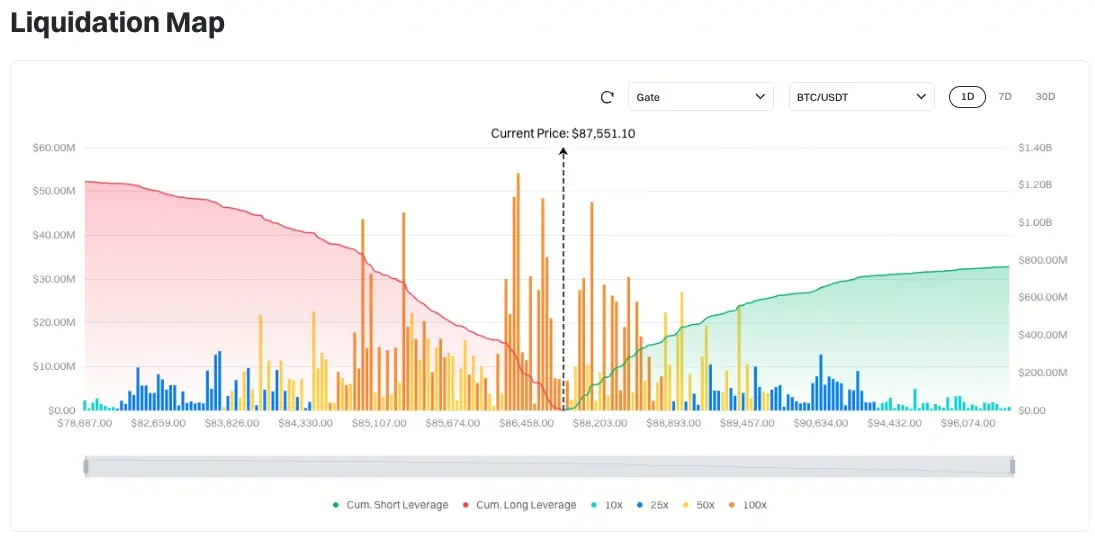

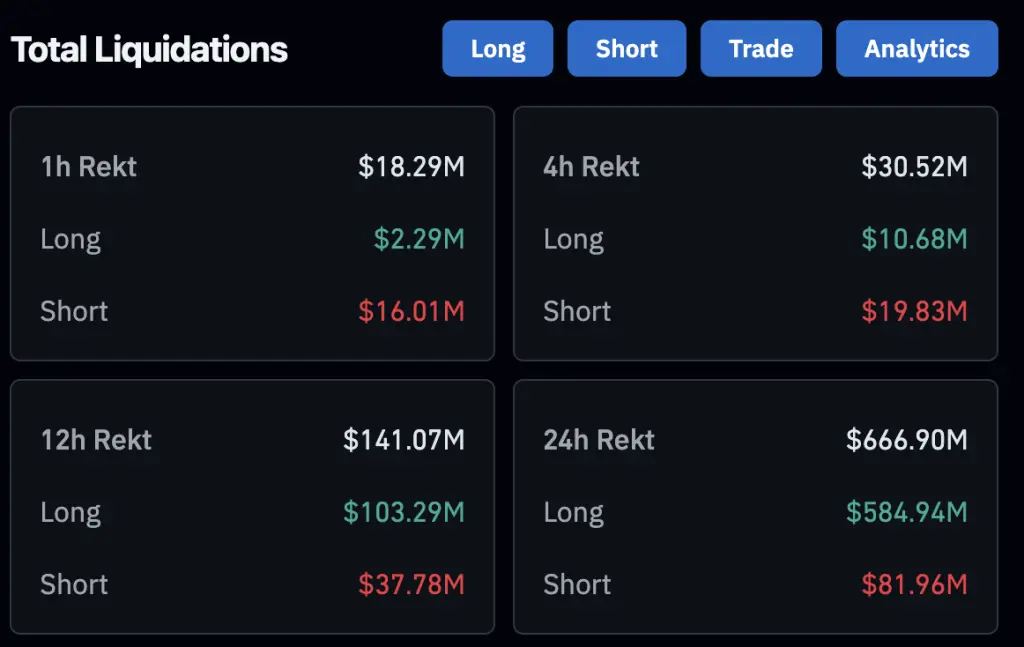

XRP drops below $2! $584 million liquidation wave hits, is the bear market officially starting?

XRP has once again fallen below the key psychological support level of $2, sparking intense debate in the market about whether a bear market has officially begun. Long liquidation surged to $584 million, indicating that a large number of leveraged long positions were forced to close during this sudden drop. However, paradoxically, exchange-traded funds (ETFs) linked to XRP have attracted net inflows for 21 consecutive days, reflecting ongoing interest from institutional buyers.

XRP-4.03%

MarketWhisper·12-17 00:49

UK Cryptocurrency Regulation Coming Soon! DeFi and Exchanges Face New Rules, Opinions Due by February

The UK Financial Conduct Authority (FCA) has recently launched three major consultations, marking the substantive phase of the UK's cryptocurrency regulatory framework. These proposals cover exchange operations, staking services, lending platforms, and decentralized finance (DeFi). The deadline for public comments is February 12, 2026. The UK Treasury also announced that legislation will be introduced by October 2027 to incorporate cryptocurrency companies into the existing financial legal system.

MarketWhisper·12-17 00:38

XRP Pushes Deeper Into Institutional Finance as Vivopower Builds $900M Ripple-Linked Exposure Structure

XRP is gaining institutional traction as Vivopower advances a Ripple-linked equity structure converting share ownership into indirect token exposure, signaling rising demand for compliant, large-scale access without requiring direct XRP custody.

Vivopower Advances Ripple-Linked XRP Strategy for

XRP-4.03%

Coinpedia·12-17 00:33

Ran Neuner Admits Crypto Market Is Broken, Gets Shut Down By XRP Bull

Entrepreneur Ran Neuner just went ballistic on how the crypto market is underperforming despite having all the ingredients of a bull market.

A popular technical analyst and XRP advocate criticized him for focusing on alts that don’t matter.

To date, a bearish outlook has dominated investors.

Blockzeit·12-17 00:03

Media Personality Predicts XRP Will Shock the World in 2026

Despite XRP's recent price decline, the community remains optimistic about its future potential, predicting significant recovery and growth by 2026, driven by its fundamentals and real-world applications.

XRP-4.03%

TheCryptoBasic·12-16 14:47

Analyst Says XRP Could See an Absolute Parabolic Run in 2027

XRP community figure Chad Steingraber has outlined a timeline that places XRP’s most aggressive growth phase in 2027.

According to Steingraber, 2026 would likely be a steady build-up period, with tokenized assets growing “fast and consistently.”

Meanwhile, he believes the real shift comes in 2027,

XRP-4.03%

TheCryptoBasic·12-16 14:16

20 Reasons XRP Could Be the Best Investment for 2026

A prominent market expert has shared 20 reasons he believes XRP could be the best investment for 2026 despite recent weakness.

Notably, XRP entered 2025 with bullish momentum after gaining nearly 46% in January and reclaiming levels above $3. However, this early uptick failed to hold

Amid the

XRP-4.03%

TheCryptoBasic·12-16 12:53

The spot XRP ETF funds have surpassed $1 billion in inflows since its launch in November.

XRP spot ETFs in the U.S. exceeded $1 billion in inflows, reflecting growing institutional interest in altcoin ETFs. This milestone, supported by significant investments from various funds, contrasts sharply with outflows from bitcoin and ethereum ETFs amid market instability.

TapChiBitcoin·12-16 11:34

XRP Faces Breakdown Risk If Price Fails To Hold The $1.92 Level

_XRP trades below key EMAs near $1.92 support; rising futures OI and weak spot flows signal risk of breakdown toward $1.80._

XRP is trading near a key support level at $1.92, raising concerns among traders and investors. Price action on both the 3-day and 4-hour charts shows bearish pressure,

XRP-4.03%

LiveBTCNews·12-16 11:15

CME Group launches spot price futures contracts for XRP and Solana

CME Group has expanded its cryptocurrency derivatives portfolio by launching XRP and Solana (SOL) futures contracts priced at spot market levels, catering to growing demand from both institutional and retail investors. These new contracts enhance investment flexibility and efficiency.

TapChiBitcoin·12-16 10:35

XRP skyrockets to $100? Korean intelligence 276 analyst exposed for fabricating credentials

A prediction that XRP will reach $100 by 2029 is spreading wildly on the X forum, with YoungHoon Kim, who made this claim, claiming an IQ of 276. However, independent research has debunked this claim, and high-IQ organizations do not recognize such IQ scores. A report published by VICE in July 2025 shows that Kim's credentials have not been verified.

XRP-4.03%

MarketWhisper·12-16 08:28

Analyst Who Correctly Predicted XRP Crash to $1.88 Sets His Next Price Target

Market expert Dark Defender suggests that XRP, having completed Wave 4 in its Elliot Wave pattern, could rise over 200% to $5.85. Despite recent volatility and declines, he highlights key support levels and advises ignoring FUD for potential growth.

XRP-4.03%

TheCryptoBasic·12-16 07:41

XRP Crashed 48% Since Ripple Co-founder Larsen Sold $200M, But There’s More

A CryptoQuant author points out that XRP has dropped nearly 50% since Ripple co-founder Chris Larsen sold millions, but there’s more to the story.

This disclosure came from JA Maartunn, CryptoQuant’s community analyst, amid XRP’s current struggles, as the crypto asset finally relinquishes the

TheCryptoBasic·12-16 06:46

CME Group Expands Crypto Derivatives With Spot-Quoted XRP and SOL Futures

CME Group launches spot-quoted XRP and SOL futures, expanding retail-focused crypto access with longer expiries and reduced roll costs.

CME Group has launched spot-quoted XRP and SOL futures, expanding its cryptocurrency derivatives lineup. The move follows strong demand for spot-quoted

LiveBTCNews·12-16 06:11

GPT-5.2 Major Prediction: XRP Might Return to $5, Meme Coins to Welcome a New Cycle?

Recently, the new generation artificial intelligence GPT-5.2 has made bidirectional price forecasts for the three major popular cryptocurrencies XRP, Dogecoin, and Shiba Inu up to 2026, sparking widespread market attention. According to its analysis, XRP is expected to break through the $3 to $5 range in an optimistic scenario, while Dogecoin and Shiba Inu may lead a new Meme coin cycle, with targets of $0.35 and $0.00005 respectively. These predictions were released at a critical turning point in the crypto market: on one hand, gold prices are approaching historical highs, and Bitcoin has pulled back from its high; on the other hand, institutions represented by Grayscale believe that 2026 will mark the dawn of the "institutionalization era" of cryptocurrencies, with fundamental changes occurring in market driving logic. While AI predictions are not market truths, they offer a novel perspective for observing the interaction between retail sentiment and macro trends.

MarketWhisper·12-16 06:00

What if You Hold 1,000 XRP and the XRP Price Rockets Like BNB

What would be the worth of 1,000 XRP tokens if XRP recorded an explosive rally similar to what BNB witnessed earlier this year?

BNB is one of only two crypto assets seeing gains this year, despite the ongoing market turbulence, being the token with the largest year-to-date increase. For context, th

TheCryptoBasic·12-16 06:00

Bitcoin, Ethereum, and XRP plummet 5%! Total Crypto market cap falls below $3.1 trillion

The crypto market continued its decline in mid-December, with Bitcoin falling to around $85,800 during Asian trading hours, along with Ethereum and XRP which each declined over 5% for the week. The total market cap of crypto assets slightly decreased to approximately $3.06 trillion, a decline of over 2% this week. This sell-off occurred as investors awaited the release of key US economic data, with the crypto fear and greed index dropping to 16, the lowest level in nearly three weeks.

MarketWhisper·12-16 05:45

XRP ETFs Finally Cross $1B Netflows After 21 Days of Consistent Inflows

XRP ETFs have now crossed the $1 billion mark in cumulative net inflows, becoming the second fastest to reach this milestone, only behind Bitcoin ETFs.

This is according to data aggregated by market analytics resource Sosovalue. Notably, the four XRP ETFs ended the previous week with $990.91

TheCryptoBasic·12-16 05:22

CrunchBase Founder Reveals XRP Among His Biggest Crypto Investments

Michael Arrington, founder of TechCrunch, revealed XRP as one of his top five crypto holdings, alongside Bitcoin and Ethereum. His long-standing support for XRP includes backing its real-world utility and involvement in institutional projects to enhance adoption.

TheCryptoBasic·12-16 05:22

XRP Today News: Japan's interest rate hike expectations and delays in US legislation are double bearish factors, causing XRP to fall below $1.9

XRP price experienced significant selling pressure on December 15, dropping 3.95% to $1.8993, hitting a new low since November 21. The decline was mainly driven by the convergence of two major bearish factors: the panic to close yen carry trades ahead of the Bank of Japan's imminent rate hike, and an unexpected delay in the review process of the US cryptocurrency market structure bill. Although short-term technical indicators have turned bearish, analysts believe that strong XRP spot ETF capital inflows and long-term expectations for crypto-friendly legislation still provide key support for the medium-term trend. The market is currently engaged in an intense struggle between short-term macro headwinds and long-term fundamental bullishness.

XRP-4.03%

MarketWhisper·12-16 03:06

XRP Today's News: Yen Arbitrage Liquidation Panic Strikes, $1.82 Support at Risk

On December 16, XRP fell to $1.8657, down more than the broader market. The 10-year Japanese government bond yield approached an 18-year high of 1.981%, with expectations that the Bank of Japan will raise interest rates by 25 basis points this week. Concerns over unwinding yen carry trades are weighing on the market. From a technical perspective, XRP broke below $1.90 and the 50-day and 200-day EMAs, confirming a short-term bearish trend with a target support at $1.8239.

XRP-4.03%

MarketWhisper·12-16 02:17

Gate Daily (December 16): JPMorgan's tokenized fund launches on Ethereum; digital asset ETP sees three consecutive weeks of inflows

Bitcoin (BTC) crashes and plummets, temporarily reporting around $85,994 on December 16. JPMorgan launches its first tokenized money market fund on Ethereum, offering qualified investors the opportunity to earn USD returns through its institutional trading platform Morgan Money. Digital asset ETP experiences net inflows for the third consecutive week, mainly driven by demand in the United States.

MarketWhisper·12-16 01:18

XRP copying the 2017 script? Traders: After breaking through, replay the 1440% surge myth

XRP price has been hovering around $2 for several days, forming a critical technical stalemate. From the daily chart, the sharp decline over the past few months has created a descending wedge pattern, with the price narrowing around $2. Well-known trader Steph is Crypto pointed out that the current trend is remarkably similar to the accumulation phase in 2017, when XRP surged from $0.25 to $3.84, a gain of 1440%.

XRP-4.03%

MarketWhisper·12-16 00:54

Load More

Hot Tags

Hot Topics

MoreCrypto Calendar

MoreHayabusa Yükseltmesi

VeChain, Aralık ayında planlanan Hayabusa yükseltmesini duyurdu. Bu yükseltmenin, protokol performansını ve tokenomi'yi önemli ölçüde artırmayı hedeflediği belirtiliyor ve ekip, bu güncellemeyi bugüne kadarki en çok fayda odaklı VeChain sürümü olarak nitelendiriyor.

2025-12-27

Litewallet Gün Batımları

Litecoin Vakfı, Litewallet uygulamasının 31 Aralık'ta resmi olarak sona ereceğini duyurdu. Uygulama artık aktif olarak korunmamakta olup, bu tarihe kadar yalnızca kritik hata düzeltmeleri yapılacaktır. Destek sohbeti de bu tarihten sonra sona erecektir. Kullanıcıların Nexus Cüzdan'a geçiş yapmaları teşvik edilmektedir; Litewallet içinde geçiş araçları ve adım adım bir kılavuz sağlanmıştır.

2025-12-30

OM Token Göçü Sona Erdi

MANTRA Chain, kullanıcıları OM token'larını 15 Ocak'tan önce MANTRA Chain ana ağına taşımaları için bir hatırlatma yayınladı. Taşıma işlemi, $OM'nin yerel zincirine geçişi sırasında ekosistemdeki katılıma devam edilmesini sağlar.

2026-01-14

CSM Fiyat Değişikliği

Hedera, Ocak 2026'dan itibaren KonsensüsSubmitMessage hizmeti için sabit USD ücretinin $0.0001'den $0.0008'e yükseleceğini duyurdu.

2026-01-27

Vesting Kilidi Gecikti

Router Protocol, ROUTE tokeninin Hakediş kilidinin 6 aylık bir gecikme ile açılacağını duyurdu. Ekip, projenin Open Graph Architecture (OGA) ile stratejik uyum sağlamak ve uzun vadeli ivmeyi koruma hedefini gecikmenin başlıca nedenleri olarak belirtiyor. Bu süre zarfında yeni kilit açılımları gerçekleşmeyecek.

2026-01-28