Bitcoin (BTC) News Today

Latest crypto news and price forecasts for BTC: Gate News brings together the latest updates, market analysis, and in-depth insights.

Russia doubles down on ruble-only rule, keeps Bitcoin out of payments

Russia locks all domestic payments to the ruble, treats Bitcoin only as an investment, but pilots crypto for cross-border trade and rolls out a digital ruble CBDC.

Summary

Under a 2020 law and fresh statements from MP Anatoly Aksakov, Russia bans using Bitcoin and other cryptocurrencies to pay

BTC0.84%

Cryptonews·58m ago

Bitcoin Tests Range Lows as Fed, AI, and BoJ Drive Swings

Bitcoin broke below its $88K–$92K range to test $86.5K as macro forces, not crypto-specific trends, drove price action.

A Fed rate cut and dovish liquidity moves clashed with cautious forward guidance, widening the gap with market expectations.

AI stock repricing and potential Bank of

CryptoFrontNews·59m ago

Bitcoin bulls debate Saylor’s hard fork fix for quantum threat

Saylor claims quantum won't break Bitcoin but urges a hard fork to freeze vulnerable P2PK coins, cutting supply and igniting ethics, security and governance backlash.

Summary

Saylor proposes a backward‑incompatible Bitcoin hard fork to freeze old P2PK outputs, including Satoshi‑era coins,

BTC0.84%

Cryptonews·1h ago

Ray Dalio Endorses Bitcoin as a Portfolio Hedge Against Fiat Devaluation

Ray Dalio supports investing in Bitcoin, suggesting up to 15% of portfolios should include it and gold as protection against fiat devaluation. His approach focuses on macroeconomic risks, positioning Bitcoin as a digital gold for stability among conservative investors.

BTC0.84%

Coinfomania·2h ago

Evening Must-Read 5 Articles | Will Various Assets Rise Again Collectively?

1. Looking Back at 2025: What Drove BTC Prices Through the "Four Seasons" of the Year?

As 2025 draws to a close, Golden Finance, in this moment of bidding farewell to the old and welcoming the new, launches the series of articles "Looking Back at 2025." Reflecting on the year's developments in the crypto industry, we also hope that in the new year, winter will dissipate and the stars will shine brightly. In 2025, the crypto market was once glorious, reaching new all-time highs, then returning to calm, and entering a phase of oscillation and bottoming out. This article reviews the performance of the crypto market this year. Click to read

2. Bitwise: Top 10 Crypto Predictions for 2026

Driven by strong institutional demand and a series of favorable regulatory developments, Bitcoin, Ethereum, Solana, and Ripple (XRP) all hit record highs (respectively $126,080, $4,946, $293, and $3.65). Stablecoins and tokenization have become household terms, Morgan Stanley,

金色财经_·2h ago

Bhutan to Deploy 10,000 BTC for Gelephu Mindfulness City

Bhutan plans to invest 10,000 Bitcoin to develop the Gelephu Mindfulness City (GMC), aiming to create jobs and retain youth. GMC will integrate various sectors and focus on sustainable growth, leveraging crypto and renewable energy over 20 years.

BTC0.84%

CryptoFrontNews·2h ago

Hyperliquid Whale Closes BTC Long and Flips to Massive ETH Short

Another decisive action was made by a popular trader of Hyperliquids. The wallet pension-usdt.eth sold a long position in Bitcoin. The trade brought out a profit of 1.04 million dollars. This victory prolonged a perfect streak. Since December 8 the trader has a dozen consecutive winning trades. The

Coinfomania·3h ago

Ahead of the Bank of Japan's rate hike, why does Bitcoin fall first?

On December 15, Bitcoin dropped from $90,000 to $85,616, a single-day decline of over 5%. There was no major crash event, but gold hardly moved on the same day. The answer might need to be sought in Tokyo, as yen arbitrage position unwinding is changing Bitcoin's pricing logic.

(Background: Yen bottom signal? Morgan Stanley warns: The Japanese yen will appreciate by 10% in early 2026, and US Treasury yields have stabilized and declined)

(Additional context: Japanese bond yields soared to 1.86%, a 17-year high, "causing Bitcoin to crash," revealing the danger of 600 trillion yen in arbitrage unwinding)

Table of Contents

The Butterfly Effect in Tokyo

Is Bitcoin Still Digital Gold?

What Will Happen on December 19?

Accepted by People, Influenced by People

The answer might need to be sought in Tokyo. On December 15, Bitcoin dropped from 90,0

BTC0.84%

動區BlockTempo·3h ago

Bitcoin faces ‘Q‑Day’ risk if quantum threat isn’t patched by 2026–2028

By 2028, Bitcoin could face serious security and price pressure if it fails to adopt quantum‑resistant cryptography, with Charles Edwards warning delays past 2026 risk a prolonged bear market and confidence shock.

Summary

Charles Edwards says quantum computers could crack Bitcoin's elliptic‑cu

BTC0.84%

Cryptonews·3h ago

The US Just Unlocked the Biggest Bitcoin Demand Driver in History, $150,000 – $440,000 ATH in 2026?

The US just unlocked the biggest Bitcoin demand driver in history.

BTC price is expected to surge continuously over the coming year.

BTC Rainbow chart predicts $150,000 – $440,000 ATH by 2026.

Earlier this year, the US government under current President Donald J. Trump and his

BTC0.84%

CryptoNewsLand·4h ago

Nasdaq Warns Bitcoin Treasury Firm KindlyMD as Shares Linger Under $1

Bitcoin treasury company KindlyMD is now officially on the Nasdaq countdown clock after its shares fell below the $1 minimum bid requirement, putting the company at risk of delisting if it fails to rebound by mid-2026.

KindlyMD Stock Below $1 Triggers Nasdaq Compliance Notice

According to a

BTC0.84%

Coinpedia·5h ago

Gate Research Institute: Market volatility continues, with holdings concentrated on betting on year-end fluctuations

Options Market Trends

Latest data shows BTC IV at 45% and ETH IV at 68%, both continuing to decline compared to last week, remaining at levels close to the one-year average, reflecting a weakening market expectation of future volatility.

From the skew structure perspective, this week BTC 25-Delta Skew across all maturities has moved uniformly downward, showing a convergence trend, currently centered around approximately -5 vol. This indicates that in the near term, put options still carry a certain premium over call options, and downside protection demand remains. ETH's skew has moved more evenly across the entire maturity structure, with even slight put premiums appearing in the longer-term options.

BTC and ETH

GateResearch·5h ago

Cryptocurrency ETF capital flows reverse: BTC and ETH face capital withdrawal pressure while Solana attracts light investment

On December 16 (ET), US-based spot cryptocurrency ETF funds experienced notable capital flow fluctuations, reflecting the cautious sentiment of institutional investors. The Bitcoin spot ETF saw a net outflow of $277 million, with Fidelity's FBTC fund being the only one to record net inflows, indicating

TapChiBitcoin·5h ago

Looking back at 2025: What has driven BTC prices through "all four seasons" in a year?

In 2025, the crypto market experienced a journey from the glory of reaching $100,000 BTC to a period of consolidation. The loose policies at the beginning of the year and Trump's rise to power drove the market upward, but later tariffs and economic concerns affected the trend, ultimately leading BTC to fluctuate above $90,000 by the end of the year. There is uncertainty about the market's future direction.

金色财经_·5h ago

Vanguard Bitcoin: $3.2B MicroStrategy Stake Signals Crypto Move

Vanguard's $3.2 billion investment in MicroStrategy signals rising institutional interest in Bitcoin and cryptocurrency. This move reflects a growing acceptance of digital assets within traditional finance and may inspire other investors to seek indirect exposure to Bitcoin through publicly traded companies.

BTC0.84%

Coinfomania·5h ago

Bitcoin UBI test puts Marshall Islands’ stablecoin wallet in spotlight

National UBI sends $800 a year to Marshall Islands citizens, with an optional stablecoin wallet to reach remote atolls and test on-chain social safety nets.

Summary

Marshall Islands now pays residents roughly $200 per quarter in UBI, funded by a US-backed trust tied to past nuclear testing.

Cryptonews·6h ago

Michael Saylor Strategy Reaches a Defining Market Milestone

Michael Saylor’s Strategy has crossed a threshold that few Bitcoin-focused companies ever reach. The firm has now remained qualified for S&P 500 inclusion for more than 120 consecutive days, placing Bitcoin exposure closer to America’s most influential equity index. This achievement signals more tha

BTC0.84%

Coinfomania·6h ago

Is Bitcoin (BTC) Poised for Reversal? This Emerging Bullish Fractal Setup Suggest So!

Date: Wed, Dec 17, 2025 | 06:50 AM GMT

The broader cryptocurrency market has been experiencing choppy price action over the past several weeks, a phase that began after the sharp sell-off on October 10. That correction dragged Bitcoin

BTC0.84%

CoinsProbe·7h ago

Bitcoin Lightning Network Capacity Soars to New All-Time Highs

The Lightning Network has reached a record capacity, enhancing Bitcoin's potential as a global medium of exchange by enabling faster, lower-cost transactions. Major exchanges' integrations are driving this growth, increasing trust and utility while addressing scalability challenges.

BTC0.84%

Cryptoknowmics·7h ago

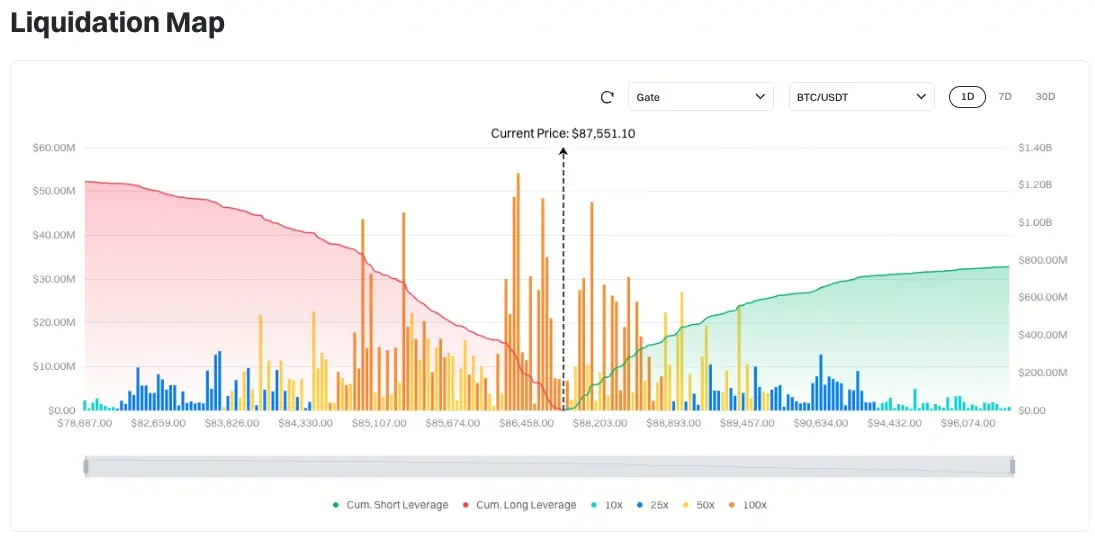

Gate Research Institute: Mainstream assets experience structural rebound | BTC short-term holdings remain under pressure

Cryptocurrency Asset Overview

BTC (+2.05% | Current Price 87,572 USDT)

After a rapid decline, BTC found support above $85,000 and is now consolidating around $87,500. In terms of moving averages, MA5 and MA10 are gradually flattening and approaching the price, while MA30 remains in a downtrend, indicating that the short-term is in a rebound and correction phase, but the medium-term resistance has not been fully resolved. The MACD green bars are clearly converging, with the fast and slow lines rising from low levels. The bullish momentum is recovering but has not yet formed a strong reversal. If BTC can effectively hold above the $87,000–$87,500 range, it may further test the resistance at $88,500–$89,000; if it falls below $86,500 again, the rebound structure could be broken, and the market may revert to a sideways and weak pattern.

ETH (+0.46

GateResearch·7h ago

Bhutan pledges 10K Bitcoin to develop its ‘mindfulness city’

The Kingdom of Bhutan says it will tap into 10,000 Bitcoin from its stash to help build its special administrative region, the Gelephu Mindfulness City (GMC).

Located in the town of Gelephu in Southern Bhutan, GMC was launched in 2024 as Bhutan’s new economic hub to stop the exodus of young

BTC0.84%

Cointelegraph·7h ago

Gate Research Institute: BTC Short-term Holdings Continue to Face Pressure | Stablecoin Settlement Enters Banking System

Cryptocurrency Market Overview

BTC (+2.05% | Current price 87,572 USDT): After a rapid decline, BTC found support above $85,000. Currently, the price has returned to around $87,500 for consolidation. In terms of moving averages, MA5 and MA10 are gradually flattening and approaching the price, while MA30 remains in a downtrend, indicating that the short-term is in a rebound and correction phase, but the medium-term resistance has not been fully resolved. The MACD green bars are clearly converging, with the fast and slow lines rising from low levels. The bullish momentum is recovering but has not yet formed a strong reversal. If BTC can effectively hold above the $87,000–$87,500 range, it may further test the resistance at $88,500–$89,000; if it falls below $86,500 again, the rebound structure could be broken, and the market may revert to a sideways and weak pattern.

ETH (+0.46% |

GateResearch·8h ago

Bitcoin and Ethereum ETF Outflows Surge as BTC Slips Below $88,000 — Is $70,000 the Next Stop?

The $583 million ETF outflow event marks a pivotal moment for crypto markets. As Bitcoin tests critical support and Ethereum faces institutional repositioning, ETF flow data is once again proving to be a leading indicator of sentiment.

CryptopulseElite·8h ago

MetaMask Now Fully Supports Bitcoin – Unlock New Crypto Possibilities

![Metamask Now Fully Supports Bitcoin – Unlock New Crypto Possibilities]()MetaMask Expands Support to Bitcoin and Multiple Blockchains in 2025

MetaMask, one of the leading cryptocurrency wallet providers, has announced the integration of Bitcoin into its platform, signaling a broader move towards m

BTC0.84%

CryptoDaily·8h ago

Elon Musk discusses the future of cryptocurrency: Bitcoin is a store of value, not a trading currency

Elon Musk believes that few people truly understand the essence of "money." Bitcoin, as a store of value, is not suitable for high-frequency trading, while Dogecoin is more practical in terms of trading efficiency and payments.

PANews·9h ago

Bitcoin and Ethereum ETFs see $582 million outflow in a single day; is the bull market foundation weakening?

U.S. spot Bitcoin and Ethereum ETFs experienced significant capital outflows this Monday, with a single-day net outflow totaling $582.4 million, marking the highest level in nearly two weeks. Among them, Bitcoin ETFs saw outflows of $357.6 million, while Ethereum ETFs experienced nearly $225 million in outflows. Analysts pointed out that this wave of redemptions mainly stems from institutional investors' "macro de-risking" operations amid volatility in U.S. tech stocks and increasing uncertainty in Federal Reserve policies, rather than a crisis of confidence in cryptocurrencies themselves. Meanwhile, Michael Saylor, co-founder of MicroStrategy (formerly MicroStrategy), publicly stated that the development of quantum computing will "strengthen" rather than destroy Bitcoin, injecting new technological confidence into the market's long-term narrative.

MarketWhisper·11h ago

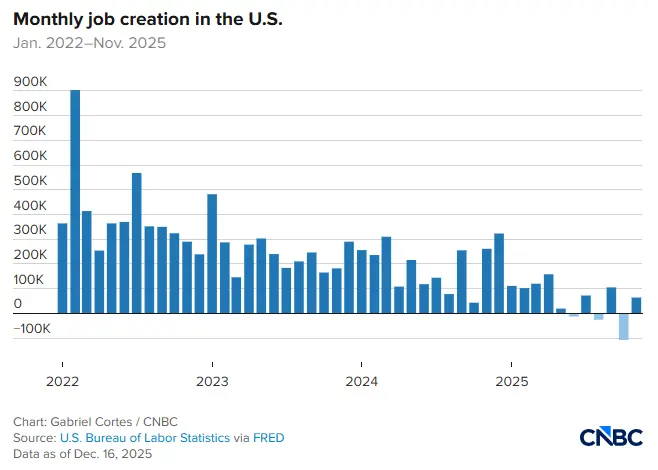

How to interpret complex signals from the unexpectedly strong US employment data and Bitcoin prices?

The latest data from the U.S. Bureau of Labor Statistics (BLS) shows that non-farm employment increased by 64,000 in November, far exceeding market expectations of 50,000, but the unemployment rate rose to 4.6%, reaching a new high since September 2021. After this employment report, which sends mixed signals, Bitcoin experienced intense volatility, initially surging above $87,000, then pulling back, and attempting again to break the $88,000 mark. This is the first major macroeconomic report since the Federal Reserve cut interest rates last week, highlighting the market's difficult balancing act between strong employment data and potential economic cracks, making the upcoming CPI inflation data even more critical.

BTC0.84%

MarketWhisper·11h ago

Bitwise and Grayscale's Major Prediction: The Four-Year Bitcoin Cycle Is Dead; 2026 Will Hit a New All-Time High

Top cryptocurrency asset management firms Bitwise and Grayscale have successively released their 2026 market outlooks, both predicting that Bitcoin will break the traditional "four-year cycle" pattern and set new all-time highs next year. Bitwise Chief Investment Officer Matt Hougan pointed out that the forces driving the old cycle (halving, interest rates, leverage) have weakened, and the continued influx of institutional capital and regulatory clarity will become the new dominant logic. Additionally, the report forecasts that Bitcoin's volatility will continue to stay below that of tech giant Nvidia, and its correlation with the US stock market will further decrease, marking its transition from a highly volatile speculative asset to a more attractive strategic allocation asset in global investment portfolios.

BTC0.84%

MarketWhisper·12h ago

The real impact of quantitative easing policies on cryptocurrencies

Source: The Crypto Advisor, Compilation: Shaw Golden Finance

In the past week, our internal discussion atmosphere has undergone a subtle change. It’s not about any earth-shattering event—no bold predictions, no sweeping conclusions—just a slight but noticeable shift in tone. The Federal Reserve’s recent decisions have sparked a cautious sense of excitement. The widely expected rate cut, combined with a moderate-scale government bond purchase plan, has been enough to reignite active discussions. This isn’t because the Fed’s policies are aggressive, but because it seems to be the first clear signal of a potential shift beginning.

The impact of a monetary policy shift rarely appears immediately on charts. You first hear its effects: slight fluctuations in the financing markets, a minor decrease in market volatility, and a slight reduction in risk appetite. Liquidity doesn’t change overnight but quietly circulates within the system, gradually altering the market.

BTC0.84%

金色财经_·12h ago

Gate Daily (December 17): Putin's government refuses to recognize Bitcoin as currency; U.S. senator calls for investigation into Trump's relationship with PancakeSwap

Bitcoin (BTC) slightly rebounded and is temporarily reported at around $87,680 on December 17. Non-farm payrolls appeared better than expected, but the rising unemployment rate triggered volatility in the US stock and cryptocurrency markets. The chairman of the Russian State Duma Financial Market Committee stated that cryptocurrencies will never become currency in Russia and can only serve as investment tools. US Senator Warren called for an investigation into crypto projects related to Trump.

MarketWhisper·12h ago

UK Cryptocurrency Regulation Coming Soon! DeFi and Exchanges Face New Rules, Opinions Due by February

The UK Financial Conduct Authority (FCA) has recently launched three major consultations, marking the substantive phase of the UK's cryptocurrency regulatory framework. These proposals cover exchange operations, staking services, lending platforms, and decentralized finance (DeFi). The deadline for public comments is February 12, 2026. The UK Treasury also announced that legislation will be introduced by October 2027 to incorporate cryptocurrency companies into the existing financial legal system.

MarketWhisper·13h ago

Why did Bitcoin rise today? Non-farm payrolls of 64,000 exceeded expectations, and the Federal Reserve's dovish shift ignited the rebound.

December 17, Bitcoin price slightly rebounded to around $87,500, recovering some of the overnight losses. The US November non-farm payrolls data showed an increase of 64,000 jobs, higher than the expected 45,000, but the unemployment rate rose to 4.6%, exceeding expectations. This mixed non-farm payrolls data keeps the Federal Reserve's probability of a rate cut in January at 24%, reducing macroeconomic uncertainty.

MarketWhisper·13h ago

Interest rate cuts lead to a crash? The Federal Reserve, Bank of Japan, and Christmas holiday form a "deadly triangle trap"

BTC has fallen from $95,000 to $85,000, with over 200,000 traders liquidated in the past 24 hours, and $600 million wiped out.

Everyone is asking: Weren't we told a few days ago that rate cuts are good for the market?

The answer lies in three dates: December 11 (Federal Reserve rate cut), December 19 (Japan rate hike), December 23 (Christmas holiday).

01. The Federal Reserve's "Rate Cut + Hawkish" Combo

On the 11th, the Federal Reserve cut interest rates by 25 basis points as scheduled. However, the dot plot indicates that in 2026, there may be only one rate cut, far below market expectations of 2-3 cuts.

The market wants "continuous liquidity injection," but Powell is offering a "symbolic rate cut + future tightening."

What's more concerning is that among the 12 voting members, 3 oppose the rate cut, with 2 advocating to keep rates unchanged. This shows that the Fed's internal vigilance against inflation exceeds market expectations.

Rate cuts should have released liquidity, but hawkish signals are emerging.

BTC0.84%

PANews·14h ago

Bitcoin Treasury KindlyMD Faces Nasdaq Delisting With Stock Down 99%

KindlyMD faces potential Nasdaq delisting as its stock closed at $0.38, below the $1 minimum. The company must maintain a $1 closing price for at least 10 days by June 2026 to comply, amid challenges following a Nakamoto merger and delayed earnings.

BTC0.84%

Decrypt·15h ago

Load More

Hot Tags

Hot Topics

MoreCrypto Calendar

MoreHayabusa Yükseltmesi

VeChain, Aralık ayında planlanan Hayabusa yükseltmesini duyurdu. Bu yükseltmenin, protokol performansını ve tokenomi'yi önemli ölçüde artırmayı hedeflediği belirtiliyor ve ekip, bu güncellemeyi bugüne kadarki en çok fayda odaklı VeChain sürümü olarak nitelendiriyor.

2025-12-27

Litewallet Gün Batımları

Litecoin Vakfı, Litewallet uygulamasının 31 Aralık'ta resmi olarak sona ereceğini duyurdu. Uygulama artık aktif olarak korunmamakta olup, bu tarihe kadar yalnızca kritik hata düzeltmeleri yapılacaktır. Destek sohbeti de bu tarihten sonra sona erecektir. Kullanıcıların Nexus Cüzdan'a geçiş yapmaları teşvik edilmektedir; Litewallet içinde geçiş araçları ve adım adım bir kılavuz sağlanmıştır.

2025-12-30

OM Token Göçü Sona Erdi

MANTRA Chain, kullanıcıları OM token'larını 15 Ocak'tan önce MANTRA Chain ana ağına taşımaları için bir hatırlatma yayınladı. Taşıma işlemi, $OM'nin yerel zincirine geçişi sırasında ekosistemdeki katılıma devam edilmesini sağlar.

2026-01-14

CSM Fiyat Değişikliği

Hedera, Ocak 2026'dan itibaren KonsensüsSubmitMessage hizmeti için sabit USD ücretinin $0.0001'den $0.0008'e yükseleceğini duyurdu.

2026-01-27

Vesting Kilidi Gecikti

Router Protocol, ROUTE tokeninin Hakediş kilidinin 6 aylık bir gecikme ile açılacağını duyurdu. Ekip, projenin Open Graph Architecture (OGA) ile stratejik uyum sağlamak ve uzun vadeli ivmeyi koruma hedefini gecikmenin başlıca nedenleri olarak belirtiyor. Bu süre zarfında yeni kilit açılımları gerçekleşmeyecek.

2026-01-28