Ethereum (ETH) News Today

Latest crypto news and price forecasts for ETH: Gate News brings together the latest updates, market analysis, and in-depth insights.

12.16 AI Daily Cryptocurrency Market Turmoil Intensifies, Regulatory Policies Tighten

AI Today Discoveries: 1. The Federal Reserve raises interest rates by 75 basis points, triggering intense fluctuations in global markets 2. China's new cryptocurrency regulatory framework: a comprehensive upgrade to systematic governance 3. Japan plans to impose a 20% tax rate on cryptocurrency trading income 4. Ethereum network upgrade brings significant breakthroughs, driving the ecosystem's vigorous development 5. Musk states AI will promote "全民高收入" (high income for all), and humans may no longer need to work

GateUser-26c36996·3h ago

Gate Research Institute: Ripple Expands RLUSD to Ethereum Layer 2 Network | Visa Announces Launch of Stablecoin Consulting Services

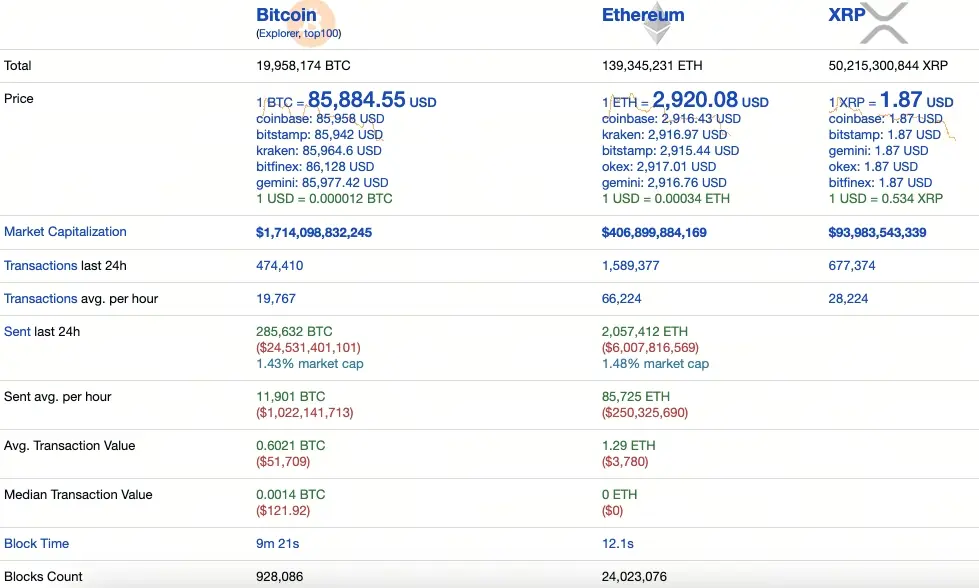

Crypto Market Overview

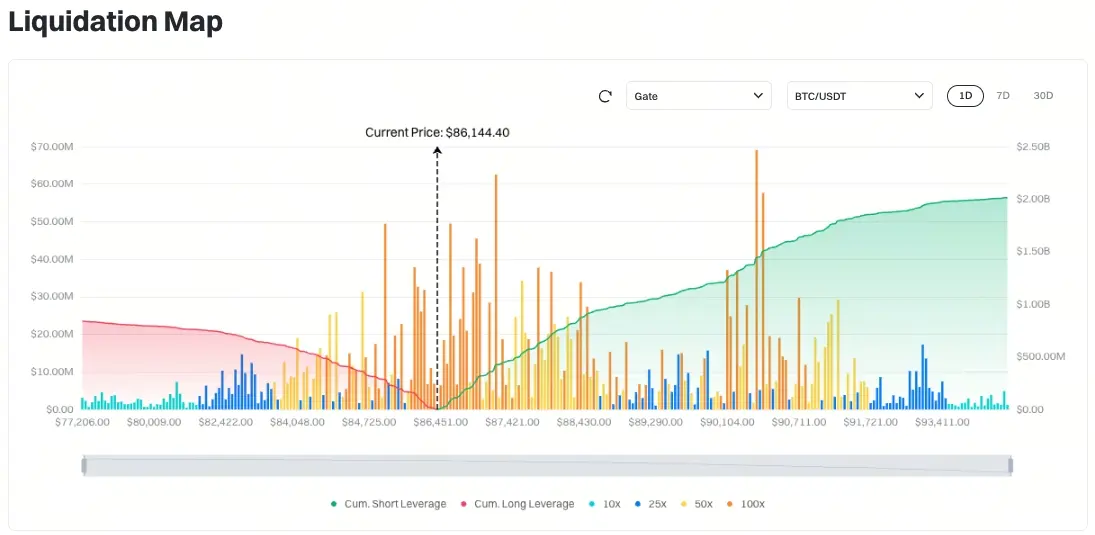

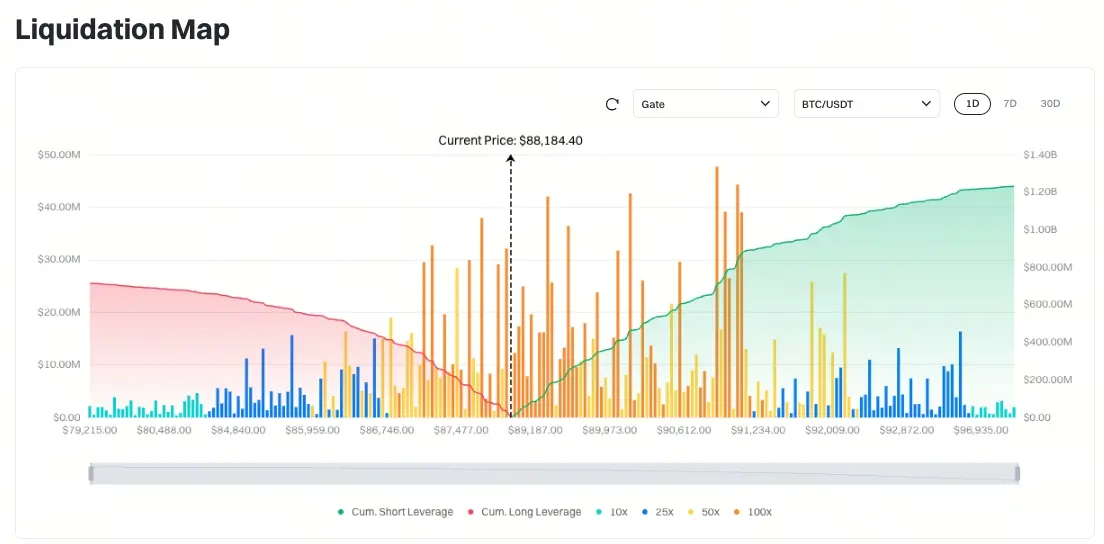

BTC (-4.20% | Current price 85,740 USDT): After failing to effectively break through the key resistance level of 95,000 USD last week, Bitcoin's price continued to weaken and gradually retraced to the core supply and demand zone. From a daily chart perspective, both the 100-day and 200-day moving averages are above the price, showing a downward trend slightly above the 100,000 USD level, further reinforcing the medium-term bearish technical pattern. However, the current price has approached the lower band of the Bollinger Bands, and both RSI and KDJ are in oversold zones, indicating that the short-term downward momentum is weakening. The 79,000–82,000 USD range remains the most critical demand support zone, where strong buying previously entered, forming a temporary bottom in this round of correction; if the price faces further pressure and declines again, this area is likely to remain the core of bullish defense.

GateResearch·7h ago

What Is J.P. Morgan's New Tokenized Money Market Fund on Ethereum?

J.P. Morgan Asset Management launched its first fully tokenized money market fund on a public blockchain—the My OnChain Net Yield Fund (MONY)—marking a major milestone in Wall Street's adoption of distributed ledger technology for traditional investment products.

ETH-6.04%

CryptopulseElite·7h ago

Bitcoin, Ethereum, and XRP plummet 5%! Total Crypto market cap falls below $3.1 trillion

The crypto market continued its decline in mid-December, with Bitcoin falling to around $85,800 during Asian trading hours, along with Ethereum and XRP which each declined over 5% for the week. The total market cap of crypto assets slightly decreased to approximately $3.06 trillion, a decline of over 2% this week. This sell-off occurred as investors awaited the release of key US economic data, with the crypto fear and greed index dropping to 16, the lowest level in nearly three weeks.

MarketWhisper·7h ago

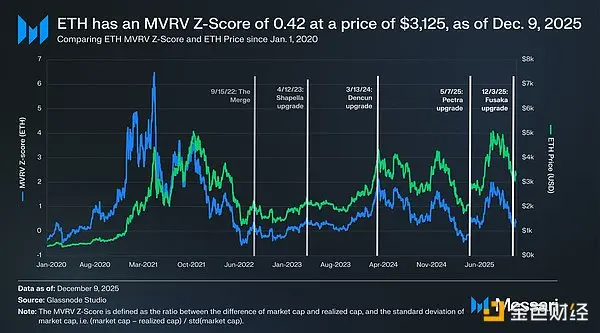

Ethereum 2026: Is ETH Undervalued According to the MVRV Indicator?

The article analyzes the relationship between Ethereum (ETH) price and fundamentals, indicating that ETH's MVRV Z-Score currently shows it is undervalued, with an overall bullish trend. As Ethereum maintains its dominant position in the tokenized asset space and with upcoming regulatory funding, the current price offers a constructive opportunity for long-term investment.

ETH-6.04%

金色财经_·8h ago

Mantle price (MNT) aims for a 30% recovery after Ethereum staking platform upgrade

Mantle (MNT) remains steady above the short-term support zone around $1.23 at the time of writing on Tuesday, despite the overall bleak outlook of the cryptocurrency market. If the bulls continue to increase pressure and consolidate trend control, MNT could potentially extend its recovery rally.

TapChiBitcoin·10h ago

Is DAT still useful during a bear market?

Author: Crypto Weituo; Source: X, @thecryptoskanda

After BMNR and MSTR consecutively fell below mNAV 1, basically everyone talking about DAT would say, “The DAT scam is over.”

From the perspective of the crypto-native community, DAT is invalid: it’s like letting others buy coins for you with your own money, especially since several coins have ETFs. Currently, buying DAT can be seen as paying for the personal brands of Tom Lee and Michael Saylor — donating money to these two influencers who target traditional finance.

But does it really serve no purpose at all? Maybe not.

1. Earning income through holding coins to support DAT’s performance

Many DAT projects are considering or already doing this. Mainly by using the held tokens for staking, such as Solana’s DAT; there are also discussions about using lending protocols to generate revenue.

金色财经_·10h ago

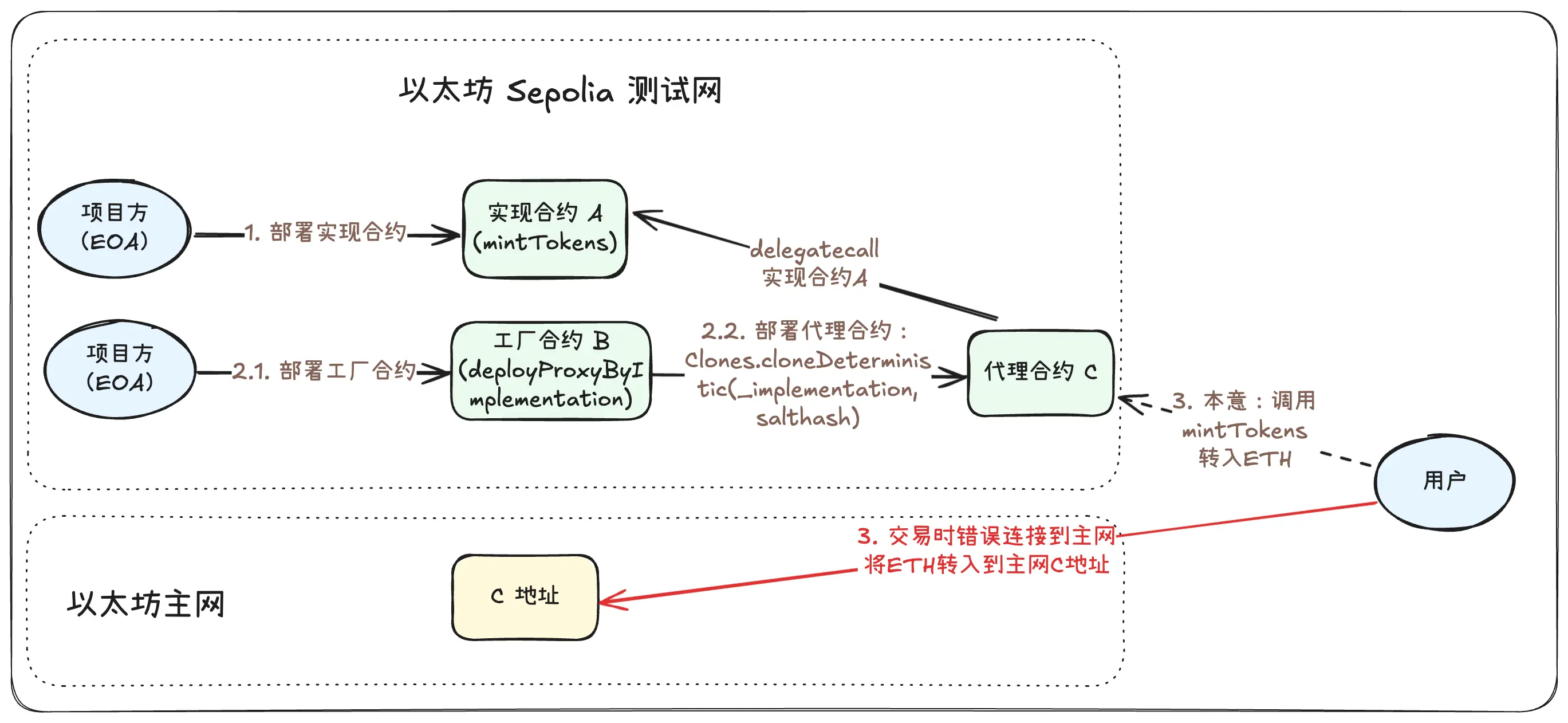

Web3 Security Series: If funds are mistakenly transferred to another chain, can they still be recovered?

In the crypto world, a single click mistake can trigger a "digital disaster." One of the most common nightmares is sending assets to the wrong blockchain. For example, intending to send ETH to an address on the Ethereum Sepolia testnet, but accidentally sending it to an address on the Ethereum mainnet. In such cases, is it still possible to recover the mistakenly transferred funds from the Ethereum mainnet? Whether assets can be recovered depends crucially on the type of the recipient address. This article will analyze different scenarios.

1. Scenario 1: The recipient address is an EOA

EOA (Externally Owned Account) is the common wallet address controlled directly by a private key or mnemonic phrase.

Prerequisites for asset recovery:

- You transferred assets to an EOA address.

- You possess the private key or mnemonic phrase for this target EOA address.

ETH-6.04%

PANews·10h ago

Are investors losing interest in altcoins? Is long-term allocation still meaningful?

The crypto market is undergoing a structural shift, with capital no longer favoring niche altcoins but focusing on high-quality assets with clear regulation and ample liquidity. The altcoin index has plummeted nearly 40% this year, forming a stark contrast to the US stock market.

(Background: Small-cap tokens have fallen to a four-year low, is the "altcoin bull" completely hopeless?)

(Additional context: By targeting altcoins on DEXs, we made $50 million in one year)

Table of Contents

US Stocks vs. Altcoins: Two Different Worlds

Return Imbalance Under High Correlation

Capital Flows to Quality Assets

Diversification Has Lost Its Meaning

Over the past year, the crypto and US stock markets have shown a stark contrast. The S&P 500 and Nasdaq 100 indices have increased by 47% and 49% respectively over two years, while the altcoin index remains deep in a decline. The crypto market is now experiencing capital flow toward high-quality assets.

動區BlockTempo·10h ago

BitMine aggressively buys 100,000 Ethereum, still claiming to buy despite a paper loss of 3 billion

Ethereum asset management company BitMine Immersion expanded its digital asset reserves last week, acquiring 102,259 ETH since the last update. This acquisition increased the company's Ethereum holdings to 39.6 million, valued at approximately $11.82 billion, with a goal to hold 5% of the circulating supply of Ethereum.

MarketWhisper·11h ago

The best moment in the crypto industry is coming? Tom Lee's BitMine invests an additional $320 million to acquire more Ethereum

After months of adjustment in the crypto market, industry leader Tom Lee's BitMine Immersion Technology demonstrated remarkable boldness by investing approximately $320 million last week to acquire 102,259 ETH. This move brought its total Ethereum holdings close to 4 million, worth over $12.4 billion, solidifying its position as the "world's largest Ethereum treasury company." Despite the market's general caution and BitMine facing an unrealized loss of about $3 billion due to Ethereum's price correction from its peak, Tom Lee remains optimistic about the future of crypto assets. His "5% alchemy" goal and expectations for active regulation and Wall Street's entry sent a strong long-term confidence signal to the market.

MarketWhisper·12h ago

JPMorgan's tokenized money market fund MONY launches on Ethereum, a traditional financial giant further expanding into the crypto realm

JPMorgan Chase, a leading global financial institution, officially launched its first tokenized money market fund—the My OnChain Net Yield Fund (MONY). The fund operates on the Ethereum blockchain and is open to qualified investors, with an initial seed capital of $100 million. This move marks the systematic introduction of the asset management giant, which manages nearly $4 trillion, into the blockchain world with its flagship traditional financial products. The goal is to leverage tokenization technology to improve transaction efficiency, expand application scenarios, and meet the growing client demand for on-chain yield assets.

MarketWhisper·12h ago

Gate Daily (December 16): JPMorgan's tokenized fund launches on Ethereum; digital asset ETP sees three consecutive weeks of inflows

Bitcoin (BTC) crashes and plummets, temporarily reporting around $85,994 on December 16. JPMorgan launches its first tokenized money market fund on Ethereum, offering qualified investors the opportunity to earn USD returns through its institutional trading platform Morgan Money. Digital asset ETP experiences net inflows for the third consecutive week, mainly driven by demand in the United States.

MarketWhisper·12h ago

Technical analysis for December 16: SPX, DXY, BTC, ETH, BNB, XRP, SOL, DOGE, ADA, BCH

Bitcoin (BTC) attempted to recover on Monday, but selling pressure remains dominant and there are no clear signs of weakening. Trader CrypNuevo stated in a series of posts on X that BTC is likely to continue fluctuating within a broad accumulation zone from $80,000 to $99,000. Notably,

TapChiBitcoin·12h ago

Crypto Wallet MetaMask Expands From Ethereum and Solana to Bitcoin

In brief

MetaMask rolled out support for Bitcoin, allowing users to buy, sell, and send BTC in-wallet.

The network expansion is the latest in feature enhancements that include in-wallet perps, prediction market trading, and more.

MetaMask recently added support for Monad and Sei, and will add a

Decrypt·18h ago

Tom Lee's BitMine Keeps Buying Ethereum, Adding $320 Million to ETH Treasury

In brief

BitMine bought more than 100,000 ETH valued around $320 million last week.

The firm now owns 3.2% of the circulating ETH supply, or about $12.4 billion in total.

Ethereum and BitMine's stock price are both falling Monday.

Decrypt's Art, Fashion, and Entertainment Hub.

Decrypt·21h ago

BitMine adds 102,000 ETH to its holdings "Total holdings approach 4 million ETH," Tom Lee: The crypto market has recovered from the October shock

The world's largest Ethereum (ETH) reserve company, BitMine, announced this evening (15th) that it has added an additional 102,259 ETH in the past week, continuing to advance its long-term core strategy of accumulating ETH.

(Previous summary: BitMine invests another $120 million to purchase 38,000 ETH! ETH maintains support at $3,100 with consolidation and volatility)

(Background addition: BitMine invests another $110 million to add 33,000 ETH! Tom Lee declares: ETH has already bottomed out)

The world's largest Ethereum (ETH) reserve company, BitMine Immersion

動區BlockTempo·23h ago

Firedancer launches on mainnet, but Solana still hasn't met Ethereum's security standards

After three years of development, Firedancer officially launched on the Solana mainnet in December 2025, after creating more than 50,000 blocks during a 100-day testing period with a small number of validators.

The milestone announced by Solana's official account on 12/12 is not just a performance upgrade. This is a significant effort to...

TapChiBitcoin·12-15 12:35

Evening Must-Read 5 Articles | The Future of the U.S. Economy Amid Inflation Fission

1. Not Just a Quick Purchase of Juventus: The $15 Billion Annual Profits of the Tether Empire

On December 12, 2025, Tether announced plans to acquire Italian football club Juventus FC entirely. Tether submitted a full cash mandatory bid to its controlling shareholder Exor to purchase 65.4% of its shares and is prepared to launch a public tender offer for the remaining shares after the transaction is completed, aiming to increase its stake to 100%. However, EXOR Group rejected Tether's proposal to acquire Juventus shares, reaffirming no intention to sell Juventus shares. Click to read

2. US SEC Hands-On Guide to Crypto Asset Custody

The US SEC Investor Education and Assistance Office issued this investor notice to help retail investors understand how to hold crypto assets. This notice outlines the types of crypto asset custody

金色财经_·12-15 11:50

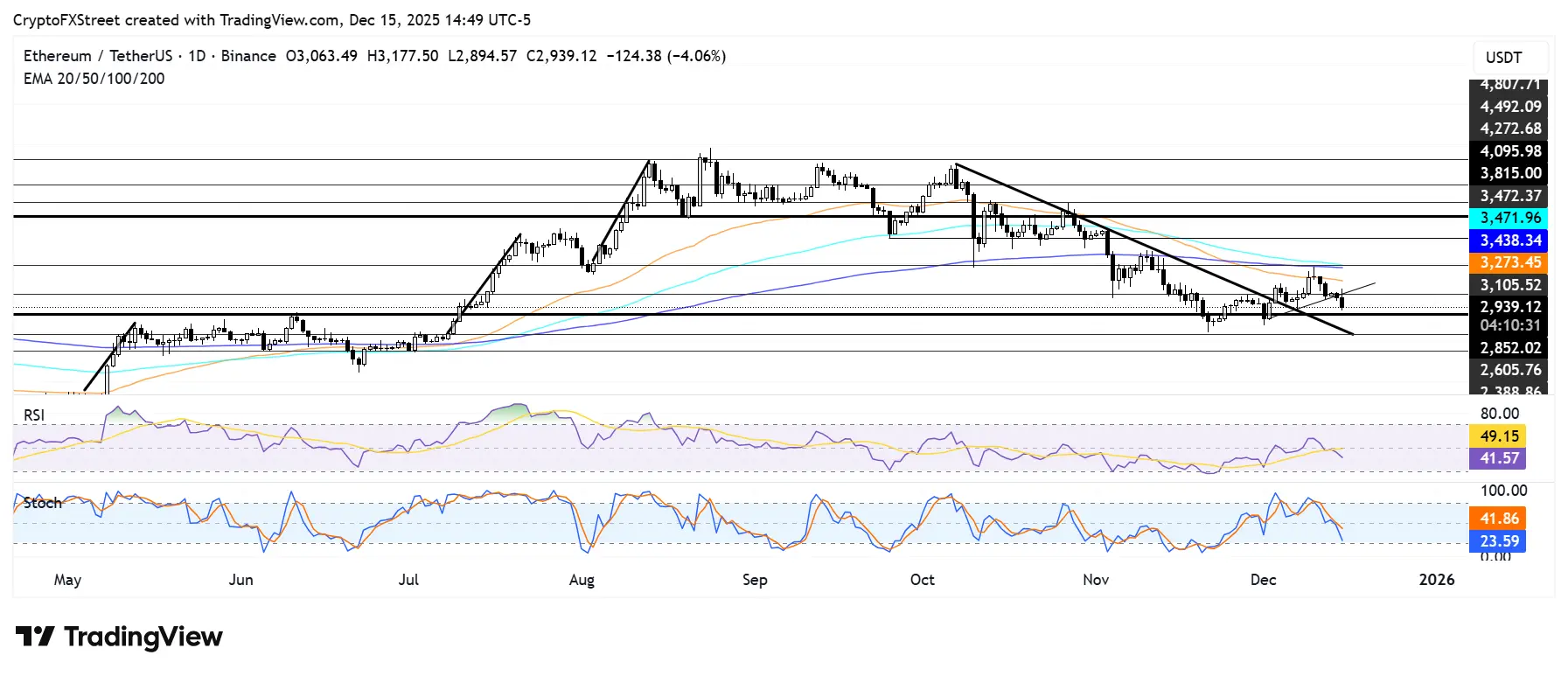

Ethereum Prediction for Dec 15: ETH is Back Above 20-Day SMA, Where Next?

Ethereum shows improving short-term momentum, trading above its 20-day average at $3,144.21 amid mixed signals. Key supports and resistances suggest potential volatility, with bullish prospects contingent on maintaining key support levels.

ETH-6.04%

TheCryptoBasic·12-15 11:09

Price prediction for the top 3 cryptocurrencies: BTC, ETH, and XRP enter a sensitive phase at key technical levels

Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP) are hovering around key technical levels in Monday's trading session, after a slight correction last week. The three largest market cap cryptocurrencies are facing the risk of deeper downward pressure, as signals indicate market movement.

TapChiBitcoin·12-15 10:04

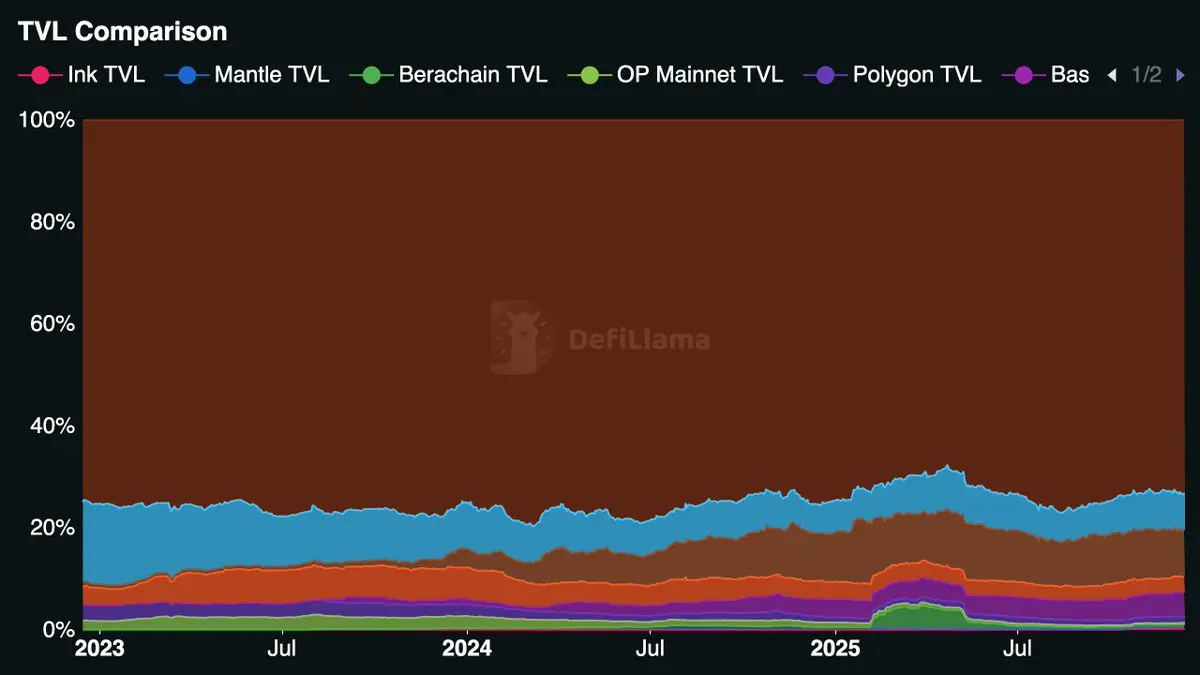

Small-cap tokens fall to a four-year low, is the "Shanzhai Bull" completely hopeless?

Despite a correlation of up to 0.9 with major Crypto market tokens, small-cap tokens have failed to provide any diversification value. In the first quarter of 2025, they plummeted by 46.4%, with an annual decline of approximately 38%, while the major US stock market index achieved double-digit growth with controlled pullbacks. This article is based on an article by Gino Matos, organized, translated, and written by ForesightNews.

(Background: Current situation of the altcoin ETF market: XRP as the biggest winner, LTC and DOGE abandoned by the market)

(Additional context: We earned $50 million in one year by targeting altcoins on DEX)

Table of Contents

Choose a reliable altcoin index

Sharpe Ratio and Drawdown

Bitcoin Investors and Crypto Liquidity

What does this mean for liquidity in the next market cycle

動區BlockTempo·12-15 09:15

Algorithm Transparency: Ethereum Foundation's Perspective on Free Speech and Censorship Resistance

Davide Crapis and Vitalik Buterin from the Ethereum Foundation emphasize the importance of transparency in algorithms that protect freedom of speech, proposing the use of zero-knowledge proofs to ensure integrity without revealing sensitive information.

ETH-6.04%

TapChiBitcoin·12-15 07:25

Solana transfers 16 times more to Ethereum! 70% of clients are concentrated, scaring away 12 billion in funds

After three years of development, Firedancer launched on the Solana mainnet in December 2024, marking the network's first attempt to eliminate architectural bottlenecks that cause the most severe failures: nearly complete reliance on a single validator client. Over the past five years, Solana has experienced seven outages, five of which were caused by client errors.

MarketWhisper·12-15 07:22

Fidelity survey shocks! 24% of Taiwanese hold digital assets, 51% are interested in increasing their holdings

Fidelity's latest investor survey shows that although Taiwanese regulators currently only allow institutional investors and professional investors to participate, 24% of individual investors in Taiwan have already held digital assets, and 51% express willingness to increase their holdings. In the Asia-Pacific region overall, 23% of investors hold digital assets, and more than half plan to increase their allocation within a year. Fidelity states that digital assets will reach a critical turning point in 2025, as regulatory frameworks become clearer and investment channels improve, leading to a significant increase in institutional participation.

MarketWhisper·12-15 07:10

What Is the Most Used Blockchain? Data Shows Solana Leading Over Ethereum in 2025

In the competitive landscape of blockchain networks, determining the "most used" chain involves analyzing key metrics like Total Value Locked (TVL), transaction volumes, user counts, fee revenues, and value transfers—areas where Solana has shown remarkable growth compared to Ethereum and its Layer-2 solutions.

CryptopulseElite·12-15 06:21

Crazy accumulation of 3.86 million ETH, what is the investment logic of the "brainless bull" Tom Lee?

From multiple interviews with Tom Lee, we can roughly see his long-term optimistic core logic about Ethereum:

1. Ethereum is the core settlement layer for future financial infrastructure.

ETH is not only a digital currency but also the infrastructure for building and operating DeFi, stablecoins, NFTs, on-chain markets, RWA, and more. Especially in terms of RWA, this will be the biggest narrative in the future. Wall Street is bringing trillions of assets (bonds/stocks, etc.) on-chain to Ethereum. As the dominant settlement layer, Ethereum will generate a large demand and drive the increase in ETH value. Tokenization is not short-term speculation but a structural transformation that will drive ETH into a bull market independent of BTC.

2. Institutional adoption and ecosystem maturity.

Currently, approximately 4 million BTC wallets worldwide hold over $10,000 in assets, while the global holdings of stocks/pension accounts with similar amounts are about 900 million, a gap of over 200 times.

PANews·12-15 06:07

Gate Research Institute: Market Under Pressure and Consolidation | BTC Upward Momentum Restricted by Options Structure

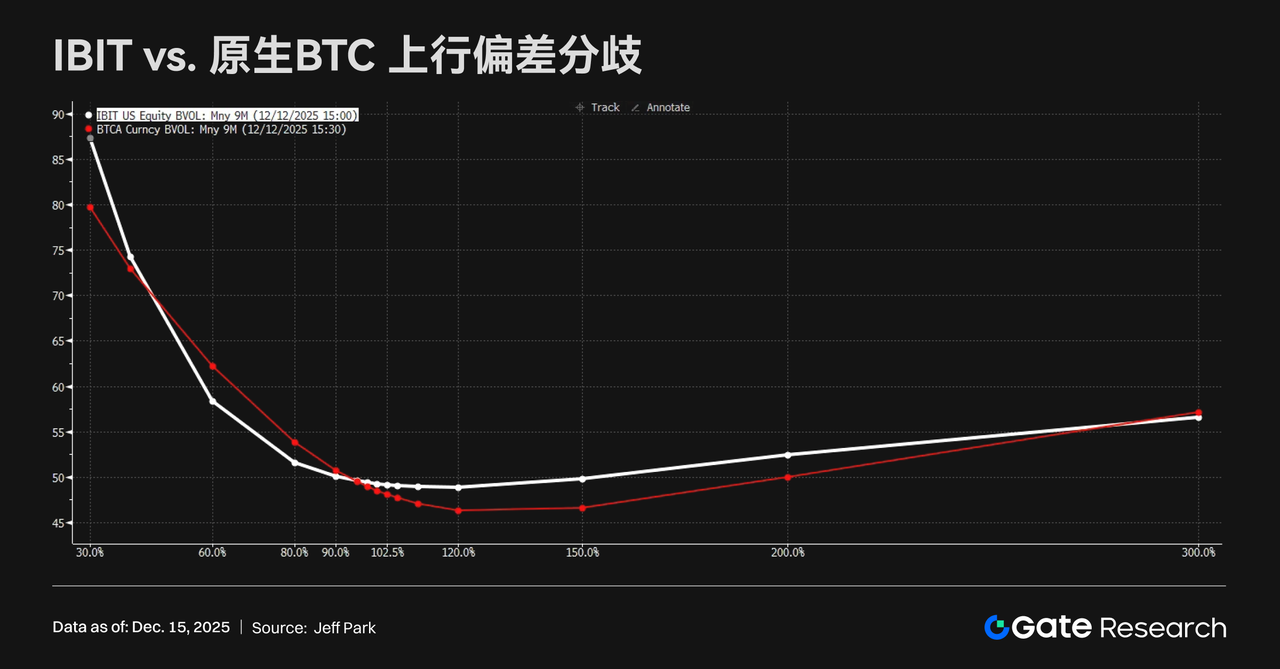

Gate Research Institute Daily Report: December 15 — The overall crypto market continues to face pressure, with BTC and ETH maintaining low-level consolidation, while GT shows relative resilience. Under the weak performance of mainstream coins, tokens such as FHE, ICE, and BAS have reversed trends and strengthened amid catalysts like privacy computing collaborations with Chainlink, token migrations and mainnet transitions, as well as ERC-8004 protocol upgrades, reflecting a concentrated battle for structural opportunities among funds. The structural selling pressure in the options market still suppresses BTC upside momentum. The divergence between ETF bullish demand and OG holders selling volatility suggests that BTC is more likely to remain in short-term consolidation rather than make rapid breakthroughs; Ant International is reconstructing corporate treasury management systems through blockchain, AI, and tokenized deposits; after the mainnet launch of Stable, on-chain activity has been below expectations, highlighting ongoing challenges for the differentiated implementation of stablecoin public chains.

GateResearch·12-15 05:40

Institutional Demand Stays Strong as Bitcoin, Ethereum, Solana, ETFs Add $530M

Institutional demand for crypto stayed strong last week. From December 8 to December 12, spot ETFs tracking Bitcoin, Ethereum, and Solana pulled in a combined $530 million. The steady inflows came despite choppy prices and cautious market sentiment

Bitcoin led the pack. U.S. spot Bitcoin ETFs

Coinfomania·12-15 05:32

Cathie Wood Ranks Her Top Crypto Winners for the Next 3–5 Years: BTC, ETH, SOL

Bitcoin leads due to liquidity, institutional adoption, and declining volatility.

Ethereum attracts institutions building scalable, structured blockchain infrastructure.

Solana targets consumers with speed, simplicity, and direct real-world usage.

Cathie Wood has never shied away from bold

CryptoNewsLand·12-15 05:14

Month-old Ethereum client bug blamed for Prysm outage

A bug in Prysm, introduced on a testnet before Ethereum's Fusaka upgrade, caused node validation issues, impacting performance and leading to missed rewards for validators. The incident raises concerns over client diversity in the Ethereum network.

Cointelegraph·12-15 04:59

Cardano accelerates DeFi, targeting Ethereum and Solana's capital flow through Pyth

Cardano has taken an important step this week by fundamentally changing the network's approach to market infrastructure.

Within the framework of Pentad and Intersect governance, which have just officially gone live, the coordinating committee approved the deployment of the low-latency oracle suite of

TapChiBitcoin·12-15 03:33

What is Tempo? Stripe enters the blockchain aiming at the 2 trillion stablecoin market

What is Tempo? It is a Layer 1 blockchain jointly developed by the $90 billion fintech giant Stripe and top crypto venture Paradigm, designed specifically for stablecoin payments and traditional financial institutions. Its core innovations include dedicated payment channels ensuring each transaction costs only one-tenth of a cent, the ability to pay Gas directly with any USD stablecoin without native tokens, and built-in stablecoin DEX for automatic conversions.

MarketWhisper·12-15 03:30

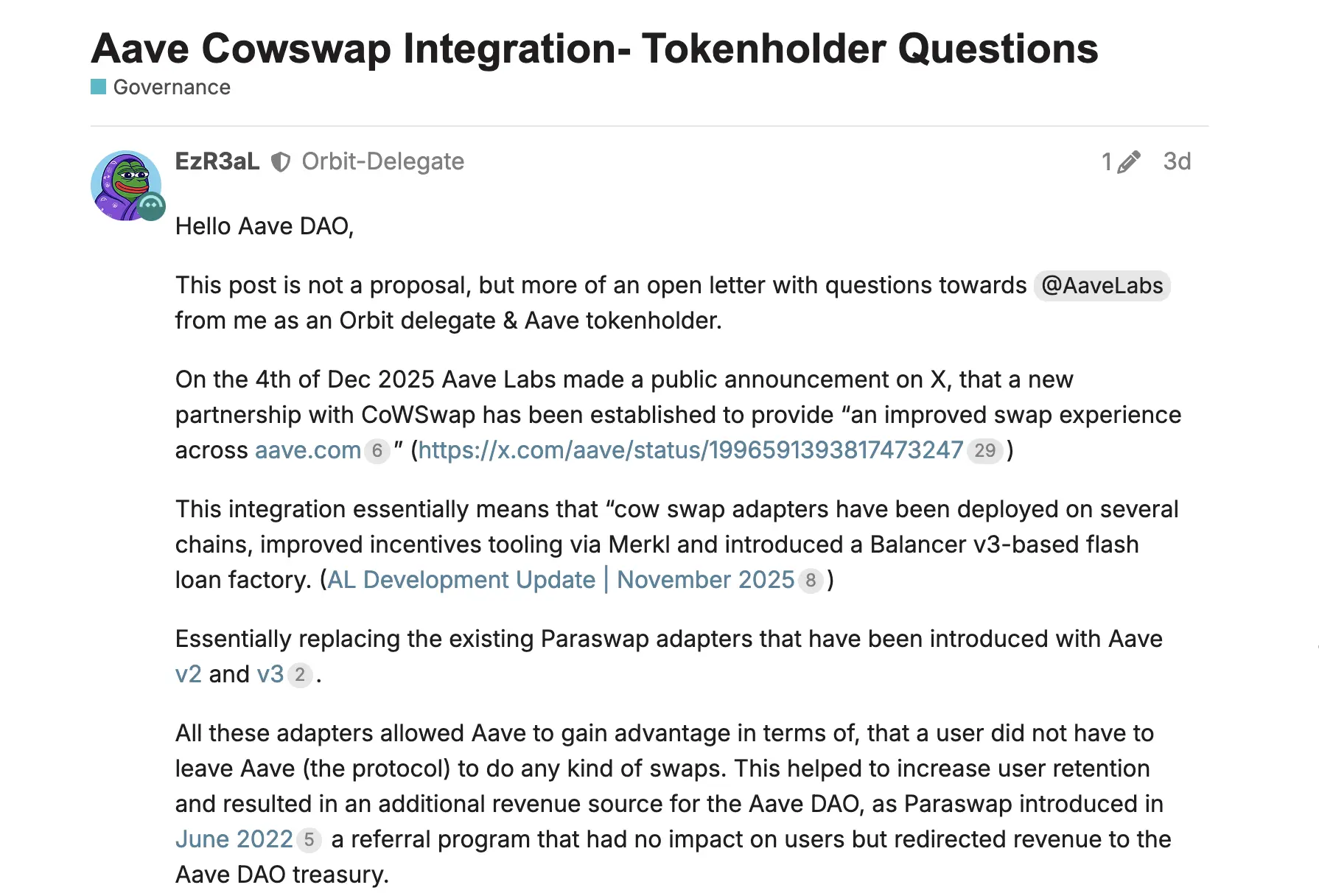

Aave Governance Crisis! Laboratory Embezzles $10 Million in Fees, Igniting Community Outrage

Aave Decentralized Autonomous Organization (DAO) and Aave Labs have erupted into a heated conflict over fee distribution issues related to CoW Swap integration. DAO members revealed that the fees generated from using CoW Swap for crypto asset exchanges are flowing into private addresses controlled by Aave Labs, rather than the Aave DAO treasury. This has resulted in a weekly loss of approximately $200,000 worth of Ethereum, amounting to an annual loss of up to $10 million.

MarketWhisper·12-15 03:04

Gate Daily (December 15): SEC releases crypto custody guidelines; UK plans to implement crypto regulation rules by 2027

Bitcoin (BTC) opened this week with a sharp decline, currently around $88,460 as of December 15. The UK Treasury plans to establish crypto regulatory rules, to be implemented starting in 2027. The U.S. Securities and Exchange Commission (SEC) released crypto custody guidelines aimed at educating investors. Hong Kong Legislative Council member Wu Jiezhuang was successfully re-elected, promising to continue promoting Web3 development.

MarketWhisper·12-15 01:21

Load More

Hot Tags

Hot Topics

MoreCrypto Calendar

MoreHayabusa Yükseltmesi

VeChain, Aralık ayında planlanan Hayabusa yükseltmesini duyurdu. Bu yükseltmenin, protokol performansını ve tokenomi'yi önemli ölçüde artırmayı hedeflediği belirtiliyor ve ekip, bu güncellemeyi bugüne kadarki en çok fayda odaklı VeChain sürümü olarak nitelendiriyor.

2025-12-27

Litewallet Gün Batımları

Litecoin Vakfı, Litewallet uygulamasının 31 Aralık'ta resmi olarak sona ereceğini duyurdu. Uygulama artık aktif olarak korunmamakta olup, bu tarihe kadar yalnızca kritik hata düzeltmeleri yapılacaktır. Destek sohbeti de bu tarihten sonra sona erecektir. Kullanıcıların Nexus Cüzdan'a geçiş yapmaları teşvik edilmektedir; Litewallet içinde geçiş araçları ve adım adım bir kılavuz sağlanmıştır.

2025-12-30

OM Token Göçü Sona Erdi

MANTRA Chain, kullanıcıları OM token'larını 15 Ocak'tan önce MANTRA Chain ana ağına taşımaları için bir hatırlatma yayınladı. Taşıma işlemi, $OM'nin yerel zincirine geçişi sırasında ekosistemdeki katılıma devam edilmesini sağlar.

2026-01-14

CSM Fiyat Değişikliği

Hedera, Ocak 2026'dan itibaren KonsensüsSubmitMessage hizmeti için sabit USD ücretinin $0.0001'den $0.0008'e yükseleceğini duyurdu.

2026-01-27

Vesting Kilidi Gecikti

Router Protocol, ROUTE tokeninin Hakediş kilidinin 6 aylık bir gecikme ile açılacağını duyurdu. Ekip, projenin Open Graph Architecture (OGA) ile stratejik uyum sağlamak ve uzun vadeli ivmeyi koruma hedefini gecikmenin başlıca nedenleri olarak belirtiyor. Bu süre zarfında yeni kilit açılımları gerçekleşmeyecek.

2026-01-28