Post content & earn content mining yield

placeholder

通讯员

$XPL Crazy! 🚀

Entry: $0.0935 - $0.0945 🟩

Target 1: $0.1015 🎯

Target 2: $0.1050 🎯

Target 3: $0.1120 🎯

Stop Loss: $0.0875 🛑

Massive accumulation confirmed. Trading volume is exploding. Bullish momentum is undeniable. This is not a drill. The bull market is sprinting. Join now, don’t wait too long. The chart is screaming opportunity. This is your chance to make significant gains. Don’t get left behind.

Disclaimer: Risk is your own. $XPL #Gate广场发帖领五万美金红包

Entry: $0.0935 - $0.0945 🟩

Target 1: $0.1015 🎯

Target 2: $0.1050 🎯

Target 3: $0.1120 🎯

Stop Loss: $0.0875 🛑

Massive accumulation confirmed. Trading volume is exploding. Bullish momentum is undeniable. This is not a drill. The bull market is sprinting. Join now, don’t wait too long. The chart is screaming opportunity. This is your chance to make significant gains. Don’t get left behind.

Disclaimer: Risk is your own. $XPL #Gate广场发帖领五万美金红包

XPL19,59%

- Reward

- like

- Comment

- Repost

- Share

Alts vs BTC Falling Wedge 🔥

If 126K marked the BTC cycle top, then when macro liquidity rotates, it will chase asymmetric upside in alts like $TNSR , $BERA , and $0G .

History shows the potential:

- 2017 → Alts ran 10x–100x

- 2020–21 → TOTAL2 surged ~+1800%

Right now, sentiment is dead. Replies are full of disbelief—and that’s exactly what signals we’re near the bottom. Retail always shows up late, at the top. $TNSR $BERA $OG

If 126K marked the BTC cycle top, then when macro liquidity rotates, it will chase asymmetric upside in alts like $TNSR , $BERA , and $0G .

History shows the potential:

- 2017 → Alts ran 10x–100x

- 2020–21 → TOTAL2 surged ~+1800%

Right now, sentiment is dead. Replies are full of disbelief—and that’s exactly what signals we’re near the bottom. Retail always shows up late, at the top. $TNSR $BERA $OG

- Reward

- like

- Comment

- Repost

- Share

Brothers, take a few minutes to seriously read the BTC post. Wishing everyone a Happy New Year and great wealth in 2026!#我在Gate广场过新年

$BTC "The Book of Changes" (I Ching) Hexagram 44 "Gou" (Coming Upon) states: "There is wind in the sky, Gou; later, it issues commands to the four directions." The upper trigram Qian represents Heaven, and the lower trigram Xun represents Wind. Wind spreads across the world, penetrating everywhere, symbolizing an unexpected encounter. However, this "meeting" is not all joy— the hexagram clearly states: "A young woman, do not take her," implying that those who

$BTC "The Book of Changes" (I Ching) Hexagram 44 "Gou" (Coming Upon) states: "There is wind in the sky, Gou; later, it issues commands to the four directions." The upper trigram Qian represents Heaven, and the lower trigram Xun represents Wind. Wind spreads across the world, penetrating everywhere, symbolizing an unexpected encounter. However, this "meeting" is not all joy— the hexagram clearly states: "A young woman, do not take her," implying that those who

View Original

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 1

- Comment

- Repost

- Share

骋骋

骋骋

Created By@ChainStrategyStudyGroup-

Listing Progress

0.00%

MC:

$2.42K

More Tokens

In a bear market, all the news-based rebounds are just paper tigers.

Woke up to the sky falling again, BlackRock is also here to scam, this circle is completely rotten.

To trade successfully, you need to learn to sell the news. Yesterday, BlackRock announced a 40% increase in purchases of UNI.

Today, UNI's gains have already been wiped out, leaving only a long lightning rod. The liquidity in the bear market is still too poor.

Chasing after news usually results in being buried. Every piece of good news in a bear market is premeditated harvest.

Are you okay if you bought $uni yesterda

View OriginalWoke up to the sky falling again, BlackRock is also here to scam, this circle is completely rotten.

To trade successfully, you need to learn to sell the news. Yesterday, BlackRock announced a 40% increase in purchases of UNI.

Today, UNI's gains have already been wiped out, leaving only a long lightning rod. The liquidity in the bear market is still too poor.

Chasing after news usually results in being buried. Every piece of good news in a bear market is premeditated harvest.

Are you okay if you bought $uni yesterda

- Reward

- like

- Comment

- Repost

- Share

#AIBT Those with coins, please hold on tight and stay steady while waiting for AIBT to take off.

View Original

- Reward

- like

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VLRBAW9BBW

View Original

- Reward

- like

- Comment

- Repost

- Share

#Gate广场发帖领五万美金红包

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VVHGAFFYVA

View OriginalParticipate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VVHGAFFYVA

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- 3

- Repost

- Share

DriedConfusion :

:

Sold out at noon too, sold at 7.177View More

We never really saw a bull market in #BTC barely a decompression from 2022 dump

Alts were always losing wrt to #BTC

Alts were always losing wrt to #BTC

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Market structure:Short-term consolidation continues without confirmed breakout

- Reward

- like

- Comment

- Repost

- Share

Gm and happy Thursday ☕️

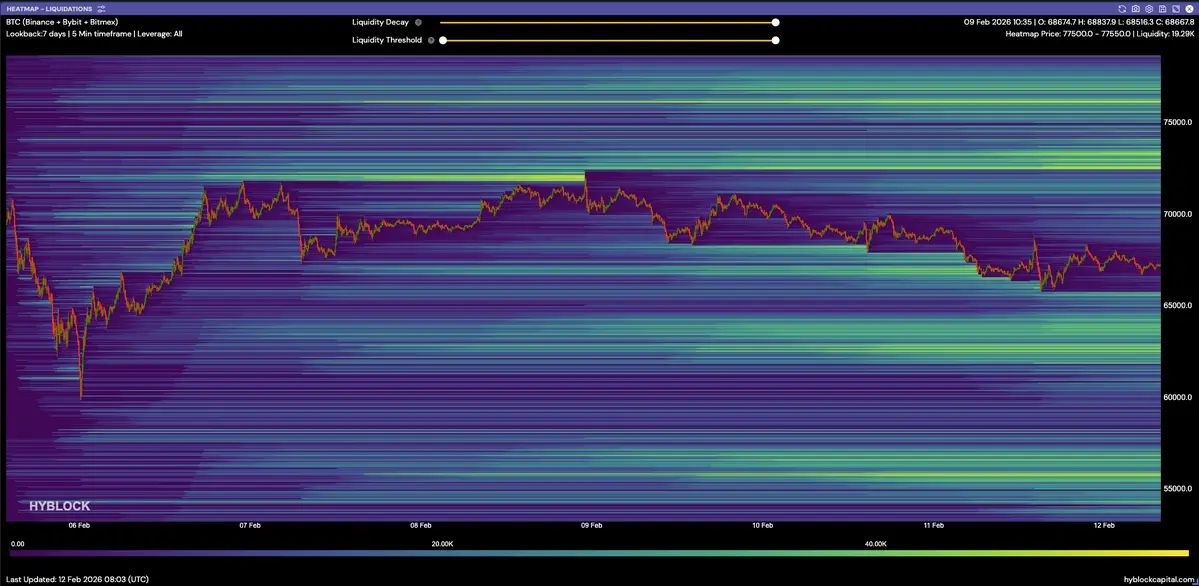

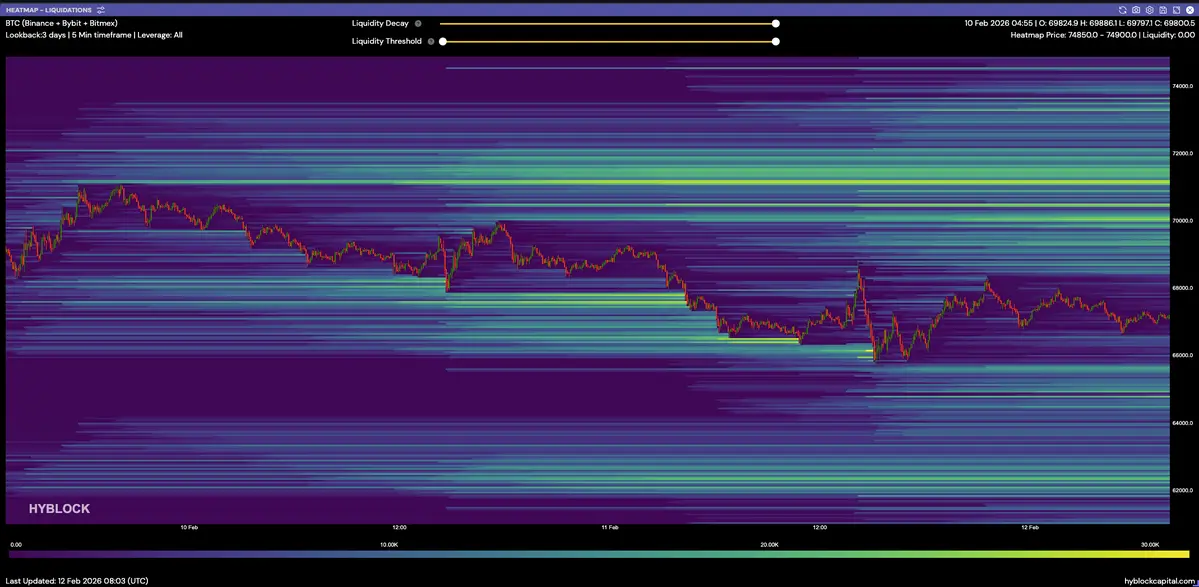

$BTC Update & Hyblock Heatmaps

Bitcoin is slowly trending down and no longer in a compression below resistance.

This is post-distribution phase, and the market is deciding whether this zone becomes a base or a pause before continuation.

From here:

Stabilization and consolidation at this level would be a first sign of strength.

Failure to hold opens the door to a deeper sweep into the next lower liquidity pools.

Have a great day and see you soon!

$BTC Update & Hyblock Heatmaps

Bitcoin is slowly trending down and no longer in a compression below resistance.

This is post-distribution phase, and the market is deciding whether this zone becomes a base or a pause before continuation.

From here:

Stabilization and consolidation at this level would be a first sign of strength.

Failure to hold opens the door to a deeper sweep into the next lower liquidity pools.

Have a great day and see you soon!

- Reward

- like

- Comment

- Repost

- Share

cgod

陈神之路

Created By@GateUser-8953e191

Listing Progress

0.00%

MC:

$2.41K

More Tokens

GM chat <3

Woke up to a ton of DMs about the Xeet cards, let me wake up first and we’ll sort it out.

Didn’t expect this much interest.

I’ll prioritise friends and people I’ve built real connections with, then we’ll form a solid squad.

Woke up to a ton of DMs about the Xeet cards, let me wake up first and we’ll sort it out.

Didn’t expect this much interest.

I’ll prioritise friends and people I’ve built real connections with, then we’ll form a solid squad.

- Reward

- like

- Comment

- Repost

- Share

Most founders hide their burn rate until they're 60 days from zero.

Then they panic raise at whatever terms they can get..

The uncomfortable truth: if you can't explain where every dollar went last quarter, you're not ready to ask for more.

Transparency isn't optional there.

Lesson in that for many.

Then they panic raise at whatever terms they can get..

The uncomfortable truth: if you can't explain where every dollar went last quarter, you're not ready to ask for more.

Transparency isn't optional there.

Lesson in that for many.

- Reward

- like

- Comment

- Repost

- Share

Join the horse racing predictions, complete tasks to earn horse racing tickets, enjoy daily million Gift Coins giveaways, and share a 100,000 USDT prize pool—all at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=XgNAUVAK

- Reward

- like

- Comment

- Repost

- Share

BTC Micro Trend Analysis on Lower Timeframes

- Reward

- like

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=AGDBU19C

View Original

- Reward

- like

- Comment

- Repost

- Share

On February 12, according to Lookonchain monitoring, trader 0xC6F5 closed his ETH long position 9 hours ago, incurring a loss of $547,000.

However, just 2 hours ago, he opened a new long position with 9,366 ETH (worth $18.44 million) at 25x leverage. #Gate广场发帖领五万美金红包

However, just 2 hours ago, he opened a new long position with 9,366 ETH (worth $18.44 million) at 25x leverage. #Gate广场发帖领五万美金红包

ETH0,48%

- Reward

- 1

- 1

- Repost

- Share

DragonSoars :

:

111111111111111111111111111111$UNI / USDT –

This chart is defined by a single event: a sharp liquidity expansion from the 3.22 base into 4.57, followed by immediate rejection. That vertical candle is not trend continuation it’s liquidity being taken above a thin range.

After the spike, price sold off aggressively and has now compressed back around 3.40–3.45. That tells you two things:

first, late buyers at the highs are trapped; second, price is back inside the prior value area.

Structure on the 1H is neutral to weak. The impulse high at 4.57 stands as clear buy-side liquidity already cleared. Since then, we’ve seen lower

This chart is defined by a single event: a sharp liquidity expansion from the 3.22 base into 4.57, followed by immediate rejection. That vertical candle is not trend continuation it’s liquidity being taken above a thin range.

After the spike, price sold off aggressively and has now compressed back around 3.40–3.45. That tells you two things:

first, late buyers at the highs are trapped; second, price is back inside the prior value area.

Structure on the 1H is neutral to weak. The impulse high at 4.57 stands as clear buy-side liquidity already cleared. Since then, we’ve seen lower

UNI3,19%

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More6.05K Popularity

2.89K Popularity

1.41K Popularity

32.25K Popularity

246.69K Popularity

News

View MoreEspresso(ESP) will launch spot trading in the Gate Layer1 zone on February 12, with pre-market contracts synchronized and converted to standard perpetual contracts.

9 m

XRP Community Day ignites market expectations. With ETF funds backing, can the price break through $1.50?

10 m

Gate Launchpool Episode 360 is now live with Aztec(AZTEC). Stake BTC, USDT, or AZTEC to share airdrops of 2,587,500 AZTEC.

10 m

Gate founder Dr. Han delivers a speech at Consensus HK, exploring the evolution of Web3 driven by intelligence

20 m

Ju.com launches multi-currency 30-day fixed-term financial products, with an annualized rate of up to 15%

21 m

Pin