# CryptoMarket

74.91K

GateUser-9a01c836

In uncertain markets, discipline becomes your edge. 📉📈

Clear entries, defined risk, and patience help traders survive volatility and catch real opportunities. #GateioSquare #CryptoMarket #Trading

Clear entries, defined risk, and patience help traders survive volatility and catch real opportunities. #GateioSquare #CryptoMarket #Trading

- Reward

- 1

- 7

- Repost

- Share

GateUser-9a01c836 :

:

1000x VIbes 🤑View More

Markets don’t move on emotion, but traders do. 🧠

Staying calm, following data, and respecting risk are the keys to long-term success in volatile conditions. #GateioSquare #CryptoMarket #Trading

Staying calm, following data, and respecting risk are the keys to long-term success in volatile conditions. #GateioSquare #CryptoMarket #Trading

- Reward

- 1

- 9

- Repost

- Share

GateUser-9a01c836 :

:

DYOR 🤓View More

#FedRateDecisionApproaches FedRateDecisionApproaches 🚨

The market is entering a high-volatility zone. As the Federal Reserve rate decision gets closer, liquidity is tightening and traders are positioning aggressively.

Interest rate decisions don’t just move stocks — they shake crypto, gold, dollar strength, and global risk sentiment.

If rates stay higher for longer →

Risk assets like BTC may face short-term pressure.

If dovish signals appear →

Expect momentum, liquidity expansion, and potential upside volatility.

This is not the time for emotional trades.

This is the time for:

• Risk manageme

The market is entering a high-volatility zone. As the Federal Reserve rate decision gets closer, liquidity is tightening and traders are positioning aggressively.

Interest rate decisions don’t just move stocks — they shake crypto, gold, dollar strength, and global risk sentiment.

If rates stay higher for longer →

Risk assets like BTC may face short-term pressure.

If dovish signals appear →

Expect momentum, liquidity expansion, and potential upside volatility.

This is not the time for emotional trades.

This is the time for:

• Risk manageme

BTC0,43%

- Reward

- 8

- 8

- Repost

- Share

Peacefulheart :

:

2026 GOGOGO 👊View More

In uncertain markets, discipline becomes your edge. 📉📈

Clear entries, defined risk, and patience help traders survive volatility and catch real opportunities. #GateioSquare #CryptoMarket #Trading

Clear entries, defined risk, and patience help traders survive volatility and catch real opportunities. #GateioSquare #CryptoMarket #Trading

- Reward

- 1

- Comment

- Repost

- Share

🟣 Solana (SOL) Near Critical Retest of $119 — Key Levels to Watch

The broader crypto market remains under pressure, and Solana continues to trade deep in the red as selling momentum intensifies.

On Jan 25, well-known crypto analyst Ali Martinez highlighted that SOL is still facing downside pressure and may be heading toward a retest of its 2025 lows.

🔹 New Support Zone Emerging SOL appears to be in an extended correction phase. On-chain data suggests a potential new support zone around $119.

After rallying to $144.62 last week, Solana faced strong resistance near the $144 level and was repea

The broader crypto market remains under pressure, and Solana continues to trade deep in the red as selling momentum intensifies.

On Jan 25, well-known crypto analyst Ali Martinez highlighted that SOL is still facing downside pressure and may be heading toward a retest of its 2025 lows.

🔹 New Support Zone Emerging SOL appears to be in an extended correction phase. On-chain data suggests a potential new support zone around $119.

After rallying to $144.62 last week, Solana faced strong resistance near the $144 level and was repea

SOL1,79%

- Reward

- 1

- Comment

- Repost

- Share

⚠️ US Government Shutdown Risk Spikes to 81%

Polymarket now shows an 81% probability of a US government shutdown — political & fiscal uncertainty is back on the table.

📉 If a shutdown happens:

Short-term market volatility spikes

Gold & Silver benefit as safe havens

Crypto reacts mixed: initial risk-off, but potential inflows as alternative hedge

📈 If avoided:

Risk assets like BTC & stocks may rally on relief

Dollar stability could slow safe-haven flows

💡 Markets are watching Washington closely — headline risk is alive.

Are you hedging or staying risk-on?

#USGovShutdown #CryptoMarket #BTC #G

Polymarket now shows an 81% probability of a US government shutdown — political & fiscal uncertainty is back on the table.

📉 If a shutdown happens:

Short-term market volatility spikes

Gold & Silver benefit as safe havens

Crypto reacts mixed: initial risk-off, but potential inflows as alternative hedge

📈 If avoided:

Risk assets like BTC & stocks may rally on relief

Dollar stability could slow safe-haven flows

💡 Markets are watching Washington closely — headline risk is alive.

Are you hedging or staying risk-on?

#USGovShutdown #CryptoMarket #BTC #G

BTC0,43%

- Reward

- 2

- 1

- Repost

- Share

CryptoChampion :

:

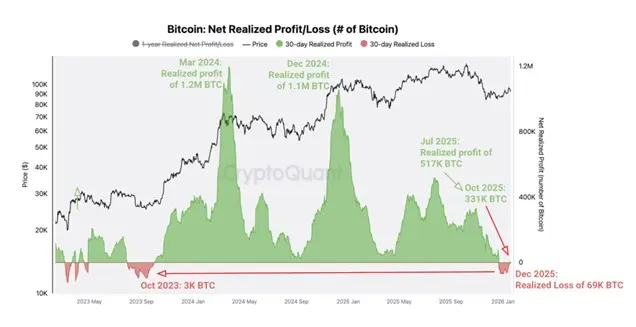

2026 GOGOGO 👊$BTC 💥 Realized Profits Are Drying Up

• Earlier peaks: >1M BTC locked in profits

• Now: Realized losses are rising

What it means:

✅ Weak hands are exiting

✅ Long-term holders remain calm

✅ Late-cycle behavior, not panic

Markets are digesting, not crashing. Watch how disciplined players react — they’re setting up for the next leg.

#CryptoMarket #GoldandSilverHitNewHighs #TrumpWithdrawsEUTariffThreats

• Earlier peaks: >1M BTC locked in profits

• Now: Realized losses are rising

What it means:

✅ Weak hands are exiting

✅ Long-term holders remain calm

✅ Late-cycle behavior, not panic

Markets are digesting, not crashing. Watch how disciplined players react — they’re setting up for the next leg.

#CryptoMarket #GoldandSilverHitNewHighs #TrumpWithdrawsEUTariffThreats

BTC0,43%

- Reward

- 1

- Comment

- Repost

- Share

#FedRateDecisionApproaches FedRateDecisionApproaches 🚨

The market is entering a high-volatility zone. As the Federal Reserve rate decision gets closer, liquidity is tightening and traders are positioning aggressively.

Interest rate decisions don’t just move stocks — they shake crypto, gold, dollar strength, and global risk sentiment.

If rates stay higher for longer →

Risk assets like BTC may face short-term pressure.

If dovish signals appear →

Expect momentum, liquidity expansion, and potential upside volatility.

This is not the time for emotional trades.

This is the time for:

• Risk manageme

The market is entering a high-volatility zone. As the Federal Reserve rate decision gets closer, liquidity is tightening and traders are positioning aggressively.

Interest rate decisions don’t just move stocks — they shake crypto, gold, dollar strength, and global risk sentiment.

If rates stay higher for longer →

Risk assets like BTC may face short-term pressure.

If dovish signals appear →

Expect momentum, liquidity expansion, and potential upside volatility.

This is not the time for emotional trades.

This is the time for:

• Risk manageme

BTC0,43%

- Reward

- 1

- Comment

- Repost

- Share

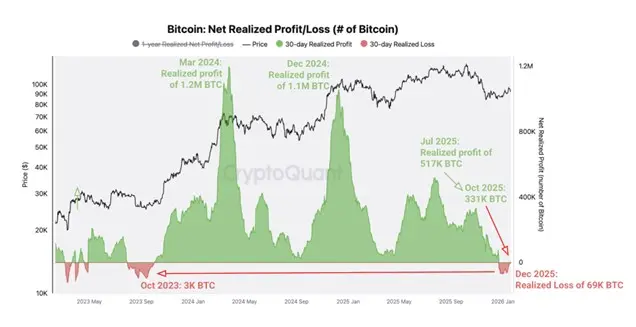

$BTC 💥 Realized Profits Are Drying Up

• Earlier peaks: >1M BTC locked in profits

• Now: Realized losses are rising

What it means:

✅ Weak hands are exiting

✅ Long-term holders remain calm

✅ Late-cycle behavior, not panic

Markets are digesting, not crashing. Watch how disciplined players react — they’re setting up for the next leg.

#CryptoMarket #GoldandSilverHitNewHighs #TrumpWithdrawsEUTariffThreats

• Earlier peaks: >1M BTC locked in profits

• Now: Realized losses are rising

What it means:

✅ Weak hands are exiting

✅ Long-term holders remain calm

✅ Late-cycle behavior, not panic

Markets are digesting, not crashing. Watch how disciplined players react — they’re setting up for the next leg.

#CryptoMarket #GoldandSilverHitNewHighs #TrumpWithdrawsEUTariffThreats

BTC0,43%

- Reward

- 1

- Comment

- Repost

- Share

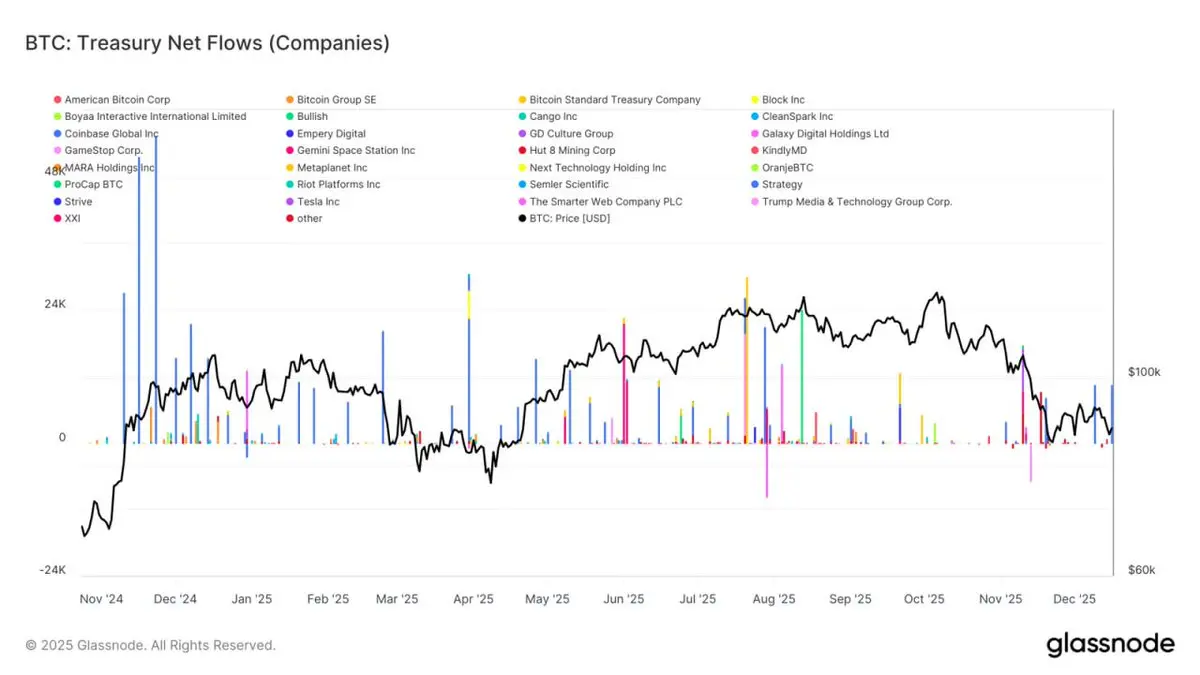

Corporate #Bitcoin treasury activity driven by discrete events rather than sustained accumulation 💼📊. Net flows show sporadic large inflows from few firms with long quiet periods, showing opportunistic not systematic demand ⚡️. Bursts coincide with favorable prices or strategic decisions but haven\'t formed consistent bid shaping market structure 📉👀. Recent weakness didn\'t trigger coordinated treasury accumulation, corporates remain disciplined and price-sensitive 🎯💰. Contributing to flow volatility but not reliable cycle-wide structural demand 📈⚡️. #CryptoMarket $BTC

BTC0,43%

- Reward

- 1

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

554 Popularity

63.68K Popularity

23.26K Popularity

8.06K Popularity

7.19K Popularity

7.23K Popularity

6.08K Popularity

6.07K Popularity

71.71K Popularity

18.44K Popularity

80.74K Popularity

22.96K Popularity

48.61K Popularity

42.84K Popularity

195.23K Popularity

News

View MoreSenior Thai electricity official involved in illegal Bitcoin mining, thousands of devices seized

1 m

USDC and USDT cash outflows trigger market concerns; Bitcoin's rise may be hindered

1 m

Bitwise has registered "Bitwise Uniswap ETF" in Delaware

9 m

2U2.ai builds an AI-driven Meme infrastructure layer, reconstructing the production and dissemination chain of Meme culture

11 m

A major whale deposited 2 million USDC into Hyperliquid and opened a HYPE short position.

11 m

Pin