# Cryptoanalysis

18.26K

ox_Alan

The crypto market is currently navigating one of its most intense periods of volatility in early 2026. Bitcoin (BTC) has experienced a sharp correction, dipping below $80,000 and briefly touching lows around $75,000–$78,000 in recent trading sessions—the weakest levels since mid-2025. Ethereum (ETH) has followed suit, sliding toward the $2,400 range amid broader sell-offs. Over the past weekend alone, liquidations surged dramatically, with billions in leveraged positions wiped out as panic selling intensified. The Fear & Greed Index has plunged into extreme fear territory, prompting the age-ol

- Reward

- 1

- Comment

- Repost

- Share

The crypto market is currently navigating one of its most intense periods of volatility in early 2026. Bitcoin (BTC) has experienced a sharp correction, dipping below $80,000 and briefly touching lows around $75,000–$78,000 in recent trading sessions—the weakest levels since mid-2025. Ethereum (ETH) has followed suit, sliding toward the $2,400 range amid broader sell-offs. Over the past weekend alone, liquidations surged dramatically, with billions in leveraged positions wiped out as panic selling intensified. The Fear & Greed Index has plunged into extreme fear territory, prompting the age-ol

- Reward

- 2

- 4

- Repost

- Share

HighAmbition :

:

thanks for the updateView More

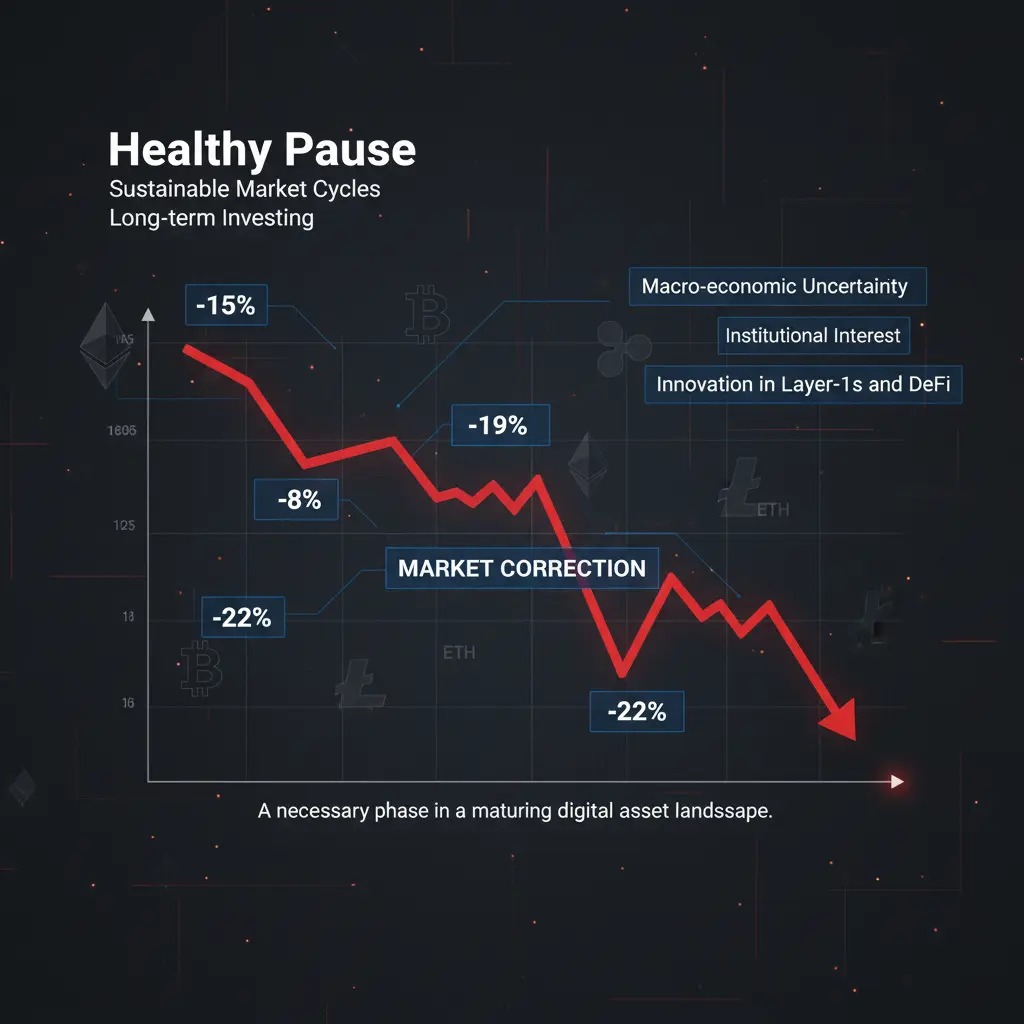

📉 Crypto Market Pullback: A Healthy Pause in a Maturing Market

The recent Crypto Market Pullback has caught the attention of traders and long-term investors alike, but it’s important to view this phase with perspective. After an extended period of strong rallies and optimistic sentiment, markets naturally cool down as profits are taken and leverage is reduced. Such pullbacks are not signs of weakness; rather, they are a normal and necessary part of sustainable market cycles.

Macro-economic uncertainty, shifting liquidity conditions, and cautious risk appetite have also contributed to the shor

The recent Crypto Market Pullback has caught the attention of traders and long-term investors alike, but it’s important to view this phase with perspective. After an extended period of strong rallies and optimistic sentiment, markets naturally cool down as profits are taken and leverage is reduced. Such pullbacks are not signs of weakness; rather, they are a normal and necessary part of sustainable market cycles.

Macro-economic uncertainty, shifting liquidity conditions, and cautious risk appetite have also contributed to the shor

DEFI4,54%

- Reward

- 5

- 10

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

Bitcoin is showing some interesting movements today. After a period of consolidation, it seems like the bulls are trying to push through the major resistance levels. 📊

Key things to watch:

Support Zone: If BTC stays above the current support, we might see another leg up soon.

Volume: Trading volume on Gate.io is looking healthy, which is a good sign for volatility.

Market Sentiment: Whether you are looking to Open Long or wait for a better entry, always keep your stop-loss in place! 🛡️

What are your thoughts? Is BTC going to hit a new high this week or should we expect a correction? Let me k

Key things to watch:

Support Zone: If BTC stays above the current support, we might see another leg up soon.

Volume: Trading volume on Gate.io is looking healthy, which is a good sign for volatility.

Market Sentiment: Whether you are looking to Open Long or wait for a better entry, always keep your stop-loss in place! 🛡️

What are your thoughts? Is BTC going to hit a new high this week or should we expect a correction? Let me k

BTC-1,87%

- Reward

- 2

- Comment

- Repost

- Share

#BitcoinUpdate 🚀

Bitcoin is compressing on higher timeframes — and the 3-day chart is starting to tell a story. Price action is shaping a potential reversal base, the kind that usually forms before momentum returns, not after.

This isn’t random volatility. It’s structure doing its work.

🔹 Key downside reference: $80,600

A sustained close below this level would weaken the setup and force a reassessment. Structure always comes first.

🔹 Alternative scenario:

A brief sweep toward the $78K area followed by a fast recovery would still support a bullish reversal narrative — classic liquidity grab

Bitcoin is compressing on higher timeframes — and the 3-day chart is starting to tell a story. Price action is shaping a potential reversal base, the kind that usually forms before momentum returns, not after.

This isn’t random volatility. It’s structure doing its work.

🔹 Key downside reference: $80,600

A sustained close below this level would weaken the setup and force a reassessment. Structure always comes first.

🔹 Alternative scenario:

A brief sweep toward the $78K area followed by a fast recovery would still support a bullish reversal narrative — classic liquidity grab

BTC-1,87%

- Reward

- 14

- 15

- Repost

- Share

Falcon_Official :

:

2026 GOGOGO 👊View More

📊 Peter Brandt’s Crypto Market Insight – January 30, 2026

Renowned trader Peter Brandt, famous for predicting the 2018 Bitcoin crash, shared a new chart analysis today:

ETH shows a symmetrical triangle formation.

Total crypto market cap is forming an expanding right-angle pattern.

⚡ Key takeaway: Bulls need a clear breakout to dominate, while history suggests these patterns can trigger volatility or bearish pressure.

💡 Brandt’s Bitcoin forecast:

“Bitcoin will bottom out and rebound between August and October, then soar all the way up. At least for now, that’s how it looks.”

📉 Market snapsho

Renowned trader Peter Brandt, famous for predicting the 2018 Bitcoin crash, shared a new chart analysis today:

ETH shows a symmetrical triangle formation.

Total crypto market cap is forming an expanding right-angle pattern.

⚡ Key takeaway: Bulls need a clear breakout to dominate, while history suggests these patterns can trigger volatility or bearish pressure.

💡 Brandt’s Bitcoin forecast:

“Bitcoin will bottom out and rebound between August and October, then soar all the way up. At least for now, that’s how it looks.”

📉 Market snapsho

- Reward

- 22

- 26

- Repost

- Share

repanzal :

:

great post thanks for sharing good informationView More

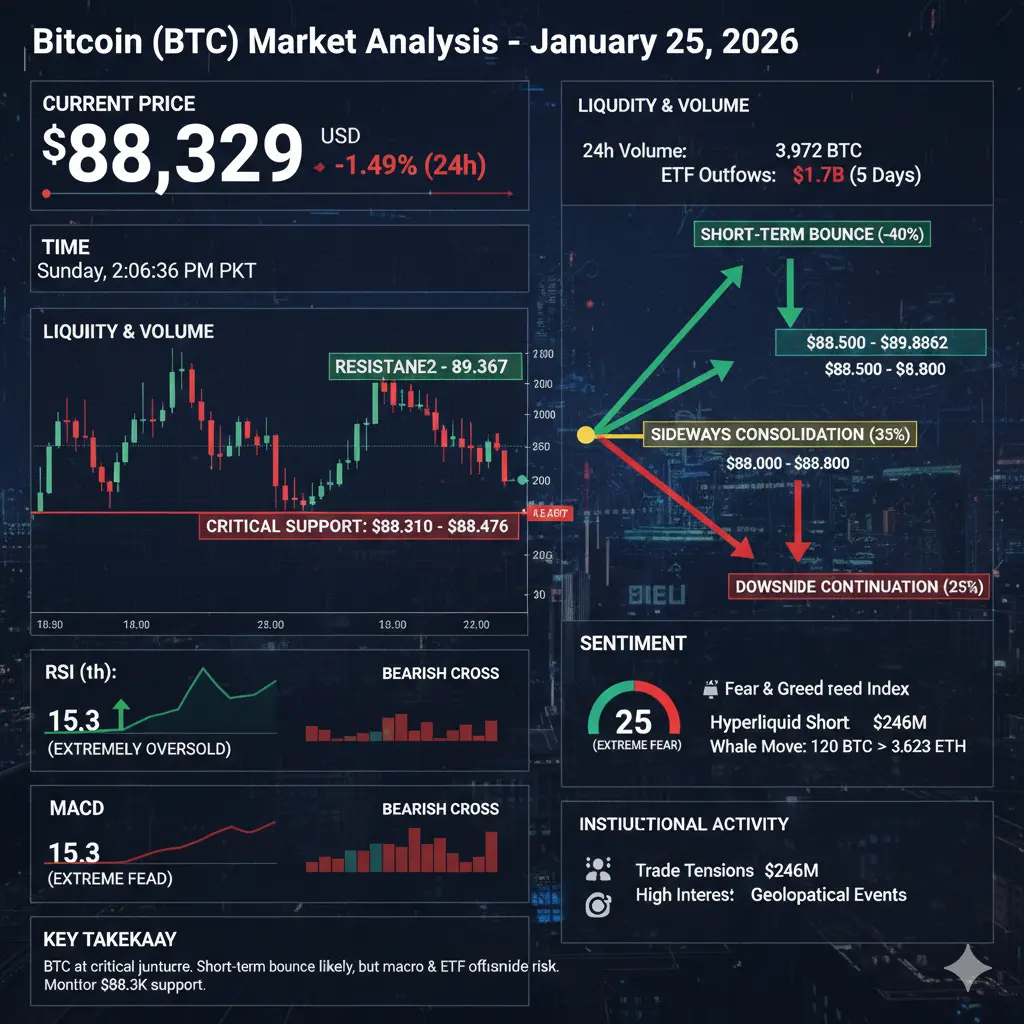

🚨 #BTCMarketAnalysis – Bitcoin Update

Current Price: $88,329 (↓1.49% 24h)

24h Range: $88,128 – $89,673 (~1.75% volatility)

Support / Resistance: $88,310–$88,476 | $88,862–$89,367

🔹 Key Highlights:

Extreme Fear: Fear & Greed Index 25 → panic selling visible

High Volume Sell-Off: 24h volume 3,972 BTC ($354M), ETF outflows $1.7B in 5 days

Technical Oversold: RSI (1h) 15.3, Bollinger Bands below lower band → short-term bounce possible

Liquidity Tightening: Bid-ask spreads widened, institutional shorts rising

📊 Short-Term Outlook (1–3 Days):

Bounce: $88,500–$88,862 (~40% chance)

Consolidation: $

Current Price: $88,329 (↓1.49% 24h)

24h Range: $88,128 – $89,673 (~1.75% volatility)

Support / Resistance: $88,310–$88,476 | $88,862–$89,367

🔹 Key Highlights:

Extreme Fear: Fear & Greed Index 25 → panic selling visible

High Volume Sell-Off: 24h volume 3,972 BTC ($354M), ETF outflows $1.7B in 5 days

Technical Oversold: RSI (1h) 15.3, Bollinger Bands below lower band → short-term bounce possible

Liquidity Tightening: Bid-ask spreads widened, institutional shorts rising

📊 Short-Term Outlook (1–3 Days):

Bounce: $88,500–$88,862 (~40% chance)

Consolidation: $

BTC-1,87%

- Reward

- 2

- 1

- Repost

- Share

Karik254 :

:

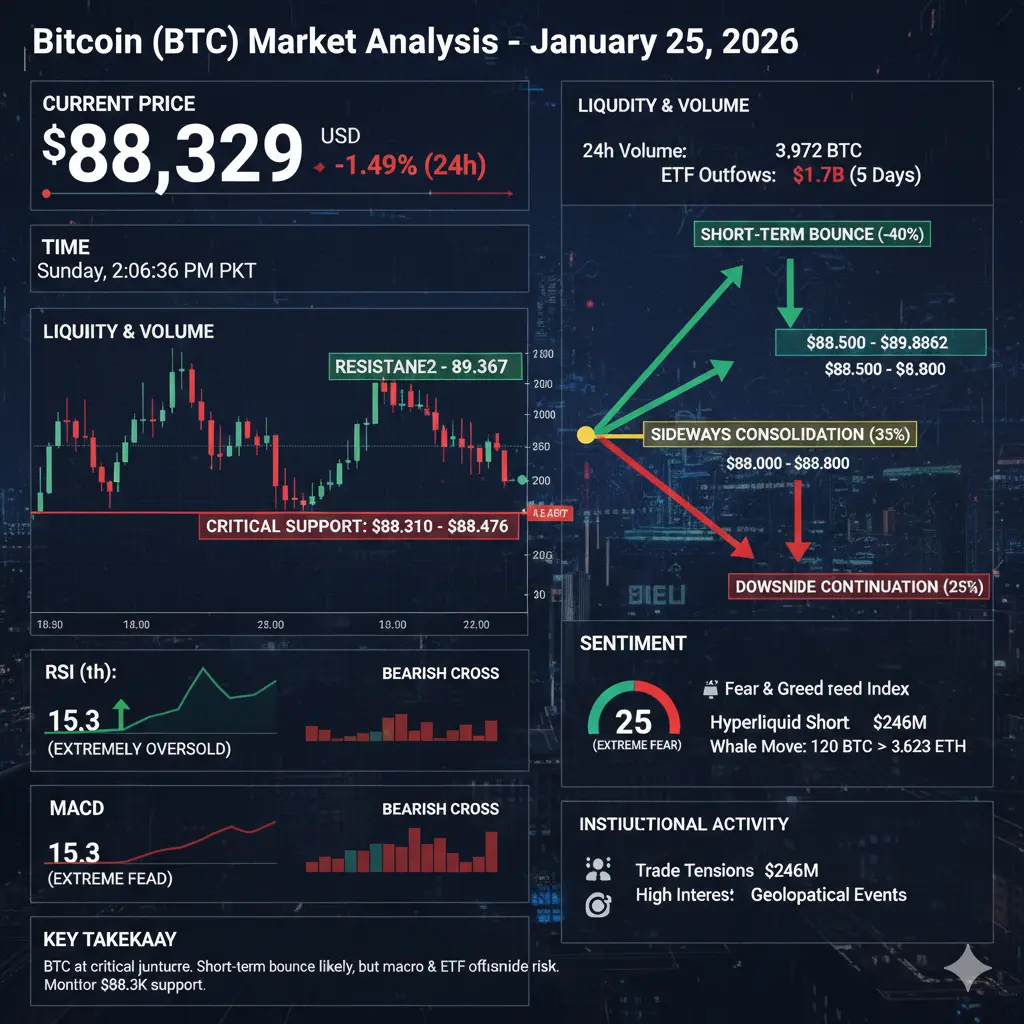

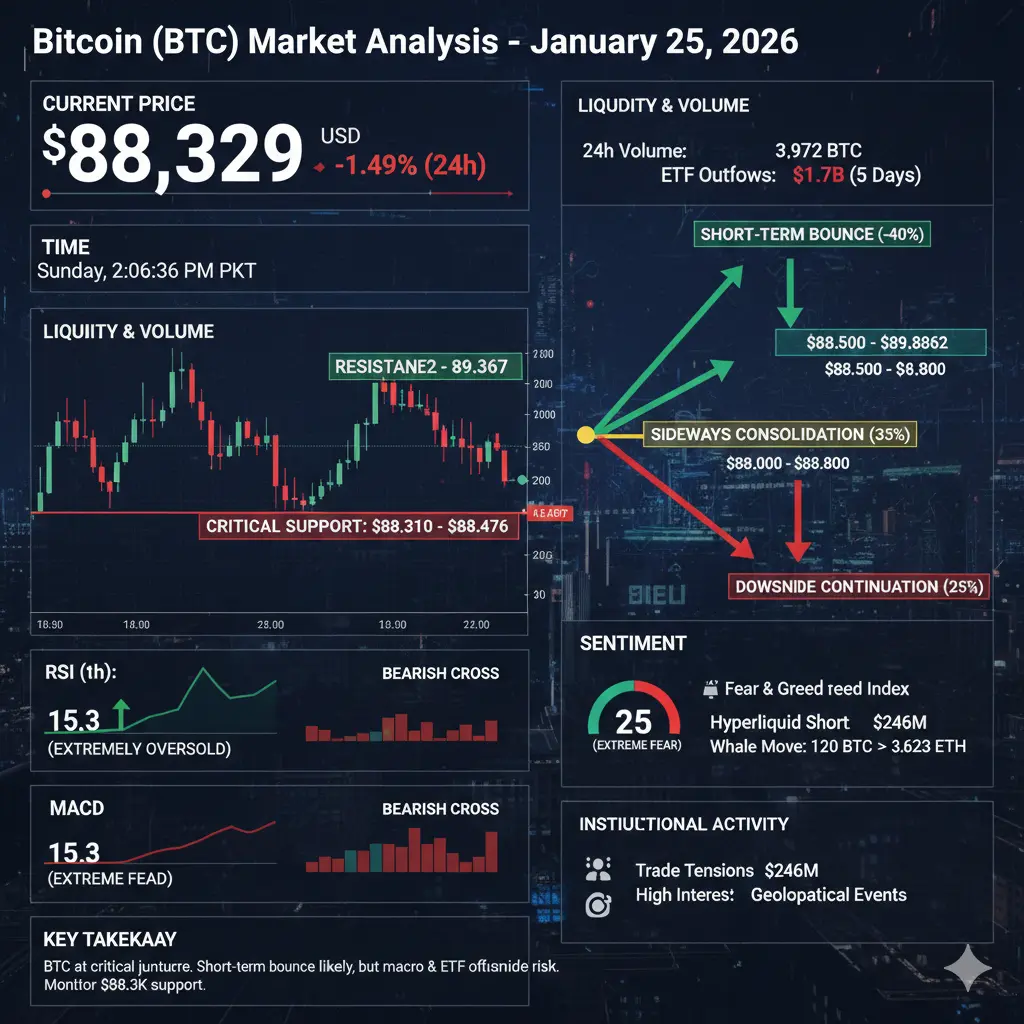

2026 GOGOGO 👊🚨 #BTCMarketAnalysis – Bitcoin Update

Current Price: $88,329 (↓1.49% 24h)

24h Range: $88,128 – $89,673 (~1.75% volatility)

Support / Resistance: $88,310–$88,476 | $88,862–$89,367

🔹 Key Highlights:

Extreme Fear: Fear & Greed Index 25 → panic selling visible

High Volume Sell-Off: 24h volume 3,972 BTC ($354M), ETF outflows $1.7B in 5 days

Technical Oversold: RSI (1h) 15.3, Bollinger Bands below lower band → short-term bounce possible

Liquidity Tightening: Bid-ask spreads widened, institutional shorts rising

📊 Short-Term Outlook (1–3 Days):

Bounce: $88,500–$88,862 (~40% chance)

Consolidation: $

Current Price: $88,329 (↓1.49% 24h)

24h Range: $88,128 – $89,673 (~1.75% volatility)

Support / Resistance: $88,310–$88,476 | $88,862–$89,367

🔹 Key Highlights:

Extreme Fear: Fear & Greed Index 25 → panic selling visible

High Volume Sell-Off: 24h volume 3,972 BTC ($354M), ETF outflows $1.7B in 5 days

Technical Oversold: RSI (1h) 15.3, Bollinger Bands below lower band → short-term bounce possible

Liquidity Tightening: Bid-ask spreads widened, institutional shorts rising

📊 Short-Term Outlook (1–3 Days):

Bounce: $88,500–$88,862 (~40% chance)

Consolidation: $

BTC-1,87%

- Reward

- 1

- Comment

- Repost

- Share

🚀 $CYBER Spot Analysis: Identifying the Reversal Floor for a Long-Term Move

Market Context:

As we move into the second quarter of 2026, the decentralized social layer narrative is regaining traction۔ CyberConnect ($CYBER), a leader in the Web3 social space, is currently exhibiting a classic "Bottoming Out" pattern after a prolonged correction phase۔

The Reversal Zone:

Technical indicators suggest that $CYBER is entering a high-probability "Reversal Zone" between $0.60 and $0.82۔

• Support Base: This range has acted as a significant psychological floor.

• Technical Setup: We are seeing bull

Market Context:

As we move into the second quarter of 2026, the decentralized social layer narrative is regaining traction۔ CyberConnect ($CYBER), a leader in the Web3 social space, is currently exhibiting a classic "Bottoming Out" pattern after a prolonged correction phase۔

The Reversal Zone:

Technical indicators suggest that $CYBER is entering a high-probability "Reversal Zone" between $0.60 and $0.82۔

• Support Base: This range has acted as a significant psychological floor.

• Technical Setup: We are seeing bull

CYBER1,33%

- Reward

- like

- Comment

- Repost

- Share

ETH Technical Outlook | Structured Recovery Within a Broader Correction

Ethereum ($ETH) is showing signs of stabilization after a deep corrective move that followed a strong rejection from the $4,450–$4,950 macro supply zone (0.786–1 Fib). That rejection confirmed a distribution top and pushed price into the $2,620 macro demand area, where buyers stepped in decisively.

From this long-term demand, ETH is now attempting a rounded, structured recovery, printing higher lows—more consistent with early accumulation than panic-driven selling. While short-term momentum is improving, the higher-timefra

Ethereum ($ETH) is showing signs of stabilization after a deep corrective move that followed a strong rejection from the $4,450–$4,950 macro supply zone (0.786–1 Fib). That rejection confirmed a distribution top and pushed price into the $2,620 macro demand area, where buyers stepped in decisively.

From this long-term demand, ETH is now attempting a rounded, structured recovery, printing higher lows—more consistent with early accumulation than panic-driven selling. While short-term momentum is improving, the higher-timefra

ETH-4,36%

- Reward

- 1

- 2

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

34.79K Popularity

69.62K Popularity

370K Popularity

49K Popularity

64.87K Popularity

21.71K Popularity

27.41K Popularity

21.24K Popularity

93.76K Popularity

39.49K Popularity

34.35K Popularity

29.17K Popularity

18.5K Popularity

24.76K Popularity

216.52K Popularity

News

View MoreData: ETH Breaks Through $2300

1 h

Data: BTC surpasses $77,000 in value

1 h

Betting that Bitcoin will fall below $75,000, the options value reaches $1.159 billion, equal to the value of $100,000 call options.

1 h

Sygnum: As Ethereum's supply tightens, 45% of ETH is now locked, reducing circulating supply and potentially impacting market liquidity.

1 h

A certain whale deposited 1,127,000 USDC into Hyperliquid and then opened a short position on BNB.

1 h

Pin