# FedLeadershipImpact

6.74K

Macro expectations are back in focus. How much do they influence your crypto decisions at this stage?

AYATTAC

#FedLeadershipImpact 🪶 AYATTAC Rising star top1 ranking Take: Macro Expectations Back in Focus 📊

🔹 The Human Insight

The "crypto-only" bubble has burst—not in terms of price, but in terms of narrative. Macro signals are aggressively re-entering the spotlight, dictating the pace of the current cycle. We are no longer just watching candles; we are watching liquidity flows, interest rates, and the pulse of global risk-on sentiment.

📊 Main Market Analysis

1. On-Chain & Price Structure

BTC: Maintaining a strong foothold near the $29.5K–$30K support zone.

ETH: Demonstrating resilient accumulatio

🔹 The Human Insight

The "crypto-only" bubble has burst—not in terms of price, but in terms of narrative. Macro signals are aggressively re-entering the spotlight, dictating the pace of the current cycle. We are no longer just watching candles; we are watching liquidity flows, interest rates, and the pulse of global risk-on sentiment.

📊 Main Market Analysis

1. On-Chain & Price Structure

BTC: Maintaining a strong foothold near the $29.5K–$30K support zone.

ETH: Demonstrating resilient accumulatio

- Reward

- 9

- 12

- Repost

- Share

Luna_Star :

:

Buy To Earn 💎View More

#FedLeadershipImpact Fed Leadership Impact on Global Markets and Crypto Outlook

The leadership of the Federal Reserve plays a critical role in shaping global financial markets. Changes in tone, policy direction, or leadership expectations at the Fed often trigger immediate reactions across equities, bonds, commodities, and the crypto market. As investors closely watch signals from the central bank, Fed leadership impact has become one of the most important macro themes influencing market behavior.

At the core of this impact is monetary policy control. The Federal Reserve sets interest rates an

The leadership of the Federal Reserve plays a critical role in shaping global financial markets. Changes in tone, policy direction, or leadership expectations at the Fed often trigger immediate reactions across equities, bonds, commodities, and the crypto market. As investors closely watch signals from the central bank, Fed leadership impact has become one of the most important macro themes influencing market behavior.

At the core of this impact is monetary policy control. The Federal Reserve sets interest rates an

BTC-0,57%

- Reward

- like

- Comment

- Repost

- Share

#FedLeadershipImpact The recent wave of volatility across global markets has been driven less by price action itself and more by a sudden shift in expectations around monetary leadership. The nomination of Kevin Warsh as the next Federal Reserve Chair has introduced a powerful uncertainty premium, forcing investors to reassess not just interest rate trajectories, but the philosophy that may guide monetary policy in the coming years. Markets are rarely afraid of tightening alone; they are afraid of not knowing how far and how fast that tightening may go.

The concept of a “Warsh Effect” is now b

The concept of a “Warsh Effect” is now b

BTC-0,57%

- Reward

- 3

- 1

- Repost

- Share

LittleQueen :

:

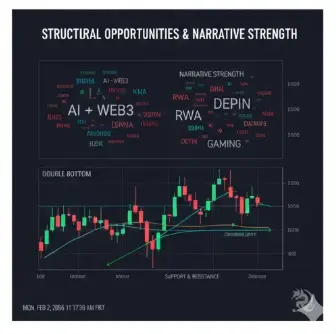

Buy To Earn 💎February 2, 2026 14:50 (UTC+8), BTC is currently trading at $75,300, with a daily low of approximately $74,800, a 24-hour decline of about 5%. Panic selling continues, dominated by bears, oversold but no clear reversal signals.

📊 Key Levels and Indicator Overview

- Resistance: 76,800-77,000 / 79,500 / 80,000 USD; Support: 75,000 / 72,000 / 70,000 USD (Strong support at 72,000 USD).

- Moving Averages: 50/200-day moving averages are in a bearish alignment, with prices significantly deviating from the averages, indicating strong bearish pressure.

- RSI(: 14): 25-28, deeply oversold, possibly a w

📊 Key Levels and Indicator Overview

- Resistance: 76,800-77,000 / 79,500 / 80,000 USD; Support: 75,000 / 72,000 / 70,000 USD (Strong support at 72,000 USD).

- Moving Averages: 50/200-day moving averages are in a bearish alignment, with prices significantly deviating from the averages, indicating strong bearish pressure.

- RSI(: 14): 25-28, deeply oversold, possibly a w

BTC-0,57%

- Reward

- 3

- 2

- Repost

- Share

HeavenSlayerSupporter :

:

2026 Go Go Go 👊View More

#FedLeadershipImpact 📊 Macro Meets Crypto: February Check-In

After months of crypto-focused narratives, macro trends are back in the spotlight. Interest rates, inflation data, and global liquidity are once again influencing market sentiment — not just traditional markets, but digital assets too.

🔥 Why it matters for crypto:

Bitcoin & Ethereum correlations: BTC often reacts to macro shifts like rate hikes or liquidity tightening.

DeFi and Lending: Borrowing costs, stablecoin yields, and liquidity incentives are increasingly affected by global financial conditions.

Investor behavior: Risk appe

After months of crypto-focused narratives, macro trends are back in the spotlight. Interest rates, inflation data, and global liquidity are once again influencing market sentiment — not just traditional markets, but digital assets too.

🔥 Why it matters for crypto:

Bitcoin & Ethereum correlations: BTC often reacts to macro shifts like rate hikes or liquidity tightening.

DeFi and Lending: Borrowing costs, stablecoin yields, and liquidity incentives are increasingly affected by global financial conditions.

Investor behavior: Risk appe

- Reward

- 5

- 2

- Repost

- Share

Peacefulheart :

:

2026 GOGOGO 👊View More

#FedLeadershipImpact #FedLeadershipImpact 🏦⚡

The Fed isn’t just setting rates — it’s shaping market psychology. Leadership changes in 2026 are sending shockwaves through crypto, equities, and commodities alike.

Why it matters:

🔹 Policy Tone Shift: New leadership could redefine liquidity expectations and interest rate paths.

🔹 Market Sentiment: BTC, ETH, and tech stocks respond faster than ever to Fed signals — risk-on or risk-off flows are amplified.

🔹 Macro Dominoes: Dollar strength, Treasury yields, and global capital rotation hinge on who’s at the helm.

Traders and investors: this isn’t

The Fed isn’t just setting rates — it’s shaping market psychology. Leadership changes in 2026 are sending shockwaves through crypto, equities, and commodities alike.

Why it matters:

🔹 Policy Tone Shift: New leadership could redefine liquidity expectations and interest rate paths.

🔹 Market Sentiment: BTC, ETH, and tech stocks respond faster than ever to Fed signals — risk-on or risk-off flows are amplified.

🔹 Macro Dominoes: Dollar strength, Treasury yields, and global capital rotation hinge on who’s at the helm.

Traders and investors: this isn’t

- Reward

- 1

- 3

- Repost

- Share

AYATTAC :

:

Buy To Earn 💎View More

# FedLeadershipImpact

🏛️ Macro is Back:

The Fed's Influence on Crypto

It feels like we are in a "risk-on/risk-off"

mode dictated by central banks once again. With shifting expectations around

interest rates and leadership moves, every word from the Federal Reserve sends

ripples through the market. 📉📈

But let's be honest—how much does this actually dictate

your personal strategy?

We want to know: Are you adjusting

your bags based on macro data, or are you strictly sticking to technicals and

on-chain fundamentals?

👇 Vote with your

comment: 🔹 Heavy

Influence: I trade the Fed's moves. �

🏛️ Macro is Back:

The Fed's Influence on Crypto

It feels like we are in a "risk-on/risk-off"

mode dictated by central banks once again. With shifting expectations around

interest rates and leadership moves, every word from the Federal Reserve sends

ripples through the market. 📉📈

But let's be honest—how much does this actually dictate

your personal strategy?

We want to know: Are you adjusting

your bags based on macro data, or are you strictly sticking to technicals and

on-chain fundamentals?

👇 Vote with your

comment: 🔹 Heavy

Influence: I trade the Fed's moves. �

- Reward

- 1

- Comment

- Repost

- Share

# FedLeadershipImpact

🏛️ Macro is Back:

The Fed's Influence on Crypto

It feels like we are in a "risk-on/risk-off"

mode dictated by central banks once again. With shifting expectations around

interest rates and leadership moves, every word from the Federal Reserve sends

ripples through the market. 📉📈

But let's be honest—how much does this actually dictate

your personal strategy?

We want to know: Are you adjusting

your bags based on macro data, or are you strictly sticking to technicals and

on-chain fundamentals?

👇 Vote with your

comment: 🔹 Heavy

Influence: I trade the Fed's moves. �

🏛️ Macro is Back:

The Fed's Influence on Crypto

It feels like we are in a "risk-on/risk-off"

mode dictated by central banks once again. With shifting expectations around

interest rates and leadership moves, every word from the Federal Reserve sends

ripples through the market. 📉📈

But let's be honest—how much does this actually dictate

your personal strategy?

We want to know: Are you adjusting

your bags based on macro data, or are you strictly sticking to technicals and

on-chain fundamentals?

👇 Vote with your

comment: 🔹 Heavy

Influence: I trade the Fed's moves. �

- Reward

- like

- Comment

- Repost

- Share

#FedLeadershipImpact

The impact of Federal Reserve leadership is once again at the center of global market discussions, as investors closely evaluate how policy direction, communication style, and decision-making at the top influence risk assets. In early 2026, markets are particularly sensitive to signals coming from the Fed, with leadership credibility playing a crucial role in shaping expectations around interest rates, liquidity conditions, and long-term economic stability. Even subtle shifts in tone from Fed officials can ripple across equities, bonds, commodities, and crypto markets, re

The impact of Federal Reserve leadership is once again at the center of global market discussions, as investors closely evaluate how policy direction, communication style, and decision-making at the top influence risk assets. In early 2026, markets are particularly sensitive to signals coming from the Fed, with leadership credibility playing a crucial role in shaping expectations around interest rates, liquidity conditions, and long-term economic stability. Even subtle shifts in tone from Fed officials can ripple across equities, bonds, commodities, and crypto markets, re

- Reward

- 4

- 6

- Repost

- Share

HighAmbition :

:

Watching Closely 🔍️View More

#FedLeadershipImpact

s global markets digest ongoing Fed guidance and potential leadership implications, macro expectations have returned to the forefront of strategic decision-making, especially in the crypto space. Beyond mere rate decisions, Fed leadership shapes expectations around balance sheet management, liquidity injections, forward guidance on inflation, and even regulatory stances that indirectly impact risk assets. For cryptocurrencies, this influence is increasingly pronounced: Bitcoin and Ethereum have shown heightened sensitivity to macro indicators, while altcoins like XRP, DOG

s global markets digest ongoing Fed guidance and potential leadership implications, macro expectations have returned to the forefront of strategic decision-making, especially in the crypto space. Beyond mere rate decisions, Fed leadership shapes expectations around balance sheet management, liquidity injections, forward guidance on inflation, and even regulatory stances that indirectly impact risk assets. For cryptocurrencies, this influence is increasingly pronounced: Bitcoin and Ethereum have shown heightened sensitivity to macro indicators, while altcoins like XRP, DOG

- Reward

- 4

- 4

- Repost

- Share

HighAmbition :

:

Happy New Year! 🤑View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

378.32K Popularity

6.81K Popularity

6.74K Popularity

4.1K Popularity

2.77K Popularity

4.81K Popularity

2.48K Popularity

3.17K Popularity

2.17K Popularity

23 Popularity

54.05K Popularity

68.92K Popularity

20.38K Popularity

26.61K Popularity

201.43K Popularity

News

View MoreSpot gold prices briefly surged past $4,800 per ounce, breaking through the short-term resistance level.

4 m

Analysis: CME Bitcoin futures show a clear price gap, offering a glimmer of hope for the bulls

7 m

Hong Kong Monetary Authority: Plans to issue the first stablecoin issuer licenses in March

16 m

Foreign media: ICE actions trigger turmoil in the U.S. House of Representatives, government shutdown may affect this week's non-farm payrolls

18 m

Digital asset market infrastructure provider Prometheum completes an additional $23 million funding

19 m

Pin