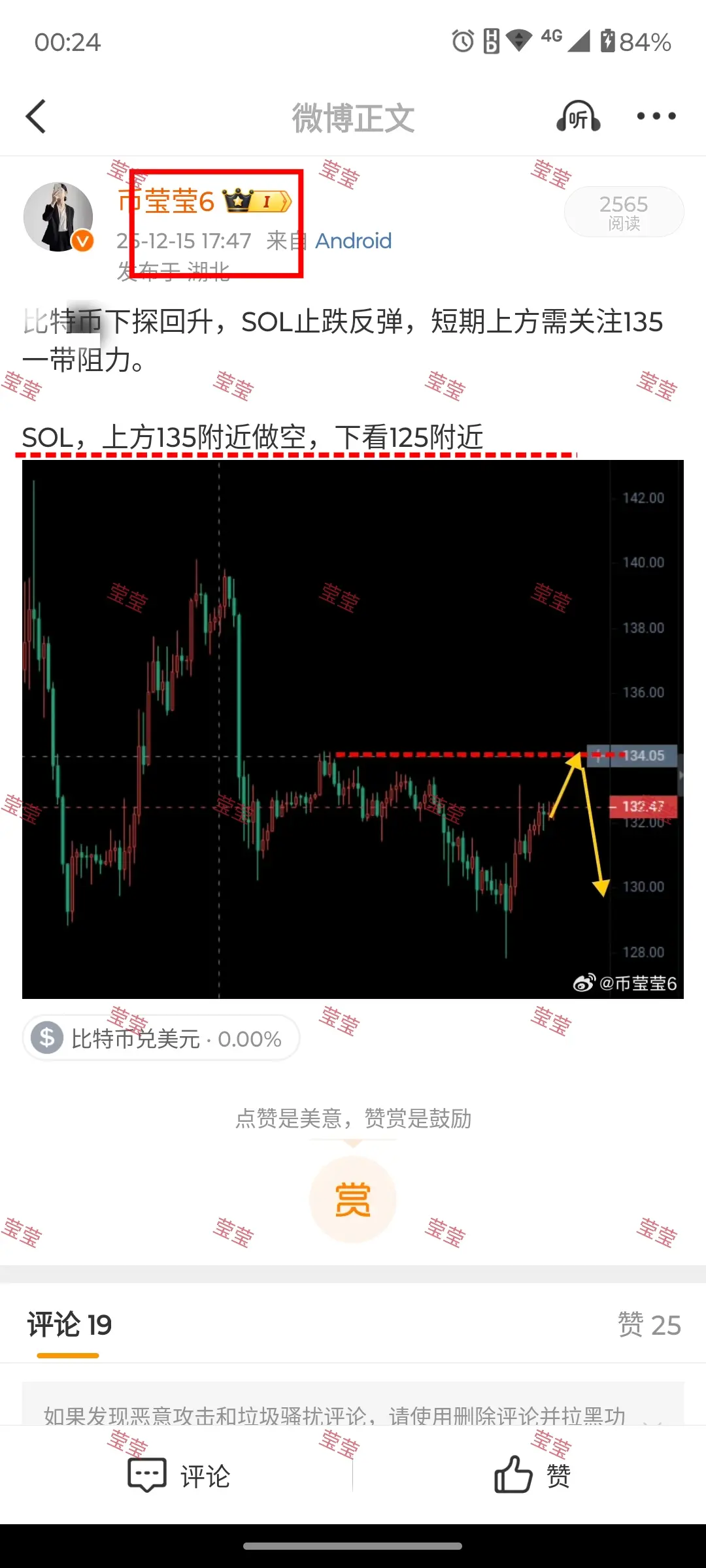

The market is trending downward, with three expected tests; Bitcoin's 90,000 level has once again become a strong resistance.

On Tuesday, the non-farm payroll report unexpectedly released data for two months, increasing uncertainty.

On Friday, the probability of a rate hike in Japan is gradually increasing, and Bitcoin continues to face resistance.

Under the influence of downward pressure, combined with the impact of interest rate factors, breaking below 85,000 is just a matter of a large bearish candle... #BTC

On Tuesday, the non-farm payroll report unexpectedly released data for two months, increasing uncertainty.

On Friday, the probability of a rate hike in Japan is gradually increasing, and Bitcoin continues to face resistance.

Under the influence of downward pressure, combined with the impact of interest rate factors, breaking below 85,000 is just a matter of a large bearish candle... #BTC

BTC-1.1%