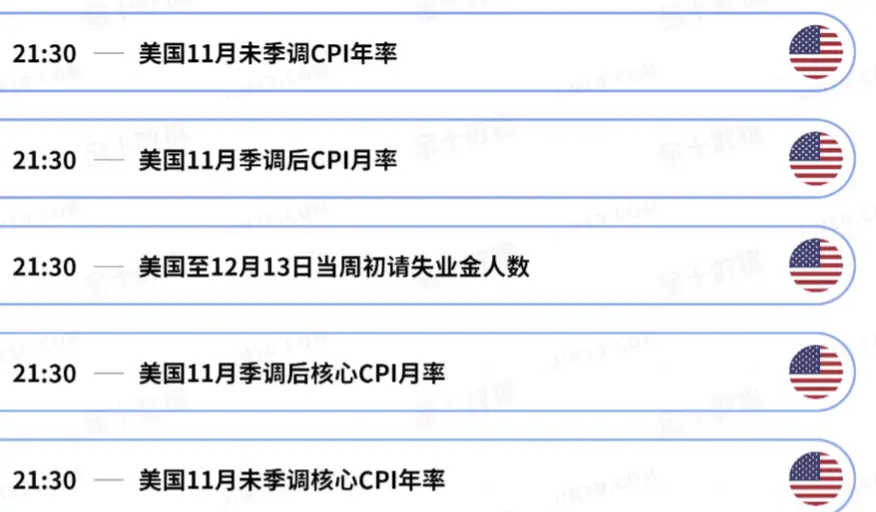

These days, the market is less about price movements and more about questioning one's own resolve. CPI and the Bank of Japan's policy remain undecided, global funds are on the sidelines, and the market lacks certainty despite abundant information.

The more it is this way, the easier people are to become obsessed with predictions and heavy bets, forgetting the Stoic advice: the only things within our control are judgment and choice; prices and outcomes are never fully in our hands. The crypto world is essentially a testing ground for this philosophy—so-called control is just delayed risk.

BTC s

View OriginalThe more it is this way, the easier people are to become obsessed with predictions and heavy bets, forgetting the Stoic advice: the only things within our control are judgment and choice; prices and outcomes are never fully in our hands. The crypto world is essentially a testing ground for this philosophy—so-called control is just delayed risk.

BTC s