This Week's Ethereum (ETH) Price Review (12.29-1.4)

1. Core Trend: Oscillating Upward, Breaking Through Key Resistance

- Overall Rhythm: This week, ETH showed a pattern of "narrow-range consolidation → increased volume rally → breakout to new highs." Starting around 2760, it reached a high of 3166 on January 4, with a total increase of approximately 6.15%, breaking out of the previous consolidation zone of 2800-3000.

- Key Milestones: Narrow-range consolidation from December 29-30 (2748-2840); on January 2, driven by institutional fund inflows, a single-day surge of 5.02% broke through the 3000 mark; on January 3, it surged to 3150 but faced resistance and pulled back; today, it successfully broke through this resistance, hitting a recent new high.

2. Core Driving Factors

1. Technical Upgrade Expectations: After the Fusaka upgrade, Layer2 transaction fees decrease by 40%-60%, the total network TPS reaches 34,000, combined with the anticipated Pectra upgrade in early 2026 (batch transactions, increased staking limits), reinforcing long-term value consensus.

2. Continued Favorable Capital Flows: Whales holding 10,000-100,000 ETH have accumulated over 22 million tokens; a certain exchange's supply has fallen to a nine-year low of 10.2 million; spot ETF capital outflows have ended, with weekly net inflows exceeding 67 million.

3. Macro Liquidity Support: The Federal Reserve's rate cut expectations strengthen, the US dollar index weakens, risk asset valuation centers rise, and institutional allocations increase (BlackRock, Fidelity, and others are adding holdings off-exchange).

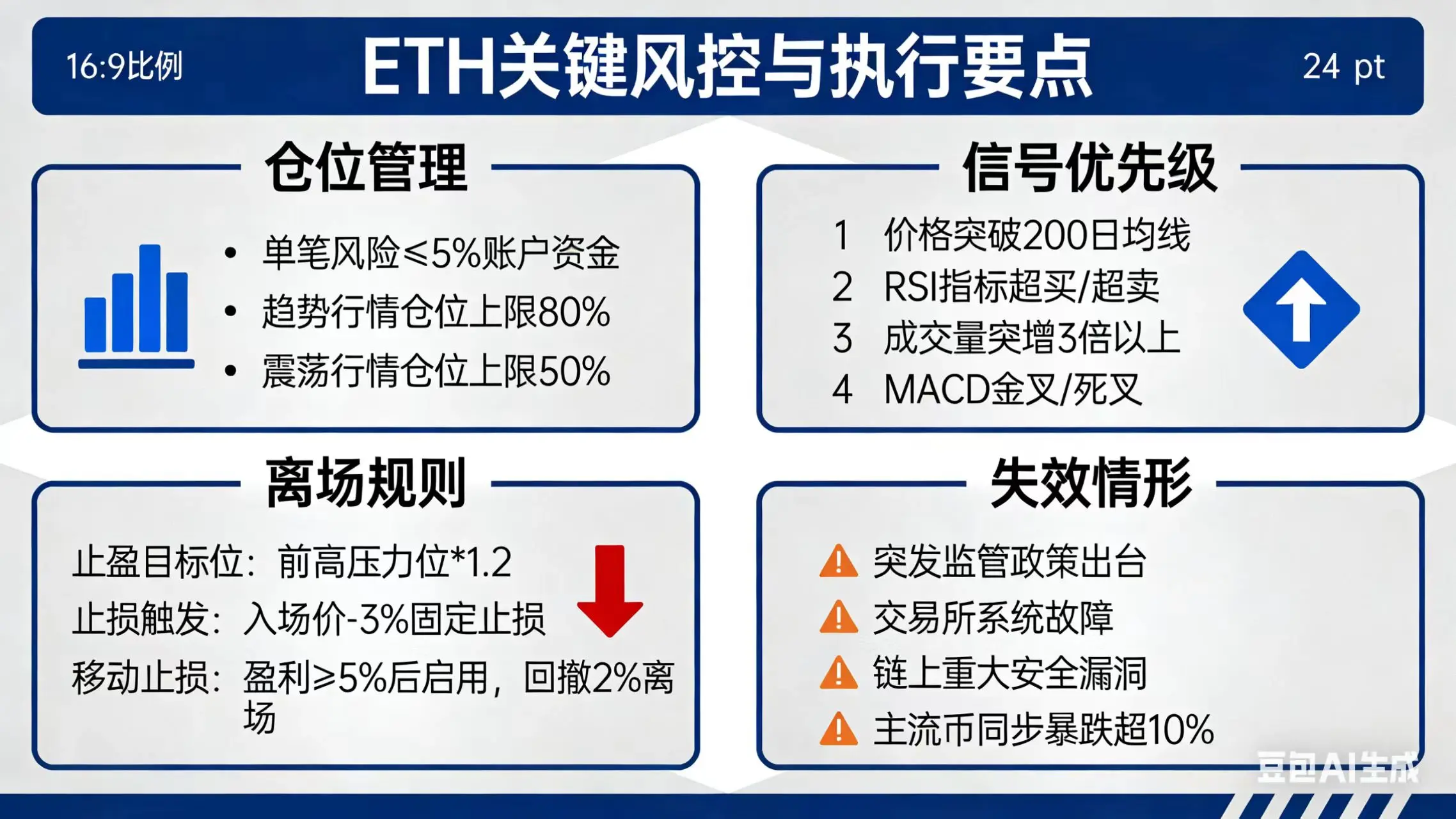

3. Key Technical Signals

- Indicator Status: Daily Bollinger Bands are opening upward; MACD maintains a golden cross; RSI is neutral to slightly strong (39%-60 range), with no obvious overbought risk.

- Support and Resistance: Short-term support at 3060-3080 (January 3 low), strong support at 3000 (psychological level + previous consolidation upper boundary); resistance at 3200-3250 (previous dense trading zone), and 3500 (medium-term target).

4. Future Outlook

- Optimistic Scenario: If ETH stabilizes above 3150 and trading volume remains above 12 billion, an attack toward 3300 is possible.

- Risk Warning: Profit-taking pressure around 3200 is significant; if trading volume shrinks, a pullback to 3000 to confirm support may occur. High volatility risk in the cryptocurrency market should be watched carefully. $ETH $SOL $BTC #加密市场开年反弹

1. Core Trend: Oscillating Upward, Breaking Through Key Resistance

- Overall Rhythm: This week, ETH showed a pattern of "narrow-range consolidation → increased volume rally → breakout to new highs." Starting around 2760, it reached a high of 3166 on January 4, with a total increase of approximately 6.15%, breaking out of the previous consolidation zone of 2800-3000.

- Key Milestones: Narrow-range consolidation from December 29-30 (2748-2840); on January 2, driven by institutional fund inflows, a single-day surge of 5.02% broke through the 3000 mark; on January 3, it surged to 3150 but faced resistance and pulled back; today, it successfully broke through this resistance, hitting a recent new high.

2. Core Driving Factors

1. Technical Upgrade Expectations: After the Fusaka upgrade, Layer2 transaction fees decrease by 40%-60%, the total network TPS reaches 34,000, combined with the anticipated Pectra upgrade in early 2026 (batch transactions, increased staking limits), reinforcing long-term value consensus.

2. Continued Favorable Capital Flows: Whales holding 10,000-100,000 ETH have accumulated over 22 million tokens; a certain exchange's supply has fallen to a nine-year low of 10.2 million; spot ETF capital outflows have ended, with weekly net inflows exceeding 67 million.

3. Macro Liquidity Support: The Federal Reserve's rate cut expectations strengthen, the US dollar index weakens, risk asset valuation centers rise, and institutional allocations increase (BlackRock, Fidelity, and others are adding holdings off-exchange).

3. Key Technical Signals

- Indicator Status: Daily Bollinger Bands are opening upward; MACD maintains a golden cross; RSI is neutral to slightly strong (39%-60 range), with no obvious overbought risk.

- Support and Resistance: Short-term support at 3060-3080 (January 3 low), strong support at 3000 (psychological level + previous consolidation upper boundary); resistance at 3200-3250 (previous dense trading zone), and 3500 (medium-term target).

4. Future Outlook

- Optimistic Scenario: If ETH stabilizes above 3150 and trading volume remains above 12 billion, an attack toward 3300 is possible.

- Risk Warning: Profit-taking pressure around 3200 is significant; if trading volume shrinks, a pullback to 3000 to confirm support may occur. High volatility risk in the cryptocurrency market should be watched carefully. $ETH $SOL $BTC #加密市场开年反弹