VernacularBlockchain

No content yet

VernacularBlockchain

Cryptocurrency Outlook: Bold Predictions for 2026

【Plain Language Summary】This article provides an in-depth outlook on the transformative leap of cryptocurrencies in 2026.

Experts predict that Bitcoin will break the four-year cycle, reaching new highs of $150,000 to $180,000; Ethereum is expected to surpass $10,000 thanks to technological upgrades. As regulations become clearer, institutional funds will flood in, driving the popularity of AI agent trading, real-world asset (RWA) tokenization, and stablecoins.

2026 will be a pivotal year for cryptocurrencies to move from the fringe to the mains

View Original【Plain Language Summary】This article provides an in-depth outlook on the transformative leap of cryptocurrencies in 2026.

Experts predict that Bitcoin will break the four-year cycle, reaching new highs of $150,000 to $180,000; Ethereum is expected to surpass $10,000 thanks to technological upgrades. As regulations become clearer, institutional funds will flood in, driving the popularity of AI agent trading, real-world asset (RWA) tokenization, and stablecoins.

2026 will be a pivotal year for cryptocurrencies to move from the fringe to the mains

- Reward

- like

- Comment

- Repost

- Share

The four-year cycle is dead, the "Institutional Era" is coming

【Plain Language Guide】The crypto industry is currently popularizing the "Institutional Era," and the traditional four-year cycle pattern has been declared invalid.

The core narrative for 2026 will be dominated by AI agents (agent economy), stablecoin settlement layers, and sovereign institutions. As crypto ETPs aggressively raise funds, Bitcoin volatility may become lower than Nvidia's. Investors should be cautious of the demise of sleeping L2 solutions and focus on top-tier assets and application layer revenue.

This marks the end

【Plain Language Guide】The crypto industry is currently popularizing the "Institutional Era," and the traditional four-year cycle pattern has been declared invalid.

The core narrative for 2026 will be dominated by AI agents (agent economy), stablecoin settlement layers, and sovereign institutions. As crypto ETPs aggressively raise funds, Bitcoin volatility may become lower than Nvidia's. Investors should be cautious of the demise of sleeping L2 solutions and focus on top-tier assets and application layer revenue.

This marks the end

BTC1,59%

- Reward

- like

- Comment

- Repost

- Share

Banks outperform DeFi by 10 times in absolute profit, but fall short in a key metric

【Plain Language Summary】This article explores whether the return on $1 bank deposits is 10 times that of Aave USDC.

Banks dominate in absolute profit scale, such as RBC's net profit of $14.7 billion, while Aave's annual revenue is only $105 million. However, in terms of efficiency per unit, DeFi achieves a hundredfold surpass, generating tens of millions of dollars per person with nearly zero operating costs. Aave's lending mainly involves crypto leverage arbitrage, not real-world financing.

The bank's advanta

【Plain Language Summary】This article explores whether the return on $1 bank deposits is 10 times that of Aave USDC.

Banks dominate in absolute profit scale, such as RBC's net profit of $14.7 billion, while Aave's annual revenue is only $105 million. However, in terms of efficiency per unit, DeFi achieves a hundredfold surpass, generating tens of millions of dollars per person with nearly zero operating costs. Aave's lending mainly involves crypto leverage arbitrage, not real-world financing.

The bank's advanta

AAVE-1,44%

- Reward

- like

- Comment

- Repost

- Share

Pantera Capital Researcher: 12 Predictions for the Cryptocurrency Market in 2026

【Plain Language Summary】This article predicts that the crypto industry will enter a year of application explosion and institutional integration.

It highlights the rise of AI-driven intelligent agents (x402), interface innovations, tokenized gold, and other RWA assets. Meanwhile, the industry will face survival challenges as governance tokens transition to equity-like assets, along with technical discussions on Bitcoin's quantum security.

In terms of competitive landscape, Hyperliquid is expected to dominate the de

View Original【Plain Language Summary】This article predicts that the crypto industry will enter a year of application explosion and institutional integration.

It highlights the rise of AI-driven intelligent agents (x402), interface innovations, tokenized gold, and other RWA assets. Meanwhile, the industry will face survival challenges as governance tokens transition to equity-like assets, along with technical discussions on Bitcoin's quantum security.

In terms of competitive landscape, Hyperliquid is expected to dominate the de

- Reward

- like

- Comment

- Repost

- Share

Lighter Airdrop: What to Expect?

【Plain Language Guide】An in-depth analysis focusing on the biggest airdrop potential stock in 2025, Lighter.

According to Polymarket data, this zero-fee perpetual contract DEX has a 73% chance of launching TGE on December 29. The project has sparked widespread discussion with a background financing of $1.5 billion and an airdrop promise of 25% token supply.

Despite the current market downturn, its pre-FDV has reached $3.5 billion, which could make it the most entrepreneurial trader scholarship after Hyperliquid.

For more details, please see:

View Original【Plain Language Guide】An in-depth analysis focusing on the biggest airdrop potential stock in 2025, Lighter.

According to Polymarket data, this zero-fee perpetual contract DEX has a 73% chance of launching TGE on December 29. The project has sparked widespread discussion with a background financing of $1.5 billion and an airdrop promise of 25% token supply.

Despite the current market downturn, its pre-FDV has reached $3.5 billion, which could make it the most entrepreneurial trader scholarship after Hyperliquid.

For more details, please see:

- Reward

- like

- Comment

- Repost

- Share

MicroStrategy: The Life and Death Game of the World's Largest Bitcoin Whale

【Plain Language Guide】MicroStrategy (now Strategy Inc.) holds 670,000 BTC, accounting for 3.2% of the global total, transforming from a software company into a Bitcoin reserve entity.

Its model leverages stock premiums, issuing ATMs, perpetual preferred shares, and the “42/42 Plan” to raise $84 billion in financing to increase Bitcoin holdings, creating a flywheel effect. Rumors of selling coins are false; they are actually wallet rotations, with continued buying.

Software business losses rely on financing. Risks inclu

【Plain Language Guide】MicroStrategy (now Strategy Inc.) holds 670,000 BTC, accounting for 3.2% of the global total, transforming from a software company into a Bitcoin reserve entity.

Its model leverages stock premiums, issuing ATMs, perpetual preferred shares, and the “42/42 Plan” to raise $84 billion in financing to increase Bitcoin holdings, creating a flywheel effect. Rumors of selling coins are false; they are actually wallet rotations, with continued buying.

Software business losses rely on financing. Risks inclu

BTC1,59%

- Reward

- like

- Comment

- Repost

- Share

Say goodbye to 12 seconds of waiting: Ethereum enters the "instant transaction" era

[Plain Language Guide] This article is a deep analysis of how ETHGas uses "real-time Ethereum" technology to eliminate transaction delays. It points out that the traditional Ethereum block time of 12 seconds leads to "dark forest" dilemmas such as MEV exploitation.

By splitting blocks into dozens of sub-blocks and introducing a pre-confirmation mechanism, ETHGas has achieved instant, certain, and fair transaction execution without compromising the security of the mainnet, thus officially bringing Ethereum into

[Plain Language Guide] This article is a deep analysis of how ETHGas uses "real-time Ethereum" technology to eliminate transaction delays. It points out that the traditional Ethereum block time of 12 seconds leads to "dark forest" dilemmas such as MEV exploitation.

By splitting blocks into dozens of sub-blocks and introducing a pre-confirmation mechanism, ETHGas has achieved instant, certain, and fair transaction execution without compromising the security of the mainnet, thus officially bringing Ethereum into

ETH1,25%

- Reward

- like

- Comment

- Repost

- Share

7 encryption trends and lessons to master before 2026

[Plain Language Guide] The "market massacre" of 2025 ended the wild era of encryption currency, and the industry is experiencing the growing pains of returning from speculative games to fundamentals.

This article deeply analyzes the seven core trends before 2026: from the explosion of prediction markets to the rise of "ownership tokens", from options cash flow strategies to the wave of securities tokenization.

Refusing to be a "liquidity exit," one must clearly understand the logic of value capture and build a personal professional moat in

View Original[Plain Language Guide] The "market massacre" of 2025 ended the wild era of encryption currency, and the industry is experiencing the growing pains of returning from speculative games to fundamentals.

This article deeply analyzes the seven core trends before 2026: from the explosion of prediction markets to the rise of "ownership tokens", from options cash flow strategies to the wave of securities tokenization.

Refusing to be a "liquidity exit," one must clearly understand the logic of value capture and build a personal professional moat in

- Reward

- like

- Comment

- Repost

- Share

Bitcoin 2026 Data-Driven Outlook

[Plain Language Guide] The data indicates that in 2025, although Bitcoin will reach a new high in USD, it has already dropped 50% when priced in gold, experiencing a historic shift in market positions.

As 75% of the sell-off is absorbed by retail and institutions, quantitative tightening (QT) comes to an end, and global liquidity (M2) begins to expand again, the market is trending towards maturity.

The benchmark prediction for 2026 looks towards 100,000 dollars, and the worst moments may have passed. Positive macro factors will support its stabilization and rec

[Plain Language Guide] The data indicates that in 2025, although Bitcoin will reach a new high in USD, it has already dropped 50% when priced in gold, experiencing a historic shift in market positions.

As 75% of the sell-off is absorbed by retail and institutions, quantitative tightening (QT) comes to an end, and global liquidity (M2) begins to expand again, the market is trending towards maturity.

The benchmark prediction for 2026 looks towards 100,000 dollars, and the worst moments may have passed. Positive macro factors will support its stabilization and rec

BTC1,59%

- Reward

- like

- Comment

- Repost

- Share

Thank you @ Christmas Gift Box, Sweater➕labubu combination, so adorable❤️

View Original

- Reward

- like

- Comment

- Repost

- Share

The Great Crypto Shift of 2026: Telling Stories Is Not as Good as Making Real Money

【Plain Language Intro】This article deeply analyzes the underlying logic restructuring of the 2026 crypto market: Hyperliquid HIP-3 protocol removes technical barriers, pushing DEX into a PvE mode of expansion beyond crypto assets;

Market pricing standards shift from "illusory narratives" to "real cash flow," with Hyperliquid and other high-income protocols defining new valuation benchmarks; at the same time, prediction markets are evolving into economic mechanisms that capture collective expectations, transform

【Plain Language Intro】This article deeply analyzes the underlying logic restructuring of the 2026 crypto market: Hyperliquid HIP-3 protocol removes technical barriers, pushing DEX into a PvE mode of expansion beyond crypto assets;

Market pricing standards shift from "illusory narratives" to "real cash flow," with Hyperliquid and other high-income protocols defining new valuation benchmarks; at the same time, prediction markets are evolving into economic mechanisms that capture collective expectations, transform

HYPE1,13%

- Reward

- like

- Comment

- Repost

- Share

Bhutan Makes a Major Bet on Bitcoin to Build Future Economic Hub

【Plain Language Summary】The Bhutan government announced a allocation of 10,000 Bitcoins (approximately $1 billion) to fund the construction of "Gleup Mindfulness City," officially making it the country's economic engine.

The country leverages abundant hydropower resources for green mining and adopts a collateral loan and revenue strategy rather than direct sales, aiming to convert surplus energy into digital assets.

This move empowers tourism and identity systems through blockchain technology, aiming to increase employment, curb

【Plain Language Summary】The Bhutan government announced a allocation of 10,000 Bitcoins (approximately $1 billion) to fund the construction of "Gleup Mindfulness City," officially making it the country's economic engine.

The country leverages abundant hydropower resources for green mining and adopts a collateral loan and revenue strategy rather than direct sales, aiming to convert surplus energy into digital assets.

This move empowers tourism and identity systems through blockchain technology, aiming to increase employment, curb

BTC1,59%

- Reward

- like

- Comment

- Repost

- Share

When issuing tokens becomes a production line, someone is paying Bitcoin developers

【Plain Language Guide】The latest report by 1A1z reveals: only 13 institutions worldwide have been funding Bitcoin Core long-term, and OKEx is the only listed trading platform.

Since 2019, they have quietly invested nearly $2 million to support core maintainers like Marco Falke, Brink, and others, consistently for ten years without publicity. While the industry chases hot trends and pours marketing dollars, some choose to spend money on the "operating system" and the last mile to users.

This is not PR, but a rar

【Plain Language Guide】The latest report by 1A1z reveals: only 13 institutions worldwide have been funding Bitcoin Core long-term, and OKEx is the only listed trading platform.

Since 2019, they have quietly invested nearly $2 million to support core maintainers like Marco Falke, Brink, and others, consistently for ten years without publicity. While the industry chases hot trends and pours marketing dollars, some choose to spend money on the "operating system" and the last mile to users.

This is not PR, but a rar

BTC1,59%

- Reward

- 1

- Comment

- Repost

- Share

When the Federal Reserve is politically hijacked, a historic opportunity for Bitcoin arises?

【Plain Explanation】The Fed cut interest rates by 25 basis points and purchased 40 billion USD of government bonds. This should have been a big positive, but it triggered market panic: long-term yields rose instead of falling.

The core reason is not economic data, but investors are already pricing in the structural risk of "loss of Federal Reserve independence." Political interference undermines central bank credibility, shaking the foundation of US dollar trust, and the anti-inflation, anti-censorship

【Plain Explanation】The Fed cut interest rates by 25 basis points and purchased 40 billion USD of government bonds. This should have been a big positive, but it triggered market panic: long-term yields rose instead of falling.

The core reason is not economic data, but investors are already pricing in the structural risk of "loss of Federal Reserve independence." Political interference undermines central bank credibility, shaking the foundation of US dollar trust, and the anti-inflation, anti-censorship

BTC1,59%

- Reward

- 1

- Comment

- Repost

- Share

How to Find Your Edge in Cryptocurrency?

【Plain Language Guide】In the unpredictable crypto market, a lack of advantage stems from blind gambling. This article emphasizes that the key to sustained profitability lies in developing a repeatable strategy, skill, or knowledge—your “Edge.”

Through specific cases such as arbitrage, long-term accumulation, selective trading windows, and DeFi yield farming, it illustrates how to develop incentivized or proactive profit strategies. True advantage lies in further honing skills (such as technical analysis, networking) and exploiting market imbalances (suc

View Original【Plain Language Guide】In the unpredictable crypto market, a lack of advantage stems from blind gambling. This article emphasizes that the key to sustained profitability lies in developing a repeatable strategy, skill, or knowledge—your “Edge.”

Through specific cases such as arbitrage, long-term accumulation, selective trading windows, and DeFi yield farming, it illustrates how to develop incentivized or proactive profit strategies. True advantage lies in further honing skills (such as technical analysis, networking) and exploiting market imbalances (suc

- Reward

- 2

- Comment

- Repost

- Share

2026 Omen: How will AI "wipe out" the DeFi and crypto world?

In 2026, AI agents will penetrate the cryptocurrency ecosystem deeply, and are expected to manage at least 5% of Defi and empower smart contracts through "even coding".

ERC-8004 may become the initialization of AI agents Decentralized AI will accelerate its popularity due to open source models and global settings, while prediction markets will continue to serve as an explosive case for cryptocurrencies to productize vaults through machine learning.

Despite slow corporate adoption, privacy and compliance solutions will be key. In addi

View OriginalIn 2026, AI agents will penetrate the cryptocurrency ecosystem deeply, and are expected to manage at least 5% of Defi and empower smart contracts through "even coding".

ERC-8004 may become the initialization of AI agents Decentralized AI will accelerate its popularity due to open source models and global settings, while prediction markets will continue to serve as an explosive case for cryptocurrencies to productize vaults through machine learning.

Despite slow corporate adoption, privacy and compliance solutions will be key. In addi

- Reward

- like

- Comment

- Repost

- Share

Where will the money for the next bull market come from?

[Plain Language Guide] The sharp drop in Bitcoin has triggered market panic, but long-term structural positives are gathering.

Retail funds and the purchasing power demand of Digital Asset Treasuries (DAT) are supporting the new bull market. The real capital will come from: liquidity released by Fed rate cuts, regulatory barriers removed by the SEC’s “innovation thaw,” and gradual institutional allocation through ETFs and RWA (Real World Asset tokenization).

RWA is expected to bring in trillions of dollars in traditional assets, shifting

[Plain Language Guide] The sharp drop in Bitcoin has triggered market panic, but long-term structural positives are gathering.

Retail funds and the purchasing power demand of Digital Asset Treasuries (DAT) are supporting the new bull market. The real capital will come from: liquidity released by Fed rate cuts, regulatory barriers removed by the SEC’s “innovation thaw,” and gradual institutional allocation through ETFs and RWA (Real World Asset tokenization).

RWA is expected to bring in trillions of dollars in traditional assets, shifting

BTC1,59%

- Reward

- like

- Comment

- Repost

- Share

Quantum Computing and Blockchain: Matching Urgency with Real Threats

[Plain Language Introduction] The timeline for cryptographically relevant quantum computers (CRQC) is exaggerated.

Immediate transition to post-quantum cryptography is necessary due to the risk of "harvest now, decrypt later" (HNDL) attacks. However, digital signatures (which blockchains mainly rely on) are not vulnerable to HNDL threats, and migration strategies that hinder thoughtful consideration should be avoided. For Bitcoin, urgency arises from governance and the complex logistics of dormant coins.

The main near-term ri

[Plain Language Introduction] The timeline for cryptographically relevant quantum computers (CRQC) is exaggerated.

Immediate transition to post-quantum cryptography is necessary due to the risk of "harvest now, decrypt later" (HNDL) attacks. However, digital signatures (which blockchains mainly rely on) are not vulnerable to HNDL threats, and migration strategies that hinder thoughtful consideration should be avoided. For Bitcoin, urgency arises from governance and the complex logistics of dormant coins.

The main near-term ri

BTC1,59%

- Reward

- like

- Comment

- Repost

- Share

The Dawn of Ethereum

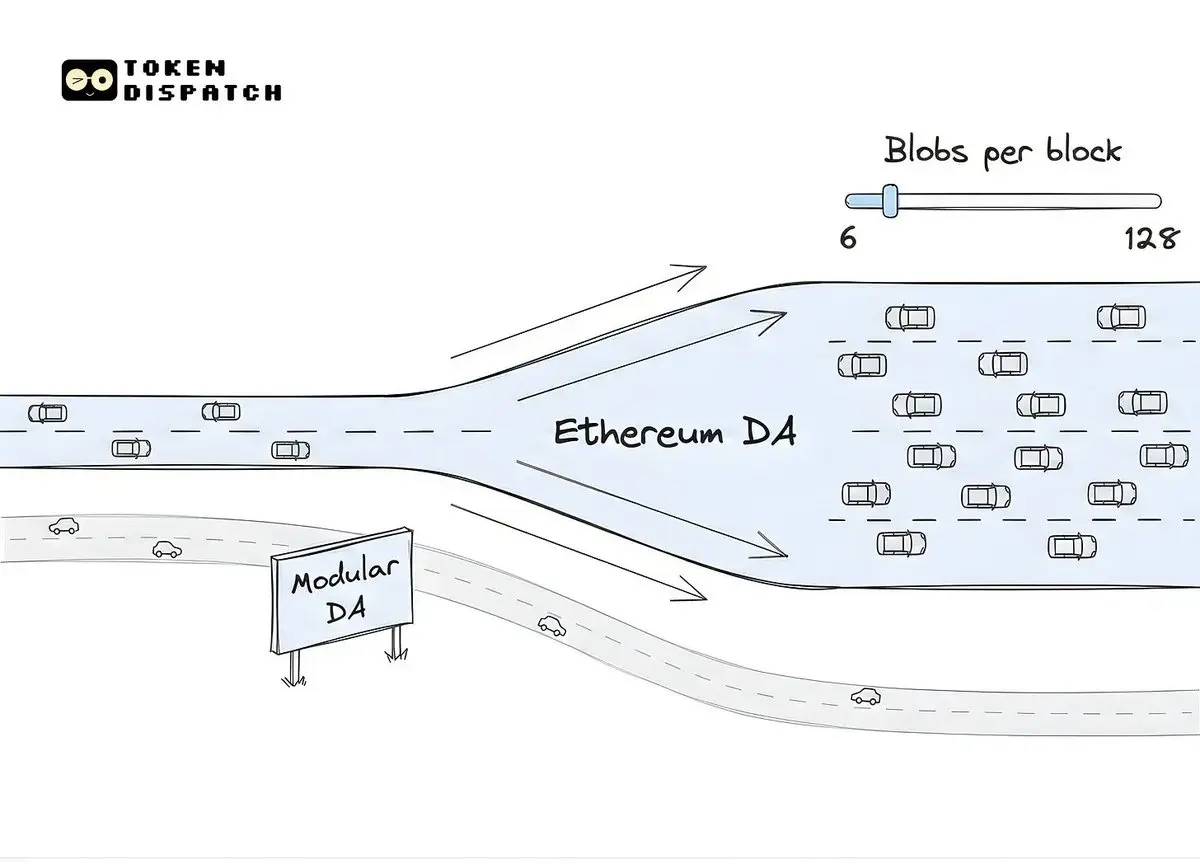

[Plain Language Guide] Ethereum's Fusaka upgrade (December 7, 2025) marks a powerful rebuttal to the narrative of "non-scalability." Following Dencun's reduction of Rollup costs, Fusaka introduces PeerDAS technology, which, through efficient data availability sampling, significantly increases Ethereum's blob capacity. The target is to reach 128 blobs per block (16MB), surpassing the current capacity of modular DA solutions like Celestia.

This upgrade achieves large-scale scalability without sacrificing decentralization, greatly improving the economic model and user experie

View Original[Plain Language Guide] Ethereum's Fusaka upgrade (December 7, 2025) marks a powerful rebuttal to the narrative of "non-scalability." Following Dencun's reduction of Rollup costs, Fusaka introduces PeerDAS technology, which, through efficient data availability sampling, significantly increases Ethereum's blob capacity. The target is to reach 128 blobs per block (16MB), surpassing the current capacity of modular DA solutions like Celestia.

This upgrade achieves large-scale scalability without sacrificing decentralization, greatly improving the economic model and user experie

- Reward

- like

- Comment

- Repost

- Share

Don’t rush to sell!

[Plain Language Guide] This article refutes the claim that the current cryptocurrency downturn is caused by panic from yen carry trade unwinding. The author points out that yen leverage has dropped significantly, and most market leverage was cleared out in August.

The real driving force behind the decline is mechanical: as we enter December, institutional adjustments for risk resetting and tax loss harvesting have automatically triggered selling. As long as Bitcoin holds the key $80,000 - $82,000 level, the long-term structure remains excessive. This week’s Powell remarks a

[Plain Language Guide] This article refutes the claim that the current cryptocurrency downturn is caused by panic from yen carry trade unwinding. The author points out that yen leverage has dropped significantly, and most market leverage was cleared out in August.

The real driving force behind the decline is mechanical: as we enter December, institutional adjustments for risk resetting and tax loss harvesting have automatically triggered selling. As long as Bitcoin holds the key $80,000 - $82,000 level, the long-term structure remains excessive. This week’s Powell remarks a

BTC1,59%

- Reward

- like

- Comment

- Repost

- Share