秦政闯天涯

No content yet

秦政闯天涯

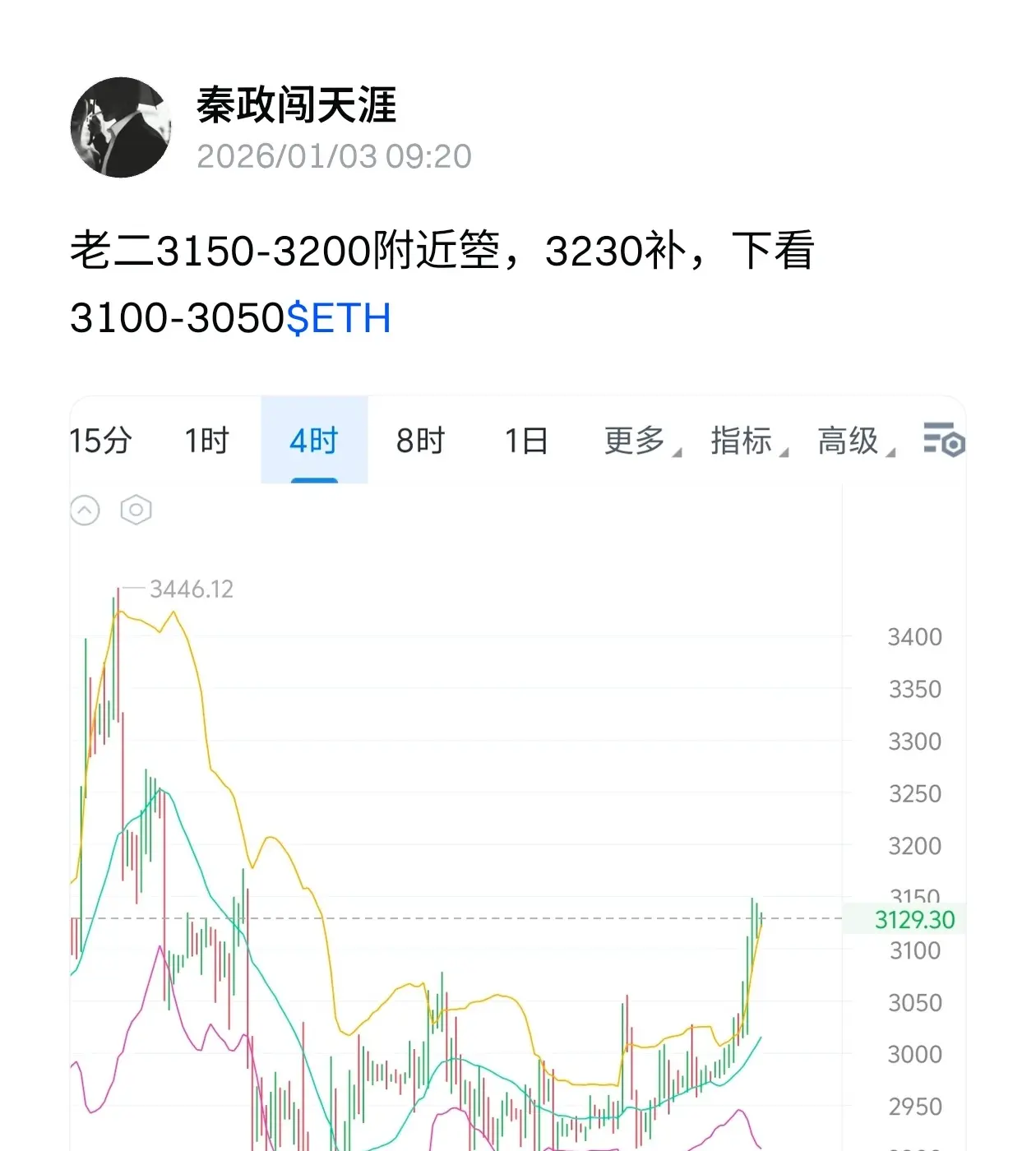

Second place around 3240-3280,补 at 3320, then look at 3180-3080

View Original

- Reward

- like

- Comment

- Repost

- Share

A once slow upward trend has caused considerable frustration among the bears, but fortunately, this bullish push has not been a smooth, one-way rally. The current rally shows signs of stalling and is hovering at high levels. At this point, it is not advisable to blindly chase the rally and go long.

From a technical perspective, although the bullish momentum has strengthened, it has not yet formed a breakthrough rally. On the 4-hour chart, Bitcoin's price is steadily climbing along the upper band of the Bollinger Bands. Occasionally, there are pullbacks, but they are quickly bought back by the

From a technical perspective, although the bullish momentum has strengthened, it has not yet formed a breakthrough rally. On the 4-hour chart, Bitcoin's price is steadily climbing along the upper band of the Bollinger Bands. Occasionally, there are pullbacks, but they are quickly bought back by the

BTC0,88%

- Reward

- like

- Comment

- Repost

- Share

The current trend is very clear; a pullback to buy more steadily!

Highest level 93,750/3,183

Zhiying at 93,600/3,180

This kind of market sentiment is as easy as breathing to make profits~

View OriginalHighest level 93,750/3,183

Zhiying at 93,600/3,180

This kind of market sentiment is as easy as breathing to make profits~

- Reward

- like

- Comment

- Repost

- Share

Two days of firm resolve, eat meat!

View Original

- Reward

- like

- 2

- Repost

- Share

MoorMoom :

:

Hello, how are you? Will you be my friend? I'm a good girl. You can check my posts. Please tell me if you're sad. My front is closed.View More

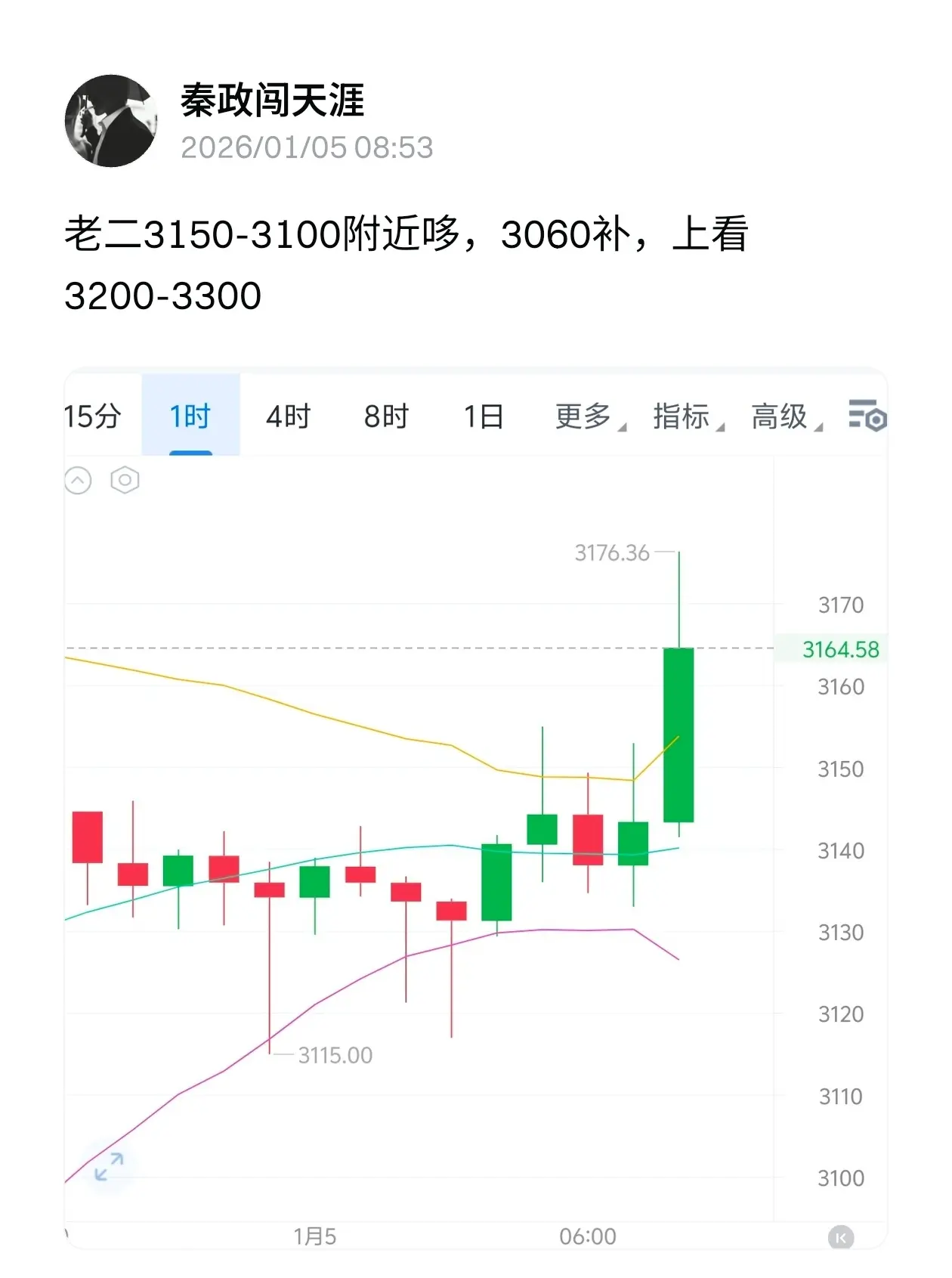

The second one is around 3150-3100, with a rebound at 3060, aiming to see 3200-3300.

View Original

- Reward

- like

- Comment

- Repost

- Share

From a detailed analysis of the 1-hour chart, last Sunday the market showed a pattern of rising sharply and then pulling back. Subsequently, the price entered a sideways consolidation phase to build momentum. Later, the price successfully stabilized above the 91,000 level, clearly indicating that the bullish forces are dominant and relatively strong.

Regarding the overall current market pattern, it is in the midst of a Wave 4 correction. Based on this development, it is highly likely that the market will follow with a Wave 5 upward movement.

Looking at the short-term Bollinger Bands, they cont

Regarding the overall current market pattern, it is in the midst of a Wave 4 correction. Based on this development, it is highly likely that the market will follow with a Wave 5 upward movement.

Looking at the short-term Bollinger Bands, they cont

BTC0,88%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

The second one is around 3140-3100, with a rebound at 3060, aiming to see 3200-3300.

View Original

- Reward

- like

- Comment

- Repost

- Share

Analyzing the market situation, on the daily chart level, the price is steadily rising along the upward channel. During the process, it relies on weak retracements to solidify the bottom foundation, with the buying power continuously released. The moving average system is also rising in sync, and the overall buying trend is clear and quite persistent. On the four-hour chart, the operating channel remains upward, with the price ascending along the upper band in an orderly manner, forming a one-sided upward trend. The short-term retracements during this period are actually preparing for subseque

BTC0,88%

- Reward

- like

- Comment

- Repost

- Share

Today, we ignore short-term fluctuations and firmly implement the Gaokong strategy, as predicted: the rebound is ultimately the end of a strong bow, and the market is falling back as expected, with the Gaokong force fully unleashed!

This is not luck, but a mastery of the cyclical pattern of "big rises followed by corrections," and a precise judgment of the trend structure.

View OriginalThis is not luck, but a mastery of the cyclical pattern of "big rises followed by corrections," and a precise judgment of the trend structure.

- Reward

- like

- Comment

- Repost

- Share

The technical chart is clearly outlined, with the upper pressure level like a boulder across, showing significant suppression power, and the bulls' offensive repeatedly thwarted. The bears are gathering strength, and the downward trajectory has become clearly directed, with the trend pattern not to be ignored. In view of this, we should closely follow the market pulse, focus on high points, with Gao Kong as the main, and patiently wait for the flowering of profit-taking in cautiousness and boldness.

Bitcoin: Consolidation around 90500-91000, with a correction at 91500, looking down to 89500-88

Bitcoin: Consolidation around 90500-91000, with a correction at 91500, looking down to 89500-88

BTC0,88%

- Reward

- like

- Comment

- Repost

- Share

2025 Year-End, the US stock market delivers an impressive performance. As of the last week of December 31, US stock funds experienced their second consecutive week of large net capital inflows, injecting momentum into the market.

This is driven by the AI boom. Breakthroughs and commercialization of AI technology are accelerating, boosting the technology sector, radiating to upstream and downstream industries, and becoming the core engine behind the rise of the US stock market. Investor sentiment is high, with optimistic expectations for corporate earnings prospects, supporting steady market gr

View OriginalThis is driven by the AI boom. Breakthroughs and commercialization of AI technology are accelerating, boosting the technology sector, radiating to upstream and downstream industries, and becoming the core engine behind the rise of the US stock market. Investor sentiment is high, with optimistic expectations for corporate earnings prospects, supporting steady market gr

- Reward

- like

- Comment

- Repost

- Share

Second place around 3020-3060, buy at 3100, watch for 2960-2860

View Original

- Reward

- like

- Comment

- Repost

- Share

Observation of the 1-hour chart shows that after the price of Bitcoin surged rapidly to the 88,881 level, it quickly formed a long upper shadow. This pattern clearly reveals heavy selling pressure above and indicates that the bullish momentum is showing signs of exhaustion.

Additionally, the sharp increase in price in the short term has caused the divergence between the price and the MA7 and MA30 moving averages to widen significantly. Technically, a correction is urgently needed to restore balance, with the MA30 support below becoming the primary level for a pullback.

Further analysis shows t

Additionally, the sharp increase in price in the short term has caused the divergence between the price and the MA7 and MA30 moving averages to widen significantly. Technically, a correction is urgently needed to restore balance, with the MA30 support below becoming the primary level for a pullback.

Further analysis shows t

BTC0,88%

- Reward

- like

- Comment

- Repost

- Share

The Federal Reserve's policy direction becomes crucial, and the US dollar's annual decline may continue.

As 2025 comes to an end, the US dollar exchange rate has experienced its largest annual drop in nearly eight years, intensifying market concerns. The Bloomberg US Dollar Spot Index fell about 8% for the year, reflecting dollar weakness and global capital's shaken confidence in dollar assets. The trigger for the decline was Trump's new tariffs policy in April 2025, after which the dollar fell and failed to rebound effectively.

The fundamental reason lies in market bets on changes in Federal

View OriginalAs 2025 comes to an end, the US dollar exchange rate has experienced its largest annual drop in nearly eight years, intensifying market concerns. The Bloomberg US Dollar Spot Index fell about 8% for the year, reflecting dollar weakness and global capital's shaken confidence in dollar assets. The trigger for the decline was Trump's new tariffs policy in April 2025, after which the dollar fell and failed to rebound effectively.

The fundamental reason lies in market bets on changes in Federal

- Reward

- like

- 1

- Repost

- Share

AR111 :

:

Buy To Earn 💎S&P 500 closes with three consecutive gains, 2025 annual increase of 16%, continuing the bull market resilience

On the final trading day of 2025, U.S. stocks traded lightly, with the S&P 500 index closing down 0.7%, all sectors weakening, failing to bring about a "Santa Claus rally." Trading volume on that day shrank by approximately 45% compared to the 20-day moving average.

Despite the lackluster performance at the close, the S&P 500 rose 16% for the year, marking its third consecutive year of annual gains, with the previous two years exceeding 20%. On the same day, the Nasdaq 100 index fell

View OriginalOn the final trading day of 2025, U.S. stocks traded lightly, with the S&P 500 index closing down 0.7%, all sectors weakening, failing to bring about a "Santa Claus rally." Trading volume on that day shrank by approximately 45% compared to the 20-day moving average.

Despite the lackluster performance at the close, the S&P 500 rose 16% for the year, marking its third consecutive year of annual gains, with the previous two years exceeding 20%. On the same day, the Nasdaq 100 index fell

- Reward

- like

- Comment

- Repost

- Share

The second one is around 2960-2920, with support at 2880, aiming for 3000-3080.

View Original

- Reward

- like

- Comment

- Repost

- Share