Overnight continued to maintain wide-range fluctuations, with the daily chart closing lower, marking the fourth consecutive trading day of decline this week. An evening doji appeared overnight, which coincides with Friday's time point. The appearance of a doji generally indicates a choice of direction. Therefore, today's trend will likely continue testing yesterday's high. If it does not break through, the weak and wide-range oscillation will persist. Based on this benchmark, the Asian and European sessions should see a rally to perform technical correction. Additionally, the continued decline

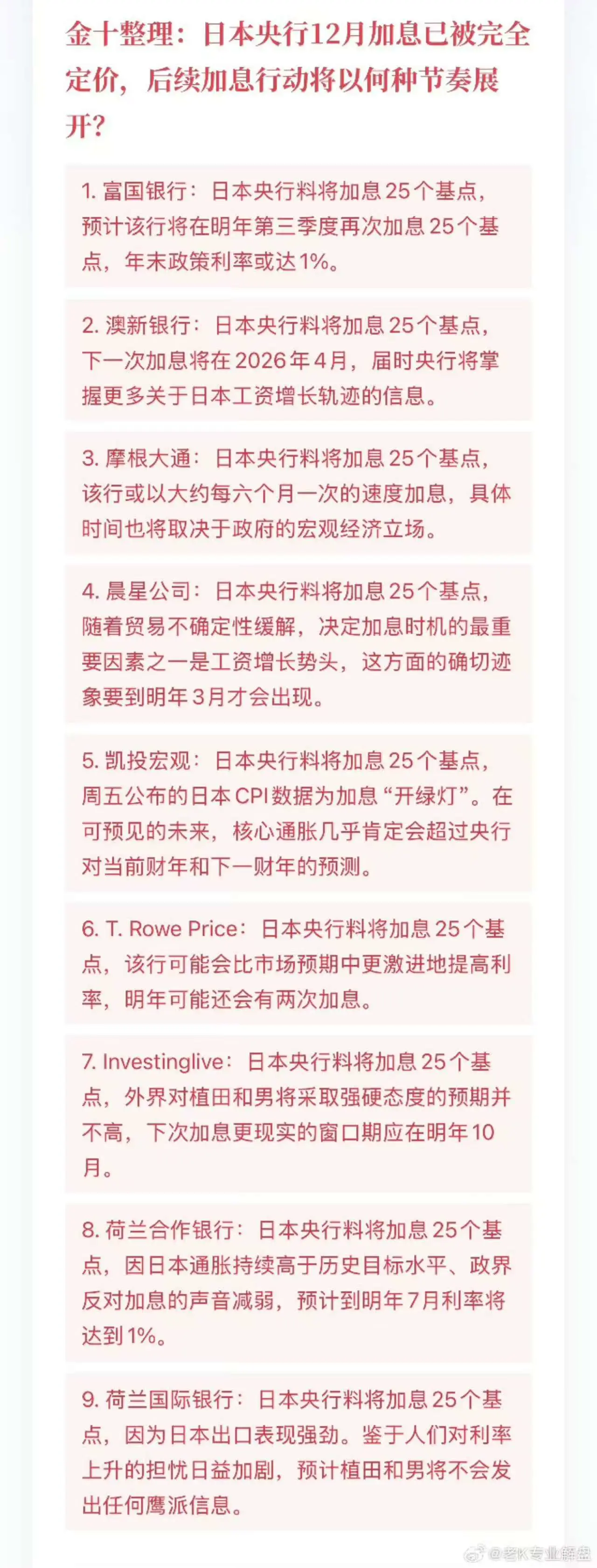

View OriginalIs the interest rate hike in Japan bullish or bearish?

bullish

bearish

5 ParticipantsEnds In 5 Hour

[The user has shared his/her trading data. Go to the App to view more.]