逸尘Eason

No content yet

逸尘Eason

12.19 Friday Intraday Mistress Analysis

The four-hour level tested 2997 and faced resistance, constrained by the upper band at 3019, and significantly below the previous high of 3446. The rebound momentum is weak, entering a seriously overbought zone, with a high probability of a short-term reversal. Although the MACD shows a red histogram, the momentum correction is only a short-term phenomenon.

Personal suggestion, for reference only (strictly set stop-loss):

Mistress around 3000, buy on dip at 3060, target 2880, 2750$ETH

The four-hour level tested 2997 and faced resistance, constrained by the upper band at 3019, and significantly below the previous high of 3446. The rebound momentum is weak, entering a seriously overbought zone, with a high probability of a short-term reversal. Although the MACD shows a red histogram, the momentum correction is only a short-term phenomenon.

Personal suggestion, for reference only (strictly set stop-loss):

Mistress around 3000, buy on dip at 3060, target 2880, 2750$ETH

ETH0.52%

- Reward

- like

- Comment

- Repost

- Share

12.19 Friday Intraday Bitcoin Analysis

The Bank of Japan raised interest rates by 25 basis points as expected, increasing the benchmark rate from 0.5% to 0.75%, hitting a 30-year high and marking the first rate hike in 11 months since January 2025. Global liquidity continues to tighten, and risk assets face significant fundamental downside pressure. The intraday rally is merely a weak rebound after a slight overlap. On the four-hour chart, the price remains under strong resistance from the MA144 and MA169 moving averages. The bullish momentum is unable to break through, and the MACD momentum r

The Bank of Japan raised interest rates by 25 basis points as expected, increasing the benchmark rate from 0.5% to 0.75%, hitting a 30-year high and marking the first rate hike in 11 months since January 2025. Global liquidity continues to tighten, and risk assets face significant fundamental downside pressure. The intraday rally is merely a weak rebound after a slight overlap. On the four-hour chart, the price remains under strong resistance from the MA144 and MA169 moving averages. The bullish momentum is unable to break through, and the MACD momentum r

BTC-0.02%

- Reward

- like

- Comment

- Repost

- Share

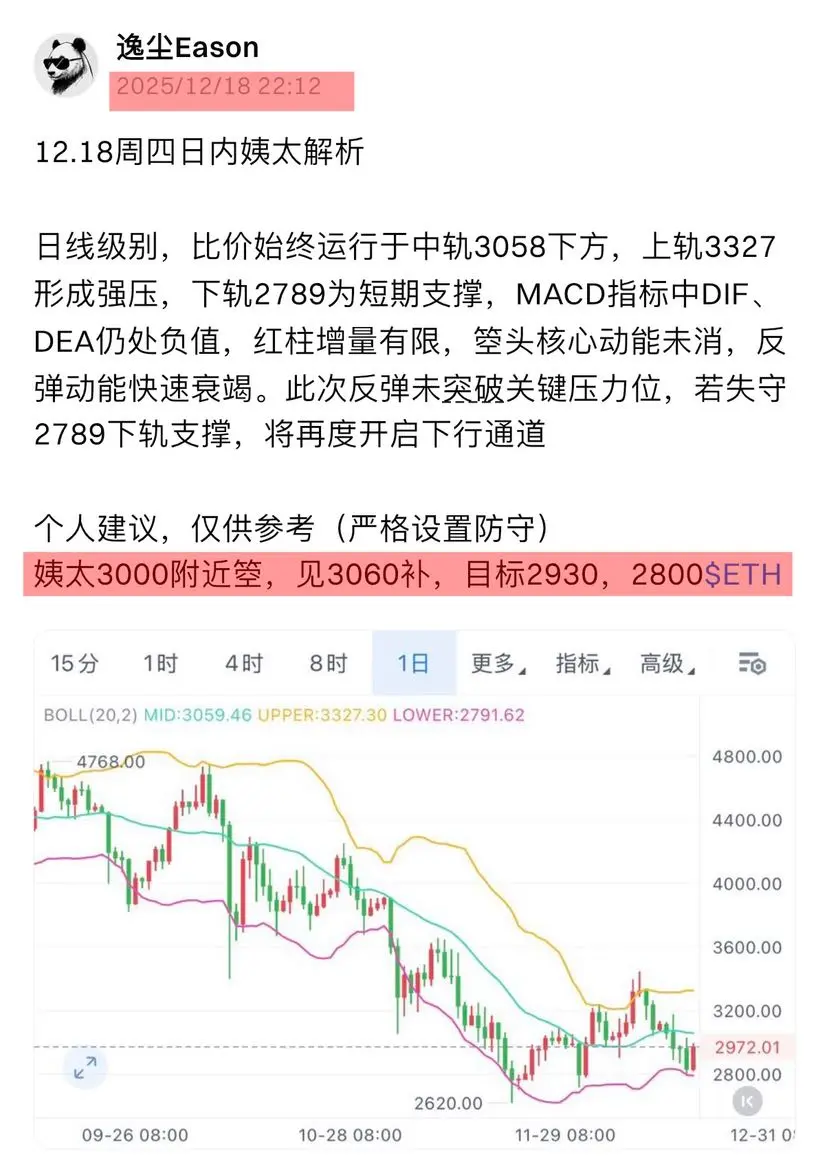

12.18 Thursday Intraday Mistress Analysis

On the daily chart, the price remains below the middle band 3058, with the upper band 3327 forming strong resistance, and the lower band 2789 serving as short-term support. The MACD indicator's DIF and DEA are still in negative territory, with limited red histogram growth. The core momentum of the Kumo cloud has not dissipated, and the rebound momentum is rapidly weakening. This rebound has not broken through the key resistance level. If the support at the lower band 2789 is lost, a downward channel will be reinitiated.

Personal advice, for reference o

On the daily chart, the price remains below the middle band 3058, with the upper band 3327 forming strong resistance, and the lower band 2789 serving as short-term support. The MACD indicator's DIF and DEA are still in negative territory, with limited red histogram growth. The core momentum of the Kumo cloud has not dissipated, and the rebound momentum is rapidly weakening. This rebound has not broken through the key resistance level. If the support at the lower band 2789 is lost, a downward channel will be reinitiated.

Personal advice, for reference o

ETH0.52%

- Reward

- like

- Comment

- Repost

- Share

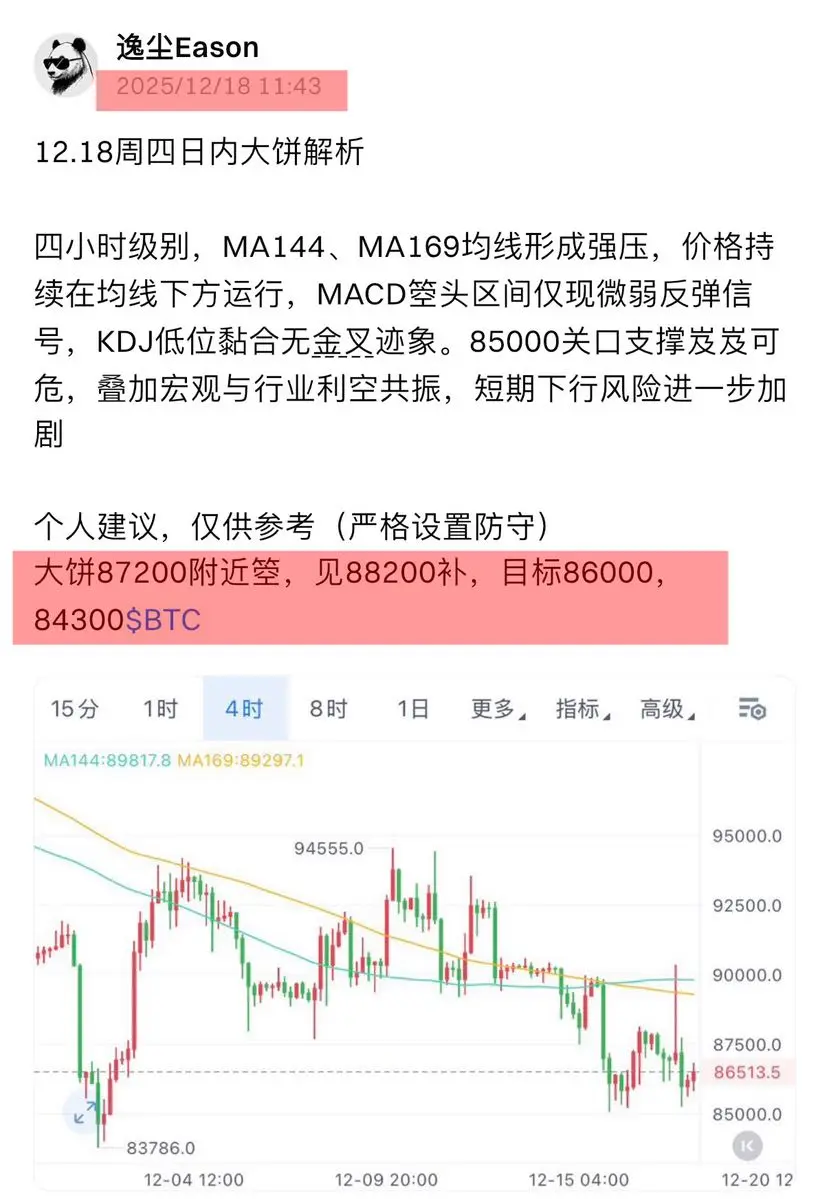

12.18 Thursday Intraday Bitcoin Analysis

At the four-hour level, the MA144 and MA169 moving averages form strong resistance. The price continues to operate below these averages. The MACD histogram shows only a weak rebound signal, and the KDJ is at a low level with no golden cross indication. The support at the 85,000 level is precarious. Coupled with macro and industry bearish signals, the short-term downside risk is further increased.

Personal advice, for reference only (strictly set defensive measures)

Bitcoin around 87,200, see a rebound at 88,200, target 86,000, 84,300$BTC

At the four-hour level, the MA144 and MA169 moving averages form strong resistance. The price continues to operate below these averages. The MACD histogram shows only a weak rebound signal, and the KDJ is at a low level with no golden cross indication. The support at the 85,000 level is precarious. Coupled with macro and industry bearish signals, the short-term downside risk is further increased.

Personal advice, for reference only (strictly set defensive measures)

Bitcoin around 87,200, see a rebound at 88,200, target 86,000, 84,300$BTC

BTC-0.02%

- Reward

- like

- Comment

- Repost

- Share

Recently, the US non-farm payroll data exceeded expectations, increasing market expectations for the Federal Reserve to maintain high interest rates. The US dollar index strengthened, and the market came under obvious pressure.

On the daily chart, the 3068 level forms strong resistance, and the price has not been able to break through. The momentum remains, but there has been no effective rebound in the oversold zone, indicating that the buying power is exhausted.

Personal suggestion, for reference only (strictly set stop-loss)

Around 3000, buy on dips at 3070, target 2900, 2780

View OriginalOn the daily chart, the 3068 level forms strong resistance, and the price has not been able to break through. The momentum remains, but there has been no effective rebound in the oversold zone, indicating that the buying power is exhausted.

Personal suggestion, for reference only (strictly set stop-loss)

Around 3000, buy on dips at 3070, target 2900, 2780

- Reward

- like

- Comment

- Repost

- Share

The 4-hour MA144 and MA169 moving averages form a strong resistance zone above, and the price has not been able to effectively break through the moving average resistance. The rebound is weak, and although the MACD indicator's momentum has slightly diminished, the overall pattern remains unchanged. This rebound appears more like a weak correction.

Personal suggestion, for reference only (strictly set stop-loss)

Around 87,800 for support, see 88,600 for a rebound, target 86,300, 85,000$BTC

Personal suggestion, for reference only (strictly set stop-loss)

Around 87,800 for support, see 88,600 for a rebound, target 86,300, 85,000$BTC

BTC-0.02%

- Reward

- like

- Comment

- Repost

- Share

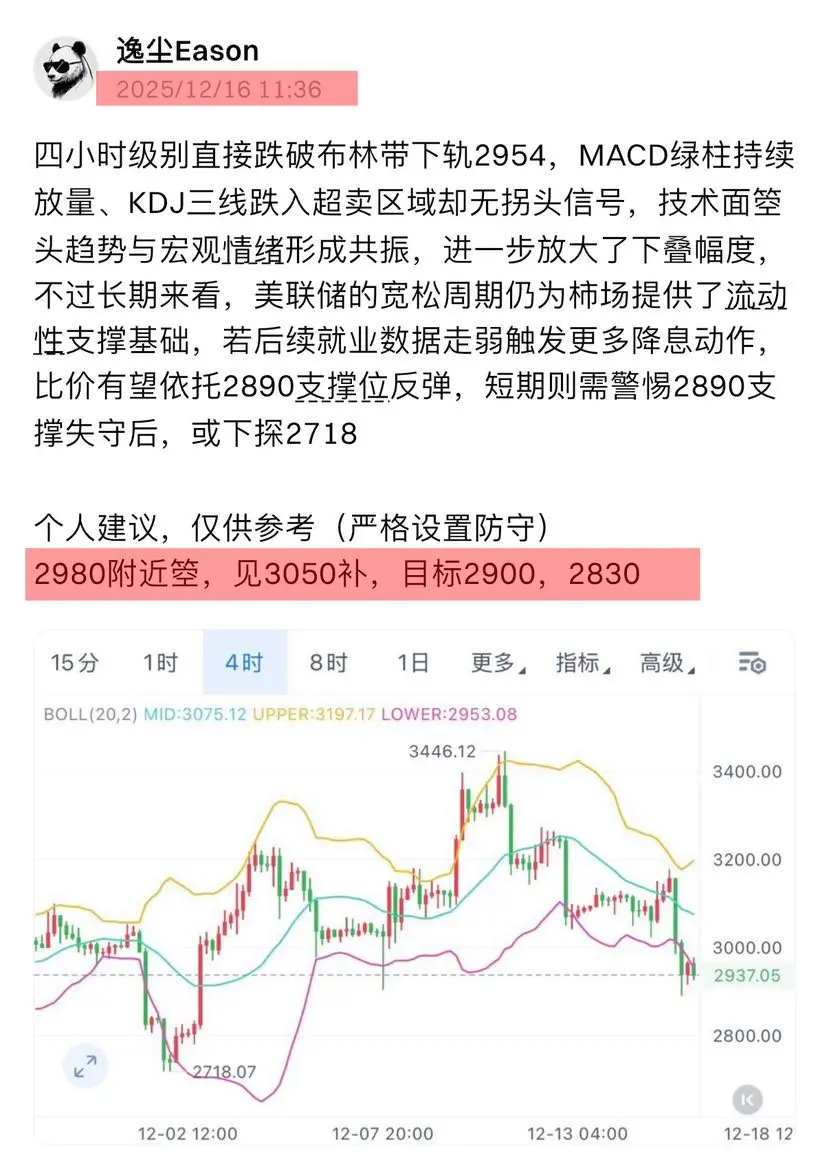

The four-hour level directly broke below the lower Bollinger Band at 2954. The MACD green histogram continues to expand, and the KDJ three lines have entered the oversold area but show no signs of reversal. The technical trend resonates with macro sentiment, further amplifying the downward movement. However, in the long term, the Federal Reserve's easing cycle still provides liquidity support for the market. If subsequent employment data weakens and triggers more rate cuts, the price is expected to rebound around the 2890 support level. In the short term, caution is needed: if the 2890 support

View Original

- Reward

- like

- Comment

- Repost

- Share

Price surged to 89,940 before quickly pulling back, with a dip to 85,073 supporting the move. In the short term, multiple moving averages are being broken, with MA144 and MA169 forming strong resistance above. Overall, the four-hour trend is clear, and attention should be paid to the validity of the 85,000 key support level. If the support is broken or if it dips further to previous lows.

Personal suggestion, for reference only (strictly set stop-loss)

Around 86,700 for a rebound, aiming for 87,700, with targets of 85,200 and 84,000.

View OriginalPersonal suggestion, for reference only (strictly set stop-loss)

Around 86,700 for a rebound, aiming for 87,700, with targets of 85,200 and 84,000.

- Reward

- like

- Comment

- Repost

- Share

The direction was also provided in advance, and those with strong execution have already benefited. The lowest reached 3012, with a potential of 165 points#FHE代币剧烈波动 .

FHE-26.12%

- Reward

- 1

- Comment

- Repost

- Share

Price comparison has always been limited by the middle band of the Bollinger Bands at 3124. Multiple attempts to break through have failed to stabilize. Although the MACD green histogram is narrowing, the DIF and DEA are still in a bearish alignment, and the momentum of the bearish divergence has not fundamentally dissipated. The rebound strength of the KDJ three lines is weak.

Personal suggestion, for reference only (strictly set stop-loss)

A dip around 3150, buy at 3220, target 3080, 2980

View OriginalPersonal suggestion, for reference only (strictly set stop-loss)

A dip around 3150, buy at 3220, target 3080, 2980

- Reward

- 1

- Comment

- Repost

- Share

Although the MACD maintains red bars, the momentum has shown signs of weakening. While it supports the short-term trend, the trading volume has not increased accordingly. Combining this with the 4-hour rhythm, we are currently in the pressure zone after rebounding from the previous lows. If it cannot break through the upper band, it may fall back to test the middle band support at 137.71.

SOL can rebound around 144-147, target 136, 130, if it breaks continue looking down to 120$SOL

SOL can rebound around 144-147, target 136, 130, if it breaks continue looking down to 120$SOL

SOL0.74%

- Reward

- 1

- Comment

- Repost

- Share

From the four-hour level, the current rebound is merely a weak repair. Although the MACD shows a small red bar, the trend has not reversed. It is approaching overbought, and pullback momentum has accumulated. Considering the previous downward trend, this rebound is unlikely to break the resistance level, and there is a high probability of a short-term drop to test the 850-870 support.

BNB can fluctuate around 899-907, with targets at 870, 838, and if it breaks down, continue to look at 800$BNB .

BNB can fluctuate around 899-907, with targets at 870, 838, and if it breaks down, continue to look at 800$BNB .

BNB0.52%

- Reward

- like

- Comment

- Repost

- Share

11.27 Thursday Daily BTC Analysis

On the four-hour level, the price rebound directly encounters strong resistance at MA144 and MA169. Although the MACD red histogram is expanding in the short term, the momentum is difficult to sustain.

Personal advice, for reference only (strictly set defense)

BTC around 91500, see 92500 to add, target 89800, 88000$BTC

On the four-hour level, the price rebound directly encounters strong resistance at MA144 and MA169. Although the MACD red histogram is expanding in the short term, the momentum is difficult to sustain.

Personal advice, for reference only (strictly set defense)

BTC around 91500, see 92500 to add, target 89800, 88000$BTC

BTC-0.02%

- Reward

- 1

- Comment

- Repost

- Share

11.26 Wednesday Daily ETH Analysis

After losing the middle track in price comparison and approaching the lower track support, the MACD shows a bottom divergence but is still in the channel area. The downward trend since September at the daily level remains unchanged, and the current rebound at low levels is limited.

Personal advice, for reference only (set strict defenses)

ETH around 2980, buy at 3050, target 2850, 2730$ETH

After losing the middle track in price comparison and approaching the lower track support, the MACD shows a bottom divergence but is still in the channel area. The downward trend since September at the daily level remains unchanged, and the current rebound at low levels is limited.

Personal advice, for reference only (set strict defenses)

ETH around 2980, buy at 3050, target 2850, 2730$ETH

ETH0.52%

- Reward

- like

- Comment

- Repost

- Share

11.26 Wednesday Daily BTC Analysis

On the four-hour level, the price comparison has always been under pressure below the MA144 mid-term moving average. The previous downward trend from the high has not changed, and although the MACD has formed a golden cross, the expansion of the red bars is weak, indicating that the short-term rebound momentum has shown signs of exhaustion.

Personal advice, for reference only (strictly set up defense)

BTC is around 88500, add at 89200, target 87000, 85300$BTC

On the four-hour level, the price comparison has always been under pressure below the MA144 mid-term moving average. The previous downward trend from the high has not changed, and although the MACD has formed a golden cross, the expansion of the red bars is weak, indicating that the short-term rebound momentum has shown signs of exhaustion.

Personal advice, for reference only (strictly set up defense)

BTC is around 88500, add at 89200, target 87000, 85300$BTC

BTC-0.02%

- Reward

- like

- Comment

- Repost

- Share