ChenJiaguanA

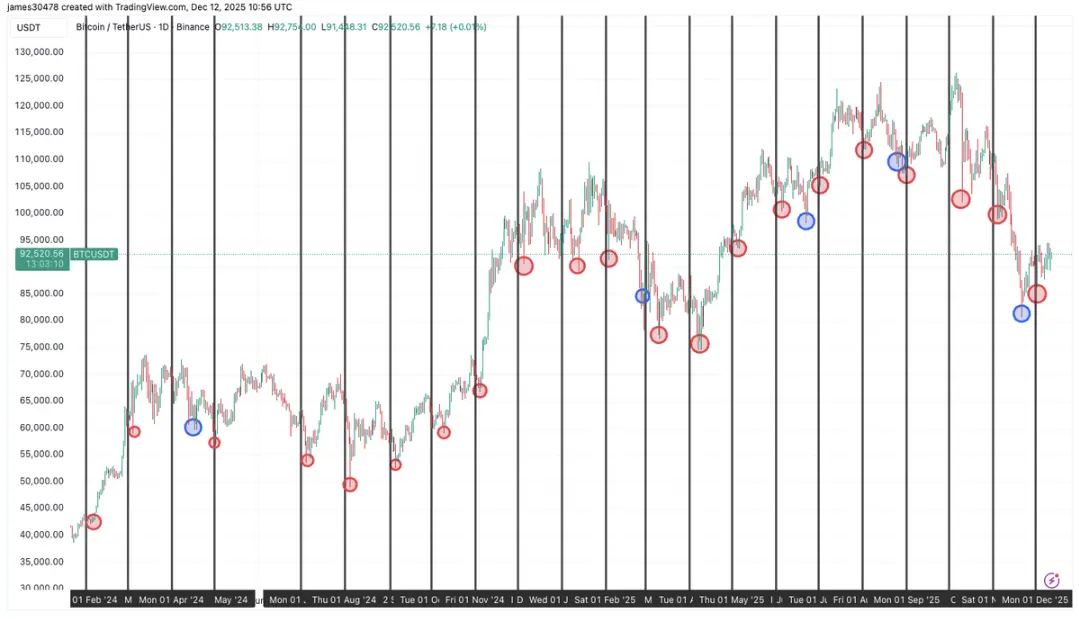

From a short-term perspective, the short-term rebound momentum of Bitcoin has shown signs of weakening on the hourly chart. The upward strength is clearly insufficient, which directly reflects the market's low enthusiasm for chasing highs. The short-term trend is likely to be dominated by oscillation and digestion.

Above key support levels, a cautious and optimistic trading approach can be maintained; if support levels are broken with increased volume, caution should be exercised as a deep correction may occur.

Currently, the market is showing weakness. Trading strategies can combine short-ter

View OriginalAbove key support levels, a cautious and optimistic trading approach can be maintained; if support levels are broken with increased volume, caution should be exercised as a deep correction may occur.

Currently, the market is showing weakness. Trading strategies can combine short-ter