AetherXCapital

No content yet

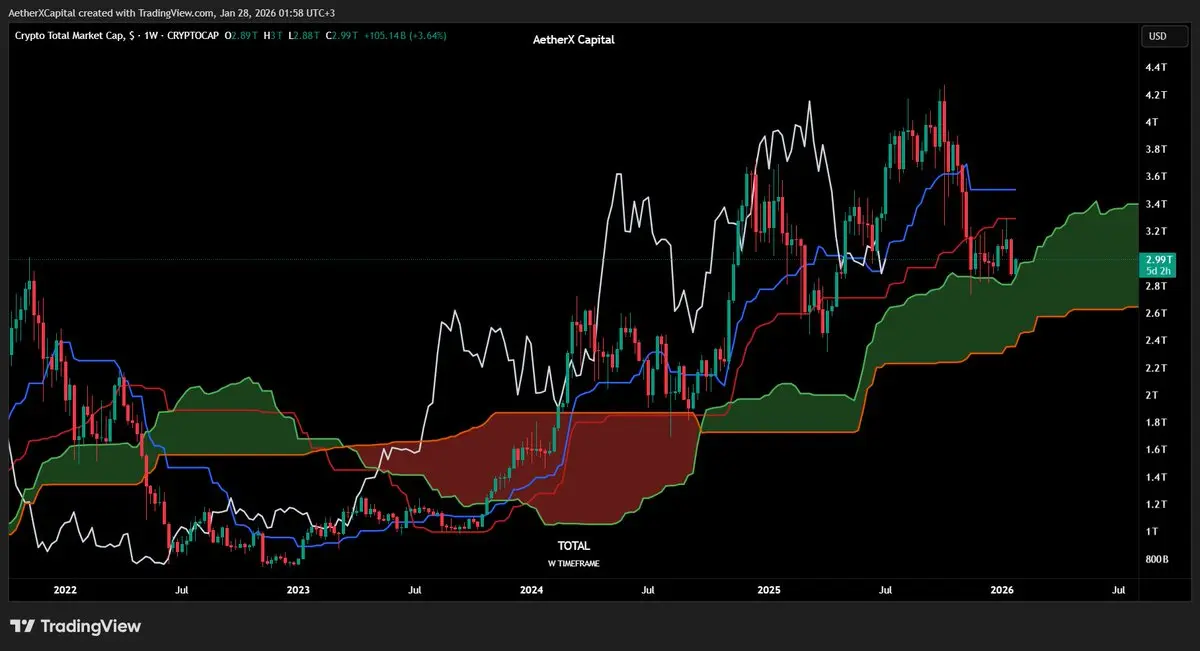

Crypto Total Market Cap has tested the 200-day EMA and 200-day MA as support on the weekly chart and has retraced its entire recent upward impulse

As long as TOTAL remains above both levels, a recovery is still likely 👀

As long as TOTAL remains above both levels, a recovery is still likely 👀

- Reward

- 1

- Comment

- Repost

- Share

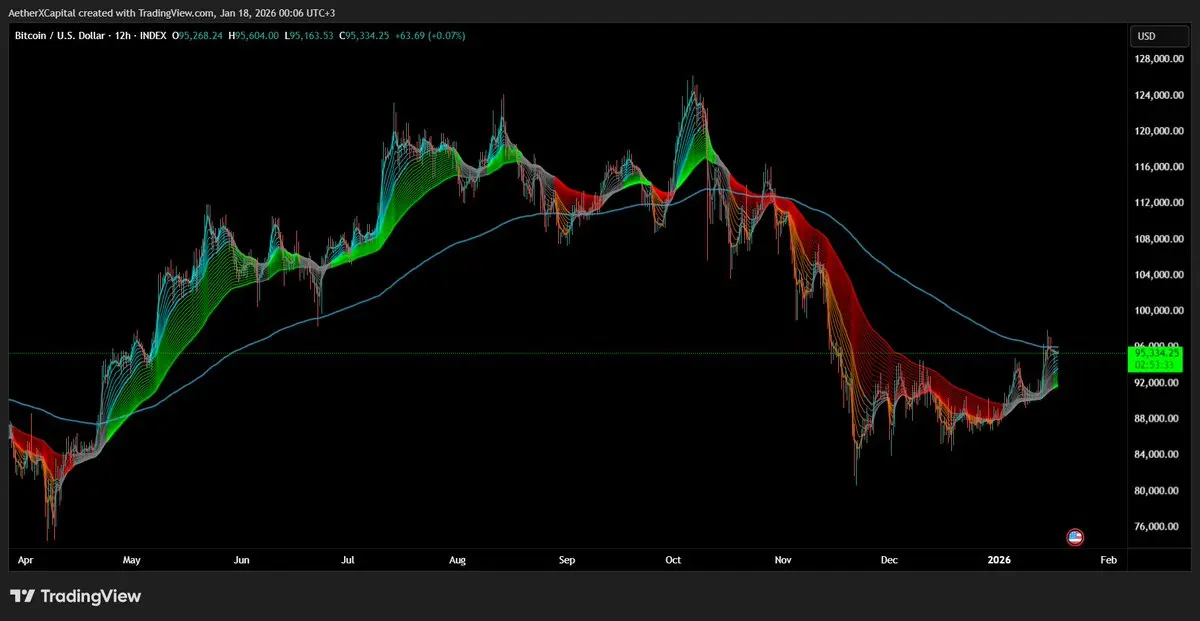

Breakout to the downside of the Ichimoku Cloud on the weekly chart

Bitcoin has officially lost the bullish structure according to this indicator ⚠️

If it finds acceptance below the cloud the bear market could have begun

It needs to reclaim the cloud for us to have hope again for the bull market to resume

$BTC 1W

Bitcoin has officially lost the bullish structure according to this indicator ⚠️

If it finds acceptance below the cloud the bear market could have begun

It needs to reclaim the cloud for us to have hope again for the bull market to resume

$BTC 1W

BTC-0,58%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Bitcoin nearly tested the origin of the latest bullish impulse, and TOTAL tested a bullish order block on the weekly chartA perfect combination for the bottom of this correction to finally form

BTC-0,58%

- Reward

- like

- Comment

- Repost

- Share

Crypto Total Market Cap still has a bullish structure according to the Ichimoku CloudWe are only concerned if it finds acceptance within the cloud, because if it does, the probability of testing its support level increases, and if it breaks down from the cloud, we could expect the bear market to begin

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Some say, "Technical Analysis and indicators don't work."

So what do many profitable traders use?

They have their limitations, but that doesn't mean they don't work

One could argue that price action is much better than indicators, but even so, they are useful

So what do many profitable traders use?

They have their limitations, but that doesn't mean they don't work

One could argue that price action is much better than indicators, but even so, they are useful

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- 2

- Repost

- Share

SujonFF :

:

“ETH is not just crypto, it's innovation. Strong ecosystem, real utility, long-term potential. Bullish on Ethereum.”View More

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share