DegenSing

No content yet

DegenSing

Web3 Job is good: - Ambassador ($0 - $200 per month) - Moderator ($0 - $500 per month) - Deals ($20 - $10,000 per project) - Alpha Caller ($0 - $50 per month) - Content Creator ($0 - $400 per month) - Airdrop ($0 - $100,000 per project) - Yapper ($100 - 30,000 per project)

- Reward

- like

- Comment

- Repost

- Share

So many people are losing credibility on CT cause they're sidelined on coins that are running..

And they can't help but tweet about how "this shouldn't be pumping" or "this makes no sense"..

Listen.. you'll never catch everything.. and you don't have to play everything..

The market is irrational.. always has been.. there's nothing you can do to change that..

You can either quit.. or embrace it..

Anything else is just burning energy for nothing..

It's pointless and exhausting being the old man yelling at clouds about how "the market is broken" while everyone else is making money..

Nobody respec

And they can't help but tweet about how "this shouldn't be pumping" or "this makes no sense"..

Listen.. you'll never catch everything.. and you don't have to play everything..

The market is irrational.. always has been.. there's nothing you can do to change that..

You can either quit.. or embrace it..

Anything else is just burning energy for nothing..

It's pointless and exhausting being the old man yelling at clouds about how "the market is broken" while everyone else is making money..

Nobody respec

- Reward

- 1

- Comment

- Repost

- Share

I'm not gonna lie to you.. Things are about to get hard.. Crypto is in a rough place right now.. Consumer apps.. most of them didn't work.. Memecoins.. rugged a lot of normal people who trusted the wrong narratives.. I could keep going but you already know the rest.. If

- Reward

- 1

- Comment

- Repost

- Share

Web3 Job is good:

- Ambassador ($0 - $200 per month)

- Moderator ($0 - $500 per month)

- Deals ($20 - $10,000 per project)

- Alpha Caller ($0 - $50 per month)

- Content Creator ($0 - $400 per month)

- Airdrop ($0 - $100,000 per project)

- Yapper ($100 - 30,000 per project)

Apply right now

- Ambassador ($0 - $200 per month)

- Moderator ($0 - $500 per month)

- Deals ($20 - $10,000 per project)

- Alpha Caller ($0 - $50 per month)

- Content Creator ($0 - $400 per month)

- Airdrop ($0 - $100,000 per project)

- Yapper ($100 - 30,000 per project)

Apply right now

- Reward

- 1

- Comment

- Repost

- Share

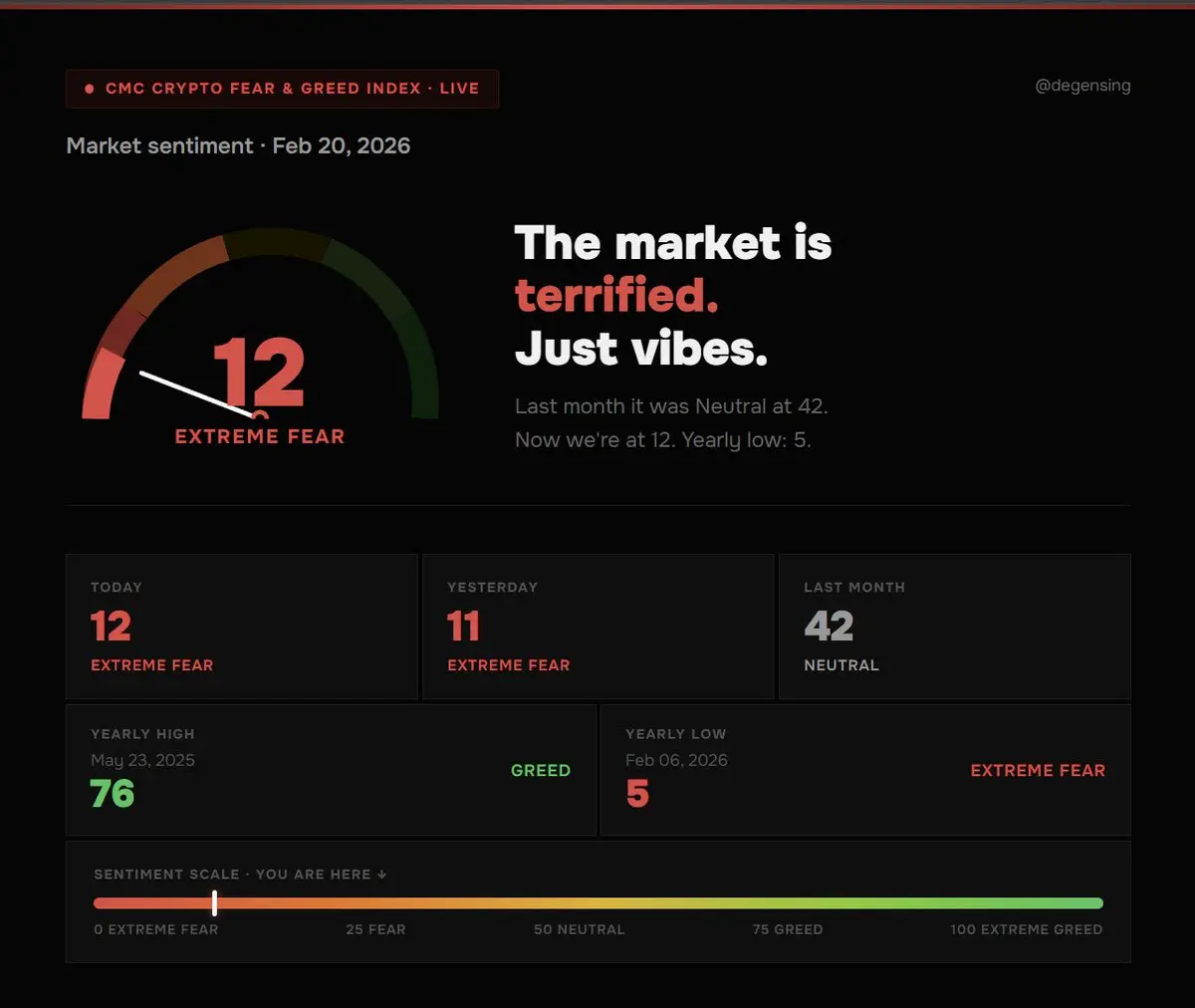

crypto fear & greed just hit 12. not fear.. Extreme Fear. last month we were at 42 (Neutral). yearly low was 5 on Feb 6th. the market is genuinely terrified rn. that's it. that's the tweet.

- Reward

- 1

- Comment

- Repost

- Share

I'm not gonna lie to you..

Things are about to get hard..

Crypto is in a rough place right now..

Consumer apps.. most of them didn't work..

Memecoins.. rugged a lot of normal people who trusted the wrong narratives..

I could keep going but you already know the rest..

If you're trying to build right now.. you're gonna have to build at the intersection of crypto.. not inside of it..

Pure crypto products aren't getting traction like they used to.. you need something that bridges Web2 users into Web3.. not something that only serves people already here..

You're gonna have to learn how to pivot.. e

Things are about to get hard..

Crypto is in a rough place right now..

Consumer apps.. most of them didn't work..

Memecoins.. rugged a lot of normal people who trusted the wrong narratives..

I could keep going but you already know the rest..

If you're trying to build right now.. you're gonna have to build at the intersection of crypto.. not inside of it..

Pure crypto products aren't getting traction like they used to.. you need something that bridges Web2 users into Web3.. not something that only serves people already here..

You're gonna have to learn how to pivot.. e

- Reward

- 1

- Comment

- Repost

- Share

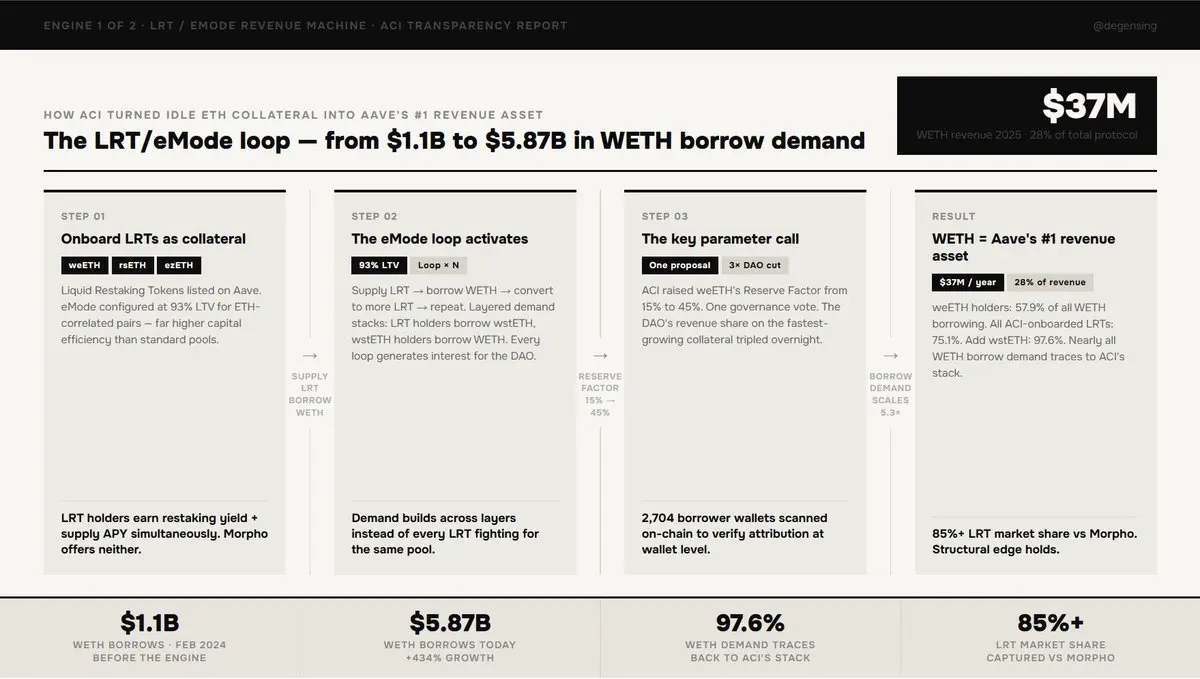

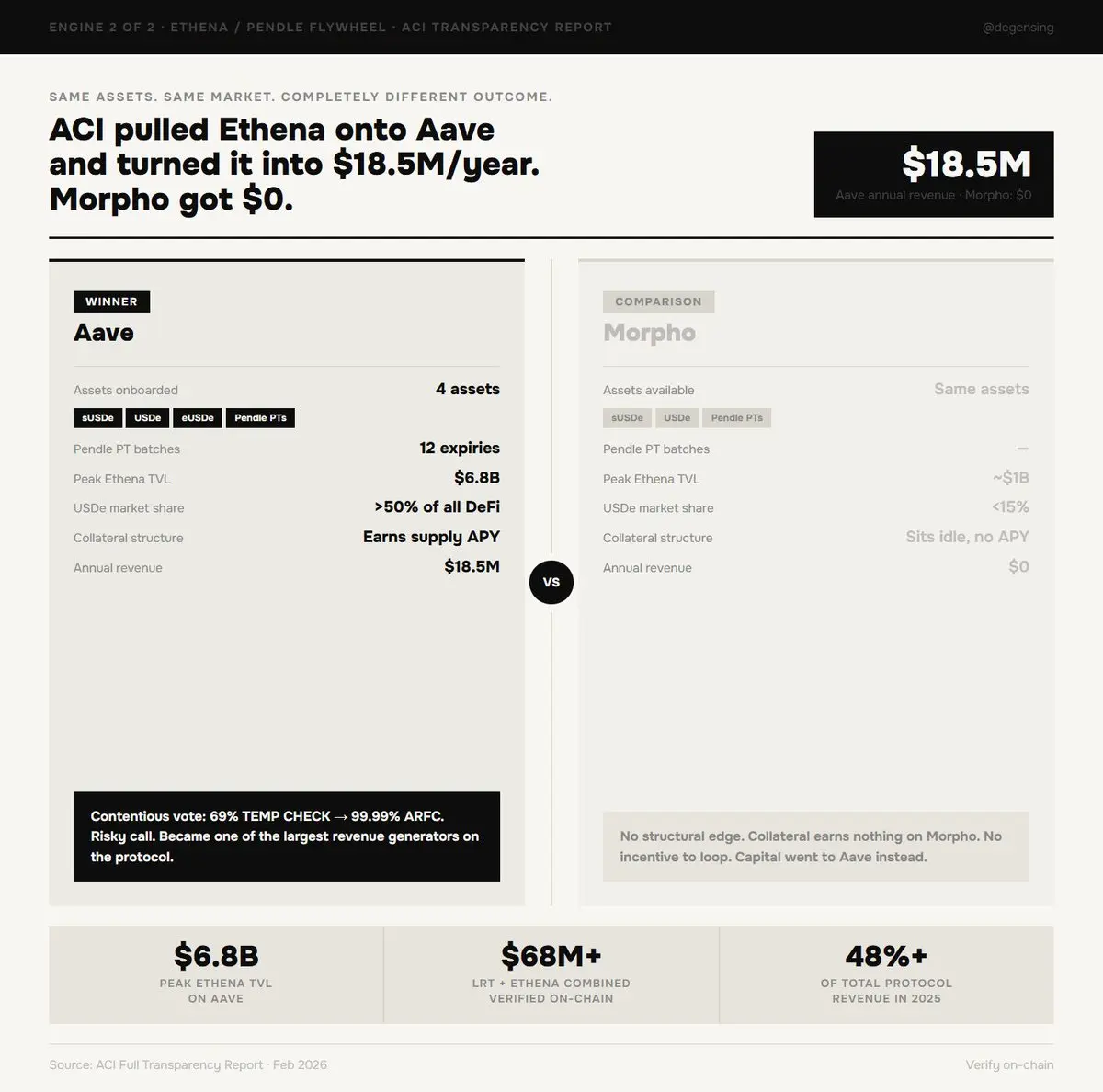

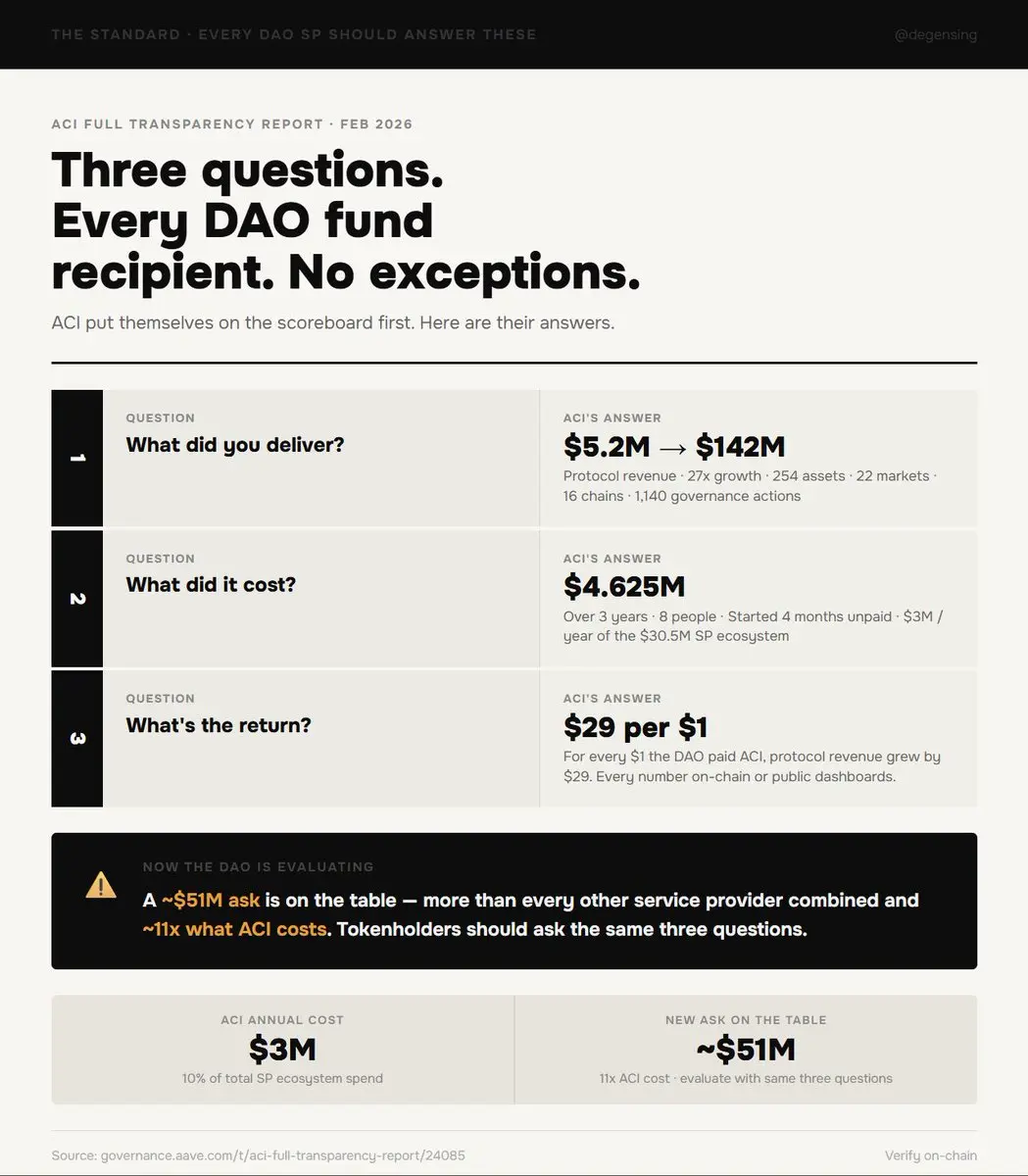

ACI just dropped the most transparent governance report I've seen in DeFi. 8 people. $4.625M paid by the DAO over three years. And they started four months before they saw a single dollar. Here's what they actually built and why it matters right now. In February 2024, WETH

- Reward

- 1

- Comment

- Repost

- Share

crypto fear & greed just hit 12.

not fear.. Extreme Fear.

last month we were at 42 (Neutral). yearly low was 5 on Feb 6th.

the market is genuinely terrified rn.

that's it. that's the tweet.

not fear.. Extreme Fear.

last month we were at 42 (Neutral). yearly low was 5 on Feb 6th.

the market is genuinely terrified rn.

that's it. that's the tweet.

- Reward

- 1

- Comment

- Repost

- Share

The global financial system has spent centuries financing scarcity.. Sovereign debt. Mortgages. Corporate bonds. All of them are claims on systems built around things being scarce and expensive. Stani is saying that era is ending. And Aave wants to be the bank that finances

AAVE-4,38%

- Reward

- 1

- Comment

- Repost

- Share

Let that sink in for a second.. To reach net zero by 2050, solar needs to go from 1,700 GW today to 14,000–15,500 GW. That's a $10–12 trillion investment gap at minimum. In the abundance case - where cheap solar energy triggers industrial renaissances, desalination at scale,

- Reward

- 1

- Comment

- Repost

- Share

Here's exactly how Aave finances solar on-chain.. A solar developer tokenizes $100M in project debt. Deposits it as collateral on Aave. Borrows $70M in GHO stablecoins within minutes. Redeploys immediately into the next project. What used to take 6–12 months of infrastructure

AAVE-4,38%

- Reward

- like

- Comment

- Repost

- Share

Every major transformation in history needed finance first.. Mesopotamian temples funded irrigation that built the first cities. Columbus got VC money from the Spanish crown. J.P. Morgan financed Edison. Country banks turned farms into factories. The pattern has never changed:

- Reward

- like

- Comment

- Repost

- Share

Here's DeFi's actual bottleneck right now.. Supply side? Solved. Aave has $34–44B TVL. $133M in annualized revenue. Over 60% of all DeFi lending runs through it. The problem is demand side. Where does all that hungry capital actually go? Right now it mostly lends against BTC,

AAVE-4,38%

- Reward

- like

- Comment

- Repost

- Share

ACI just dropped the most transparent governance report I've seen in DeFi.

8 people. $4.625M paid by the DAO over three years. And they started four months before they saw a single dollar.

Here's what they actually built and why it matters right now.

In February 2024, WETH borrows on Aave sat at around $1.1B. Not bad.. but not where the opportunity was.

ACI saw something. They onboarded weETH, rsETH, and ezETH as collateral, and configured eMode at 93% LTV for ETH-correlated pairs. The loop is elegant: supply an LRT, borrow WETH, convert to more LRT, repeat. Every cycle stacks borrow demand

8 people. $4.625M paid by the DAO over three years. And they started four months before they saw a single dollar.

Here's what they actually built and why it matters right now.

In February 2024, WETH borrows on Aave sat at around $1.1B. Not bad.. but not where the opportunity was.

ACI saw something. They onboarded weETH, rsETH, and ezETH as collateral, and configured eMode at 93% LTV for ETH-correlated pairs. The loop is elegant: supply an LRT, borrow WETH, convert to more LRT, repeat. Every cycle stacks borrow demand

- Reward

- like

- Comment

- Repost

- Share

Bitcoin is closing in on its longest losing streak since 2022.. 5 consecutive weekly red candles. Fear & Greed at 6 - same reading as the FTX collapse. Everyone's calling it the end. Here's the thing though.. In 2022 BTC went 9 straight weeks in the red. Dropped from $40K to

- Reward

- 2

- Comment

- Repost

- Share

Everyone was an AI crypto believer when prices were up 10x.. Now prices are down. The hype crowd is gone. And honestly? That's the best filter the market has. Because the protocols that were actually building something didn't stop shipping just because the chart went red. ->

- Reward

- 2

- Comment

- Repost

- Share

Bitcoin is closing in on its longest losing streak since 2022..

5 consecutive weekly red candles. Fear & Greed at 6 - same reading as the FTX collapse. Everyone's calling it the end.

Here's the thing though..

In 2022 BTC went 9 straight weeks in the red. Dropped from $40K to $15.5K. Every headline said the same thing they're saying now..

And then it went to $126,500.

We're at week 5. We haven't even matched 2022 yet.

This isn't a prediction. It's just pattern recognition. The streak always ends. The only question worth asking right now is whether you're going to be holding when it does.

5 consecutive weekly red candles. Fear & Greed at 6 - same reading as the FTX collapse. Everyone's calling it the end.

Here's the thing though..

In 2022 BTC went 9 straight weeks in the red. Dropped from $40K to $15.5K. Every headline said the same thing they're saying now..

And then it went to $126,500.

We're at week 5. We haven't even matched 2022 yet.

This isn't a prediction. It's just pattern recognition. The streak always ends. The only question worth asking right now is whether you're going to be holding when it does.

- Reward

- 2

- Comment

- Repost

- Share

The market is in that weird in-between phase right now.. BTC pulled back. ETH is looking sleepy. Nobody knows if we're about to run or bleed out slowly for another few weeks.. And this is exactly where most people make the mistake. They either panic sell or just sit there

ETH0,36%

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More283.54K Popularity

88.77K Popularity

411.01K Popularity

107.77K Popularity

14.98K Popularity

Pin