InvestingWithBrandon

No content yet

InvestingWithBrandon

People underestimate how much $1 can grow.

$1 invested at 11% annual returns turns into:

- $8.94 in 20 years

- $238 in 50 years

(brainless SP500 returns here)

BUT WHAT IF THERE WAS A WAY FOR YOU TO GET 20% PER YEAR...

$1 invested at 20% annual returns turns into:

- $53 in 20 years

- $20,283 in 50 years

(my CAGR in last 10 years is 24% FYI)

Now think about this:

Every dollar you spend on things you don’t need isn’t just a dollar lost today...

IT'S THOUSANDS LOST IN THE FUTURE...

$1 invested at 11% annual returns turns into:

- $8.94 in 20 years

- $238 in 50 years

(brainless SP500 returns here)

BUT WHAT IF THERE WAS A WAY FOR YOU TO GET 20% PER YEAR...

$1 invested at 20% annual returns turns into:

- $53 in 20 years

- $20,283 in 50 years

(my CAGR in last 10 years is 24% FYI)

Now think about this:

Every dollar you spend on things you don’t need isn’t just a dollar lost today...

IT'S THOUSANDS LOST IN THE FUTURE...

- Reward

- like

- Comment

- Repost

- Share

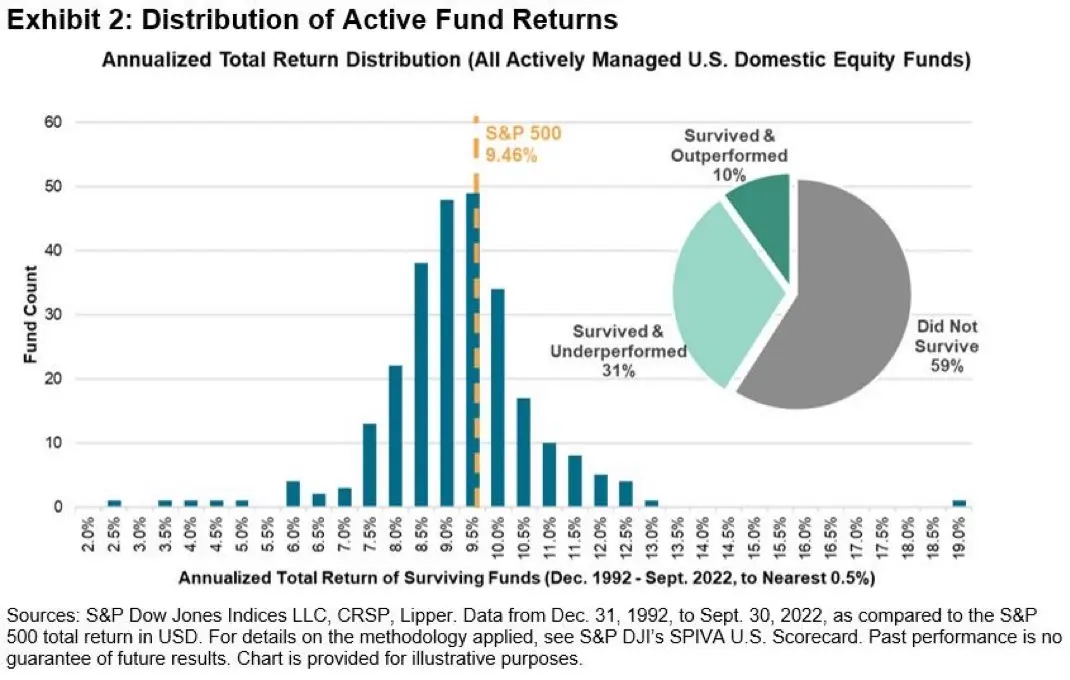

When people say hedge funds are great & view them as the “pinnacle of investing” yet 9 out of 10 underperform the SP500…

- Reward

- like

- Comment

- Repost

- Share

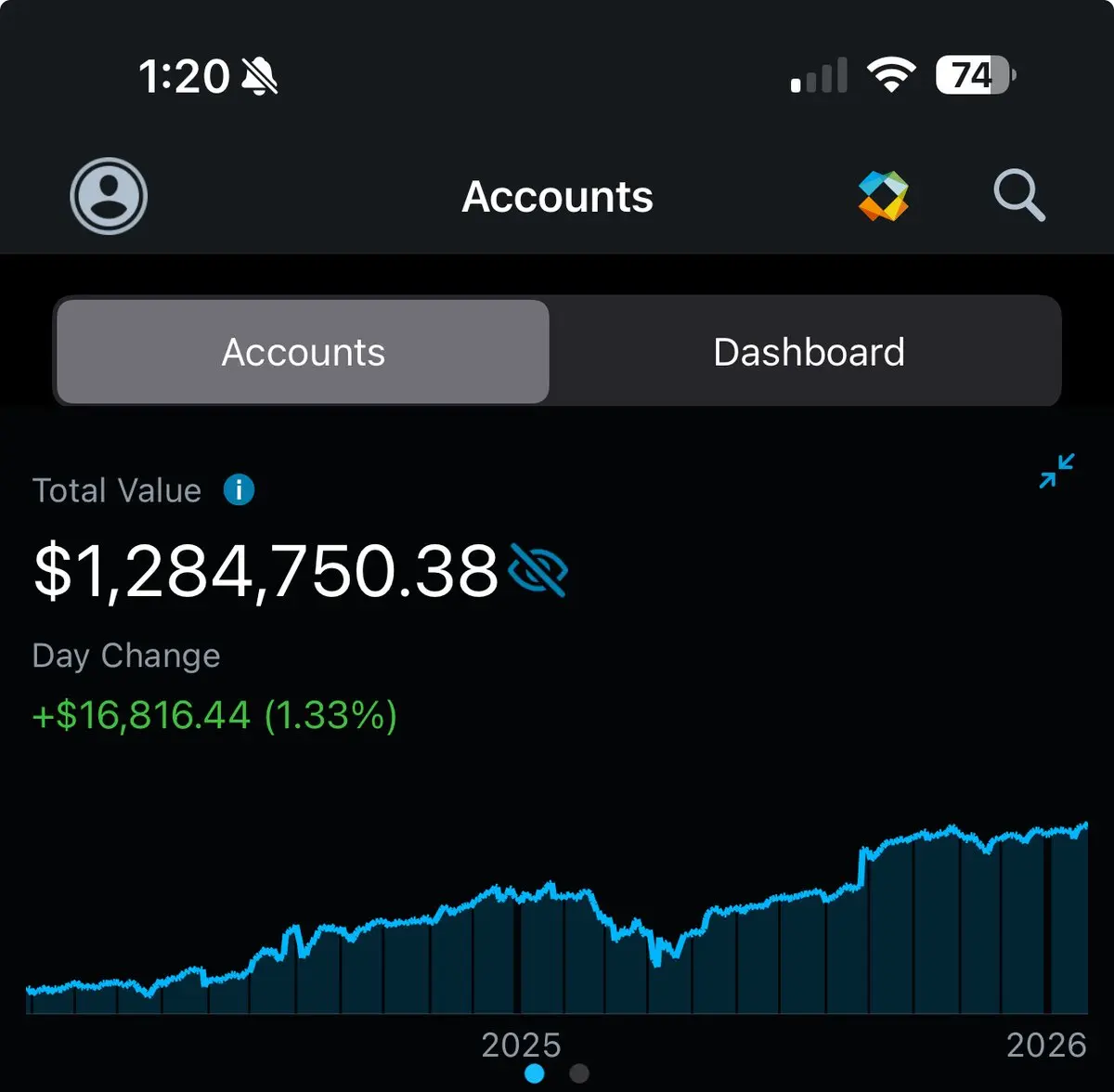

Selling 1+ year portfolio secured put options retired me.

If done correctly, it can retire anyone.

If done correctly, it can retire anyone.

- Reward

- like

- Comment

- Repost

- Share

Hard Truth:

The people on the right do not even beat the SP500 in the long run.

The people on the right do not even beat the SP500 in the long run.

- Reward

- 1

- Comment

- Repost

- Share

🔴It's now 2026.

For 95%+ of retail investors:

- Day trading still doesn't work.

- Swing trading still doesn't work.

- Cash secured puts still suck.

- Covered calls still suck.

- Spreads still suck.

The problem for retail "investors"?

They will continue to do the same thing & expect a different result.

Me?

- I will continue to build my base portfolio

- Sell portfolio secured puts (not cash secured)

- Buy leap calls when it makes sense

- Keep ratios in check

- Do all 1+ year option contracts

- Continue to capitalize in volatility

- Be patient & outperform 95% of all retail investors in the long

For 95%+ of retail investors:

- Day trading still doesn't work.

- Swing trading still doesn't work.

- Cash secured puts still suck.

- Covered calls still suck.

- Spreads still suck.

The problem for retail "investors"?

They will continue to do the same thing & expect a different result.

Me?

- I will continue to build my base portfolio

- Sell portfolio secured puts (not cash secured)

- Buy leap calls when it makes sense

- Keep ratios in check

- Do all 1+ year option contracts

- Continue to capitalize in volatility

- Be patient & outperform 95% of all retail investors in the long

- Reward

- 2

- 1

- Repost

- Share

Wetik :

:

Hold tight 💪5 CRITICAL Things I Need Before I Invest In A Company:

1. Macro/Economic thesis must be good.

2. Company must be near intrinsic value.

3. Company must have a moat.

4. Company must have pricing power.

5. Company must have a durable competitive advantage.

If all 5 tests pass, I will allocate in a bullish way.

- Buying shares.

- Selling 1+ year portfolio secured puts (not cash secured)

- Buy LEAPS calls.

Then what?

I sit and be patient.

I let the company work for me.

I let the EPS climb.

I let the valuation bounce back to where it should be.

Once I capture the "majority of the expected move" I wi

1. Macro/Economic thesis must be good.

2. Company must be near intrinsic value.

3. Company must have a moat.

4. Company must have pricing power.

5. Company must have a durable competitive advantage.

If all 5 tests pass, I will allocate in a bullish way.

- Buying shares.

- Selling 1+ year portfolio secured puts (not cash secured)

- Buy LEAPS calls.

Then what?

I sit and be patient.

I let the company work for me.

I let the EPS climb.

I let the valuation bounce back to where it should be.

Once I capture the "majority of the expected move" I wi

- Reward

- 2

- Comment

- Repost

- Share

The BIGGEST hack with selling portfolio secured puts is that you can technically make an unlimited ROI.

(not kidding)

Roll with me on this one, it will BLOW YOUR MIND!

So selling puts is a bullish strategy.

That's why I would never want to sell "cash secured puts", I sell "portfolios secured puts."

(cash sits there and does nothing, but portfolio secured works for you being invested)

Ok.

So when I sell portfolio secured puts and collect say $20k for example, I take that cash flow and buy $20k in shares of the company I am bullish on. (same one I am selling puts on)

I usually sell 1 year contra

(not kidding)

Roll with me on this one, it will BLOW YOUR MIND!

So selling puts is a bullish strategy.

That's why I would never want to sell "cash secured puts", I sell "portfolios secured puts."

(cash sits there and does nothing, but portfolio secured works for you being invested)

Ok.

So when I sell portfolio secured puts and collect say $20k for example, I take that cash flow and buy $20k in shares of the company I am bullish on. (same one I am selling puts on)

I usually sell 1 year contra

- Reward

- 1

- Comment

- Repost

- Share

I'd rather own 5 ULTRA high conviction stocks vs 50 garbage companies that are pipe dreams...

What I Look For:

- Good Valuation

- Moat

- Pricing power

- Durable Competitive Advantage

- Ok To Hold For Long Run

- All 1+ year option contracts

You work hard for your money, stop gambling like most retail "traders" do.

What I Look For:

- Good Valuation

- Moat

- Pricing power

- Durable Competitive Advantage

- Ok To Hold For Long Run

- All 1+ year option contracts

You work hard for your money, stop gambling like most retail "traders" do.

- Reward

- like

- Comment

- Repost

- Share

The reason most people think options are “dangerous” is because the only version they’ve seen is pure gambling...

Zero clue on valuation.

Zero clue on the actual business.

Zero clue if the business will even be around in 5 years.

All they know is weekly lotto tickets essentially.

& then they wonder why their returns are crappy over the long term...

Zero clue on valuation.

Zero clue on the actual business.

Zero clue if the business will even be around in 5 years.

All they know is weekly lotto tickets essentially.

& then they wonder why their returns are crappy over the long term...

- Reward

- 1

- Comment

- Repost

- Share

🟢THIS IS HOW TO INVEST $100,000 RIGHT NOW:

(works on any amount though)

$35k $VOO

$35k $Q

$15k individual companies

$10k $BLV

$5k leap calls

(A little more conservative now cause valuations are on the high side)

Then for the magic part:

Sell 1 year puts portfolio secured, not cash secured on companies that meet this criteria:

1. Must be below intrinsic value.

2. Must have a moat.

3. Must have pricing power.

4. Must have a durable competitive advantage.

5. I must be ok to hold for the long run. In the event I get assigned shares, I can use the wheel strategy & patiently "get rid" of the shares

(works on any amount though)

$35k $VOO

$35k $Q

$15k individual companies

$10k $BLV

$5k leap calls

(A little more conservative now cause valuations are on the high side)

Then for the magic part:

Sell 1 year puts portfolio secured, not cash secured on companies that meet this criteria:

1. Must be below intrinsic value.

2. Must have a moat.

3. Must have pricing power.

4. Must have a durable competitive advantage.

5. I must be ok to hold for the long run. In the event I get assigned shares, I can use the wheel strategy & patiently "get rid" of the shares

- Reward

- 2

- Comment

- Repost

- Share

Become a real investor with Stocks & Options here:

- Reward

- 2

- Comment

- Repost

- Share

I make about $30k a month with options.

NO Day trading

NO Swing trading

NO Covered calls

NO Cash secured puts

NO BS

INSTEAD, I DO THIS:

Build base portfolio

Sell portfolio secured puts (not cash secured)

Buy LEAP calls with the premium from sold puts

BUY shares with the premium from sold puts

Be patient through volatility

(all 1+year option contracts)

I can explain it to a 12 year old & I will likely outperform 95% of people that read this.

Simple wins.

NO Day trading

NO Swing trading

NO Covered calls

NO Cash secured puts

NO BS

INSTEAD, I DO THIS:

Build base portfolio

Sell portfolio secured puts (not cash secured)

Buy LEAP calls with the premium from sold puts

BUY shares with the premium from sold puts

Be patient through volatility

(all 1+year option contracts)

I can explain it to a 12 year old & I will likely outperform 95% of people that read this.

Simple wins.

- Reward

- 1

- Comment

- Repost

- Share

I have been selling portfolio secured puts for the last 10 years & have been assigned a total of 4 times.

Think about that.

Just 4 times.

& every time I got assigned, I made money still.

This is the power of selling portfolio secured puts on great companies at good prices with 1+ year expiration dates.

Keep it simple.

Stop over trading & under performing.

Think about that.

Just 4 times.

& every time I got assigned, I made money still.

This is the power of selling portfolio secured puts on great companies at good prices with 1+ year expiration dates.

Keep it simple.

Stop over trading & under performing.

- Reward

- 2

- Comment

- Repost

- Share

If your entire “plan” is:

- Sell covered calls on everything

- Sell cash secured puts on whatever’s trending

- Repeat weekly

You don’t have a plan. You have a treadmill that is more work & will not even beat the SP500 in the long run.

My system is brutally simple:

- Build the base portfolio

- Sell portfolio secured puts when great companies go on sale

- All option contracts are 1+ year in duration

- Buy shares & calls funded by the sold put premium

- Beat the market in the long run

DONE.

- Sell covered calls on everything

- Sell cash secured puts on whatever’s trending

- Repeat weekly

You don’t have a plan. You have a treadmill that is more work & will not even beat the SP500 in the long run.

My system is brutally simple:

- Build the base portfolio

- Sell portfolio secured puts when great companies go on sale

- All option contracts are 1+ year in duration

- Buy shares & calls funded by the sold put premium

- Beat the market in the long run

DONE.

- Reward

- 1

- Comment

- Repost

- Share

The fastest way to spot a retail investor with no system?

Look at their trade history.

500+ trades a year. Constant stress. Constant “adjustments.” Underperforming the SP500 in the long term... All for what?

The actual truth...

There are not 500 "table pounder" opportunities a year. There are a few dozen usually... & I’d rather go big on those with longer duration option contracts & actually beat the market in the long term.

Look at their trade history.

500+ trades a year. Constant stress. Constant “adjustments.” Underperforming the SP500 in the long term... All for what?

The actual truth...

There are not 500 "table pounder" opportunities a year. There are a few dozen usually... & I’d rather go big on those with longer duration option contracts & actually beat the market in the long term.

- Reward

- 1

- Comment

- Repost

- Share

This chart theoretically shows where the market should go between now and 2030.

(I plotted my expected EPS growth line on Q)

You can see 2026 I expect nada!

(valuations need to reset a little and take a breather)

But if valuations do reset & come a little closer to intrinsic value, we could see super solid years in the market for 2027 and beyond.

Regardless, there will be a LOT of volatility along the way and the market is not going to follow this in a straight line up and to the right.

(the market will bounce above & below the line)

BUT! The market will follow it in the long term.

Again,

(I plotted my expected EPS growth line on Q)

You can see 2026 I expect nada!

(valuations need to reset a little and take a breather)

But if valuations do reset & come a little closer to intrinsic value, we could see super solid years in the market for 2027 and beyond.

Regardless, there will be a LOT of volatility along the way and the market is not going to follow this in a straight line up and to the right.

(the market will bounce above & below the line)

BUT! The market will follow it in the long term.

Again,

- Reward

- 1

- Comment

- Repost

- Share

If your options strategy needs the stock to move in the next 3 to 5 days to make money... you don’t have a strategy.

You have chips on the casino table...

& eventually, the house will win.

(yes I know corny analogy, but true!)

This is why I only do 1+ year options contracts. I only need to be right over time, not by Friday at 12:17pm.

You have chips on the casino table...

& eventually, the house will win.

(yes I know corny analogy, but true!)

This is why I only do 1+ year options contracts. I only need to be right over time, not by Friday at 12:17pm.

- Reward

- like

- Comment

- Repost

- Share