Shenron1226

No content yet

Shenron1226

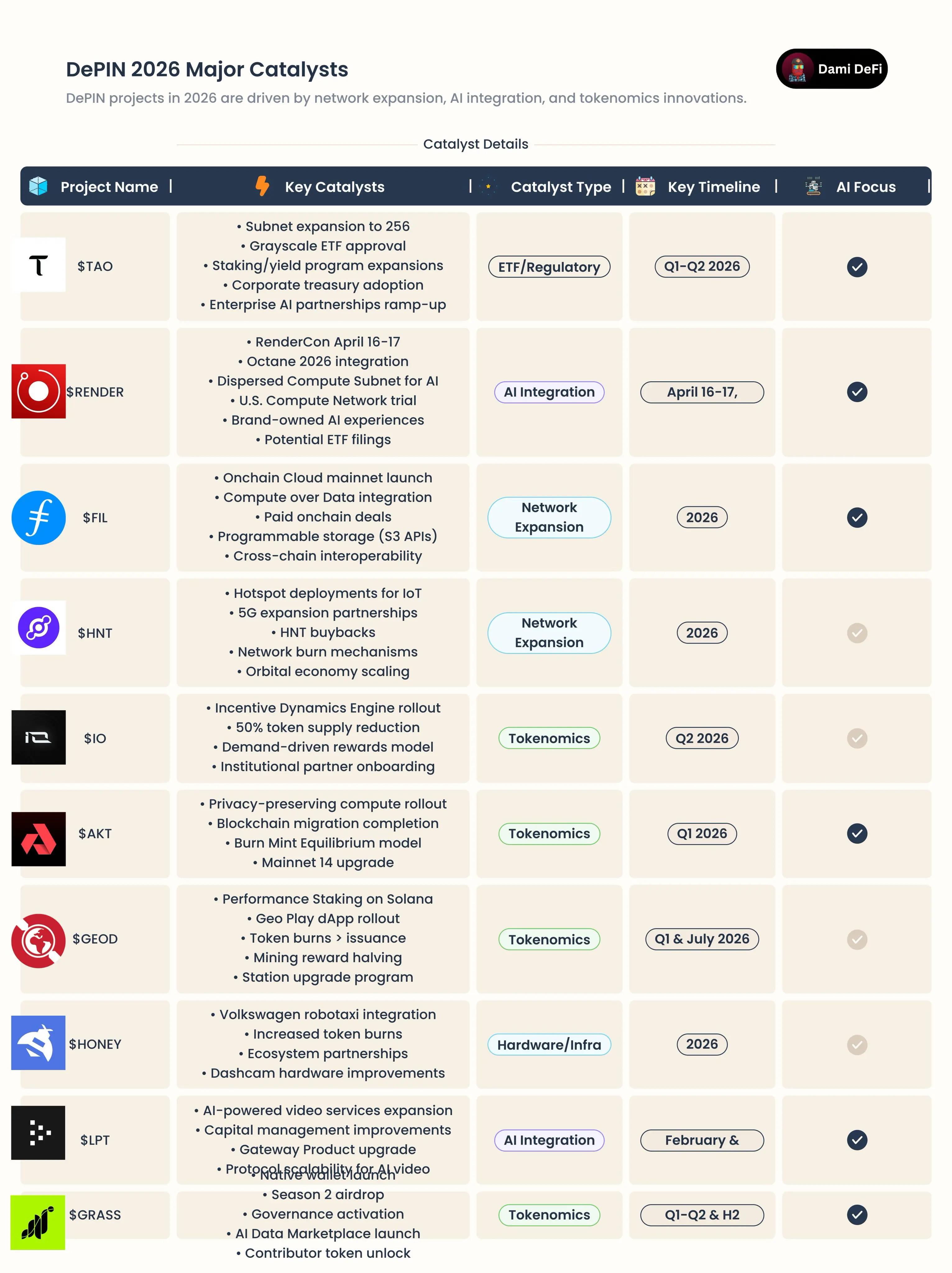

DePIN Is About to EXPLODE in 2026

Here are the MAJOR catalysts hitting this year:

$TAO: Subnet expansion to 256, Grayscale ETF approval in Q1-Q2, staking and yield program expansions, corporate treasury adoption of TAO, enterprise AI partnerships ramp-up

$RENDER: RenderCon April 16-17, Octane 2026 integration for real-time rendering, Dispersed Compute Subnet for AI workloads, U.S.-based Compute Network trial expansion, surge in brand-owned AI experiences and GPU-powered creation, potential ETF filings advancing

$FIL: Onchain Cloud mainnet launch, Compute over Data integration for verifiable AI

Here are the MAJOR catalysts hitting this year:

$TAO: Subnet expansion to 256, Grayscale ETF approval in Q1-Q2, staking and yield program expansions, corporate treasury adoption of TAO, enterprise AI partnerships ramp-up

$RENDER: RenderCon April 16-17, Octane 2026 integration for real-time rendering, Dispersed Compute Subnet for AI workloads, U.S.-based Compute Network trial expansion, surge in brand-owned AI experiences and GPU-powered creation, potential ETF filings advancing

$FIL: Onchain Cloud mainnet launch, Compute over Data integration for verifiable AI

- Reward

- like

- Comment

- Repost

- Share

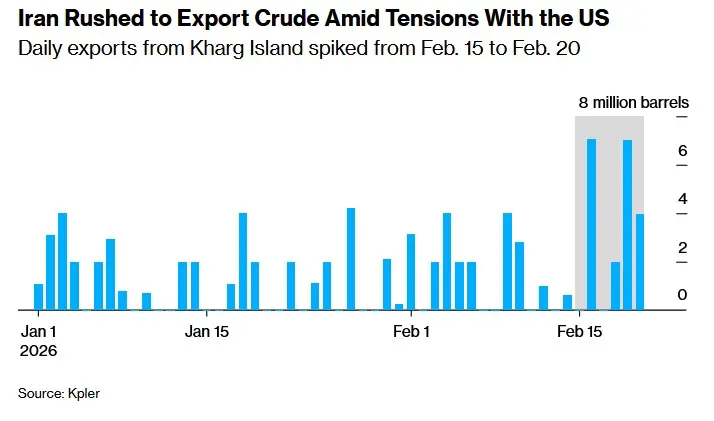

Iran is rushing to export oil amid surging tensions with the US:

Iranian crude exports jumped +200% MoM, to 20 million barrels between February 15-20.

This is equivalent to over 3 million barrels per day, far above Iran's usual daily exports.

Satellite imagery confirms the spike, with tankers near Iranian ports more than doubling from 8 to 18 over the same period.

The same pattern was seen last year, when Iran rushed to ship crude shortly before American air strikes, and again in 2024 during elevated tensions.

Iran largely depends on oil revenue to keep its economy running and is loading as mu

Iranian crude exports jumped +200% MoM, to 20 million barrels between February 15-20.

This is equivalent to over 3 million barrels per day, far above Iran's usual daily exports.

Satellite imagery confirms the spike, with tankers near Iranian ports more than doubling from 8 to 18 over the same period.

The same pattern was seen last year, when Iran rushed to ship crude shortly before American air strikes, and again in 2024 during elevated tensions.

Iran largely depends on oil revenue to keep its economy running and is loading as mu

- Reward

- like

- Comment

- Repost

- Share

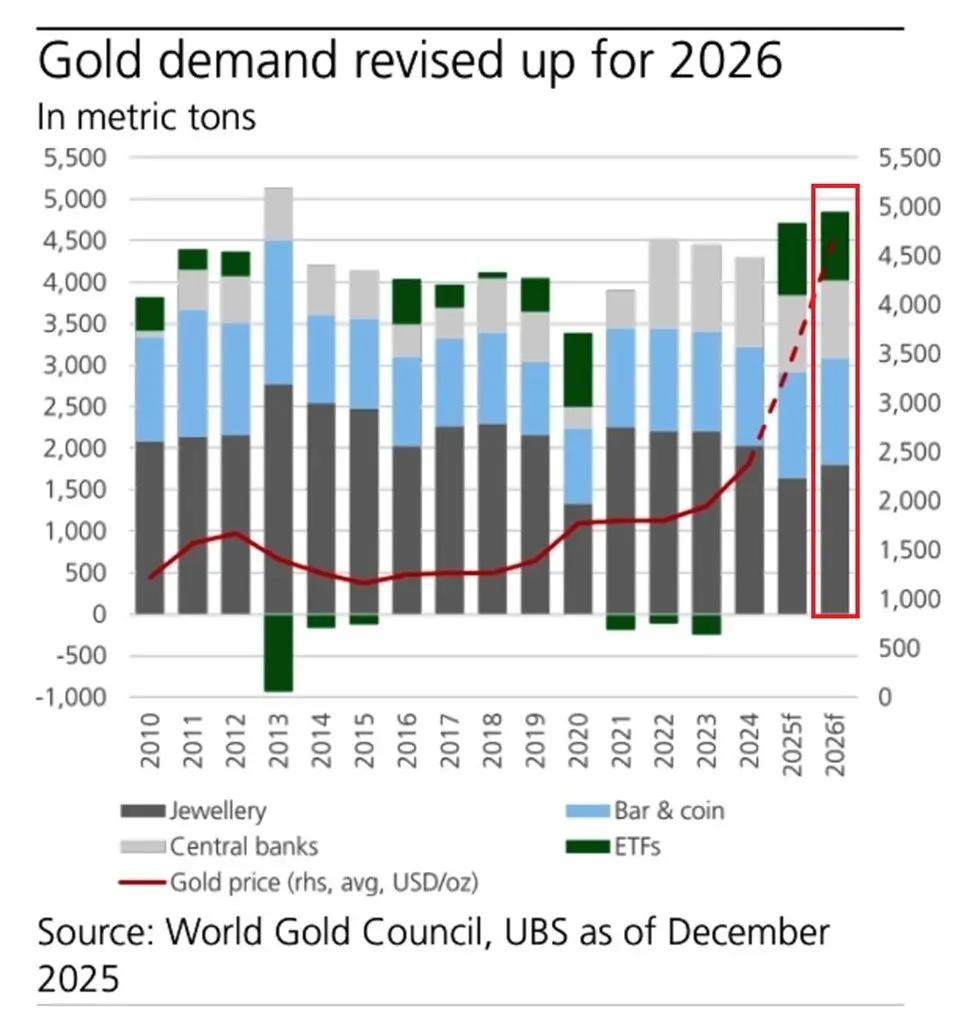

Gold demand is set to rise further this year:

Global gold demand is projected to rise to a record ~4,900 tonnes in 2026, marking the 2nd-consecutive annual increase.

Jewelry demand is expected to rise by +100 tonnes, to ~1,700 tonnes, the highest since 2024.

World central bank purchases are estimated to come in at a historically high ~1,000 tonnes.

Physical-backed gold ETFs are expected to record ~900 tonnes in net inflows for the 2nd-consecutive year.

Meanwhile, bar and coin demand is expected to remain steady at ~1,300 tonnes.

The world cannot get enough gold.

Global gold demand is projected to rise to a record ~4,900 tonnes in 2026, marking the 2nd-consecutive annual increase.

Jewelry demand is expected to rise by +100 tonnes, to ~1,700 tonnes, the highest since 2024.

World central bank purchases are estimated to come in at a historically high ~1,000 tonnes.

Physical-backed gold ETFs are expected to record ~900 tonnes in net inflows for the 2nd-consecutive year.

Meanwhile, bar and coin demand is expected to remain steady at ~1,300 tonnes.

The world cannot get enough gold.

- Reward

- like

- Comment

- Repost

- Share

US margin debt surged +53 billion in January, to a record $1.28 trillion.

This marks the 9th consecutive monthly increase.

YoY, margin debt jumped +$342 billion, or +36%, the biggest increase since the 2021 meme stock frenzy.

Furthermore, margin debt as a % of real disposable personal income exceeded 6.0% for the first time on record.

The percentage is now nearly 3 TIMES higher than the 2000 Dot-Com Bubble peak.

Market-cap adjusted margin debt has also hit an all-time high.

Investors are using more leverage than ever.

This marks the 9th consecutive monthly increase.

YoY, margin debt jumped +$342 billion, or +36%, the biggest increase since the 2021 meme stock frenzy.

Furthermore, margin debt as a % of real disposable personal income exceeded 6.0% for the first time on record.

The percentage is now nearly 3 TIMES higher than the 2000 Dot-Com Bubble peak.

Market-cap adjusted margin debt has also hit an all-time high.

Investors are using more leverage than ever.

- Reward

- like

- Comment

- Repost

- Share

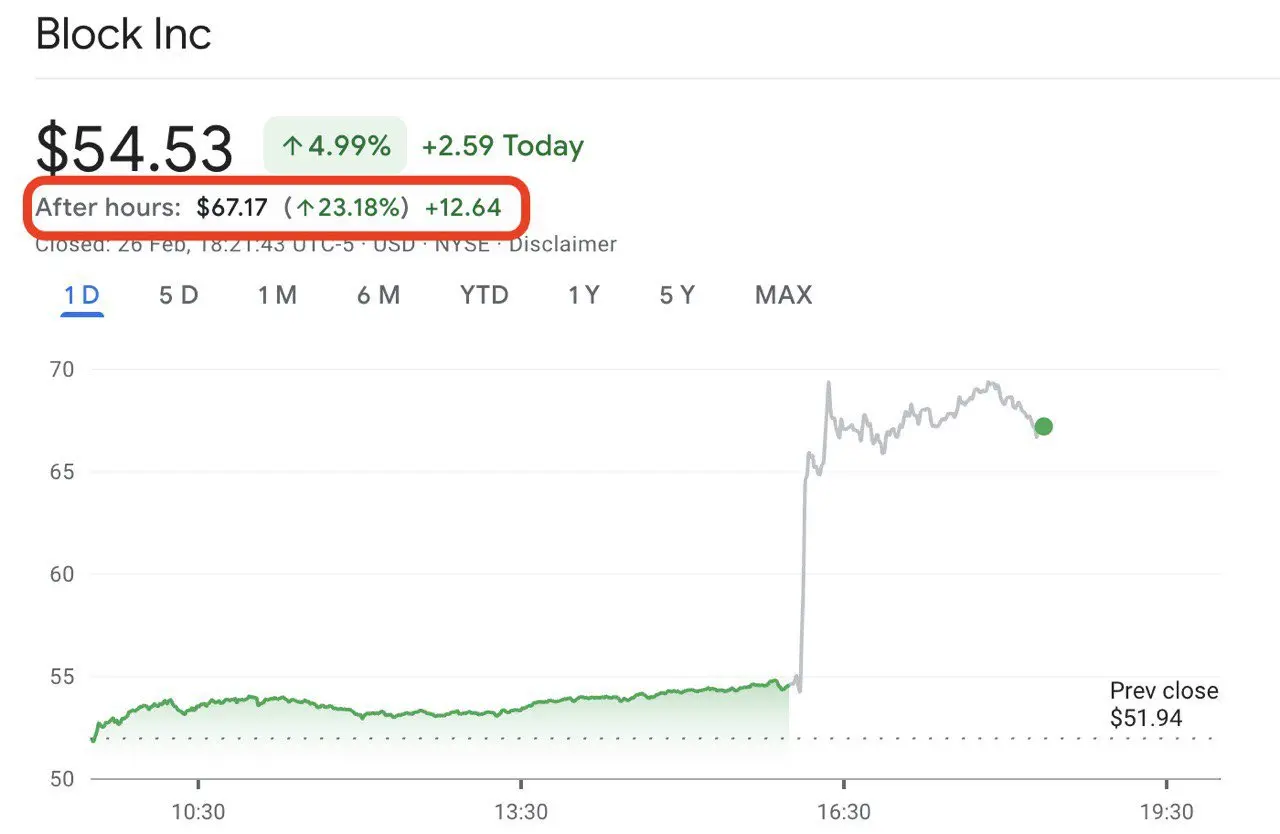

We just saw the first major layoff directly because of AI.

Twitter founder Jack Dorsey laid off 4,000 people, 40% of the company’s headcount to go all in on AI and agentic workflows.

After the announcement, Block stock $XYZ surged 23% in 60 minutes, adding nearly $6 billion to its market cap.

Jack said what every CEO knows but won’t admit: “AI paired with smaller teams is enabling a new way of working. And that’s accelerating rapidly.”

The new math after AI is brutal:

100 people + AI = 1,000 people

Twitter founder Jack Dorsey laid off 4,000 people, 40% of the company’s headcount to go all in on AI and agentic workflows.

After the announcement, Block stock $XYZ surged 23% in 60 minutes, adding nearly $6 billion to its market cap.

Jack said what every CEO knows but won’t admit: “AI paired with smaller teams is enabling a new way of working. And that’s accelerating rapidly.”

The new math after AI is brutal:

100 people + AI = 1,000 people

- Reward

- like

- Comment

- Repost

- Share

THIS IS MASSIVE !!

Ethereum is finally solving its biggest problem.

Yesterday, Vitalik unveiled a new technical roadmap to make Ethereum quantum resistant.

This roadmap has identified four critical vulnerabilities in the current network and proposes replacing them with post-quantum cryptography over a four-year period.

The plan involves seven planned network forks occurring roughly every six months to incrementally harden the protocol with key upgrades, including:

Validator Signatures: Replacing the current BLS (Boneh-Lynn-Shacham) signatures with "lean" quantum-safe hash-based signatures.

Dat

Ethereum is finally solving its biggest problem.

Yesterday, Vitalik unveiled a new technical roadmap to make Ethereum quantum resistant.

This roadmap has identified four critical vulnerabilities in the current network and proposes replacing them with post-quantum cryptography over a four-year period.

The plan involves seven planned network forks occurring roughly every six months to incrementally harden the protocol with key upgrades, including:

Validator Signatures: Replacing the current BLS (Boneh-Lynn-Shacham) signatures with "lean" quantum-safe hash-based signatures.

Dat

ETH-4,85%

- Reward

- like

- 1

- Repost

- Share

GateUser-d2803116 :

:

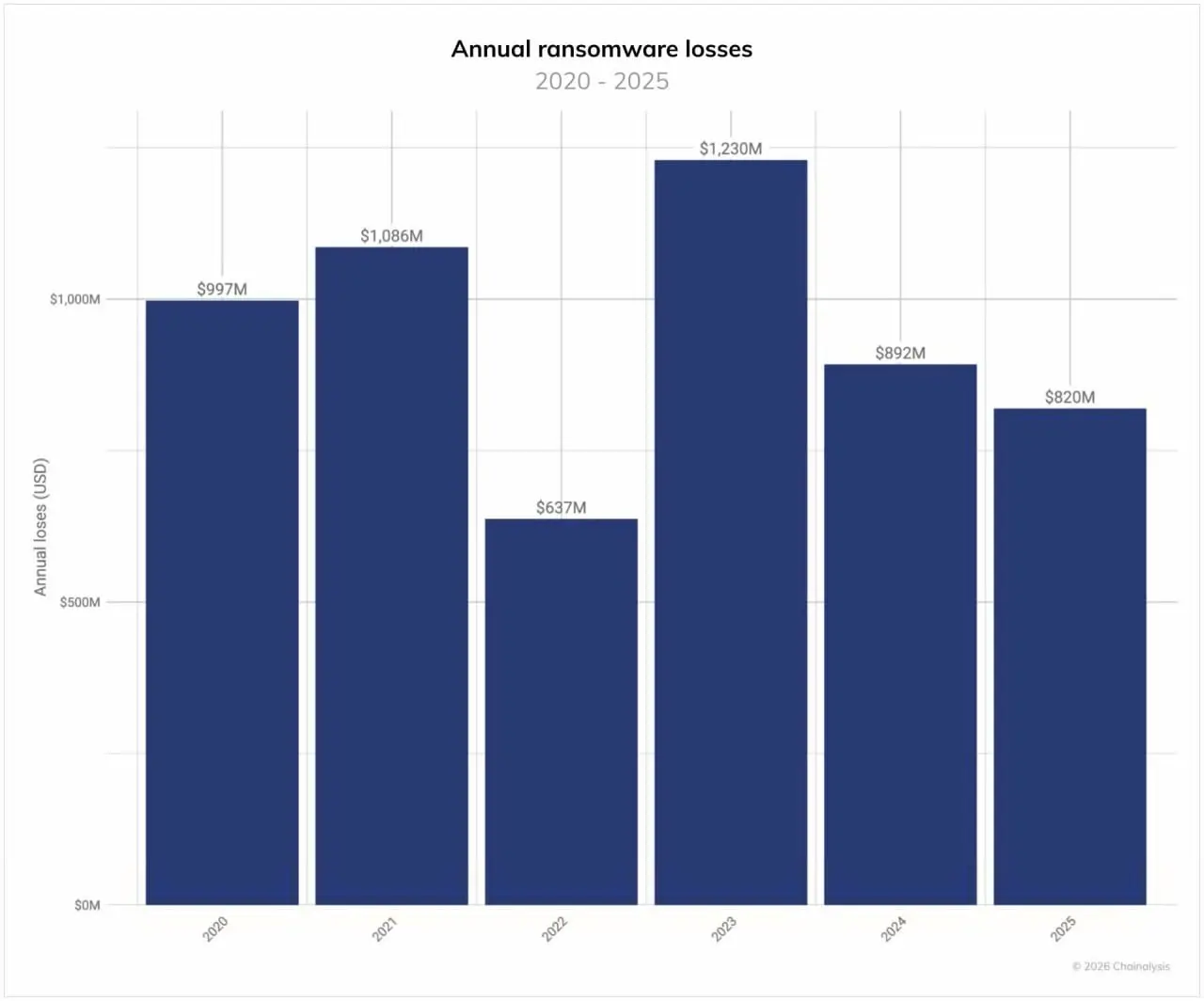

out bro⚡️ INSIGHT: Ransomware payments declined in 2025 to around $820M, even as attack volume hit record highs, per Chainalysis.

- Reward

- like

- Comment

- Repost

- Share

Ctrl Alt, backed by Ripple, secures a $280,000,000 diamond tokenization deal in the UAE 🇦🇪💎

Luxury assets are officially moving onchain.

Tokenization is expanding beyond traditional finance.

Luxury assets are officially moving onchain.

Tokenization is expanding beyond traditional finance.

- Reward

- like

- Comment

- Repost

- Share

LATEST: SBI TO LAUNCH JAPAN’S FIRST TRUST-BANK BASED JPY STABLECOIN IN Q2

SBI Holdings and Startale Group announced JPYSC, a yen-denominated stablecoin set for Q2 launch, with issuance managed by SBI Shinsei Trust Bank.

SBI Holdings and Startale Group announced JPYSC, a yen-denominated stablecoin set for Q2 launch, with issuance managed by SBI Shinsei Trust Bank.

- Reward

- like

- Comment

- Repost

- Share

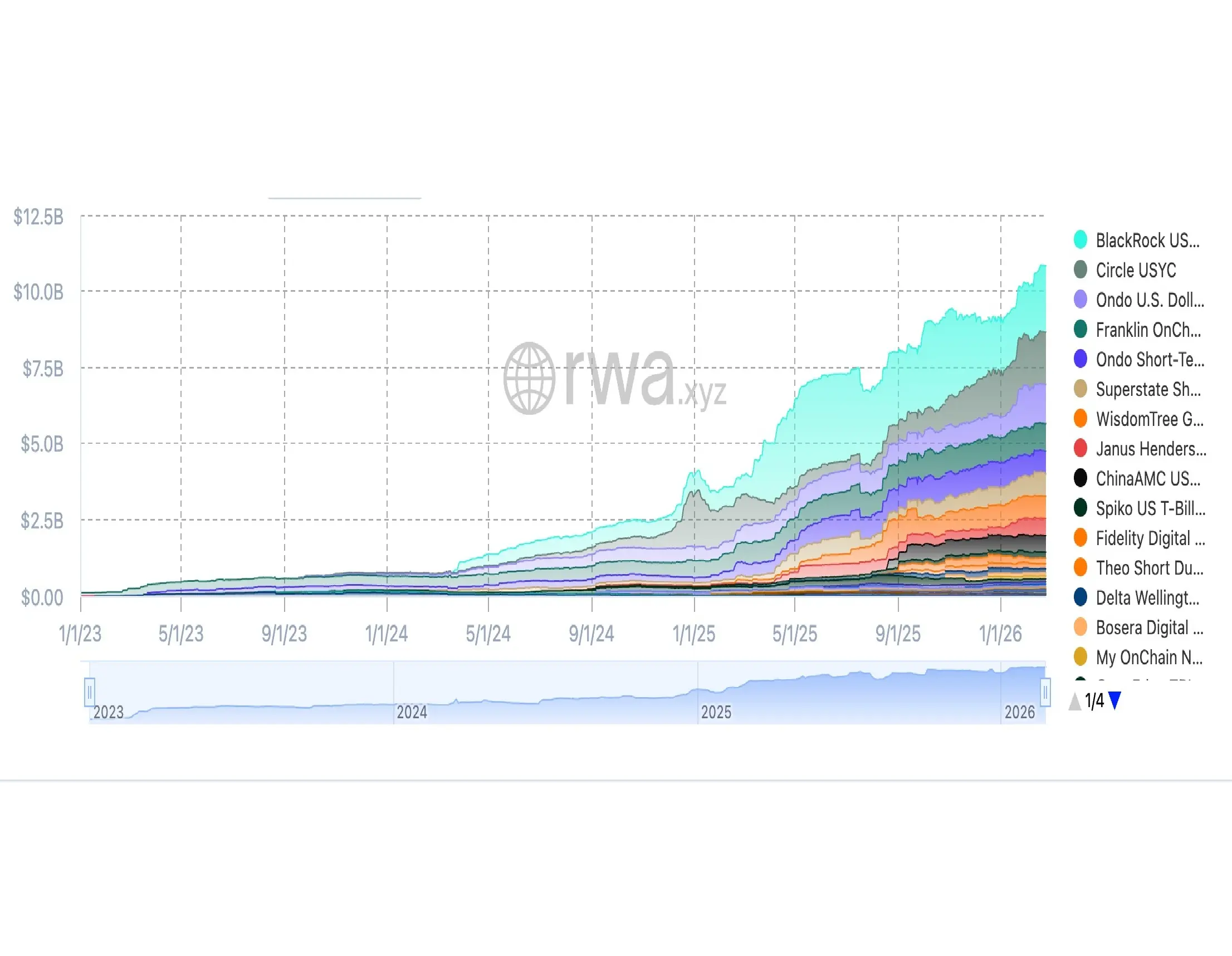

🚨 TOKENIZED U.S. TREASURIES SURPASS $10B IN VALUE LOCKED

The market for tokenized U.S. Treasury securities has officially crossed $10.8 billion as of February 25, 2026, marking over $1.9 billion in year-to-date inflows. This signals a shift from experimental pilots to functional onchain financial infrastructure.

• YTD Growth: +20% since January 1, 2026, despite broader crypto market downturns.

• Top Products: Circle’s USYC ($1.7B) and BlackRock’s BUIDL (~$2.2B) lead institutional offerings.

• Yields: Average 7-day APY ~3.28%.

Tokenized Treasuries are proving that real-world assets onchain a

The market for tokenized U.S. Treasury securities has officially crossed $10.8 billion as of February 25, 2026, marking over $1.9 billion in year-to-date inflows. This signals a shift from experimental pilots to functional onchain financial infrastructure.

• YTD Growth: +20% since January 1, 2026, despite broader crypto market downturns.

• Top Products: Circle’s USYC ($1.7B) and BlackRock’s BUIDL (~$2.2B) lead institutional offerings.

• Yields: Average 7-day APY ~3.28%.

Tokenized Treasuries are proving that real-world assets onchain a

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

⚡️ NEW: Tether has taken a strategic stake in creator platform Whop, which will integrate Tether’s Wallet Development Kit to enable creator payouts in USDT and USAT.

- Reward

- 2

- 3

- Repost

- Share

ybaser :

:

To The Moon 🌕View More

LATEST: 💰 Asset manager Bitwise acquired Chorus One, a staking infrastructure firm overseeing $2.2 billion in assets, expanding its staking capabilities across 30+ blockchains.

- Reward

- 1

- Comment

- Repost

- Share

This is INSANE.

Since Jane Street was sued two days ago, the 10 AM manipulation has stopped.

Bitcoin is up 10%, adding $120 billion to its market cap, and the BTC weekly candle has turned green after 5 consecutive red candles.

The total crypto market has added nearly $200 billion over the same period.

Since Jane Street was sued two days ago, the 10 AM manipulation has stopped.

Bitcoin is up 10%, adding $120 billion to its market cap, and the BTC weekly candle has turned green after 5 consecutive red candles.

The total crypto market has added nearly $200 billion over the same period.

BTC-2,11%

- Reward

- like

- Comment

- Repost

- Share

BREAKING: Amazon, Google, Meta, Microsoft, xAI, Oracle and OpenAI are set to sign an agreement with the Trump Administration to generate their own electricity supply for AI data centers, per Fox News.

This includes:

1. Meeting with President Trump in March to sign the pledge

2. Companies will build, bring, or buy their own power supply for new AI data centers

3. Companies will agree to protect Americans from price hikes

Trump is shifting attention to surging electricity costs.

This includes:

1. Meeting with President Trump in March to sign the pledge

2. Companies will build, bring, or buy their own power supply for new AI data centers

3. Companies will agree to protect Americans from price hikes

Trump is shifting attention to surging electricity costs.

- Reward

- 2

- 1

- Repost

- Share

ybaser :

:

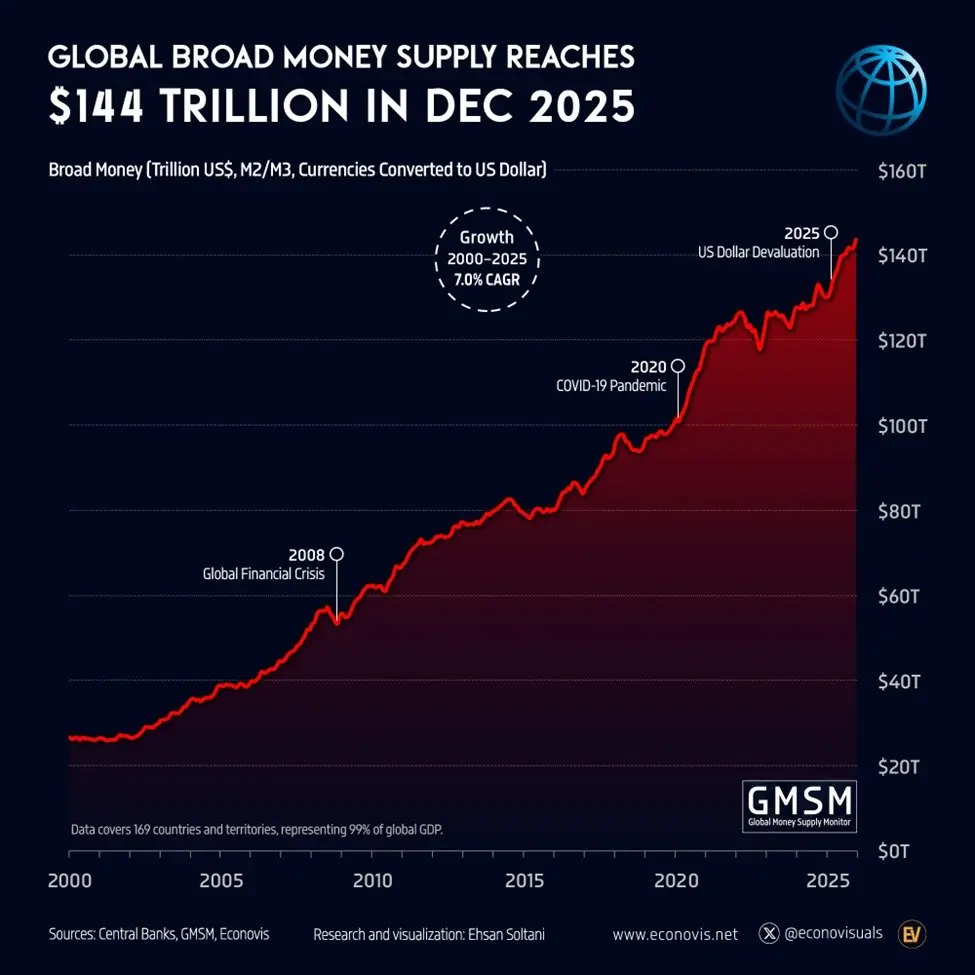

Ape In 🚀BREAKING: Global broad money supply surged +$13.6 trillion YoY, or +10.4%, in December 2025, to a record $144 trillion.

This marks the 3rd consecutive monthly acceleration in growth.

Since 2000, global money supply has risen +$118 trillion, a +7.0% compounded annual growth rate over 25 years.

Since the 2020 pandemic alone, money supply has surged +$44 trillion, or +44%.

The fastest increase over this period was recorded in February 2021, at +18.7%.

Global money creation has never moved this fast outside of a crisis.

This marks the 3rd consecutive monthly acceleration in growth.

Since 2000, global money supply has risen +$118 trillion, a +7.0% compounded annual growth rate over 25 years.

Since the 2020 pandemic alone, money supply has surged +$44 trillion, or +44%.

The fastest increase over this period was recorded in February 2021, at +18.7%.

Global money creation has never moved this fast outside of a crisis.

- Reward

- like

- Comment

- Repost

- Share

INSIGHT: Stablecoins are growing fast, but at $226B they’re still tiny next to ACH's $93T and card networks.

ACH-2,89%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

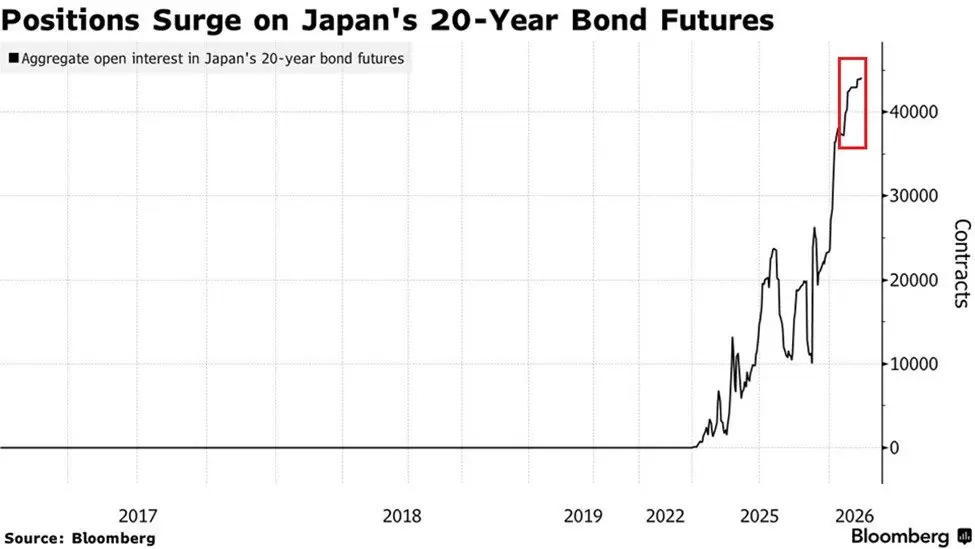

Foreign investors are piling into Japanese government bonds at a record pace:

Open interest in Japan's 20Y government bond futures surged to a record 44,093 contracts last week.

By comparison, in July 2025, open interest was nonexistent when the Japan Exchange Group tried to revive liquidity after 3 years without a single trade.

This comes as cumulative net purchases by foreign investors rose to 3,615 contracts in the first week of February, 22 times above domestic participation.

At the same time, overseas investors bought ~14,000 contracts of 10Y JGB futures in the first 2 weeks of the month,

Open interest in Japan's 20Y government bond futures surged to a record 44,093 contracts last week.

By comparison, in July 2025, open interest was nonexistent when the Japan Exchange Group tried to revive liquidity after 3 years without a single trade.

This comes as cumulative net purchases by foreign investors rose to 3,615 contracts in the first week of February, 22 times above domestic participation.

At the same time, overseas investors bought ~14,000 contracts of 10Y JGB futures in the first 2 weeks of the month,

- Reward

- like

- Comment

- Repost

- Share