UnlimitedCryptoTrading

No content yet

UnlimitedCryptoTrading

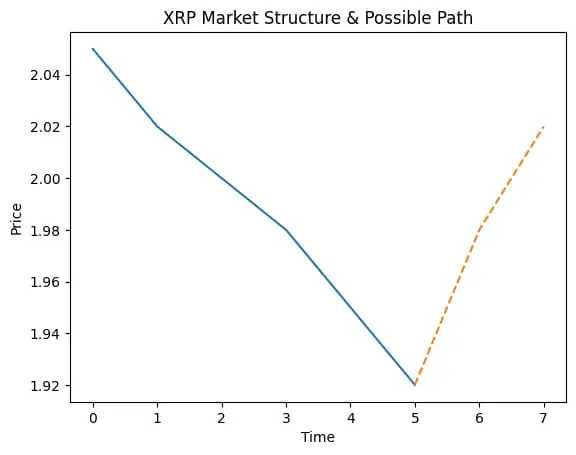

$XRP XRP/USDT Market View

XRP is showing signs of recovery after a recent pullback. The price bounced from the lower zone and is now trying to move higher, but the market still needs confirmation before calling it a strong trend change.

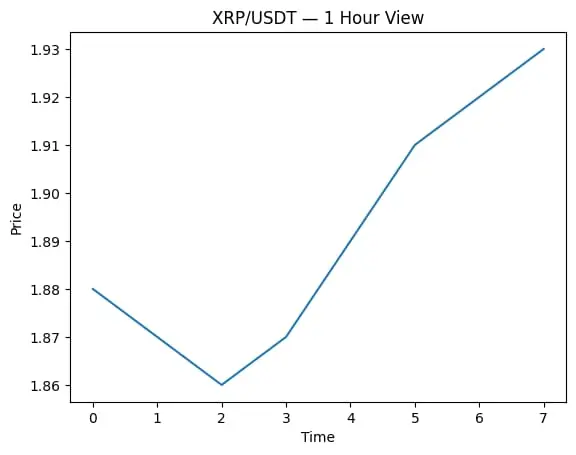

1 Hour view

On the 1H timeframe, XRP has formed a short-term base and pushed upward with better momentum. Buyers are active, but price is still facing nearby resistance. A healthy hold above this zone can lead to a continuation toward the recent intraday highs. Weak follow-through could result in short consolidation.

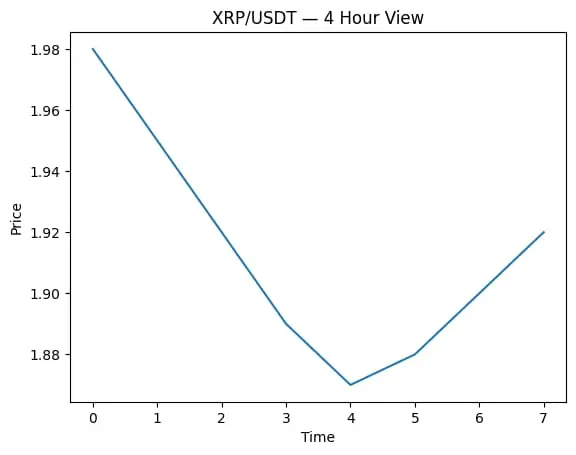

4 Hour view

On the 4H chart, the broader t

XRP is showing signs of recovery after a recent pullback. The price bounced from the lower zone and is now trying to move higher, but the market still needs confirmation before calling it a strong trend change.

1 Hour view

On the 1H timeframe, XRP has formed a short-term base and pushed upward with better momentum. Buyers are active, but price is still facing nearby resistance. A healthy hold above this zone can lead to a continuation toward the recent intraday highs. Weak follow-through could result in short consolidation.

4 Hour view

On the 4H chart, the broader t

XRP0.2%

- Reward

- like

- Comment

- Repost

- Share

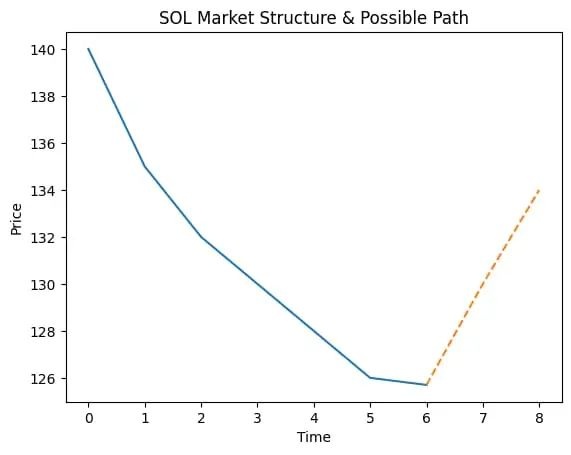

$SOL SOL/USDT Market View

SOL is currently consolidating after a strong bounce from the recent low. Price faced rejection near the upper zone and is now cooling down, which looks like a healthy pause rather than weakness.

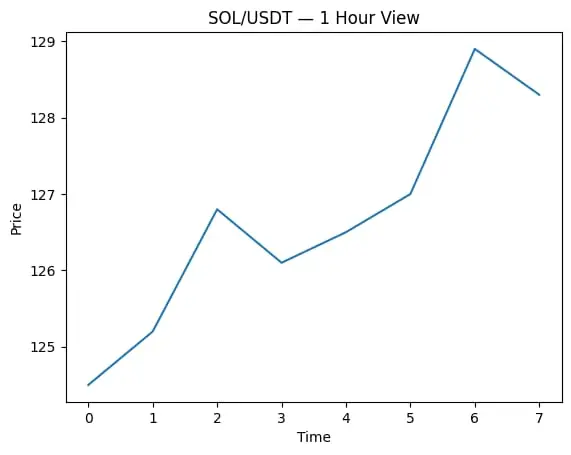

1 Hour view

Short-term momentum is slowing.

Price is holding above recent support.

A small pullback or sideways move is possible before the next decision.

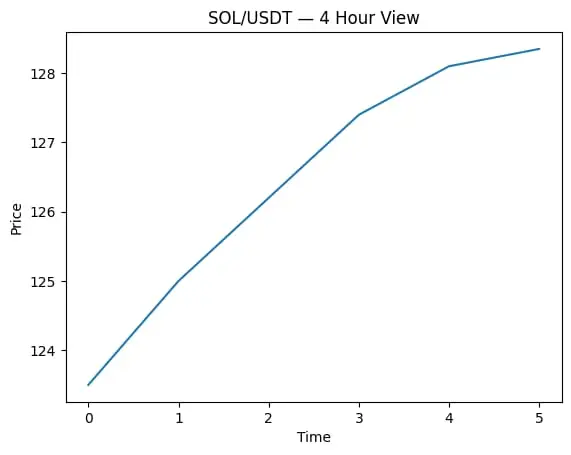

4 Hour view

Structure still looks stable.

Higher low formation keeps the bullish bias alive.

If support holds, price may attempt another push upward.

Loss of support could lead to a deeper correction.

Overall, SOL is at a

SOL is currently consolidating after a strong bounce from the recent low. Price faced rejection near the upper zone and is now cooling down, which looks like a healthy pause rather than weakness.

1 Hour view

Short-term momentum is slowing.

Price is holding above recent support.

A small pullback or sideways move is possible before the next decision.

4 Hour view

Structure still looks stable.

Higher low formation keeps the bullish bias alive.

If support holds, price may attempt another push upward.

Loss of support could lead to a deeper correction.

Overall, SOL is at a

SOL0.58%

- Reward

- like

- Comment

- Repost

- Share

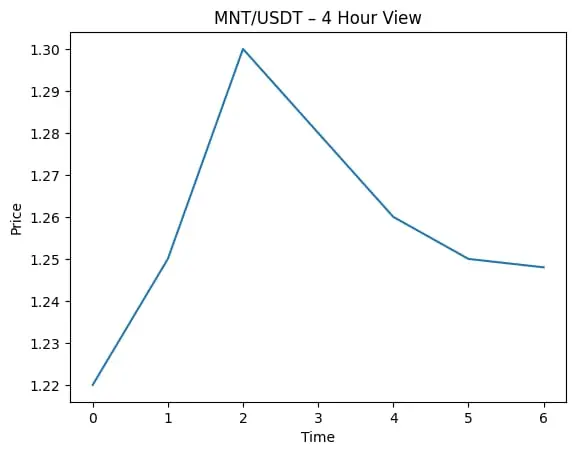

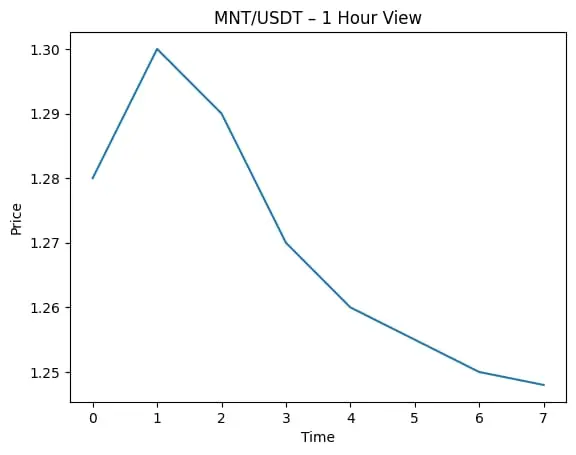

MNT/USDT Market View

MNT/USDT has seen a healthy pullback after the recent move up and is now trying to stabilize. Price is cooling off, which looks more like a reset than a breakdown.

1 Hour view:

On the 1H timeframe, price is moving in a short-term downward channel after rejection from the recent high. Selling pressure is slowing, and the market is trying to form a base. If buyers defend this zone, a small rebound toward the previous intraday range is possible. Losing this level may bring one more dip before any bounce.

4 Hour view:

On the 4H chart, momentum has weakened, but the structure i

MNT/USDT has seen a healthy pullback after the recent move up and is now trying to stabilize. Price is cooling off, which looks more like a reset than a breakdown.

1 Hour view:

On the 1H timeframe, price is moving in a short-term downward channel after rejection from the recent high. Selling pressure is slowing, and the market is trying to form a base. If buyers defend this zone, a small rebound toward the previous intraday range is possible. Losing this level may bring one more dip before any bounce.

4 Hour view:

On the 4H chart, momentum has weakened, but the structure i

MNT0.83%

- Reward

- like

- Comment

- Repost

- Share

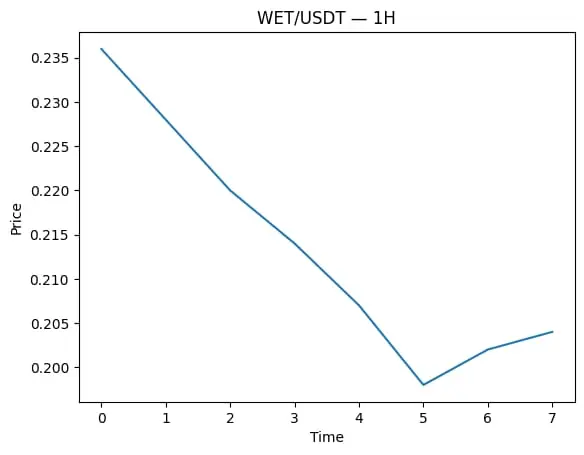

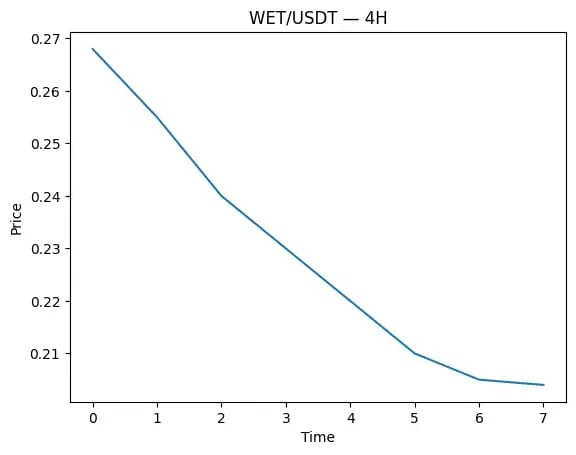

$WET WET/USDT Market View

Price has taken a strong pullback and is now trying to stabilize after heavy selling pressure. The recent drop looks more like a cooling phase than panic, and the market is starting to search for a short-term base.

1 Hour view On the 1H timeframe, price is moving sideways after the drop. Selling pressure is slowing down, which often hints at a short relief bounce. If buyers step in, a small recovery toward the recent intraday range is possible. Failure to hold this zone may lead to another short dip before any real bounce.

4 Hour view On the 4H chart, the trend is s

Price has taken a strong pullback and is now trying to stabilize after heavy selling pressure. The recent drop looks more like a cooling phase than panic, and the market is starting to search for a short-term base.

1 Hour view On the 1H timeframe, price is moving sideways after the drop. Selling pressure is slowing down, which often hints at a short relief bounce. If buyers step in, a small recovery toward the recent intraday range is possible. Failure to hold this zone may lead to another short dip before any real bounce.

4 Hour view On the 4H chart, the trend is s

WET-13.26%

- Reward

- like

- Comment

- Repost

- Share

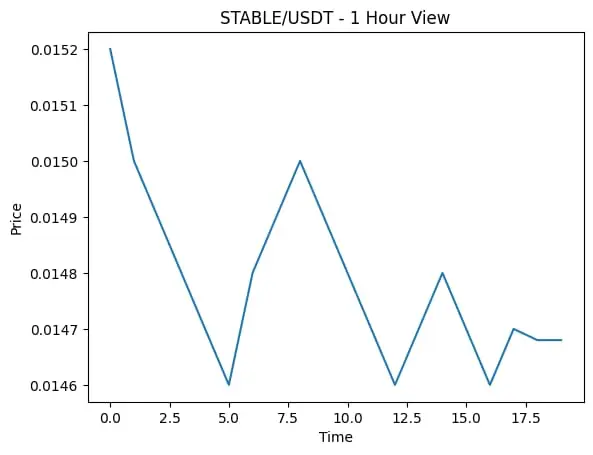

$STABLE STABLE/USDT Market View

STABLE is moving in a tight range after rejecting the recent high. Price is cooling down, but it’s still holding above a key short-term support zone. This area is important for the next direction.

1 Hour view

Short-term pullback after rejection

Selling pressure is easing near support

A small bounce is possible if buyers defend this zone

Losing support may bring another slow dip

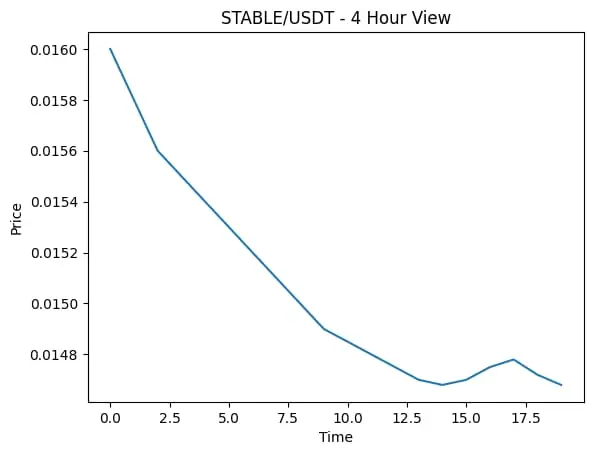

4 Hour view

Overall structure looks neutral to slightly weak

Price is still inside a range, no clear trend yet

Consolidation here could build a base for the next move

Trend turns positi

STABLE is moving in a tight range after rejecting the recent high. Price is cooling down, but it’s still holding above a key short-term support zone. This area is important for the next direction.

1 Hour view

Short-term pullback after rejection

Selling pressure is easing near support

A small bounce is possible if buyers defend this zone

Losing support may bring another slow dip

4 Hour view

Overall structure looks neutral to slightly weak

Price is still inside a range, no clear trend yet

Consolidation here could build a base for the next move

Trend turns positi

STABLE-1.48%

- Reward

- 1

- Comment

- Repost

- Share

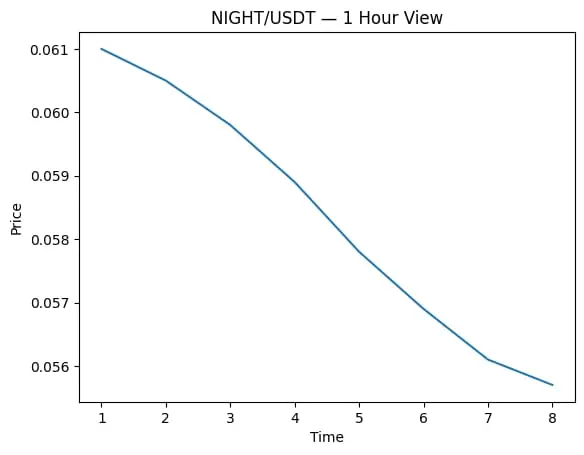

$NIGHT NIGHT/USDT Market View

NIGHT is under short-term pressure after a sharp pullback, but price is now trying to stabilize near a key demand zone. Sellers are slowing down, and this area could decide the next move.

1 Hour view

Strong sell-off already happened

Price is holding near recent lows

If buyers step in, a short relief bounce is possible

Loss of this level may bring another small dip

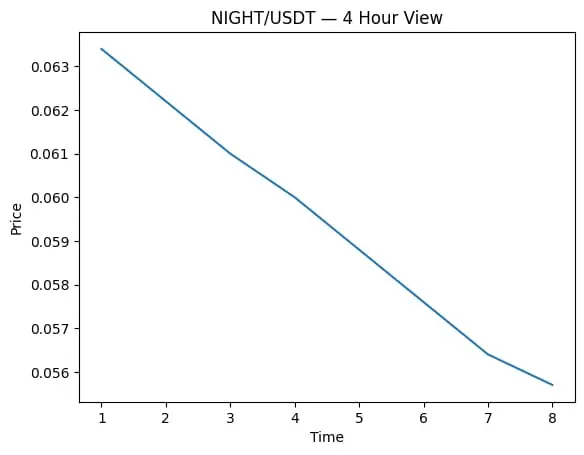

4 Hour view

Overall structure still weak

Trend remains bearish until price reclaims higher resistance

Sideways consolidation here can build a base for recovery

Trend change needs clear higher highs

Thi

NIGHT is under short-term pressure after a sharp pullback, but price is now trying to stabilize near a key demand zone. Sellers are slowing down, and this area could decide the next move.

1 Hour view

Strong sell-off already happened

Price is holding near recent lows

If buyers step in, a short relief bounce is possible

Loss of this level may bring another small dip

4 Hour view

Overall structure still weak

Trend remains bearish until price reclaims higher resistance

Sideways consolidation here can build a base for recovery

Trend change needs clear higher highs

Thi

NIGHT-5.51%

- Reward

- like

- Comment

- Repost

- Share

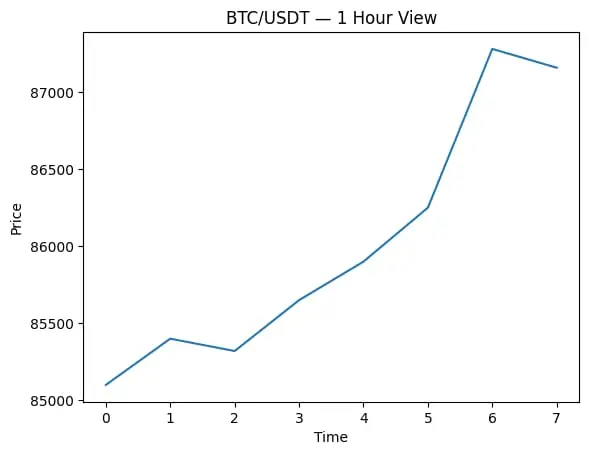

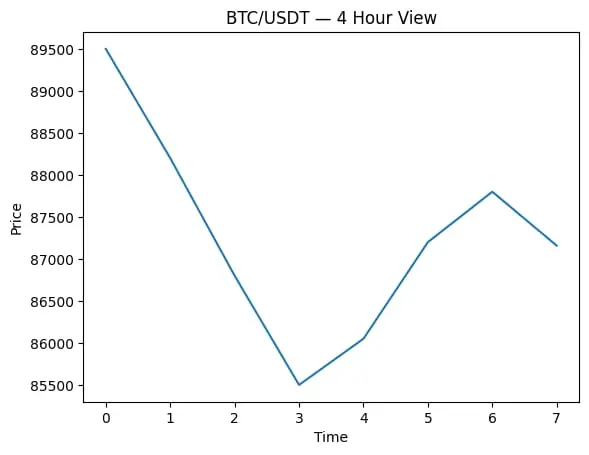

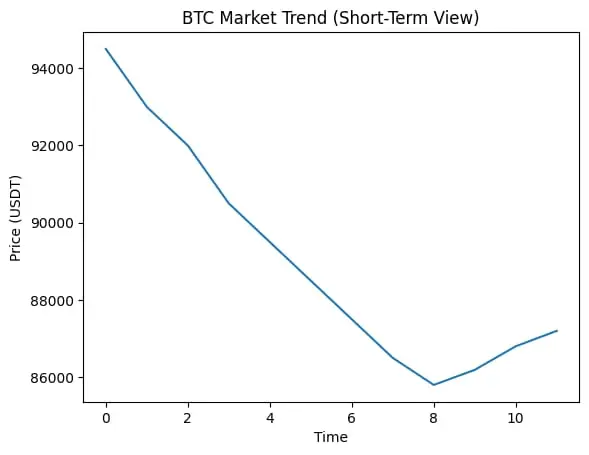

$BTC BTC Market Update (Personal View)

BTC is showing a short-term recovery after the recent pullback. Price bounced well from the lower zone and is now trying to stabilize. Sellers are still active, but panic pressure looks reduced.

1H view

Short-term bounce from the local low

Price trying to hold above intraday support

Small pullbacks are possible before the next move

4H view

Overall structure still healthy

Pullback looks corrective, not a breakdown

As long as higher support holds, trend remains intact

Outlook In the near term, BTC may consolidate and test nearby resistance again. On the h

BTC is showing a short-term recovery after the recent pullback. Price bounced well from the lower zone and is now trying to stabilize. Sellers are still active, but panic pressure looks reduced.

1H view

Short-term bounce from the local low

Price trying to hold above intraday support

Small pullbacks are possible before the next move

4H view

Overall structure still healthy

Pullback looks corrective, not a breakdown

As long as higher support holds, trend remains intact

Outlook In the near term, BTC may consolidate and test nearby resistance again. On the h

BTC0.2%

- Reward

- like

- Comment

- Repost

- Share

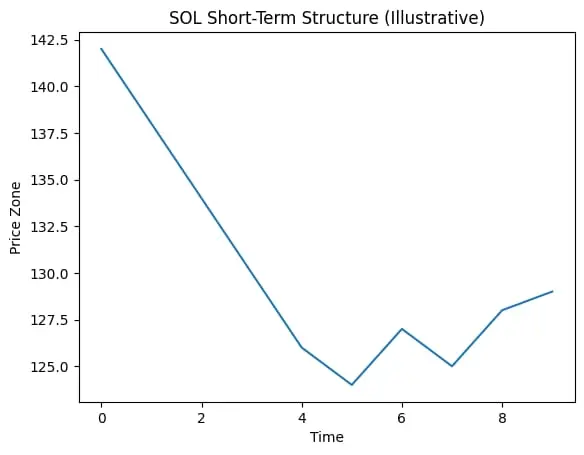

$SOL Price is trying to stabilize after a sharp pullback. The recent drop found support near the lower zone, and now we’re seeing small higher lows. That usually tells me sellers are slowing down, not fully gone, but less aggressive.

What the indicators hint

Short timeframe (1H–4H): Momentum is slowly recovering. RSI is climbing from oversold areas, showing buyers are stepping back in.

Mid timeframe: Price is still below the strong resistance zone, so upside may come in steps, not a straight line.

Volume: No big spike yet, which means this move looks more like a cautious rebound, not hype.

F

What the indicators hint

Short timeframe (1H–4H): Momentum is slowly recovering. RSI is climbing from oversold areas, showing buyers are stepping back in.

Mid timeframe: Price is still below the strong resistance zone, so upside may come in steps, not a straight line.

Volume: No big spike yet, which means this move looks more like a cautious rebound, not hype.

F

SOL0.58%

- Reward

- like

- Comment

- Repost

- Share

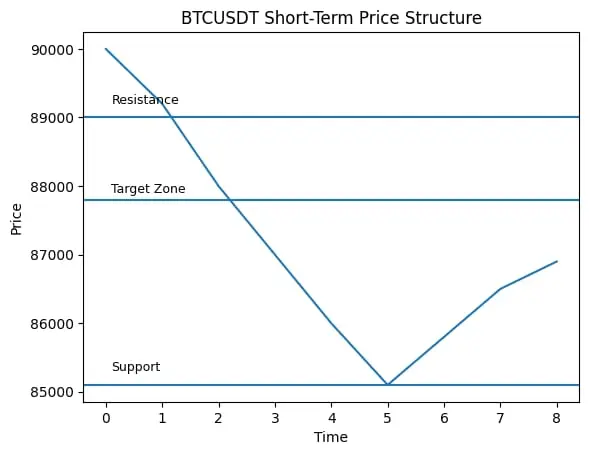

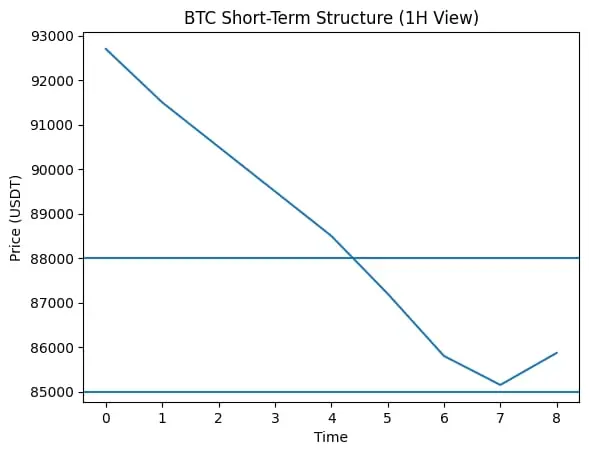

$BTC BTC saw a strong drop and bounced from the 85,100 area. That zone is acting like short-term support for now. On the 1H chart, price is trying to recover above local moving averages, but momentum is still mixed.

What I see:

Short timeframe shows a relief bounce

RSI is rising, but not overheated yet

MACD is improving, still below zero → recovery, not full reversal

Volume is okay, not aggressive

Possible scenarios:

1H–4H: If price holds above 85,800, we may see a push toward 87,800 – 88,500

Failure case: Losing 85,100 again could bring another test of lower levels

Higher timeframe: Trend i

What I see:

Short timeframe shows a relief bounce

RSI is rising, but not overheated yet

MACD is improving, still below zero → recovery, not full reversal

Volume is okay, not aggressive

Possible scenarios:

1H–4H: If price holds above 85,800, we may see a push toward 87,800 – 88,500

Failure case: Losing 85,100 again could bring another test of lower levels

Higher timeframe: Trend i

BTC0.2%

- Reward

- like

- Comment

- Repost

- Share

$BTC BTC recently moved down from the upper range and found support near 85.1k. After that drop, price is trying to stabilize around 86k, which shows sellers are slowing down and buyers are stepping in carefully.

What the chart is saying

Short-term trend is still weak, but the sharp selling pressure has cooled.

Moving averages are close to each other, which often means the market is preparing for a decision.

Momentum indicators are coming up from low levels, hinting at a possible short bounce.

Future view by timeframe

Short term: A sideways to slow recovery is possible as long as price holds

What the chart is saying

Short-term trend is still weak, but the sharp selling pressure has cooled.

Moving averages are close to each other, which often means the market is preparing for a decision.

Momentum indicators are coming up from low levels, hinting at a possible short bounce.

Future view by timeframe

Short term: A sideways to slow recovery is possible as long as price holds

BTC0.2%

- Reward

- like

- Comment

- Repost

- Share

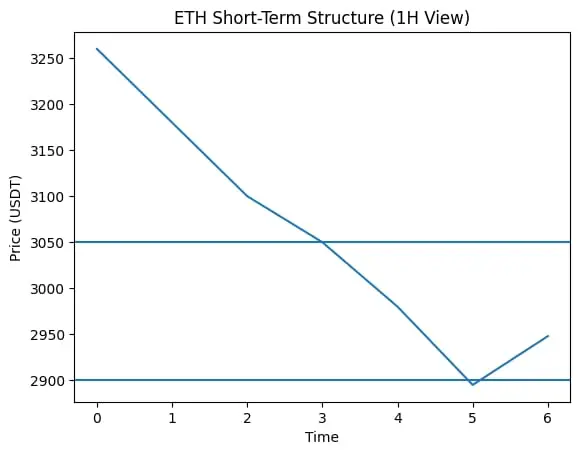

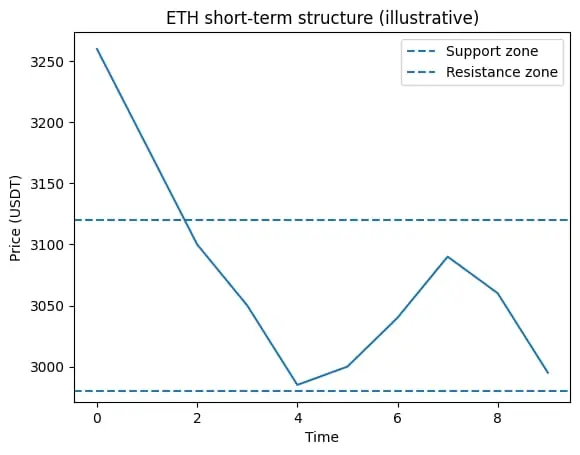

$ETH ETH saw a fast sell-off and bounced from the 2.89k area, which looks like short-term support. The reaction was quick, but overall pressure is still there.

What I see

1H timeframe: Price is below short MAs → trend is still weak.

Momentum: RSI dipped into oversold and is trying to recover → relief bounce makes sense.

Support: 2.9k zone is important. Holding above it keeps ETH stable.

Resistance: 3.05k–3.10k area. A break above this zone can shift momentum.

Next moves (opinion)

Short term: Sideways or slow bounce toward 3.05k.

If 2.9k fails: More downside pressure possible.

Higher timefram

What I see

1H timeframe: Price is below short MAs → trend is still weak.

Momentum: RSI dipped into oversold and is trying to recover → relief bounce makes sense.

Support: 2.9k zone is important. Holding above it keeps ETH stable.

Resistance: 3.05k–3.10k area. A break above this zone can shift momentum.

Next moves (opinion)

Short term: Sideways or slow bounce toward 3.05k.

If 2.9k fails: More downside pressure possible.

Higher timefram

ETH-2.3%

- Reward

- like

- Comment

- Repost

- Share

$BTC BTC saw a sharp drop and is now trying to stabilize around the 85.8k zone. Selling pressure was strong, but the bounce from the recent low shows buyers are still active.

What the chart says

1H timeframe: Trend is still weak, price below short MAs → pressure remains.

Momentum: RSI was deeply oversold, now cooling down → small relief bounce is normal.

Key support: 85k area. As long as this holds, downside slows.

Key resistance: 88k–89k zone. Bulls need a clean break to regain strength.

Possible moves

Short term: Sideways to mild bounce toward 88k if support holds.

If 85k breaks: Next drop

What the chart says

1H timeframe: Trend is still weak, price below short MAs → pressure remains.

Momentum: RSI was deeply oversold, now cooling down → small relief bounce is normal.

Key support: 85k area. As long as this holds, downside slows.

Key resistance: 88k–89k zone. Bulls need a clean break to regain strength.

Possible moves

Short term: Sideways to mild bounce toward 88k if support holds.

If 85k breaks: Next drop

BTC0.2%

- Reward

- like

- Comment

- Repost

- Share

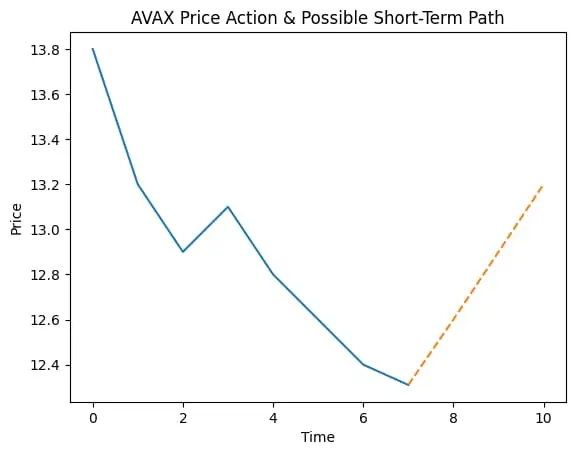

$AVAX AVAX just made a sharp drop toward the 12.3 zone. The fall was fast, and momentum indicators are stretched, which usually means sellers are getting tired.

What I see on the chart

1H timeframe: Strong sell-off, RSI deep oversold → bounce setup.

Momentum (MACD & KDJ): Still bearish, but downside speed is slowing.

Volume: Spike on the drop = emotional selling, often near short-term support.

Possible path

Short term: Relief bounce toward 12.8 – 13.2 if support holds.

Mid term: Holding above 12.3 keeps recovery chances alive.

Risk: Clean break below 12.3 may invite more downside.

Just a per

What I see on the chart

1H timeframe: Strong sell-off, RSI deep oversold → bounce setup.

Momentum (MACD & KDJ): Still bearish, but downside speed is slowing.

Volume: Spike on the drop = emotional selling, often near short-term support.

Possible path

Short term: Relief bounce toward 12.8 – 13.2 if support holds.

Mid term: Holding above 12.3 keeps recovery chances alive.

Risk: Clean break below 12.3 may invite more downside.

Just a per

AVAX-2.63%

- Reward

- like

- Comment

- Repost

- Share

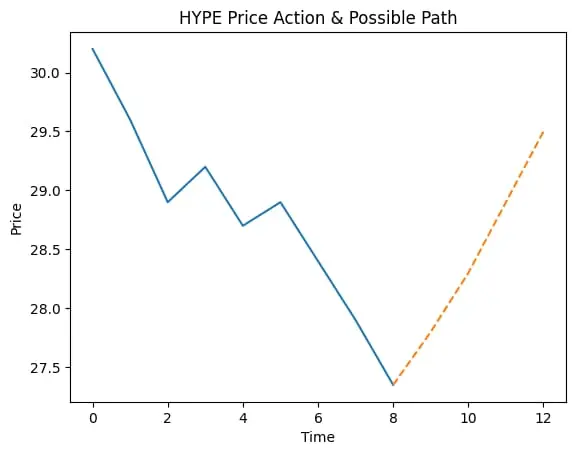

$HYPE Price just dipped hard to the 27 area after failing near 30. Short-term momentum looks weak, but selling pressure is slowing down.

What the chart shows

1H view: Strong drop, RSI is deep oversold → bounce is possible.

Momentum tools: MACD & KDJ still bearish, but starting to flatten.

Volume: Spike on the drop = panic selling, often seen near local bottoms.

Simple outlook

Short term: A relief bounce toward 28.5 – 29.2 is possible if buyers step in.

Mid term: If price holds above 27, range recovery toward 30 can happen.

Risk zone: Losing 27 may open another leg down.

This is just a person

What the chart shows

1H view: Strong drop, RSI is deep oversold → bounce is possible.

Momentum tools: MACD & KDJ still bearish, but starting to flatten.

Volume: Spike on the drop = panic selling, often seen near local bottoms.

Simple outlook

Short term: A relief bounce toward 28.5 – 29.2 is possible if buyers step in.

Mid term: If price holds above 27, range recovery toward 30 can happen.

Risk zone: Losing 27 may open another leg down.

This is just a person

HYPE-2.99%

- Reward

- like

- Comment

- Repost

- Share

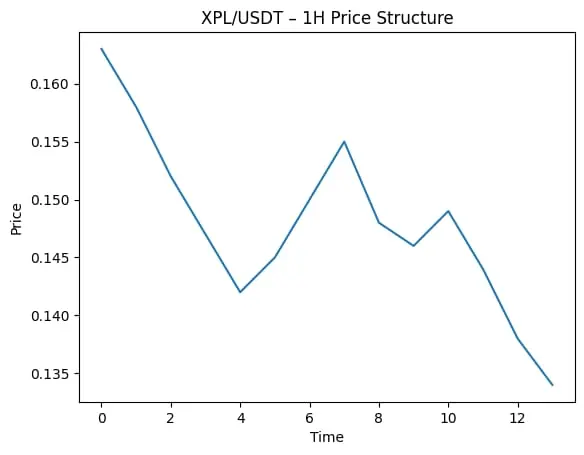

#FHETokenExtremeVolatility $XPL Price is under pressure after breaking down from the 0.15–0.16 zone and is now sitting near 0.134. On the 1H timeframe, trend is still bearish, but the speed of the drop is slowing.

My view from different angles:

Short term (1H): Oversold signals are forming. A small bounce or sideways move between 0.132 – 0.138 looks possible.

Intraday (4H): As long as price stays below 0.145, sellers are in control.

Upside scenario: Reclaiming 0.145 could open a move toward 0.15.

Downside risk: Losing 0.132 may push price toward 0.125.

Momentum is weak, volume is fading, so

My view from different angles:

Short term (1H): Oversold signals are forming. A small bounce or sideways move between 0.132 – 0.138 looks possible.

Intraday (4H): As long as price stays below 0.145, sellers are in control.

Upside scenario: Reclaiming 0.145 could open a move toward 0.15.

Downside risk: Losing 0.132 may push price toward 0.125.

Momentum is weak, volume is fading, so

XPL-2.9%

- Reward

- like

- Comment

- Repost

- Share

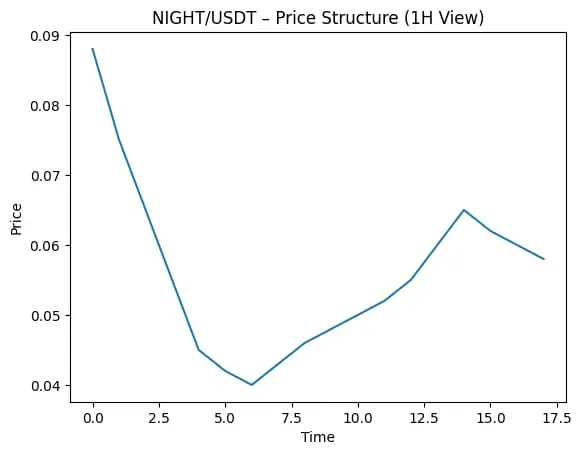

$NIGHT After a strong drop from the 0.08 zone, price found support near 0.04 and bounced. Right now it’s trading around 0.059, showing weakness but not panic.

What the chart suggests:

Short term (1H): Momentum is still soft. Price may move sideways between 0.056 – 0.061.

Intraday view (4H): Holding above 0.055 keeps the recovery structure valid.

Upside scenario: A stable break above 0.062–0.064 could push toward 0.068 – 0.07.

Downside risk: Losing 0.055 may bring another test near 0.05.

RSI is cooling and MACD is flat, which often means consolidation before the next move.

This is only a pers

What the chart suggests:

Short term (1H): Momentum is still soft. Price may move sideways between 0.056 – 0.061.

Intraday view (4H): Holding above 0.055 keeps the recovery structure valid.

Upside scenario: A stable break above 0.062–0.064 could push toward 0.068 – 0.07.

Downside risk: Losing 0.055 may bring another test near 0.05.

RSI is cooling and MACD is flat, which often means consolidation before the next move.

This is only a pers

NIGHT-5.51%

- Reward

- like

- Comment

- Repost

- Share

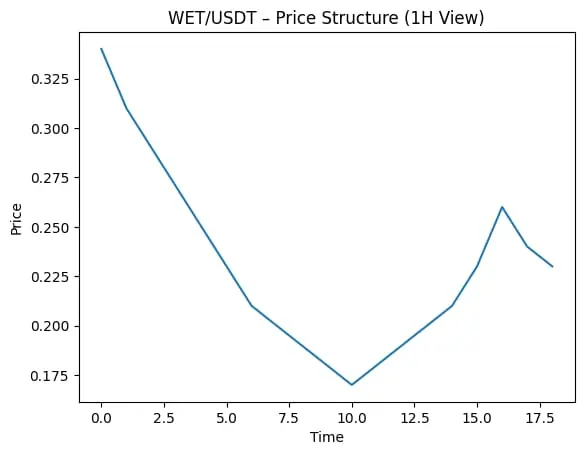

$WET Price bounced strongly from the 0.17 zone and is now cooling near 0.23 after a sharp push. On the 1H timeframe, momentum is still positive, but short-term indicators suggest a small pause or pullback is healthy.

What I see next:

Short term (1H–4H): Price may range between 0.22 – 0.24 while the market digests the move.

Mid term: Holding above 0.21–0.22 keeps the structure bullish.

Upside levels: A clean break above 0.24 can open the way toward 0.26–0.28.

Downside risk: Losing 0.21 could bring a retest near 0.19.

Volume expansion and momentum recovery would confirm the next leg up.

This i

What I see next:

Short term (1H–4H): Price may range between 0.22 – 0.24 while the market digests the move.

Mid term: Holding above 0.21–0.22 keeps the structure bullish.

Upside levels: A clean break above 0.24 can open the way toward 0.26–0.28.

Downside risk: Losing 0.21 could bring a retest near 0.19.

Volume expansion and momentum recovery would confirm the next leg up.

This i

WET-13.26%

- Reward

- 1

- Comment

- Repost

- Share

$XRP XRP saw a strong drop after failing to hold the recent highs. The move down was fast and emotional, and now price is sitting near a short-term demand zone.

What stands out

Short-term trend is bearish, but momentum looks stretched

RSI on lower timeframes is deeply oversold → selling pressure is slowing

Volume spiked on the drop, often seen near temporary bottoms

Possible outlook

Short term (hours): A pause or small bounce is likely as sellers cool off

Near term (1–3 days): If this level holds, price may try to recover toward the previous breakdown area

Risk side: If support fails, one mo

What stands out

Short-term trend is bearish, but momentum looks stretched

RSI on lower timeframes is deeply oversold → selling pressure is slowing

Volume spiked on the drop, often seen near temporary bottoms

Possible outlook

Short term (hours): A pause or small bounce is likely as sellers cool off

Near term (1–3 days): If this level holds, price may try to recover toward the previous breakdown area

Risk side: If support fails, one mo

XRP0.2%

- Reward

- like

- Comment

- Repost

- Share

$SOL Price just had a sharp pullback after failing to hold the recent bounce. On the lower timeframe, momentum looks stretched on the downside — sellers pushed hard, but that kind of move often cools off quickly.

What the chart is saying

Short-term trend: weak, still under pressure

Momentum indicators: deeply oversold → selling strength is fading

Volume spike on the drop: likely panic selling, not steady distribution

Possible scenarios

Short term (hours–1 day): A slow bounce or sideways move is possible as selling pressure eases. Quick recovery attempts may face resistance.

Mid term (1–3 day

What the chart is saying

Short-term trend: weak, still under pressure

Momentum indicators: deeply oversold → selling strength is fading

Volume spike on the drop: likely panic selling, not steady distribution

Possible scenarios

Short term (hours–1 day): A slow bounce or sideways move is possible as selling pressure eases. Quick recovery attempts may face resistance.

Mid term (1–3 day

SOL0.58%

- Reward

- like

- Comment

- Repost

- Share

$ETH ETH just dipped into a strong support zone near 2,980–3,000 after a sharp sell-off. On the 1H chart, momentum looks stretched, showing sellers may be slowing down.

What the chart suggests:

Short-term (1H): Oversold signals hint at a possible bounce toward 3,080–3,120.

Mid-term (4H): Trend is still weak unless price reclaims the 3,120+ area.

Structure view: Holding above support could lead to consolidation; losing it may bring more downside pressure.

This is only a personal market view based on price action and indicators — not financial advice.

Always manage risk and trade responsibly.

What the chart suggests:

Short-term (1H): Oversold signals hint at a possible bounce toward 3,080–3,120.

Mid-term (4H): Trend is still weak unless price reclaims the 3,120+ area.

Structure view: Holding above support could lead to consolidation; losing it may bring more downside pressure.

This is only a personal market view based on price action and indicators — not financial advice.

Always manage risk and trade responsibly.

ETH-2.3%

- Reward

- like

- Comment

- Repost

- Share