Asiftahsin

No content yet

Asiftahsin

RIVER Technical Outlook: Parabolic Rejection From Macro Supply, Entering Deep Correction Phase

RIVER experienced a strong parabolic advance into the $70–$88 macro supply zone (0.786–1 Fib), where price was sharply rejected. That move marked a blow-off top, followed by aggressive distribution and a fast corrective sell-off.

Price has now lost all key retracement levels and is moving into a deep correction / reset phase after the vertical expansion.

EMA Structure (Strong Bearish Shift After Distribution)

20 EMA: $37.799

50 EMA: $26.838

100 EMA: $15.177

200 EMA: N/A

RIVER has decisively broken be

RIVER experienced a strong parabolic advance into the $70–$88 macro supply zone (0.786–1 Fib), where price was sharply rejected. That move marked a blow-off top, followed by aggressive distribution and a fast corrective sell-off.

Price has now lost all key retracement levels and is moving into a deep correction / reset phase after the vertical expansion.

EMA Structure (Strong Bearish Shift After Distribution)

20 EMA: $37.799

50 EMA: $26.838

100 EMA: $15.177

200 EMA: N/A

RIVER has decisively broken be

- Reward

- 5

- 4

- Repost

- Share

Discovery :

:

Thank you so much for the helpful information.View More

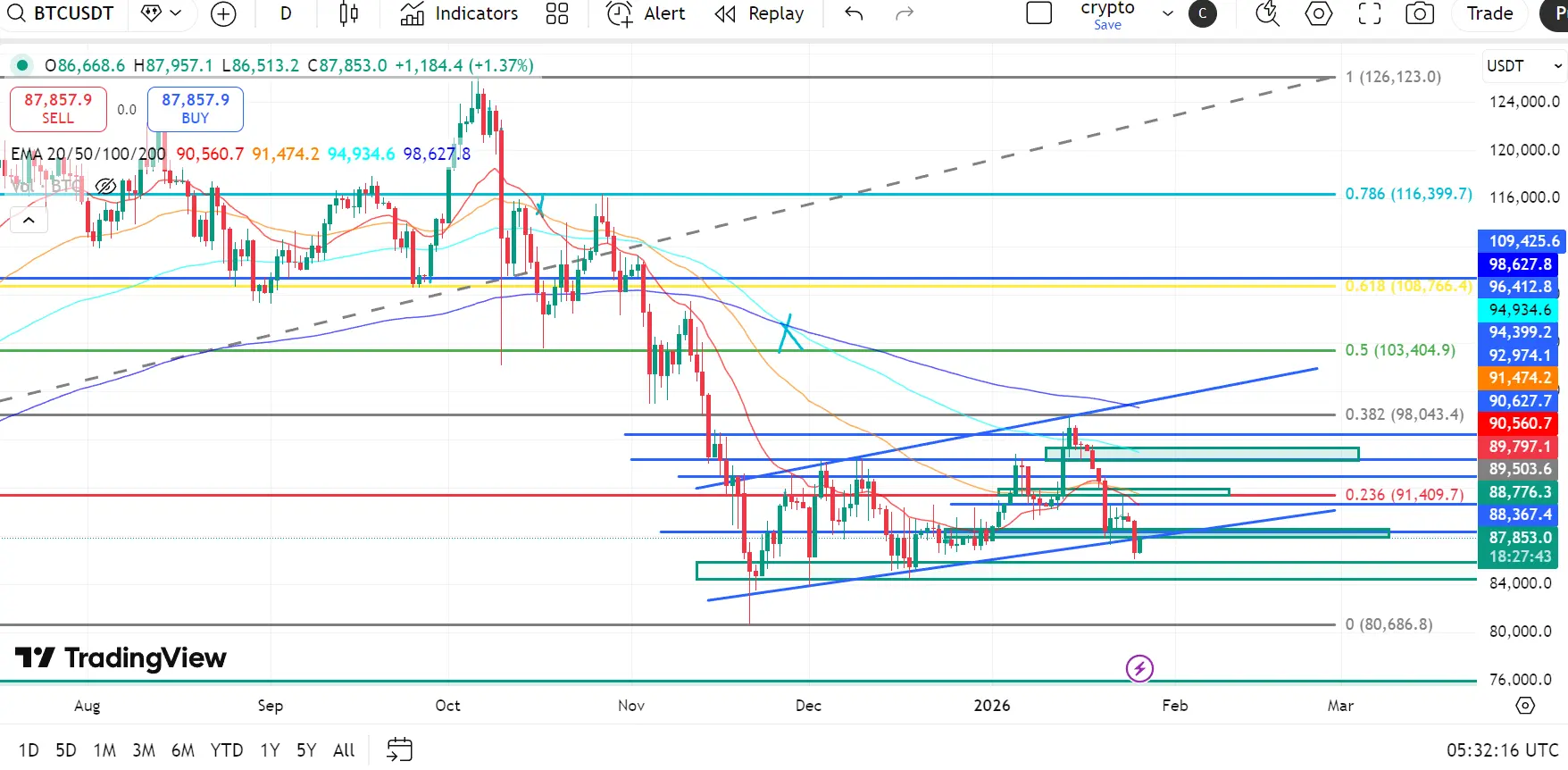

BTC Technical Outlook: Breakdown From Rising Structure Confirms Bearish Expansion

Bitcoin has decisively broken below its rising corrective structure and failed to hold the $84,000–$81,000 support cluster, confirming a continuation of the broader corrective phase from the cycle high. The rejection from the 0.236 Fibonacci level ($91,400) marked a clear lower high, followed by a sharp impulsive breakdown — a classic bearish continuation signal.

Price is now trading deep below all major Fibonacci retracements, indicating loss of medium-term bullish structure.

EMA Structure (Full Bearish Realignm

Bitcoin has decisively broken below its rising corrective structure and failed to hold the $84,000–$81,000 support cluster, confirming a continuation of the broader corrective phase from the cycle high. The rejection from the 0.236 Fibonacci level ($91,400) marked a clear lower high, followed by a sharp impulsive breakdown — a classic bearish continuation signal.

Price is now trading deep below all major Fibonacci retracements, indicating loss of medium-term bullish structure.

EMA Structure (Full Bearish Realignm

BTC-2,13%

- Reward

- 1

- 1

- Repost

- Share

Ryakpanda :

:

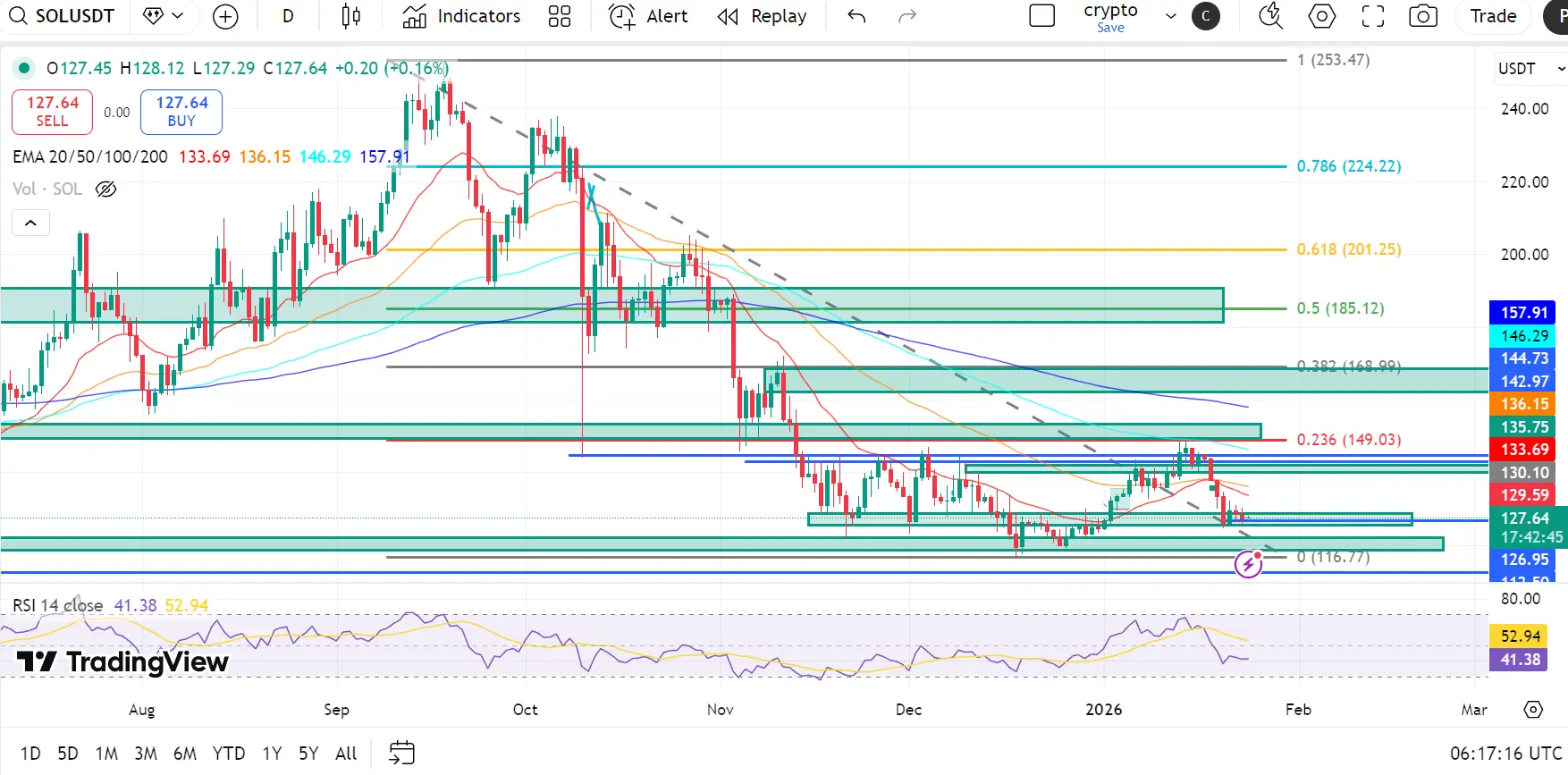

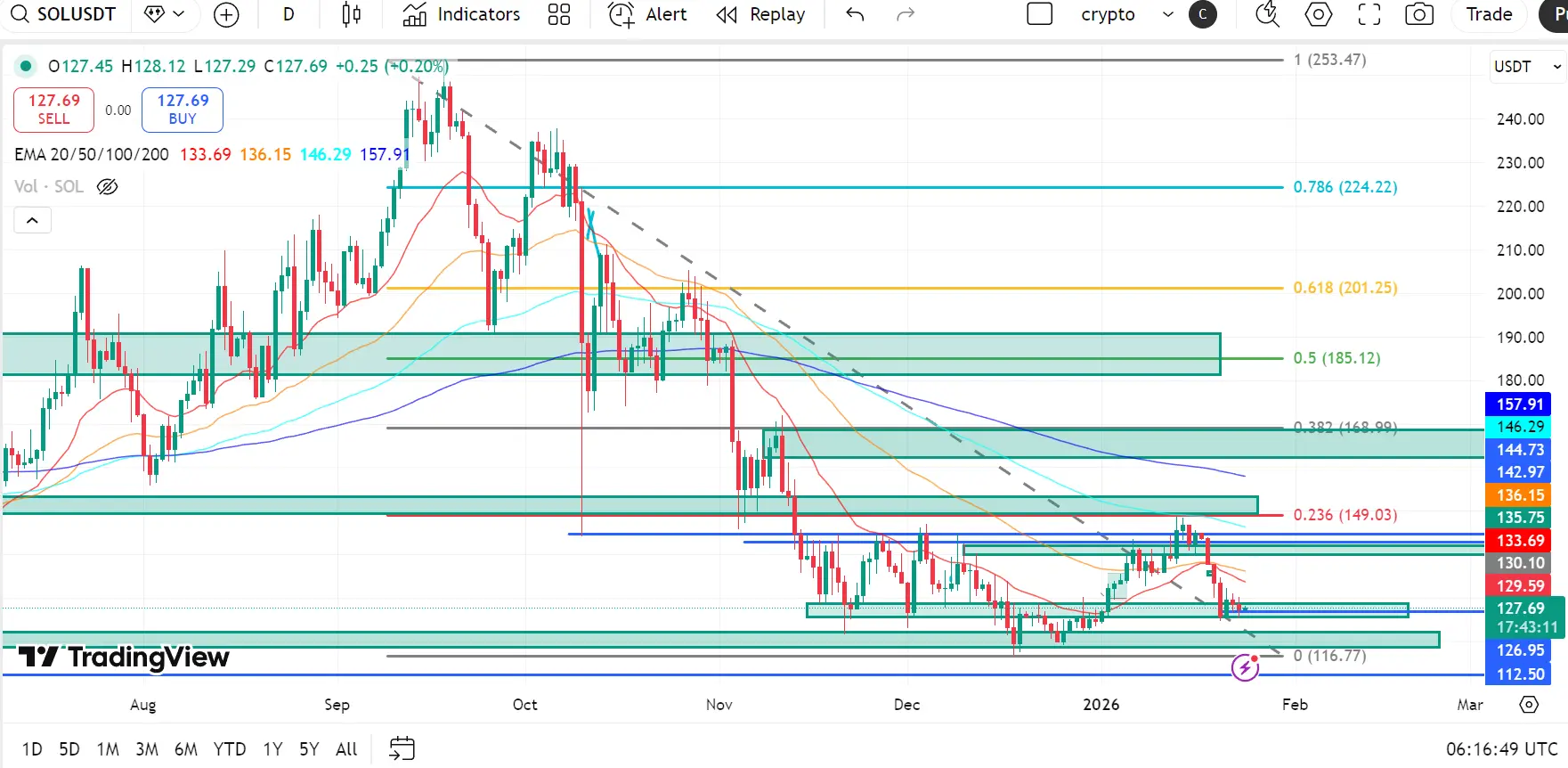

2026 Go Go Go 👊SOL Technical Outlook: Solana Breaks Cycle Base as Bearish Expansion Accelerates

Solana has decisively broken below its long-standing cycle base support near $116–$120, confirming a continuation of the broader corrective downtrend from the cycle high. The failure to hold the 0.236 Fibonacci retracement ($149) earlier marked a structural lower high, and the subsequent breakdown below horizontal demand has shifted market control firmly to sellers.

Price is now trading within the macro demand zone around $102–$110, where short-term reaction is possible. However, overall structure remains decisive

Solana has decisively broken below its long-standing cycle base support near $116–$120, confirming a continuation of the broader corrective downtrend from the cycle high. The failure to hold the 0.236 Fibonacci retracement ($149) earlier marked a structural lower high, and the subsequent breakdown below horizontal demand has shifted market control firmly to sellers.

Price is now trading within the macro demand zone around $102–$110, where short-term reaction is possible. However, overall structure remains decisive

SOL-2,87%

- Reward

- 3

- 3

- Repost

- Share

NewName :

:

Thank you for information! View More

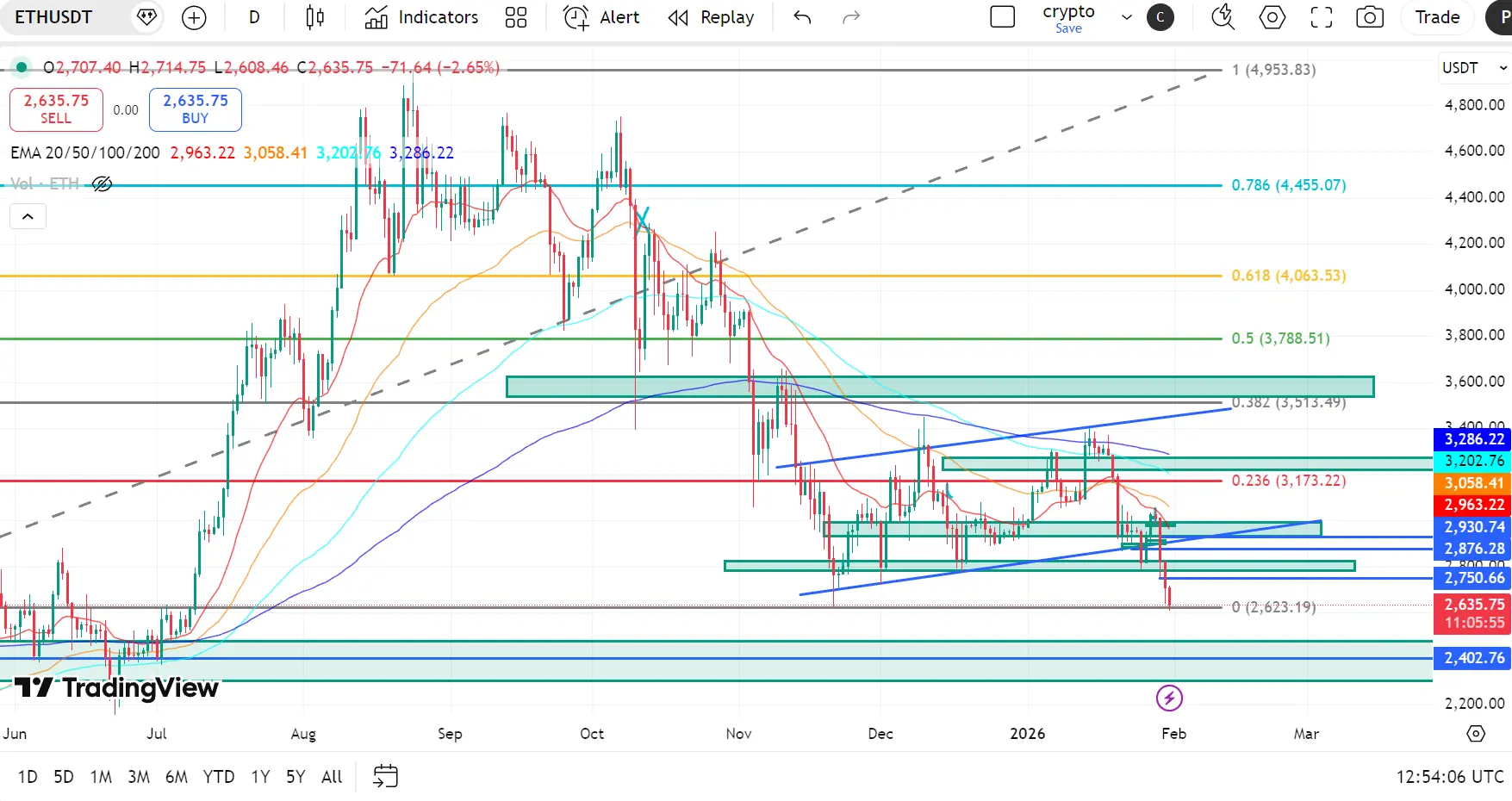

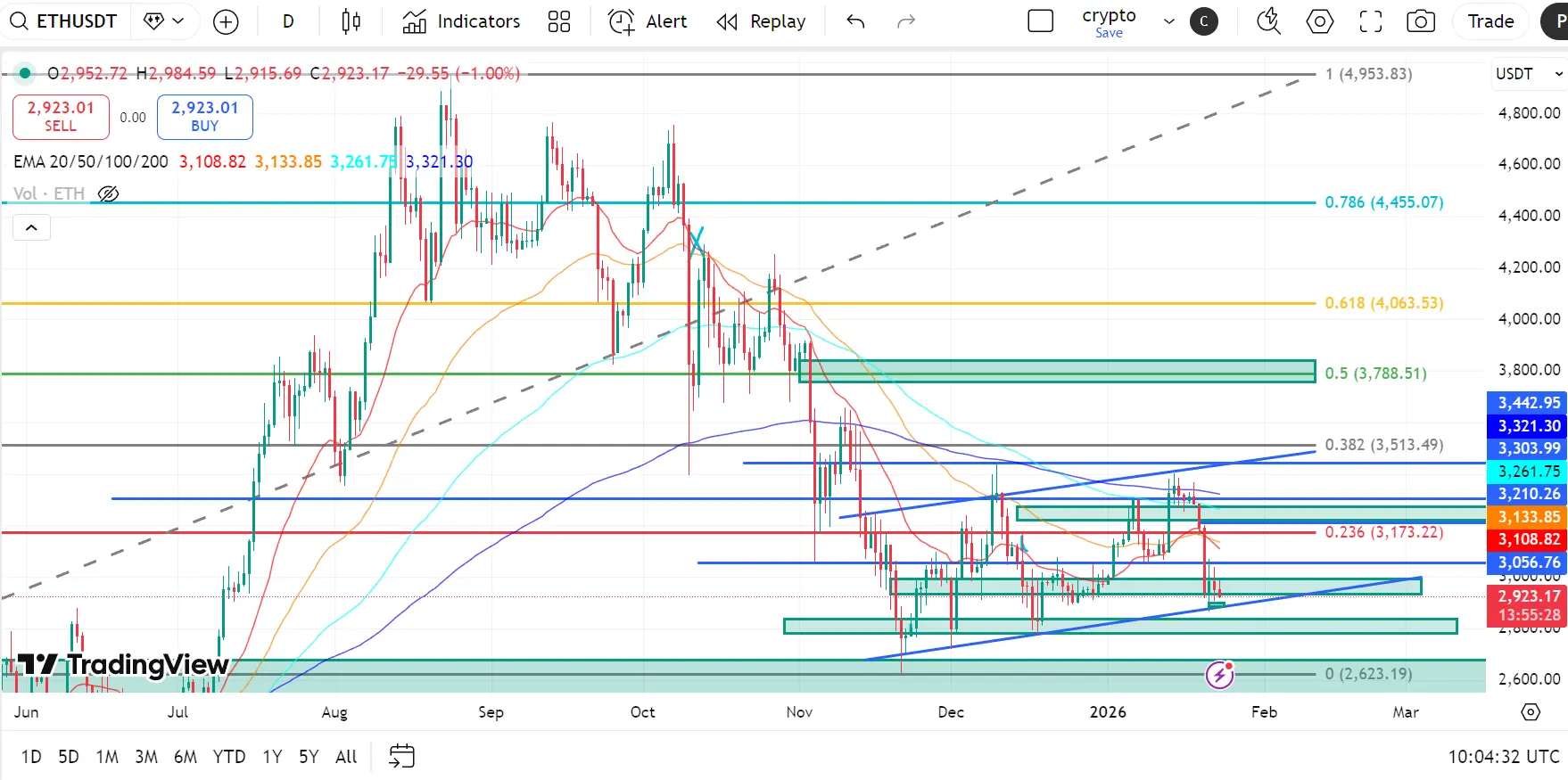

ETH Technical Outlook: Ethereum Breaks Structure Support as Bearish Control Strengthens

Ethereum has decisively broken below the rising corrective channel and failed to hold the $2,900–$2,875 demand zone, confirming a continuation of the broader corrective decline from the cycle high. The loss of structural support near the 0.236 Fibonacci retracement ($3,173) has shifted market control firmly back to sellers.

Price is now trading near the 0 Fibonacci base around $2,623, where short-term demand reaction may occur. However, overall structure remains weak, and any upside movement is currently vi

Ethereum has decisively broken below the rising corrective channel and failed to hold the $2,900–$2,875 demand zone, confirming a continuation of the broader corrective decline from the cycle high. The loss of structural support near the 0.236 Fibonacci retracement ($3,173) has shifted market control firmly back to sellers.

Price is now trading near the 0 Fibonacci base around $2,623, where short-term demand reaction may occur. However, overall structure remains weak, and any upside movement is currently vi

ETH-7,22%

- Reward

- 3

- 2

- Repost

- Share

Ryakpanda :

:

Hop on board!🚗View More

XRP Technical Outlook: Price Holds Cycle Base as Downtrend Structure Remains Intact

XRP continues to trade within a well-defined corrective downtrend after failing to reclaim the $2.70–$2.95 supply region, which aligns with the 0.5–0.618 Fibonacci retracement zone. Persistent rejection from the descending trend channel and repeated failures below key moving averages confirm that the medium-term structure remains bearish.

Price is currently consolidating near the $1.75–$1.80 cycle base, where selling pressure has slowed. However, the lack of impulsive upside continuation suggests stabilization

XRP continues to trade within a well-defined corrective downtrend after failing to reclaim the $2.70–$2.95 supply region, which aligns with the 0.5–0.618 Fibonacci retracement zone. Persistent rejection from the descending trend channel and repeated failures below key moving averages confirm that the medium-term structure remains bearish.

Price is currently consolidating near the $1.75–$1.80 cycle base, where selling pressure has slowed. However, the lack of impulsive upside continuation suggests stabilization

XRP-4,18%

- Reward

- 5

- 6

- Repost

- Share

User_any :

:

Happy New Year! 🤑View More

BTC Technical Outlook: Breakdown From Local Range, Retesting Macro Demand

Bitcoin remains within a broader corrective structure after the rejection from the $108K–$116K macro supply zone (0.618–0.786 Fib). That rejection marked a distribution top, followed by a strong bearish continuation into late Q4.

Recent price action shows BTC losing the $88K–$90K range base and now moving lower into the $83K–$80K macro demand zone, where buyers previously stepped in aggressively. Momentum has weakened again, and the higher-timeframe trend remains bearish.

EMA Structure (Bearish Bias, Breakdown Phase)

20

Bitcoin remains within a broader corrective structure after the rejection from the $108K–$116K macro supply zone (0.618–0.786 Fib). That rejection marked a distribution top, followed by a strong bearish continuation into late Q4.

Recent price action shows BTC losing the $88K–$90K range base and now moving lower into the $83K–$80K macro demand zone, where buyers previously stepped in aggressively. Momentum has weakened again, and the higher-timeframe trend remains bearish.

EMA Structure (Bearish Bias, Breakdown Phase)

20

BTC-2,13%

- Reward

- 6

- 5

- 1

- Share

User_any :

:

2026 GOGOGO 👊View More

SOL Technical Outlook: Price Holds Cycle Base as Broader Corrective Structure Persists

Solana remains in a prolonged corrective phase after failing to sustain acceptance above the $185–$200 supply zone, which coincides with the 0.5–0.618 Fibonacci retracement area. Repeated rejections from the descending trendline and continued inability to reclaim key moving averages confirm that the medium-term structure remains neutral-to-bearish.

Price is currently consolidating just above the $118–$123 cycle base, where selling pressure has slowed. However, the absence of strong impulsive upside follow-th

Solana remains in a prolonged corrective phase after failing to sustain acceptance above the $185–$200 supply zone, which coincides with the 0.5–0.618 Fibonacci retracement area. Repeated rejections from the descending trendline and continued inability to reclaim key moving averages confirm that the medium-term structure remains neutral-to-bearish.

Price is currently consolidating just above the $118–$123 cycle base, where selling pressure has slowed. However, the absence of strong impulsive upside follow-th

SOL-2,87%

- Reward

- 7

- 4

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

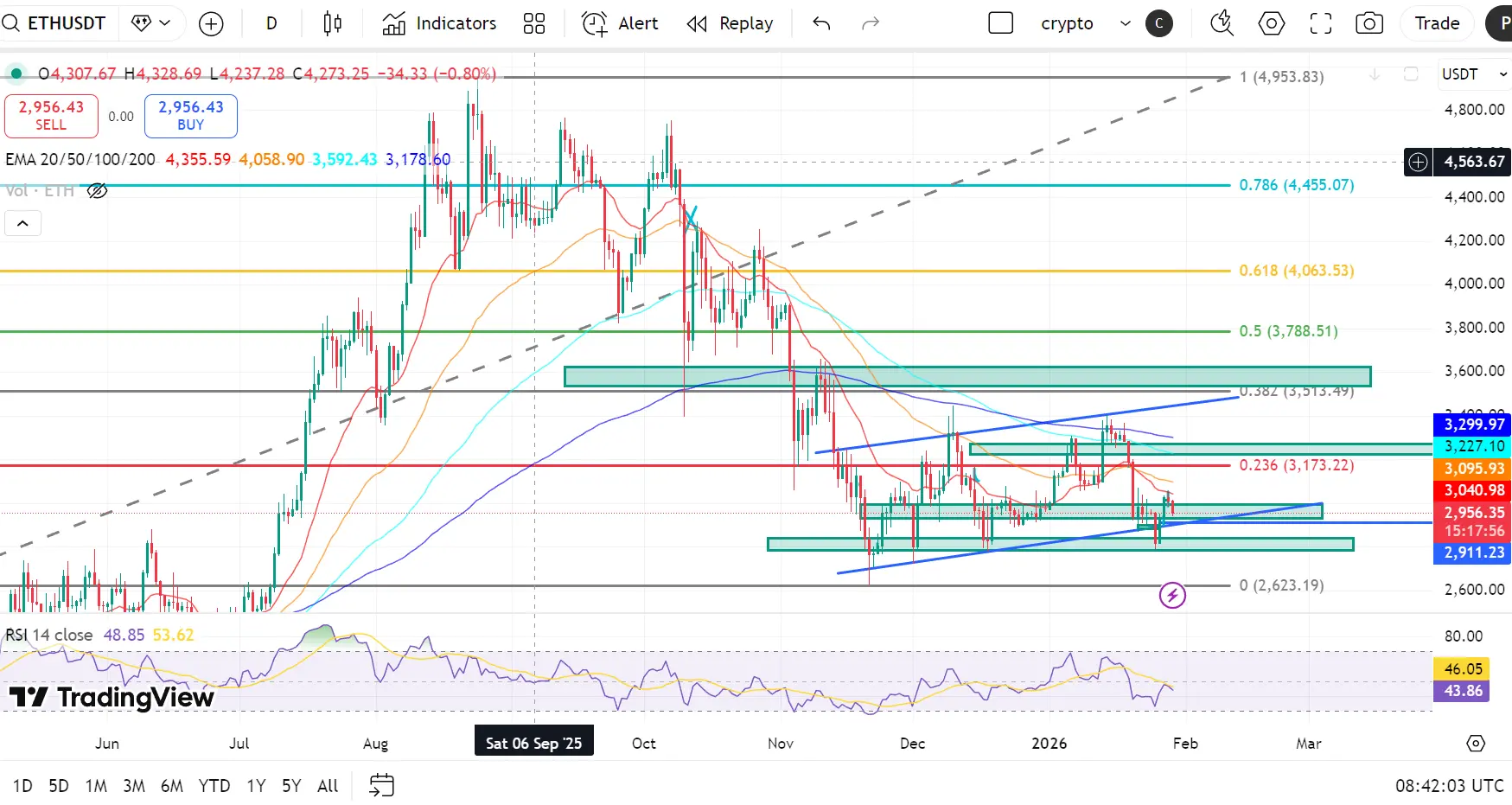

ETH Technical Outlook: Ethereum Consolidates Near Structural Base as Corrective Pressure Persists

Ethereum remains under sustained corrective pressure after repeated failures to reclaim the $3,170–$3,230 resistance zone, which aligns with the 0.236 Fibonacci retracement and the declining EMA structure. Rejection from this region continues to reinforce a neutral-to-bearish medium-term structure, with upside attempts remaining corrective in nature.

Price is currently consolidating around the $2,900–$3,000 region, holding above the rising base support while failing to attract strong follow-throug

Ethereum remains under sustained corrective pressure after repeated failures to reclaim the $3,170–$3,230 resistance zone, which aligns with the 0.236 Fibonacci retracement and the declining EMA structure. Rejection from this region continues to reinforce a neutral-to-bearish medium-term structure, with upside attempts remaining corrective in nature.

Price is currently consolidating around the $2,900–$3,000 region, holding above the rising base support while failing to attract strong follow-throug

ETH-7,22%

- Reward

- 7

- 4

- Repost

- Share

ybaser :

:

Happy New Year! 🤑View More

XRP Technical Outlook: Price Compresses Near Cycle Lows as Bearish Structure Persists

XRP remains under broad corrective pressure after failing to reclaim the $2.70–$2.95 resistance region, which aligns with the 0.5–0.618 Fibonacci retracement cluster. The sustained rejection from the descending trendline and repeated failures below key EMAs continue to reinforce a neutral-to-bearish medium-term structure.

Price is currently consolidating around the $1.90–$2.00 zone, hovering just above the cycle base support near $1.77, indicating indecision as selling momentum slows but conviction buying rem

XRP remains under broad corrective pressure after failing to reclaim the $2.70–$2.95 resistance region, which aligns with the 0.5–0.618 Fibonacci retracement cluster. The sustained rejection from the descending trendline and repeated failures below key EMAs continue to reinforce a neutral-to-bearish medium-term structure.

Price is currently consolidating around the $1.90–$2.00 zone, hovering just above the cycle base support near $1.77, indicating indecision as selling momentum slows but conviction buying rem

XRP-4,18%

- Reward

- 41

- 29

- 1

- Share

MKamran :

:

"Discover seamless crypto trading on Gate.io – fast, secure, and user-friendly! Start today!"View More

BTC Technical Outlook: Stabilizing Above Macro Demand After Distribution Rejection

Bitcoin remains within a broader corrective structure after the sharp rejection from the $108K–$116K macro supply zone (0.618–0.786 Fib). That rejection marked a distribution top, followed by an extended bearish move into November–December.

Recent price action shows BTC defending the $88K–$90K macro demand base, where buyers have started to build a rounded accumulation structure. Momentum has stabilized, though the higher-timeframe trend has not yet turned bullish.

EMA Structure (Bearish Bias, Short-Term Stabili

Bitcoin remains within a broader corrective structure after the sharp rejection from the $108K–$116K macro supply zone (0.618–0.786 Fib). That rejection marked a distribution top, followed by an extended bearish move into November–December.

Recent price action shows BTC defending the $88K–$90K macro demand base, where buyers have started to build a rounded accumulation structure. Momentum has stabilized, though the higher-timeframe trend has not yet turned bullish.

EMA Structure (Bearish Bias, Short-Term Stabili

BTC-2,13%

- Reward

- 19

- 9

- Repost

- Share

Mohibi :

:

thank you for sharing thisView More

XRP Technical Outlook: Stabilizing Near Macro Demand Base After Extended Decline

XRP remains within a broader corrective structure after the sharp rejection from the $3.25–$3.66 macro supply zone (0.786–1 Fib). That rejection marked a distribution top, followed by a continued bearish trend inside a descending channel.

Recent price action shows XRP defending the $1.77–$1.90 macro demand base, where buyers have started to build a rounded accumulation structure. Momentum has stabilized, though the higher-timeframe trend has not yet turned bullish.

EMA Structure (Bearish Bias, Short-Term Stabiliza

XRP remains within a broader corrective structure after the sharp rejection from the $3.25–$3.66 macro supply zone (0.786–1 Fib). That rejection marked a distribution top, followed by a continued bearish trend inside a descending channel.

Recent price action shows XRP defending the $1.77–$1.90 macro demand base, where buyers have started to build a rounded accumulation structure. Momentum has stabilized, though the higher-timeframe trend has not yet turned bullish.

EMA Structure (Bearish Bias, Short-Term Stabiliza

XRP-4,18%

- Reward

- 6

- 3

- Repost

- Share

User_any :

:

Happy New Year! 🤑View More

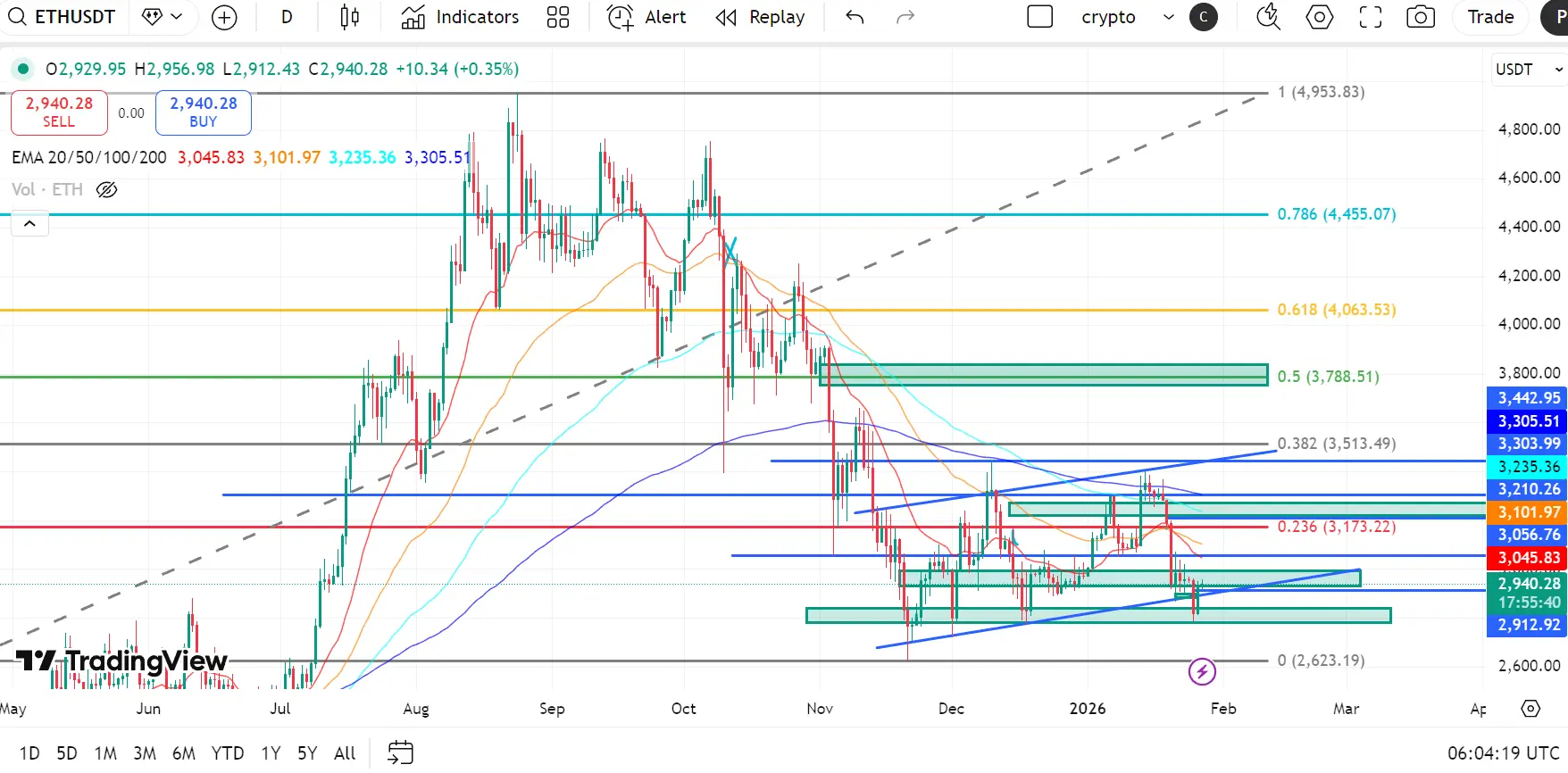

ETH Technical Outlook: Stabilizing After Prolonged Downtrend

Ethereum remains within a broader corrective structure after the sharp rejection from the $4,450–$4,950 macro supply zone (0.786–1 Fib). That rejection marked a distribution top, followed by strong bearish continuation and now a range-bound stabilization phase near the lower end of the structure.

Recent price action shows ETH defending the $2,620–$2,900 macro demand base, where buyers have started to build a rounded accumulation structure. Momentum has stabilized, though the higher-timeframe trend has not yet flipped bullish.

EMA Str

Ethereum remains within a broader corrective structure after the sharp rejection from the $4,450–$4,950 macro supply zone (0.786–1 Fib). That rejection marked a distribution top, followed by strong bearish continuation and now a range-bound stabilization phase near the lower end of the structure.

Recent price action shows ETH defending the $2,620–$2,900 macro demand base, where buyers have started to build a rounded accumulation structure. Momentum has stabilized, though the higher-timeframe trend has not yet flipped bullish.

EMA Str

ETH-7,22%

- Reward

- 14

- 7

- Repost

- Share

CRYPTODZ01 :

:

Bullish market at its peak 🐂View More

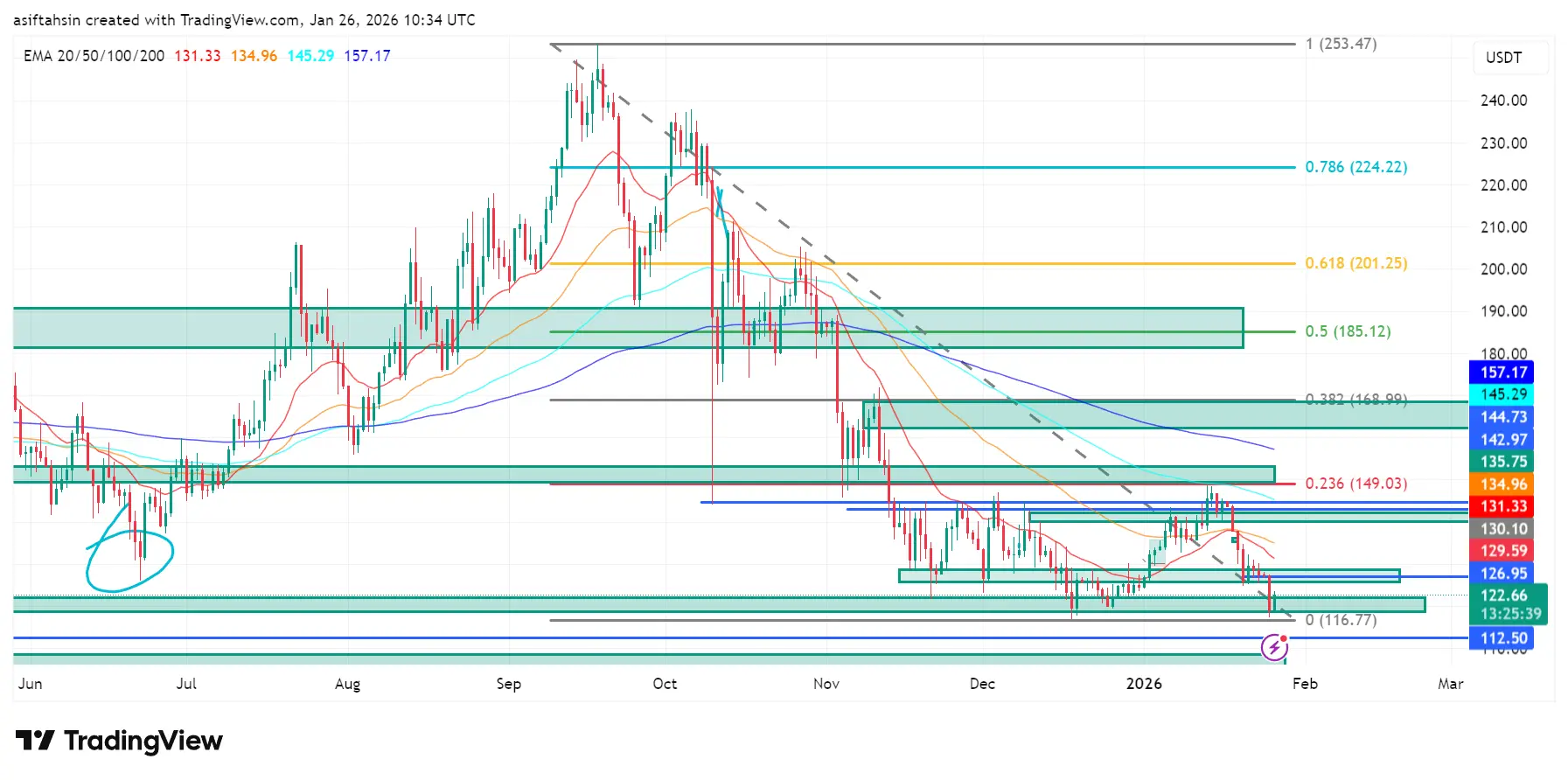

SOL Technical Outlook: Base Formation Develops After Prolonged Correction

Solana remains within a broader corrective structure after the sharp rejection from the $224–$253 macro supply zone (0.786–1 Fib). That rejection marked a distribution top, followed by sustained bearish continuation and now a range-bound stabilization phase near the lower end of the structure.

Recent price action shows SOL defending the $116–$123 macro demand base, where buyers have started to build a rounded accumulation structure. Momentum has stabilized, though the higher-timeframe trend has not yet flipped bullish.

E

Solana remains within a broader corrective structure after the sharp rejection from the $224–$253 macro supply zone (0.786–1 Fib). That rejection marked a distribution top, followed by sustained bearish continuation and now a range-bound stabilization phase near the lower end of the structure.

Recent price action shows SOL defending the $116–$123 macro demand base, where buyers have started to build a rounded accumulation structure. Momentum has stabilized, though the higher-timeframe trend has not yet flipped bullish.

E

SOL-2,87%

- Reward

- 9

- 6

- Repost

- Share

ybaser :

:

Just go for it💪View More

BTC Technical Outlook: Accumulation Structure Develops Above Macro Demand

Bitcoin remains within a broader corrective structure after the sharp rejection from the $116K–$126K macro supply zone (0.786–1 Fib). That rejection marked a distribution top, followed by strong bearish continuation and now a range-bound stabilization phase near the lower end of the structure.

Recent price action shows BTC defending the $88.5K–$90.0K macro demand base, where buyers have started to build a rounded accumulation structure. Momentum has stabilized, though the higher-timeframe trend has not yet flipped bullis

Bitcoin remains within a broader corrective structure after the sharp rejection from the $116K–$126K macro supply zone (0.786–1 Fib). That rejection marked a distribution top, followed by strong bearish continuation and now a range-bound stabilization phase near the lower end of the structure.

Recent price action shows BTC defending the $88.5K–$90.0K macro demand base, where buyers have started to build a rounded accumulation structure. Momentum has stabilized, though the higher-timeframe trend has not yet flipped bullis

BTC-2,13%

- Reward

- 9

- 10

- Repost

- Share

ybaser :

:

Just go for it💪View More

XRP Technical Outlook: Descending Channel Base Forms Near Macro Demand

XRP remains within a broader corrective structure after the sharp rejection from the $3.25–$3.65 macro supply zone (0.786–1 Fib). That rejection marked a distribution top, followed by sustained bearish continuation and now a range-bound stabilization phase near the lower end of the structure inside a descending channel.

Recent price action shows XRP defending the $1.85–$1.77 macro demand base, where buyers have started to build a rounded accumulation structure. Momentum has stabilized, though the higher-timeframe trend has

XRP remains within a broader corrective structure after the sharp rejection from the $3.25–$3.65 macro supply zone (0.786–1 Fib). That rejection marked a distribution top, followed by sustained bearish continuation and now a range-bound stabilization phase near the lower end of the structure inside a descending channel.

Recent price action shows XRP defending the $1.85–$1.77 macro demand base, where buyers have started to build a rounded accumulation structure. Momentum has stabilized, though the higher-timeframe trend has

XRP-4,18%

- Reward

- 18

- 15

- Repost

- Share

ybaser :

:

2026 Go Go Go 👊View More

ETH Technical Outlook: Base Formation Develops After Prolonged Corrective Phase

Ethereum remains within a broader corrective structure after the sharp rejection from the $4,450–$4,950 macro supply zone (0.786–1 Fib). That rejection marked a distribution top, followed by sustained bearish continuation and now a range-bound stabilization phase near the lower end of the structure.

Recent price action shows ETH defending the $2,620–$2,900 macro demand base, where buyers have started to build a rounded accumulation structure. Momentum has stabilized, though the higher-timeframe trend has not yet fl

Ethereum remains within a broader corrective structure after the sharp rejection from the $4,450–$4,950 macro supply zone (0.786–1 Fib). That rejection marked a distribution top, followed by sustained bearish continuation and now a range-bound stabilization phase near the lower end of the structure.

Recent price action shows ETH defending the $2,620–$2,900 macro demand base, where buyers have started to build a rounded accumulation structure. Momentum has stabilized, though the higher-timeframe trend has not yet fl

ETH-7,22%

- Reward

- 10

- 5

- 1

- Share

ybaser :

:

Hold on tight, we're about to take off 🛫View More

SOL Technical Outlook: Range Base Forms Inside Broader Downtrend

Solana remains within a broader corrective structure after the sharp rejection from the $220–$253 macro supply zone (0.786–1 Fib). That rejection marked a distribution top, followed by sustained bearish continuation inside a descending channel.

Recent price action shows SOL defending the $116–$128 macro demand base, where buyers have started to build a rounded accumulation structure. Momentum has stabilized, though the higher-timeframe trend has not yet flipped bullish.

EMA Structure (Bearish Bias, Short-Term Stabilization)

20 EM

Solana remains within a broader corrective structure after the sharp rejection from the $220–$253 macro supply zone (0.786–1 Fib). That rejection marked a distribution top, followed by sustained bearish continuation inside a descending channel.

Recent price action shows SOL defending the $116–$128 macro demand base, where buyers have started to build a rounded accumulation structure. Momentum has stabilized, though the higher-timeframe trend has not yet flipped bullish.

EMA Structure (Bearish Bias, Short-Term Stabilization)

20 EM

SOL-2,87%

- Reward

- 9

- 7

- Repost

- Share

ybaser :

:

Watching Closely 🔍️View More

BTC Technical Outlook: Accumulation Structure Forms Near Macro Demand

Bitcoin remains within a broader corrective structure after the sharp rejection from the $116K–$126K macro supply zone (0.786–1 Fib). That rejection marked a distribution top, followed by strong bearish continuation and now a range-bound stabilization phase near the lower end of the structure.

Recent price action shows BTC defending the $88.7K–$90.5K macro demand base, where buyers have started to build a rounded accumulation structure. Momentum has stabilized, though the higher-timeframe trend has not yet flipped bullish.

Bitcoin remains within a broader corrective structure after the sharp rejection from the $116K–$126K macro supply zone (0.786–1 Fib). That rejection marked a distribution top, followed by strong bearish continuation and now a range-bound stabilization phase near the lower end of the structure.

Recent price action shows BTC defending the $88.7K–$90.5K macro demand base, where buyers have started to build a rounded accumulation structure. Momentum has stabilized, though the higher-timeframe trend has not yet flipped bullish.

BTC-2,13%

- Reward

- 8

- 7

- Repost

- Share

ybaser :

:

Buy To Earn 💎View More

ETH Technical Outlook: Ethereum Consolidates Below Key Fib Resistance After Sharp Corrective Decline

Ethereum remains in a medium-term corrective structure following the rejection from the $4,450–$4,950 macro resistance region. The breakdown below the rising trendline and subsequent loss of the 0.382–0.5 Fibonacci cluster confirmed a transition from bullish continuation into a neutral-bearish market phase.

Price is currently stabilizing near the $2,950–$3,050 region, attempting to form a base after the impulsive selloff from the $4,000+ highs. This zone represents a critical decision area for

Ethereum remains in a medium-term corrective structure following the rejection from the $4,450–$4,950 macro resistance region. The breakdown below the rising trendline and subsequent loss of the 0.382–0.5 Fibonacci cluster confirmed a transition from bullish continuation into a neutral-bearish market phase.

Price is currently stabilizing near the $2,950–$3,050 region, attempting to form a base after the impulsive selloff from the $4,000+ highs. This zone represents a critical decision area for

ETH-7,22%

- Reward

- 7

- 4

- Repost

- Share

UnlimitedStrategy :

:

Buy To Earn 💎View More