#美联储主席人选预测 Market Analysis

Wall Street's "Hawks" and the Crypto World’s "Friends": What Does Kevin Warsh's Leadership of the Federal Reserve Mean?

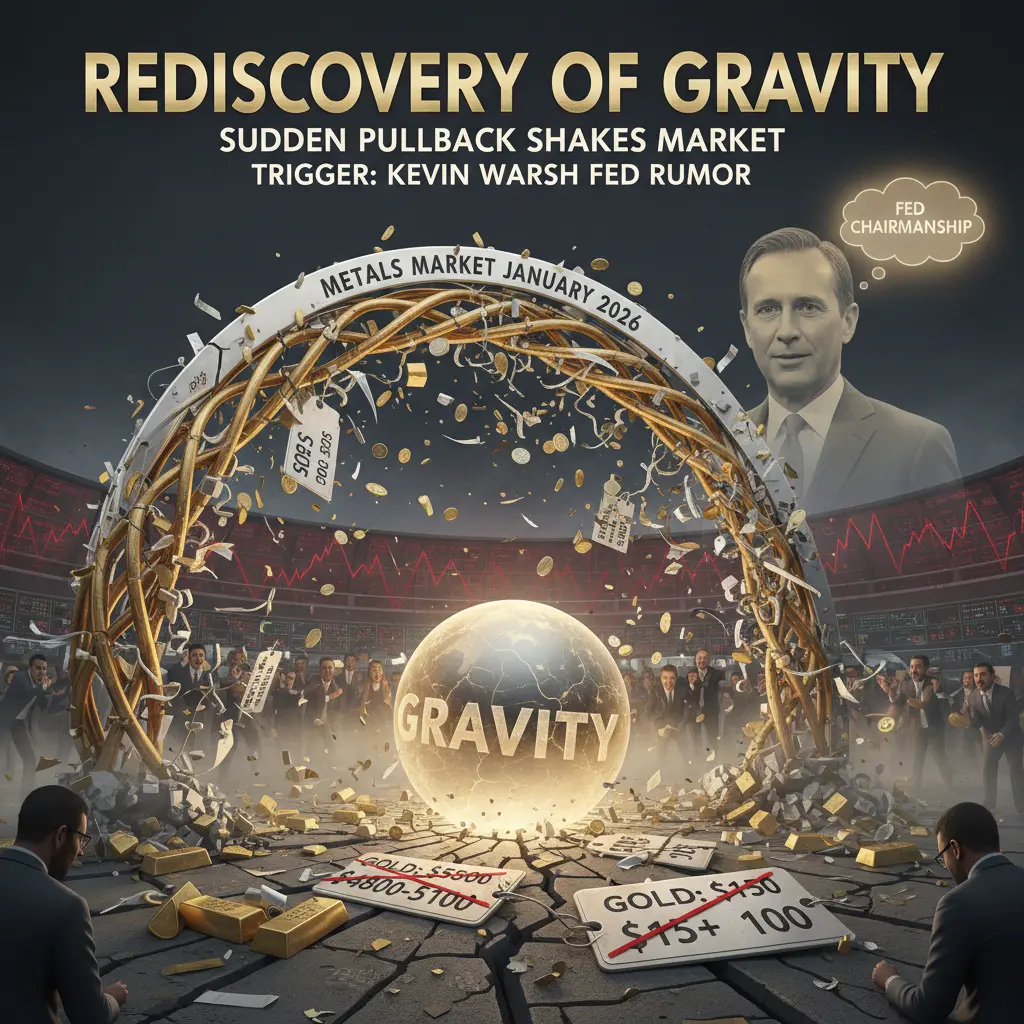

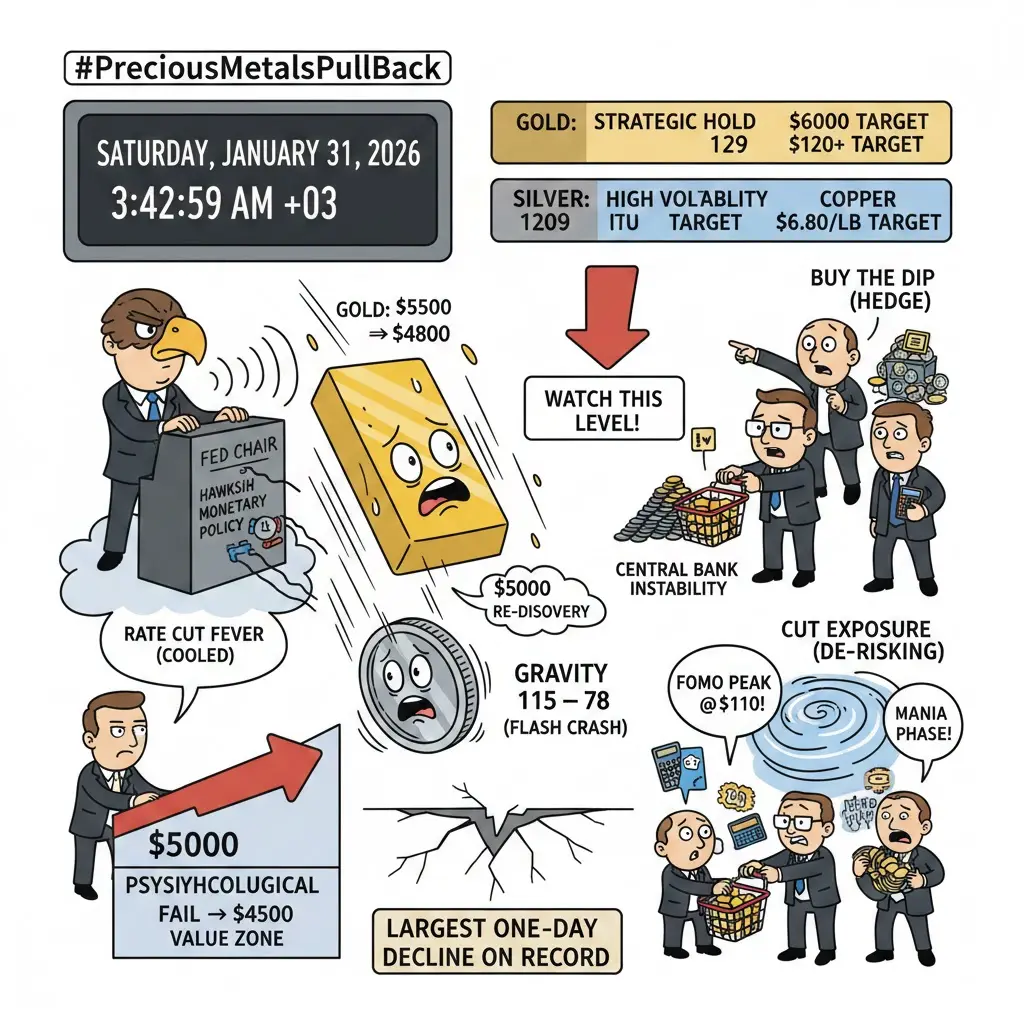

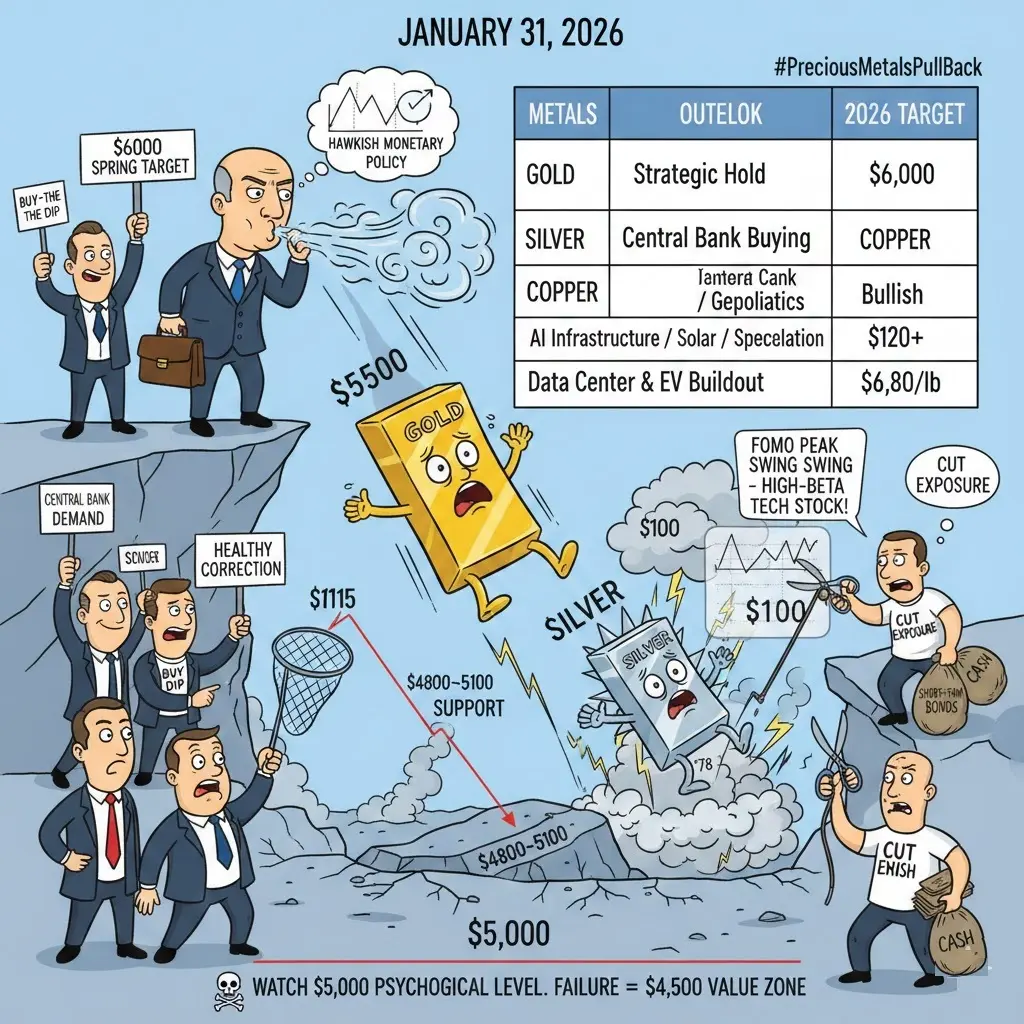

Just now, the "faucet" of the global financial markets has welcomed a new leader. Donald Trump officially nominated Kevin Warsh to serve as the next Federal Reserve Chair. Once the news broke, the crypto market and US stocks instantly "changed faces," with Bitcoin experiencing a short-term dip, as if an invisible hand was choking its throat. Many newcomers to the space might be confused: changing the Fed Chair, is it really such a big deal?

It's like your neighborhood property manager changing. The previous manager (Powell), though slow in action, was somewhat predictable with occasional benefits (interest rate cuts); the new manager (Warsh), reportedly a "stern judge," not only avoids benefits but might also tighten access controls in the community.

For the crypto markets, which rely on "liquidity" to survive, this is undoubtedly a sudden cold snap. But if we peel back the "hawkish" exterior, you'll find that Kevin Warsh's attitude toward Web3 actually contains a significant reversal. Today, let's dig into what this "Wall Street's youngest governor" might bring to our wallets.

Farewell to "Excessive Money Printing": When the Biggest Whale Stops Spending

First, we need to understand why the market fears Kevin Warsh. In the financial world, Warsh has a prominent label—"Sound Money Advocate." If the Federal Reserve is compared to a "water plant" responsible for injecting liquidity into the market, previous leaders (like Bernanke, Yellen) believed in "adding water when there's too much dough, adding dough when there's too much water," printing money (QE) during crises. But Warsh is different. As early as after the 2008 financial crisis, he was the youngest "opponent" within the Fed. He publicly criticized the Fed's bond-buying actions as "kidnapping other countries' monetary policies," believing that prolonged low interest rates would create huge asset bubbles.

What does this mean for the crypto market? Imagine that the rise of cryptocurrencies (especially Bitcoin) is largely due to the fact that money in the market is "too cheap." When bank interest rates are at 0%, money floods into risk assets seeking returns. Warsh's rise signals that the era of "cheap money" might be ending. He doesn't sway like Powell, who swings between rate cuts this month and hints at hikes next month in a Tai Chi dance.

Warsh's logic is firm: inflation is a fierce tiger that must be kept in a cage. If he perceives a risk of rising inflation, he will not hesitate to maintain high interest rates or even tighten liquidity. For seasoned crypto investors used to "the Fed printing money and prices rising," this is like being suddenly cut off from milk.

In the short term, market expectations of "rate cuts and liquidity flooding" will quickly cool down, which is the core reason why risk assets immediately declined once the news broke.

Enemies' Enemy is a Friend: The End of CBDC

If the story ends here, it would indeed be bearish. But the Web3 world is never black and white. While Warsh is "hawkish" on monetary policy, he might be the biggest "ally" of the crypto industry when it comes to digital currency architecture. This brings us to his stance on CBDC (Central Bank Digital Currencies) and stablecoins.

Over the past few years, central banks worldwide have been researching CBDCs, trying to issue a digital currency fully controlled by the government. For crypto purists, CBDC is like installing a 24-hour surveillance camera in your wallet—every transaction is watched by the government. Kevin Warsh firmly opposes the Fed issuing retail CBDCs. He has publicly stated that the Fed should not directly intervene in ordinary people's bank accounts through CBDC, as it is inefficient and an invasion of privacy.

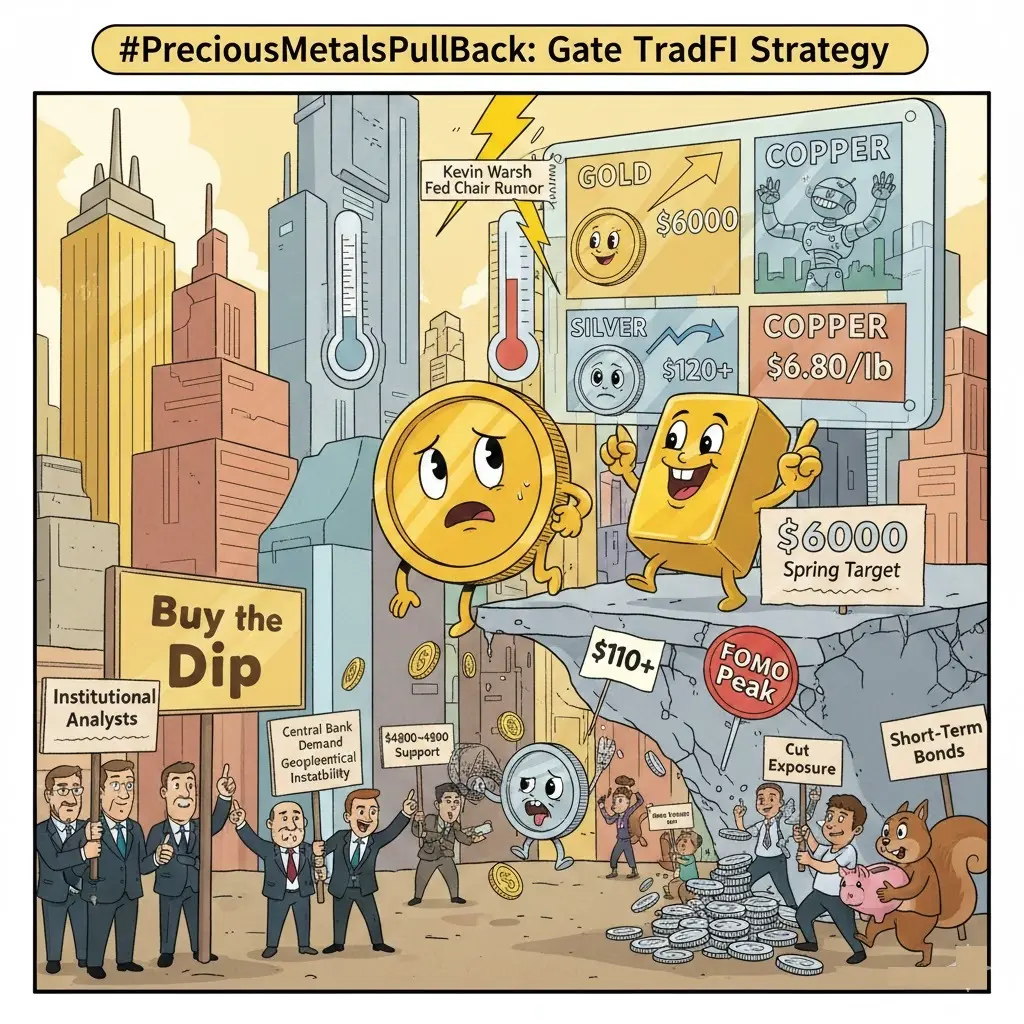

He believes that the baton of innovation should be handed to the private sector. Key point: he opposes government-issued CBDC but supports regulated private stablecoins (like USDC, PYUSD). In his vision, the future of digital dollars shouldn't be the Fed releasing an app for everyone to use, but rather private companies like Circle and PayPal issuing stablecoins, with the Fed overseeing regulation and wholesale settlement behind the scenes. What does this mean for Web3?

It suggests that the "Damocles sword" of regulation hanging over stablecoins for years might be lifted. If Warsh takes office, the US is very likely to introduce clear legislation favorable to stablecoin development. Once stablecoins are integrated into the formal financial system, they will become a high-speed highway connecting traditional finance (TradFi) and decentralized finance (DeFi). This long-term benefit for the entire crypto ecosystem far exceeds the short-term thrill of a rate cut.

Bitcoin: From "Rat Poison" to "Alarm Bell"

Even more interesting is Warsh's view on Bitcoin. Years ago, many traditional finance giants called Bitcoin "rat poison." But Warsh's perspective is quite unique. While he doesn't believe Bitcoin can replace the dollar, he sees it as a "policy alarm." He mentioned in an interview: "If Bitcoin's price skyrockets, it indicates that our fiat monetary policy has problems, and people no longer trust the dollar's purchasing power." This view is very "Austrian School." He doesn't see Bitcoin as an enemy to be suppressed but as a mirror. This attitude shift is crucial. In the eyes of current regulators, cryptocurrencies are often seen as "regulated gambling." But in Warsh's view, cryptocurrencies could be a "market mechanism to hedge against excessive fiat issuance." If the Fed Chair considers Bitcoin's existence reasonable and a form of supervision over the Fed's own discipline, then the SEC's (Securities and Exchange Commission) "regulation for regulation's sake" crackdown might be restrained at a higher level.

Post-Pain New Order

Looking ahead from this point in time, Kevin Warsh's nomination will bring a "schizophrenic" trend to the market.

Short-term (next 3-6 months): Be prepared for "hard times." The market needs to reprice "liquidity expectations." The hope that the Fed will quickly cut rates by 100 basis points to pump the market may be dashed. As Warsh's hawkish rhetoric gains traction, US Treasury yields could stay high, draining liquidity from the crypto space. Altcoins and meme projects may face severe bloodletting.

Mid-term (next 1-2 years): With the implementation of new regulatory frameworks, we will see the "formalization" of the US crypto market.

• Stablecoin payments may explode: With Fed's tacit approval, stablecoins could truly enter the payments sector, not just trading chips on exchanges.

• Institutional entry accelerates: Warsh represents the consensus of Wall Street elites. His appointment will make giants like BlackRock and Fidelity more confident in allocating funds to crypto assets because they see reduced policy risks.

Advice for ordinary investors: Don't be scared off by short-term price fluctuations, and avoid blindly leveraging for rebounds.

Warsh's appointment is essentially a significant signal that the crypto market is moving from the "wild west" era to the "compliance" era. He may turn off the "floodgates" of liquidity, but he will repair the pipelines leading to the future. In this process, projects without real value, solely supported by liquidity bubbles, will die; those that truly solve problems and are built on compliant stablecoins will usher in a real golden age. The Fed's baton has been handed over, the style of the symphony has changed, but the dance is not over.

Wall Street's "Hawks" and the Crypto World’s "Friends": What Does Kevin Warsh's Leadership of the Federal Reserve Mean?

Just now, the "faucet" of the global financial markets has welcomed a new leader. Donald Trump officially nominated Kevin Warsh to serve as the next Federal Reserve Chair. Once the news broke, the crypto market and US stocks instantly "changed faces," with Bitcoin experiencing a short-term dip, as if an invisible hand was choking its throat. Many newcomers to the space might be confused: changing the Fed Chair, is it really such a big deal?

It's like your neighborhood property manager changing. The previous manager (Powell), though slow in action, was somewhat predictable with occasional benefits (interest rate cuts); the new manager (Warsh), reportedly a "stern judge," not only avoids benefits but might also tighten access controls in the community.

For the crypto markets, which rely on "liquidity" to survive, this is undoubtedly a sudden cold snap. But if we peel back the "hawkish" exterior, you'll find that Kevin Warsh's attitude toward Web3 actually contains a significant reversal. Today, let's dig into what this "Wall Street's youngest governor" might bring to our wallets.

Farewell to "Excessive Money Printing": When the Biggest Whale Stops Spending

First, we need to understand why the market fears Kevin Warsh. In the financial world, Warsh has a prominent label—"Sound Money Advocate." If the Federal Reserve is compared to a "water plant" responsible for injecting liquidity into the market, previous leaders (like Bernanke, Yellen) believed in "adding water when there's too much dough, adding dough when there's too much water," printing money (QE) during crises. But Warsh is different. As early as after the 2008 financial crisis, he was the youngest "opponent" within the Fed. He publicly criticized the Fed's bond-buying actions as "kidnapping other countries' monetary policies," believing that prolonged low interest rates would create huge asset bubbles.

What does this mean for the crypto market? Imagine that the rise of cryptocurrencies (especially Bitcoin) is largely due to the fact that money in the market is "too cheap." When bank interest rates are at 0%, money floods into risk assets seeking returns. Warsh's rise signals that the era of "cheap money" might be ending. He doesn't sway like Powell, who swings between rate cuts this month and hints at hikes next month in a Tai Chi dance.

Warsh's logic is firm: inflation is a fierce tiger that must be kept in a cage. If he perceives a risk of rising inflation, he will not hesitate to maintain high interest rates or even tighten liquidity. For seasoned crypto investors used to "the Fed printing money and prices rising," this is like being suddenly cut off from milk.

In the short term, market expectations of "rate cuts and liquidity flooding" will quickly cool down, which is the core reason why risk assets immediately declined once the news broke.

Enemies' Enemy is a Friend: The End of CBDC

If the story ends here, it would indeed be bearish. But the Web3 world is never black and white. While Warsh is "hawkish" on monetary policy, he might be the biggest "ally" of the crypto industry when it comes to digital currency architecture. This brings us to his stance on CBDC (Central Bank Digital Currencies) and stablecoins.

Over the past few years, central banks worldwide have been researching CBDCs, trying to issue a digital currency fully controlled by the government. For crypto purists, CBDC is like installing a 24-hour surveillance camera in your wallet—every transaction is watched by the government. Kevin Warsh firmly opposes the Fed issuing retail CBDCs. He has publicly stated that the Fed should not directly intervene in ordinary people's bank accounts through CBDC, as it is inefficient and an invasion of privacy.

He believes that the baton of innovation should be handed to the private sector. Key point: he opposes government-issued CBDC but supports regulated private stablecoins (like USDC, PYUSD). In his vision, the future of digital dollars shouldn't be the Fed releasing an app for everyone to use, but rather private companies like Circle and PayPal issuing stablecoins, with the Fed overseeing regulation and wholesale settlement behind the scenes. What does this mean for Web3?

It suggests that the "Damocles sword" of regulation hanging over stablecoins for years might be lifted. If Warsh takes office, the US is very likely to introduce clear legislation favorable to stablecoin development. Once stablecoins are integrated into the formal financial system, they will become a high-speed highway connecting traditional finance (TradFi) and decentralized finance (DeFi). This long-term benefit for the entire crypto ecosystem far exceeds the short-term thrill of a rate cut.

Bitcoin: From "Rat Poison" to "Alarm Bell"

Even more interesting is Warsh's view on Bitcoin. Years ago, many traditional finance giants called Bitcoin "rat poison." But Warsh's perspective is quite unique. While he doesn't believe Bitcoin can replace the dollar, he sees it as a "policy alarm." He mentioned in an interview: "If Bitcoin's price skyrockets, it indicates that our fiat monetary policy has problems, and people no longer trust the dollar's purchasing power." This view is very "Austrian School." He doesn't see Bitcoin as an enemy to be suppressed but as a mirror. This attitude shift is crucial. In the eyes of current regulators, cryptocurrencies are often seen as "regulated gambling." But in Warsh's view, cryptocurrencies could be a "market mechanism to hedge against excessive fiat issuance." If the Fed Chair considers Bitcoin's existence reasonable and a form of supervision over the Fed's own discipline, then the SEC's (Securities and Exchange Commission) "regulation for regulation's sake" crackdown might be restrained at a higher level.

Post-Pain New Order

Looking ahead from this point in time, Kevin Warsh's nomination will bring a "schizophrenic" trend to the market.

Short-term (next 3-6 months): Be prepared for "hard times." The market needs to reprice "liquidity expectations." The hope that the Fed will quickly cut rates by 100 basis points to pump the market may be dashed. As Warsh's hawkish rhetoric gains traction, US Treasury yields could stay high, draining liquidity from the crypto space. Altcoins and meme projects may face severe bloodletting.

Mid-term (next 1-2 years): With the implementation of new regulatory frameworks, we will see the "formalization" of the US crypto market.

• Stablecoin payments may explode: With Fed's tacit approval, stablecoins could truly enter the payments sector, not just trading chips on exchanges.

• Institutional entry accelerates: Warsh represents the consensus of Wall Street elites. His appointment will make giants like BlackRock and Fidelity more confident in allocating funds to crypto assets because they see reduced policy risks.

Advice for ordinary investors: Don't be scared off by short-term price fluctuations, and avoid blindly leveraging for rebounds.

Warsh's appointment is essentially a significant signal that the crypto market is moving from the "wild west" era to the "compliance" era. He may turn off the "floodgates" of liquidity, but he will repair the pipelines leading to the future. In this process, projects without real value, solely supported by liquidity bubbles, will die; those that truly solve problems and are built on compliant stablecoins will usher in a real golden age. The Fed's baton has been handed over, the style of the symphony has changed, but the dance is not over.