Virtuals Protocol Launches New Structures to Support Agent Experiments, Growth, and Scale

1h ago

Polygon PoS Hits Record Demand as 3M POL Burned in Single Day

3h ago

Trending Topics

View More10.63K Popularity

21.96K Popularity

15.55K Popularity

7.31K Popularity

98.2K Popularity

Hot Gate Fun

View More- MC:$3.56KHolders:10.00%

- MC:$3.56KHolders:10.00%

- MC:$3.6KHolders:10.00%

- MC:$3.62KHolders:20.00%

- MC:$4.18KHolders:22.78%

Pin

Reports Suggest Venezuela May Hold Up to 600,000 BTC in Alleged Shadow Reserve

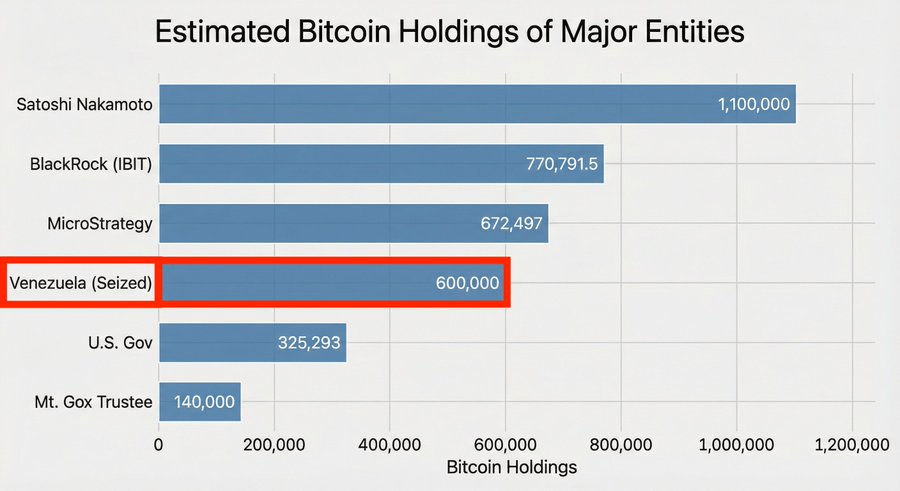

Venezuela may currently be under the most chaotic period in its history with the capture of former president Nicolas Maduro, but the Latin American country has emerged as one of the world’s largest Bitcoin holders. According to some reports, the Venezuelan government holds twice as much BTC as the U.S, and what happens next could have massive ripple effects on the top crypto’s price. According to a report by Whale Hunting, published on Project Brazen, Venezuela currently holds 600,000 BTC, valued at $55.6 billion at press time. This makes the country the fourth-largest BTC holder after Satoshi Nakamoto, BlackRock’s iBIT ETF, and the largest corporate holder, Strategy.

Source: TFTC on X

According to the Whale Hunting report, Maduro and his cronies have been channelling billion in oil revenue and gold reserves into BTC over the years. This project was spearheaded by Alex Saab, an infamous Colombian businessman who served as as a key intermediary for Maduro’s government. Reports describe Saab as “the only person on Earth who knows how to access what sources estimate could be as much as $60 billion in Bitcoin.” The claims have not been confirmed by any blockchain analysts as most of the crypto dealings in the Maduro government were kept under wraps. However, the report notes that Maduro has been converting a portion of the income from oil and gold into BTC since 2018. That year alone, the country exported 73 tons of gold; the precious metal traded at an average of $1270 per ounce in 2018, which would have translated to $3 billion in income for Venezuela. If any of this went to Bitcoin, which ended the year at $3,400, and has not been sold throughout the years, then the Maduro regime was sitting on billions worth of Bitcoin. With Maduro Arrested, What’s Next for Venezuela’s 600,000 BTC? As CNF reported, Maduro was arrested in a widely-criticized operation by the Trump administration, which has already shaken up the crypto markets. While BTC has yet to record notable gains, analysts say that its position as a hedge against events like the US invasion of a sovereign nation has become strengthened. It’s unclear what happens to the BTC stash now that Maduro is under capture in the U.S. A lot of it will come down to who has access to it. Currently, Saab is believed to be the mastermind, but his whereabouts remain unknown. Other parties could be in the mix too. According to Whale Hunting, the conversion of gold and oil proceeds to BTC also involved intermediaries from Turkey and the UAE, who moved the assets through mixers and cold wallets to Venezuela. “The keys to those wallets, sources say, are held by a small circle of trusted operatives—with Saab at the center,” the report says. BTC trades at $92,750 at press time, gaining **1.4% **to open the week with a $1.85 trillion market cap. After a weekend slump, trading volume shot up by 33% to hit $33 billion.