Search results for "SIX"

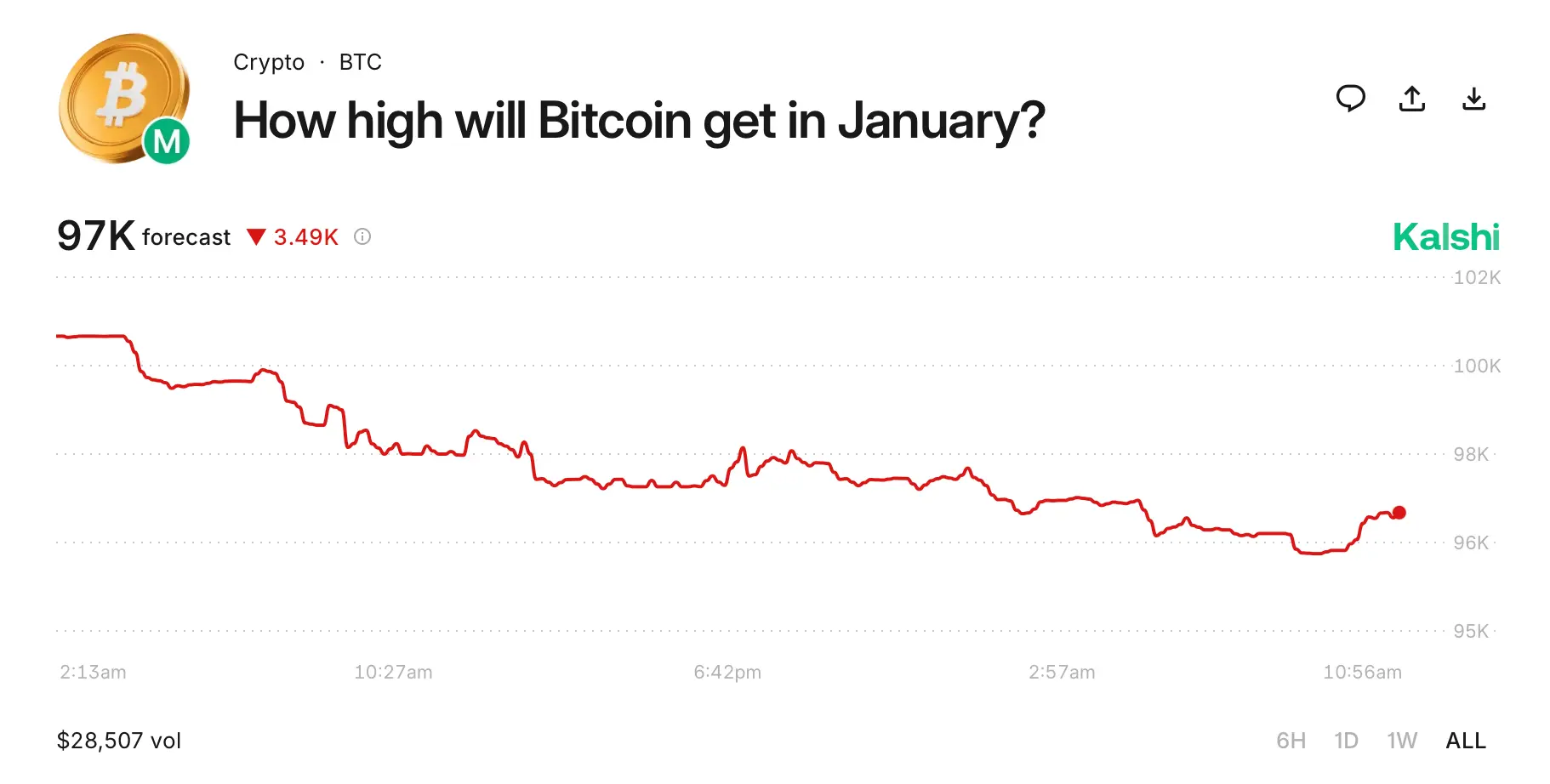

Prediction Market Data Shows Waning Confidence in January Bitcoin Breakout

Bitcoin dipped to an intraday low of $89,343 on Thursday, Jan. 8, before stabilizing just above $90,000 by 11:25 a.m. EST, as prediction markets collectively pared back expectations for a six-figure January move.

$100K Still Possible, but January Odds Are Sliding

Across major prediction

BTC-0,03%

Coinpedia·1h ago

Bitcoin ETF ends seven consecutive losing days! Attracts $355 million in a single day

The US Bitcoin Spot ETF saw a massive capital inflow yesterday. According to sosovalue data, the net inflow for the day reached as high as $355 million, ending a seven-day streak of net outflows and boosting market sentiment.

After experiencing a challenging period characterized by continuous capital withdrawals, the US Bitcoin Spot ETF has seen a significant turnaround, with investors re-entering the market with substantial funds. This positive momentum has eased market participants' nerves, who had endured several days of capital redemptions throughout the holiday period, which had put pressure on investor sentiment.

The $355 million net inflow represents a major reversal in recent institutional capital rotation trends. This rebound occurred after ETF capital outflows had accumulated to over $1.1 billion over six consecutive trading days, reflecting year-end portfolio rebalancing and reduced holiday liquidity. Market analysts attribute the recent capital outflows primarily to

BTC-0,03%

区块客·7h ago

Ethereum spot ETF experienced a net outflow of $98.45 million after 3 trading days of inflow

The US Ethereum spot ETF market turned to net outflows after three trading days, with short-term supply and demand experiencing another fluctuation.

According to SoSoValue data, as of January 7 (local time), the US Ethereum spot ETF market experienced a single-day net outflow of $98.45 million.

After three consecutive trading days of capital inflows on the 2nd ($174.43 million), 5th ($168.13 million), and 6th ($114.74 million), the trend reversed to net outflows on that day. As short-term buying momentum slowed, the total net inflow amounted to $12.69 billion.

Looking at the fund flows of each ETF on that day, only Franklin EZET recorded a net inflow of $2.38 million. On the other hand, six ETFs experienced net outflows: ▲ Grayscale ETHE (–$52.05 million), ▲ Fidelity FETH (–$13.29 million), ▲ Grayscale ETH (–$130...

TechubNews·10h ago

Elon Musk: Nvidia’s Self-Driving Tech Is Still Years From Challenging Tesla

In brief

Elon Musk says Nvidia’s autonomous driving software will not pressure Tesla for five to six years or longer.

Nvidia unveiled Alpamayo, an open-source AI model family for self-driving systems, at CES 2026.

Musk argues legacy automakers face long delays in integrating cameras and A

Decrypt·20h ago

Bitcoin ETF ends seven consecutive losing days! Attracts $355 million in a single day

The US Bitcoin Spot ETF saw a massive capital inflow yesterday. According to sosovalue data, the net inflow for the day reached as high as $355 million, ending a seven-day streak of net outflows and boosting market sentiment.

After experiencing a challenging period characterized by continuous capital withdrawals, the US Bitcoin Spot ETF has seen a significant turnaround, with investors re-entering the market with substantial funds. This positive momentum has eased market participants' nerves, who had endured several days of capital redemptions throughout the holiday period, which had put pressure on investor sentiment.

The $355 million net inflow represents a major reversal in recent institutional capital rotation trends. This rebound occurred after ETF capital outflows had accumulated to over $1.1 billion over six consecutive trading days, reflecting year-end portfolio rebalancing and reduced holiday liquidity. Market analysts attribute the recent capital outflows primarily to

BTC-0,03%

区块客·01-07 11:15

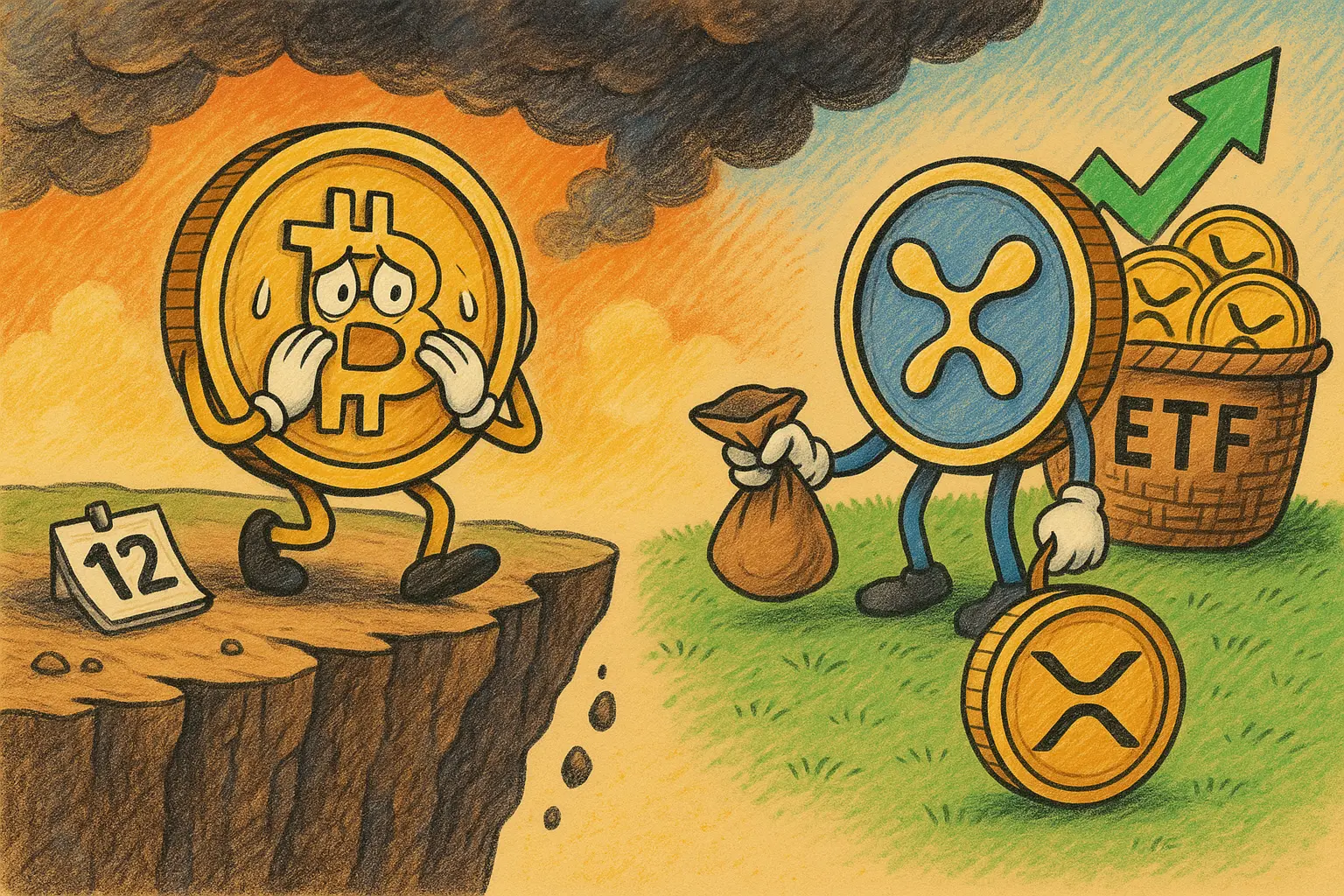

[Spot ETF] XRP·SOL continuous inflow for 6 consecutive trading days, DOGE·LTC·HBAR stagnate

In the US altcoin spot ETF market, XRP and Solana continue their streak of inflows, while Dogecoin, Litecoin, and Hedera show stagnant capital.

According to SosoValue, as of January 6 (local time), the US XRP spot ETF market experienced a total daily net inflow of $19.12 million.

Since December 29, it has maintained inflows for six consecutive trading days, with the total net inflow expanding to $1.25 billion.

▲Franklin XRPZ ($7.35 million) ▲Canary XRPC ($6.49 million) ▲Bitwise XRP ($3.54 million) ▲Grayscale GXRP ($1.75 million) confirmed net inflows, while ▲21Shares TOXR showed no change in capital flow.

The total trading volume was $58.92 million, and the total net asset size of XRP spot ETFs reached 16

TechubNews·01-07 05:06

Trump pressure, interest rate cuts, stablecoins... The six hurdles the Federal Reserve cannot avoid by 2026

The Federal Reserve will face six major challenges in 2026: threats to policy independence from political interference, limited room for interest rate adjustments, disputes over the size of the balance sheet, banking regulation reforms, new approaches to stablecoin regulation, and the need to optimize monetary policy communication mechanisms. This article is based on a piece by Wall Street Insights, compiled, translated, and written by Foresight News.

(Background: Forbes analyzes key crypto trends for 2026: five major trends reveal the industry is officially maturing)

(Additional context: Bloomberg summarizes expectations from 50 Wall Street institutions for 2026: AI-driven global average growth of 3%, high valuation risks still warrant caution)

Table of Contents

Threats to Political Independence

Interest Rate Policy Enters Wait-and-See Period

Disputes Over Balance Sheet Size

Urgent Need for Banking Regulation Reform

New Ideas for Stablecoin Regulation

The Need to Reform the Monetary Policy Framework

動區BlockTempo·01-07 03:40

The Sui price is expected to continue its upward trend after breaking through the long-term resistance.

As of Tuesday's recording, Sui (SUI) is trading above $1.95, approaching the highest peak in the past two months. The upward momentum remains solid after a streak of six consecutive bullish sessions, reflecting growing optimism in the market. Meanwhile, the signals

SUI-0,56%

TapChiBitcoin·01-06 09:05

MSTR Trades Below Bitcoin Holdings as Analysts Eye $500 Rebound

MicroStrategy's stock has dropped 66% in six months, trading at a 20-25% discount to its Bitcoin holdings. Analysts see potential recovery if Bitcoin stabilizes. Key support levels hold at $150-$157, with targets set for $200. The upcoming MSCI ruling may impact the stock's index status.

BTC-0,03%

CryptoFrontNews·01-06 05:36

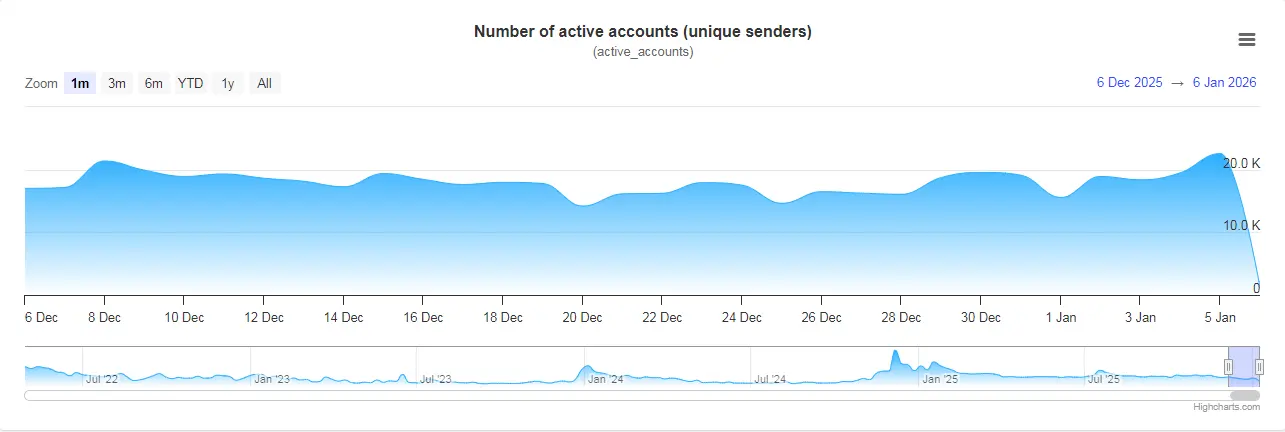

XRP Today News: ETF Sets Record Inflows, Up 27%, Breaks Through Double Moving Averages to Reach $3

XRP has risen for six consecutive days, breaking through $2.35, with active users surging by 45%. On January 5, XRP spot ETF trading volume hit a new high of $72.15 million, with a total net inflow of $1.23 billion and zero outflows. The Market Structure Bill will be reviewed on January 15, and XRP has increased by 27% following the news. This year, it has risen by 29.13%, far surpassing BTC's 7.38%.

MarketWhisper·01-06 02:56

Foreign exchange reserves decrease by $2.6 billion... the government invests US dollars to "stabilize the exchange rate"

In December last year, our country's foreign exchange reserves turned downward again after 7 months due to reasons such as exchange rate stabilization measures. According to the Bank of Korea, influenced by factors such as foreign exchange market interventions, foreign exchange reserves decreased by 2.6 billion USD compared to the previous month.

As of the end of December 2025, foreign exchange reserves were reported at 428.05 billion USD (approximately 618 trillion KRW). This figure slightly decreased compared to November, one month earlier. Our foreign exchange reserves fell to 404.6 billion USD at the end of May last year, reaching the lowest level in about five years. After that, they continued to grow for six consecutive months until November, but this growth trend was broken at the end of the year.

The main reason for the decrease in foreign exchange reserves is government market interventions to ease exchange rate fluctuations. The Bank of Korea pointed out that, despite factors such as increased foreign currency deposits by financial institutions at the end of the quarter and the appreciation of other currency assets into USD, the primary cause of the decline in foreign exchange reserves remains the exchange rate.

TechubNews·01-05 21:41

Bullish rally! Traders bet on Bitcoin breaking $100,000 at the start of 2026

In the first week of 2026, the cryptocurrency market is filled with bullish sentiment. As Bitcoin stabilizes above the $90,000 mark, derivatives traders are holding strong expectations for the new year's market, increasingly betting that Bitcoin will further surge past the $100,000 milestone.

According to data from Deribit, the world's largest cryptocurrency options exchange, since last Friday (the 2nd), demand for Bitcoin call options with a strike price of $100,000 expiring at the end of January has surged rapidly, indicating that the market is not only optimistic about January's行情 but also targeting the highly significant "six-figure" milestone.

A call option is a contract that gives the buyer the right (but not the obligation) to purchase the underlying asset at a predetermined price within a specific period in the future. The recent surge in demand for the $100,000 strike price options suggests that the market is betting that Bitcoin's price will be able to hold steady or even break through this level before or at the time of the contract's expiration.

区块客·01-05 14:39

Bitcoin Triggers Rare 'Hash Ribbon' Signal: $100,000 Next? - U.Today

Bitcoin has activated its first Hash Ribbon buy signal in over six months, indicating possible long-term uptrends. Following a price recovery to $93,000 and a record hashrate, the signal suggests miner stabilization, potentially enhancing a bullish outlook for BTC.

BTC-0,03%

UToday·01-05 13:53

Bitcoin Nears $100K As Analyst Predicts Imminent Breakout

Bitcoin pushed into the low $90,000s on Monday, a momentum swing that has traders scanning for confirmation of a move back into six-figure territory. Seeing this, renowned market analyst Michaël van de Poppe tweeted, “There we go! Final hurdle before $100K: that’s where Bitcoin is currently at. I

BTC-0,03%

BlockChainReporter·01-05 12:36

Bitcoin ETF ends seven consecutive losing days! Attracts $355 million in a single day

US Bitcoin Spot ETF saw a massive influx of capital yesterday. According to sosovalue data, the net inflow for the day reached as high as $355 million, ending a seven-day streak of net outflows and boosting market sentiment.

After experiencing a challenging period characterized by continuous capital withdrawals, the US Bitcoin Spot ETF has seen a significant turnaround, with investors re-entering the market with substantial funds. This positive momentum has eased market participants' nerves, who had endured several days of capital redemptions throughout the holiday period, which had put pressure on investor sentiment.

The $355 million net inflow represents a major reversal in recent institutional capital rotation trends. This rebound occurred after ETF capital outflows had accumulated to over $1.1 billion over six consecutive trading days, reflecting year-end portfolio rebalancing and reduced holiday liquidity. Market analysts mainly attribute the recent capital outflows to

BTC-0,03%

区块客·01-05 11:23

Cathie Wood heavily bets on CRISPR! Gene editing therapy with 90% remission rate shocks the medical community

CRISPR Therapeutics (CRSP) develops gene editing therapies with core technology CRISPR/Cas9. Cathie Wood is a heavy investor, with the stock price at $53.77, up 2.54%. Zugo-Cel shows a 90% remission rate and 70% complete remission in lymphoma trials. SLE patients experience B cell depletion within 48 hours, achieving drug-free remission in six months.

MarketWhisper·01-05 10:06

'All In' for Bull Run If BTC Breaks Six Figures, Top Analyst Says - U.Today

Bitcoin faces key resistance at $95,000 on its path to potentially reach $100,000. While it's in a recovery phase and showing signs of a reversal, the cryptocurrency is still correcting from prior peaks, with market sentiment reflecting a modest 82% chance of hitting six figures this year.

BTC-0,03%

UToday·01-04 09:40

Bitcoin ETF ends seven consecutive losing days! Attracts $355 million in a single day

US Bitcoin Spot ETF saw a massive influx of capital yesterday. According to sosovalue data, the net inflow for the day reached as high as $355 million, ending a seven-day streak of net outflows and boosting market sentiment.

After experiencing a challenging period characterized by continuous capital withdrawals, the US Bitcoin Spot ETF has seen a significant turnaround, with investors re-entering the market with substantial funds. This positive momentum has eased market participants' nerves, who had endured several days of capital redemptions throughout the holiday period, which had put pressure on investor sentiment.

The $355 million net inflow represents a major reversal in recent institutional capital rotation trends. This rebound occurred after ETF capital outflows had accumulated to over $1.1 billion over six consecutive trading days, reflecting year-end portfolio rebalancing and reduced holiday liquidity. Market analysts mainly attribute the recent capital outflows to

BTC-0,03%

区块客·01-03 12:18

XRP Price Action Hints at 50% Upside Despite Open Interest at 6-Month Low - BTC Hunts

The post XRP Price Action Hints at 50% Upside Despite Open Interest at 6-Month Low appeared first on Coinpedia Fintech News

XRP is showing signs of strength even as market volatility remains muted. Despite open interest dropping to its lowest level in six months, recent XRP price action

BTCHUNTS·01-03 00:08

Bitcoin ETF ends seven consecutive losing days! Attracts $355 million in a single day

US Bitcoin Spot ETF saw a massive influx of capital yesterday. According to sosovalue data, the net inflow for the day reached as high as $355 million, ending a seven-day streak of net outflows and boosting market sentiment.

After experiencing a challenging period characterized by continuous capital withdrawals, the US Bitcoin Spot ETF has seen a significant turnaround, with investors re-entering the market with substantial funds. This positive momentum has eased market participants' nerves, who had endured several days of capital redemptions throughout the holiday period, which had put pressure on investor sentiment.

The $355 million net inflow represents a major reversal in recent institutional capital rotation trends. This rebound occurred after ETF capital outflows had accumulated to over $1.1 billion over six consecutive trading days, reflecting year-end portfolio rebalancing and reduced holiday liquidity. Market analysts mainly attribute the recent capital outflows to

BTC-0,03%

区块客·01-02 12:13

Bitcoin Futures Policy Expert Amir Zaidi Rejoins CFTC to Shape Future Regulations

Amir Zaidi Returns to CFTC as Key Regulatory Figure in US Crypto Market

Amir Zaidi, a notable policymaker instrumental in launching regulated Bitcoin futures in the United States, has rejoined the Commodity Futures Trading Commission (CFTC) as chief of staff after a six-year hiatus. His return

BTC-0,03%

CryptoBreaking·01-02 04:55

The Last Time This Ethereum Signal Flipped, ETH Price Doubled Soon After

Ethereum’s validator data is starting to tell an interesting story. For the first time in six months, more ETH is lining up to be staked than unstaked. At first glance, that might sound like background noise. In reality, it’s one of those signals that tends to matter more with a bit of

CaptainAltcoin·01-01 23:05

[Midnight News Brief] Justin Sun makes a large purchase of LIT tokens... holding 5.32% of the circulating supply, etc.

HTX address transferred $400 million USDT to Aave, Sun Yuchen used $33 million to purchase LIT. In December last year, a hacker attack resulted in a loss of $76 million, a 60% decrease. Novus CEO stated that cryptocurrencies will accelerate integration into mainstream finance. MicroStrategy's stock price has declined for six consecutive months, and analysts say DOGE could drop another 30%. Binance Alpha added AIAV.

LIT8,51%

TechubNews·01-01 15:45

MSTR Meltdown: Saylor’s Bitcoin Bet Erases $90B as Shares Crash 66%

_MicroStrategy’s stock drops 66%, wiping $90B from its market cap, despite holding $59B in Bitcoin and stable liquidity._

MicroStrategy’s stock has taken a massive hit, dropping 66% over the last six months. As a result, nearly $90 billion has been wiped from the company’s market cap.

This

BTC-0,03%

LiveBTCNews·01-01 13:10

China's Digital Renminbi Opens "Deposit Interest Rate Increase" Starting New Year's Day! Coinbase Policy Director: If the US stablecoin policy makes mistakes, the US dollar hegemony could be shaken

China's digital yuan is about to undergo a major upgrade: the real-name wallet balance will be eligible for savings interest starting from 2026. This move is not only a global first but also triggers high alert within the US cryptocurrency industry: Coinbase policy chief publicly warns that if US stablecoin regulation fails, the dollar's dominant position in future digital financial systems could face severe challenges.

(Background recap: China's "counter-stablecoin" stance is set: allowing digital yuan deposits to earn interest, with stablecoin advantages completely eliminated)

(Additional background: People's Bank of China Governor Pan Gongsheng:坚持严打加密货币!StableCoin still in early development stage, actively promoting digital yuan development)

The six major state-owned banks—Industrial and Commercial Bank of China, Agricultural Bank of China, Bank of China, China Construction Bank, Postal Savings Bank, and Bank of Communications—announced today (31) that starting from January 1, 2026, they will open accounts for customers to...

動區BlockTempo·01-01 12:20

Bitcoin ETF ends seven consecutive losing days! Attracts $355 million in a single day

US Bitcoin Spot ETF saw a massive influx of capital yesterday. According to sosovalue data, the net inflow for the day reached as high as $355 million, ending a seven-day streak of net outflows and boosting market sentiment.

After experiencing a challenging period characterized by continuous capital withdrawals, the US Bitcoin Spot ETF has seen a significant turnaround, with investors re-entering the market with substantial funds. This positive momentum has eased market participants' nerves, who had endured several days of capital redemptions throughout the holiday period, which had put pressure on investor sentiment.

The $355 million net inflow represents a major reversal in recent institutional capital rotation trends. This rebound occurred after ETF capital outflows had accumulated to over $1.1 billion over six consecutive trading days, reflecting year-end portfolio rebalancing and reduced holiday liquidity. Market analysts mainly attribute the recent capital outflows to

BTC-0,03%

区块客·01-01 12:13

PA Daily | Trump Media Group to distribute digital tokens to DJT shareholders; a trader profits millions of dollars amid abnormal BROCCOLI714 market conditions

Today's News Highlights:

1. International gold and silver both saw their largest annual gains since 1979, with gold increasing over 64% and silver over 147% cumulatively.

2. NEO co-founder Zhang Zhengwen announced the NEO governance structure and account status, and decided to return to mainnet management.

3. A certain Binance account was suspected of being hacked; the hacker attempted to pump up BROCCOLI714 to transfer funds, and trader Vida precisely intercepted and profited by millions of dollars.

4. Binance released its 2025 year-end letter: platform's annual trading volume reached $34 trillion.

5. Trump Media Group: will distribute digital tokens based on the Cronos blockchain to DJT stockholders.

6. Tether's BTC reserves reached 96,185 coins, with an unrealized profit of $3.524 billion, making it the fifth-largest BTC wallet.

Macro

Six major state-owned banks announced: starting tomorrow, interest will be accrued on digital renminbi real-name wallet balances, with the current savings account interest rate at 0.05%.

PANews·01-01 09:19

Bitcoin Futures Policy Expert Amir Zaidi Rejoins CFTC to Shape Future Regulations

Amir Zaidi Returns to CFTC as Key Regulatory Figure in US Crypto Market

Amir Zaidi, a notable policymaker instrumental in launching regulated Bitcoin futures in the United States, has rejoined the Commodity Futures Trading Commission (CFTC) as chief of staff after a six-year hiatus. His return

BTC-0,03%

CryptoBreaking·01-01 04:40

China, Nvidia H200 2 million units sold out in an instant... Still racing ahead under Trump's "25% tariffs"

NVIDIA is expanding production at TSMC due to rising demand for the H200 GPU, with an estimated $54 billion in revenue from orders in the Chinese market. The H200 is six times faster than the H20. Although the U.S. government has restricted exports, sales to China have been permitted, and profit-sharing ratios have been adjusted. NVIDIA plans to use existing inventory to meet orders while actively increasing production to satisfy ongoing market demand, demonstrating a strategy of balancing semiconductor policies.

TechubNews·2025-12-31 22:24

China's Digital Renminbi Opens "Deposit Interest Rate Increase" Starting New Year's Day! Coinbase Policy Director: If the US stablecoin policy makes mistakes, the US dollar hegemony could be shaken

China's digital yuan is about to undergo a major upgrade: the real-name wallet balance will be eligible for savings interest starting from 2026. This move is not only a global first but also triggers high alert within the US cryptocurrency industry: Coinbase policy chief publicly warns that if US stablecoin regulation fails, the dollar's dominant position in future digital financial systems could face severe challenges.

(Background recap: China's "counter-stablecoin" stance is set: allowing digital yuan deposits to earn interest, with stablecoin advantages completely eliminated)

(Additional background: People's Bank of China Governor Pan Gongsheng:坚持严打加密货币!StableCoin still in early development stage, actively promoting digital yuan development)

The six major state-owned banks—Industrial and Commercial Bank of China, Agricultural Bank of China, Bank of China, China Construction Bank, Postal Savings Bank, and Bank of Communications—announced today (31) that starting from January 1, 2026, they will open accounts for customers to...

動區BlockTempo·2025-12-31 12:20

Bitcoin ETF ends seven consecutive losing days! Attracts $355 million in a single day

US Bitcoin Spot ETF saw a massive influx of capital yesterday. According to sosovalue data, the net inflow for the day reached as high as $355 million, ending a seven-day streak of net outflows and boosting market sentiment.

After experiencing a challenging period characterized by continuous capital withdrawals, the US Bitcoin Spot ETF has seen a significant turnaround, with investors re-entering the market with substantial funds. This positive momentum has eased market participants' nerves, who had endured several days of capital redemptions throughout the holiday period, which had put pressure on investor sentiment.

The $355 million net inflow represents a major reversal in recent institutional capital rotation trends. This rebound occurred after ETF capital outflows had accumulated to over $1.1 billion over six consecutive trading days, reflecting year-end portfolio rebalancing and reduced holiday liquidity. Market analysts mainly attribute the recent capital outflows to

BTC-0,03%

区块客·2025-12-31 12:12

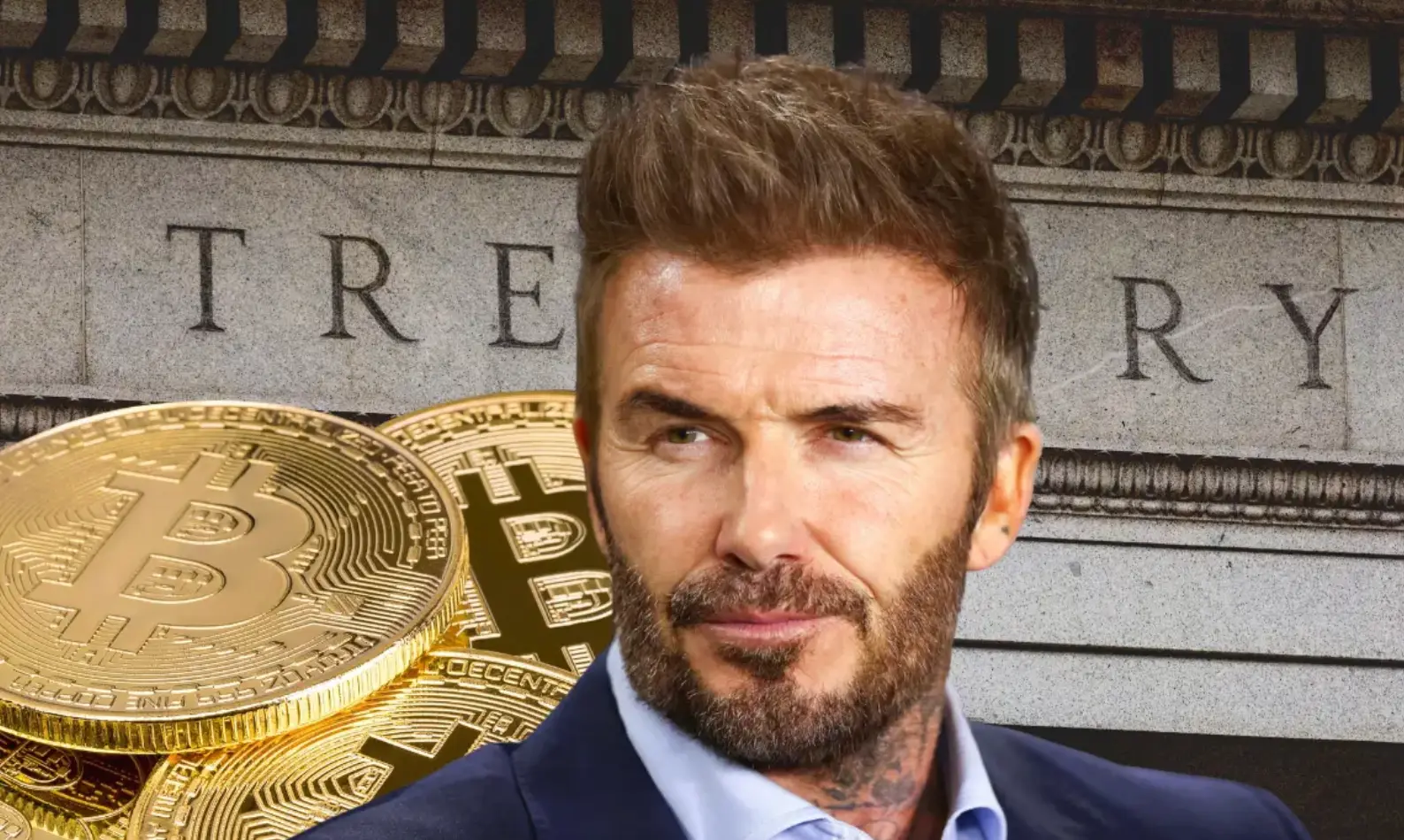

David Beckham-Backed Health Firm Prenetics Abandons Bitcoin Treasury Strategy

Hong Kong-based health sciences company Prenetics Global has reversed its high-profile Bitcoin treasury initiative just six months after launch, citing a shift in focus toward its core consumer health brand co-founded with soccer legend David Beckham.

BTC-0,03%

CryptopulseElite·2025-12-31 07:11

Lighter platform coin $LIT officially launched! The airdrop scale reaches up to $675 million, and a Taiwanese high school student made a crazy profit of 6 million USD in a single deal.

Decentralized perpetual contract exchange Lighter will conduct a large-scale airdrop in 2025, distributing a total of $LIT platform tokens worth $675 million, attracting many early users to profit. One Taiwanese high school student, through personal effort, mined six-figure points and earned millions of dollars in profit, sparking heated discussion.

動區BlockTempo·2025-12-30 13:50

Ethereum Validator Queue Flips, Signaling Major Network Shift

Ethereum’s Staking Queue Reverses Trend, Indicating Increased Validator Confidence

For the first time in six months, Ethereum’s validator staking queue has overtaken its exit queue, signaling a pivotal shift in network staking dynamics. Recent data reveals that nearly twice as much Ether is now que

CryptoBreaking·2025-12-30 08:10

Last night's and this morning's important news (December 29 - December 30)

Ethereum validator entry queue size rises for the first time in 6 months to nearly twice the exit queue, staking demand rebounds

According to Cointelegraph, the size of the Ethereum validator entry queue has surged for the first time in six months to nearly twice the size of the exit queue. This growth indicates a rebound in staking demand, primarily driven by digital asset treasury companies like BitMine, and possibly supported by the Pectra upgrade.

An address opened a 300 BTC long position 7 hours ago, becoming one of the Top 5 Hyperliquid BTC long positions

According to on-chain analyst @ai\_9684xtpa monitoring, address 0x931…ae7a3 opened a 300 BTC long position 7 hours ago, ranking among the Top 5 Hyperliquid BTC long positions. Currently, this $26 million BTC long position has an average entry price of 87,965.3.

PANews·2025-12-30 02:33

Hoskinson: Midnight Could Pave Way for $10B Cardano Sidechains

Charles Hoskinson has clarified that the Glacier Drop initiative is a foundational feature of Cardano's ecosystem, linked to the Midnight project. It will serve as a distribution mechanism for new tokens and be refined over six months to enhance user experience, underpinning Cardano's growth strategy.

TheCryptoBasic·2025-12-29 14:33

Spot Bitcoin ETFs See $782 Million Holiday Outflows

US-listed spot Bitcoin exchange-traded funds (ETFs) continued to see heavy withdrawals over the Christmas period, extending a six-day outflow streak that analysts say is more likely driven by seasonal factors than a decline in institutional interest.

Data from SoSoValue shows that investors

BTC-0,03%

CryptoBreaking·2025-12-29 13:58

Ethereum staking inflows outpace exits for first time since June 2025

Ethereum's staking queues have flipped for the first time in six months, with inflows outpacing exits as BitMine ramps up staking and Pectra-driven demand lifts sentiment.

Summary

Ethereum's entry queue has grown while the exit queue has contracted, reversing a six-month trend and extending

ETH-0,91%

Cryptonews·2025-12-29 09:30

Ethereum Validator Queue Flips, Signaling Major Network Shift

Ethereum’s Staking Queue Reverses Trend, Indicating Increased Validator Confidence

For the first time in six months, Ethereum’s validator staking queue has overtaken its exit queue, signaling a pivotal shift in network staking dynamics. Recent data reveals that nearly twice as much Ether is now que

CryptoBreaking·2025-12-29 08:05

I analyzed 86 million on-chain transactions on Polymarket: Discover these six major profit models

In-Depth Analysis of Polymarket Prediction Markets: Six Practical Strategies, from French Traders' $85 Million Arbitrage to 1800% Annualized High-Probability Bond Strategies, Revealing How Top Traders Continually Profit in Zero-Sum Games. This article is adapted from a piece by Lin Wanwan's Cat, organized, translated, and written by PANews.

(Previous context: Leading prediction market Polymarket announces self-built L2, is the flagship of Polygon gone?)

(Additional background: How to achieve 40% annualized returns through arbitrage on Polymarket?)

Table of Contents

1. Research Background

2. Research Methods and Selection Criteria

2.1 Data Sources

2.2 Evaluation Dimensions and Weights

2.3 Exclusion Criteria

3

動區BlockTempo·2025-12-29 06:01

Bitcoin faces a year-end defense battle, XRP ETF surge triggers token supply crisis

Bitcoin needs to rise by 6.24% before the end of the year to avoid its first loss after the halving. The opening price of $93,374 has now fallen to $89,000, which is 30% below the all-time high. Since breaking below the 365-day moving average in November, the structural upward trend has been broken. On the other hand, XRP faces supply tightness due to ETF buying interest, with exchange reserves dropping to a new low of 1.5 billion coins. Six US ETFs have attracted 750 million coins.

MarketWhisper·2025-12-29 03:28

Trump WLFI proposal faces opposition! Burning 5% of token treasury to incentivize USD1 stablecoin sparks controversy

Trump Family Crypto Project WLFI Announces New Governance Vote, which will authorize the use of less than 5% of the unlocked WLFI token supply for treasury funds, accelerating the adoption of the USD1 stablecoin through targeted incentives. However, the initiative faced strong opposition early on, with preliminary data showing that 46.1% of voters oppose the measure. Since its launch six months ago, USD1 has grown to a market cap of $3.2 billion.

MarketWhisper·2025-12-29 01:05

Spot Bitcoin ETFs See $782 Million Holiday Outflows

US-listed spot Bitcoin exchange-traded funds (ETFs) continued to see heavy withdrawals over the Christmas period, extending a six-day outflow streak that analysts say is more likely driven by seasonal factors than a decline in institutional interest.

Data from SoSoValue shows that investors

BTC-0,03%

CryptoBreaking·2025-12-28 13:50

Top 6 BNB Chain DApps on BNB Chain With Highest User Activity in the Past 7 Days

Today, BNB Chain analytics released statistics on the top six decentralized applications (DApps) on the blockchain network over the past seven days. DApps have made the Binance network one of the prominent decentralized platforms in the blockchain landscape

Decentralized applications allow

BlockChainReporter·2025-12-28 06:03

I analyzed 86 million on-chain transactions on Polymarket: Discover these six major profit models

In-Depth Analysis of Polymarket Prediction Markets: Six Practical Strategies, from French Traders' $85 Million Arbitrage to 1800% Annualized High-Probability Bond Strategies, Revealing How Top Traders Continually Profit in Zero-Sum Games. This article is adapted from a piece by Lin Wanwan's Cat, organized, translated, and written by PANews.

(Previous context: Leading prediction market Polymarket announces self-built L2, is the flagship of Polygon gone?)

(Additional background: How to achieve 40% annualized returns through arbitrage on Polymarket?)

Table of Contents

1. Research Background

2. Research Methods and Selection Criteria

2.1 Data Sources

2.2 Evaluation Dimensions and Weights

2.3 Exclusion Criteria

3

動區BlockTempo·2025-12-28 06:00

Polymarket 2025 Six Major Profit Models Report, starting from 95 million on-chain transactions

Author: Lin Wanwan's Cat

On the night of the 2024 US presidential election, a French trader netted $85 million on Polymarket.

This figure exceeds the annual performance of most hedge funds.

Polymarket, a decentralized prediction market that has processed over $9 billion in trading volume and hosts 314,000 active traders, is redefining the boundaries of "voting with money."

But we must first be honest: prediction markets are a zero-sum game.

Only 0.51% of wallets on Polymarket achieved profits exceeding $1,000.

So, what exactly did the winners do right?

Recently, I wrote a series of strategies and have been systematically backtracking and analyzing 86 million on-chain transactions,

Deconstructing the holding logic and entry/exit timing of top traders,

Summarizing six proven profitable strategies.

PANews·2025-12-28 01:25

Bored Ape parent company Yuga Labs announces acquisition of Improbable's Unreal Engine platform, taking the team and technology entirely

Blue-chip NFT project Bored Ape Yacht Club's parent company Yuga Labs CEO Greg Solano announced that Yuga Labs has acquired the Unreal Engine-based creative platform that drives the Otherside metaverse from UK tech company Improbable, and has reached a permanent licensing agreement with Improbable for Otherside high-concurrency technology.

(Background: Yuga Labs teams up with Six Studios under Big Brother Ma Jie to launch Bored Ape BAYC series animations)

(Additional background: Yuga Labs sold CryptoPunks! Infinite Node Foundation acquires intellectual property rights: continuing the cyberpunk spirit)

動區BlockTempo·2025-12-27 04:40

Elon Musk reboots Republican campaign funding! Trump faces impeachment in the 2026 midterm elections

On December 16, Elon Musk, with a net worth of $749 billion, announced the resumption of funding for the Republican Party, returning after a six-month break from breaking ties with Trump. The 2026 midterm elections are approaching, with the Republican advantage being slight and lagging behind the Democratic Party in funding. Musk gains three major benefits: Tesla's new energy subsidies, SpaceX government contracts, and the passage of autonomous driving legislation. The two sides broke apart in May over the "Beautiful Bill," reconciled in September, and then the EU fines facilitated a trench warfare community.

MarketWhisper·2025-12-26 05:10

Ctrip Overseas Version Launches Stablecoin Payments! Book Tickets with USDT and Save 18% to Tap into Southeast Asia

Trip.com, the overseas version of Ctrip, has quietly launched a stablecoin payment feature, allowing global users to book hotels and flights using USDT and USDC. Real-world testing shows that purchasing tickets from Nha Trang to Ho Chi Minh City in Vietnam with USDT saves about 18% compared to traditional payment methods, and hotel bookings save 2.35%. The platform supports six public blockchains including Ethereum, Solana, and TON.

MarketWhisper·2025-12-26 03:20

Entrepreneur's Statement: From Start to Giving Up, Why I No Longer Do Web3 Payments

In the past six months, I have gone from being a bystander in Web3 to immersing myself in the payments industry. And now, I have decided to stop and no longer pursue Web3 payments.

This is not a retreat after failure, but a strategic adjustment made after truly getting involved. During these six months, I visited Yiwu, Shui Bei, Putian, and even Mexico, observing the most bustling areas in reports to see how payments are actually made. I also got hands-on experience, building an MVP for Web3 payments, managing accounts, creating Web3 payment tools, and trying to run the envisioned process from the first step to the last.

But the more I delved into it, the clearer I became about one thing: this is not an industry where "making a good product equals winning." Payments are not about features; they depend on banking relationships, licenses, capital efficiency, and long-term risk management capabilities.

Many payment businesses that seem to be "profitable" fundamentally do not earn from their capabilities.

PANews·2025-12-26 02:09

Load More