Post content & earn content mining yield

placeholder

TheManStandingOnTheCandlestick

Today's public strategy reference:

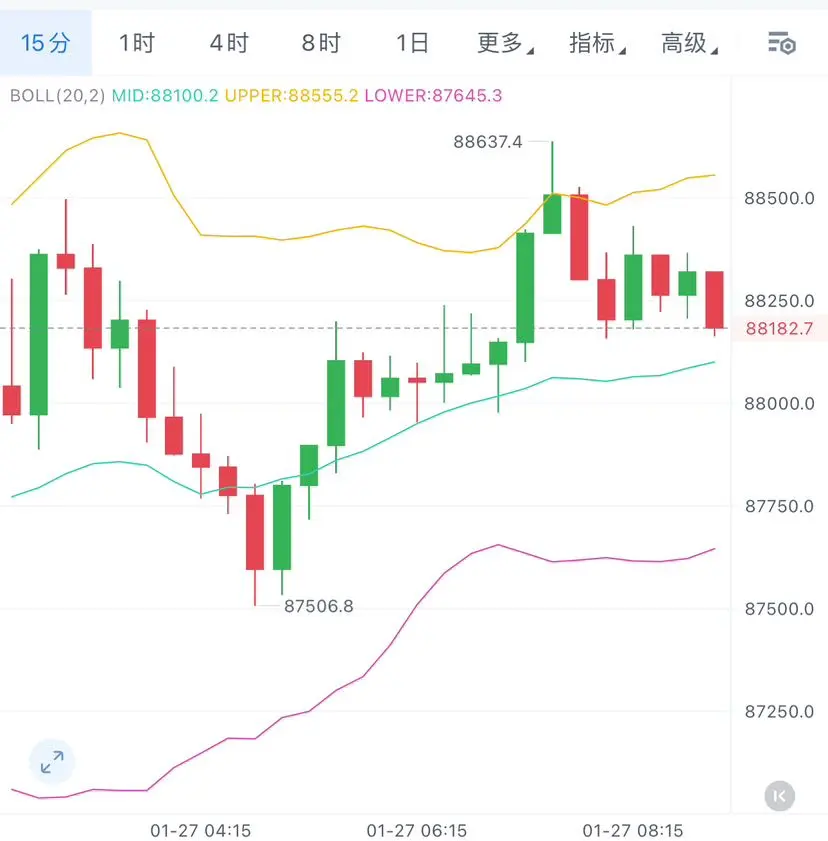

Yesterday, Bitcoin stabilized around 87,500-88,000! It surged to 88,800 in the evening! The bullish trend is healthy! And the support below is stable! Today, our strategy is to continue buying on dips for better safety!

Yesterday's strategy was the same! I believe friends who saw it could enjoy some meat-filled buns!

Bitcoin: Pull back to around 87,500-87,000, target around 88,500-90,000

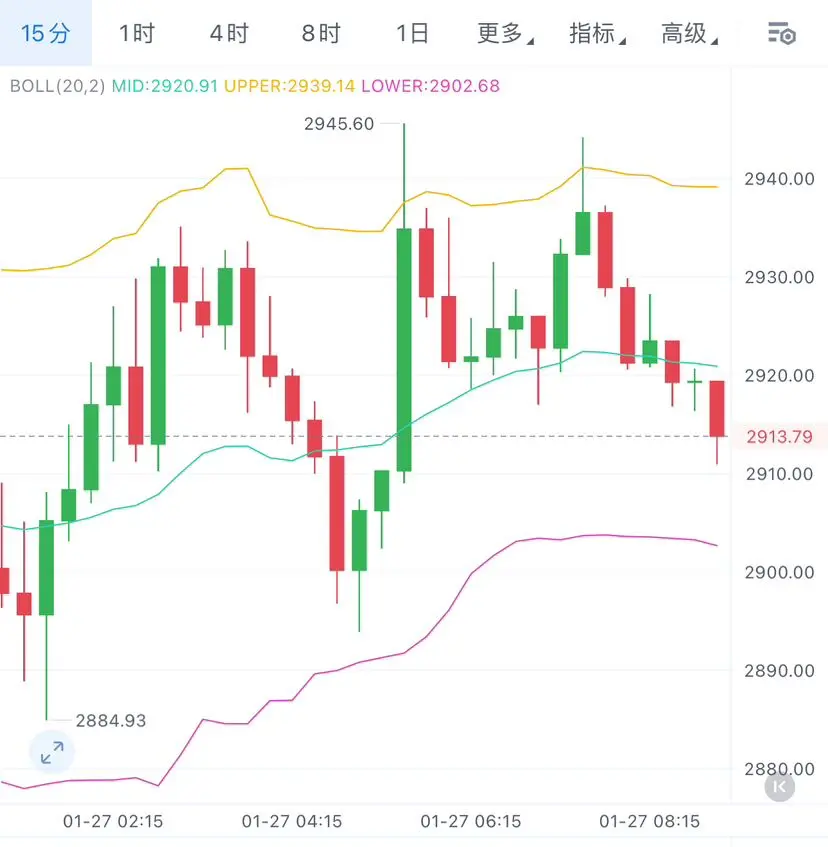

Altcoin: Pull back to around 2,890-2,880, target around 2,950-3,000

$BTC #内容挖矿焕新公测开启

$ETH #黄金白银再创新高

View OriginalYesterday, Bitcoin stabilized around 87,500-88,000! It surged to 88,800 in the evening! The bullish trend is healthy! And the support below is stable! Today, our strategy is to continue buying on dips for better safety!

Yesterday's strategy was the same! I believe friends who saw it could enjoy some meat-filled buns!

Bitcoin: Pull back to around 87,500-87,000, target around 88,500-90,000

Altcoin: Pull back to around 2,890-2,880, target around 2,950-3,000

$BTC #内容挖矿焕新公测开启

$ETH #黄金白银再创新高

- Reward

- like

- Comment

- Repost

- Share

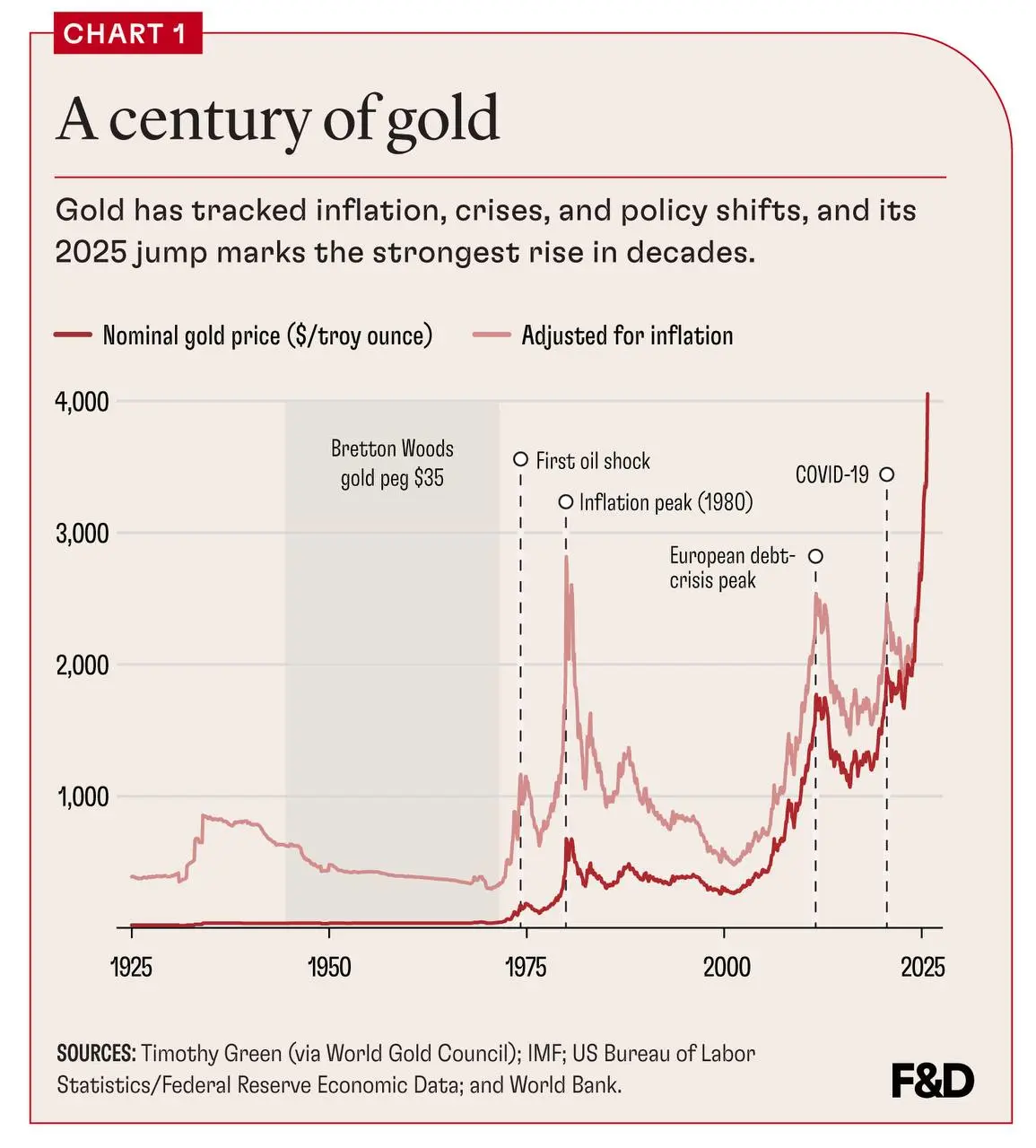

A historical analysis of gold's price growth reveals that it does not increase steadily but rather in bursts during periods of global financial instability.

Key periods include:

- 1970s: Oil shock and inflation led to a dramatic increase, with gold rising approximately 20 times.

- 1980: Peak inflation created a historic growth spike, followed by a prolonged correction.

- 2008-2011: The financial crisis and European debt issues pushed gold above $1,000 per ounce, reaching new highs.

- 2020: The COVID-19 pandemic saw gold prices approach $2,000 per once

- 2025-2026 (projected): A potential surge

Key periods include:

- 1970s: Oil shock and inflation led to a dramatic increase, with gold rising approximately 20 times.

- 1980: Peak inflation created a historic growth spike, followed by a prolonged correction.

- 2008-2011: The financial crisis and European debt issues pushed gold above $1,000 per ounce, reaching new highs.

- 2020: The COVID-19 pandemic saw gold prices approach $2,000 per once

- 2025-2026 (projected): A potential surge

- Reward

- like

- Comment

- Repost

- Share

Ethereum successfully solidified the key support at $2890 during the early hours, with multiple tests failing to break below and accompanied by rapid rebounds. This indicates a strong buying interest beneath this level. The price has formed a clear defensive pattern locally, providing a technical basis for subsequent rebounds.

If the price can further stabilize above the $2930 level in the early session, it suggests that the short-term consolidation pattern may be broken, and upward momentum will be strengthened. At that point, the price is expected to attempt to retest the $2950 level or even

If the price can further stabilize above the $2930 level in the early session, it suggests that the short-term consolidation pattern may be broken, and upward momentum will be strengthened. At that point, the price is expected to attempt to retest the $2950 level or even

ETH2,46%

- Reward

- like

- Comment

- Repost

- Share

币会一飞冲天

币牛牛

Created By@币安心

Listing Progress

0.00%

MC:

$3.39K

Create My Token

- Reward

- 1

- 2

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

#TrumpWithdrawsEUTariffThreats From Confrontation to Calculation: A Strategic Reset in 2026

The opening weeks of 2026 offered global markets a powerful reminder: political signals still move capital faster than data. When U.S. President Donald Trump announced potential customs tariffs ranging from 10% to 25% on eight European nations — including Germany, France, the UK, and the Nordic bloc — markets immediately began pricing in the return of a transatlantic trade war. The announcement was tied to tensions surrounding Washington’s Arctic strategy and the controversial Greenland acquisition disc

The opening weeks of 2026 offered global markets a powerful reminder: political signals still move capital faster than data. When U.S. President Donald Trump announced potential customs tariffs ranging from 10% to 25% on eight European nations — including Germany, France, the UK, and the Nordic bloc — markets immediately began pricing in the return of a transatlantic trade war. The announcement was tied to tensions surrounding Washington’s Arctic strategy and the controversial Greenland acquisition disc

- Reward

- 1

- 1

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊NAB Business Index Jumps to 9 as December Data Shows Growth - - #cryptocurrency #bitcoin #altcoins

BTC1,21%

- Reward

- 1

- 2

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

February 22nd, 2017

- Reward

- like

- Comment

- Repost

- Share

$BNB Yesterday, Nanyu BNB was also successfully validated. BNB 970 moved north to the first target level of 881, precisely capturing an 11-point profit-taking window#内容挖矿焕新公测开启

BNB1,4%

- Reward

- like

- Comment

- Repost

- Share

Brother Chuan is up. I don't know how your short positions are doing in the early morning. For those still holding, find an opportunity to close them!

We'll re-enter. I emphasized in the comment section that you might not see it.

Find an opportunity to close, wait for Brother Chuan to brush his teeth, wash his face, and start the broadcast!

View OriginalWe'll re-enter. I emphasized in the comment section that you might not see it.

Find an opportunity to close, wait for Brother Chuan to brush his teeth, wash his face, and start the broadcast!

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

#IranTradeSanctions IranTradeSanctions In early 2026, Iran-related sanctions have evolved from a targeted geopolitical instrument into a system-wide pressure mechanism that is reshaping global trade behavior, diplomatic alignment, and market confidence, marking a critical shift where sanctions are no longer regional tools but global variables influencing interconnected economies. What once aimed to isolate Tehran now extends across capital flows, technology access, logistics networks, and financial infrastructure, affecting not only Iran but every economy linked to its trade ecosystem. This tr

- Reward

- 1

- Comment

- Repost

- Share

Gate #Launchpool new users who stake $USDT for the first time can share in 10,000,000 $SKR

🔹 Minimum stake of 0.1 $USDT

🔹 staking to receive 100 $USDT rewards

🔹 $USDT staking pool with an annualized return of up to 1022%

Stake now: https://www.gate.com/launchpool/SKR?pid=492&rid=982

Learn more: https://www.gate.com/article/49428

🔹 Minimum stake of 0.1 $USDT

🔹 staking to receive 100 $USDT rewards

🔹 $USDT staking pool with an annualized return of up to 1022%

Stake now: https://www.gate.com/launchpool/SKR?pid=492&rid=982

Learn more: https://www.gate.com/article/49428

SKR17,53%

- Reward

- 1

- 3

- Repost

- Share

HighAmbition :

:

Buy To Earn 💎View More

#JapanBondMarketSell-Off #JapanBondMarketSellOff

When the World’s Last Anchor Breaks: The Quiet Reset of Global Capital

The late-January 2026 sell-off in Japanese Government Bonds is not a regional story.

It’s a global inflection point.

When 40-year JGB yields surged past 4.2% for the first time since their creation, markets weren’t reacting to volatility — they were pricing a regime shift. For decades, Japan acted as the gravitational center of global rates. That era is ending.

And everything built on top of it is now being repriced.

The catalyst was political, but the consequences are struct

When the World’s Last Anchor Breaks: The Quiet Reset of Global Capital

The late-January 2026 sell-off in Japanese Government Bonds is not a regional story.

It’s a global inflection point.

When 40-year JGB yields surged past 4.2% for the first time since their creation, markets weren’t reacting to volatility — they were pricing a regime shift. For decades, Japan acted as the gravitational center of global rates. That era is ending.

And everything built on top of it is now being repriced.

The catalyst was political, but the consequences are struct

BTC1,21%

- Reward

- 2

- Comment

- Repost

- Share

请叫我麦总

请叫我麦总

Created By@ChineseMemeGlobalAmbassador

Listing Progress

0.00%

MC:

$3.41K

Create My Token

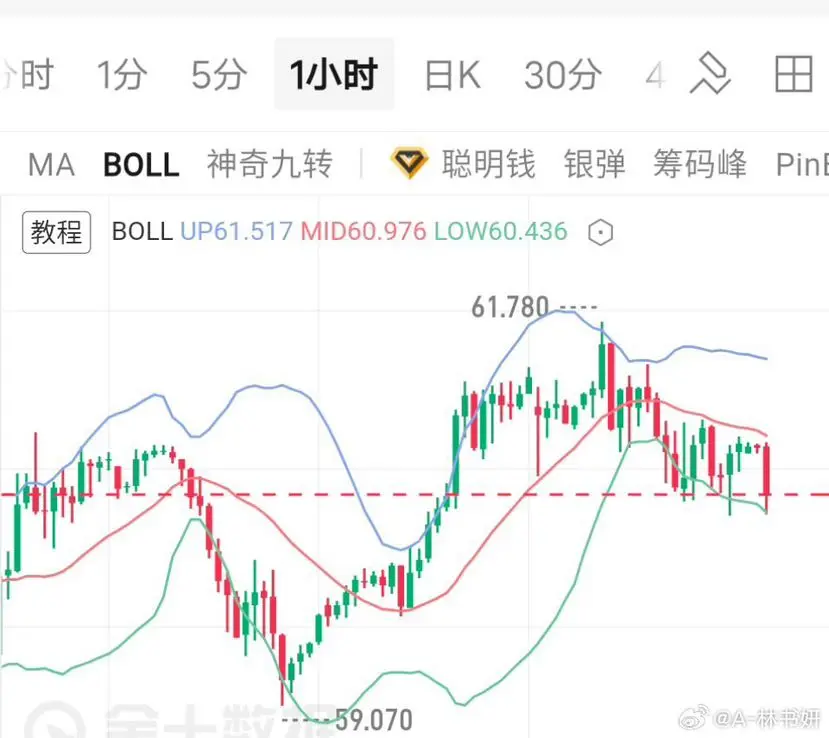

1.27 Morning Crude Oil Outlook Sharing

Crude oil opened yesterday at 61.11, initially falling back to 60.69 before rebounding strongly. The daily chart surged to 61.78 but faced resistance and pulled back. After testing the low at 60.4, it rallied towards the end of the session, ultimately closing at 60.91. The daily candlestick is a spinning top with a slightly longer upper shadow than the lower shadow.

On the daily level, crude oil continues to oscillate slightly upward supported by short-term moving averages; on the 4-hour chart, it remains in a narrow range at high levels with limited vola

View OriginalCrude oil opened yesterday at 61.11, initially falling back to 60.69 before rebounding strongly. The daily chart surged to 61.78 but faced resistance and pulled back. After testing the low at 60.4, it rallied towards the end of the session, ultimately closing at 60.91. The daily candlestick is a spinning top with a slightly longer upper shadow than the lower shadow.

On the daily level, crude oil continues to oscillate slightly upward supported by short-term moving averages; on the 4-hour chart, it remains in a narrow range at high levels with limited vola

- Reward

- 1

- Comment

- Repost

- Share

Viewing the Top Market Coins Spot Chart and comparing them

- Reward

- 7

- 2

- Repost

- Share

HilalSafi24 :

:

2026 GOGOGO 👊2026 GOGOGO 👊View More

#TrumpWithdrawsEUTariffThreats

Trade War Averted? Trump Drops European Tariffs 🇺🇸🇪🇺

Markets just got a breather.

Trump has officially canceled the planned 10% tariffs on European nations that were set for Feb 1 — following high-level discussions at Davos.

The result? A clear Relief Rally across tech stocks and major European indices.

For now, the immediate trade-war risk is off the table.

But attention is already shifting to upcoming Arctic & strategic negotiations, which could reintroduce volatility later on.

💭 Big Question:

Is this the beginning of a sustained risk-on trend — or just

Trade War Averted? Trump Drops European Tariffs 🇺🇸🇪🇺

Markets just got a breather.

Trump has officially canceled the planned 10% tariffs on European nations that were set for Feb 1 — following high-level discussions at Davos.

The result? A clear Relief Rally across tech stocks and major European indices.

For now, the immediate trade-war risk is off the table.

But attention is already shifting to upcoming Arctic & strategic negotiations, which could reintroduce volatility later on.

💭 Big Question:

Is this the beginning of a sustained risk-on trend — or just

- Reward

- 4

- 4

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

Good Morning, Crypto Friends!

Today is Tuesday, January 27, 2026. I am Wang Yibo—your guide to real-time hot topics and prime trading opportunities!

🔥 Die-hard fans, check-in, like & let’s get rich together! 🍗🍗🌹🌹

💎 Market Highlights – Multi-Asset Divergence

Precious metals: Gold dipped below $5,000, Silver erased a 14% gain in a single day—shocking reversal!

US Stocks: All three major indices closed higher, defying global risk trends.

Crypto: Signs of stabilization; Ethereum accumulation by whale institutions attracts attention.

Key Drivers: Geopolitics, policy expectations, and capital

Today is Tuesday, January 27, 2026. I am Wang Yibo—your guide to real-time hot topics and prime trading opportunities!

🔥 Die-hard fans, check-in, like & let’s get rich together! 🍗🍗🌹🌹

💎 Market Highlights – Multi-Asset Divergence

Precious metals: Gold dipped below $5,000, Silver erased a 14% gain in a single day—shocking reversal!

US Stocks: All three major indices closed higher, defying global risk trends.

Crypto: Signs of stabilization; Ethereum accumulation by whale institutions attracts attention.

Key Drivers: Geopolitics, policy expectations, and capital

- Reward

- 1

- 1

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊BNB's recent bearish trend has basically played out as expected, with the 850 target successfully reached, marking a phase completion. Currently, the price has slightly rebounded and has regained above 880.

From the 4-hour structure, after being pressured around 960, the market continued to weaken, repeatedly probing lower before finding support near 856. Subsequently, a technical rebound occurred, and the price oscillated around the midline. However, judging by the strength and continuity of the rebound, the bulls are clearly losing momentum, and there are no effective signs of a trend revers

From the 4-hour structure, after being pressured around 960, the market continued to weaken, repeatedly probing lower before finding support near 856. Subsequently, a technical rebound occurred, and the price oscillated around the midline. However, judging by the strength and continuity of the rebound, the bulls are clearly losing momentum, and there are no effective signs of a trend revers

BNB1,4%

- Reward

- like

- Comment

- Repost

- Share

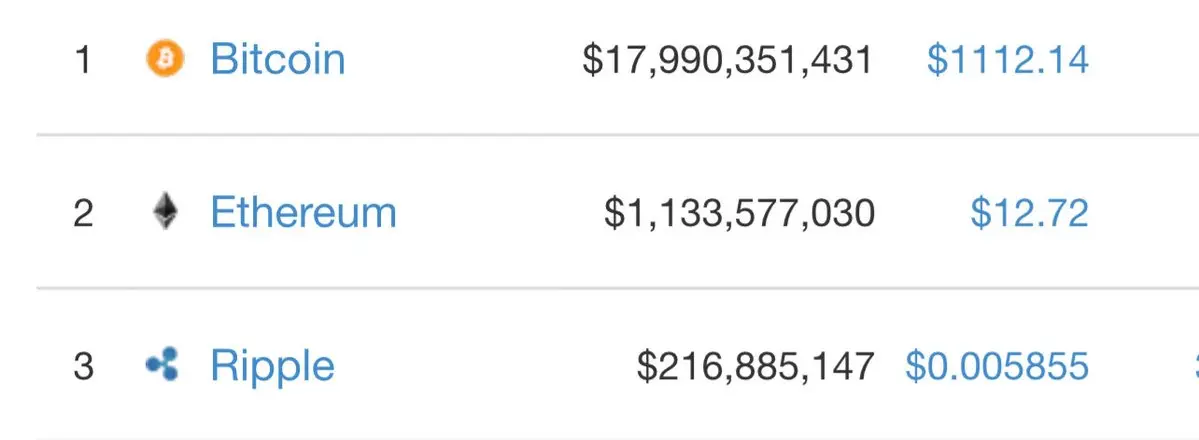

very soon we’ll wake up and see this

- Reward

- like

- Comment

- Repost

- Share

🔹 Precious metals surge masks the strengthening crypto fundamentals, ETH and BTC gains are just a matter of time

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More27.44K Popularity

103.32K Popularity

72.51K Popularity

21.06K Popularity

40.42K Popularity

Hot Gate Fun

View More- MC:$0.1Holders:10.00%

- MC:$3.44KHolders:20.04%

- MC:$3.41KHolders:20.00%

- MC:$3.39KHolders:10.00%

- MC:$3.4KHolders:10.00%

News

View MoreGate announces the 2025 Year-End Community Gala rankings, showcasing top streamers and content creators' highlight moments.

4 m

PUMP(Pump.fun)24小时上涨12.00%

4 m

Ethereum network fees drop to the lowest level since May 2017

7 m

Data: Kiln transferred 1,891,869 TON tokens to TON, worth approximately $2.87 million

8 m

RootData: CHEEL will unlock tokens worth approximately $3.31 million in one week

10 m

Pin