GateUser-7727df56

#PI #PI #PFVS Launchpad 认购开启 #ETH突破2700美元 #4月CPI数据公布 Pioneers, Dr. Nicholas will deliver a keynote speech at 11:05 AM Eastern Time on Friday, May 16, in M country, 8:05 AM Pacific Time. Please remember to watch the live broadcast on time, as this is Dr. Nicholas's first time officially introducing the development of the web3 network and the new features of digital tokens and ecosystems at a global summit on behalf of the web3 network. This is a moment for the web3 network to shine on the global stage. We look forward to significant announcements regarding the open source of the network, the op

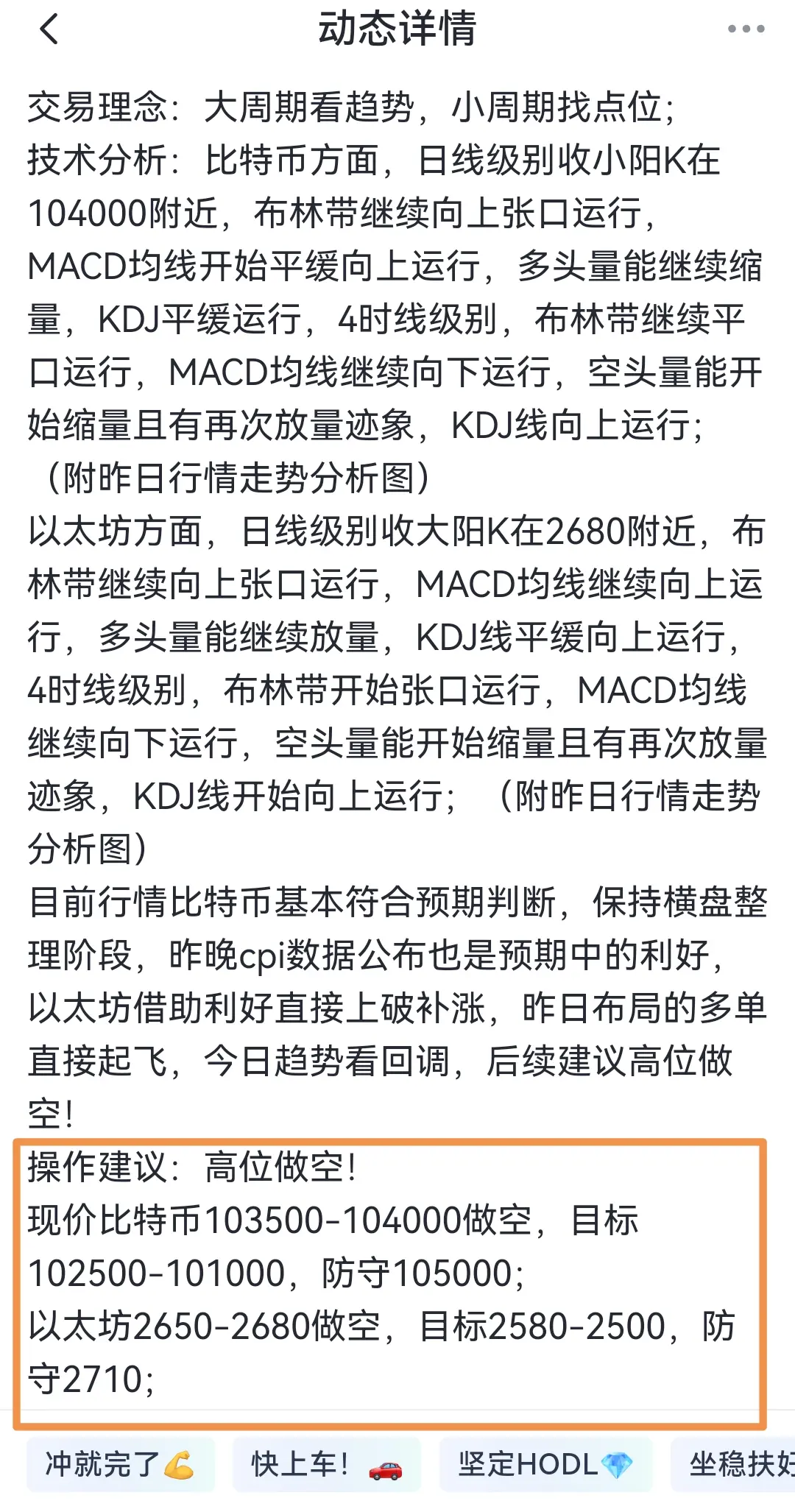

View Original