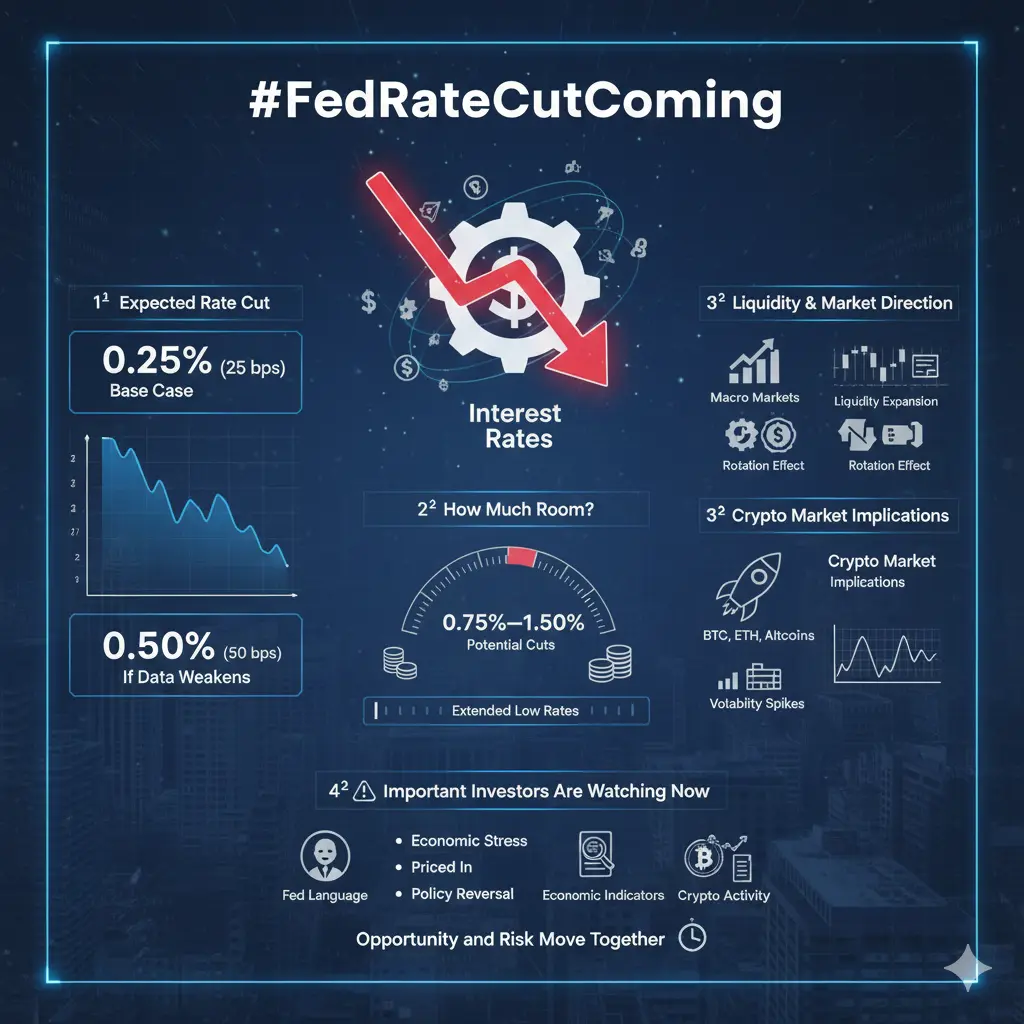

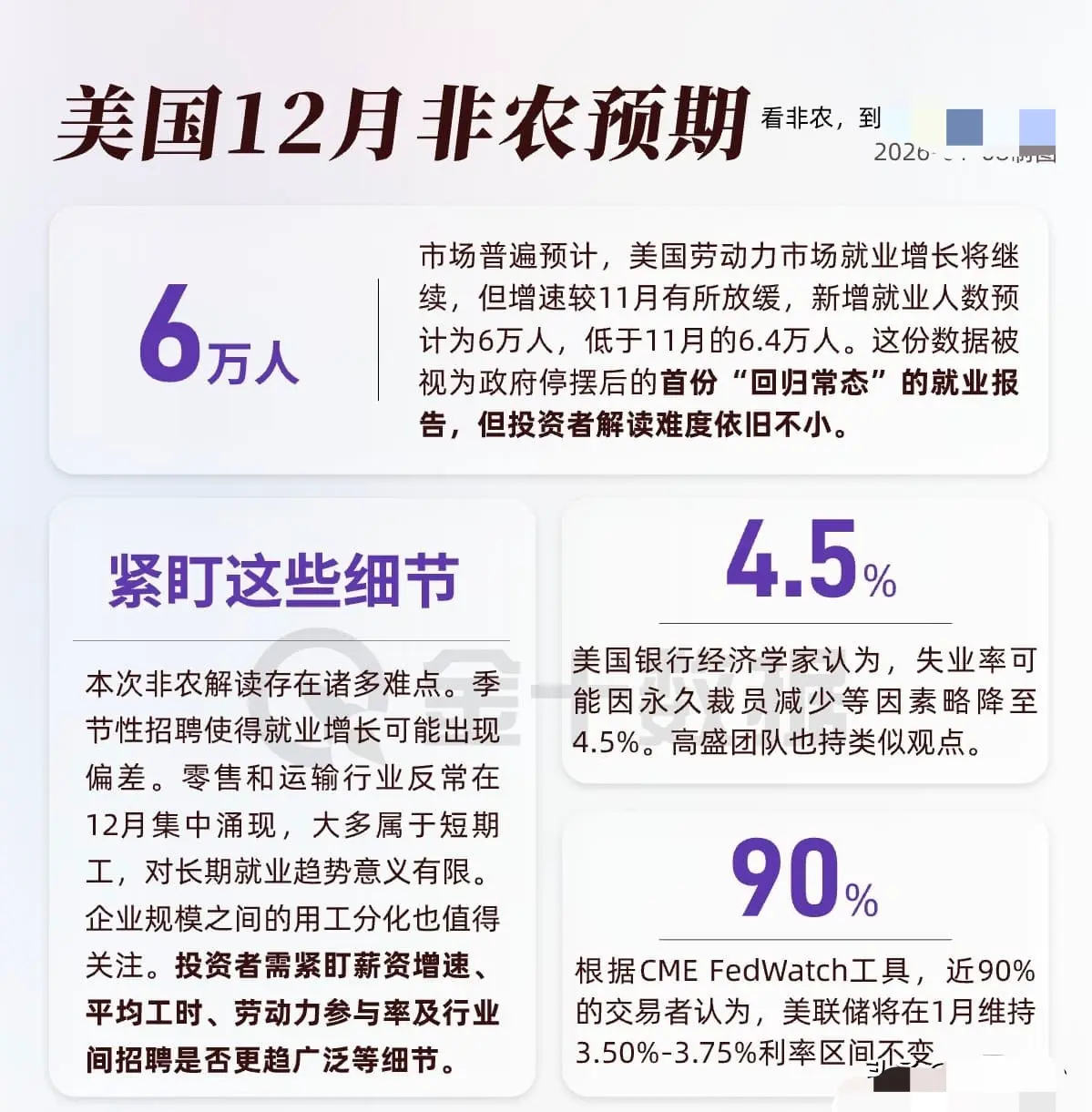

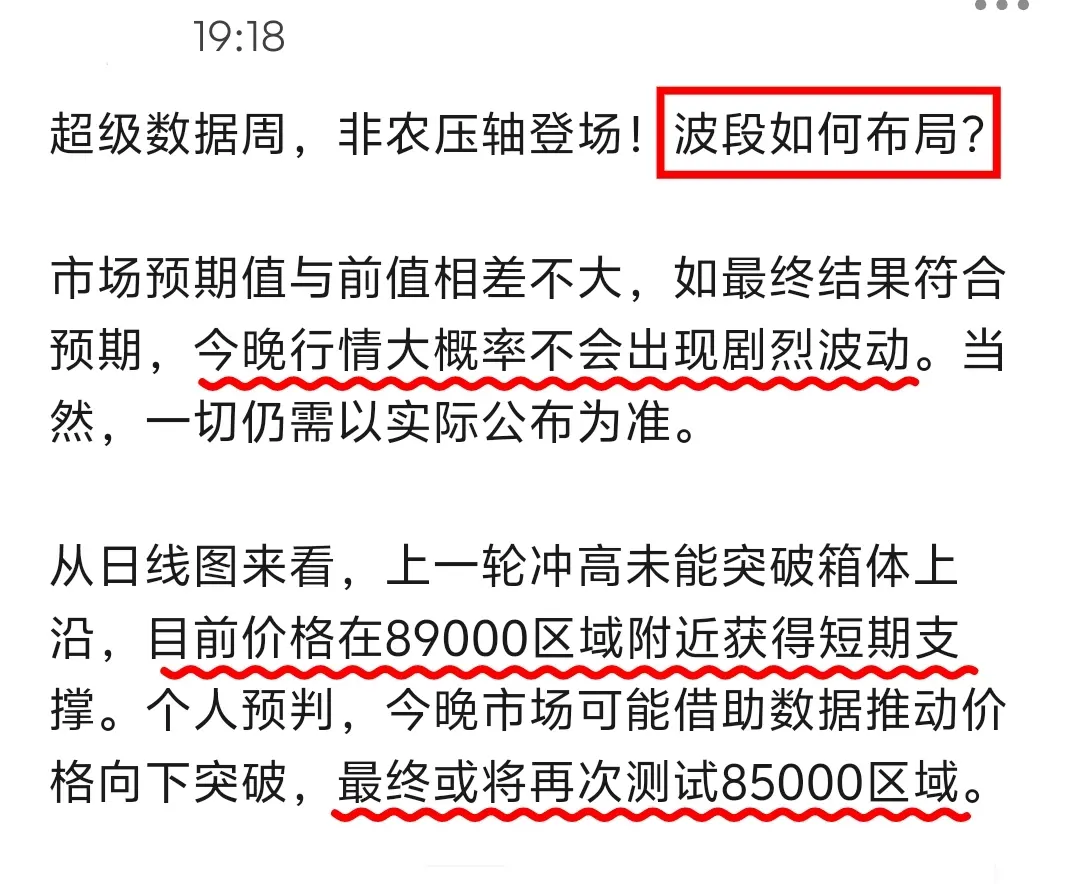

#美联储降息 Influenced by strong US employment data, the probability of the Federal Reserve maintaining interest rates in January has soared to 88.4%, and market expectations for rate cuts and liquidity easing have significantly cooled down. This macroeconomic backdrop directly suppresses the upward momentum of the crypto market, leading to increased short-term selling pressure on Bitcoin. As signs of exhaustion appear in capital inflow momentum, the market generally expects prices to enter a sideways consolidation phase in the coming months, with overall investor sentiment turning cautious, and t

BTC-1,05%