#BitcoinDropsBelow$65K 🔥 Bitcoin Drops Below $65K — February 2026 Deep Dive 🔥

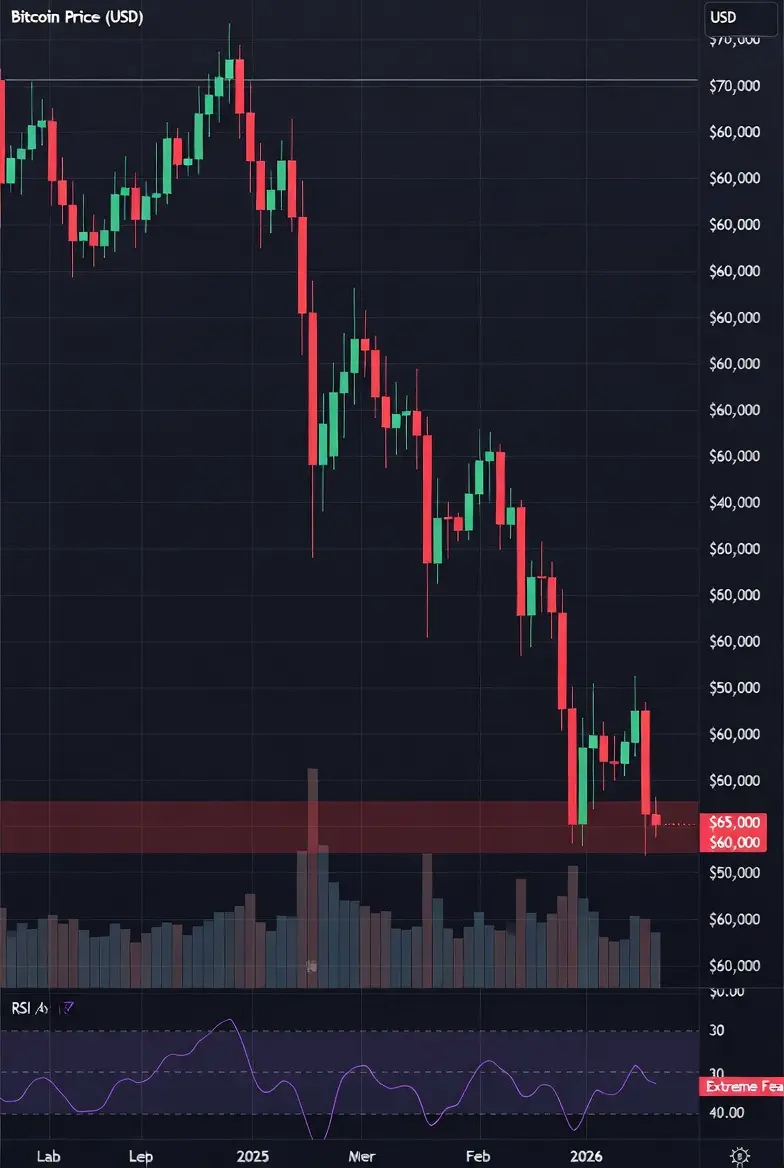

Bitcoin has just broken below the critical $65,000 support level in early February 2026, signaling a significant escalation in the ongoing pullback from the 2025 bull run highs near $126,000. This breach represents not just a psychological blow for traders but a key technical breakdown that could shape short-term market behavior.

Currently, BTC is trading around $69,000 after briefly dipping near $60,000 earlier in the week, with flashes below $61,000 reported on February 5. This reflects a roughly 45-50% drawdown from October/November 2025 highs, wiping out most post-election gains and forcing the market into a painful reset phase. The magnitude of this correction reminds everyone that rapid parabolic rallies often face equally sharp pullbacks.

The $65K level was a critical support zone watched by both retail and institutional traders. Its breach triggered cascading stop-loss orders and forced liquidations, amplifying selling pressure. Traders who had long positions relying on this support found themselves squeezed, resulting in further downside acceleration and extreme volatility in intraday sessions.

Several major factors fueled this breakdown. Heavy profit-taking dominated after the euphoric 2025 rally, fueled by pro-crypto policy optimism and high retail enthusiasm. Overextended longs started unwinding aggressively near $70K–$80K, creating a domino effect that cascaded through the market.

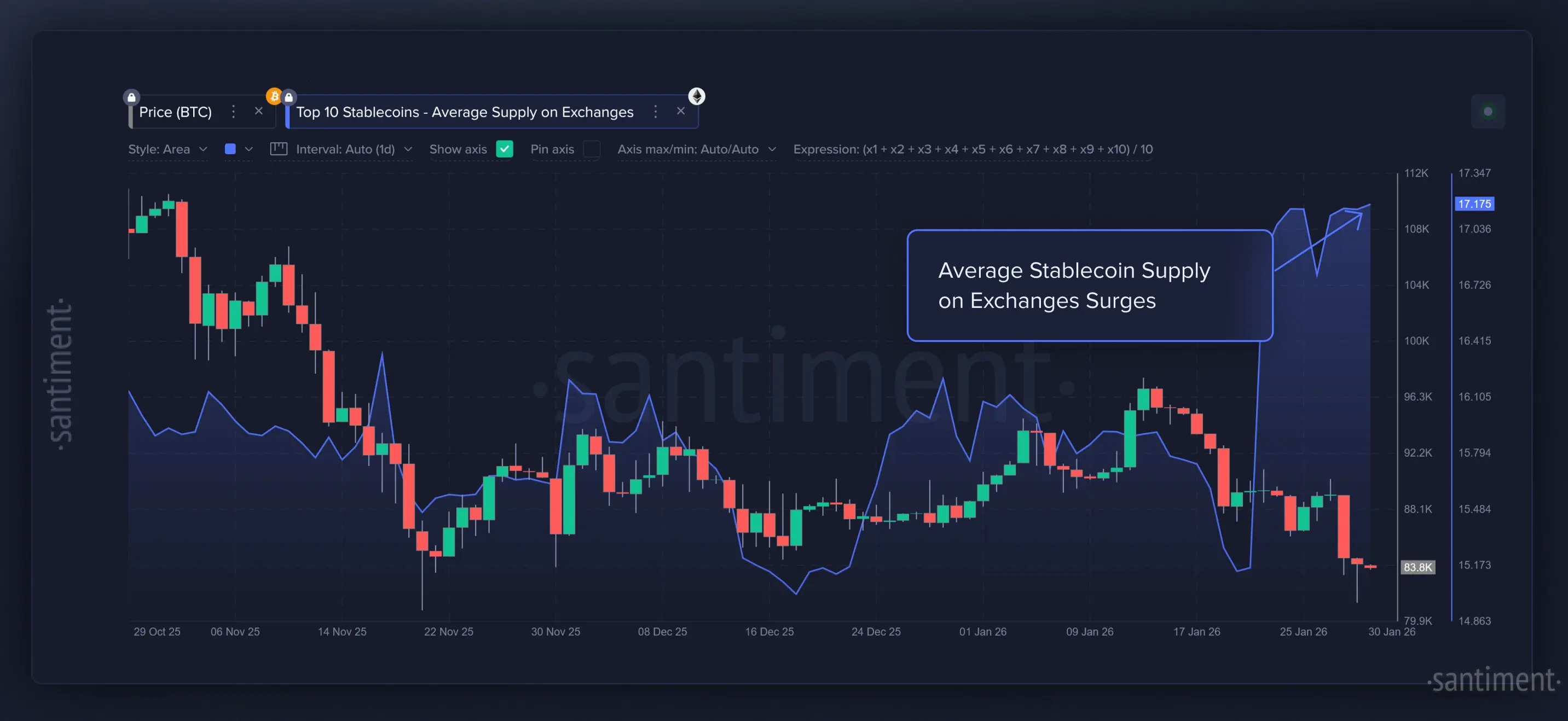

Another key driver was the liquidation cascade. Realized losses hit approximately $3.2 billion in a single day, with leveraged positions wiped out en masse. Large stablecoin outflows further drained liquidity, meaning that even small sell orders had outsized impacts on price, creating exaggerated volatility.

Institutional dynamics added pressure. Spot BTC and ETH ETFs experienced heavy outflows over recent weeks and months. Funds that had entered aggressively during the 2025 hype cycle began exiting or hedging amid rising macro uncertainty. This marks one of the first major episodes of ETF-driven bearish pressure, highlighting how traditional financial channels now influence crypto market swings.

Macro headwinds intensified the pullback. A stronger US dollar, geopolitical tension, sharp corrections in gold and silver, tech stock weakness, and hawkish Fed signals all contributed to a broader risk-off sentiment. In such an environment, crypto, being a risk asset, naturally became a primary target for liquidation and portfolio rotation.

Trading liquidity is thin compared to 2025 peaks. Low volume amplifies price swings, making moves appear more violent than they might be in a deeper market. Sentiment has also flipped drastically: the Fear & Greed Index plunged into extreme fear territory (single-digit readings), indicating that most traders are either capitulating or sitting on the sidelines.

Looking ahead, there are two main paths for BTC. In a bullish recovery scenario, stabilization around current levels or a bounce above $70K–$71K could signal that selling exhaustion is over, setting up a healthy consolidation base before the next upward move. Alternatively, in a deeper correction scenario, broken support levels point to $62K, $58K–$60K, and potentially $54K if panic accelerates, extending short-term “crypto winter” sentiment.

Traders and investors are prioritizing capital preservation. Short-term traders are employing tight stops, low or no leverage, and waiting for volume-backed reversal signals such as higher highs or higher lows. Long-term holders may scale in gradually on dips, viewing this as a mid-cycle correction rather than a cycle end. Patience, discipline, and risk management remain the strongest tools in navigating this volatile environment.

Bitcoin has just broken below the critical $65,000 support level in early February 2026, signaling a significant escalation in the ongoing pullback from the 2025 bull run highs near $126,000. This breach represents not just a psychological blow for traders but a key technical breakdown that could shape short-term market behavior.

Currently, BTC is trading around $69,000 after briefly dipping near $60,000 earlier in the week, with flashes below $61,000 reported on February 5. This reflects a roughly 45-50% drawdown from October/November 2025 highs, wiping out most post-election gains and forcing the market into a painful reset phase. The magnitude of this correction reminds everyone that rapid parabolic rallies often face equally sharp pullbacks.

The $65K level was a critical support zone watched by both retail and institutional traders. Its breach triggered cascading stop-loss orders and forced liquidations, amplifying selling pressure. Traders who had long positions relying on this support found themselves squeezed, resulting in further downside acceleration and extreme volatility in intraday sessions.

Several major factors fueled this breakdown. Heavy profit-taking dominated after the euphoric 2025 rally, fueled by pro-crypto policy optimism and high retail enthusiasm. Overextended longs started unwinding aggressively near $70K–$80K, creating a domino effect that cascaded through the market.

Another key driver was the liquidation cascade. Realized losses hit approximately $3.2 billion in a single day, with leveraged positions wiped out en masse. Large stablecoin outflows further drained liquidity, meaning that even small sell orders had outsized impacts on price, creating exaggerated volatility.

Institutional dynamics added pressure. Spot BTC and ETH ETFs experienced heavy outflows over recent weeks and months. Funds that had entered aggressively during the 2025 hype cycle began exiting or hedging amid rising macro uncertainty. This marks one of the first major episodes of ETF-driven bearish pressure, highlighting how traditional financial channels now influence crypto market swings.

Macro headwinds intensified the pullback. A stronger US dollar, geopolitical tension, sharp corrections in gold and silver, tech stock weakness, and hawkish Fed signals all contributed to a broader risk-off sentiment. In such an environment, crypto, being a risk asset, naturally became a primary target for liquidation and portfolio rotation.

Trading liquidity is thin compared to 2025 peaks. Low volume amplifies price swings, making moves appear more violent than they might be in a deeper market. Sentiment has also flipped drastically: the Fear & Greed Index plunged into extreme fear territory (single-digit readings), indicating that most traders are either capitulating or sitting on the sidelines.

Looking ahead, there are two main paths for BTC. In a bullish recovery scenario, stabilization around current levels or a bounce above $70K–$71K could signal that selling exhaustion is over, setting up a healthy consolidation base before the next upward move. Alternatively, in a deeper correction scenario, broken support levels point to $62K, $58K–$60K, and potentially $54K if panic accelerates, extending short-term “crypto winter” sentiment.

Traders and investors are prioritizing capital preservation. Short-term traders are employing tight stops, low or no leverage, and waiting for volume-backed reversal signals such as higher highs or higher lows. Long-term holders may scale in gradually on dips, viewing this as a mid-cycle correction rather than a cycle end. Patience, discipline, and risk management remain the strongest tools in navigating this volatile environment.