# InstitutionalCrypto

3.41K

QueenOfTheDay

#StrategyBitcoinPositionTurnsRed 🏦 Institutional BTC Accumulation – Strategy Under Review?

Major BTC-holding companies like Strategy are now reporting unrealized losses following recent price declines. While this looks concerning on the surface, it doesn’t necessarily signal panic among institutions.

🔍 Will this change institutional accumulation behavior?

Probably not a full stop, but a shift in approach.

📊 What’s likely to change:

✔️ Slower, more staggered accumulation

✔️ Increased focus on cost-averaging zones

✔️ Higher sensitivity to macro & liquidity signals

✔️ More emphasis on balance-

Major BTC-holding companies like Strategy are now reporting unrealized losses following recent price declines. While this looks concerning on the surface, it doesn’t necessarily signal panic among institutions.

🔍 Will this change institutional accumulation behavior?

Probably not a full stop, but a shift in approach.

📊 What’s likely to change:

✔️ Slower, more staggered accumulation

✔️ Increased focus on cost-averaging zones

✔️ Higher sensitivity to macro & liquidity signals

✔️ More emphasis on balance-

BTC-2,79%

- Reward

- 1

- Comment

- Repost

- Share

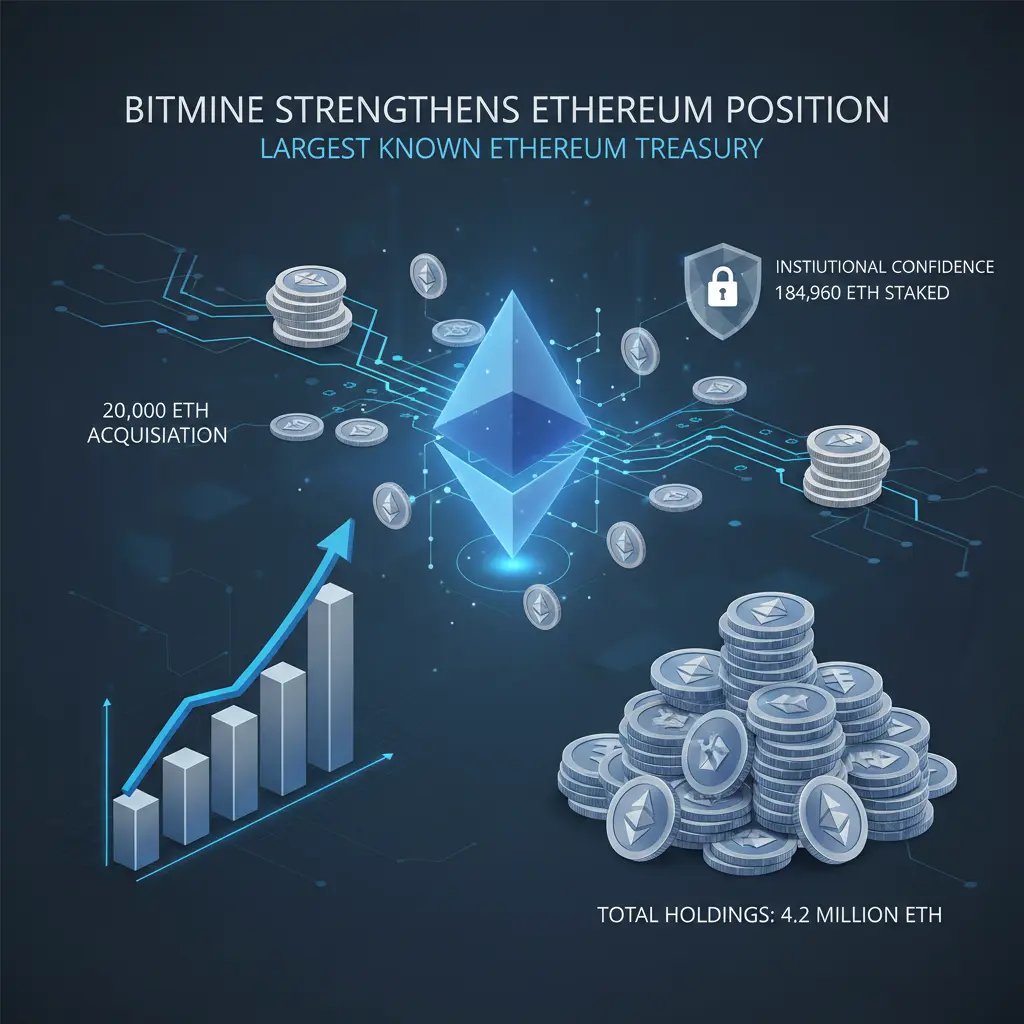

BitMine Strengthens Ethereum Position with Major Acquisition

BitMine has made a significant move in the crypto market, acquiring 20,000 ETH (worth ~$58.22M) on January 27th, 2026. This latest purchase brings their total Ethereum holdings to an impressive 4.2 million ETH, making BitMine the largest known Ethereum treasury.

In addition, BitMine staked 184,960 ETH (~$538M), supporting the Ethereum network and earning staking rewards. This move signals strong institutional confidence in Ethereum and highlights the growing trend of major players participating in Ethereum’s Proof-of-Stake network.

S

BitMine has made a significant move in the crypto market, acquiring 20,000 ETH (worth ~$58.22M) on January 27th, 2026. This latest purchase brings their total Ethereum holdings to an impressive 4.2 million ETH, making BitMine the largest known Ethereum treasury.

In addition, BitMine staked 184,960 ETH (~$538M), supporting the Ethereum network and earning staking rewards. This move signals strong institutional confidence in Ethereum and highlights the growing trend of major players participating in Ethereum’s Proof-of-Stake network.

S

ETH-1,81%

- Reward

- 5

- 6

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

# InstitutionalHoldingsDebate

A Tale of Two Strategies: The Institutional

Divide on Bitcoin 📉📈

The current market climate has revealed a fascinating

divergence in institutional behavior regarding BTC. On one side, we see major

players continuing to accumulate, viewing volatility as a long-term buying

opportunity. On the other, recent market declines are undeniably putting

pressure on portfolios, forcing difficult conversations about risk management.

This split brings us to a critical juncture. Are these

institutions holding firm to their original long-term strategies, weathering

the storm

A Tale of Two Strategies: The Institutional

Divide on Bitcoin 📉📈

The current market climate has revealed a fascinating

divergence in institutional behavior regarding BTC. On one side, we see major

players continuing to accumulate, viewing volatility as a long-term buying

opportunity. On the other, recent market declines are undeniably putting

pressure on portfolios, forcing difficult conversations about risk management.

This split brings us to a critical juncture. Are these

institutions holding firm to their original long-term strategies, weathering

the storm

BTC-2,79%

- Reward

- 1

- 1

- Repost

- Share

BeautifulDay :

:

2026 GOGOGO 👊🏛️ $83K: The Institutional Rebound is Loading

The conversation about "caution" is outdated. In a market where 86% of institutional investors are already allocated, an $83,000 Bitcoin isn't a red flag—it’s a structural retest of the new global floor.

While short-term liquidations have cleared the board, the long-term institutional "bid" remains. We are no longer trading in a vacuum; we are trading alongside global treasuries and sovereign-sized funds.

📊 The 2026 Reality Check

ETF Stabilization: Despite recent outflows of $1.1B, US spot flows are returning to neutral. This "cooling" of se

The conversation about "caution" is outdated. In a market where 86% of institutional investors are already allocated, an $83,000 Bitcoin isn't a red flag—it’s a structural retest of the new global floor.

While short-term liquidations have cleared the board, the long-term institutional "bid" remains. We are no longer trading in a vacuum; we are trading alongside global treasuries and sovereign-sized funds.

📊 The 2026 Reality Check

ETF Stabilization: Despite recent outflows of $1.1B, US spot flows are returning to neutral. This "cooling" of se

- Reward

- 1

- 2

- Repost

- Share

Nil3437 :

:

$BTC - There’s a lot of liquidity sitting on the downside on the short-term liquidation heatmap.Avoid leverage over the coming days.View More

🌈 #GateLiveStreamingInspiration – Jan. 21

Go live now and get extra official support & promotional exposure!

🔹 Today’s Hot Topics:

Tariff threats return: Crypto flashed down overnight — can BTC hold?

Prediction markets explode: Daily volume hits $814M — momentum to continue?

Regulatory watch: Crypto lawyer Passalacqua joins CFTC — what’s next for rules?

Institutional moves: BlackRock + Delaware Life investing in Bitcoin

Macro & risk: Rising military tensions under Trump → funds flowing into crypto & gold

🔥 Start streaming now: Gate Live

📌 Tip: Early, insightful streams get higher visibilit

Go live now and get extra official support & promotional exposure!

🔹 Today’s Hot Topics:

Tariff threats return: Crypto flashed down overnight — can BTC hold?

Prediction markets explode: Daily volume hits $814M — momentum to continue?

Regulatory watch: Crypto lawyer Passalacqua joins CFTC — what’s next for rules?

Institutional moves: BlackRock + Delaware Life investing in Bitcoin

Macro & risk: Rising military tensions under Trump → funds flowing into crypto & gold

🔥 Start streaming now: Gate Live

📌 Tip: Early, insightful streams get higher visibilit

BTC-2,79%

- Reward

- 1

- 2

- Repost

- Share

📊 Goldman Eyes Prediction Markets: A Quiet Institutional Shift

Wall Street has just crossed a subtle but historic threshold.

During Goldman Sachs’ Q4 2025 earnings call (Jan 15, 2026), CEO David Solomon confirmed that the firm is actively exploring prediction markets. This is not a side experiment. Solomon personally held multi-hour meetings with leadership from the two dominant platforms — widely reported as Kalshi and Polymarket — and disclosed that dedicated internal teams are now studying the space.

The implication is clear:

The question is no longer if institutional capital enters predic

Wall Street has just crossed a subtle but historic threshold.

During Goldman Sachs’ Q4 2025 earnings call (Jan 15, 2026), CEO David Solomon confirmed that the firm is actively exploring prediction markets. This is not a side experiment. Solomon personally held multi-hour meetings with leadership from the two dominant platforms — widely reported as Kalshi and Polymarket — and disclosed that dedicated internal teams are now studying the space.

The implication is clear:

The question is no longer if institutional capital enters predic

- Reward

- 10

- 16

- Repost

- Share

Crypto_Teacher :

:

Watching Closely 🔍️View More

#InstitutionsAccelerateDigitalAssetPositioning #InstitutionsAccelerateDigitalAssetPositioning – The Digital Asset Race Is On!

The crypto and digital asset landscape is evolving at lightning speed, and it’s no longer just a playground for retail traders. Major institutions – including global banks, hedge funds, pension funds, and corporations – are not just entering the market; they are aggressively positioning themselves to dominate it. This is more than investment; it’s a strategic play shaping the future of finance.

Breaking It Down:

1️⃣ Institutions:

These are the financial titans controlli

The crypto and digital asset landscape is evolving at lightning speed, and it’s no longer just a playground for retail traders. Major institutions – including global banks, hedge funds, pension funds, and corporations – are not just entering the market; they are aggressively positioning themselves to dominate it. This is more than investment; it’s a strategic play shaping the future of finance.

Breaking It Down:

1️⃣ Institutions:

These are the financial titans controlli

- Reward

- 16

- 7

- Repost

- Share

BabaJi :

:

Bull Run 🐂View More

JUST IN: Strategy acquires 1,955 $BTC for $217.4 Million at an average of $111,196 per BTC, pushing total holdings to 638,460 $BTC worth ~$47.17 Billion. The firm has achieved an impressive 25.8% $BTC yield YTD 2025. $MSTR $STRC $STRK $STRF $STRD

#Bitcoin #CryptoNews $BTC #InstitutionalCrypto CryptoMarket

#Bitcoin #CryptoNews $BTC #InstitutionalCrypto CryptoMarket

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

10.63K Popularity

7.41K Popularity

6.44K Popularity

2.67K Popularity

4.18K Popularity

3.37K Popularity

3.25K Popularity

24.27K Popularity

16.41K Popularity

8.72K Popularity

1.05K Popularity

8.74K Popularity

21.26K Popularity

17.67K Popularity

227.63K Popularity

News

View MoreThe Ministry of Public Security's draft on Internet Crime Prevention and Control Law includes illegal virtual currency transactions.

1 m

Institutions: Gold's decline has been halved, but the risk of further decline remains high

6 m

BitMart launches Warden Protocol (WARD)

8 m

Gate launches the 77th contract points airdrop, with a single transaction earning approximately $25

11 m

Data: 45,500 SOL transferred from an anonymous address, routed through a relay, and then sent to another anonymous address

18 m

Pin