# USSECPushesCryptoReform

31.43K

Vortex_King

#USSECPushesCryptoReform

#USSECPushesCryptoReform

The push for comprehensive crypto reform by the U.S. Securities and Exchange Commission marks a pivotal moment for the digital asset industry. As the global crypto market matures, regulators in the United States are moving to establish clearer rules that balance innovation with investor protection. This reform drive could reshape how cryptocurrencies, exchanges, stablecoins, and blockchain projects operate not only in America but worldwide.

🔹 Why Crypto Reform Is Happening Now

Several factors are accelerating regulatory action:

• Rapid growt

#USSECPushesCryptoReform

The push for comprehensive crypto reform by the U.S. Securities and Exchange Commission marks a pivotal moment for the digital asset industry. As the global crypto market matures, regulators in the United States are moving to establish clearer rules that balance innovation with investor protection. This reform drive could reshape how cryptocurrencies, exchanges, stablecoins, and blockchain projects operate not only in America but worldwide.

🔹 Why Crypto Reform Is Happening Now

Several factors are accelerating regulatory action:

• Rapid growt

- Reward

- 3

- 5

- Repost

- Share

ybaser :

:

good information sharedView More

#USSECPushesCryptoReform USDigitalAssetReform Structured Shift Toward Regulatory Clarity

The regulatory narrative in the United States continues to evolve as the U.S. Securities and Exchange Commission advances its digital-asset reform agenda. This is not a sudden policy reversal, but part of a broader modernization effort aimed at clarifying how cryptocurrencies integrate within existing securities law frameworks rather than operating in prolonged legal gray areas.

At the center of the reform push are three pillars: classification, compliance, and market structure. Regulators are working to d

The regulatory narrative in the United States continues to evolve as the U.S. Securities and Exchange Commission advances its digital-asset reform agenda. This is not a sudden policy reversal, but part of a broader modernization effort aimed at clarifying how cryptocurrencies integrate within existing securities law frameworks rather than operating in prolonged legal gray areas.

At the center of the reform push are three pillars: classification, compliance, and market structure. Regulators are working to d

- Reward

- 1

- 1

- Repost

- Share

Yusfirah :

:

To The Moon 🌕#USSECPushesCryptoReform

USSECPushesCryptoReform: A Structural Shift in Digital Asset Oversight

The United States is entering a pivotal phase in digital asset regulation as the U.S. Securities and Exchange Commission intensifies its push for crypto reform. What was once characterized primarily by enforcement actions is now evolving into broader policy discussions aimed at defining clearer rules for market participants. This shift reflects mounting pressure from lawmakers, institutions, and industry leaders who argue that regulatory ambiguity has constrained innovation while failing to fully p

USSECPushesCryptoReform: A Structural Shift in Digital Asset Oversight

The United States is entering a pivotal phase in digital asset regulation as the U.S. Securities and Exchange Commission intensifies its push for crypto reform. What was once characterized primarily by enforcement actions is now evolving into broader policy discussions aimed at defining clearer rules for market participants. This shift reflects mounting pressure from lawmakers, institutions, and industry leaders who argue that regulatory ambiguity has constrained innovation while failing to fully p

BTC-0,04%

- Reward

- 4

- 6

- Repost

- Share

Vortex_King :

:

To The Moon 🌕View More

#USSECPushesCryptoReform The digital asset reform initiative led by the United States Securities and Exchange Commission reflects a broader transition toward structured cryptocurrency governance inside the United States financial system. The policy direction suggests integration rather than exclusion, aiming to position digital assets within established securities law frameworks while reducing prolonged legal uncertainty that has historically affected both startups and institutional investors.

At the core of the reform agenda is a three-layer regulatory model focusing on asset classification,

At the core of the reform agenda is a three-layer regulatory model focusing on asset classification,

- Reward

- 3

- 5

- Repost

- Share

INVESTERCLUB :

:

Regulatory clarity is the ultimate catalyst for institutional liquidity. Moving assets from the grey market into a defined legal framework isn't a restriction—it’s the foundational layer for the next wave of capital formation.View More

#USSECPushesCryptoReform The digital asset reform initiative led by the United States Securities and Exchange Commission reflects a broader transition toward structured cryptocurrency governance inside the United States financial system. The policy direction suggests integration rather than exclusion, aiming to position digital assets within established securities law frameworks while reducing prolonged legal uncertainty that has historically affected both startups and institutional investors.

At the core of the reform agenda is a three-layer regulatory model focusing on asset classification,

At the core of the reform agenda is a three-layer regulatory model focusing on asset classification,

- Reward

- 3

- 2

- Repost

- Share

MasterChuTheOldDemonMasterChu :

:

Thank you for your hard work in sharing valuable information; it has been very inspiring to me🥰View More

#USSECPushesCryptoReform The narrative around U.S. crypto regulation continues to evolve as the U.S. Securities and Exchange Commission pushes forward with digital asset reform efforts. This is not a sudden pivot — it’s part of a broader modernization process aimed at clarifying how cryptocurrencies fit within existing securities law frameworks.

At its core, the reform discussion revolves around classification, compliance, and market structure. The SEC is working to define when a digital asset qualifies as a security, how trading platforms should register, and what disclosure standards apply t

At its core, the reform discussion revolves around classification, compliance, and market structure. The SEC is working to define when a digital asset qualifies as a security, how trading platforms should register, and what disclosure standards apply t

TOKEN-0,47%

- Reward

- 3

- 4

- Repost

- Share

MasterChuTheOldDemonMasterChu :

:

Happy New Year 🧨View More

#USSECPushesCryptoReform

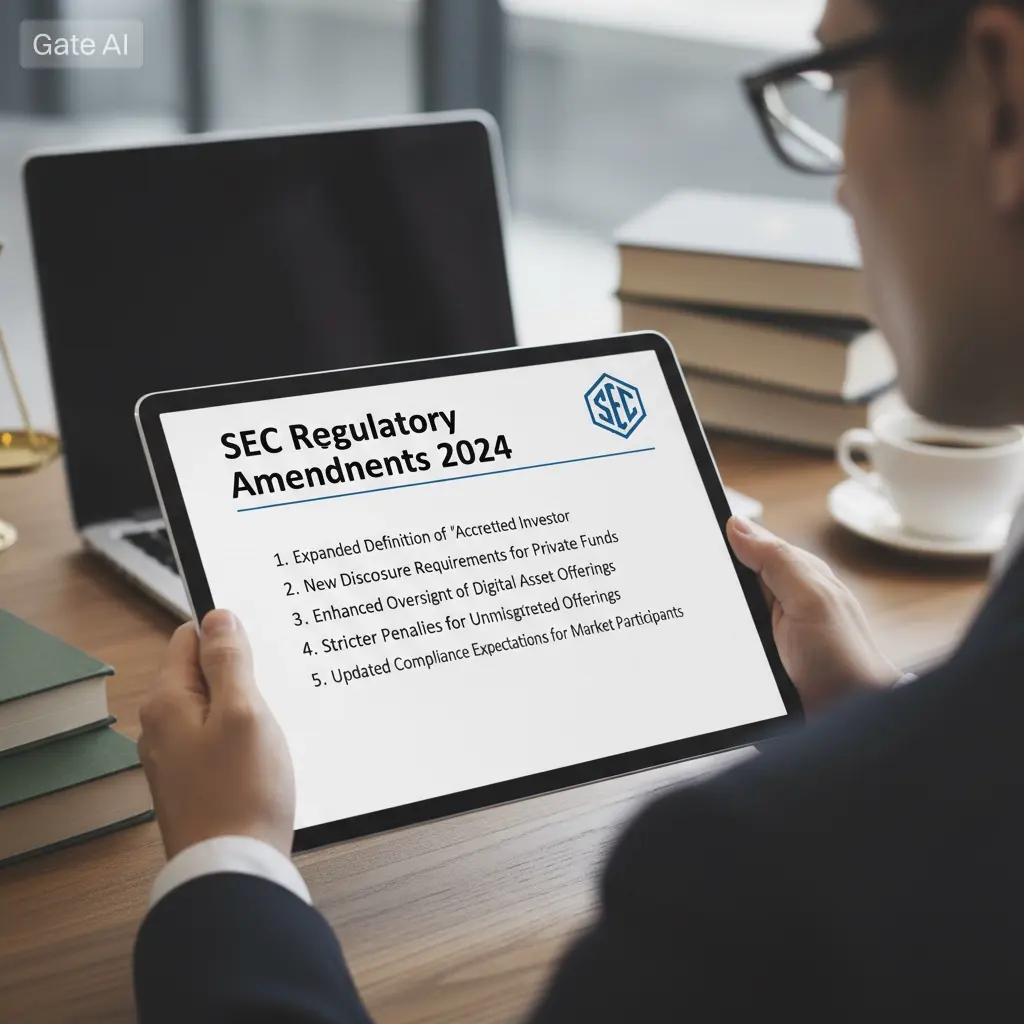

USSECPushesCryptoReform refers to ongoing efforts by the U.S. Securities and Exchange Commission (SEC) to update and clarify regulations related to cryptocurrencies and digital assets. These reforms aim to provide clearer rules, improve investor protection, and create a more structured regulatory environment for crypto markets.

What This Means

The SEC is actively proposing changes and guidance to how digital assets are classified, traded, and offered in the United States.

These reforms may affect areas such as how tokens are defined (e.g., securities vs. commodities),

USSECPushesCryptoReform refers to ongoing efforts by the U.S. Securities and Exchange Commission (SEC) to update and clarify regulations related to cryptocurrencies and digital assets. These reforms aim to provide clearer rules, improve investor protection, and create a more structured regulatory environment for crypto markets.

What This Means

The SEC is actively proposing changes and guidance to how digital assets are classified, traded, and offered in the United States.

These reforms may affect areas such as how tokens are defined (e.g., securities vs. commodities),

- Reward

- 4

- 8

- Repost

- Share

Discovery :

:

LFG 🔥View More

#USSECPushesCryptoReform It all began with years of uncertainty. The U.S. crypto market, once vibrant and experimental, faced a series of regulatory crackdowns. Individual token issuers and exchanges were penalized for non-compliance, but the absence of clear rules left the broader market in limbo. Retail and institutional participants alike hesitated to commit capital, unsure which assets would be deemed securities and which could operate freely. This was the backdrop for the movement captured by #USSECPushesCryptoReform.

Enforcement Alone Couldn’t Keep Up:

As market volumes expanded and DeFi

Enforcement Alone Couldn’t Keep Up:

As market volumes expanded and DeFi

- Reward

- 4

- 5

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

#USSECPushesCryptoReform

USSECPushesCryptoReform

When the U.S. Securities and Exchange Commission begins actively pushing crypto reform, this is not just regulatory housekeeping — it’s a structural pivot in how digital assets integrate into the world’s largest capital market.

Let’s break this down properly, strategically, and without hype.

1️⃣ From Enforcement-First to Framework-Building

For years, the SEC’s approach toward crypto was largely enforcement-driven:

Lawsuits

Exchange investigations

Token classification disputes

Regulatory ambiguity

Markets operated in uncertainty.

Now, the conver

USSECPushesCryptoReform

When the U.S. Securities and Exchange Commission begins actively pushing crypto reform, this is not just regulatory housekeeping — it’s a structural pivot in how digital assets integrate into the world’s largest capital market.

Let’s break this down properly, strategically, and without hype.

1️⃣ From Enforcement-First to Framework-Building

For years, the SEC’s approach toward crypto was largely enforcement-driven:

Lawsuits

Exchange investigations

Token classification disputes

Regulatory ambiguity

Markets operated in uncertainty.

Now, the conver

DEFI-3,14%

- Reward

- 5

- 5

- Repost

- Share

CryptoSelf :

:

To The Moon 🌕View More

#USSECPushesCryptoReform

The SEC’s Historic 2026 Crypto Reform Push: From Enforcement to Enablement – A Full Breakdown

Just weeks into February 2026, the U.S. Securities and Exchange Commission (SEC) under Chairman Paul S. Atkins has unleashed a coordinated, pro-innovation wave of crypto reforms that is reshaping America’s digital asset landscape.

On February 13, 2026, the Division of Corporation Finance (under Director James Moloney) released its “Coming Attractions” statement, explicitly prioritizing crypto assets reform as the top agenda item. This was followed by Chairman Atkins’ detailed

The SEC’s Historic 2026 Crypto Reform Push: From Enforcement to Enablement – A Full Breakdown

Just weeks into February 2026, the U.S. Securities and Exchange Commission (SEC) under Chairman Paul S. Atkins has unleashed a coordinated, pro-innovation wave of crypto reforms that is reshaping America’s digital asset landscape.

On February 13, 2026, the Division of Corporation Finance (under Director James Moloney) released its “Coming Attractions” statement, explicitly prioritizing crypto assets reform as the top agenda item. This was followed by Chairman Atkins’ detailed

- Reward

- 1

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

313.6K Popularity

102.94K Popularity

418.68K Popularity

3.6K Popularity

117.87K Popularity

309.77K Popularity

68.95K Popularity

642.18K Popularity

37.56K Popularity

36.67K Popularity

37.81K Popularity

31.43K Popularity

35.74K Popularity

64.67K Popularity

News

View MoreElliptic: Five crypto trading platforms assist Russia in evading sanctions, filling the gap left by Garantex's closure

9 m

IoTeX: Previously suffered $2 million in on-chain attack losses, expected to resume operation within 48 hours

29 m

Market Report: Top 5 cryptocurrencies by decline on February 22, 2026, with the largest drop being Kite

30 m

The negative probability of "Court orders Trump to refund tariffs" on Polymarket surpasses 80%

36 m

Fraud losses in the cryptocurrency sector reached $370 million in January, the highest in nearly 11 months

47 m

Pin