DropToZeroDon'tCry

No content yet

DropToZeroDon'tCry

BONK's "resilience" shines brightly! International-focused projects are becoming increasingly rare.

Recently, the BONK ecosystem launched the "BONKcember" themed month activities, collaborating with Ledger, adjusting the economic model, updating multiple products, expanding global sports marketing + charity initiatives, and the upcoming launch of the powerful BonkTrade — all silently proving that BONK is not a short-term hotspot, but a long-term player.

- Reward

- like

- Comment

- Repost

- Share

Bank of America December Global Fund Manager Survey Released: Cash at Historic Lows + Bull-Bear Indicator at 7.9, Sell Signal Has Been Triggered!

Fund managers' macro optimism rises to the highest since August 2021, with stock overweighting reaching a one-year high, while cash levels drop to a historic low of 3.3%—triggering a classic sell signal! The bull-bear indicator soars to 7.9, approaching the 8.0 sell threshold.

- Reward

- like

- Comment

- Repost

- Share

The Fed Chair's "Palace Coup" escalates! Hassett's confidant gains an advantage, Basent confirms large-scale money printing, with each household receiving a $1,000-2,000 tax rebate early next year—Could crypto recreate the pandemic frenzy?

Last night, the non-farm payrolls report was released smoothly. Employment exceeded expectations, but the unemployment rate hit a four-year high of 4.6%. This should have been positive for a January rate cut, but due to distorted data and December non-farm payrolls interference, the probability of a rate cut only slightly increased to 23-24%. Even more exciting is the escalation of the "Three Palace Fight" among Federal Reserve Chair candidates: Waller's interview votes split the Wosh (Wosh's win rate drops to 22%), while Haskett has regained a 54% lead.

TRUMP-1.79%

- Reward

- like

- Comment

- Repost

- Share

Trump's major statement this morning: The new Federal Reserve Chair will strongly support interest rate cuts! Will risk assets usher in a spring of easing?

Trump publicly stated: The new Federal Reserve Chair will strongly support a significant rate cut! Regardless of who the final candidate is, they are likely to firmly implement a low-interest-rate policy. This is undoubtedly bad news for the independence of the Federal Reserve—political interference will increase. But for risk markets, it's a big gift: a large rate cut = super easing, investor risk appetite will significantly increase, and high-risk assets like U.S. stocks and cryptocurrencies may usher in a new spring.

TRUMP-1.79%

- Reward

- like

- Comment

- Repost

- Share

Whale multi-signature wallet private key leaked! $27.3 million stolen overnight, hackers have laundered $12.6 million

A whale user’s multi-signature wallet was hacked due to private key leakage, resulting in a loss of approximately $27.3 million (including ETH and other assets). The hacker acted very quickly, laundering $12.6 million (about 4,100 ETH) through TornadoCash, and holding about $2 million in liquid assets.

- Reward

- like

- Comment

- Repost

- Share

Today's US stock market observation: It's not just a correction, but a year-end valuation adjustment!

Last night, the US stock market experienced a standard valuation correction: the Nasdaq plunged 1.81%, the S&P 500 fell 1.16%, marking the largest single-day decline in nearly a month, and the Dow Jones Industrial Average declined for the fourth consecutive day. The AI sector led the decline again, with giants like Oracle, Broadcom, and NVIDIA collectively breaking below key levels, revealing institutional year-end rebalancing pressures.

- Reward

- like

- Comment

- Repost

- Share

Is Japan's rate hike really that scary? Debunking the "30% monthly drop" rumor: the data is purely baseless, and the impact is far from exaggerated!

Recently, a set of data has been circulating in the market: every time Japan raises interest rates, BTC drops 24%-32% per month, with an average of 28.7%! Many people are therefore anxious about the Bank of Japan's monetary policy meeting on December 19. But upon careful review of history, you'll find that this data is purely a miscalculation and exaggerated interpretation.

BTC-0.51%

- Reward

- 1

- Comment

- Repost

- Share

SEI launches on OSL Exchange: From the West to the East, officially entering the Asia-Pacific compliant market!

Daily scrolling through tweets, countless projects shout "globalization," "compliance," and "institutional cooperation," but most remain at the PPT and PR level. Today, I came across a tweet from SEI founder Phillip, seeing that $SEI has officially launched on OSL exchange, which made me realize that SEI is strategically entering the Asia-Pacific compliance market. By 2025, if we still see "listing on exchanges" as a simple benefit, we are probably still stuck in the previous mindset.

SEI-4.23%

- Reward

- like

- 2

- Repost

- Share

GateUser-7e7b4ba4 :

:

Still urging the awesome one.View More

Big Short prototype Mike Burry issues a warning with a chart: For the first time, American household stock net assets surpass real estate, marking the third historical crossover!

The prototype of the "big short" Mike Burry posted a picture on Twitter last night, directly pointing to a major change in the asset structure of American households: the stock proportion (red line) has surpassed the real estate proportion (blue line) for the first time! Over the past 70 years, this "red surpassing blue" has only happened twice—after the "Beautiful 50" bubble in the late 1960s leading to stagflation and a bear market, and after the Internet bubble in the late 1990s, when the NASDAQ halved by 78%.

- Reward

- like

- Comment

- Repost

- Share

Special 55th birthday post goes viral with 8 million views! Kevin System shares 55 core principles that change lives

This time, at the milestone age of 55, he condensed a lifetime of wisdom into 55 golden quotes, covering aspects such as health, diet, mindset, relationships, time, wealth, and lifestyle. After reading, all I want to say is: this is what it truly means to live life to the fullest!

FIRE-20.87%

- Reward

- 1

- Comment

- Repost

- Share

Michael Saylor is making another big move! Clearly stating that stablecoins and Bitcoin are two completely different tracks!🔥🤯

In an interview with CNBC on November 29, MicroStrategy co-founder Saylor said:

Stablecoins focus on payment efficiency, essentially an upgraded version of the global payment system. Their true competitors are Visa, Mastercard, and traditional banks! And in this wave of stablecoins, the biggest winner is actually—the US dollar!💵 Because the vast majority of global stablecoins are pegged to the dollar, the larger the expansion, the stronger the dollar hegemony📈

Bitc

In an interview with CNBC on November 29, MicroStrategy co-founder Saylor said:

Stablecoins focus on payment efficiency, essentially an upgraded version of the global payment system. Their true competitors are Visa, Mastercard, and traditional banks! And in this wave of stablecoins, the biggest winner is actually—the US dollar!💵 Because the vast majority of global stablecoins are pegged to the dollar, the larger the expansion, the stronger the dollar hegemony📈

Bitc

BTC-0.51%

- Reward

- like

- Comment

- Repost

- Share

Visa Official Announcement: Supporting USDC Stablecoin Settlement in the United States! Stablecoins Officially Enter the Core of Traditional Payments

Visa officially announced on December 16th the launch of USDC stablecoin settlement functionality in the United States! This is not about retail users swiping cards to spend stablecoins, but rather allowing US issuing banks and acquirers in the US to settle directly with Circle's USDC on VisaNet.

USDC0.03%

- Reward

- like

- Comment

- Repost

- Share

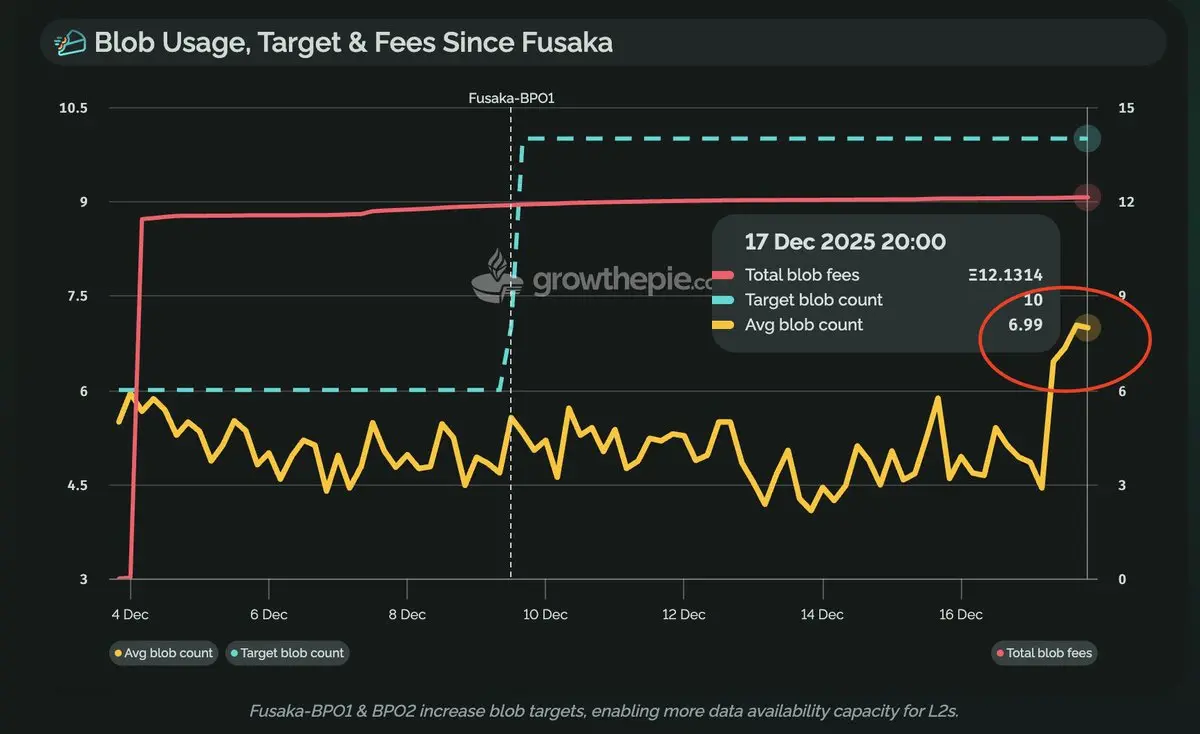

Previously, the DA capacity expansion hard fork of Ethereum $ETH after the upgrade (in Pectra's #BPO ) is more of a "cherry on top" rather than "saving the day." Recent data also perfectly verifies this!📈🔥

According to growth_epie_eth data, one week after the BPO1 upgrade on December 9, Ethereum L1 block DA utilization rate has significantly increased:

The average number of Blobs used per block has reached 7, higher than the approximately 5 before the upgrade!🤯

This boost directly pushes DA's potential capacity to a new level, making the sudden surge in L2 demand easily manageable, fully c

According to growth_epie_eth data, one week after the BPO1 upgrade on December 9, Ethereum L1 block DA utilization rate has significantly increased:

The average number of Blobs used per block has reached 7, higher than the approximately 5 before the upgrade!🤯

This boost directly pushes DA's potential capacity to a new level, making the sudden surge in L2 demand easily manageable, fully c

ETH0.35%

- Reward

- like

- Comment

- Repost

- Share

200,000 tokens! This number is incredible! 🤯🐳

"Insider trading after the 1011 flash crash" has increased their position against the trend, adding $ETH long positions. Now, their holdings have directly reached 203,340.64 ETH! The value of their single-coin position is as high as $578 million!

Key data:

Average opening price: $3,147.39

Current unrealized loss per coin: $61 million

Total position (including other coins) worth $697 million, with an unrealized loss of $69.42 million

This big player initially made a precise short during the 1011 flash crash and doubled down, leading the market to

"Insider trading after the 1011 flash crash" has increased their position against the trend, adding $ETH long positions. Now, their holdings have directly reached 203,340.64 ETH! The value of their single-coin position is as high as $578 million!

Key data:

Average opening price: $3,147.39

Current unrealized loss per coin: $61 million

Total position (including other coins) worth $697 million, with an unrealized loss of $69.42 million

This big player initially made a precise short during the 1011 flash crash and doubled down, leading the market to

ETH0.35%

- Reward

- like

- Comment

- Repost

- Share

"Trump's account" is here: the government directly deposits $1,000 when a child is born, which can grow to $600,000 by retirement!

From the moment a child is born, the government directly deposits $1,000 seed money, allowing it to grow like a snowball in the S&P 500 with an average annual compound interest of 10%, easily reaching $600,000 by retirement! And it doesn't stop there. Starting from July 4, 2026 (the 250th anniversary of the founding of the United States), parents, relatives, and even employers can contribute an additional maximum of $5,000 each year.

- Reward

- like

- Comment

- Repost

- Share

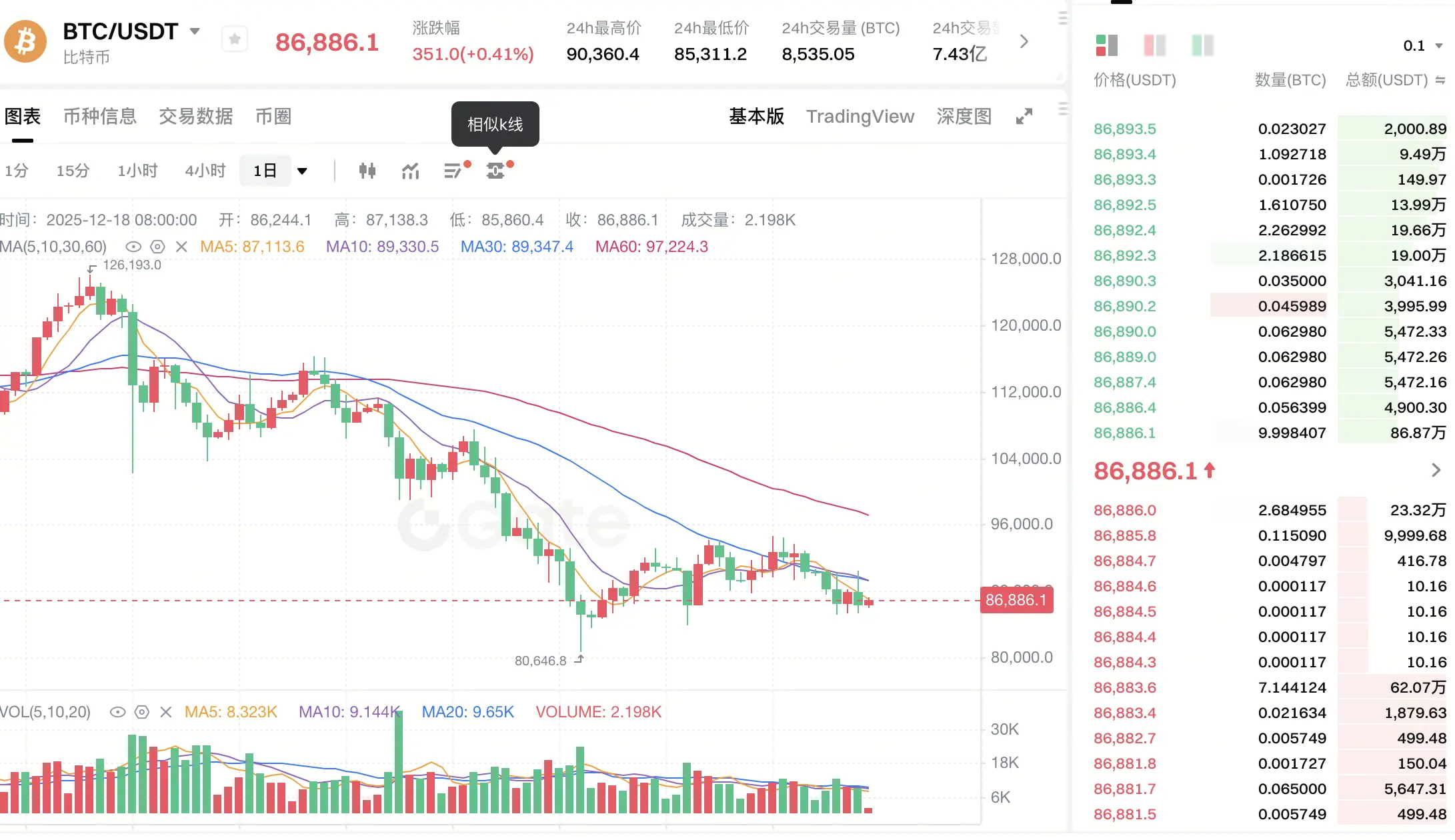

On-chain data is being thoroughly analyzed! The current market situation is much worse than it appears on the surface🫣📉

$BTC is barely holding above 86,000, but the dense area of trapped orders above is extremely exaggerated: $93k–$120k a huge price zone, directly blocking short-term upside potential!

More critical data:

Short-term holder cost basis is as high as $101.5k

Currently, 67 million BTC are in unrealized loss, accounting for 23.7%! More and more chips are underwater

Approximately 371,000 BTC are being sold at a loss

The next key support level is at $81k. Once broken, given the cu

View Original$BTC is barely holding above 86,000, but the dense area of trapped orders above is extremely exaggerated: $93k–$120k a huge price zone, directly blocking short-term upside potential!

More critical data:

Short-term holder cost basis is as high as $101.5k

Currently, 67 million BTC are in unrealized loss, accounting for 23.7%! More and more chips are underwater

Approximately 371,000 BTC are being sold at a loss

The next key support level is at $81k. Once broken, given the cu

- Reward

- like

- Comment

- Repost

- Share

Robinhood CEO revealed on CNBC last night: predicts the market is entering a "super cycle"! It is very likely to become the biggest "new meme cycle" of this round!

Prediction Markets are entering a super cycle, with explosive growth expected in the coming years! He even believes that this could be the most noteworthy new narrative in this cycle—a new asset class combining AI, social, and derivatives.

- Reward

- like

- Comment

- Repost

- Share