Gammichan

No content yet

Gammichan

Think this crash was bad?Every single Chinese person in the world is about to simultaneously sell every last Bitcoin they own in one market sell so they can hand out red envelopes of money for Chinese New Year.

BTC-1,22%

- Reward

- like

- 1

- Repost

- Share

Iker007 :

:

[憨笑]This humble "hoecake" is currently the single most hyped dish in all of Philadelphia rn.-cornmeal hoecake w/ honey-smoked whitefish-trout roe-chives#cryptosoupgroup

- Reward

- 1

- 1

- Repost

- Share

Lonely_Tree_UID18229703 :

:

very nice day ☺️😀☺️😀☺️😀☺️Not a coincidence that this is the first cycle we don\'t know who is blowing up and it\'s also the first cycle we have ETFs.

- Reward

- like

- Comment

- Repost

- Share

Just tired of people misunderstanding me on here. Thinking that cause I\'m always bullish on a long enough time frame that means I\'m never bearish. No.

- Reward

- like

- Comment

- Repost

- Share

"Gammi, you\'re never bearish"

- Reward

- like

- Comment

- Repost

- Share

Today\'s candle has me biased towards another push down to a new low.

- Reward

- like

- Comment

- Repost

- Share

A tibbir short story. gribbit.

- Reward

- like

- Comment

- Repost

- Share

It\'s cold enough to freeze my balls to my legs outside so I am inside having homemade tomato soup and grilled cheese. Gruyere, cheddar, gouda, and butterkase.#cryptosoupgroup

- Reward

- like

- Comment

- Repost

- Share

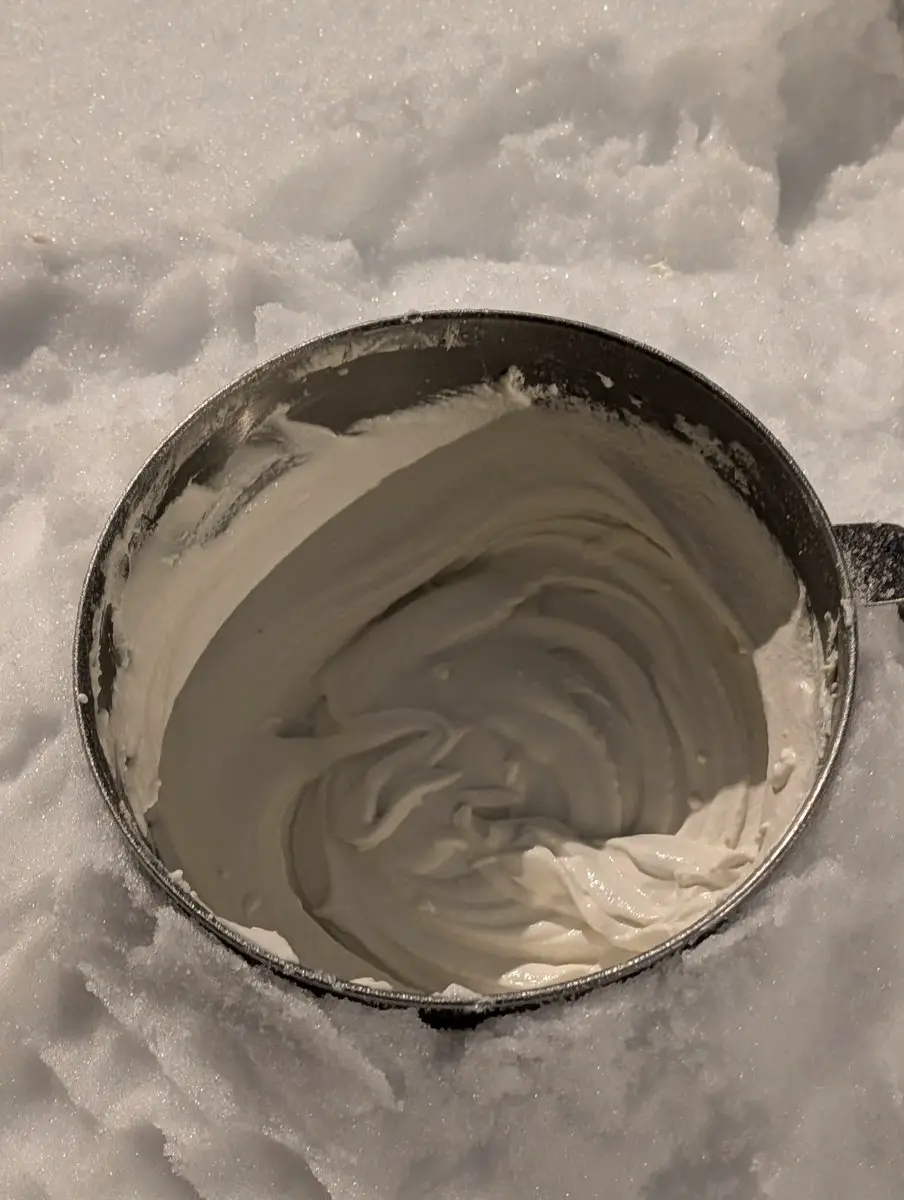

Made ice cream in the snow 😁⛄️#cryptosoupgroup

- Reward

- like

- Comment

- Repost

- Share

-BTC consolidating above 1hr trend\n-Japan situation resolved and yen is back to its default behavior of down only\n-Greenland resolution around the corner\n-Traders wiped both ways at the lows\n\nThinking we get some reversion here, at least to that first underside.

BTC-1,22%

- Reward

- like

- Comment

- Repost

- Share

This greenland thing feels like tariff tantrum V2 so far to me. Of course the resolution in this case could be quite different but so far the vibe is similar imo.

Observing and waiting for now.

Observing and waiting for now.

- Reward

- like

- Comment

- Repost

- Share

Why did nobody tell me the CEO of Rivian looks like Steve-O???

- Reward

- like

- Comment

- Repost

- Share